Omni Network Explained: Unifying the Rollup Fragmentation

TechFlow Selected TechFlow Selected

Omni Network Explained: Unifying the Rollup Fragmentation

OMNI Network is an interoperability protocol across rollups, a layer-1 blockchain, and the first AVS on EigenLayer.

Author: Yinan

Project Overview

Omni is an interoperability layer for Ethereum and a Layer 1 blockchain designed to connect rollups such as Optimism, Arbitrum, zkSync, and Starkware.

It provides developers with a simple way to scale their applications while preserving Ethereum's security properties by leveraging foundational innovations in the blockchain industry—such as restaking via EigenLayer, the Cosmos SDK, and Tendermint consensus. Omni enables developers to manage global application states across all integrated domains and aggregate liquidity to deliver seamless product experiences for users.

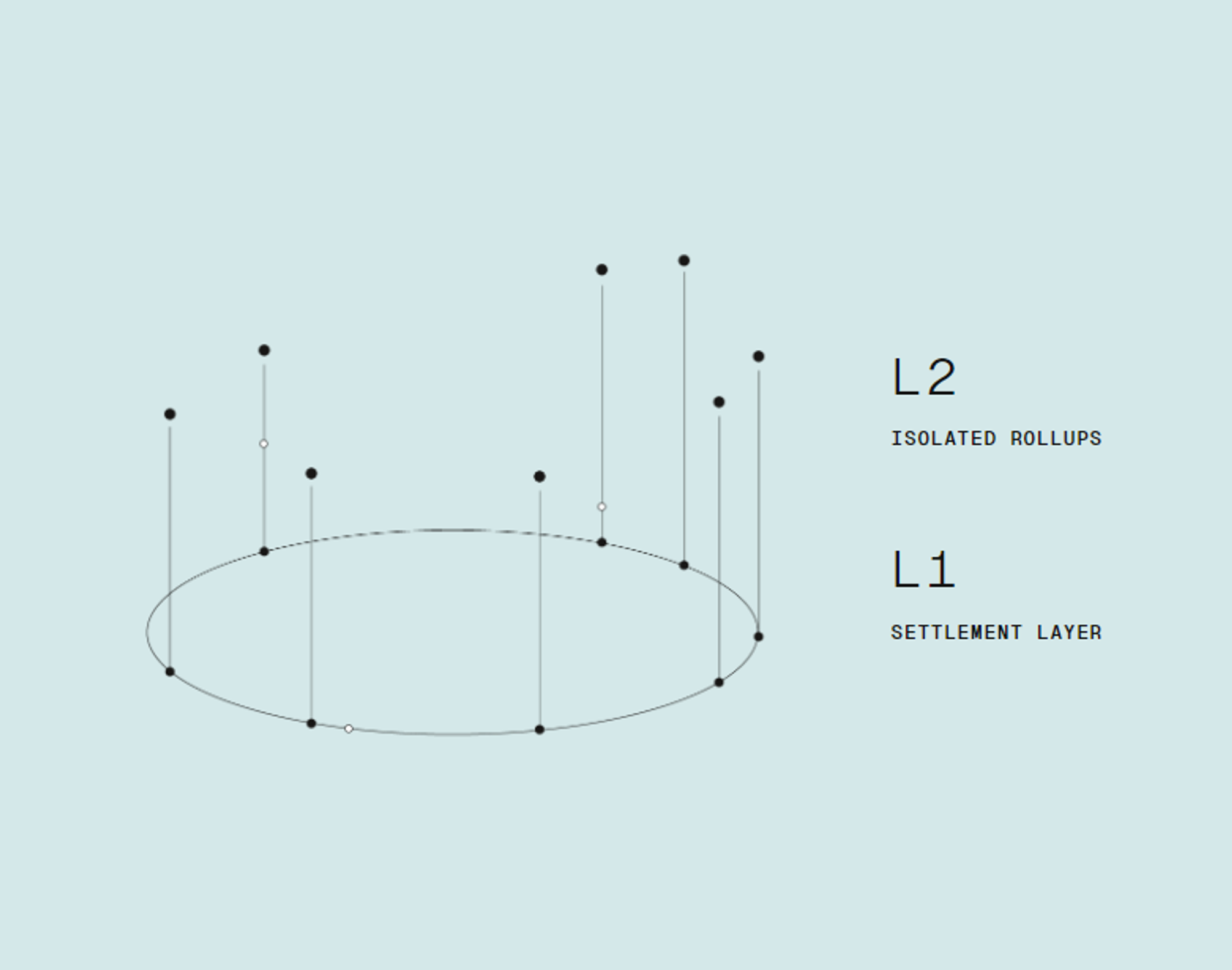

The Fragmentation Problem on Ethereum

As rollups like Arbitrum and Optimism gain popularity, Ethereum’s greatest existential threat has become fragmentation caused by these rollups.

Ethereum users and capital are increasingly scattered across isolated ecosystems, weakening overall network effects. Omni addresses this issue by integrating all rollups into a cohesive, interoperable network.

Optimizations Addressing Ethereum Fragmentation

Cross-Rollup Communication

Omni allows users and applications to interact across various rollups as if they were operating on a single, unified network.

Unified Liquidity Pools

By enabling cross-rollup transactions, Omni helps aggregate liquidity, improving capital efficiency and reducing slippage for users.

Simplified User Experience

Users enjoy a smoother experience, seamlessly moving assets or executing actions across rollups without complex procedures or multiple steps.

Developer-Friendly Platform

With Omni’s standardized communication protocols, developers can confidently build applications that function seamlessly across the entire rollup ecosystem.

Universal Gas

Regardless of whether users hold funds on Ethereum, an Optimistic Rollup, a ZK-Rollup, or any other connected network, they can transact seamlessly without worrying about different gas tokens for each network.

Key Project Highlights

Omni introduces a novel network architecture tailored for low-latency cross-rollup communication and global compatibility across Ethereum’s entire rollup ecosystem, secured cryptoeconomically through restaked $ETH. By combining technologies such as CometBFT, ABCI++, and the Engine API, Omni achieves sub-second cross-rollup message validation while leveraging Ethereum’s industry-leading cryptoeconomic security budget. Additionally, Omni is designed for easy integration with any rollup architecture and native rollup applications, offering a programmable state layer for managing cross-rollup application deployments.

In summary:

Dual-Staking Model:

Omni is a proof-of-stake network secured by the combined value of restaked ETH and staked OMNI tokens.

Sub-Second Validation:

Omni nodes use CometBFT consensus to process cross-rollup messages and Omni EVM transactions within one second. Through mechanisms such as pre-confirmations and transaction insurance, Omni delivers sub-second finality for cross-rollup messages.

Diverse Rollup Support:

Omni is designed with minimal integration requirements, ensuring compatibility with any rollup virtual machine, programming language, and data availability architecture.

Backward Compatibility:

Applications can integrate with Omni without modifying existing smart contracts. Instead, apps can send cross-rollup messages via modified frontend instructions through Omni.

Three Core Components of OMNI

Ethereum Restaking:

The Omni Network consists of validators who restake ETH and attest to rollup state updates to enable global interoperability. These ETH-based validators form the foundation of the network’s security.

Tendermint Speed and CometBFT:

By leveraging Tendermint’s PoS consensus, our validators achieve agreement on rollup states nearly an order of magnitude faster than Ethereum Layer 1.

CometBFT is a Byzantine Fault Tolerant (BFT) consensus mechanism designed to ensure resilient and efficient network protocols in distributed systems—even in the presence of failures or malicious nodes—making it ideal for Omni.

EVM Compatibility

Omni’s execution layer is EVM-compatible, powered by Ethermint (the EVM module on Cosmos), allowing developers to work in Solidity using familiar tools. The execution layer includes built-in functionality to access states, messages, and applications from integrated rollups, creating a seamless experience for accessing users and liquidity across these rollups.

What Can Omni Do?

Message Propagation

Applications can simply request that messages be delivered to targets like Arbitrum, and Omni will securely relay those messages to trigger corresponding application logic. Omni offers superior security and more advanced capabilities beyond basic message passing.

Multi-Message Propagation

Since Omni supports diverse applications, a single transaction on one rollup may trigger multiple outbound messages. For example, when a user deposits funds into an automation protocol, Omni can automatically send messages to other rollups to execute corresponding actions.

For instance, Alice deposits 10 $ETH into an automated protocol responsible for ensuring her DeFi positions across all rollups remain above a 200% collateralization ratio. The Omni network might detect this transaction and automatically send messages to Polygon’s zkEVM and Starknet to increase Alice’s positions. Alternatively, if all her current positions exceed her specified 200% threshold, no outbound messages would be sent at that moment—but as her collateral ratios drop below the threshold over the following weeks, the automation protocol begins sending messages to boost her accounts across each rollup.

This is a fundamental distinction between Omni and projects offering only interoperability—while Omni facilitates rollup interoperability, its nature as a general-purpose programmable EVM enables far more powerful use cases.

Updating State Within Omni

Users can purchase tokens or NFTs on any rollup within the broader Ethereum ecosystem by interacting with portal contracts and receive the purchased assets directly on the original rollup—without needing to consider Omni itself.

Cross-Chain DeFi Capital Interoperability

For example, create a margin account on OMNI, collateralize on Chain A, then borrow on Chain B, sharing the same margin account funds.

NFT Interoperability Across Chains

Projects can deploy on the Omni Network; with Omni, users from any chain can mint NFTs, and NFTs can be "teleported" or moved between chains.

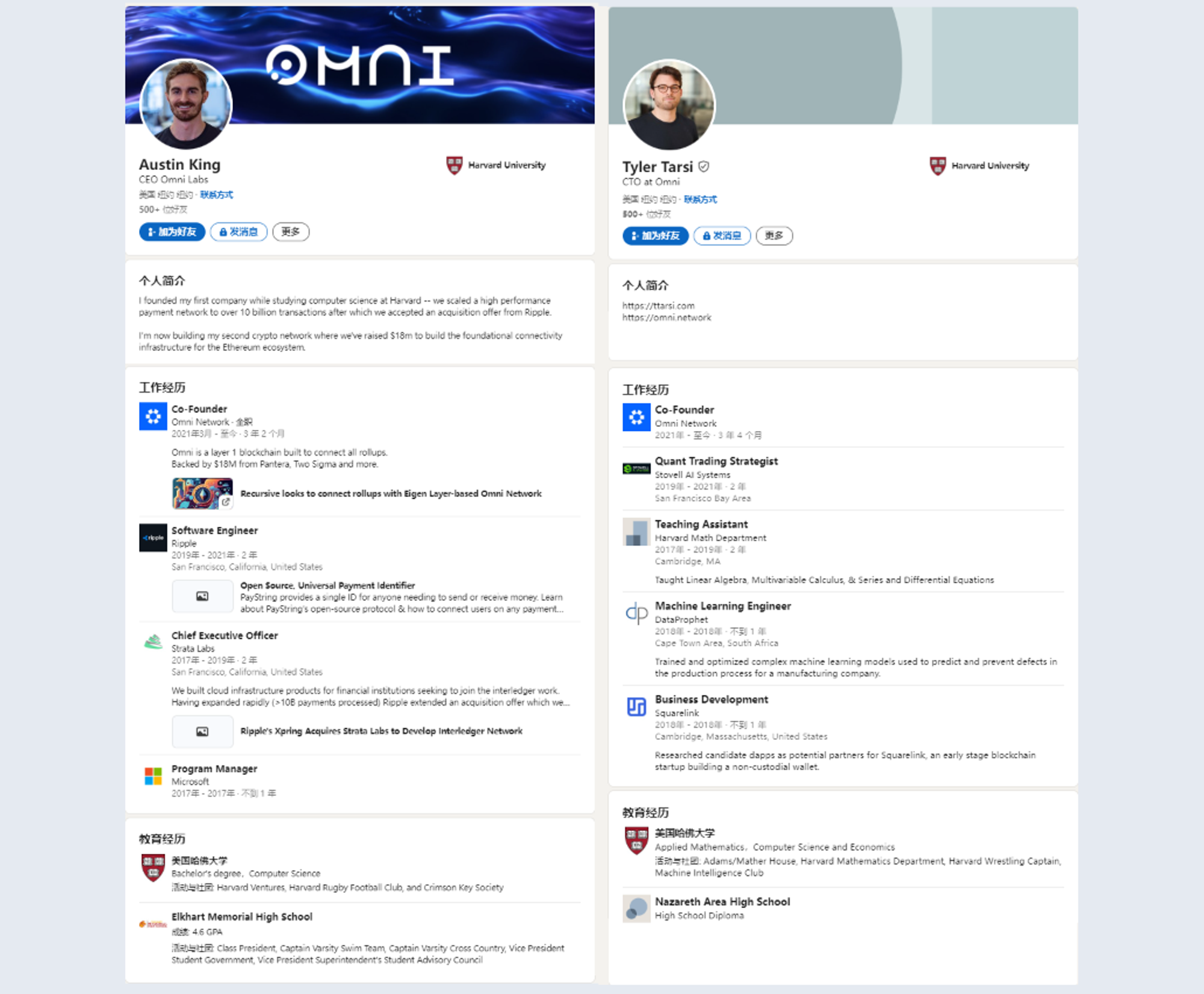

Team

Previously known as Rift Finance, Omni began as a DeFi protocol providing financial services for Web3 projects.

Austin King — Co-founder and CEO of OmniNetwork. He founded his first company, Strata Labs, while studying computer science at Harvard, scaling a high-performance payment network to over 10 billion transactions before accepting an acquisition offer from Ripple. He previously worked as a software engineer at Ripple. Omni is his second crypto network.

Tyler Tarsi — Co-founder and CTO of OmniNetwork. Previously a quantitative trading strategist at Stovell AI Systems, Tyler attended Harvard University.

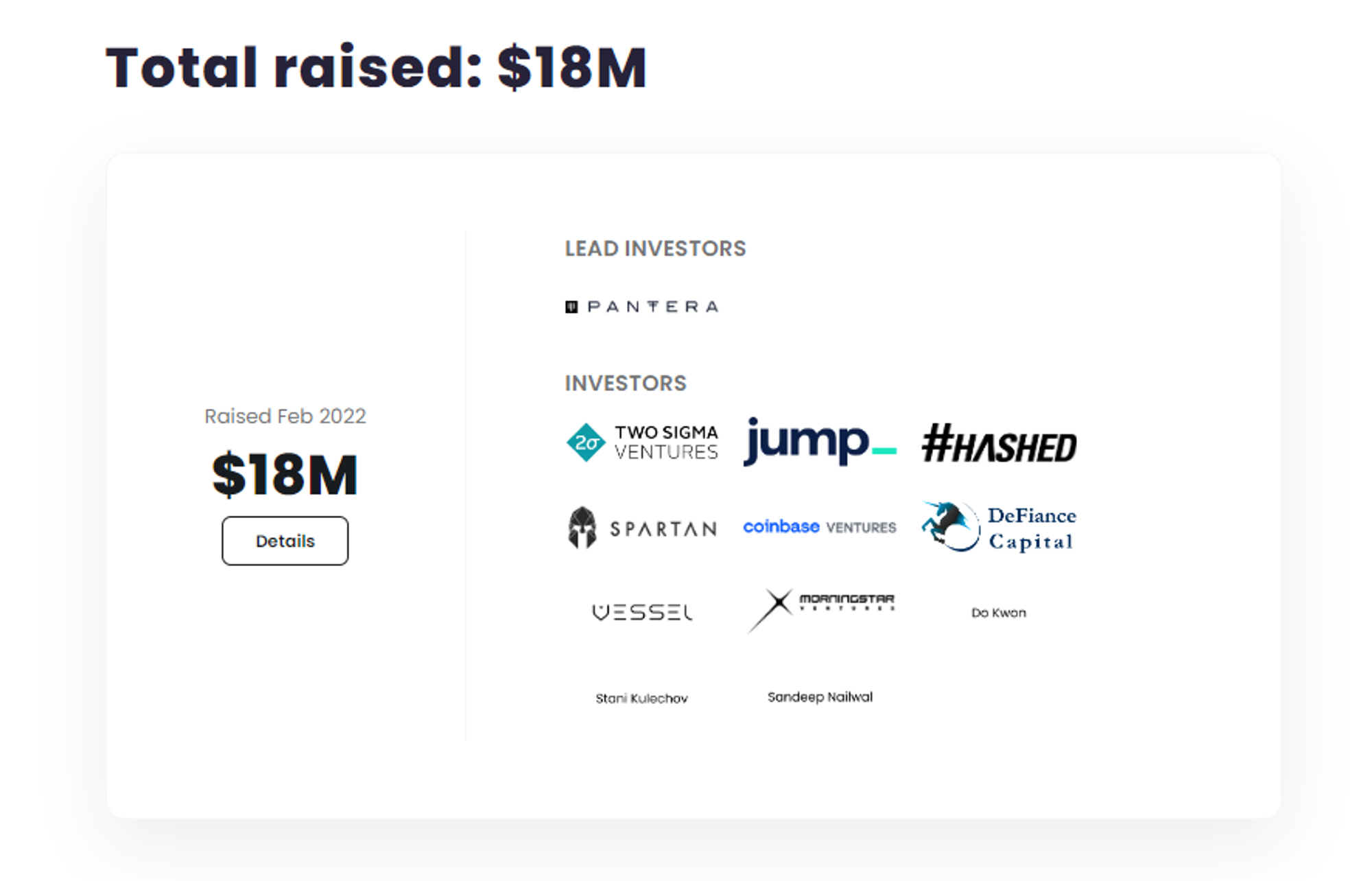

Funding

On February 8, 2022, Omni raised $18 million in a round led by Pantera Capital.

Other investors include Two Sigma Ventures, Coinbase Ventures, Spartan Group, Defiance Capital, Hashed, Jump Capital, Vessel Capital, and Morningstar Ventures. Angel investors include Terra’s Do Kwon, Aave’s Stani Kulechov, Polygon’s Sandeep Nailwal, and Joseph Naggar from Goldentree Asset Management.

Project Milestones

-

Q1 2022 — Omni completed an $18 million funding round led by Pantera Capital.

-

Q2 2023 — Omni Network released its first technical architecture document.

-

Q3 2023 — Testnet 1: Omni Origins completed.

-

Q4 2023 — Testnet 2: Omni Overdrive completed.

-

Q1 2024 — Omni became the first Active Validator Service (AVS) to secure a $1 billion commitment in restaked ETH from leading liquid restaking protocols including EtherFi, Renzo, Puffer, Kelp, Swell, EigenPie, BedRock, and Rio.

-

Q2 2024 — Mainnet launch.

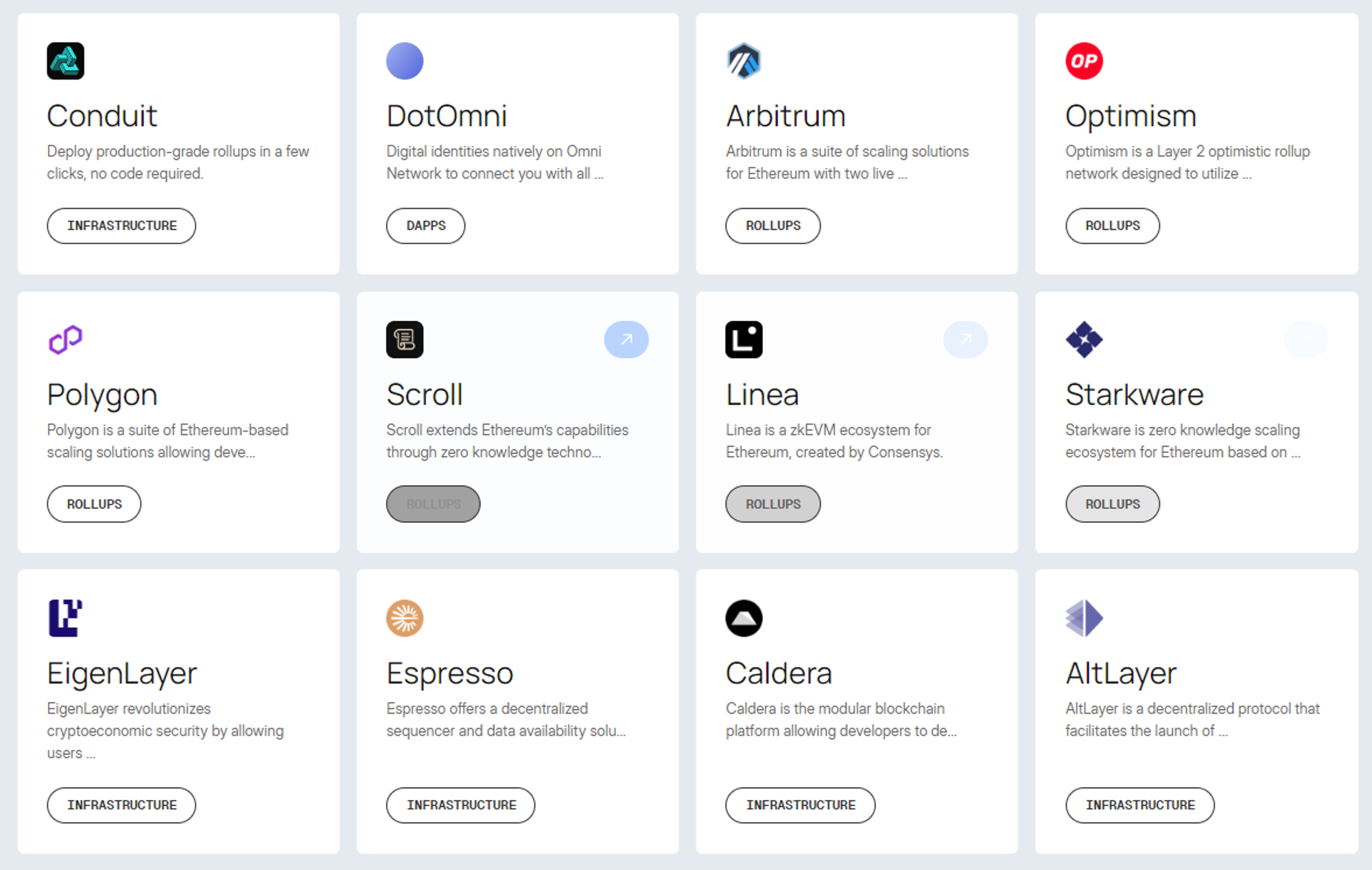

Ecosystem

AutoFarm — The first DApp launched on the Omni Network testnet, allowing users to automatically move funds to the highest-yielding pools across any chain, redefining liquidity mining. This is enabled by Autonomy, which optimizes user APY.

Since the Omni mainnet has not yet launched, the ecosystem currently focuses on announced partnerships and testnet deployments.

Tokenomics

$OMNI is the native token of Omni Network, serving several key purposes:

-

Universal Gas: OMNI acts as the payment mechanism to compensate relayers submitting transactions to target rollups.

-

Gas for Omni EVM: OMNI is the native currency used to process transactions on the Omni EVM.

-

Governance: OMNI stakeholders will govern various decisions, including protocol upgrades and developer features.

-

Staking: The Omni protocol implements a dual-staking model to ensure economic security. Security depends on the total value of staked OMNI and restaked ETH.

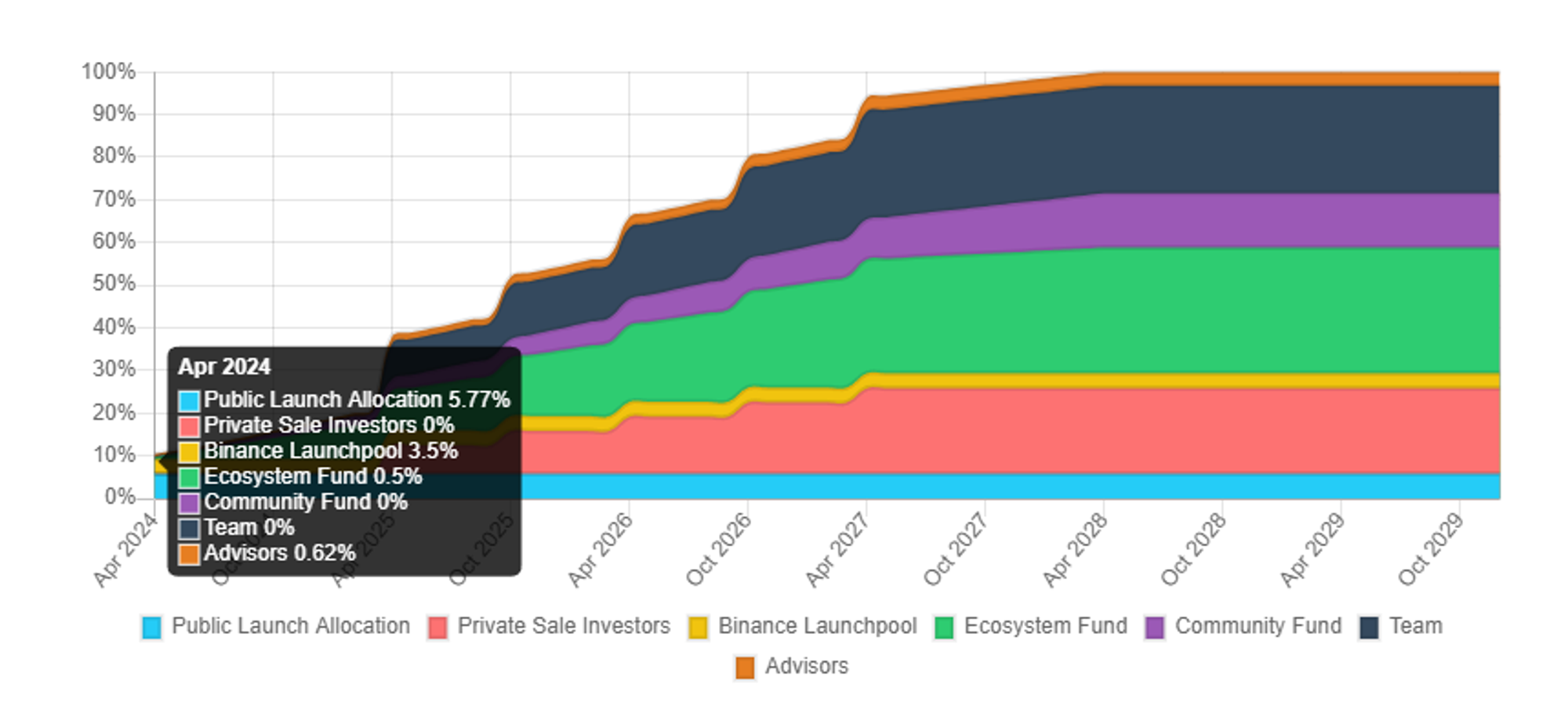

Token Distribution

-

Total Supply: 100,000,000

-

Initial Circulating Supply: 10,391,492 (10.39% of total supply)

-

Private Sale: 20.06%

-

Ecosystem: 29.5%

-

Team: 25.25%

-

Community: 12.67%

-

Advisors: 3.25%

-

Public Sale: 5.77%

-

Binance Launchpool: 3.5%

Token Release Schedule

Genesis Airdrop

The Omni Foundation is launching $OMNI as an ERC-20 token on Ethereum with a total supply of 100,000,000; 3,000,000 (3% of total supply) will be distributed as part of the genesis airdrop.

Eligibility for the airdrop was determined retroactively starting April 3, 2024. Users have 45 days to claim their $OMNI rewards; any unclaimed tokens will be returned to the Omni Foundation for future community initiatives.

Main Eligible Groups for Genesis Airdrop:

Omni Community Members: Early contributors, testnet users, builders, and key participants in the Omni community.

EigenLayer Stakers: The first 10,000 participants in EigenLayer restaking are eligible for $OMNI Genesis rewards.

Beacon Chain Solo Stakers: Rewards for 5,000 Beacon Chain solo stakers will be distributed on a first-come, first-served basis—the first 5,000 addresses to claim will each receive 60 $OMNI.

Milady Maker and Redacted Remilio Babies NFT Holders: 3,682 addresses holding Milady Maker NFTs and 2,865 addresses holding Redacted Remilio Babies NFTs are eligible for $OMNI Genesis rewards.

Pudgy Penguin NFT Holders: 4,609 addresses holding Pudgy Penguin NFTs are eligible for $OMNI Genesis rewards.

Ninjas NFT Holders: 1,585 addresses holding Ninja NFTs are eligible for $OMNI Genesis rewards.

Strategic Partner Agreements: 25 protocol organizations that partnered with Omni and contributed to its early development—including Ether.Fi, Monad, Berachain, and EigenLayer—are eligible for $OMNI rewards.

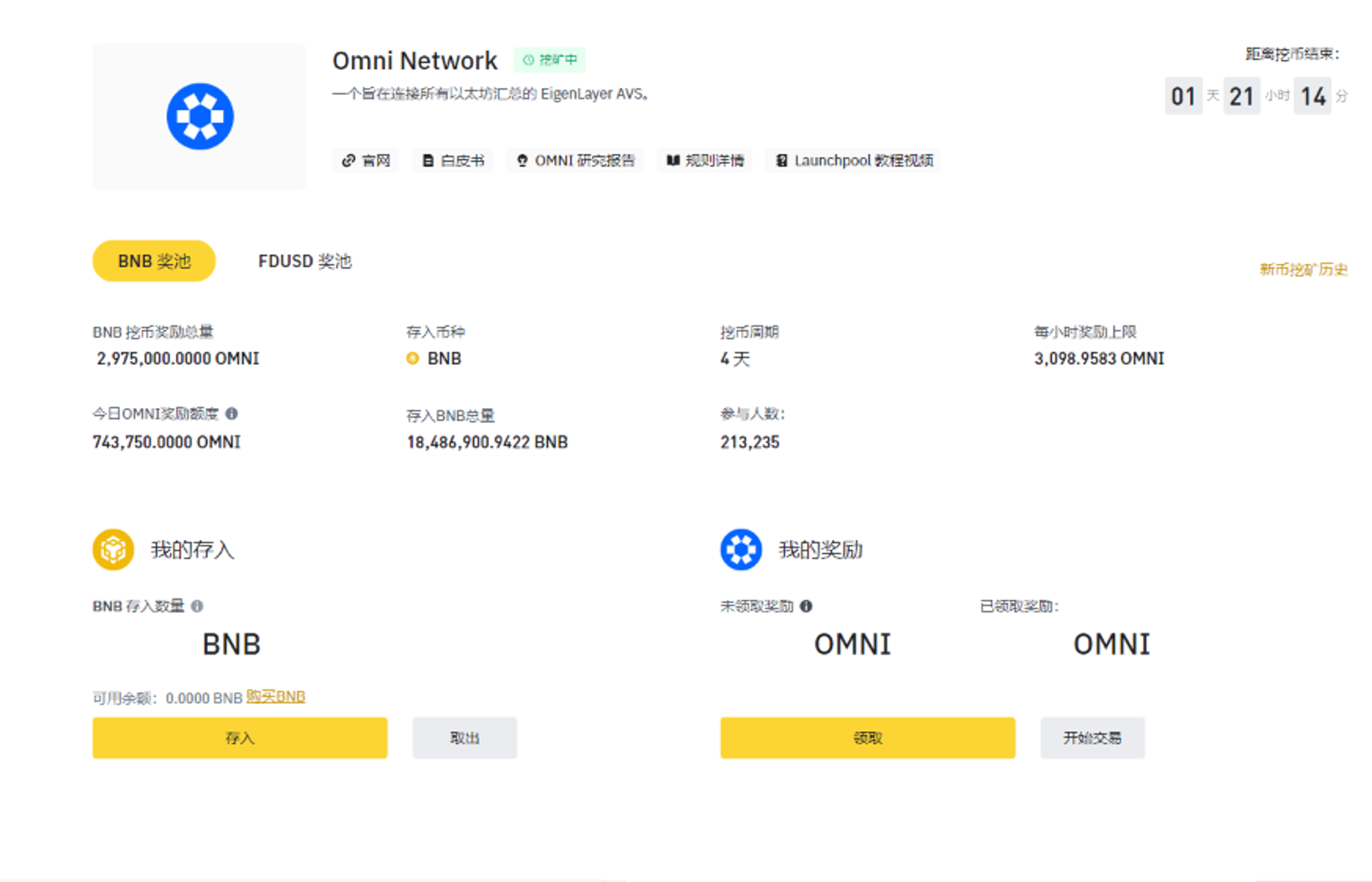

Token Listing Information

$OMNI will be listed on Binance Spot at 20:00 (UTC+8) on April 17, 2024. Currently, users can participate in mining via Binance Launchpool. This mining cycle lasts 4 days, with a total of 18,486,900 BNB committed—early participants are truly reaping significant benefits.

The project raised $18.1 million through two private token sales: 9.1% of the total OMNI supply was sold at $0.18 per OMNI (seed round), and 11% was sold at $1.50 per OMNI (Series A round), totaling 20.1% of the supply sold during private rounds.

Whale OTC market prices have reached $40, though depth remains limited, so this should be taken with caution—greater market depth generally increases reliability.

The initial circulating supply is 10,391,492 (10.39% of total supply), with a total supply of 1 billion. Based on various fundamentals—including investor institutions, founding team, social media metrics—$OMNI appears stronger than Binance’s previous Launchpool project SAGA. As of now (April 45, 2024), SAGA’s circulating market cap stands at $369 million, reflecting recent pullbacks. Considering recent market instability and weakened sentiment, downward adjustments are warranted. I estimate $OMNI’s initial circulating market cap will fall between $300–400 million. However, this is merely a reference range—new token launches typically experience high volatility. Please conduct your own research (DYOR)!

Project Summary

OMNI Network is a cross-rollup interoperability protocol and Layer 1 blockchain, and the first AVS on EigenLayer. OMNI leverages EigenLayer’s restaking to inherit Ethereum’s security and uses a Byzantine Fault Tolerant (BFT) consensus mechanism to handle high transaction volumes with low latency. The founding team consists of Harvard graduates with blockchain industry experience, backed by Pantera Capital, Jump Capital, and Coinbase Ventures—an impressive lineup. As account abstraction, chain abstraction, and intent-centric architectures mature, the sector OMNI operates in holds strong potential. By aggregating liquidity across major rollups and simplifying user operations to solve fragmentation issues, the project boasts solid fundamentals.

However, the project has not yet launched on mainnet, so users can only experience parts of its ecosystem through earlier testnets. Many described visions—such as sub-second validation—remain to be proven post-mainnet launch. Currently, $OMNI has been listed on Binance Launchpool, bringing increased liquidity and visibility. Overall, the project has strong fundamentals, but future success and user adoption will depend on the team’s ongoing execution and product maturity. It’s worth continuing to monitor developments!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News