Analyzing Ankr: Becoming the Lido for Bitcoin, an Undervalued Liquid Staking Potential

TechFlow Selected TechFlow Selected

Analyzing Ankr: Becoming the Lido for Bitcoin, an Undervalued Liquid Staking Potential

Ankr provides the most reliable RPC and has over six years of experience in the industry, leading the way in the RaaS field.

Author: Louround

Translation: TechFlow

Despite the market's rapid development, some projects have consistently aligned with market phases over the years. This requires strong business development capabilities, innovation, and revenue streams.

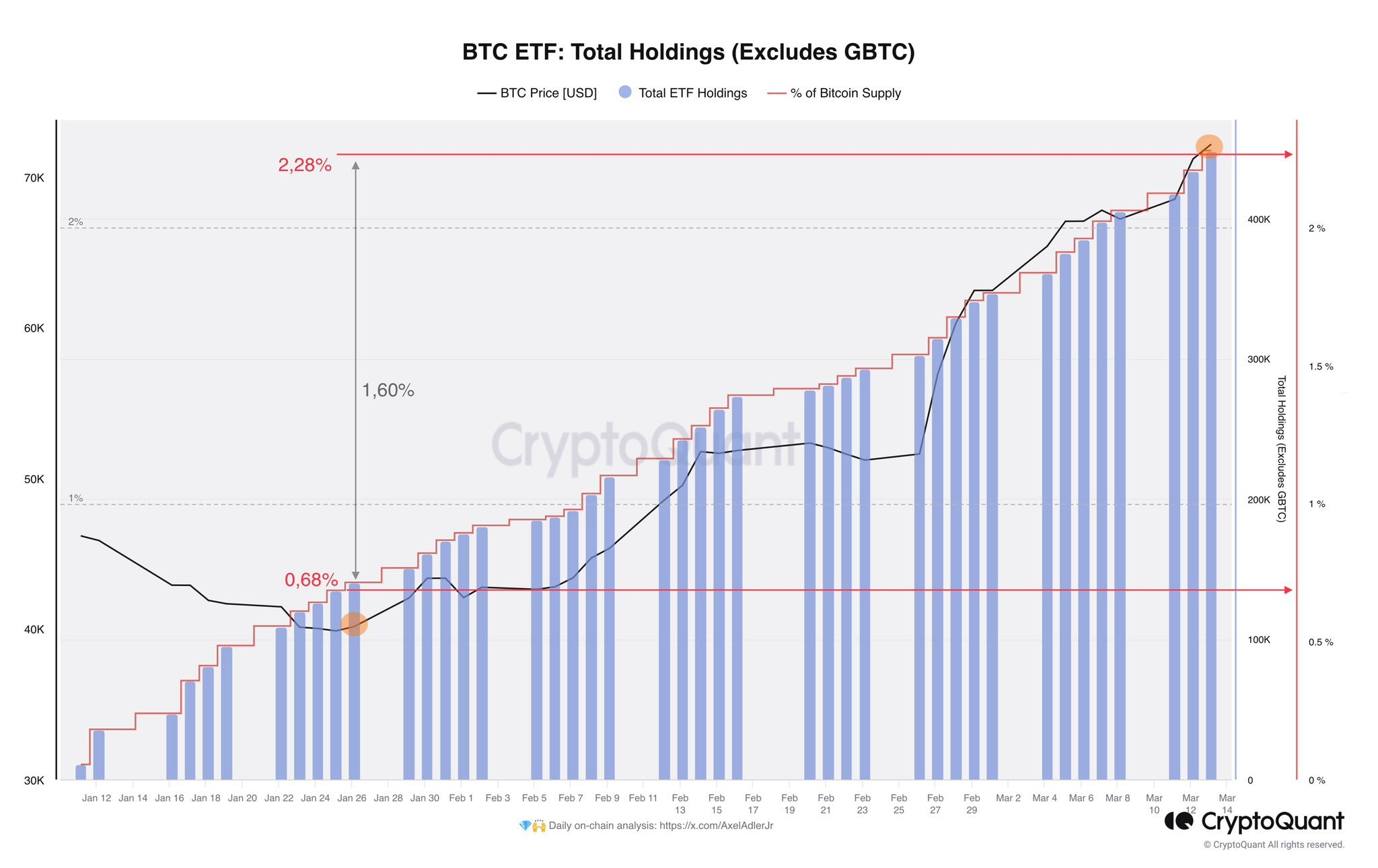

With the recent launch of Bitcoin ETFs and massive capital inflows—where institutions have purchased over 2% of BTC supply—the Bitcoin ecosystem is clearly becoming one of the hottest topics in the market.

The Bitcoin ecosystem is continuously expanding, and participants are actively seeking ways to generate additional yield on top of their holdings.

This is exactly what Babylon aims to achieve by becoming Bitcoin’s EigenLayer.

$BTC can be staked to validate proof-of-stake chains and earn additional yield. Below are some chains already secured by Babylon, offering a way for idle $BTC to generate returns on existing holdings.

Similar to EigenLayer, once you stake your $BTC, your funds will be locked and unavailable for short-term use.

This is where Ankr enters the space as a leading BTC liquid staking project, providing holders with liquidity while still earning staking rewards.

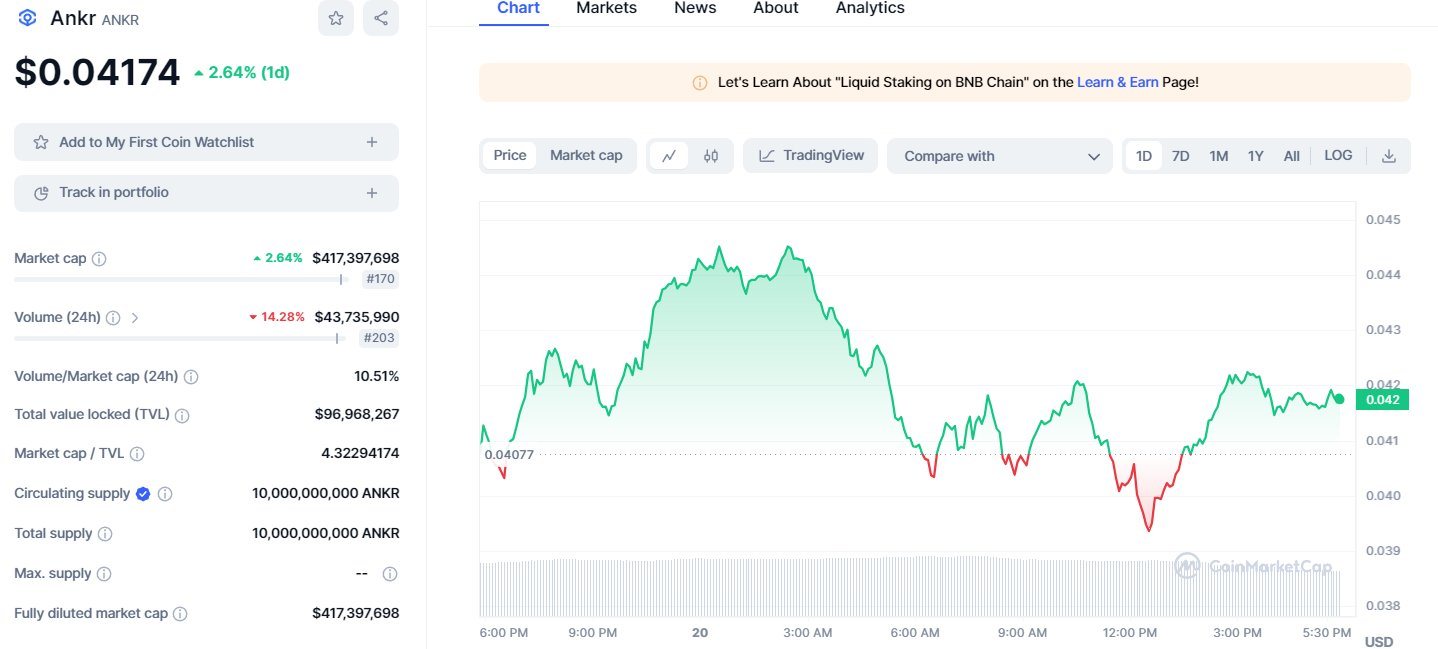

You may already know about Lido, but did you know that Ankr (currently with $100M TVL) was the first protocol to launch ETH liquid staking back in December 2020?

They offer highly reliable RPC services and possess over six years of industry experience, making them a leader in the RaaS sector.

Well, this is just the beginning. Although their FDV is only 1/10th of AltLayer’s, Ankr’s ambitions go far beyond the RaaS narrative.

Ankr recently announced an exclusive partnership with Babylon in a tweet.

Ankr will provide BTC LSTs (liquid staking tokens) for chains secured by Babylon, which will then be issued on-chain, adding further liquidity to both the chains and security layers.

Soon after, it could become the dominant player in the space. To truly grasp the significance of this event, let’s run through a few assumptions.

Babylon is the EigenLayer for Bitcoin, currently boasting a TVL of $6.4 billion.

This represents only a tiny fraction of Bitcoin’s total market cap, meaning even more idle capital could soon leverage opportunities to stake on Babylon and earn yield.

As mentioned earlier, Ankr is the first $BTC LST in the market, similar to Kelp DAO, ether.fi, and Puffer Finance for $ETH.

You might have seen that ether.fi recently launched its token, now trading at a $4.2 billion FDV.

Lido’s FDV stands at $3.2 billion.

Now guess Ankr’s current FDV? Just $419 million.

Yes, the “Lido for Bitcoin” is trading at just 1/8th of Lido’s valuation and 1/10th of EtherFi’s.

Imagine, on top of all this, they’re also leading the RaaS narrative, yet trading at just 1/10th the market cap of AltLayer and Dymension.

Ankr also leverages the DePIN narrative by offering decentralized computing power and data availability across its network. Furthermore, this expands the use cases and distribution of the $ANKR token.

If we dig deeper, Ankr attended the Nvidia conference and has recently engaged heavily around AI.

Why are Rollup-as-a-Service projects so focused on artificial intelligence?

I’ll leave it to your imagination, but right now you hold one of the most asymmetric bets in the market:

-

6 years of experience

-

First ETH LST

-

Lido for BTC

-

RaaS leader

-

DePIN narrative

-

Artificial intelligence

In summary, I believe Ankr is a project and token worth watching closely.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News