Taking FTM as an example, how can we track trending narratives in the market in real time?

TechFlow Selected TechFlow Selected

Taking FTM as an example, how can we track trending narratives in the market in real time?

The value of FTM as an asset and as an ecosystem is severely underestimated.

Author: Aurelian & Crypto Ramesses

Translation: TechFlow

If you're active on crypto Twitter, you may have recently noticed growing chatter about Fantom ($FTM). Fantom is an Ethereum Virtual Machine-compatible Layer 1 blockchain and one of the so-called "Ethereum killers."

You might have just observed that FTM’s price has been performing well, prompting the question: Why is FTM rising? Tracking bullish narratives in the cryptocurrency market is crucial for investors seeking to capitalize on emerging trends. At present, Fantom represents a particularly hot narrative.

Today, then, let’s conduct a real-time case study to understand what's happening with Fantom and show you how to execute this kind of analysis for any project.

Here's an overall outline:

-

Fantom Timeline

-

Learning How to Investigate a Narrative

-

Fantom Ecosystem and Opportunities

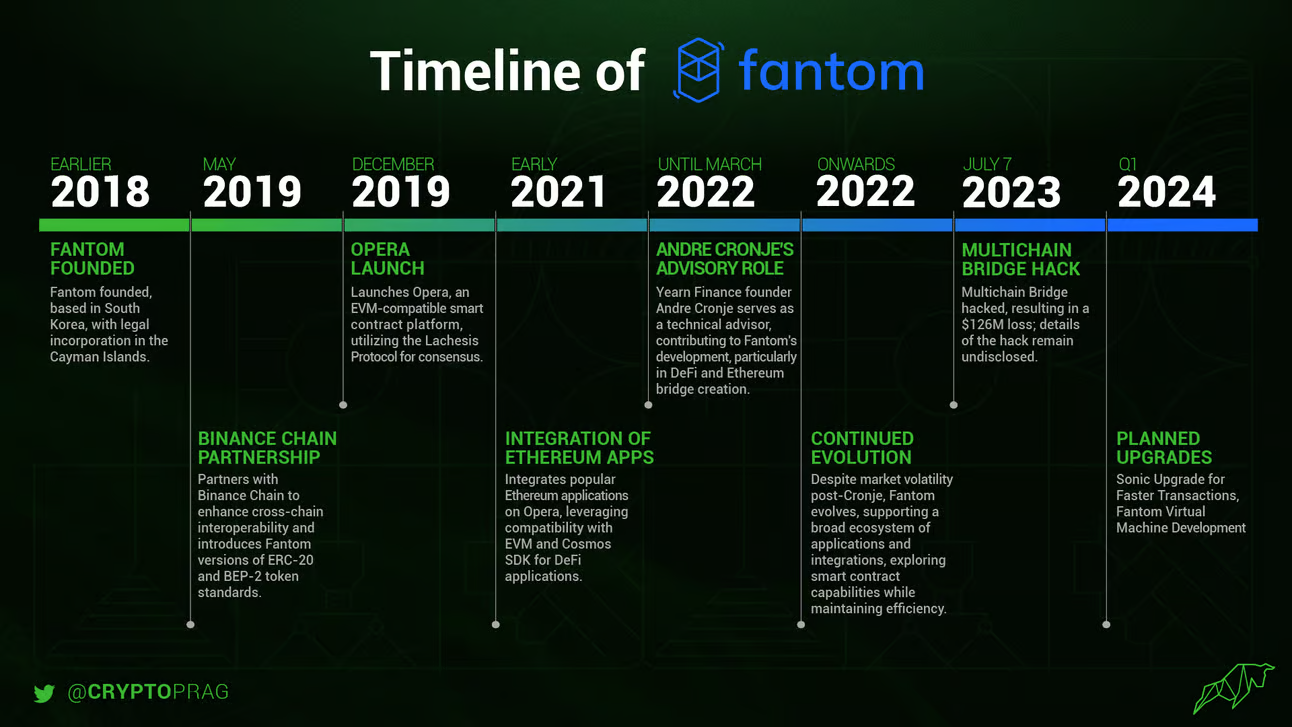

Fantom Timeline

Fantom suddenly became a very hot narrative due to its Sonic upgrade. In the following sections, we'll explore how to analyze such emerging narratives to inform your investment decisions.

How to Investigate a Narrative

Step 1: Monitor Crypto Twitter and Other Crypto Platforms

Crypto Twitter and social media play a critical role in spreading crypto narratives, where influencers, developers, and community members share updates and speculation, highlighting emerging trends. Subscribing to reputable media platforms can also alert investors to bullish narratives.

Tools like LunarCrush or CryptoMood can help quantify social sentiment, offering a data-driven approach to tracking narratives.

These platforms provide insights into market sentiment and potential investment opportunities, making them indispensable tools for tracking real-time shifts in narratives across the crypto ecosystem. In this case, we can see that crypto Twitter has been buzzing about Fantom.

Step 2: Identify the Narrative

The next step is identifying the narrative. In Fantom’s case, the focus is on its Sonic upgrade, which is expected to significantly enhance transaction speeds and make developer migration easier through the new Fantom Virtual Machine (FVM). Such upgrades could spark renewed interest and investment in the project, presenting strong potential for substantial price movements.

Step 3: Dive Deep Into the Project

After identifying a bullish narrative, delve into the specifics. For Fantom, this means understanding what the Sonic upgrade entails, including components like the FVM, Carmen database storage, and the optimized Lachesis consensus mechanism.

This stage requires researching the project’s whitepaper, community discussions, and official announcements to grasp the potential impact of the upgrade on both the project’s ecosystem and the broader crypto market.

Step 4: Analyze, Analyze, and Analyze Again

Understanding how the market reacts to the narrative is crucial. Start by examining price action.

FTM’s price surged from $0.394 to over $1 within a month—an impressively sharp rise.

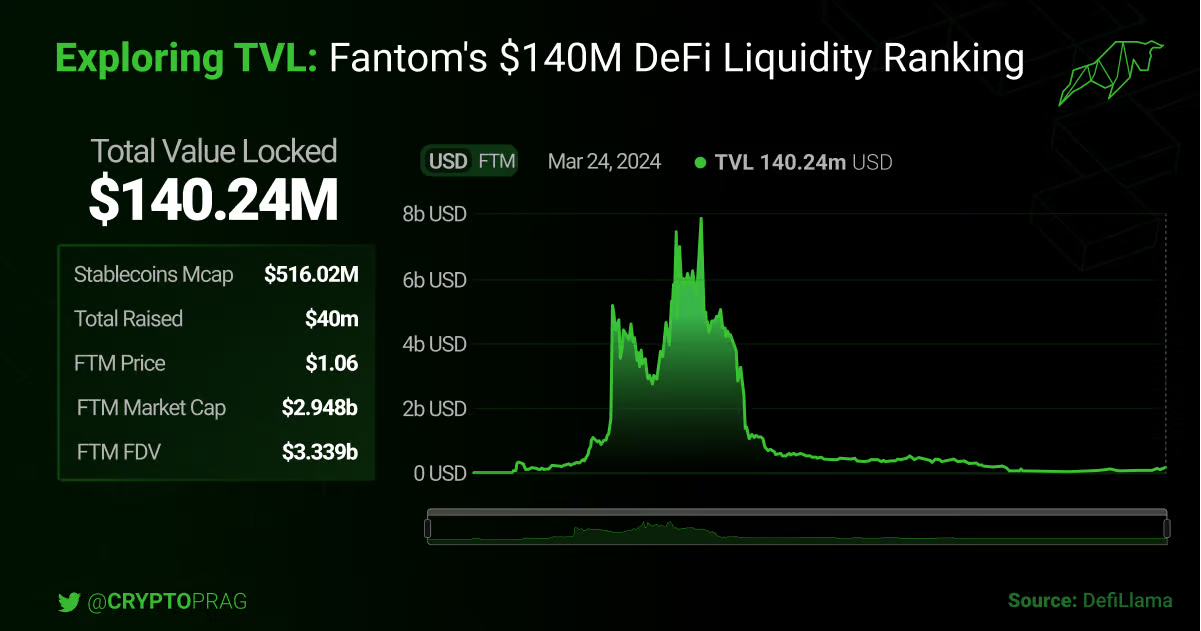

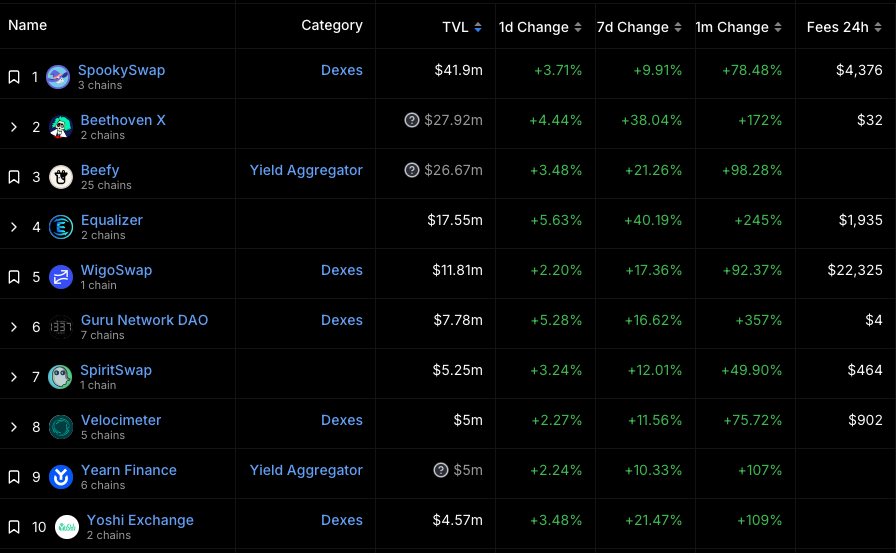

What is TVL? TVL, or “Total Value Locked,” refers to the amount of liquidity locked in DeFi applications. With a TVL of approximately $140 million, it’s not particularly impressive—ranking 32nd among all chains.

In fact, Ethereum alone hosts as many as 49 protocols currently holding more TVL than Fantom! But what about developer contributions?

Compared to its peak, the number of developers and GitHub commits is negligible. By contrast, Solana currently has 32 core developers and 758 commits.

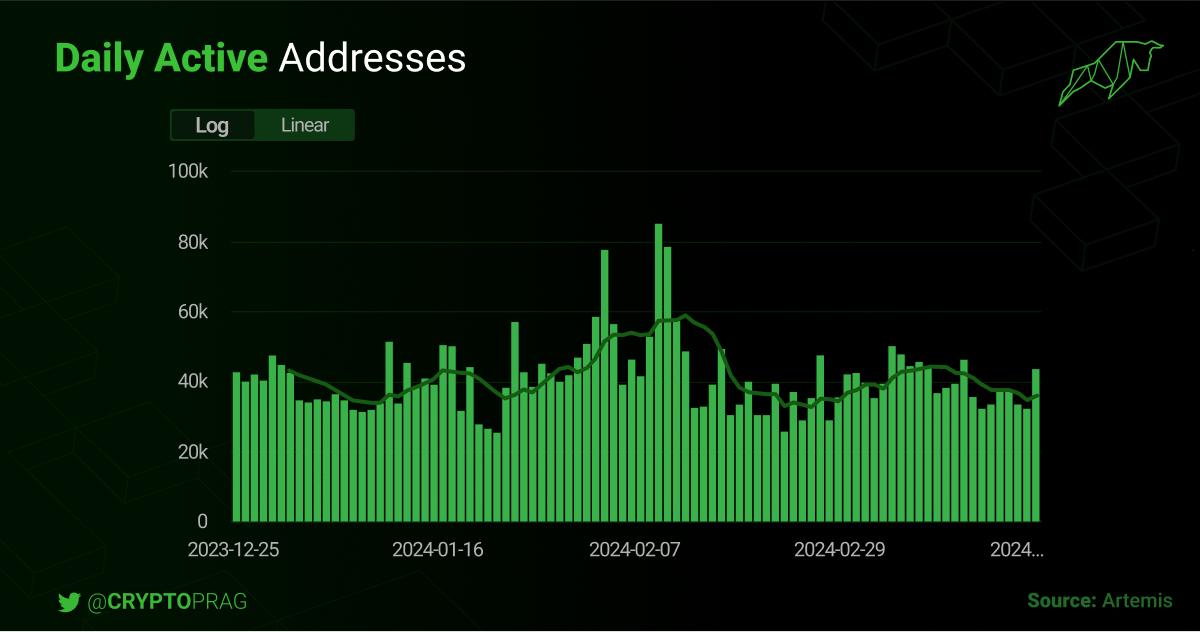

Let’s check additional statistics via the Artemis terminal.

First, let’s examine the number of daily active addresses. As you can see, Fantom averages around 40,000 active addresses. This number has remained stable since Christmas 2023.

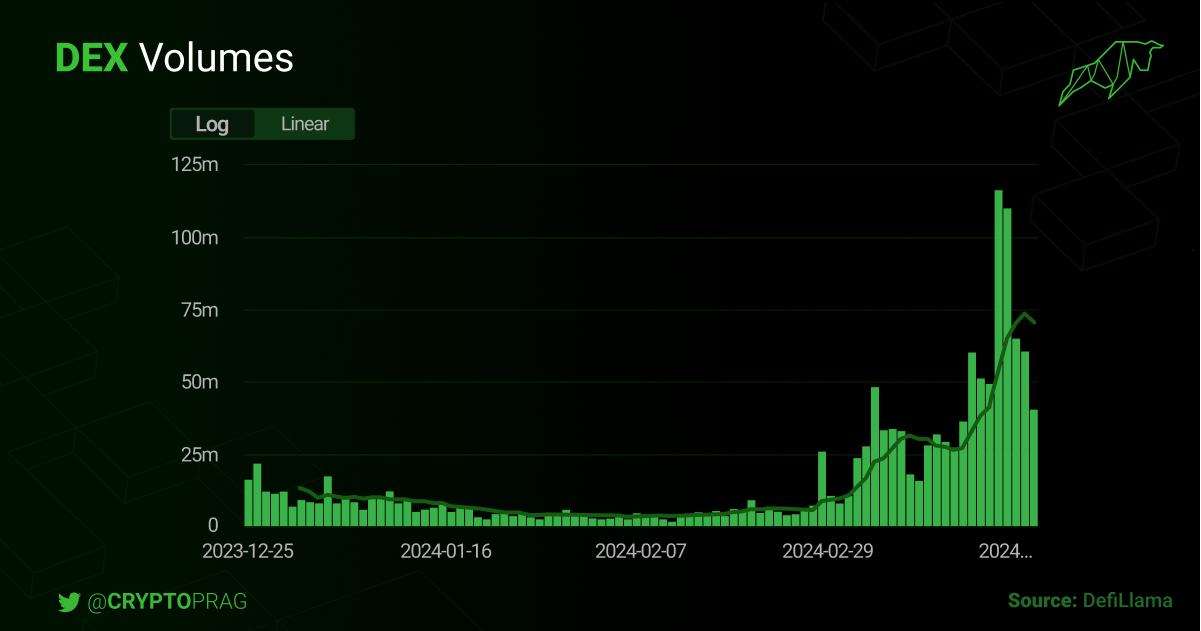

While DEX trading volume on Fantom has increased significantly, it still pales in comparison to competitors. This could imply two things:

-

Fantom lacks significant traction.

-

Fantom still has substantial room to grow—we may be only at the beginning.

Studying so many metrics enables you to do your own research rather than simply listening to the noise.

Step 5: Evaluate Leadership and Community Response

Fantom’s past challenges—including leadership issues and community frustrations—highlight the importance of strong leadership and community engagement in sustaining a project. Andre Cronje, a DeFi expert and founder of Yearn Finance, was one of Fantom’s most prominent figures.

Despite being a genius, Cronje had a notoriously unpredictable temperament. In March 2022, he stepped away from the Fantom Foundation. However, in July 2023, reports emerged suggesting he never fully left Fantom. Regardless, he remains a respected builder whose stance on Fantom could shift based on his mood.

Step 6: Continuous Monitoring

Bullish narratives can evolve rapidly. Ongoing observation of team developments and community reactions is essential. For Fantom, tracking progress toward the mainnet launch of the Sonic upgrade and monitoring community engagement levels are ongoing priorities.

Now that we’ve covered the fundamentals of investigating a new narrative—with a specific focus on Fantom—let’s dive into how to profit from the Fantom protocol.

Step 7: Draw Conclusions

In the final step, synthesize everything you’ve learned and researched to form your conclusions.

In this case, the metrics suggest that Fantom is undervalued compared to its competitors, and its ecosystem is far less developed than others.

However, this might simply mean that FTM as an asset—and the ecosystem as a whole—is severely undervalued.

Fantom Ecosystem and Opportunities

Now that you understand the narrative and have decided to participate, here’s what you need. Fantom has all the features required for a thriving ecosystem. Most wallets easily support Fantom—just add the Fantom chain to your wallet to get started. You can seamlessly add Fantom to your wallet using Chainlist or any chain you wish to interact with.

Wallets

All major wallets—including MetaMask, Trust Wallet, and Atomic Wallet—support the Fantom blockchain. Additionally, Fantom launched its dedicated Fantom PWA Wallet, specifically designed to handle and store FTM tokens. Leading hardware wallet manufacturers like Ledger and Trezor also support these chains, providing enhanced security. Be sure to store your FTM tokens in a hardware wallet for added protection.

Bridges

One of the most effective ways to potentially earn airdrops is by utilizing bridges that have received significant funding but don’t yet have their own token. For example, bridges like Hop reward users for using their services.

Taking advantage of these opportunities is usually straightforward, as users typically need to transfer funds across chains anyway. So why not use bridges rumored to offer airdrops to benefit from actions you were planning to take?

Since the last bull run, cross-chain technology has made significant strides, becoming more cost-effective and user-friendly. Using the bridges discussed in this section, users can bridge to nearly any desired chain and begin participating within minutes.

Squid Router

Squid is a cross-chain router enabling seamless token swaps and interactions across various blockchains. It recently raised $4 million in strategic funding, led by Polychain Capital, with participation from investors including Nomad Capital and North Island Ventures.

This funding aims to support Squid’s expansion within EVM and Cosmos ecosystems and enhance integration with decentralized applications.

Squid has experienced rapid growth, facilitating over 500,000 cross-chain token swaps, LP deposits, and NFT purchases, with total transaction volume exceeding $95 billion and serving over 200,000 users.

Looking ahead, Squid plans to further develop its capabilities to enable more complex transaction sequences and efficient asset routing, while integrating with other interoperability networks.

Given its funding and visibility, the likelihood of receiving an airdrop from Squid is high—especially since it doesn’t yet have a token. Therefore, click here to use Squid to bridge to Fantom.

Jumper

Jumper Exchange, created by LI.FI, aims to revolutionize crypto exchanges by providing comprehensive solutions to challenges users face in multi-chain environments. LI.FI’s vision is to simplify cross-chain transactions and deliver a seamless experience.

Jumper Exchange aggregates liquidity from the largest and best sources—including bridges and decentralized exchanges—into a single interface, supporting 20 chains, 30 DEXs, and over 15 bridge integrations.

With Jumper, users can effortlessly swap, bridge, trade, or transfer tokens, receiving automated routing recommendations based on security, speed, cost, and clicks.

The underlying infrastructure, LI.FI Protocol, has already secured substantial funding totaling $23 million through fundraising rounds involving notable investors such as Coinbase Ventures, DragonFly Capital, and CoinFund.

Although Jumper Exchange doesn’t have its own token, its robust funding and innovative approach make it a platform worth trying—especially given the possibility of future airdrops when bridging to Fantom or other supported chains.

Bungee

Bungee is an innovative bridge aggregator built by the Socket team using SocketLL infrastructure, revolutionizing token transfers across blockchains.

The project has raised $12 million across seed, pre-seed, and strategic rounds, with potential for additional investment.

Bungee boasts an impressive daily trading volume exceeding $75 million and has hinted at the possibility of future airdrops.

Backed by renowned investors such as Coinbase Ventures, Framework, Geometry, Mark Cuban, Folius, and Polygon co-founder Sandeep Nailwal, Bungee offers low-gas bridge capabilities across multiple chains including Ethereum, Polygon, BSC, Avalanche, and Fantom.

Although Bungee does not have its own token, its strong backing and promising future development make it a compelling platform—particularly for users interested in potential airdrops when bridging to Fantom or other supported chains.

It’s important to keep these bridges ready so you can act quickly when opportunities arise. Whether it’s Solana, Base, or Fantom, you need to be prepared to move funds like a crypto pro.

Top DEXs and Applications

Now that you’re familiar with wallets and bridges for accessing the Fantom ecosystem, let’s explore some protocols you can try.

When reviewing the protocols with the highest TVL on Fantom, we see some familiar names like Yearn Finance, along with lesser-known ones. While most of these platforms already have tokens, engaging in liquidity mining could still be profitable.

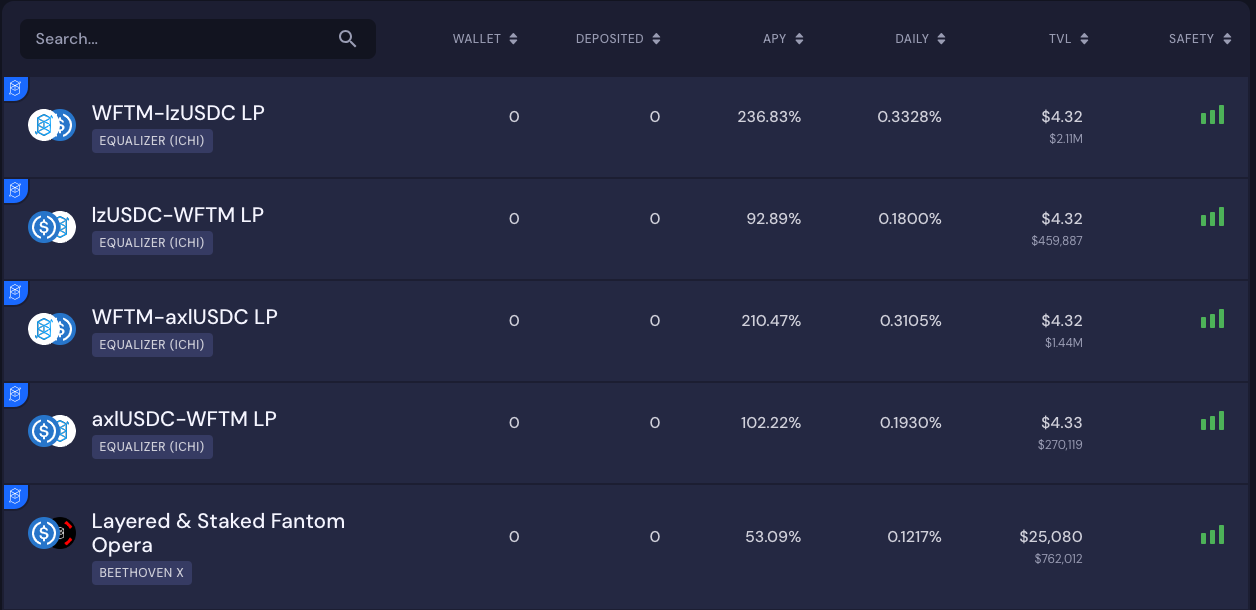

When researching Beefy, we noticed some intriguing yields reminiscent of the last bull run, with APY reaching as high as 236%. Staking tokens here allows you to experience liquidity mining—but be sure to monitor them closely.

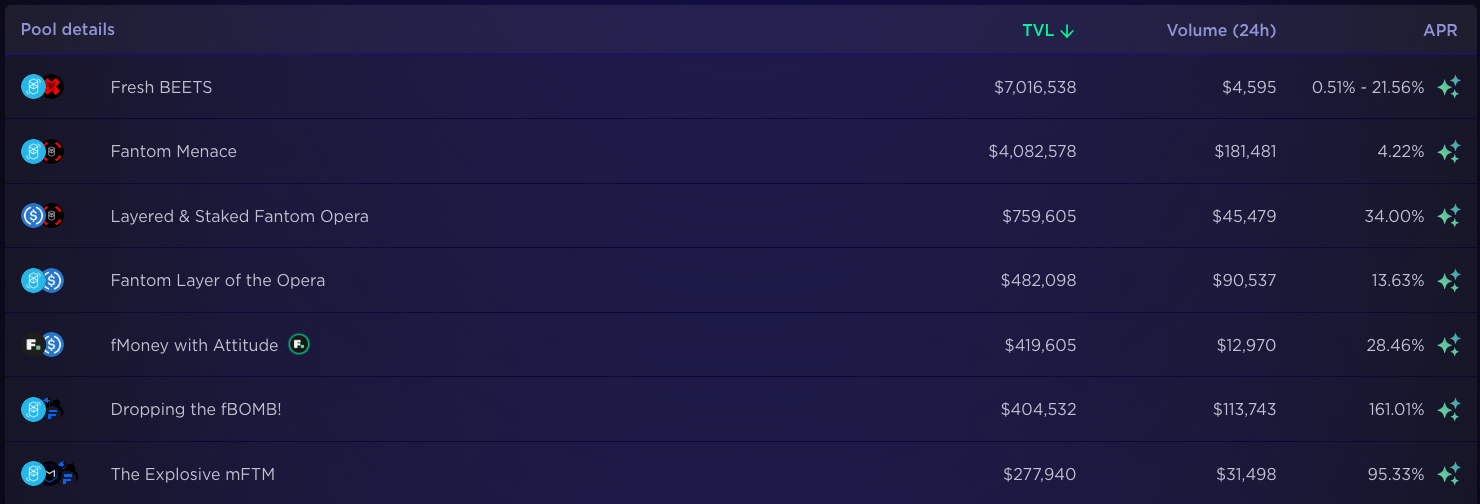

BeethovenX also offers similar returns, although its trading volume remains relatively small. Nevertheless, given the early stage of development, experimenting with liquidity mining within the Fantom ecosystem could yield benefits in the future.

For those looking to stake idle FTM tokens or stablecoins, consider staking your FTM on a CEX like Coinbase, which currently offers an annual yield of 3.33%, or stake with the Fantom Foundation, which offers up to 6.3% APY depending on your lock-up period. For stablecoin staking, check out pools on Stargate Finance and Beefy Finance, currently offering APYs of 22.9% and 10%, respectively.

That’s all for today. We hope you enjoyed this piece and are now equipped to research the next narrative you encounter, while knowing how to bridge and happily explore the Fantom ecosystem!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News