Deep into Entangle: Beyond infrastructure, the pioneer tackling real-world applications of full-chain narratives

TechFlow Selected TechFlow Selected

Deep into Entangle: Beyond infrastructure, the pioneer tackling real-world applications of full-chain narratives

Omnichain Made Easy

Author: TechFlow

During every bull market, we see new narratives emerge that give rise to top-tier projects. In 2024—a year packed with fast-moving trends—how can a new project stand out amid fierce competition and limited user attention?

One possible answer lies in the narrative and real-world implementation of "full-chain interoperability."

With the rise of RaaS platforms like Altlayer and modular blockchains like TIA, launching new chains has become increasingly easy. We are now officially entering the multi-chain era. However, this has also led to growing fragmentation of liquidity across chains and extremely complex user experiences, creating isolated islands of activity that create significant challenges and resource waste for both developers and users.

As a result, market demand and conditions will inevitably drive the development of omnichain narratives. Focusing on emerging projects within this space may reveal promising new opportunities this year.

Among them, Entangle—dedicated to providing fully customizable data and interoperability solutions—is undoubtedly one of the most值得关注 projects today.

On March 13, Entangle’s token $NGL will launch. With similar omnichain projects like Axelar listing on Binance and Wormhole generating buzz through airdrops, market expectations for $NGL are already at an all-time high.

However, it's not easy for average users to fully grasp Entangle’s specific products and business model.

The old paradigm—where infrastructure builders focused solely on laying foundations ("building nests") while waiting for applications to come ("birds")—has created bloated protocols and underdeveloped apps, which now needs to change. Entangle aims to be the catalyst for that transformation.

On one hand, the omnichain narrative is inherently low-level and requires some technical understanding. On the other hand, Entangle isn't just building a single piece of omnichain infrastructure—it has expanded into multiple domains including DeFi, gaming, and even memes. Understanding the logic and connections between these different products can be challenging.

Therefore, ahead of the $NGL launch, this article will help you understand Entangle’s technology and product architecture in simple terms, and analyze its token valuation and potential participation opportunities.

Entangle’s Core: Cross-Chain Communication, Trusted Data, and Underlying Blockchain

What exactly is Entangle doing?

Stripping away technical details, it’s building an ecosystem for omnichain interoperability.

For crypto beginners, think of “omnichain interoperability” as enabling different blockchains to “shake hands” and communicate smoothly—like building a bridge between two previously disconnected islands so information and assets can flow freely.

To achieve such seamless connectivity, several key challenges must be solved:

1. Enabling Blockchains to Communicate – Photon Messaging:

First, we need these isolated "islands" (blockchains) to talk to each other.

Each chain has its own architecture, making native cross-chain communication impossible.

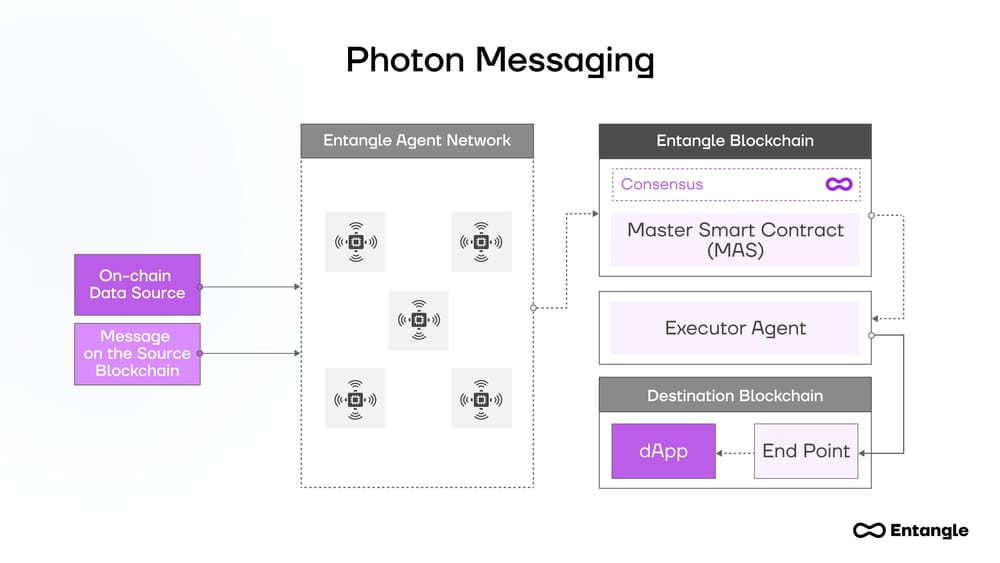

Entangle solves this using the Photon Messaging protocol.

This is a cross-chain messaging protocol that allows smart contracts on different blockchain platforms to directly communicate and interact. It's highly flexible, supporting both EVM and non-EVM networks, and uses advanced components—Executor Agents, Verifier Agents, and Receive Agents—to ensure security while allowing users to customize consensus parameters.

Imagine a global postal system where anyone in the world can fully customize how they send packages. Photon Messaging Protocol works similarly—not merely transferring data from one chain to another, but allowing developers to deploy logic and smart contracts that interact with data based on unique transmission needs.

Technically, here’s how Photon Messaging works:

When a message is generated on the source blockchain, the Executor Agent captures and processes it, ensuring it is secure and validated according to predefined rules.

Once verified, the Receive Agent takes over, ensuring the message arrives accurately on the destination blockchain. All of this revolves around Entangle’s own blockchain (discussed below), which acts as the central hub for execution paths.

2.Ensuring Messages Are Reliable – Universal Data Feeds:

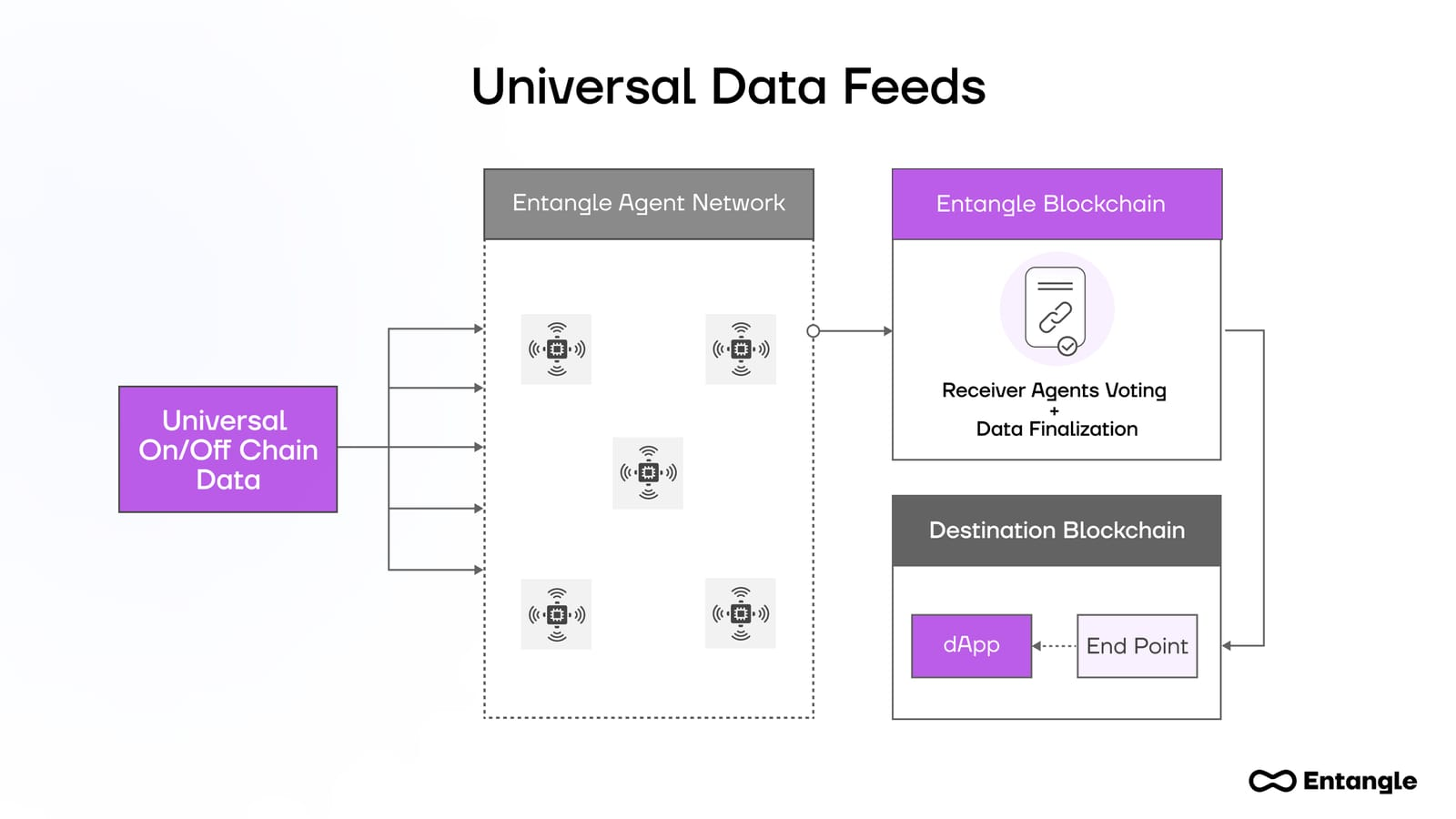

After establishing communication between blockchains, the next step is determining what data to transmit—and how to ensure its accuracy and security.

Universal Data Feeds provides a low-cost, low-latency, high-security data infrastructure compatible with nearly all on-chain and off-chain data sources. Its core function is to efficiently query data and deliver it to smart contracts, with all logic embedded within.

This capability opens doors for various use cases such as real-time asset pricing, loan collateralization, and creation of on-chain derivatives.

The security of Universal Data Feeds lies in its data validation process, where multiple verifications by the Entangle Agent Network ensure data accuracy. Receiver Agents vote on incoming data before final confirmation—similar to a peer-review team scrutinizing academic papers to ensure quality.

3.Making It All Work – Entangle Blockchain

With communication tools and message integrity safeguards in place, a robust platform is needed to support the entire system—this is where the Entangle Blockchain comes in.

It not only supports Photon Messaging and Universal Data Feeds but also ensures the network operates efficiently and securely through innovative design, overseeing data storage, verification, and processing.

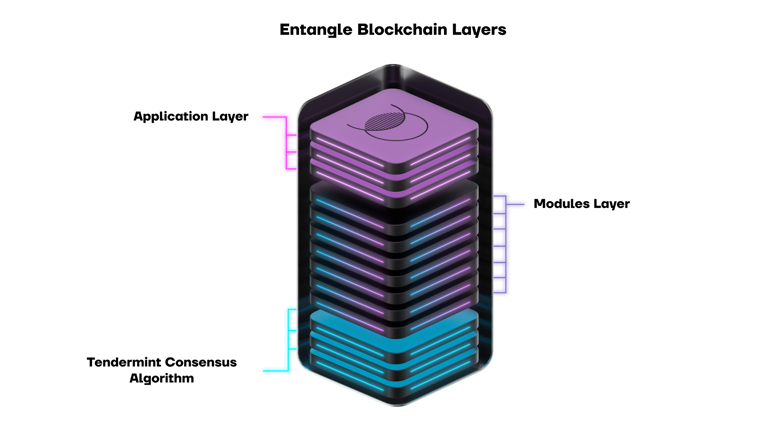

Specifically, Entangle’s blockchain consists of three layers: application layer, module layer, and consensus layer. Without diving too deep technically, a helpful analogy is:

Think of Entangle as a city. The application layer is the downtown area handling all communication and information. The module layer represents different districts, each serving specific functions (staking, asset transfers, contract deployment, messaging, etc.). The consensus layer functions like the city’s transportation system, ensuring everyone reaches their destination on time and in order.

This three-layer structure, combined with minimal gas fees and sub-three-second block confirmation times, enables efficient and cost-effective operations. Additionally, by leveraging the Ethermint library, it achieves EVM compatibility, allowing developers to deploy smart contracts on Entangle Blockchain just as easily as on Ethereum.

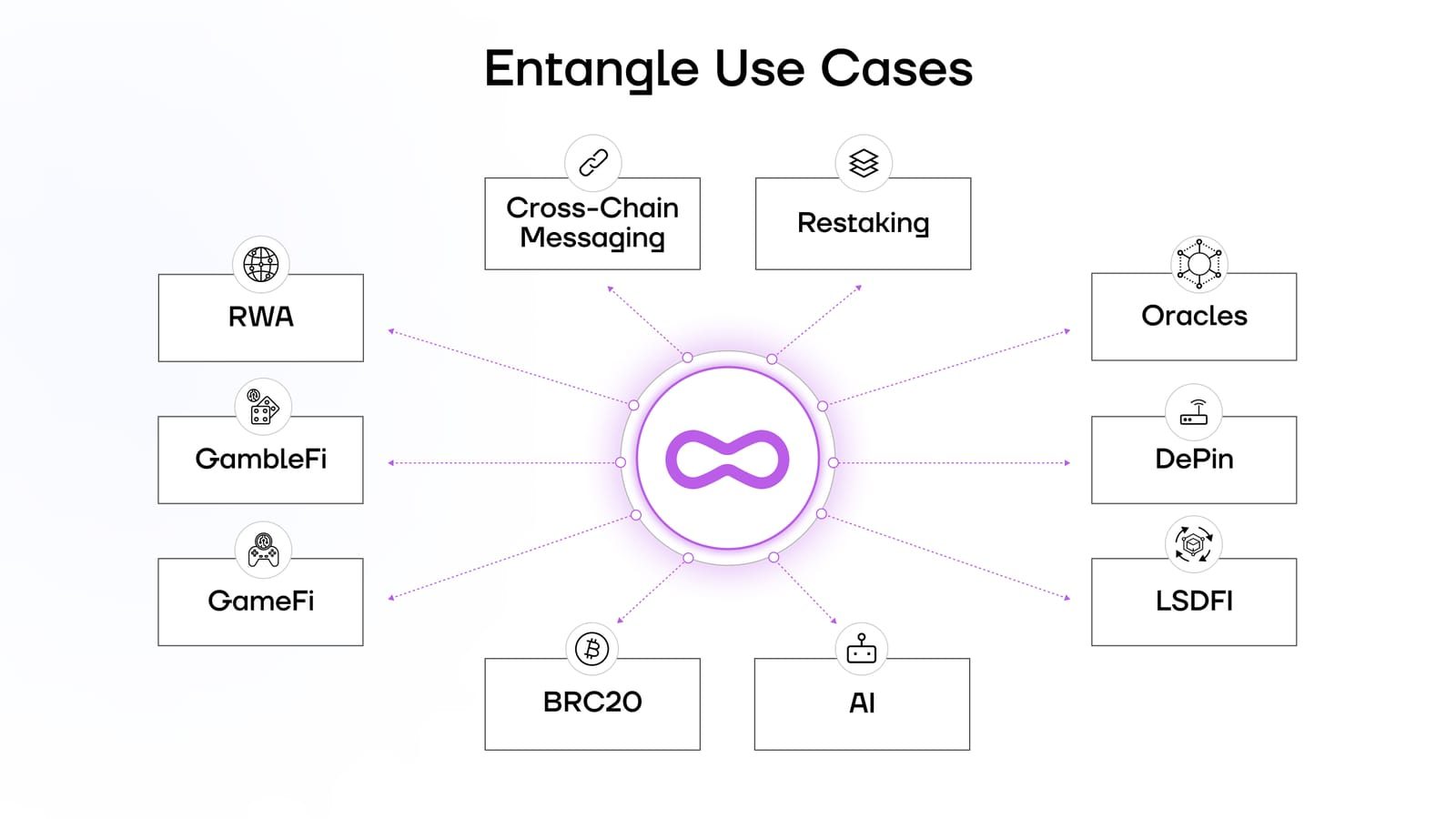

Beyond Infrastructure: Expanding Omnichain Use Cases

For Entangle, solving omnichain interoperability is just the beginning.

Once this technical foundation is established, what kinds of support and solutions can it offer across various crypto applications?

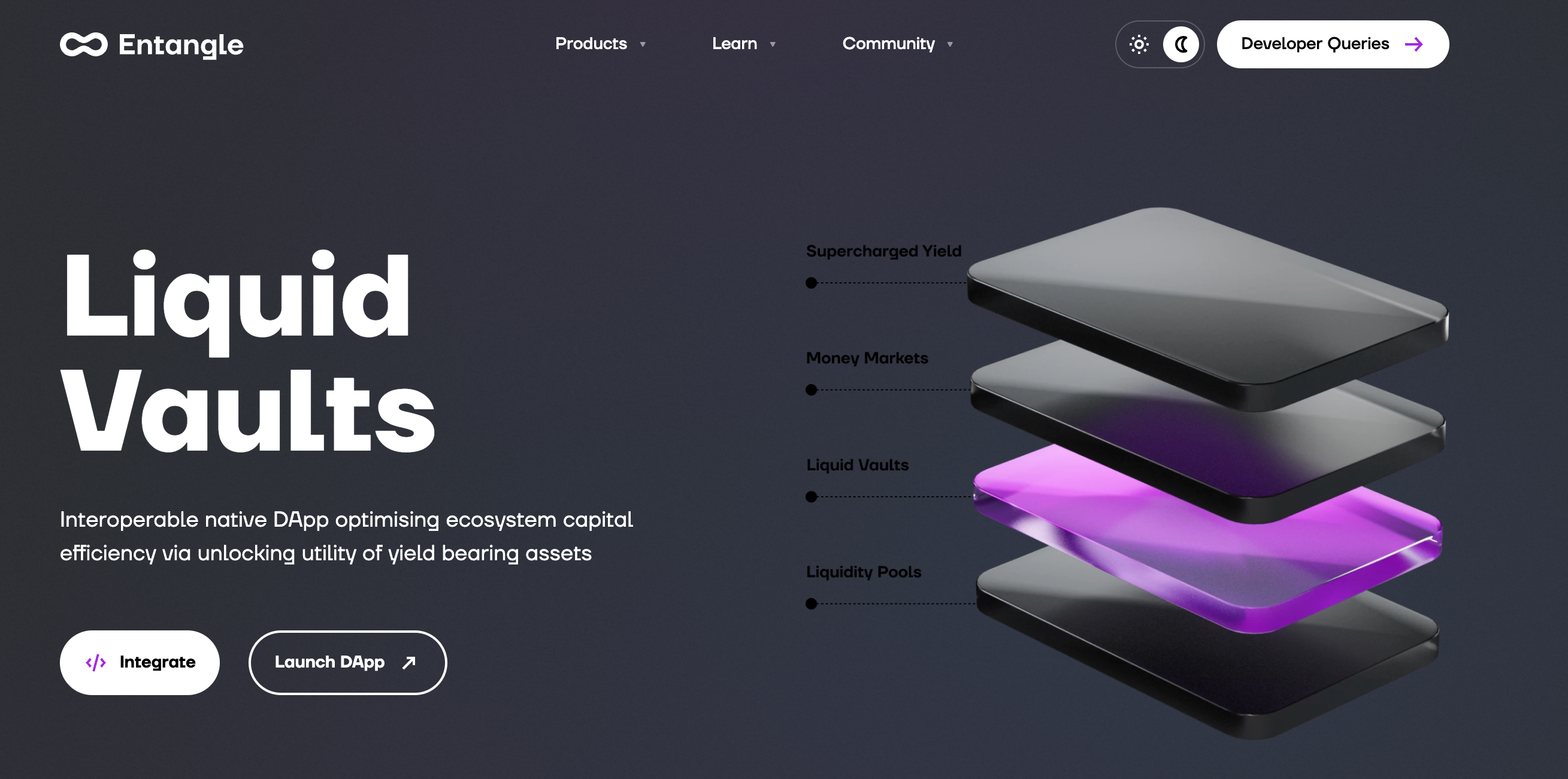

In the DeFi space, Entangle leads by example, building a native application using its own tech stack—Liquid Vaults, enabling on-chain liquidity to be composed across any network for more efficient yield generation.

More specifically, Liquid Vaults creates Composable Derivative Tokens (CDTs), allowing assets to operate across different chains:

In traditional DeFi models, assets locked in one protocol cannot generate returns elsewhere simultaneously. With CDTs, Liquid Vaults enables a “mirroring” effect—users don’t need to move or unlock their original assets to utilize them on other chains or in other protocols.

This means even if a user’s assets are earning yield in a specific protocol, they can still use corresponding CDTs in other DeFi products across different chains—for example, participating in lending markets, liquidity pools, or derivative trading. This breaks down traditional DeFi liquidity silos and unlocks multi-chain utility for assets.

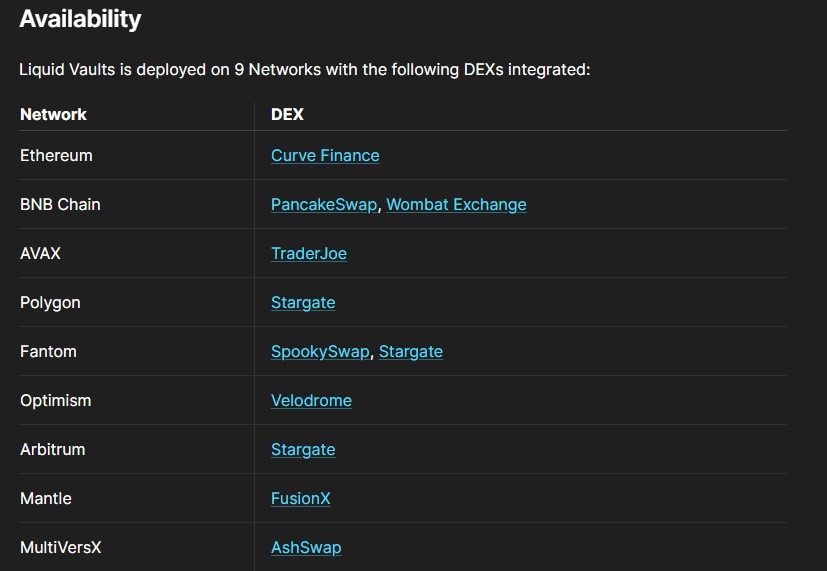

Currently, Liquid Vaults is available for testing on the testnet, and upon official launch will be deployed across nine chains and integrated with various DEXs:

From the current product page, users can see that the system allows staking assets from different chains—including the project’s native token $NGL—through Liquid Vaults to receive LSD tokens. This enables cross-chain yield generation. For instance, a user holding NGL on Ethereum could stake it on this platform and then use the corresponding LSD token on Polygon or another blockchain.

Moreover, Entangle also provides capabilities to support ecosystem development in other crypto sectors.

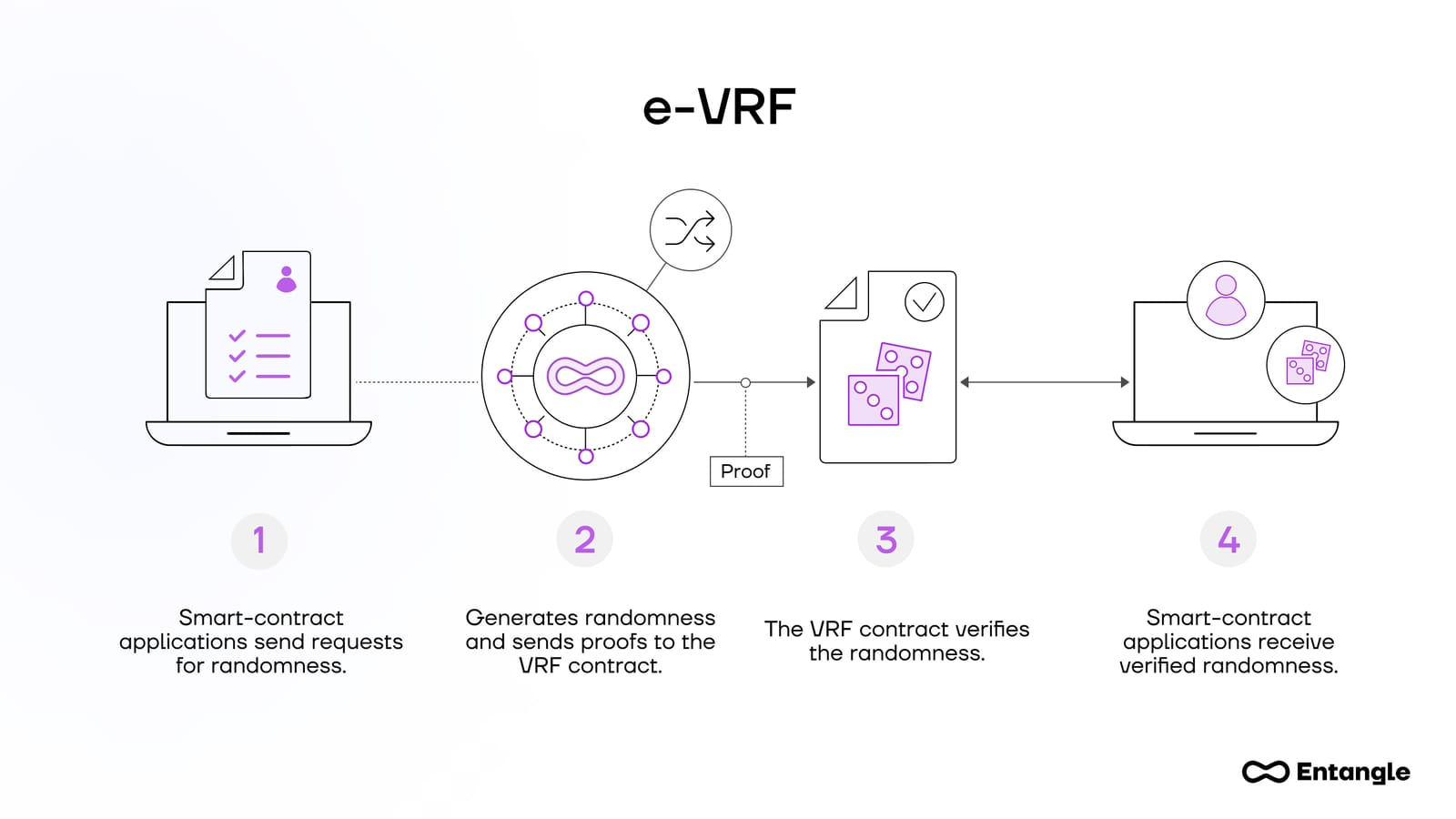

For example, in gaming, Entangle’s e-VRF offers a crucial feature for the product ecosystem: generating verifiable random numbers on-chain.

This is akin to giving blockchains a fair and transparent “lottery machine.” Each random number is generated randomly and can be independently verified, ensuring fairness for applications relying on randomness—such as on-chain games or prediction markets.

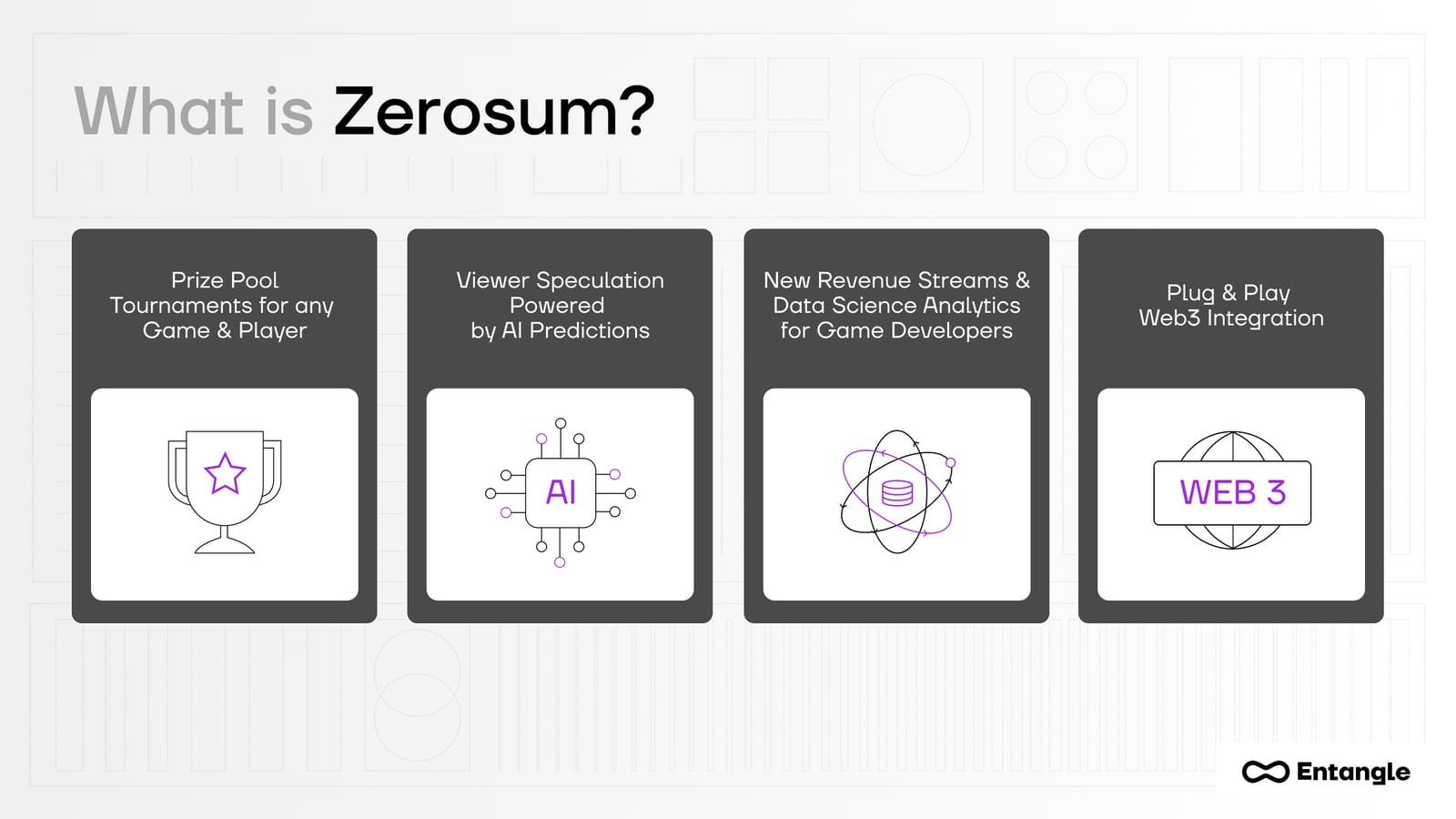

Additionally, Entangle has incubated ZeroSum, a game infrastructure platform.

Leveraging Entangle’s technology, it offers omnichain betting and tournaments for players and audiences alike, providing transparent revenue streams for stakeholders including game developers.

In summary, Entangle differs significantly from many other omnichain infrastructure projects due to its "built-in use cases."

Rather than offering only underlying technology, it directly provides relevant applications and auxiliary tools to support diverse scenarios such as DeFi, gaming, and prediction markets.

Through these innovative use cases, Entangle demonstrates value beyond being a mere tech provider—an ecosystem builder whose solutions go beyond improving asset liquidity to introducing entirely new ways of engaging with the crypto world.

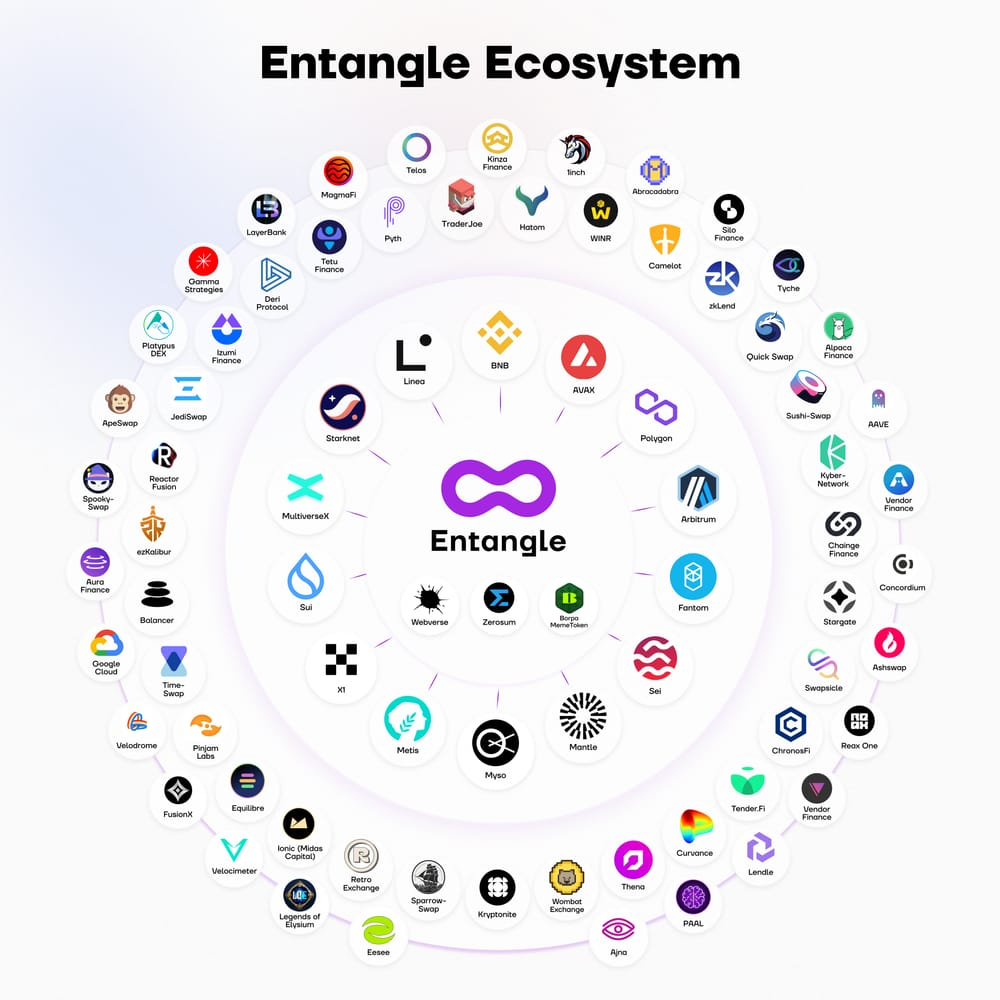

Entangle’s mainnet is expected to launch by the end of Q1 2024, initially supporting over 10 networks, featuring cross-chain communication, composable derivative tokens across 50+ dApps, and universal data feeds.

NFTs and Memes: New Gameplay Tied to Infrastructure

Before Entangle’s $NGL token officially launches, what related assets should investors watch?

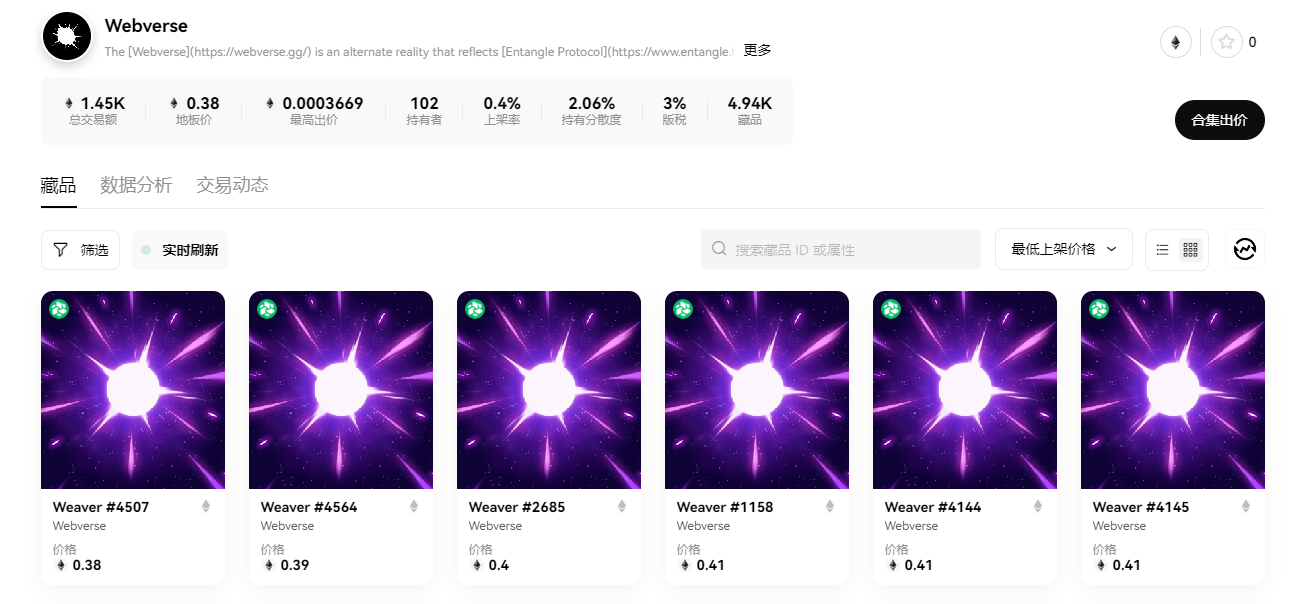

First is the Webverse NFT series, closely tied to the omnichain product design.

The Webverse NFT collection includes two types: Weaver (4,700 units) and Agent (300 units).

You can think of these NFTs as access passes to participate in Entangle’s infrastructure products and earn operational rewards:

Weaver holders can stake their NFTs into products like Liquidity Vaults, Photon Messaging, and Universal Data Feeds mentioned above. These services will naturally generate fees and revenue from omnichain activities, which form the basis for NFT staking rewards.

The rarer Agent series acts as an “upgraded version,” offering not only the benefits above but also eligibility to participate in the public sale round of the project’s native token $NGL.

On January 5, the Webverse series began minting, with Weaver initially priced at 0.15 ETH and currently floor-priced near 0.4 ETH—a roughly 3x increase.

The smoother Entangle’s operations run and the higher user activity and transaction volume grow, the greater the revenue sharing—and thus the upside potential—for Weaver NFTs. Furthermore, Entangle even has its own meme token: Borpa.

A基建 project launching a meme token may seem trivial technically—after all, building a full tech stack is far harder than issuing a token. But it’s rare for a foundational project to actively embrace memes. According to Entangle’s official explanation, they’ve clearly identified the rationale:

“As the industry shifts from tech-centric approaches to battles for attention, we bet that memecoins will surpass other crypto sectors.”

This perhaps reflects a new competitive dynamic in crypto—for obscure, hard-to-reach infrastructure projects, a meme coin is the best way to open up the market, engage users, and capture attention through联动 marketing.

However, Borpa has not yet launched; its economic model can be explored here. The author speculates further details may emerge after mainnet launch or the TGE of their native token.

$NGL Token Value Analysis

Returning to the project’s native asset, the $NGL token plays multiple roles within the Entangle platform and is set to officially launch on March 13:

First, node operators participating in the Entangle ecosystem—such as transport agents—can stake $NGL tokens to gain rights and rewards;

Beyond playing a role in network infrastructure, $NGL can also be used across various applications connected via the Entangle platform. This expands its utility beyond simple trading and staking, enabling it to function as in-app currency and enhancing its practical value.

Finally, $NGL is used to pay gas fees for transactions on the Entangle blockchain.

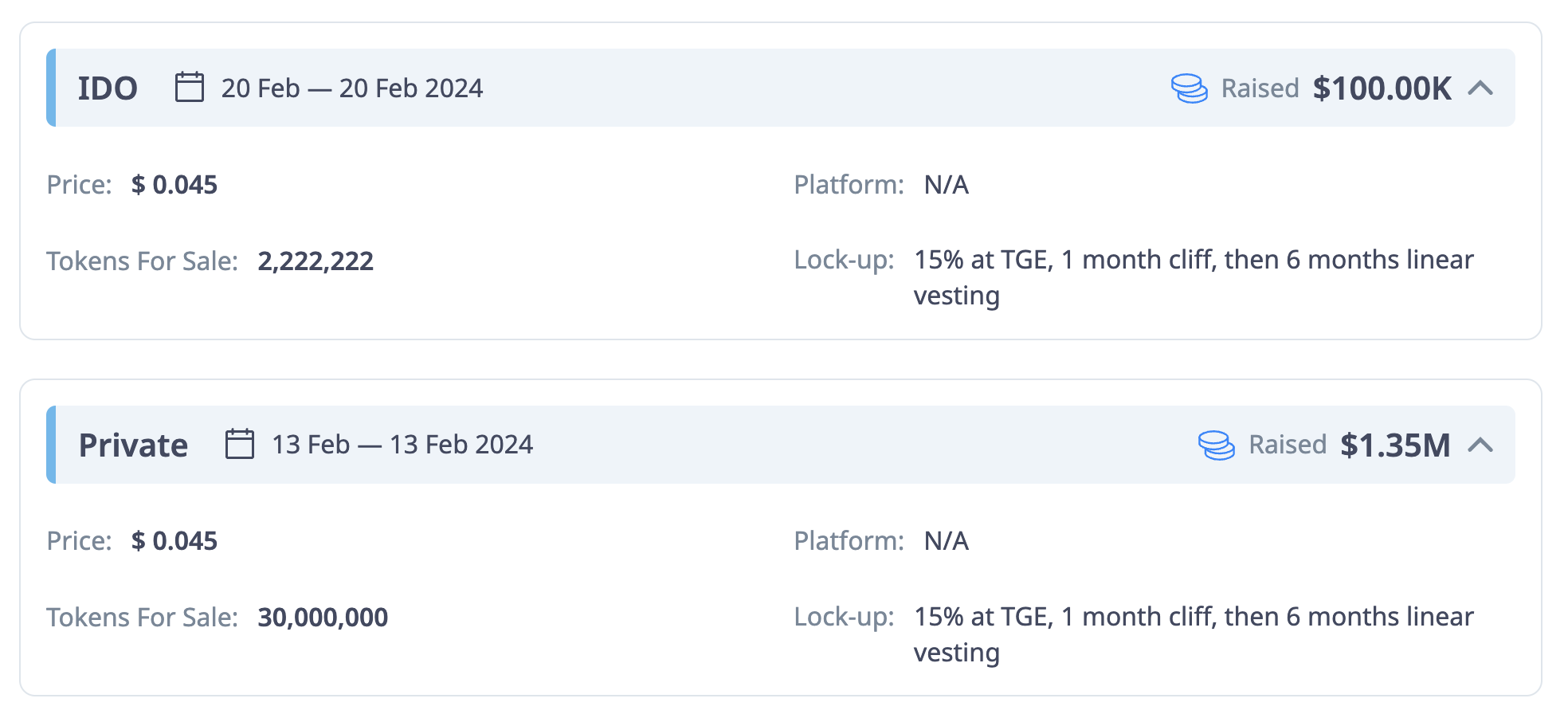

On February 20, $NGL conducted a small-scale public sale targeting whitelist participants. The whitelist round sold out within 10 minutes, and all public allocations were filled, with the sale price at $0.045.

According to the official tokenomics released so far, NGL has a total supply of 1 billion tokens, with an initial circulating supply of 18.55 million. Based on the previous private sale price of $0.045:

-

Initial circulating market cap: $970,000

-

FDV: $45 million

Is this valuation underestimated or overestimated? Let’s compare it with other projects in the same omnichain space.

LayerZero, which hasn’t launched its token yet, is valued at $3 billion. Axelar Network currently has a circulating market cap of around $800 million.

Within the same sector, Entangle appears to have a more comprehensive product matrix and broader business potential, yet its current circulating market cap is much lower—suggesting possible undervaluation.

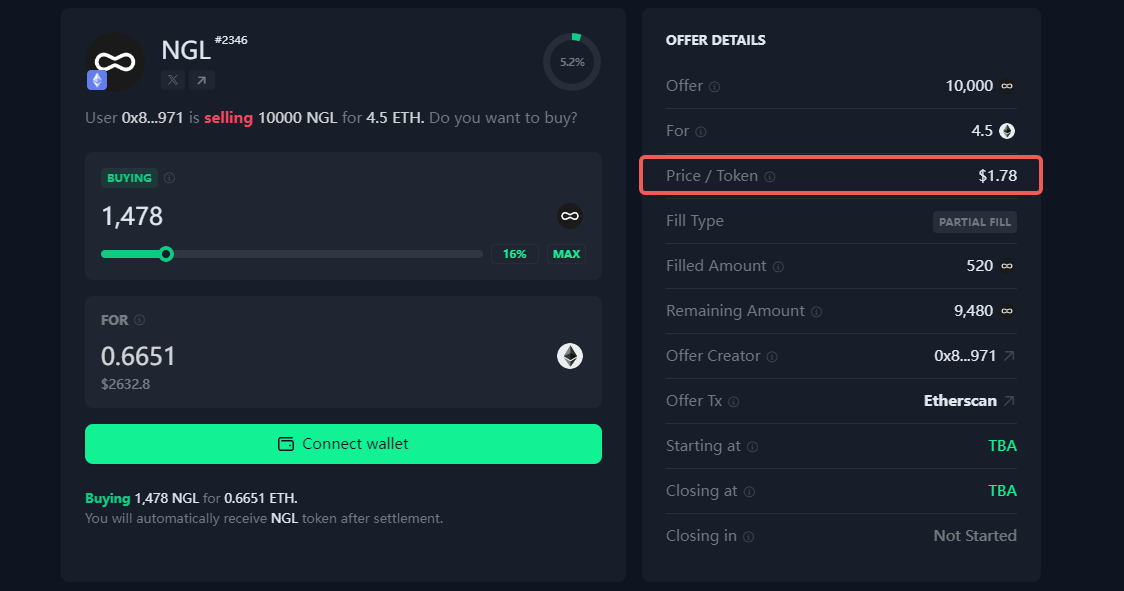

Clearly, the market is already correcting this undervaluation.

As of writing, the pre-sale price of NGL on prominent OTC and semi-primary markets like Whalesmarket has reached approximately $1.78—nearly a 40x increase from the initial private sale price—demonstrating intense market FOMO.

Why is the market so bullish on $NGL?

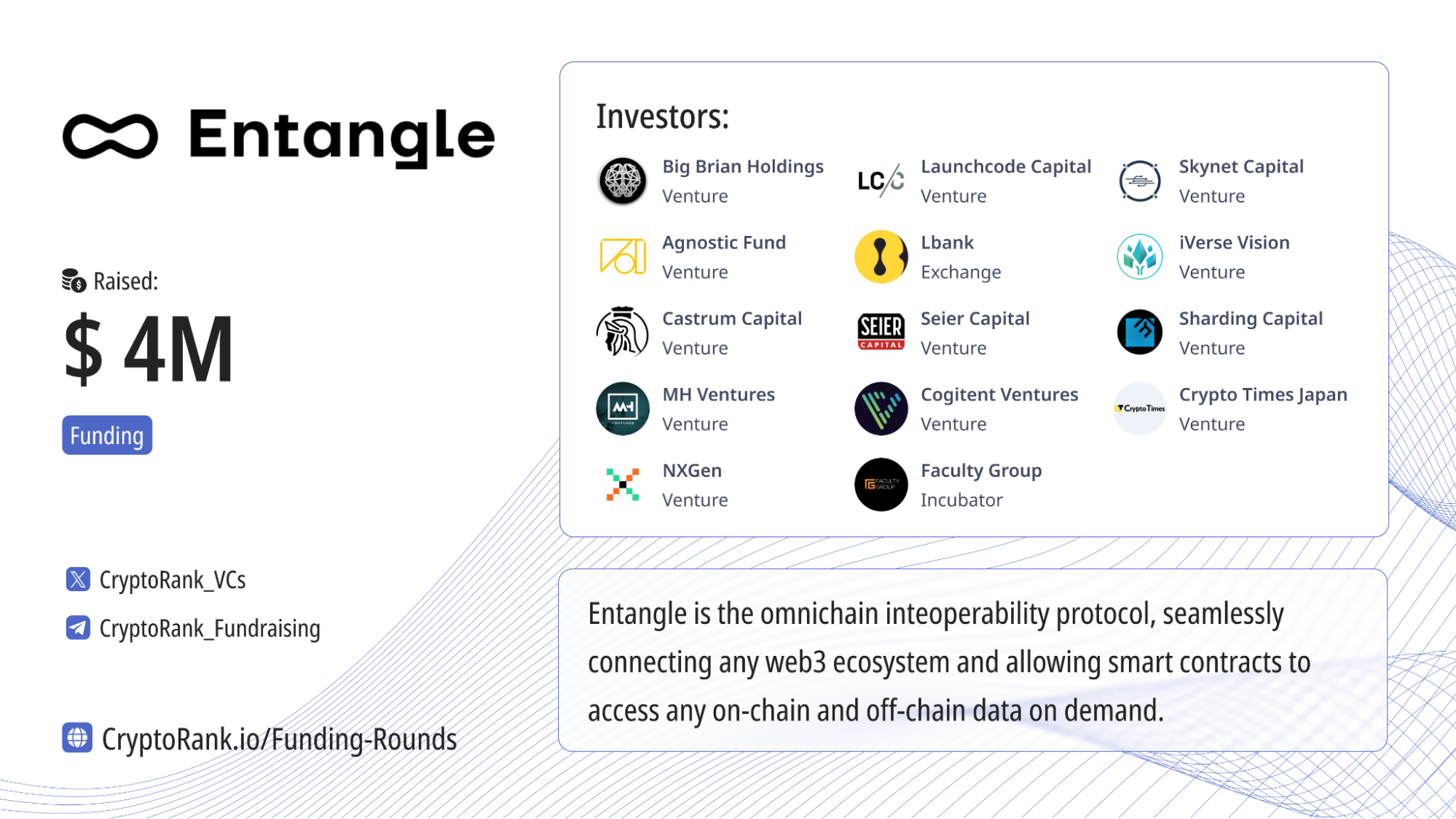

First, Entangle has received backing from well-known crypto VCs such as Big Brain Holdings, Launchcode Capital, and Cogitent Ventures. The project raised $4 million in funding back in 2023.

Notably, Big Brain Holdings previously invested in standout performers like Dymension.

Additionally, thanks to its omnichain nature, Entangle is poised to become a versatile enabler post-launch, forming strong partnerships with multiple L1s and L2s.

The broader the ecosystem integration, the greater the opportunity for diverse projects to benefit.

Pyth Network serves as a great precedent—by becoming essential infrastructure for many projects, turning itself into a “shovel,” its token value naturally appreciated.

Similarly, as an omnichain infrastructure connecting disparate applications, Entangle increases the likelihood that future projects will rely on it for credential-based airdrops, thereby raising bullish sentiment.

Lastly, the shift from “hundred chains competing” to “hundred chains interconnected” is a compelling and positive narrative.

As Entangle’s social media bio states:

“Omnichain Made Easy.”

When sophisticated technology meets poor user experience, we truly need simpler solutions—to connect liquidity and attention across every chain and co-build a unified, consistent, and collaborative crypto ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News