Bitcoin Ordinals: Potential to Become the Next Blue-Chip NFTs

TechFlow Selected TechFlow Selected

Bitcoin Ordinals: Potential to Become the Next Blue-Chip NFTs

Ordinals could prove to be a win-win for Bitcoin.

Author: 0XSTRUBE

Translation: TechFlow

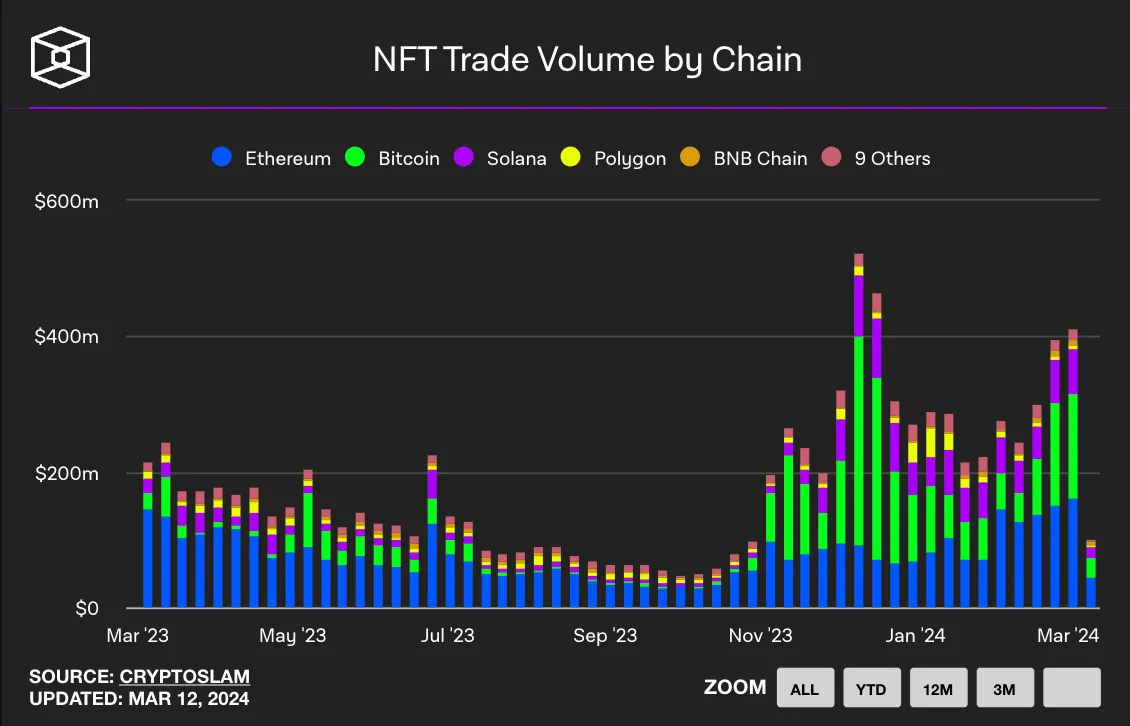

The previous cycle demonstrated significant demand for various types of "profile picture" NFTs. Projects began offering unique value to holders, including exclusive communities, events, and even allocation rights to new projects or airdrops. Ethereum was the first blockchain for NFT trading and collecting. However, other chains like Solana and Polygon started seeing increased NFT activity. The primary reason much of this activity has centered on Ethereum isn't just because it was the first chain to widely adopt NFTs, but also because it (and continues to be) regarded as the most secure NFT chain—until Bitcoin NFTs emerged.

What Are Ordinals?

Enter Bitcoin "NFTs," also known as Ordinals. One bitcoin can be divided into 100 million "satoshis"—in other words, 0.00000001 BTC = 1 satoshi. The Ordinals protocol attaches data to individual satoshis based on their rarity (for example, the first satoshi mined after a halving is rarer than one from a random block). Bitcoin NFTs, called Ordinals, store metadata directly on the Bitcoin blockchain. In this way, these NFTs arguably have a fair claim to being hosted on the most secure and decentralized blockchain available, with NFTs truly stored on-chain, unlike many other platforms.

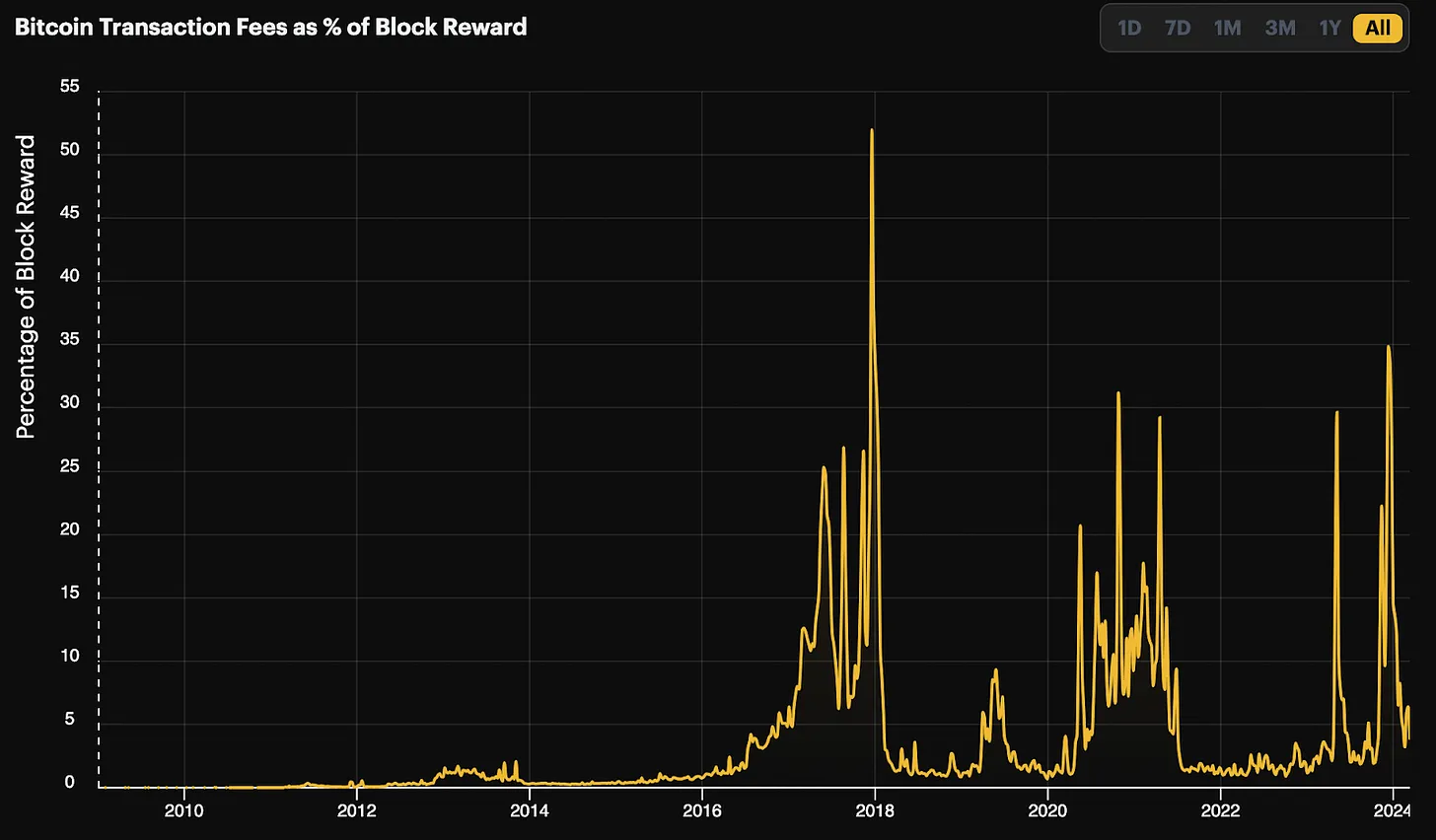

The Ordinals protocol, which introduced the concept of storing data on Bitcoin, launched in January 2023. However, it wasn't until late 2023 that people began seriously experimenting with data, and Bitcoin NFTs truly took off. The chart below shows a notable increase in Bitcoin blockchain activity at the end of 2023, coinciding with rising data usage. Fees now represent the highest proportion of total block rewards since late 2017.

Shifting Landscape of the NFT Market

As Bitcoin’s price continued rising throughout 2023 and the likelihood of ETF approval increased, Ordinals really began to gain momentum. Market participants observed how Ethereum NFTs performed exceptionally well in the prior cycle due to high collector demand and limited supply. Additionally, the wealth effect from rising prices benefited early Bitcoin holders the most. Consequently, speculation grew that Bitcoin whales would start buying Ordinals similarly to how Ethereum whales purchased Ethereum NFTs like CryptoPunks and Bored Ape Yacht Club. Increased experimentation with Bitcoin data and speculation around Bitcoin Ordinals led to a growing share of NFT trading activity occurring on Bitcoin (shown by the green portion in the chart below).

Popular Ordinals Collections

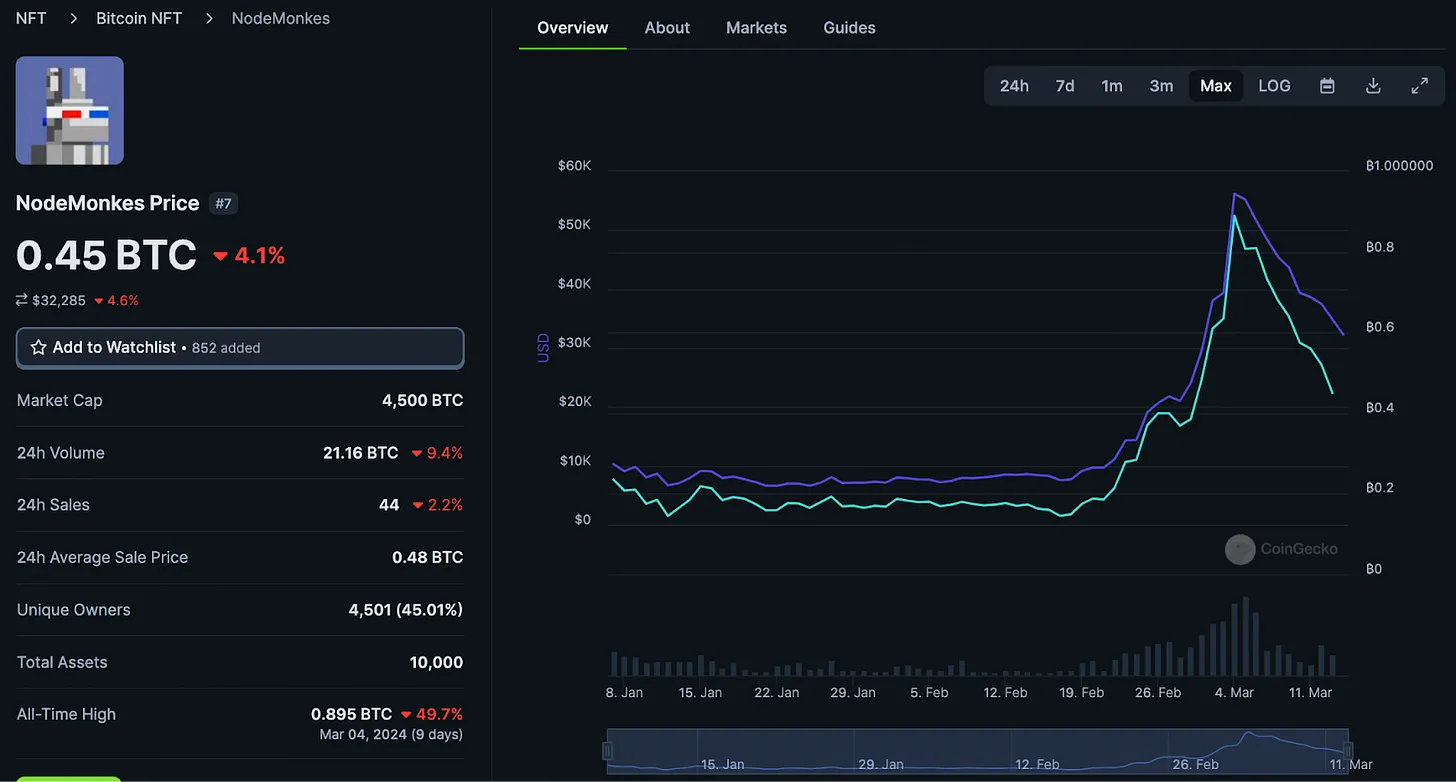

NodeMonkes

Ordinals evolved from relative obscurity to one of the most popular NFTs, both in terms of trading volume and floor price. Some top collections were only launched at the end of 2023, just weeks before Bitcoin ETFs began trading. The most prominent "blue-chip" Ordinals NFT is NodeMonkes, which has seen substantial appreciation in Bitcoin-denominated value amid BTC's broader rally.

NodeMonkes were inscribed on Bitcoin in February 2023 but weren’t officially launched until December 2023, when the Ordinals ecosystem had matured further. They were the first 10,000-piece PFP (profile picture) collection launched, hence their high floor price. NodeMonkes were released via a Dutch auction, concluding at 0.03 BTC, slightly over $1,000 at the time. The following week, in early January 2024, Gordon Goner, co-founder of the popular NFT collection Bored Ape Yacht Club, expressed support for NodeMonkes and Ordinals by purchasing a rare duck-themed NodeMonke. This sparked interest in NodeMonkes and Ordinals broadly, driving up trading volumes as many were still unfamiliar with the technology. At the time of writing, the NodeMonkes floor price has increased more than 15x in BTC terms.

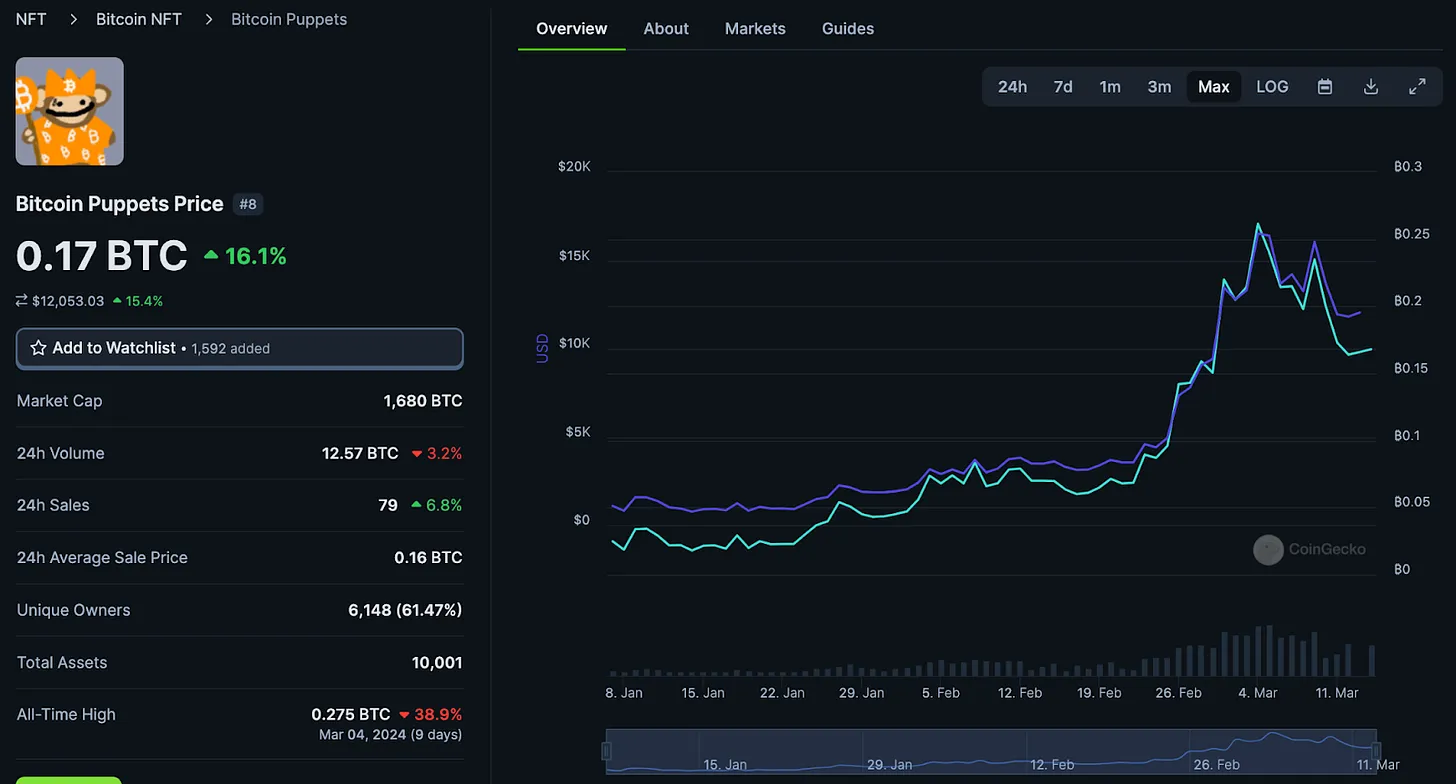

Bitcoin Puppets

Another popular project is Bitcoin Puppets, launched around the same time as NodeMonkes. Bitcoin Puppets feature artwork created using Microsoft Paint, embracing the grassroots nature of cryptocurrency. Their whitepaper makes no mention of roadmaps, promises, or guarantees, instead fully embodying meme culture rather than fundamental utility. The community is strong, and the collection has become the second-largest PFP collection on Bitcoin by market cap, trailing only NodeMonkes.

Other notable projects include Quantum Cats and Bitcoin Frogs, along with numerous others continually emerging. Details about these projects are a topic for another discussion. However, I want to emphasize how quickly Bitcoin Ordinals have emerged to become among the highest-volume and most valuable NFT collections. If BTC experiences massive inflows driven by ETF adoption and a subsequent price surge, top-tier Ordinals collections could become extremely valuable—just as top Ethereum collections did during ETH’s historic rally in 2021.

Could top Bitcoin Ordinals collections reach floor prices of $400,000 or higher, similar to Punks and BAYC? Only time will tell.

Note on Bitcoin Activity and Sustainability

There's an ongoing debate about how Bitcoin can remain sustainable once block rewards become insignificant after multiple halvings. Miners must be incentivized to continue operating and securing the network. As BTC issuance inevitably declines, transaction fees may become a crucial driver of miner revenue and profitability. Yes, this could make the Bitcoin blockchain expensive for everyday transactions and average users. However, a thriving "Layer 2" ecosystem on Bitcoin may solve this issue, with new projects actively working on solutions. Ordinals could prove to be a win-win for Bitcoin—increasing miner fee income in the medium to long term while providing critical infrastructure for data storage, enabling NFTs to exist on the most immutable and censorship-resistant chain available.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News