SAGA Economic Model Explained: The Path to Affordable Blocks

TechFlow Selected TechFlow Selected

SAGA Economic Model Explained: The Path to Affordable Blocks

The essence of SAGA's business model is distributing blockspace to downstream demanders, and the key issue lies in pricing. SAGA employs a unique "musical chair pricing" mechanism for this purpose.

Author: 0xLoki

At its core, SAGA's business model revolves around distributing blockspace to downstream demanders, with a key challenge being how to price it. To address this, SAGA employs a unique "musical chairs pricing" mechanism:

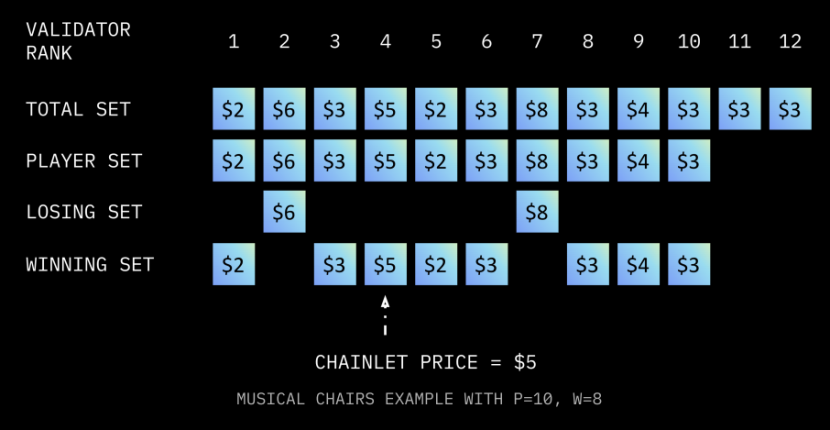

(1) Assume there are initially a=12 validators, and SAGA aims to select 8 of them for delegated validation;

(2) First, SAGA selects a certain number of validators into the bidding round based on staking ratio rankings—for example, p=10—thus eliminating the validators ranked 11th and 12th;

(3) The remaining 10 validators then submit bids, which are ranked from lowest to highest. SAGA selects the 8 lowest bidders as delegated validators, with the final price set by the highest among these 8. For instance, validator #2 (bidding $6) and validator #7 (bidding $8) are eliminated, while the remaining 8 qualify and agree to be priced at $5—the highest bid among the winners.

This mechanism may seem complex, but it achieves one primary goal: driving down blockspace prices through competitive pressure to achieve an efficient market-clearing price.

Taking the above case as an example, if validators want to earn rewards, they must ensure they rank within the top 8. The first step is securing sufficient staked amount—similar in principle to EOS’s historical super node model, where there was a stark difference in rewards between the 21st and 22nd nodes.

The second step is qualifying via bidding. From an individual validator’s perspective, whether they bid $0.01 or $5, their payout will still be $5—the market-clearing price. However, bidding $5 carries the risk of disqualification, so each validator has an incentive to bid as low as possible.

Over time, most validators realize this leads to endless downward competition, pushing prices toward zero. Considering operational costs—including opportunity cost of staked tokens—a more sustainable strategy is to bid slightly above one’s actual cost. As a result, the market price converges toward [cost + minimal profit], remaining very low over the long term and continuously eliminating high-cost validators.

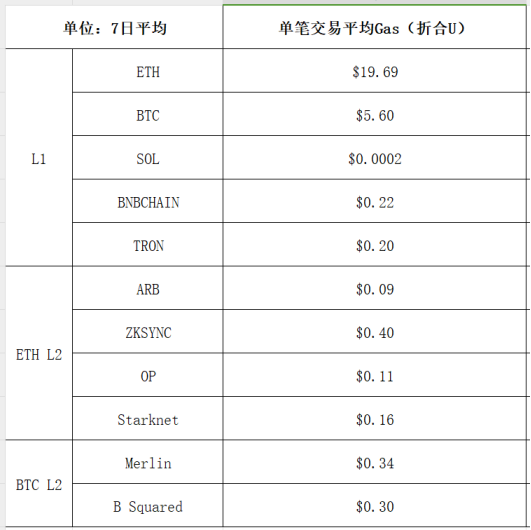

As shown in the chart below, after the Cancun upgrade, ETH L2 transaction fees dropped significantly—but they’re still not cheap enough, especially when compared to Solana. From a technical standpoint, we need the security offered by BTC/ETH; however, from a commercial perspective, mass-market applications simply cannot afford $0.1 per transaction. Hence, achieving "extremely low and stable fees" holds significant value.

Moreover, SAGA’s fee model differs from other public chains: users do not pay network fees directly. Instead, applications can choose their own monetization models—such as subscriptions, one-time purchases, ad-supported services, or even completely free access. This aligns better with Web2 business conventions and offers greater flexibility.

Another interesting observation: SAGA’s incentive testnet, Saga Pegasus, already hosts hundreds of protocols. As of April 1, 2024, the program includes 350 projects, 80% of which are games. Around 10% are NFT and entertainment-related, and another 10% are DeFi. This distribution aligns well with the economic model—SAGA is particularly well-suited for lightweight, high-user-count, high-frequency-use cases.

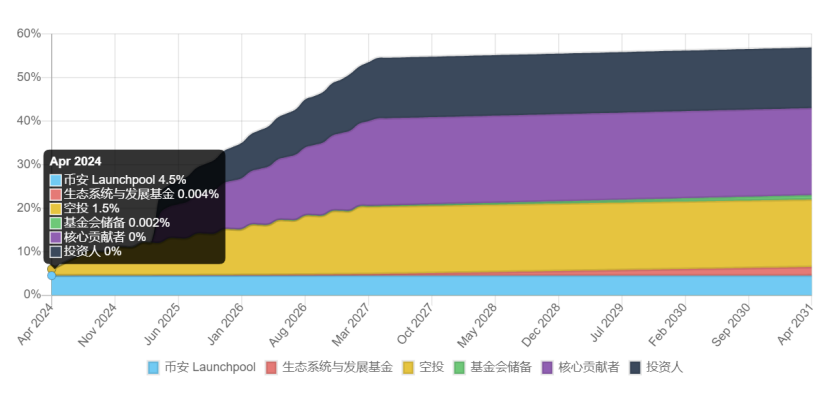

Lastly, token distribution deserves attention. According to Binance's announcement, initial circulating supply consists of only 4.5% from Launchpool and 1.5% from airdrops, with ecosystem and foundation allocations being negligible:

(1) 75% of tokens go to Binance Launchpool, meaning sell-side pressure is very limited;

(2) Only 1.5% of the total 15.5% allocated for airdrops has been distributed, suggesting multiple future rounds are likely. Considering that hundreds of projects remain active on the incentive testnet—many of which may launch their own tokens—SAGA remains worth continued participation post-launch, especially through staking.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News