In-depth Analysis of Cardano Connect - CNS, the Social Networking Platform Integrated with Domain Names, and Exploring Investment Opportunities in the Cardano Ecosystem

TechFlow Selected TechFlow Selected

In-depth Analysis of Cardano Connect - CNS, the Social Networking Platform Integrated with Domain Names, and Exploring Investment Opportunities in the Cardano Ecosystem

This platform helps you find friends, attend events, and expand your network with trustworthy people.

CNS Project Introduction

Cardano Connect (CNS) is a social networking platform built on the Cardano network. Users can create and manage their social profiles on Cardano and use .ada domains as portals for their social identities.

This platform enables users to find friends, attend events, and expand their networks through trusted connections. Additionally, CNS issues achievement certificates that are securely stored in a decentralized manner on-chain, while improving data storage efficiency. From a product perspective, CNS functions like an ENS with social business cards on Cardano.

The CNS platform includes three built-in applications.

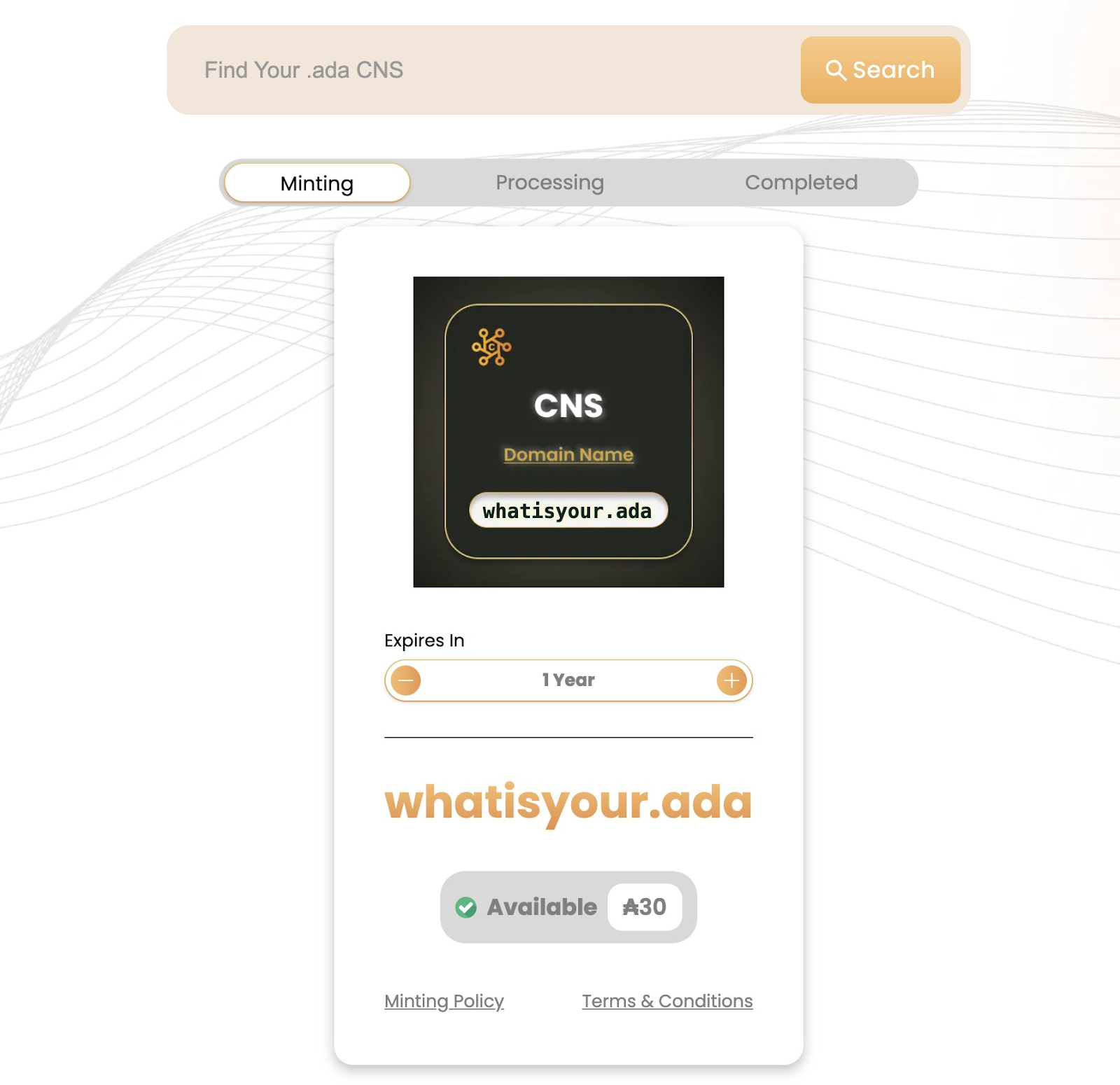

1. CNS Domain Registration: The registration process is fully decentralized. All CNS domain registration records are stored on-chain in a registry, ensuring each CNS domain is a unique NFT secured by Plutus—a typed functional language based on Haskell concepts, commonly used for complex transactions on Cardano's settlement layer requiring formal verification for high security. CNS also adopts a new data architecture allowing over 4,000 minting records per UTxO. Through further registration splitting methods, CNS V1 can support more than one million registrations. These technologies and solutions offer meaningful insights for the Cardano blockchain, and the team has stated they will open-source these innovations to support the development of the Cardano ecosystem.

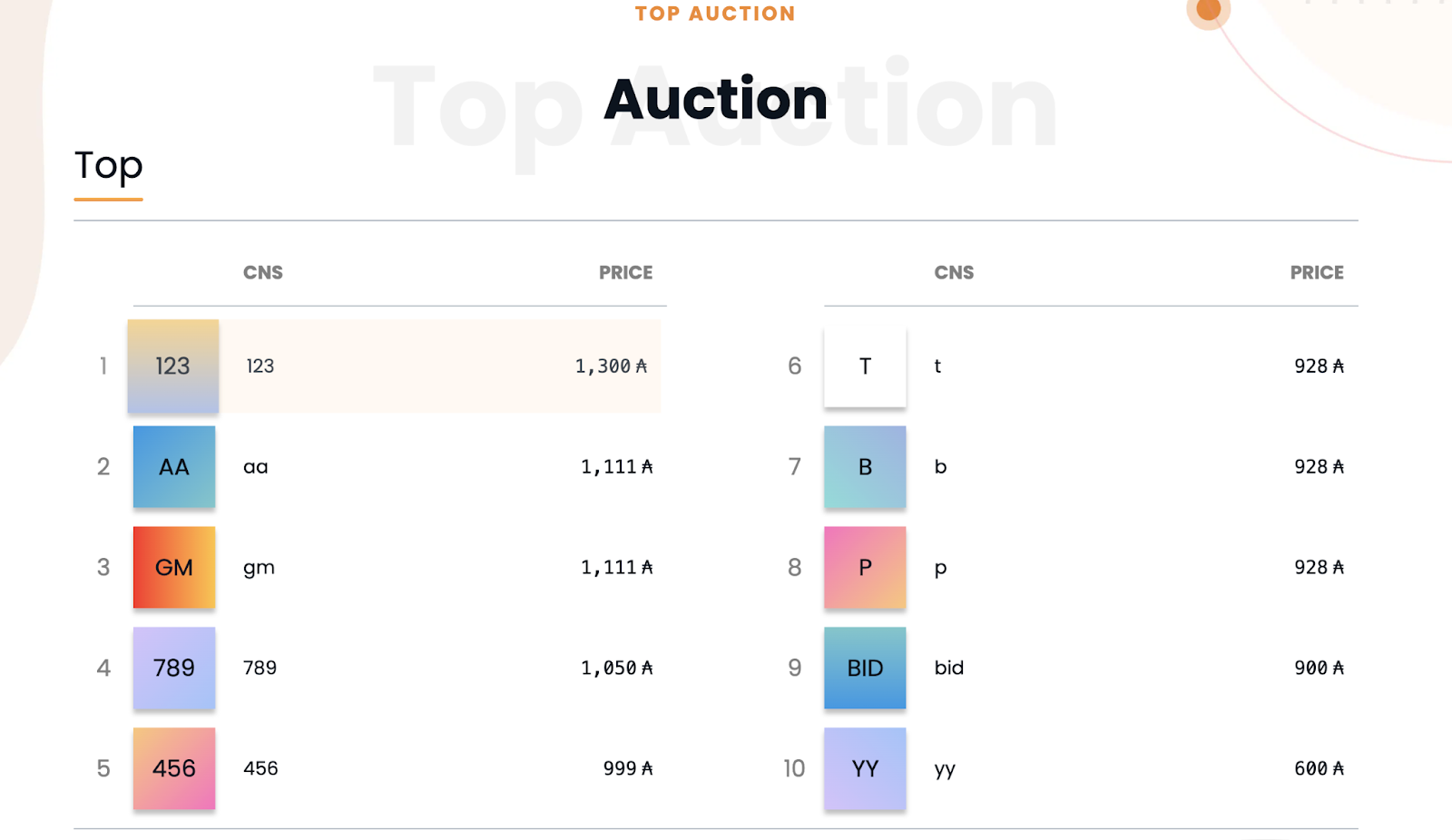

2. CNS Auction: Rare and meaningful CNS domains are reserved for auctions. The domain registration process occurs entirely on-chain and is handled by Plutus scripts to ensure security. The auction process is fully decentralized— even the CNS team cannot access funds locked in auctions, ensuring bidders face no asset security risks during the process.

3. CNS User Records: All user records, including virtual domains and social profiles, utilize a token-gated system designed to protect user data security. Only the record owner—that is, the holder of the CNS NFT—can edit these records.

Current State of the Cardano Ecosystem

It is reported that CNS has received seed funding from Emurgo. Cardano consists of three organizations: the Cardano Foundation, Input Output HK (IOHK) responsible for development, and Emurgo. Emurgo is Cardano’s official commercial arm, dedicated to driving widespread adoption and increasing awareness of the Cardano ecosystem.

When discussing Cardano and its ecosystem, despite another bull-bear market cycle, $ADA still maintains a stable position within the top ten cryptocurrencies by market capitalization. However, to most crypto enthusiasts, its ecosystem development remains shrouded in mystery. While $ADA price movements closely follow trends of major assets like BTC and ETH, the recent surge in BRC-20 tokenized assets and the resulting growth of Bitcoin Layer 2 projects stand in stark contrast to Cardano's relatively quiet atmosphere. Meanwhile, the ETH ecosystem continues to lead by example.

Comparison of ADA and BTC performance this year

According to data from Cexplorer.io, recent active account counts per Epoch (Cardano operates on 5-day epochs) hover around 100,000, peaking at 267,000; monthly active accounts average approximately 520,000, reaching a peak of 1,250,000. In addition, according to DappRadar, Ethereum, Binance Chain, and Zksync host 4,512, 5,322, and 231 Dapps respectively, whereas Cardano lists only 55 Dapps. This scarcity of Dapps directly limits the number of available projects and activities for participants, resulting in fewer on-chain interactions and hindering the formation of a healthy, self-sustaining ecosystem loop.

Looking back seven years, in September 2017, Cardano was officially launched. Founder Charles Hoskinson, also a co-founder of Ethereum, previously served as co-founder and acting CEO of BitShares, having entrepreneurial experience alongside BM and Vitalik Buterin. His technical expertise and startup background remain highly competitive even today. At that time, however, the industry's fundamentals were extremely weak, with very few professionals involved, while the internet wave was sweeping the globe. Now, the SEC has approved BTC ETFs, BTC prices have surpassed the previous high of $69,000, and macro-level interest rate cut expectations have led off-market capital to allocate to crypto as a risk asset. Combined with the upcoming Bitcoin halving cycle, we can confidently say we are in a bull market phase with ample liquidity and strong appetite for risk assets.

Today, the scale of the Cardano ecosystem compared to BTC and ETH ecosystems is akin to the disparity between early BTC and traditional finance a decade ago—no longer comparable. Despite this, ADA’s market cap remains remarkably high. ADA holders appear unmoved by the current bull market, choosing neither to cash out nor switch to more stable or predictable assets like BTC or ETH. Capital flow within the ecosystem lacks clear direction. As a PoS consensus public chain, Cardano's staking ratio reaches as high as 62%.

Cardano Connect (CNS) Airdrop Plan and Outlook

Can CNS unlock ADA's staking ratio and further attract capital to stay within the Cardano ecosystem? Could CNS's airdrop initiative become the leverage point?

According to CNS official documentation, the airdrop will primarily occur across the following stages:

1. Users who participated in the CNS testnet;

2. Participants in ADA staking campaigns (SPO);

3. Users who purchased CNS domains;

4. Weighted by the number of users invited via CNS referral program.

Thus, the primary recipients of the CNS airdrop are testnet participants, users staking $ADA through SPO programs, actual domain purchasers, and users with significant referrals.

Users aiming to earn CNS points can do so through the following actions: 1) Testnet participation, 2) Staking without purchasing, 3) Staking and purchasing, 4) Acquiring sufficient $ADA solely to buy a domain, 5) Referral activities.

The points-based airdrop mechanism popularized by Blur has been widely adopted by numerous projects. This model offers two main advantages:

-

Referral mechanisms effectively motivate individuals, enabling massive exposure in a short time and achieving strong product and marketing cold-start effects.

-

By transparently communicating airdrop expectations, continuously growing point balances displayed on front-end interfaces enhance attraction and retention, making metrics look better and further driving traffic to create a positive feedback loop.

MerlinChain, operating under the current bull market backdrop, leveraged this points-based model to achieve a staking volume of $4 billion within less than two months. Its ecosystem meme token huhu and airdrop token voya both saw gains exceeding 1000% amid inflows of traffic and liquidity, successfully creating a flywheel effect that benefited the entire ecosystem.

Looking ahead to CNS, backed by strong institutional support and official affiliations, if it can maximize the impact of this airdrop through effective operations—leveraging both internal capabilities and external market enthusiasm—we may witness not just a solid return on investment, but potentially a breakout moment for the entire Cardano ecosystem. During a period of continuous growth in the overall crypto market cap, CNS could help Cardano secure its own market position.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News