Beyond Binance Alpha: The BNB Chain Wealth Codes You Must Know

TechFlow Selected TechFlow Selected

Beyond Binance Alpha: The BNB Chain Wealth Codes You Must Know

This article focuses on the recent strong rise of the BNB Chain ecosystem, uncovering wealth opportunities beneath the surface of data.

Author: Viee, Core Contributor at Biteye

Recent May data from BNB Chain reveals strong growth momentum across its ecosystem. Its DEX trading volume remains the highest among all public blockchains globally, while the number of successful on-chain transactions surged 122% month-over-month. Meanwhile, monthly active users of stablecoins surpassed 15.3 million, achieving nearly 40% monthly growth. At the same time, meme coins within the BSC ecosystem have triggered a wave of explosive rallies—popular tokens like Ghibli and BOB frequently doubling or more in daily gains—becoming focal points of market attention. Behind these impressive figures lies a clear emergence of a new round of wealth effects within the BNB Chain ecosystem. Which hot projects are currently attracting capital inflows? How can retail investors leverage the liquidity advantages created by USD1 and Binance Alpha to capture market opportunities? This article will break down the wealth code of BNB Chain and help you uncover the next wave of potential investment opportunities.

1. Decoding BNB Chain’s Hype: Data Trends and Deep “Wealth Codes”

The recent explosion in the BNB Chain ecosystem requires understanding not just surface-level data but also the underlying logic and core drivers behind project popularity—key to capturing Alpha.

1.1 Hot Projects on BNB Chain

The table below outlines current popular projects across different categories within the BNB Chain ecosystem, along with several key characteristics:

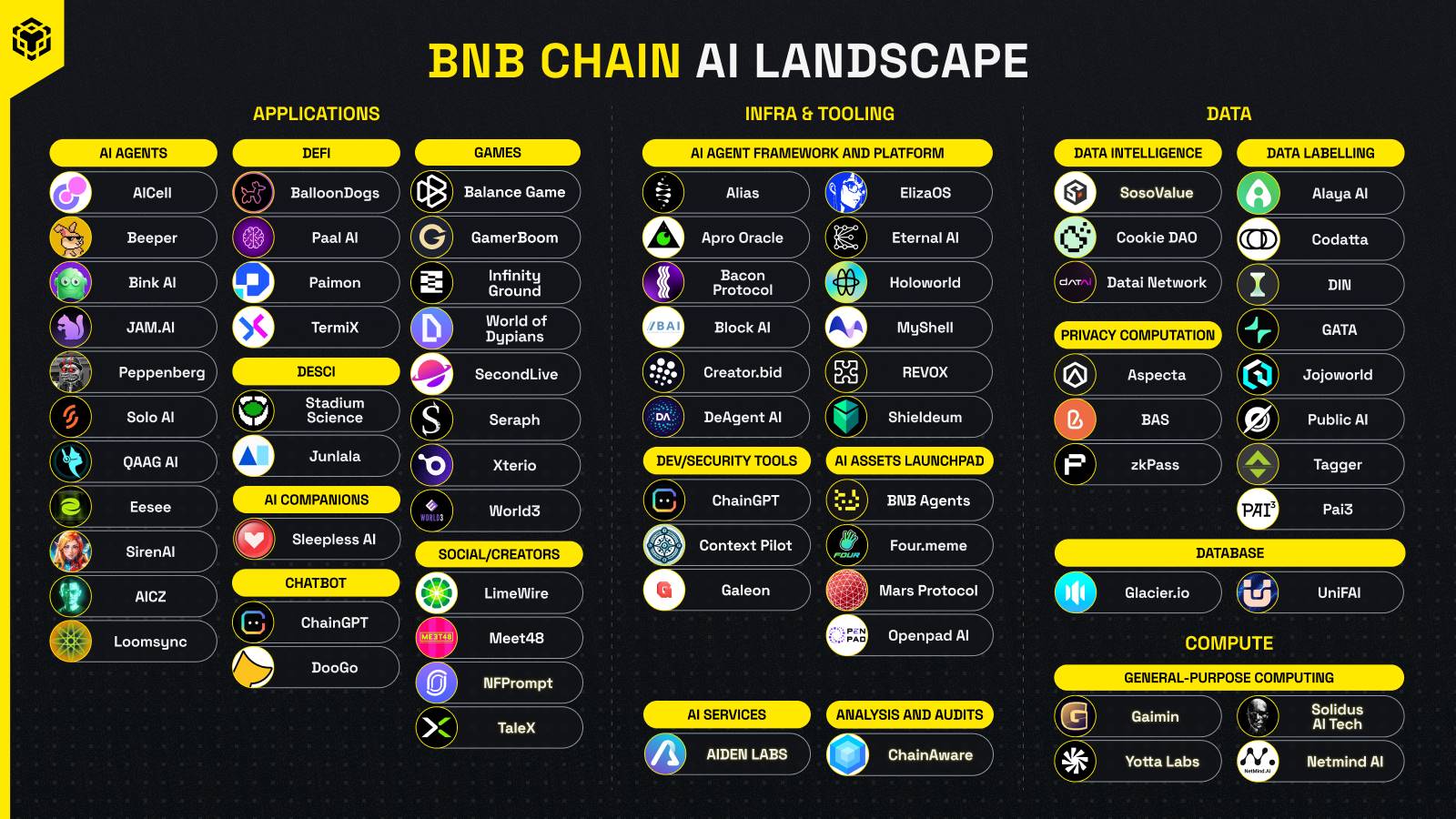

First, among recently active trading projects, major market narratives become evident. Meme sector tokens $B and $KOGE dominate trading volumes, indicating that memes remain significant gateways for traffic and capital in this market phase. AI-related tokens such as $SKYAI, $PORT3, and AI gaming token $ELDE reflect growing market pricing power around the AI x Crypto narrative. Additionally, ZK technology represented by $SOPH and real-world asset (RWA) tokenization via $RWA hold notable positions, showcasing the diversity and forward-looking nature of BNB Chain's ecosystem narratives.

Second, the list of projects supported by BNB Chain’s $100M fund reveals strategic preferences. Among the top five high-volume projects funded, three ($AIOT, $SIREN, $CGPT) clearly belong to the AI domain, covering trending areas including AI integrated with IoT/DePIN/gaming, AI agents, and AI infrastructure. Many of the previously mentioned high-volume projects have also received support from the BNB Foundation—a clear signal that BNB Chain officially endorses technically innovative sectors with long-term growth potential, expecting them to drive substantial on-chain activity.

Finally, DeFi—the traditional strength of BNB Chain—remains solid. In the DEX space, PancakeSwap achieved an enormous monthly trading volume of $71.6 billion in May, reaffirming its undisputed leadership. In the perpetuals market, platforms like MYX Finance, Aster, and KiloEx are rising rapidly, demonstrating BNB Chain’s competitiveness in derivatives with considerable trading volumes.

In summary, these popular projects paint a comprehensive picture of the BNB Chain ecosystem: led by dominant narratives, fueled by emerging sectors, and anchored by DeFi fundamentals—the directions chosen by the market through real capital allocation. For users, how can one identify opportunities within these trending projects?

1.2 Interpreting the “Wealth Code” Behind Popular Projects

Strategy 1: “Narrative + Liquidity” Dual Leadership. Consider targeting projects that align with the strongest current market narratives (e.g., Memes, AI) while being tightly integrated with powerful liquidity solutions—they often possess "double-Davis" potential. Focus especially on projects closely linked to USD1 trading competitions and core liquidity mechanisms like Binance Alpha.

Strategy 2: Value Analysis of AI Projects. AI projects on BNB Chain are diverse; layer-based analysis helps assess their position in the value chain. Additional factors include technological moats, team background, partnerships, and real-world progress. Let’s examine some leading examples:

-

Infrastructure Layer: Tokens like $SKYAI (data bridging) and $REX (modular AI Infra) provide foundational support for AI applications and stand to benefit first when AI adoption accelerates. These projects may present revaluation opportunities as technologies mature and ecosystems expand.

-

Application Layer: Projects such as $ELDE (AI gaming) and $CA (AI lifestyle engine) serve end-users directly. The key evaluation criteria are whether they can deliver killer apps and sustainable business models.

-

Data Layer: Tokens like $PORT3 and $AGT aim to build decentralized AI data networks—where data acts as fuel for AI, making value self-evident. Evaluate their ability to acquire, govern, and monetize data, and whether they can establish strong network effects.

Strategy 3: Alpha Signals from the “Official List.” The $100M grant list from BNB Chain serves as a curated watchlist pre-vetted by the foundation. While not every funded project will succeed spectacularly, inclusion signals official recognition of a project’s narrative, technical merit, team quality, or sector outlook. Analyze why each project was selected—what problems it solves—and evaluate its long-term growth potential.

In conclusion, develop strategies wisely—avoid chasing short-term pump-and-dump stories while not missing out on sustainable long-term growth. For highly speculative short-term trends, participate with small positions using quick in-and-out tactics. For promising mid-term themes, consider phased entry with continuous monitoring based on fundamental developments. When investing in hot sectors, diversify rather than concentrate bets on single projects to reduce risk exposure.

2. BNB Chain Ecosystem Fundamentals and Activity Overview

Having explored the wealth narratives and Alpha opportunities emerging on BNB Chain, we now turn to core ecosystem metrics that reveal the hard capabilities underpinning its popularity. The table below compares BNB Chain with other major blockchains across key indicators.

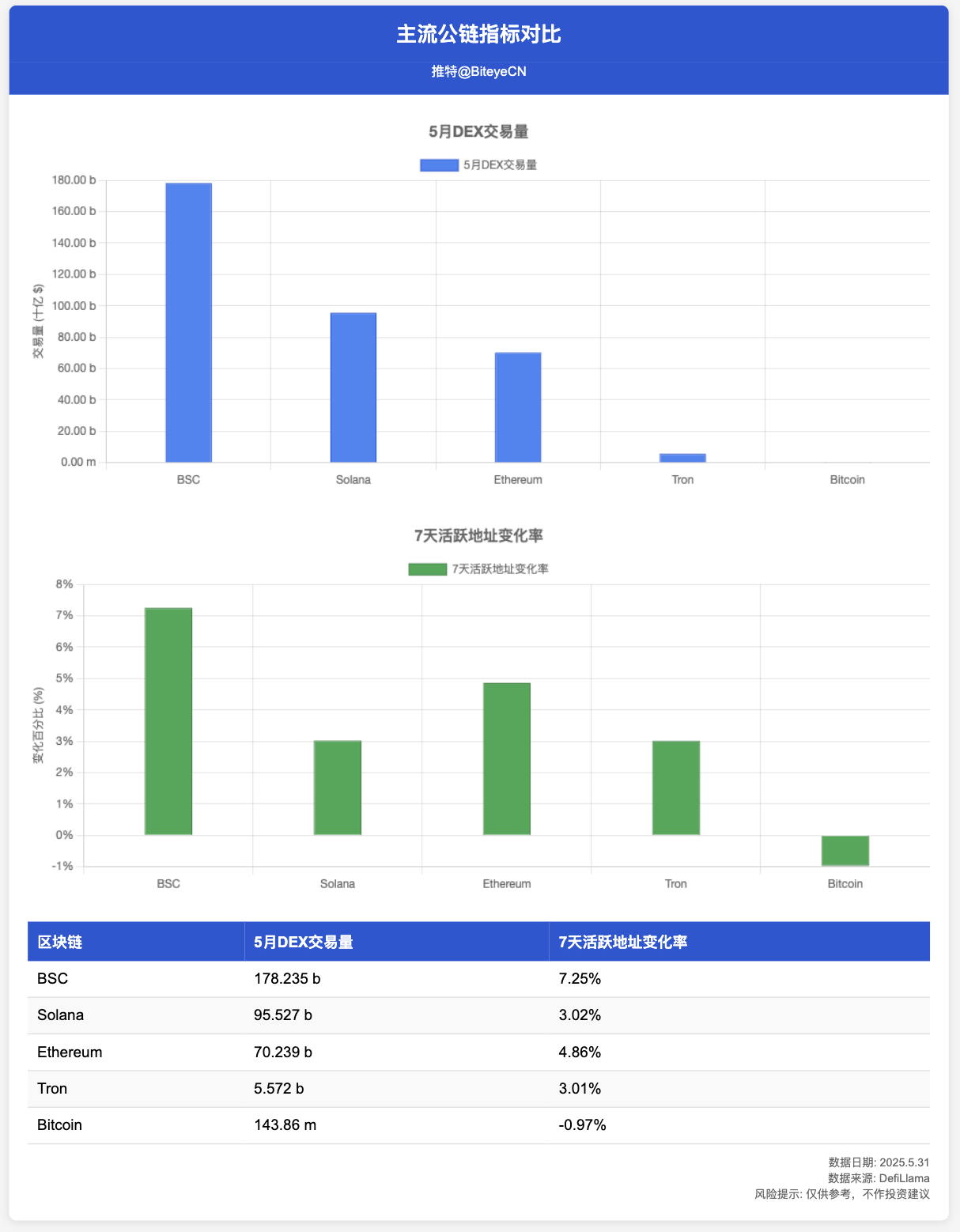

As shown in the chart, as of May 31, total DEX trading volume across all chains reached $474.135 billion. Driven by Alpha airdrops and trading competitions, BNB Chain DEX volume hit $178.228 billion in May—topping the rankings and setting a new historical high. Similarly, BNB Chain’s largest DEX recorded $165.35 billion in monthly volume, also reaching an all-time peak. This "dominant lead" confirms BNB Chain as one of the preferred platforms for on-chain traders today. Massive trading volume signifies deep liquidity, efficient price discovery, and abundant trading opportunities—drawing consistent interest from traders and market makers alike.

Trading volume relies on user base, and “7-day active address growth rate” is a critical metric for measuring user expansion. BNB Chain leads significantly here with a 7.25% increase, outpacing Ethereum (4.86%), Solana (3.02%), and Tron (3.01%)—highlighting its strong ecosystem appeal.

Another factor contributing to ecosystem vitality is cost competitiveness. Many mainstream DEX protocols on BNB Chain offer transaction fees as low as 0.01%, meaning typical transactions cost only a fraction—often less than one-tenth—of what they would on Ethereum. This advantage is particularly pronounced in high-frequency memecoin trading scenarios.

Beyond standout on-chain metrics, BNB Chain further strengthens its foundation through developer incentives. Recently, the ongoing MVB (Most Valuable Builder) program has provided funding, technical guidance, and ecosystem resource access to new projects and development teams.

Taken together, BNB Chain has clearly outpaced most major blockchains and possesses robust momentum for continued development—making it one of the most active and promising public chains today.

3. Dual Engines Driving Growth: USD1 and Binance Alpha Powering BNB Chain Momentum

The strong market appeal demonstrated by BNB Chain recently rests on solid foundations. The deep liquidity brought by the USD1 stablecoin and the efficient traffic funnel built by Binance Alpha act as two core engines jointly driving BNB Chain’s current value narrative.

3.1 USD1: Building the Liquidity Bedrock of BNB Chain

The rise of USD1 carries significance far beyond that of a typical dollar-pegged stablecoin for BNB Chain.

First, over 99% of USD1 is deployed on BNB Chain. Issued by World Liberty Financial (WLFI) and custodied by BitGo, USD1 recently gained further validation when Abu Dhabi-based investment firm MGX completed a $2 billion investment into Binance via USD1, underscoring its institutional credibility.

This high concentration is largely due to BNB Chain’s tailored “zero-gas fee” incentive mechanism, which drastically reduces transaction costs for users. As a result, USD1 has quickly become a favored stablecoin among on-chain users—especially high-frequency traders and meme coin participants—paving the way for widespread adoption.

USD1’s influence extends well beyond the meme coin space—it is expanding broadly. On major DeFi protocols like PancakeSwap and Venus, trading volumes for pairs such as USD1/USDT and USD1/BNB continue to climb. Moreover, USD1 has already launched on Ethereum (ETH) and plans to integrate with Tron (TRON). This cross-chain and cross-platform expansion amplifies liquidity flows that ultimately feed back into and strengthen the BNB Chain ecosystem.

3.2 Binance Alpha: A CEX-Powered Traffic Amplifier

As Binance’s project discovery platform, Binance Alpha has evolved into a “wealth amplifier” channeling traffic to BNB Chain.

Platform data shows that over 70% of projects listed on Alpha are BNB Chain-based tokens. Binance has even introduced specific incentives such as “Double Points for Trading BNB Chain Projects” to encourage exchange users to trade assets on BNB Chain. This exemplifies the perfect synergy within the Binance ecosystem—seamlessly combining the centralized exchange’s massive traffic and brand strength with BNB Chain’s on-chain advantages to form a powerful growth flywheel.

In summary, USD1 establishes a liquidity foundation and institutional narrative for BNB Chain through strong financial backing, while Binance Alpha continuously channels user traffic and market heat toward the chain. One anchors value on-chain, the other drives off-chain liquidity and engagement—their synergy propels BNB Chain’s wealth narrative forward.

4. Main Participation Paths for Retail Investors on BNB Chain

Earning Points & Early Interaction: Binance Alpha uses tasks and rewards to guide users in early interactions with new projects on BNB Chain. Active participation offers chances to earn early airdrop benefits.

Alpha Earn Hub Liquidity Mining: The recent launch of Binance Alpha Earn Hub provides users with direct yield-generation pathways. By providing liquidity for select Binance Alpha tokens on PancakeSwap V3, users can earn APRs as high as 1,000%—an excellent window for capturing early high-yield opportunities (note risks of impermanent loss and token depreciation).

Participating in “IPO-style Launches”: Retail investors can join TGEs via Binance Wallet, PancakeSwap IFO (Initial Farm Offering), and Four.meme—important channels for accessing new token launches on BNB Chain.

Meme Coin Trend Tracking: Use tools like Four.meme, DexScreener, and DEXTools to monitor trending meme trading pairs on BNB Chain in real time. Focus on those with unique culture, strong communities, or alignment with viral narratives. However, meme coins are extremely volatile and risky. If participating, use only small amounts with a “ready-to-go-to-zero” mindset, enter and exit quickly, and strictly apply profit-taking and stop-loss rules.

Engaging with DeFi Protocols: Provide liquidity, lend/borrow, or stake BNB on established DeFi platforms like PancakeSwap, Venus, and Lista DAO to earn relatively stable returns.

5. Key Information Channels on BNB Chain to Follow

Official Core Channels:

-

Twitter: @BNBCHAIN (primary source for official announcements, ecosystem updates, event info), @BNBCHAINZH, @four_meme_ (BNB Chain token issuance platform), @BNBChainDevs (technical and developer updates)

-

BNB Chain Blog: Official blog featuring in-depth articles, technical breakdowns, and roadmap updates.

-

DappBay: BNB Chain’s official DApp browser for discovering and evaluating on-chain applications.

Research Firms: @MessariCrypto, @Delphi_Digital, @Btieyecn, etc.

Data Analytics & Tools Platforms: BscScan, DefiLlama, DexScreener, Dune Analytics, TokenTerminal—on-chain analytics tools for deeper insights.

6. Future Outlook: The Next Wave of BNB Chain

BNB Chain continues to enhance its competitive edge through dual drivers of “technology + narrative.” Technologically, its 2025 roadmap explicitly targets “sub-second latency + gasless experience.” It has already reduced block times to 0.75 seconds at the beginning of the year, combined with high TPS, delivering smoother on-chain experiences for DApps and users. On the ecosystem front, institutional capital flowing in via the USD1 stablecoin and integration with global payment systems are accelerating BNB Chain’s convergence with mainstream finance. Simultaneously, the “AI-First” strategy embeds AI capabilities into the blockchain’s foundational layer, unlocking application potential through supporting infrastructures like opBNB and Greenfield. All signs indicate: BNB Chain has already positioned itself ahead of the next cycle of public chain breakout.

The so-called “wealth code” is not a one-time solution, but rather a probabilistic opportunity window within a specific market cycle and ecosystem phase. The current surge on BNB Chain has undoubtedly opened many such windows. Where will the tide flow next? Perhaps the answer lies in BNB Chain’s next technological breakthrough or its next breakout application.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News