In the era of stablecoin expansion, how is BNB Chain becoming the highway for future finance?

TechFlow Selected TechFlow Selected

In the era of stablecoin expansion, how is BNB Chain becoming the highway for future finance?

An increasing number of institutions, funds, and users are choosing BNB Chain for stablecoin activities.

Author: Frank, PANews

Over the past year, stablecoin market capitalization has surged significantly, and their use cases have gradually expanded. Beyond serving as "hard currency" in native crypto environments such as DeFi, stablecoins are increasingly venturing into Web2 domains like payments, cross-border settlements, and value storage.

The vast market and potential of stablecoins have made them a key resource fiercely contested among major public blockchains. To support the real-world deployment of these broader applications, higher demands are placed on foundational blockchain performance and ecosystem characteristics.

In this silent revolution of financial infrastructure, BNB Chain has established a three-dimensional infrastructure system along the "performance axis – ecosystem axis – application axis," quietly building a high-speed network for the future of finance.

Data provides the clearest evidence: an increasing number of users, projects, and institutions are choosing BNB Chain for stablecoin-related activities. Recently, USD1, the dollar-pegged stablecoin launched by Trump family's WLFI, selected BNB Chain as its primary issuance platform, with over 90% of total circulation occurring on this chain. The market cap of USD1 on BNB Chain has already exceeded $110 million.

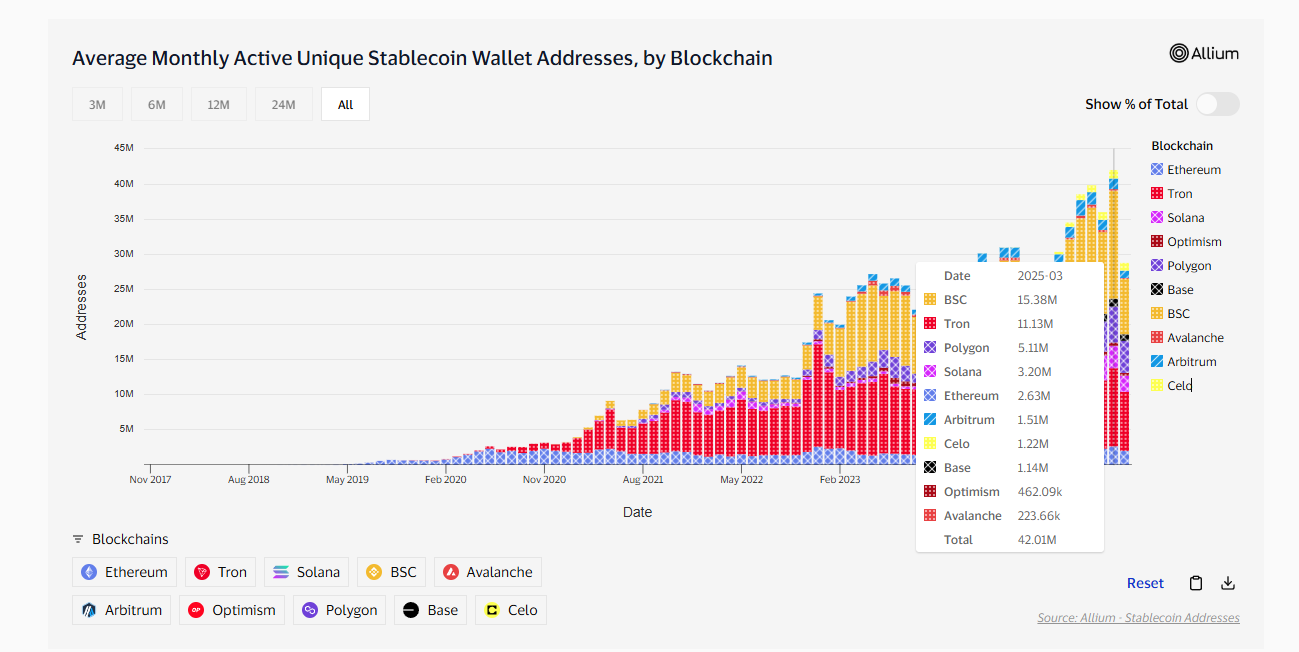

In March 2025, the number of unique active stablecoin wallet addresses on BNB Chain reached a record high of over 15.38 million, leading all other public chains. In the past month alone, BNB Chain recorded 12 million active USDT addresses—the highest among all blockchains. Over the last year, the total market cap of stablecoins on BNB Chain grew approximately 75%, demonstrating strong capital attraction.

The Three-Pillar Engine Powering the Financial Highway

During stablecoins' penetration into the real economy, BNB Chain has built a tripartite infrastructure system comprising: an ultra-fast transmission shaft offering 3-second block finality and 5,000 TPS processing capacity; a frictionless bearing enabled by fees as low as $0.03 and its zero-gas program; and a modular chassis integrating the BSC mainnet, opBNB scaling layer, and Greenfield storage layer.

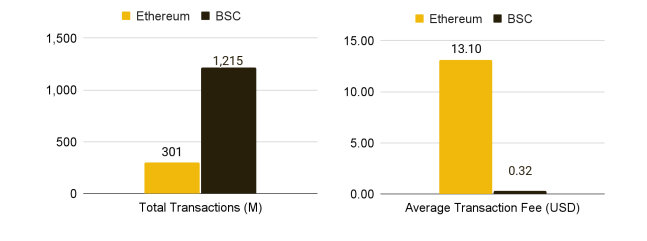

On performance, BNB Chain’s mainnet (BSC) currently achieves ~3-second block times, which will drop to 1.5 seconds following the recent Lorentz upgrade—significantly faster than Ethereum’s average of ~12 seconds. In terms of transaction throughput (TPS), BNB Chain can theoretically reach 5,000 TPS, compared to Ethereum’s post-merge (PoS) throughput of around 30 and a historical peak test result of about 22.7. This robust performance lays the foundation for large-scale, real-time stablecoin applications.

Architecturally, its multi-chain framework—comprising the general-purpose BSC, the scaling layer opBNB, and the storage layer Greenfield—is tailored to meet diverse application needs, providing flexible foundations for stablecoin integration across various scenarios. This strategic evolution indicates that BNB Chain aims not merely to serve as a conduit for stablecoins, but to become a core platform where stablecoins generate value.

Cost is another critical factor for widespread stablecoin adoption, especially in micro-payment contexts. Average transaction fees on BSC range between $0.03 and $0.11, roughly 1/30th of Ethereum’s costs. This means even if a user conducts 100 stablecoin transfers daily on BSC, the total cost could be as low as ~$3 (at $0.03 per transaction).

Building a Stablecoin “Tropical Rainforest” Ecosystem

Ecosystem development remains a prerequisite for large-scale stablecoin adoption. BNB Chain has cultivated a unique stablecoin ecosystem—a “rainforest”—by fostering developer-friendly conditions, external resource pools, and security safeguards.

Attracting developers to build stablecoin applications is vital to ecosystem vitality. BNB Chain lowers barriers through full compatibility with the Ethereum Virtual Machine (EVM), allowing smart contracts and dApps built for Ethereum to migrate to BSC with minimal modifications. Additionally, BNB Chain offers multiple developer support initiatives, including funding grants (Builder Grants), growth incentives, and the Most Valuable Builder (MVB) accelerator program, providing comprehensive support for ecosystem projects.

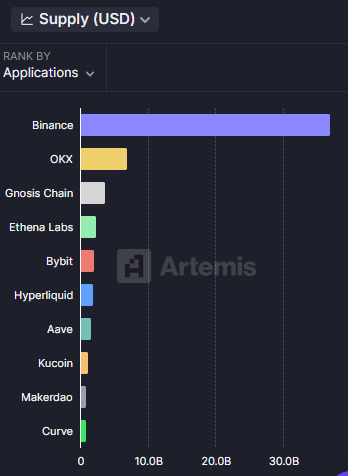

Ecologically, BNB Chain enjoys distinct advantages. It hosts one of the largest and most active user bases in the industry. Moreover, it benefits from abundant liquidity—not only due to its close ties with Binance, the world’s leading cryptocurrency exchange, but also because it integrates with most mainstream exchanges, wallets, and cross-platform channels, making it one of the most widely adopted public chains.

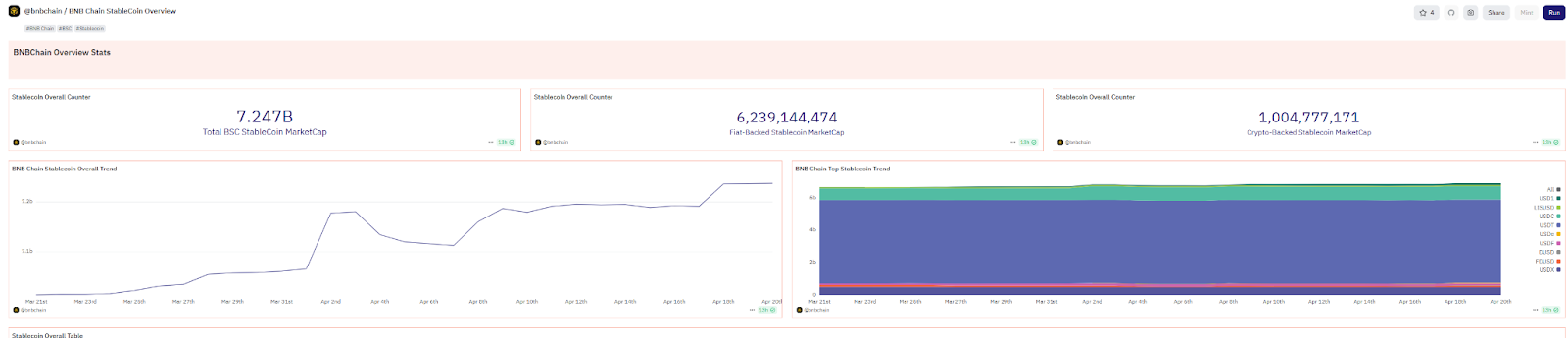

As of April 2025, the total market cap of stablecoins on BNB Chain reached $7.2 billion, ranking fourth globally, establishing itself as one of the primary blockchains for stablecoin issuance and adoption.

Meanwhile, Binance Labs (now rebranded as Yzi Labs) continues to invest heavily in BNB Chain projects. In 2024 alone, 14 out of the 46 projects funded by Binance Labs were from the BNB Chain ecosystem, including long-term MVB partners. Such ecosystem backing creates significant room for stablecoin innovation. These resources collectively generate a powerful synergistic effect driving the growth of BNB Chain’s stablecoin ecosystem.

CZ, founder of Binance, has long expressed confidence in the prospects of stablecoins. As early as 2023, he stated on social media that stablecoins hold immense potential in areas such as cross-border payments and inflation hedging, emphasizing that clearer regulation would actually accelerate their adoption. Recently, amid intensifying "stablecoin wars," CZ noted that healthy market competition is only just beginning.

To further promote stablecoin usage, BNB Chain launched its Zero Gas Festival initiative in September 2024, recently extended through June 2025. This program, a key measure to drive stablecoin payment adoption, has already covered over $3 million in transaction fees. Major exchanges and wallets have joined as partners, and newly launched USD1 is now eligible for zero gas fees, further lowering user costs for on-chain stablecoin transactions.

These combined forces create a strong feedback loop benefiting BNB Chain’s stablecoin ecosystem. Furthermore, its deep integration with a top-tier CEX generates positive externalities, granting BNB Chain unparalleled access to liquidity and user adoption unmatched by most other public chains.

While technological advancement accelerates, security safeguards are being strengthened. As part of the AvengerDAO security framework, the Red Alarm tool continuously monitors and flags high-risk projects and contracts, erecting a fraud-prevention firewall for users.

From DeFi to Offline Payments: Creating a Multi-Dimensional Stablecoin Application Space

Beyond building a solid foundation in performance and ecosystem, the ultimate destination for stablecoins lies in broader real-world applications. By actively expanding into key sectors such as DeFi, GameFi, AI, and real-world payments, BNB Chain fosters a diversified on-chain financial environment, offering stablecoins rich use cases and opportunities for value amplification.

DeFi remains one of the primary application areas for stablecoins, and BNB Chain boasts a thriving DeFi ecosystem where stablecoins play a central role. For example, PancakeSwap, the flagship DEX on BNB Chain, serves as the primary hub for stablecoin trading and liquidity, regularly recording weekly trading volumes exceeding $10 billion—enabling users to swap assets with minimal slippage.

Venus Protocol is a well-established and leading lending platform on BNB Chain. As of April 2025, its TVL on BNB Chain stands at approximately $1.55 billion. Users can deposit stablecoins to earn interest or collateralize other crypto assets (such as BNB or ETH) to borrow stablecoins.

Emerging player ListaDAO represents a new trend in lending, combining liquid staking derivatives finance (LSDFi). Users can pledge BNB or its liquid staking token slisBNB to borrow the protocol’s native stablecoin lisUSD or the newly launched USD1, a dollar-pegged stablecoin. As of April 2025, ListaDAO has achieved a TVL of $748 million and outstanding loans totaling $155 million on BNB Chain.

These lending protocols greatly expand the utility of stablecoins, transforming them into essential tools for accessing liquidity, leveraging positions, or executing yield strategies.

Beyond DeFi, BNB Chain is also pushing stablecoins into real-world payment scenarios, bridging on-chain value with offline consumption.

On the streets of Bangkok, users have utilized the TADA Telegram mini-program to enjoy free first orders paid via BNB Chain stablecoins; in Singaporean malls, dtcpay’s Visa card enables instant conversion of stablecoins into fiat for everyday spending—turning crypto experiments into tangible financial realities.

From DeFi to payments, from on-chain to off-chain, from transaction processing to value transfer—BNB Chain continuously expands the boundaries of stablecoin applications while playing a pivotal role in integrating them into the global payment system, laying a solid foundation for their mainstream adoption.

As stablecoins gradually move beyond native crypto finance into broader real-world applications, the underlying blockchain infrastructure is undergoing a profound reshuffling. In this restructuring of a new order, BNB Chain—with its high performance, low cost, strong ecosystem, security, and superior integration capabilities—is emerging as a central force in this transformation.

Here, stablecoins serve as the starting point for constructing the high-speed highway of future finance, reaching the next billion users.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News