The Duality of "Token and Coin": Insights from ERC-404 for the Blockchain Gaming Sector (Part 2)

TechFlow Selected TechFlow Selected

The Duality of "Token and Coin": Insights from ERC-404 for the Blockchain Gaming Sector (Part 2)

404 is the only innovation since this bull market began that has made our eyes light up.

Author: Brother Gua, W Labs

It's nearly a month since we published the first part: "The Duality of Image and Token: What ERC404 Reveals for the GameFi Sector (Part 1)". The entire 404 sector has remained sluggish amid broader market corrections. The leading project, Pandora, even dropped to $5,200, drawing a K-line that looks like pure "low-tier meme coin chaos." Doing research during downturns helps avoid emotional bias—a kind of "I may be cut in half, but what can you do about it?" Q spirit. Let’s still organize our thoughts into several sections:

1. Additional Clarifications on Key Concepts

Before diving into application cases, let me clarify a few points discussed recently with friends:

1. Some pointed out that Yuliverse uses DN404, not ERC404. Personally, I categorize all protocols featuring this "image-token duality" under the umbrella term "404." Thus, whether it’s ERC404, DN404, or the newly launched BT404, they all fall under the "404" category.

2. What are the differences between these protocols? As a tech novice, I’ve summarized explanations from several friends:

ERC404 was the first—it merges the ERC721 standard (the classic NFT protocol) and ERC20 (the classic token standard) into one new protocol, resulting in the highest gas fees. Its first application was Pandora, dubbed the “market leader,” which uses a blind box mechanism based on a “treasury queue rotation” model: whenever a user transfers their token, the NFT destroyed from their wallet goes to the end of the treasury’s NFT queue, while the newly minted NFT in their wallet comes from the front of that queue.

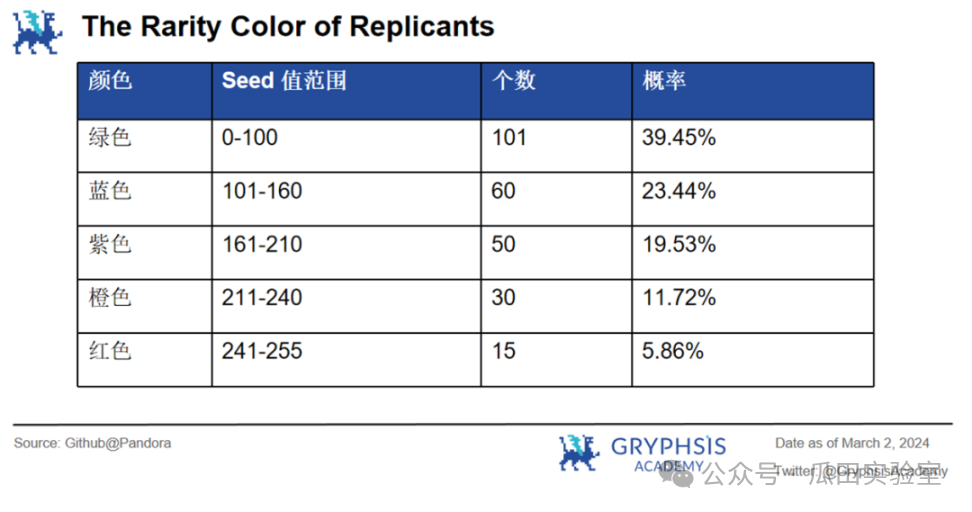

3. The probabilities for Pandora’s five-colored boxes don’t represent fixed proportions of the total supply. For example, the red box has a 5.86% drop rate—not meaning only 586 out of 10,000 NFTs can be red. Instead, players can keep grinding across different addresses; statistically, after about 1 ÷ 5.86% ≈ 17 transfers, they should obtain a red box. In theory, given enough attempts, every single one of the 10,000 NFTs could become a red box.

4. DN404 and BT404

DN404 is a newer protocol built upon ERC404, created by the author of ERC721A. It links ERC721 and ERC20 via a bridge—keeping them as two separate protocols—which reduces gas costs. It also gives developers flexibility in defining how blind boxes are drawn—for instance, instead of queue rotation, new NFTs could be issued on a first-come-first-served or random basis. ASTX was the first DN404-based project and is widely seen as the second-largest in the 404 space. Yuliverse, which we’ll discuss later, also uses the DN404 protocol.

BT404 is another recent entrant, introducing an NFT lock-up mechanism: once you obtain your desired NFT, you can lock it to prevent accidental destruction. It also plans a P2P NFT marketplace—when a player acquires a token, they can select a preferred NFT from the P2P market, and trading fees from this marketplace will be distributed proportionally among all NFT holders. Frankly, if BT404 delivers on these promises, it would be the most suitable for GameFi. GameFi NFTs trade far more frequently than profile-picture NFTs because they’re meant to be used—e.g., a warrior who opens two blind boxes and gets two helmets might sell one to buy armor.

2. Case Studies in the 404 Space

What makes Web3 fun is that when a new mechanic emerges, everyone can innovate and experiment socially through code. Let’s explore some projects leveraging 404:

Lumiterra

We began tracking Lumiterra closely in Q3 last year as a high-potential project. Back then, it was a dark horse with a strong team, bold ideas, and a hybrid vision spanning DeFi + SocialFi + GameFi—very appealing to institutional investors, backed by solid VCs. It has now matured into a well-established major player. For more details, refer to Guatian’s “Da Fei Digs into GameFi” Episode 19:

https://discordapp.com/channels/937958330855477258/1184202773101826048

In March, Lumiterra launched a new set of 404-based NFTs called “Lumiterra Totem 404”—highly innovative and addictive. Since the game is still in testing and the code hasn’t been open-sourced, we can only piece together information from fragments:

-

Currently the most innovative 404-based GameFi project we’ve seen—the team is highly creative, having written its own contract. We look forward to its open-sourcing;

-

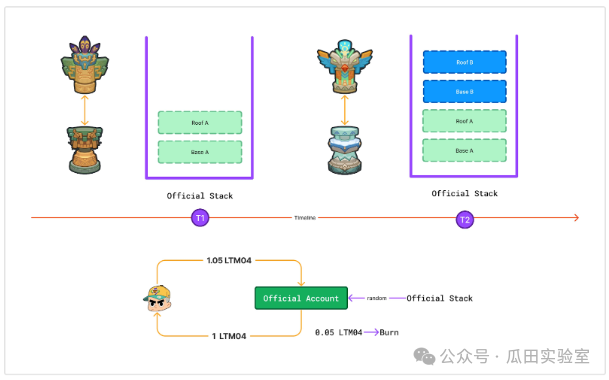

They changed the model: instead of refreshing new NFTs by transferring tokens across wallets, now only buying/selling tokens (via Uniswap trades) triggers new NFT generation. This boosts pool liquidity and increases revenue share for the project;

-

Introduced a “Lego” mechanic with three types of NFTs: Base, Top, and Totem. One Base + One Top = Totem. After merging, two tokens become one—appearing as “forced halving.” But remember, this is a game: if the Totem generates more in-game value than the lost token, the player profits. This deflationary model creates strategic tension between players and the project;

-

Unlike Pandora’s treasury queue rotation, Lumi uses a “stack” mechanism: the first NFTs burned go to the front of the minting queue. However, this risks leaving bottom NFTs permanently unminted. The team adjusted this mechanism once during testing.

Players who minted Totem NFTs in March have already seen 2–3x gains. Lumi will begin its second test phase on April 17, and reportedly will soon launch monster-type 404 NFTs with a new swap mechanism.

Yuliverse

Yuliverse is a Web3 social + location-based game active for over two years—think of it as Web3’s version of Pokémon Go.

Its team was among the first to experiment with 404 asset mechanics, launching OG 404 assets in mid-March. Total supply: 1,000, with 300 reserved for original Yuli OG users, 200 for liquidity pools, and 500 publicly minted via whitelist.

Compared to Lumiterra’s complex Totem 404 system, Yuliverse’s OG404 assets are relatively simple. Built on the DN404 protocol, they lack complex rarity tiers or NFT fusion mechanics—instead serving purely as OG Passes with image-token conversion features.

According to official info, OG404 represents the highest status in the Yuliverse ecosystem, granting top-tier benefits such as $ART token airdrops, in-game resource advantages, and access to ERC ecosystem DeFi staking. While full details haven’t been released, early whitelist minters (at 0.2 ETH each) have already made ~3x returns (current NFT price ~0.6 ETH).

Why choose DN404 over ERC404? After speaking with the team, two main reasons emerged: first, DN404’s architecture saves roughly 50% in gas fees compared to ERC404; second, the DN404 team offers stronger technical and community support for projects adopting the standard.

Overall, Yuliverse’s approach to the 404 space is relatively straightforward—more of a preliminary experiment in issuing new asset types to reward early OG participants and loyal ecosystem users. Because 404 assets are integrated into Yuliverse’s gameplay, they offer more long-term potential than other standalone 404 projects currently running in isolation.

BinaryX

BinaryX (BNX), a seasoned GameFi player that lived through the last bull-bear cycle, never stays idle. Recently, in March, BNX rode the ERC-404 hype to launch a new game, Project Matthew, built on BNB Chain (BSC), issuing an ERC-404 utility token MB4.

Here’s a quick overview of Project Matthew:

-

Built using the ERC-404 standard.

-

IGO allocation for MB4 is determined by the number of BNX tokens held.

-

Total issuance: 40,000 MB4 tokens. 90% available for minting, 10% for initial liquidity, priced at 0.05 BNB.

-

NFT rarity determines airdrop weight, but there’s no in-game utility for the 404 NFTs themselves.

-

By burning varying amounts of MB4 tokens, players can acquire premium assets (Land) in Project Matthew (basic Land can be obtained by spending BNX), enabling Play-to-Earn and earning the in-game token MC.

In summary, regular in-game assets are exchanged using BNX (achieving the design goal of burning the main token), while the MB4 IGO uses a soft-staking model tied to BNX holdings—giving BNX significant utility. Thus, the primary purpose of Project Matthew is to create burn mechanisms for the main token BNX—similar to how Gashero provided utility for StepN’s GMT.

Adding 404 assets to Matthew feels somewhat forced. We suspect the game was nearly complete when the ERC-404 trend exploded in late February, so they hastily bolted on a 404 layer. Indeed, Matthew’s 404 implementation directly copies Pandora’s open-source code without innovation—even the most game-integrated aspect, “blind box opening,” only affects airdrop tiers and lacks actual in-game functionality, making its purpose unclear.

Therefore, BinaryX’s launch of the ERC-404 token MB4 brought no protocol-level innovation—only a layered application of game utility and recursive tokenomics, a tactic veteran GameFi teams like BNX excel at. After all, players spent real money on MB4 tokens and further burned them to obtain premium in-game assets.

Still, any willingness to experiment is a positive sign.

3. Can the 404 Sector Take Off?

To conclude: 404 is the only innovation in this bull run that genuinely caught our attention—at least bringing gameplay into the protocol layer and seamlessly integrating into game economies. Combined with the characteristics discussed in Part 1, we remain optimistic about 404’s future development. This explains why NFT-focused institutions like NFTgo are placing big bets on the 404 sector.

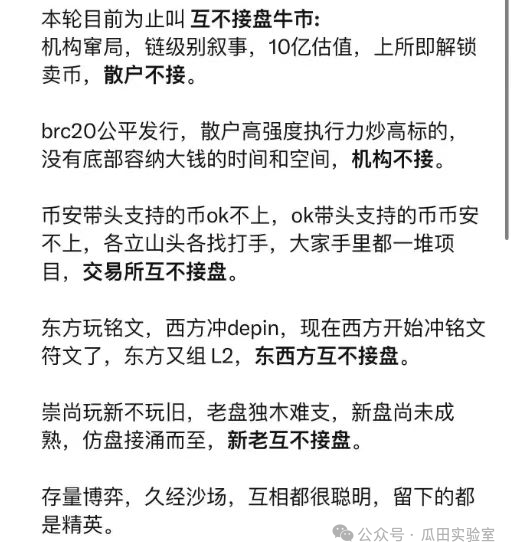

So far, 404 innovations have only appeared at the application level and haven’t yet formed a compelling macro narrative to attract capital confidence—this is why current leaders like Pandora and ASTX remain in a self-contained loop. But dig deeper: has this crypto bull run produced any other truly native Web3 innovations? Apparently not—and that’s why many seasoned players feel uneasy. That’s also why a recent post titled “No Mutual Bag-Holding Bull Market” went viral across groups: precisely because there’s no shared new narrative for this cycle, the consensus became “no mutual bag-holding.”

Recall the key innovations of the last bull run: DeFi, NFTs, GameFi, and Memes. These four fresh concepts propelled Bitcoin from $3,000 to $63,000. What comparable breakthroughs have we seen this cycle?

- AI? Great tech—but it’s Web2;

- Inscriptions/Runes? Feels no different from Memes;

- Solana ecosystem? Mostly Meme coins now;

- Then there’s the underwhelming RWA and DePIN… feeling worse than Memes.

Take Memes—they’re C-end users’ favorite, simple, direct, and rebellious. But have there been any good Memes lately? Most die within three days—worse than low-tier dogs. Last cycle’s Meme king, Dogecoin, had Musk’s endorsement. What about this cycle? The biggest gainer is still Musk’s dog, Floki.

Can we really rely solely on three external narratives (BTC halving, ETF approval, US rate cuts) to sustain an entire bull market? Especially since the first two have already materialized and been priced in. The current bull market is still fundamentally driven by capital flows: first, existing crypto funds—seasoned players entering around $16,000 BTC using savings from the bear market, supported by halving and ETF expectations; then, post-ETF approval, new Web2 capital entered, FOMO pushed prices to $73,000—then what?

Narratives driven purely by capital inflows are inherently short-lived—games of who exits fastest. Sustainable growth requires organic innovation and internal development. Calling 404’s “image-token duality” an innovation makes me a bit uneasy—but frankly, the alternatives are so weak that among a bunch of misfits, we have to pick the least ugly one.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News