Pyth Network Q1 Summary: Usage Data Continues to Grow, Traditional Finance is Entering

TechFlow Selected TechFlow Selected

Pyth Network Q1 Summary: Usage Data Continues to Grow, Traditional Finance is Entering

Pyth can scale to wherever developers are, delivering the data they need no matter where they choose to build.

Author: Pyth

Translation: TechFlow

Over the past year, the internet has undergone rapid changes.

In the Web3 space, decentralized finance (DeFi) is experiencing a renaissance led by perpetual derivatives, hybrid scaling approaches, liquid staking, and meme coin culture. DeFi is trendy again, and the entire ecosystem is feeling the surge of frenzied market activity.

Meanwhile, in the Web2 world, large language models and generative AI content are transforming how creators and consumers interact. "AI-powered" tools cannot explain where their answers originate; traffic and ad revenue are not flowing back to the original proprietary datasets. As data owners privatize their content for monetization, the open internet is likely to shrink.

Where does Pyth Network stand today?

Pyth contributors envision a world where smart contract developers and internet builders can access market data at the very moment it's created. Financial data—such as asset prices, recent trades, and latest bid/ask information—rapidly loses value over time. Financial applications, whether DeFi or CeFi, are only as valuable as the data protecting their operations.

In a world where data privatization has become the norm, previous solutions relying on acquiring, scraping, or copying public data to deliver to downstream blockchain users are no longer sustainable. Even crypto trading data from CEXs now requires payment to access.

As decentralized finance expands and traditional capital markets begin adopting on-chain rails and tools, the role of data oracles becomes increasingly critical.

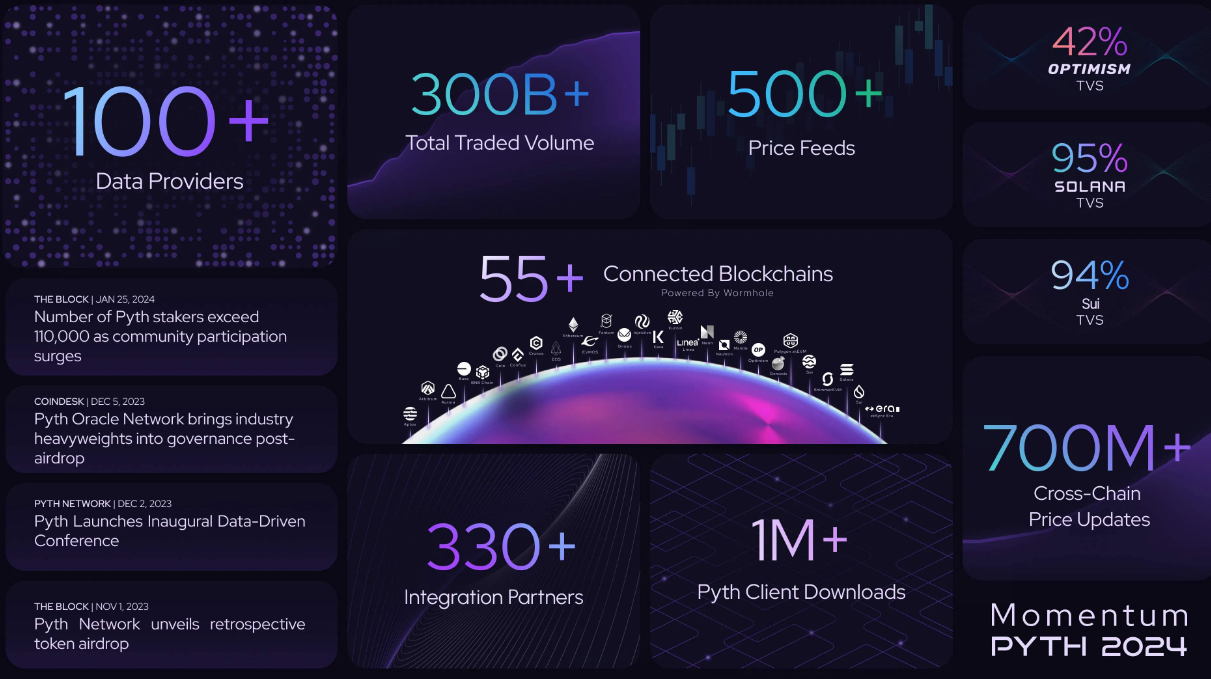

Pyth Network serves over 330 applications across more than 55 blockchains, with cumulative transaction volume exceeding $300 billion. It currently delivers over 500 real-time price feeds spanning both traditional and digital asset classes.

The driving force behind this growth is Pyth’s ability to scale alongside developers wherever they choose to build, delivering the data they need without compromise on reliability, precision, or latency—meeting the expectations of an audience raised in the Web2 era.

How we behave online and on-chain continues to evolve. Yet through it all, Pyth Network ensures the security of value we trade globally and powers the applications we depend on. This article highlights the oracle network’s latest achievements and growth over the past quarter.

Highlights

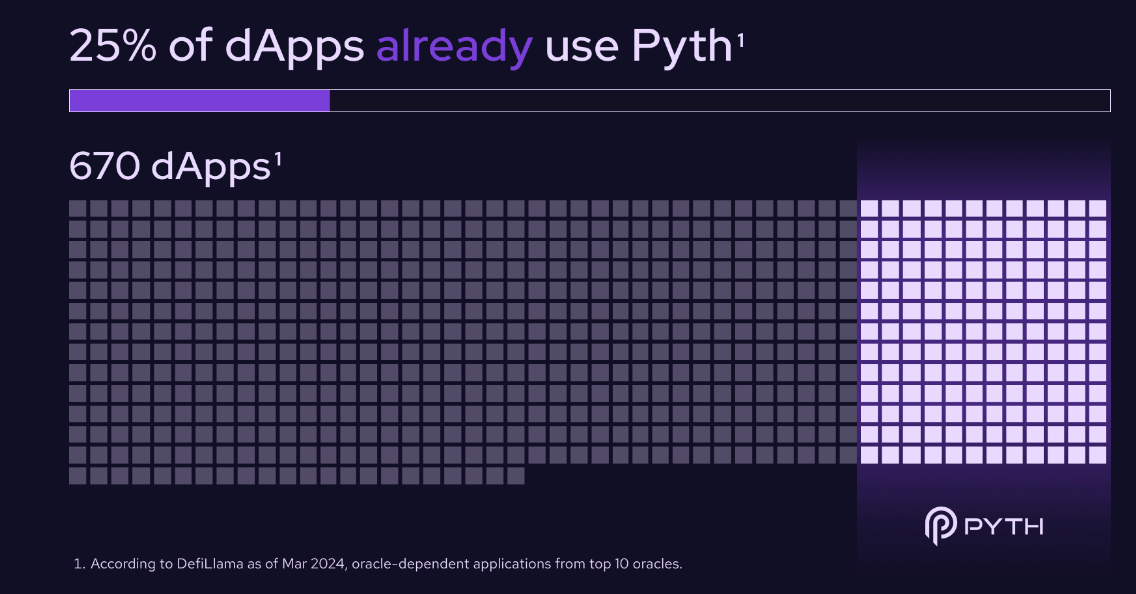

Who isn't powered by Pyth?

Who isn’t powered by Pyth today? According to the latest DefiLlama statistics, Pyth Network secures one-quarter of all DeFi protocols. By Pyth contributors’ own measure, the figure is much higher: over 330 on-chain and off-chain applications rely on Pyth data for mission-critical operations.

The key drivers behind Pyth’s price feed adoption are low-latency updates, comprehensive asset coverage, and full availability across every chain where developers want to build.

Latency is crucial for accuracy and security—it has always been a core principle for Pyth. Price updates every 400 milliseconds enable next-generation DeFi services.

Asset selection also varies significantly for protocol founders. From newly launched digital assets to more traditional instruments, developers seek to offer markets and services aligned with user demand. Traders appreciate this breadth of choice.

Extending further, the full suite of over 500 Pyth price feeds is available across all chains supporting Pyth, meaning developers can reach the markets their users love, regardless of deployment location.

Banks are joining Pyth

Pyth Network sources data directly from first-party sources and active market participants: traders, market makers, exchanges, and DEXs. By March 2024, the banking sector began joining Pyth Network’s mission.

Nomura’s digital asset subsidiary, Laser Digital, joined the Pyth data provider community, contributing its own pricing data for both digital and traditional assets to enhance the oracle network’s data coverage. Laser Digital is not only the first financial institution from the banking sector to join Pyth Network but also participates in the Web3 world as a direct, real-time price data contributor.

Laser Digital’s entry into the Pyth data provider community marks a significant milestone for both traditional finance and DeFi. The Pyth oracle provides traditional banks with a unique gateway to explore the on-chain world. In return, decentralized finance benefits from enhanced access to market data.

Pyth’s new product launch: Entropy

Pyth Entropy is a new on-chain random number generation (RNG) solution designed to power unpredictable outcomes. It has launched on EVM mainnets, including Arbitrum, Blast, Chiliz Chain, Mode, LightLink, and Optimism.

While existing on-chain RNG solutions exist, they often require strong trust assumptions or complex cryptography. Pyth Entropy is based on a commit-reveal protocol—a well-known RNG method in cryptographic circles. Entropy is designed to be easy to integrate, reliable, and fast.

Entropy aims to secure a range of decentralized use cases: prediction markets, NFTs and generative art, social media, and gaming. Several decentralized applications have already begun integrating Entropy, including SlashToken on Chiliz Chain, and FLAP and Fungible Flip on Blast.

Pyth Council elected, governance takes center stage

Pyth governance oversees critical protocol parameters—from fee updates and data provider reward mechanisms to software upgrades for on-chain programs and procedures for listing new price feeds.

The Pythian Council and Price Feed Council were elected by Pyth DAO and will now be empowered to execute specific responsibilities and key actions.

The Pythian Council consists of eight members who serve as signers for the Pythian multisig wallet. Pyth Improvement Proposals (PIPs) that may be delegated to this council include upgrading oracle programs, setting data request fees per blockchain, and other protocol or network fees. The Pyth DAO Constitution outlines the roles, powers, and procedures of governance.

On March 7, the Pythian Council members were elected and approved by Pyth DAO. Members represent Synthetix, HMX, Wormhole Foundation, Douro Labs, Solend, and the Pyth Data Association.

The Price Feed Council comprises seven members who will serve as signers for the Price Feed multisig wallet. PIPs potentially delegated to this council could include managing the list of price feeds offered via Pyth, selecting data providers, and setting minimum data provider counts per price feed.

On March 29, the Price Feed Council members were also elected and approved by Pyth DAO. Members represent Synthetix, NOBI, Douro Labs, Swissborg, ReactorFusion, and the Pyth Data Association.

Operational Pyth Improvement Proposals have passed. Community members can stake their PYTH governance tokens to participate in on-chain governance and help shape the network’s future.

Pyth Airdrop Recap: Phase Two

Phase one of Pyth Network’s retroactive airdrop program was announced in November 2023. During this initial phase, PYTH tokens were distributed to over 90,000 wallets across 27 blockchains and 200 applications.

Phase two of the airdrop oversaw the distribution of PYTH tokens to over 160 decentralized applications powered by Pyth data. These protocols span the EVM, Cosmos, Rust, and Move ecosystems and rely on Pyth to support their exchange, settlement, and trading functions.

Readers can expect announcements from contributors and founders of many of these applications regarding how they plan to use their allocations.

Douro Labs' research on fragmented liquidations

Authors at Douro Labs stated in their MEV (“Maximal Extractable Value”) research series that DeFi is not necessarily a dark forest.

Their first paper offers a taxonomy of MEV and challenges the notion that MEV is either inevitable or inherently opaque. In fact, MEV arises from suboptimal protocol design due to trade-offs between value capture and complexity. An examination of various MEV mitigation techniques suggests a need for solutions that reduce complexity for both protocols and searchers.

More specifically, the current state of protocol design acknowledges pain points on both sides: liquidations often unnecessarily leak value to miners, while searchers must navigate fragmentation across different protocol liquidations.

Click here to explore this research series and its developments.

A vibrant Pythian community

The Pythian community is entering a new golden age. The Pyth Discord now hosts over 80,000 Pythians—an increase of 120% since January 1. All newcomers are welcome. Discord serves as a place for Pyth DAO members, governance participants, and Web3 residents to relax and share ideas with like-minded individuals.

Pyth social channels host numerous recurring events, from Poker Nights to Mindful Mondays. The Discord regularly holds UFC watch parties, game nights, and other inclusive activities. Community-driven event ideas are always welcome—speak up and tell the admins!

Ecosystem metrics

Pyth Network today

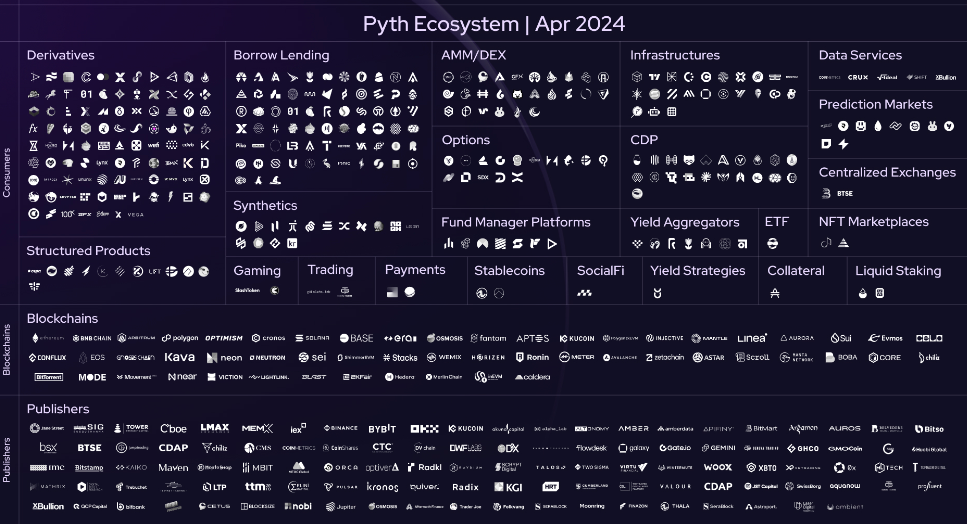

Many compare the Pyth ecosystem to a financial data version of Airbnb or Spotify’s streaming model: creators and owners of key data can participate economically in Pyth’s decentralized marketplace. Downstream users benefit from secure direct access and an ever-growing selection of assets over time.

Today, the Pyth oracle network pulls data from market makers, proprietary trading firms, decentralized exchanges, centralized and traditional liquidity venues—and recently, investment banks and fintech participants.

On the user side, data consumers span a wide range of DeFi infrastructure: decentralized exchanges, perpetual futures and derivatives, lending platforms, structured product vaults, stablecoin protocols, trading analytics, decision intelligence solutions, and more.

The growth metrics below provide visualizations showing Pyth Network’s expansion over this quarter and the past year, from adoption to feature delivery.

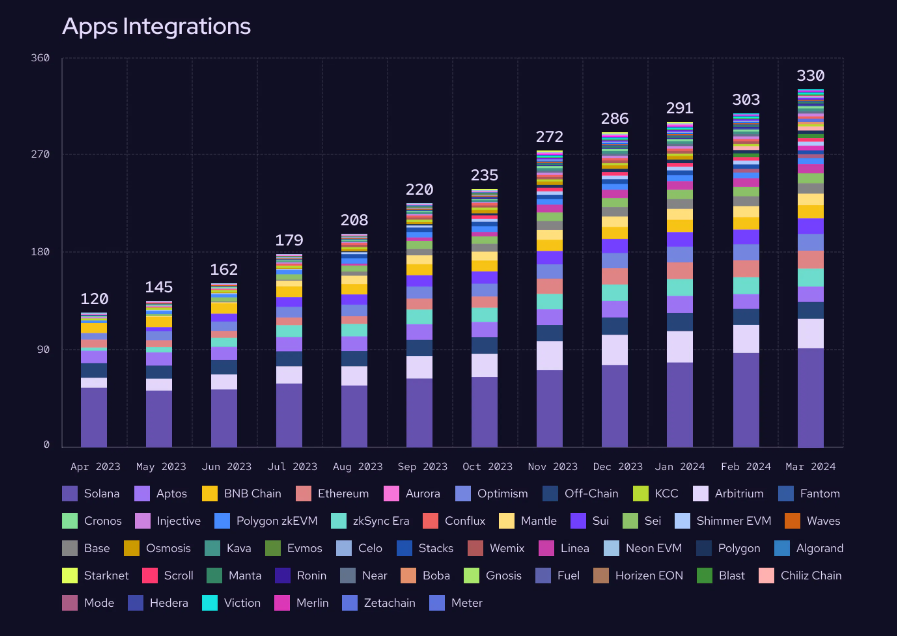

Pyth Network has integrated with over 330 Web3 and Web2 applications. This figure indicates user growth of at least 175% TTM.

“Identified” reflects the permissionless nature of integration with Pyth price feeds. True to Web3’s ethos, any protocol can leverage Pyth’s price data without contacting a sales team. In other words, any application can be powered by Pyth without Pyth contributors even knowing. Therefore, application integration counts remain conservative estimates.

Unifying the on-chain world

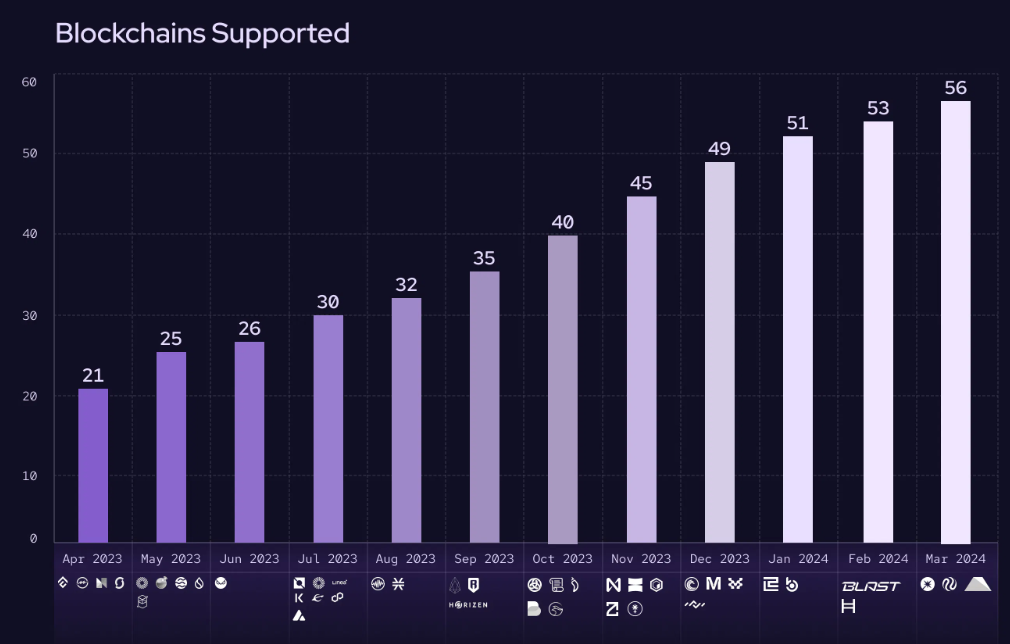

Pyth Network leads this mission, serving 56 blockchains and ensuring continuous, reliable access to hundreds of low-latency data sources on each chain.

Over the years, Pyth contributors have observed consistent vision among smart contract developers: a seamless experience that abstracts away today’s fragmented liquidity, blockchain interoperability challenges, and complex service access.

Pyth’s cross-chain oracle approach allows DeFi applications to focus on delivering optimal user experiences without worrying about their chosen blockchain. This is a crucial first step toward bringing DeFi to where it needs to go: mainstream adoption and invisibility, powering what matters in our daily lives.

Volume hits record highs

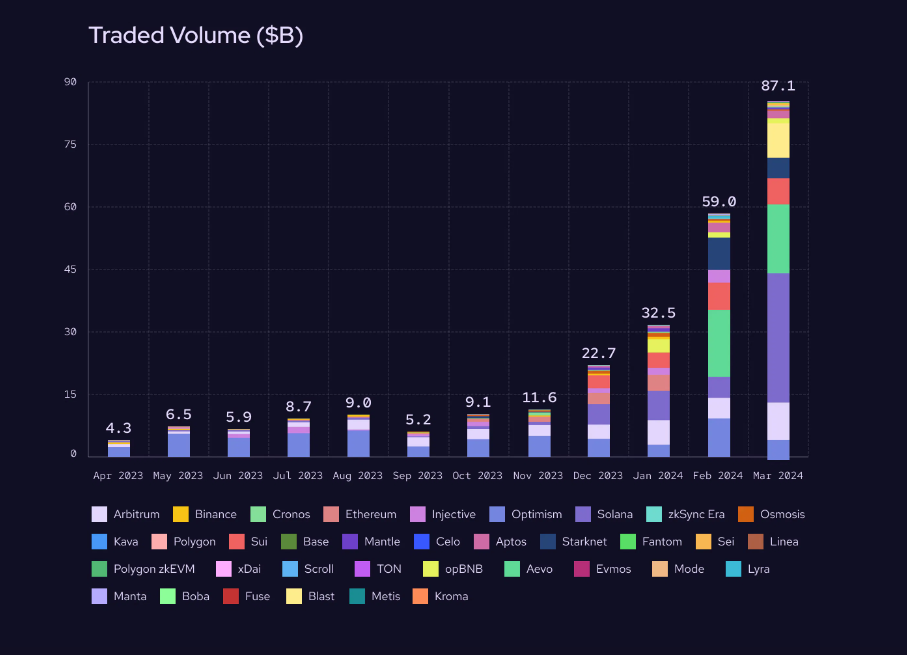

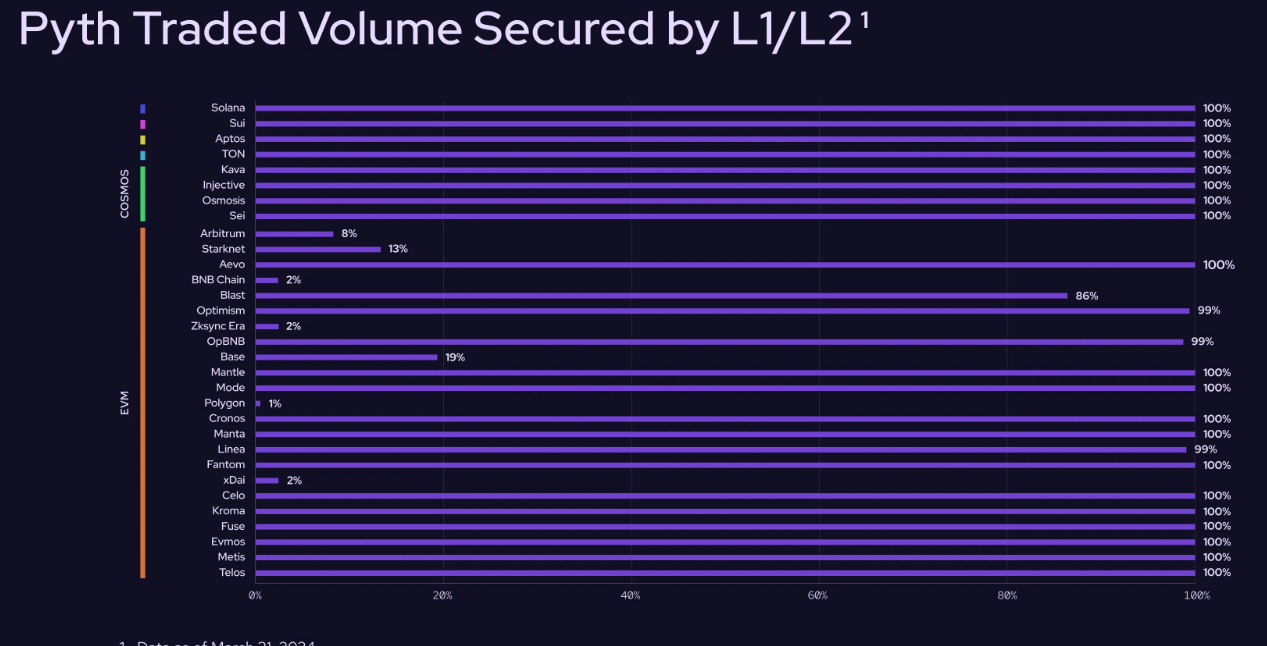

Total volume secured by Pyth oracle data is another strong metric for tracking usage and adoption. In early April, Pyth Network surpassed $300 billion in cumulative volume secured over the lifecycle of the oracle protocol.

March was an exceptionally active month for Pyth-powered applications, especially within the Solana, Arbitrum, Optimism, and Blast ecosystems. That month alone, Pyth oracles secured $87 billion in volume.

Value secured by Pyth

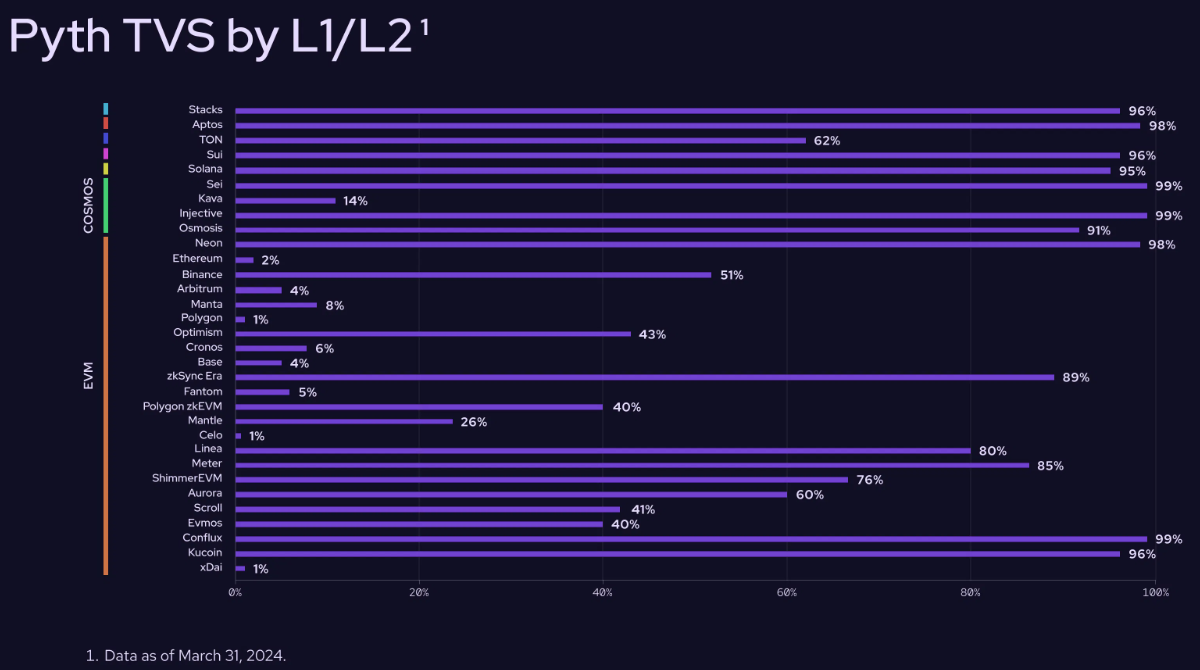

Total Value Secured (TVS) is the oracle-driven subset of a smart contract’s Total Value Locked (TVL). TVS primarily tells the story of lending and pool-based operations. In March, Pyth Network’s TVS exceeded $7 billion. The continued growth of Pyth-powered TVS signals DeFi’s resurgence as an industry heading into what appears to be the next bull market, along with growing appeal of Pyth price feeds beyond DeFi in perpetuals and trading.

Your new oracle choice

However, Total Value Secured (TVS) as a standalone metric does not reflect actual oracle growth due to its contextual nature. For instance, if TVL grows due to macro factors, oracle TVS should rise proportionally.

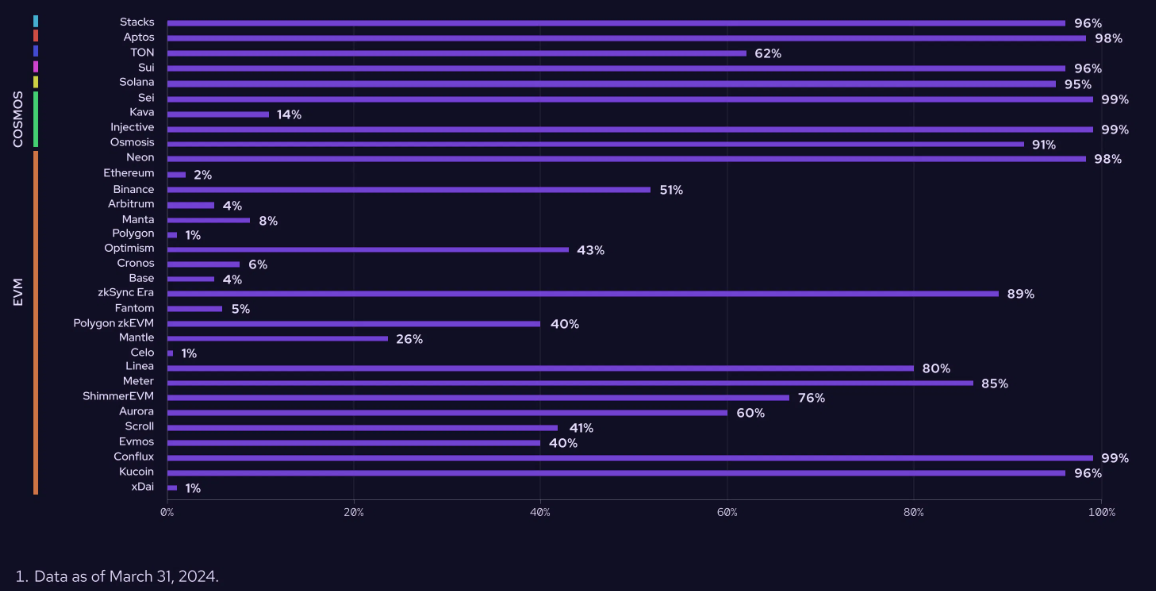

The Pyth TVS by L1/L2 chart above adds crucial context: the total value secured (oracle-driven TVL) on any given blockchain offers an alternative proxy for oracle market share. Consider Pyth Network’s dominance in TVS across chains—from the Move ecosystem (Aptos and Sui) to Cosmos (Sei, Injective, and Osmosis), to ZK chains like zkSync and Linea. On these chains, Pyth oracles secure the vast majority of locked value in applications, demonstrating Pyth as the preferred oracle in these ecosystems.

Yet TVS only tells one side of the growth story. Pyth Network’s low-latency and high-fidelity data capabilities make it the preferred oracle for many derivative applications, which typically generate massive volumes but do not reflect high TVL. Thus, looking at the percentage of overall transaction volume secured over a given period reveals Pyth’s dominance across more blockchains.

The chart above highlighting volume secured on L1/L2 underscores Pyth as the first and primary oracle provider in several DeFi ecosystems. In other words, on certain blockchains, Pyth is the leading DeFi oracle supporting transaction-based activity. This leadership is visible in the Cosmos and Move worlds, as well as high-throughput alternative L1s and L2s such as Injective, Linea, Mode, and Fantom.

All of DeFi is calling Pyth

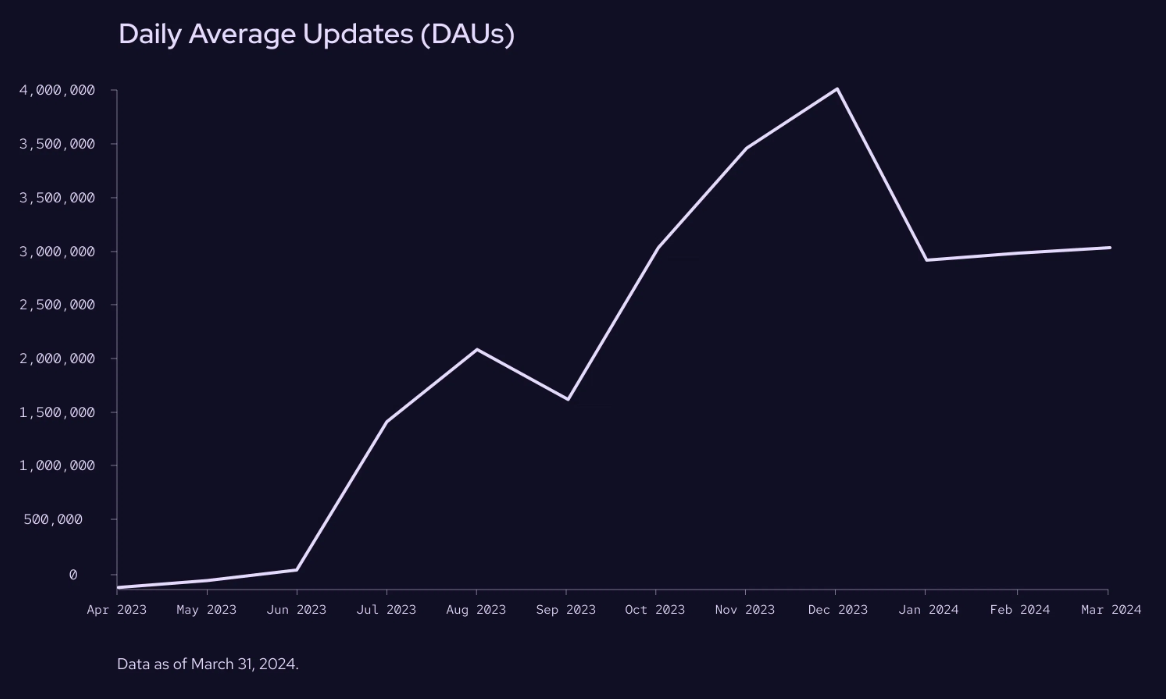

Pyth data providers transmit price data to the Pythnet appchain every 400 milliseconds. Whenever users want to use a price update and verify its origin from Pythnet, they pay a small on-chain fee to pull that price into their environment for everyone to use.

The number of price update requests—or pulls—offers insight into overall DeFi industry activity and specific blockchain ecosystem dynamics. The chart above shows average daily price updates (DAU) reaching approximately 3 million. While oracle update fees are currently minimal, Pyth governance can vote on their size and denomination. Revenue generated by the Pyth protocol currently resides on-chain; collective governance will determine the next steps.

More data sources

Pyth Network now offers over 500 real-time price feeds covering digital assets, forex pairs, metals, equities, and exchange-traded funds. More data sources mean protocol developers can launch more markets and features.

The community continues to request additional assets, including those not yet available on-chain. For example, providing price feeds for traditional assets such as energy, agriculture, or even government bond yields could unlock portfolio diversification strategies on-chain to meet the needs of sophisticated participants.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News