Analyzing Nervos Network, a UTXO-isomorphic Bitcoin L2

TechFlow Selected TechFlow Selected

Analyzing Nervos Network, a UTXO-isomorphic Bitcoin L2

This article primarily introduces the product features, ecosystem development, and token economic model of Nervos Network, a UTXO-isomorphic BTC L2.

Authors: duoduo, Alfred

1. A Brief Classification of BTC L2

The rise of BTC L2 is an unavoidable narrative in this market cycle. BTC L2 encompasses at least two aspects: first, offchain solutions that are not on the BTC chain but have some form of connection to it—such as merged mining based on shared consensus algorithms or asset bridging. Second, providing capabilities beyond those of the Bitcoin chain itself, primarily in three areas: performance optimization, programmability, and privacy. Not all projects achieve all three simultaneously; different projects and development stages emphasize different aspects. Currently, most BTC L2s focus on performance optimization and programmability, aiming to deliver faster applications and enrich the Bitcoin ecosystem.

Current Bitcoin L2 approaches broadly include state channels (e.g., Lightning Network), sidechains (e.g., Liquid, Merlin), rollups (e.g., Rollkit), and client-side validation (e.g., RGB, RGB++, Taro).

They can also be categorized into two major camps based on whether their underlying architecture is isomorphic with BTC:

-

UTXO Camp: Projects derived from the UTXO model, such as Nervos Network;

-

EVM Camp: Examples include Merlin and B², which are currently gaining traction through staking-based airdrops.

This article focuses on introducing the product features, ecosystem development, and tokenomics of Nervos Network—a BTC L2 built on UTXO isomorphism.

2. Team and Funding

The founding team of Nervos Network has deep industry experience.

Chief Architect Jan Xie: Previously contributed extensively to Ethereum clients Ruby-ethereum and pyethereum, and collaborated with Ethereum founder Vitalik Buterin on Casper consensus and sharding research. He also founded Cryptape, a company focused on foundational blockchain platform development and consensus algorithm research.

Co-founder Kevin Wang: Worked at IBM’s Silicon Valley Lab on enterprise data solutions and co-founded Launch School, an online school for software engineers. Kevin is also a co-founder of Khalani, an intent-driven centralized solver infrastructure.

Co-founder and COO Daniel Lv: Co-founder of the Ethereum wallet imToken and former CTO of cryptocurrency exchange Yunbi. Additionally, Daniel organized the Ruby China community for 10 years and co-founded ruby-china.org.

In August 2018, Nervos Network raised $28 million in funding, with participation from Polychain Capital, Sequoia China, Wanxiang Blockchain, and Blockchain Capital. On October 16, 2019, Nervos conducted an ICO on CoinList, raising $72 million.

3. Core Product Features

Launched in November 2019, Nervos Network uses Proof-of-Work (PoW) consensus and the UTXO model, making it isomorphic with Bitcoin. CKB has accumulated extensive development in security, extending Bitcoin's programmability, technical depth, and ecosystem growth. Since inception, the project has focused on building a high-performance public chain based on PoW+UTXO—an approach well-aligned with the current BTC L2 trend.

3.1 PoW: Hashrate Doubled Since Late 2023

The Nervos team believes PoW surpasses PoS in decentralization and security. Forging or reconstructing a PoW chain requires re-computing every block’s proof, making it extremely difficult. Therefore, the base layer uses a fully permissionless PoW mechanism—users only need mining hardware and electricity to participate in block production.

Nervos uses the Eaglesong mining algorithm. Common ASIC miners include Antminer K7, Goldshell CK6, and Toddminer Como. The chart below shows Nervos Network’s hashrate growth. After a dip in 2022, hashrate has rebounded and doubled since late 2023, indicating capital inflow into mining.

Currently, CKB ranks eighth in mining profitability on f2pool.

3.2 Cell Model: Security and Scalability

The Cell is the fundamental data structure in Nervos. Data within a Cell can take various forms—CKBytes, tokens, JavaScript code, or serialized JSON strings—offering developers maximum flexibility.

In the Cell model, all digital assets (e.g., CKB, tokens, collectibles) are treated as exclusive property and responsibility of their owners. While transactions must comply with smart contract rules, the assets themselves belong to users—not contracts. Even the smart contract defining a token holds no authority over it. This means attackers cannot access user assets even if they exploit vulnerabilities in contract code, significantly enhancing asset security.

Building on this, the Cell model introduces programmability via smart contracts. Specifically, it abstracts the nValue field in UTXO—which represents token value—into two fields: capacity and data. The data field stores state and can hold arbitrary information. Additionally, each Cell contains LockScript and TypeScript fields: LockScript defines ownership, while TypeScript enables customizable logic and advanced functionality.

3.3 RGB++ Protocol: Contract Expansion and Performance Boost

RGB++ is an extension of the RGB protocol, leveraging one-time seals and client-side validation to manage state transitions and transaction verification. It maps Bitcoin UTXOs to Nervos CKB Cells via isomorphic anchoring, using script constraints on both CKB and Bitcoin chains to verify correctness of state computation and validity of ownership transfers.

RGB++ addresses technical challenges faced by the original RGB protocol and unlocks new possibilities such as blockchain-enhanced client validation, transaction folding, shared state for ownerless contracts, and non-interactive transfers.

RGB++ inherits the core principles of RGB but employs different virtual machines and validation schemes. Users do not need a dedicated RGB++ client—by connecting to lightweight nodes on Bitcoin and CKB, they can independently perform full validation. RGB++ brings Turing-complete contract capabilities and performance improvements to Bitcoin, without relying on cross-chain bridges, instead ensuring security and censorship resistance through native client-side validation.

3.4 Spore Protocol: Upgraded Ordinals

In mid-March 2024, JoyID Wallet, a project in the Nervos ecosystem, officially launched the first UTXO-based orderbook marketplace—Spore DOB Marketplace—and opened trading for its first DOB asset, Unicorn Box. Unicorn Box was an airdrop to community members; claims have ended. Minting required 340 CKB, and the current floor price is 71,800 CKB—a 200x increase.

DOB (Digital Object) refers to cryptographic assets issued via the Spore protocol on the CKB blockchain. DOBs created through Spore are immutable, fully stored on-chain, and establish an intrinsic link between content and value.

If CKB is seen as an upgraded version of Bitcoin, then Spore is an upgraded version of Ordinals. Its key features are as follows:

First, supports multiple content types including video, audio, and text, giving creators more expressive freedom.

Second, content is fully stored on-chain, making DOBs complete digital assets. In contrast, traditional NFTs typically store only metadata links on-chain, with actual content hosted off-chain.

Third, minting a DOB requires spending CKB as "raw material." The amount of CKB used determines the on-chain storage space allocated. Destroying a DOB returns the occupied CKB, effectively reducing circulating supply of CKB among holders. Thus, holding Spore DOBs equates to locking up CKB.

Fourth, fee-free transactions. When minting a DOB via Spore, an extra 1 CKB is deposited by default. Under normal network conditions, this 1 CKB can cover miner fees for over 7,000 on-chain transfers, enabling essentially zero-fee transactions afterward—greatly improving user experience and aiding user acquisition.

Fifth, free movement across different UTXO chains. According to current plans, the RGB++ protocol will launch by end of March, allowing DOBs issued on CKB to leap to the Bitcoin mainnet via RGB++ Leap, becoming digital objects on Bitcoin.

4. Ecosystem Development

The Nervos Network ecosystem is taking shape, encompassing wallets, cross-chain bridges, DID, DeFi, and other projects. However, there are few well-known projects so far, and no breakout hits have emerged yet.

As a BTC L2, the primary challenge lies in enhancing utility for dormant BTC assets and unlocking liquidity. In this regard, Nervos is still in early stages.

According to community updates, the RGB++ protocol is scheduled to launch at the end of March or early April, bringing new use cases and enriching the ecosystem.

The ecosystem project Nervape recently completed a snapshot and released a whitelist. Its DOBs launching in early April will be directly issued on the Bitcoin chain.

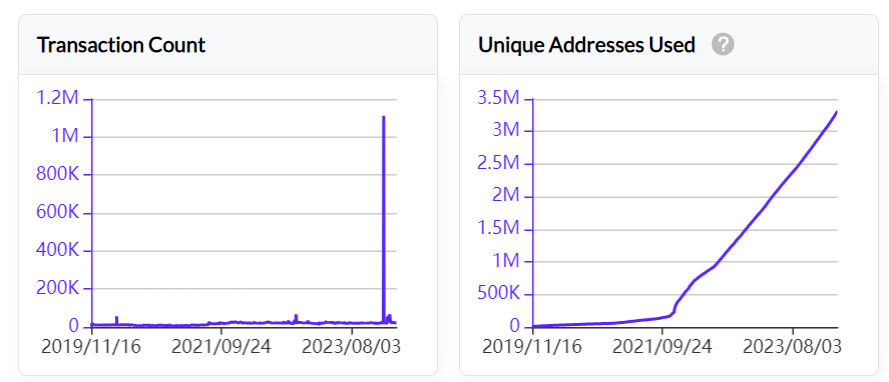

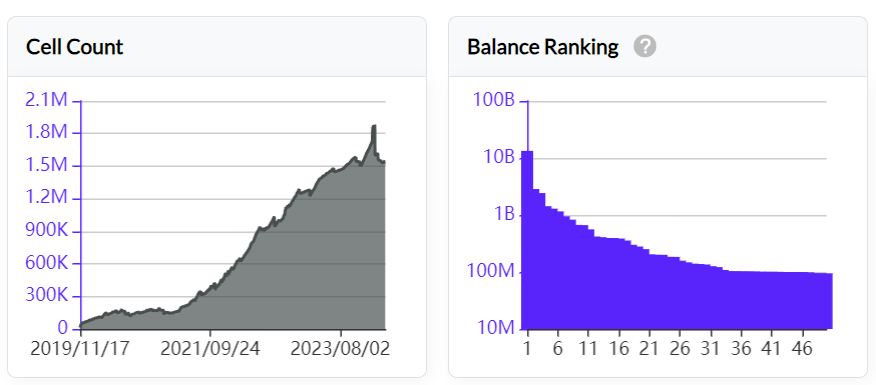

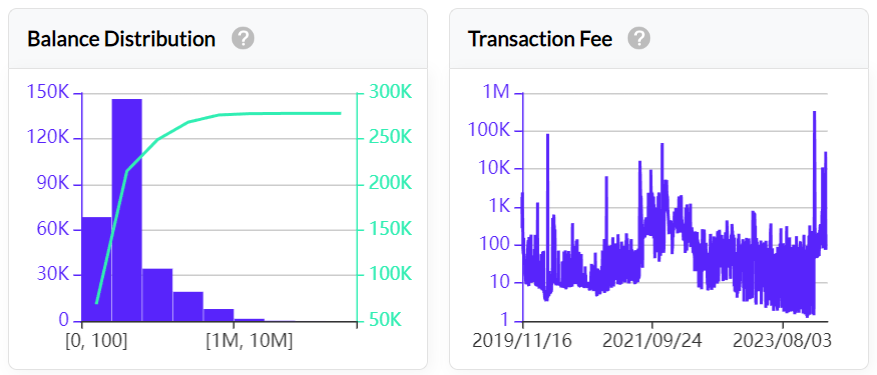

On-chain data shows growing transaction volume, with peak interaction levels seen in early 2024. Independent addresses and Cell counts continue to rise. Transaction fee revenue increased notably by the end of 2023. Overall, on-chain metrics show clear growth and rising activity.

5. Token Economics

5.1 Token Allocation and Release

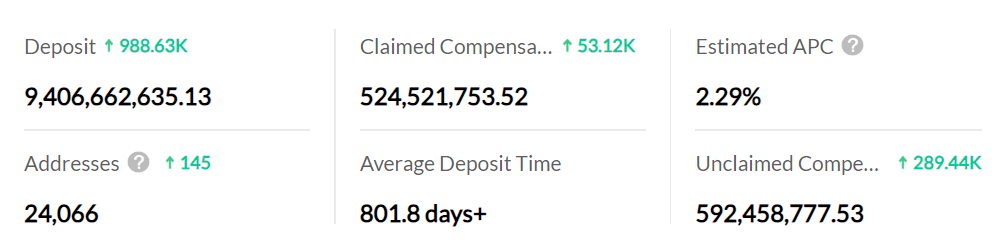

Currently, the total supply of CKB is 44.5 billion, with 43.8 billion in circulation and 9.4 billion locked in NervosDAO.

The initial supply of CKB was 33.6 billion tokens, of which 8.4 billion have been burned, leaving an actual supply of 25.2 billion distributed to investors, team, and ecosystem funds—all now fully unlocked.

CKB is an inflationary token, with inflation coming from two sources:

First, mining inflation, entirely allocated to miners. The emission schedule mirrors Bitcoin, halving every four years until reaching zero. The first four years saw 4.2 billion new CKB annually. The first halving occurred in November 2023, reducing annual issuance to 2.1 billion CKB. The second halving is expected in November 2027, further reducing issuance to 1.05 billion CKB per year.

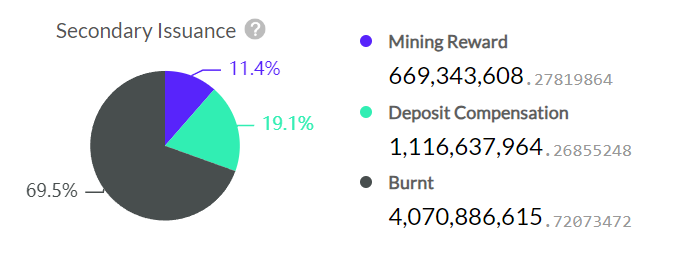

Second, a fixed annual secondary issuance of 1.344 billion tokens. These tokens are used for: incentivizing miners (as state rent for users storing data on-chain); rewarding NervosDAO depositors (users locking CKB in DAO); and treasury funding (based on liquid CKB not used for storage). Tokens allocated to the treasury are subsequently burned.

The current distribution is shown below. Approximately 5.77 billion CKB come from secondary issuance, of which 69.5% are burned, leaving about 1.77 billion entering circulation.

Based on this, approximately 2.5 billion new CKB will be issued in the coming year, resulting in an annual inflation rate of around 5.7%, which is moderate.

5.2 NervosDAO Staking

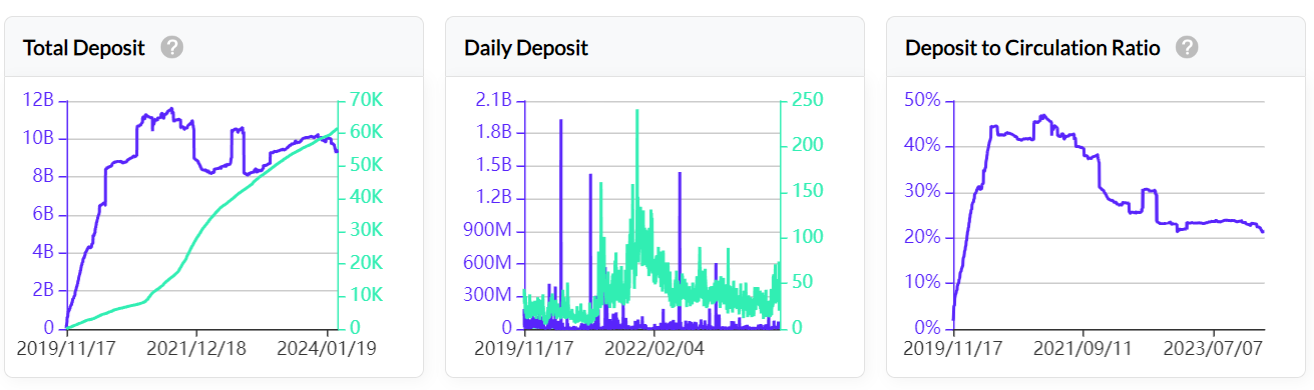

NervosDAO currently locks about 9.4 billion tokens, roughly 21% of total circulation, with an average deposit duration of around 800 days, indicating long-term holding. Current staking yield is low at only 2.29%, limiting its attractiveness.

Historically, during the 2021 bull market, peak lockups reached about 12 billion tokens, later dropping to a low near 8 billion. Overall, holdings remain relatively stable. Since late 2023, new deposits have increased. However, the staking-to-circulating ratio has generally declined, suggesting new users and tokens are not flowing into staking.

5.3 Token Distribution

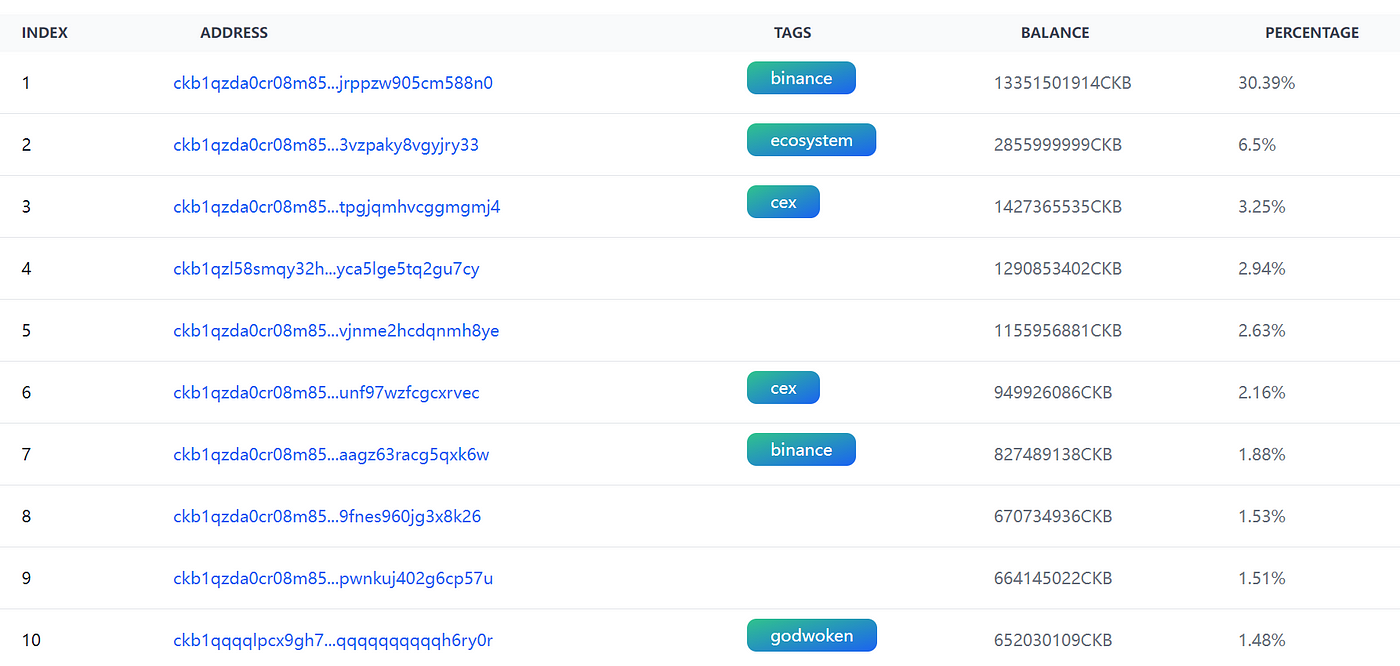

CKB token distribution is highly concentrated. There are approximately 270,000 addresses holding CKB on-chain, with the top 100 addresses controlling 76.93% of the supply, and the top 10 holding 54.28%. Binance alone holds over 32% of the total supply.

Among the top 10 addresses, excluding exchanges, four are unlabelled. The fourth-largest address began accumulating in May 2023 and has continuously received funds, with the latest transfer on March 25, 2024, and has not participated in staking. The fifth-largest address started in May 2023 with a single deposit, also not staked. The eighth-largest was established in 2021 with one deposit, fully staked. The ninth-largest was created on March 22, 2024, and has not staked.

6. Conclusion

Nervos Network is a PoW+UTXO isomorphic public chain launched in 2019, now positioned as a BTC L2. The team has strong technical expertise, and the product brings innovation in programmability and scalability. Since 2024, it has introduced concepts like RGB++ and DOB, aligning well with current BTC L2 narratives.

The ecosystem is nascent but showing decent community engagement. As a BTC L2, its focus should be on enabling easier BTC applications and unlocking BTC asset liquidity. With RGB++ scheduled to launch at the end of March or early April 2024, and ecosystem projects like Nervape planning to issue DOBs directly on the Bitcoin chain, these developments may catalyze growth in Bitcoin-native assets.

The CKB token is inflationary. Initially issued tokens are now fully circulating. Annual inflation comes from two sources: PoW mining rewards and fixed secondary issuance, part of which is burned when allocated to the treasury. Combined annual inflation is approximately 5.7%. Excluding exchange addresses, the top holders show net inflows, with new addresses accumulating CKB since 2023, though not participating in staking.

Overall, Nervos Network has solid fundamentals. Key indicators to monitor include changes in token staking, ecosystem progress, scale of adoption, and market sentiment.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News