dYdX Chain: From dApp to Application-Specific Chain Ecosystem, Veteran DeFi Aims to Build Products More Competitive Than CEX

TechFlow Selected TechFlow Selected

dYdX Chain: From dApp to Application-Specific Chain Ecosystem, Veteran DeFi Aims to Build Products More Competitive Than CEX

An in-depth analysis of dYdX Chain's development post-launch and how dYdX is building the best contract exchange.

Author: TechFlow

Introduction

In October 2023, dYdX's genesis block was created by validators, marking the official launch of the dYdX chain.

Just two months prior, dYdX had surpassed $1 trillion in total trading volume. Despite already being the largest decentralized perpetual futures exchange, dYdX's ambition is to build a product more competitive than centralized exchanges. If building an independent application-specific blockchain can deliver the performance required for such a product and achieve true decentralization, then migration becomes an inevitable choice.

In this article, we will dive deep into dYdX Chain’s development since its launch and analyze how dYdX is crafting the best contract trading experience.

Why did dYdX build its own application chain?

dYdX was once among the first movers—adopting StarkEx in 2021 reduced its gas fees to just 1/50th of previous levels, increased supported trading pairs tenfold, and fueled explosive growth in trading volume. Migrating to L2 made dYdX one of the most notable DeFi products, but that wasn’t all dYdX wanted. Its order book and matching engine remained centralized.

As the business grew further, dYdX needed infrastructure tailored specifically to its product needs—something StarkEx’s slow iteration pace couldn't support.

IOSG once offered a vivid analogy:

“An Ethereum Rollup is like an old building in the city center—advantageous due to its prime location (composability), but outdated (slow infrastructure upgrades) and restrictive (no customization allowed for tenants). dYdX, as a major tenant with little need for social interaction (low reliance on composability), decided to move to the suburbs and build a villa. Coincidentally, they found a great contractor (Cosmos SDK), so they parted ways with Rollup.”

Transitioning from tenant to homeowner, dYdX not only saved significant rent (by no longer sharing profits with StarkEx) but also gained full autonomy. On June 22, 2022, dYdX officially announced plans to develop its own independent application chain, aiming to achieve full decentralization and deliver the ultimate trading experience.

dYdX v4: A high-performance, decentralized on-chain derivatives exchange

The key to dYdX v4’s upgrade lies in using the Cosmos SDK to build its own application chain, gaining control over the base layer to optimize application-level performance.

The Cosmos SDK is an open-source toolkit enabling developers to build standalone blockchains using modular components. The Tendermint consensus algorithm ensures network security and minimal latency, allowing Cosmos chains to process thousands of transactions per second. More importantly, developers can modify and optimize their blockchains based on specific needs—for example, dYdX requires a unique validator system where nodes maintain off-chain order books. An independent app chain allows it to use its native token (instead of ETH) for transaction fees and eliminate gas costs entirely.

Such an application chain clearly enables dYdX to significantly enhance user experience—the improvements from v3 to v4 are evident.

Figure 1: Performance comparison between v3 and v4

-

Version upgrade enhances user experience

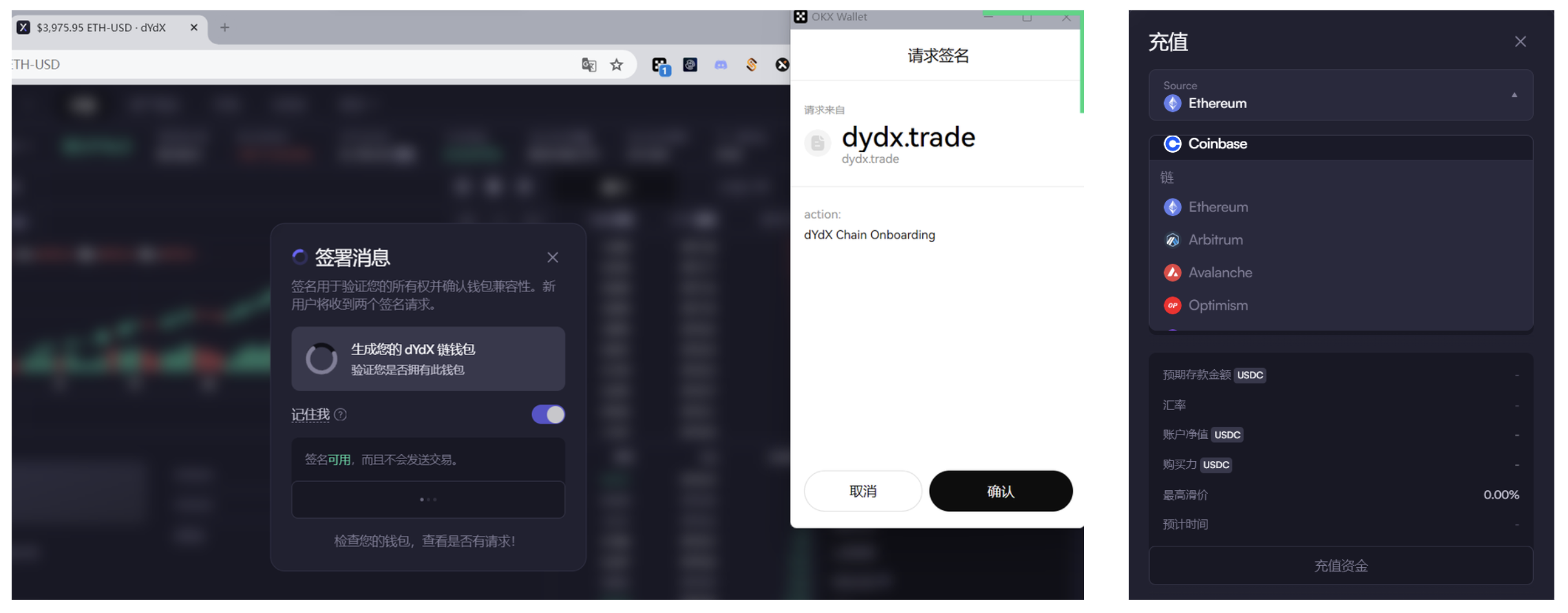

After announcing its move to an independent app chain, dYdX faced skepticism—would leaving Ethereum’s vast ecosystem lead to user loss? Through hands-on testing, I found users still access the v4 version via popular wallets like MetaMask and OKX Web3. Moreover, while v3 only supported deposits via the Ethereum network, v4 now supports cross-chain deposits from Coinbase and L2s directly into dYdX.

While leveraging Cosmos’ high performance and flexibility, dYdX has placed strong emphasis on maintaining consistent user experience. By preserving familiar deposit pathways and trading flows, users can seamlessly transition to v4 without worrying about which chain their assets originate from.

-

Improved performance

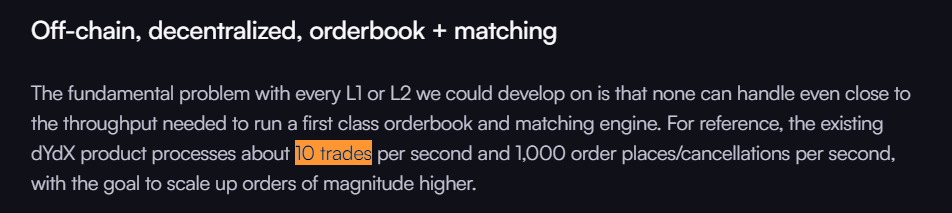

A Cosmos-based custom app chain allows dYdX to exclusively utilize the entire chain’s throughput, better meeting its demands for high-frequency trading and hedging systems. Before migration, dYdX could handle about 10 trades and 1,000 order/cancel requests per second. After migration, it can process up to 2,000 trades per second.

-

Lower gas fees

High-frequency trading involves frequent placing and canceling of orders. Paying gas fees on-chain for every action clearly discourages professional traders from switching away from CEXs. In dYdX v4, fees are only charged after successful order matching and when trade results are committed on-chain. Fees are calculated as a percentage of the trade value, offering an experience much closer to centralized exchanges.

-

Greater decentralization

dYdX v3 was a hybrid decentralized exchange: most contracts and code were open-source and on-chain, but the order book and matching engine remained centralized.

In v4, dYdX achieves fully decentralized off-chain order books and matching engines. Over 60 active global validators perform network validation and block creation, each maintaining an off-chain order book. When orders are matched in real time, new blocks are created and consensus is reached once 2/3 of validators vote in agreement. Data is updated and returned to the frontend via indexers.

-

Enhanced token utility

In v3, the dYdX token mainly provided fee discounts; v4’s move toward full decentralization unlocks far greater utility for the token.

From a governance perspective, dYdX token holders can define token functionalities, add or remove markets, and modify parameters of dYdX v4.

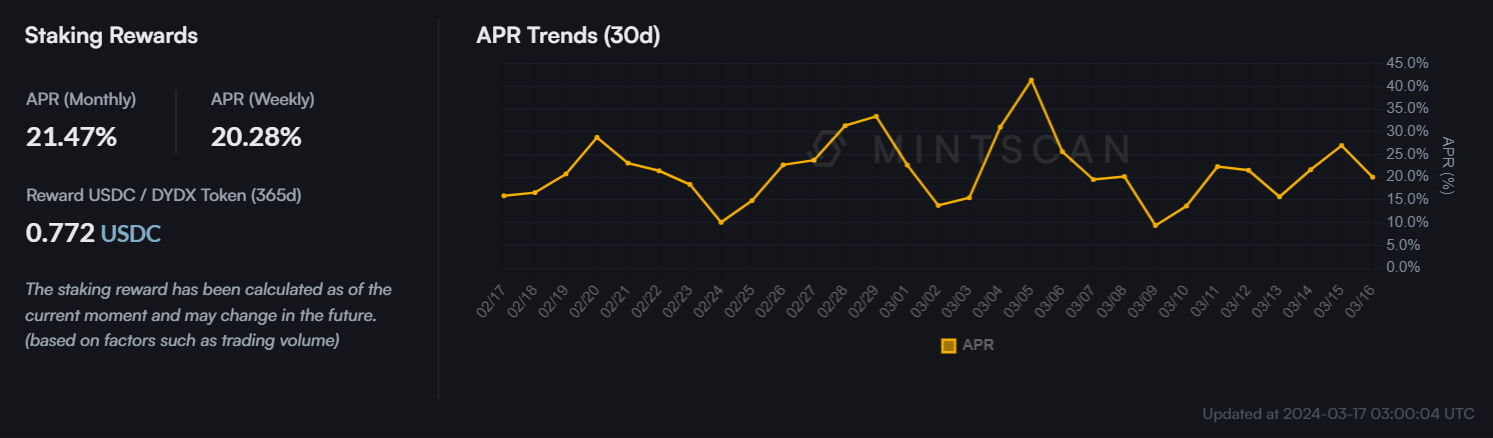

From a staking perspective, validators on the dYdX chain must stake dYdX tokens to operate and secure the network. Revenue generated by dYdX is distributed to stakers—currently offering stakers an APY as high as 20%, paid out in USDC.

-

More trading markets

Importantly, v4 enables permissionless listing, greatly expanding the range of supported derivative contracts compared to v3. It currently supports over 60 tokens, with recent additions in March including GRT, MANA, ALGO, HBAR, IMX, RNDR, and AGIX. The founder stated on Twitter plans to support over 500 tokens by the end of 2024.

Strengthening the App Chain Foundation and Accelerating Market Expansion

Advanced technology is foundational, but making users feel its benefits requires systematic execution through product design, marketing education, and operational campaigns.

Beyond improved trading experience and broader token offerings, v4 launched a series of incentive programs to smoothly migrate users from v3. Here, I summarize three ways users can participate in the dYdX ecosystem and earn rewards, ranked from highest to lowest risk:

-

Earn incentives by trading volume and maker activity

In late November, Chaos Labs launched a six-month Early Adopter Incentive Program worth $20 million, with 80% allocated to reward trading activity. Traders receive dYdX token rewards after each successful trade.

-

Hedge positions to earn funding rates

For those who want to avoid directional risk, a hedged strategy allows earning funding rates—open a short position on dYdX while holding spot long on a CEX to capture dYdX’s funding rate profit.

-

Stake dYdX for 20% APR

Alternatively, users can simply stake dYdX tokens to earn up to 20% APR, with rewards distributed in USDC. To date, dYdX has distributed over $8.2 million in USDC to 15,000 stakers—all derived from actual trading fee revenues.

-

dYdX vs. other on-chain derivatives exchanges

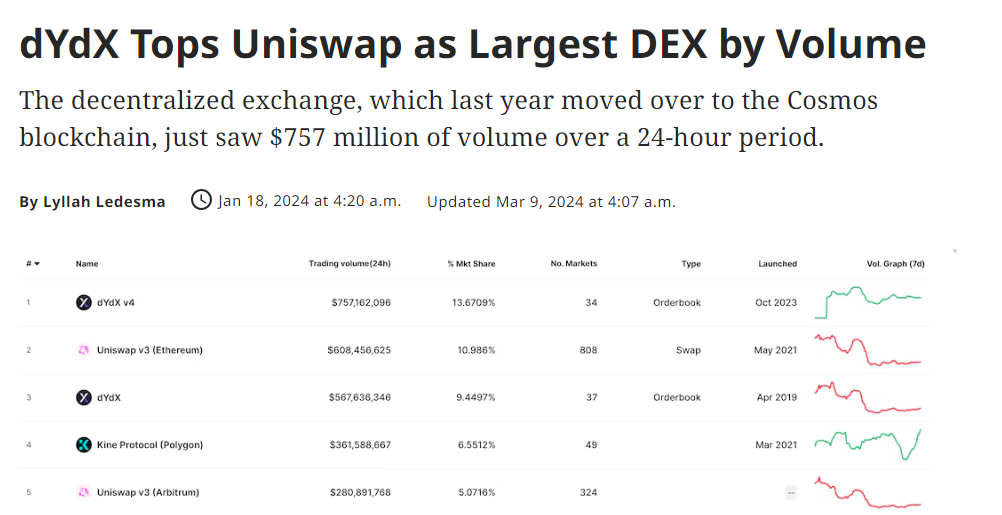

These incentive programs have effectively attracted users and trading volume. Within three months of launch, dYdX v4 achieved nearly $80 billion in total trading volume. On January 18, dYdX Chain even briefly surpassed Uniswap to become the highest-volume DEX.

Derivatives trading offers a much larger market than spot trading, leading to fierce competition with various protocols innovating aggressively. Below are some of the most competitive players in this space.

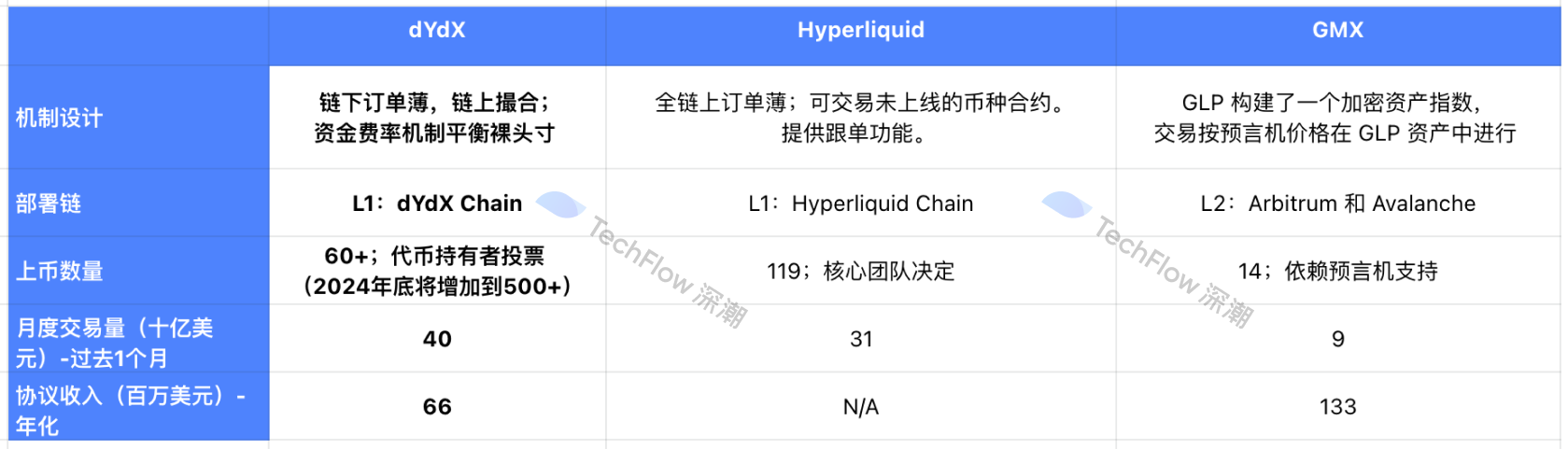

Figure 2: dYdX vs. other decentralized perpetual exchanges

GMX stands out for offering 30x leverage and zero slippage on large trades. However, its V1 mechanism exposed small-cap tokens to manipulation risks, potentially causing GLP losses. V2 mitigated this by introducing isolated liquidity pools and position caps, though it remains limited in the number of tradable assets. Additionally, GMX’s trading fees are higher than those of dYdX and others.

Hyperliquid gained attention for launching futures on the trending Friend.Tech and offering copy-trading features, with mechanisms similar to dYdX. However, listing decisions and core parameters remain fully controlled by the team—for instance, modifying the Friend.Tech futures pricing formula to prevent manipulation. It lags behind dYdX in both decentralization and product maturity.

Hyperliquid is a rising contender that captured traffic through innovative features and rapid listings. Yet, from the perspectives of user experience and decentralization, dYdX holds a clear edge, making it more favored by professional traders. Although the race in decentralized perpetual exchanges remains undecided, dYdX leads in trading volume.

Cosmos Interoperability Fuels Rapid Growth in dYdX Liquid Staking Ecosystem

Most L1s follow a path of building infrastructure first, then attracting developers. dYdX reversed this—first creating a successful application, then building a custom app chain to scale further. The application chain not only overcame performance bottlenecks but also opened new growth avenues: StarkEx’s integration with Ethereum’s ecosystem is complex, whereas Cosmos enables dYdX to interoperate seamlessly with any IBC-enabled Cosmos blockchain.

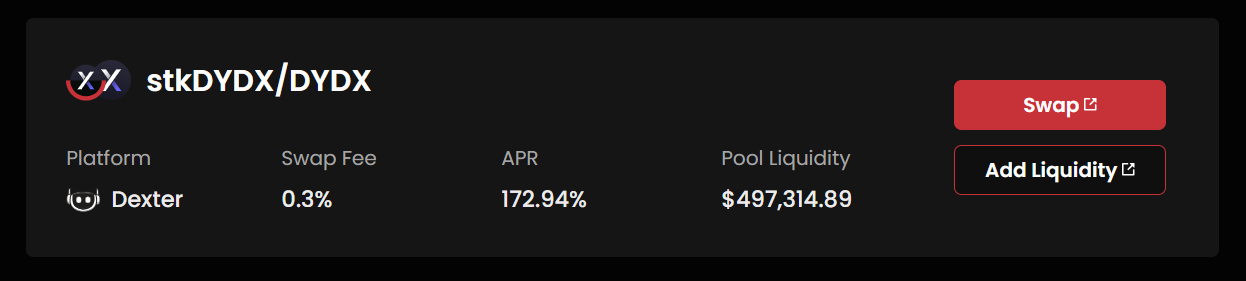

Take liquid staking as an example: dYdX’s generous distribution of fee revenue to stakers—over 106 million dYdX tokens are already staked—has created massive demand. However, staking locks liquidity, and unstaking takes 30 days, creating a perfect opportunity for LSD protocols. Three LSD projects are now racing to offer liquid staking solutions for dYdX.

Take pStake as an example: users who stake dYdX on pStake not only enjoy auto-compounded staking rewards but can also provide liquidity on Dexter to earn up to 173% APR (including PSTAKE token incentives).

Another example is integration with Squid, Axelar’s interoperability network solution, enabling seamless cross-chain access to Cosmos app chains from Ethereum L1, L2 rollups, and centralized exchanges. dYdX’s rapid adoption of bridges and liquid staking services is made possible by Cosmos’ unparalleled interoperability. Looking ahead, we can expect even more innovation as dYdX integrates with other protocols in the Cosmos ecosystem.

Conclusion

From v3 to v4, dYdX evolved from a dApp into a custom-built application chain—a transformative leap.

The performance and flexibility of a dedicated app chain enable lower trading costs and faster execution. At the same time, allowing token holders to participate in validation, governance, and revenue sharing marks a major step toward true decentralization.

Finally, becoming an application chain opens ecological possibilities for dYdX. Recent quarterly data shows significant breakthroughs in trading volume, number of supported tokens, and staking amounts.

Thanks to Cosmos’ unmatched cross-chain interoperability, every Cosmos chain can interact seamlessly. Because dYdX distributes real revenue and enables governance participation, its token has already been integrated into liquid staking and DeFi protocols across the Cosmos ecosystem.

dYdX may no longer be just the dApp we once knew—it has become an application chain with vast ecological potential. As DeFi regains mainstream attention this year, we look forward to even greater developments from dYdX Chain.

For more information, visit: dYdX Official Website |dYdX Chinese Twitter

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News