Adobe: A Beneficiary of AI or a Victim of Sora?

TechFlow Selected TechFlow Selected

Adobe: A Beneficiary of AI or a Victim of Sora?

Sora might be commercialized like Dall-E, but Adobe owns the entire content supply chain from generation to editing.

By RockFlow

Key Takeaways

① Adobe's first major growth surge stemmed from its shift from a one-time perpetual license model to a subscription-based system. Although financials dipped during the short-term transition phase, the company’s revenue grew rapidly over the following five years as its cloud strategy took effect, with its stock price increasing more than sevenfold.

② Adobe now faces a new challenge: the golden era of rapid revenue growth driven by soaring subscription user numbers has largely ended. Its two core segments—Digital Media and Experience Cloud—are now growing at around 10%, making the search for a new growth engine urgent.

③ Adobe has seized on a critical insight—the integration of AIGC into existing creative workflows. By embedding Firefly directly into its product suite, users can access AI-generated content seamlessly within their professional tools, enabling designers to use AI as an efficiency-boosting assistant. This zero-migration-cost approach allows AIGC to be smoothly incorporated into daily work processes.

④ While Sora may become commoditized like DALL-E, Adobe owns the full content supply chain—from content generation to post-production editing. This end-to-end ecosystem is tightly integrated with professional users and enterprise clients, where most monetization opportunities lie.

Adobe was initially seen as one of the biggest beneficiaries of the AI transformation. However, due to intensifying competition and market concerns that AI’s contributions may fall short of expectations, its stock has recently pulled back.

With the share price now down to levels last seen in October 2023, investors are questioning whether AI will ultimately help or hurt Adobe.

This article analyzes Adobe’s development trajectory, current situation, AI initiatives, and the emerging threat posed by Sora. The RockFlow research team believes that AI will significantly reduce time-consuming steps in creative design and dramatically boost productivity. Companies in this space will therefore have strong incentives to maintain long-term AI investments. Given Adobe’s pricing power over the foreseeable future, AI is poised to become the next catalyst for its stock—following the earlier shift from on-premise software to cloud services.

Previously, the RockFlow research team has analyzed AI education stocks such as Duolingo, the convergence of AI and fintech, and leading Silicon Valley AIGC startups. Interested readers can refer to the following articles:

Duolingo: How Is AI Shaping the Future of Education?

What Interesting Changes Has AI Brought to Fintech in 2023?

Insights from a Top Silicon Valley VC: 19 Rising Stars in the Generative AI Space

In the long run, companies like Adobe in the creative domain and Duolingo in education are both high-quality beneficiaries of the AI revolution.

1. Adobe’s Cloud Strategy Delivered Its First Golden Five-Year Run

As a global leader in creative software, while Adobe faces some competitors (such as Figma), no other company offers as broad a product ecosystem—from video and image editing to illustration and 3D, and now including AI-powered image generation and enhancement. Adobe describes its value proposition as follows: “Our products and services help unlock creativity, enhance workplace productivity, and power the long-term growth of digital businesses.”

Adobe operates three main business lines: Digital Media (including Creative Cloud and Document Cloud), Digital Experience (including Experience Cloud), and Publishing & Advertising. The first two are strategic focuses, while Publishing & Advertising is a legacy segment contributing minimal revenue.

Digital Media primarily includes creative software (Creative Cloud) and document applications (Document Cloud), such as Acrobat (PDF reader/editor), Firefly, and Photoshop. Digital Experience provides B2B customers with an integrated suite of services for data collection, analytics, and marketing management.

The key metric for both businesses is ARR (Annual Recurring Revenue). With all Adobe products now offered via subscription, the company enjoys predictable and stable revenue streams—a primary driver behind its stock rising from $70 in 2015 to $500 in 2020.

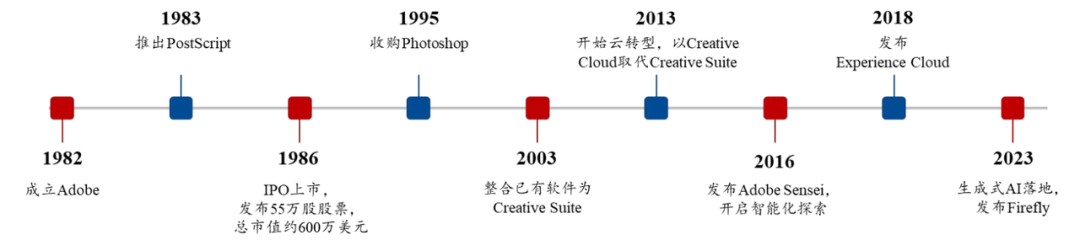

Adobe began with PostScript, a page description language for printing. Its evolution has been marked by three pivotal phases:

1) 2003: Transition from Single Product to Product Suite

Adobe launched PostScript in 1983, solving compatibility issues between personal computers and printers at the time. It quickly became the industry standard. Building on this success, Adobe expanded into vector graphics with Illustrator and acquired Photoshop as a complementary tool for photo editing.

As Illustrator and Photoshop gained dominant market share, Adobe recognized the potential in content creation software and launched additional tools—Premiere for video editing, After Effects for visual effects, and InDesign for layout—before bundling them into Creative Suite in 2003.

2) 2013: Shift from Perpetual Licenses to SaaS

Amid the 2008 financial crisis, Adobe faced declining revenues and profits, with its stock dropping 50% that year. Management began rethinking its business model. The traditional one-time license model suffered from high sales costs, slow customer acquisition, and unpredictable revenue.

In response, Adobe announced in 2013 that all its software would be available exclusively via subscription, replacing Creative Suite with Creative Cloud. Financial performance dipped during the subsequent two-year transition period. However, starting in 2015, the cloud strategy began delivering results, ushering in five years of rapid revenue growth.

3) 2016: From User Growth to Product Intelligence

In 2016, Adobe began integrating AI across its products with the launch of Adobe Sensei, an underlying AI framework. Today, Sensei powers hundreds of AI features across Adobe’s product line. In March 2023, Adobe launched Firefly, an AI content generation model, and Sensei GenAI, a customer experience management model.

Adobe is now exploring how AIGC can benefit the creative industry and expand its growth runway.

As previously noted, Adobe began its cloud transition in fiscal 2013. Revenue growth stalled during the initial two years but then surged, achieving a CAGR of 21.8% over the next five years. Starting in fiscal 2020, subscription revenue consistently accounted for over 90% of total revenue, marking the successful completion of the cloud transformation.

Today, Adobe’s core challenge is that the high-growth phase fueled by rapid subscriber expansion has largely ended. While overall revenue continues to grow, the growth rates of its two most important segments—Digital Media and Experience Cloud—have slowed to around 10%. As a result, Adobe urgently needs a new growth driver.

2. Adobe’s AI Content Supply Chain Strategy Off to a Strong Start

In March 2023, Adobe launched Firefly, an AI text-to-image model that enables users of varying skill levels to generate high-quality images.

According to Google search trends, Firefly has maintained stable traffic since its launch, without significant dips. Company data shows that Firefly generated over 2 billion images within six months, surpassed 3 billion in seven months, and exceeded 4.5 billion in eight months—outpacing other text-to-image models in both volume and growth rate.

Initially, market feedback on Firefly was positive. Despite competition from similar products like DALL-E and Midjourney—some of which initiated price wars—and critics noting that Firefly didn’t always outperform in specific areas, Adobe’s strategic positioning still excited investors.

Adobe emphasized Firefly’s compliance-focused differentiation: it is trained solely on licensed Adobe Stock content, publicly available authorized materials, and public domain works, with outputs safe for commercial use. Adobe also pledged to cover any legal claims arising from copyright infringement, further reducing client risk.

In contrast, MidJourney and Stable Diffusion have faced multiple copyright lawsuits—including a 2022 case where three artists sued MJ and SD for using their original works without permission, and a 2023 lawsuit by licensing agency Gretty alleging SD’s training data included millions of unauthorized artworks.

In this context, users—especially enterprises—prioritize lower-risk tools like Firefly when commercializing AI-generated content. Adobe also benefits from a vastly larger proprietary dataset of creative assets eligible for training.

Moreover, Adobe’s management introduced a new concept: the “content supply chain.” This frames the process of ideating, creating, and using digital content as a supply chain. Adobe identified a crucial insight: seamless integration of AIGC into existing workflows. By embedding Firefly directly into Photoshop, Illustrator, and other core products, users can generate content and immediately refine it using professional-grade tools. This aligns perfectly with designers’ needs for AI-assisted, efficiency-enhancing workflows, enabling AIGC adoption with zero migration cost.

In contrast, MidJourney and DALL-E operate as standalone web platforms with limited editing capabilities. Even when integrated with third-party tools, they cannot match Adobe’s comprehensive ecosystem.

On November 1, 2023, Adobe implemented a dual pricing model for Firefly—offering both pay-per-use and subscription options. This supported a price increase across Creative Cloud products (average hike of 9%), larger than previous increases of 8% in 2018 and 5% in 2022. The latest hike covered more regions and products and marked a rare consecutive annual price rise, underscoring both the strong monetization potential of AIGC and increased confidence in Firefly-driven revenue growth.

Thus, Adobe’s AI content supply chain strategy has achieved early success. This approach was warmly received by investors, positioning Adobe as a pioneer in AI productization—similar to Microsoft—and contributed to a market cap increase of over $110 billion in 2023 alone.

3. How Big a Threat Is Sora?

OpenAI unveiled Sora on February 15, showcasing astonishingly high-quality AI-generated videos, which triggered consecutive declines in Adobe’s stock. Given that Adobe’s flagship products are image and video editors, investors worry that diffusion models—the foundation of text-to-image and text-to-video generation—could severely undermine Adobe’s competitive advantage.

This concern is valid. AI appears to be drastically lowering the barrier to content creation—and even reducing the need for human labor. If AI can perform most creative tasks, can Adobe maintain its leadership in the creative industry ten years from now?

Beyond Sora, Adobe faces growing competition. Google and Apple already offer numerous AI-powered editing tools and continue refining them. Microsoft is aggressively rolling out new Copilot features.

If Adobe was once a niche giant operating in a relatively insulated market, it now faces unprecedented pressure. As AI models improve, tech giants are developing broad solutions targeting everyday use cases—not necessarily focused on creative professionals, but increasingly encroaching on Adobe’s territory.

To assess this threat, consider two perspectives:

First, regarding Sora, AIGC is unlikely to deliver the final output required in professional creative work. Sora (or any other model) can generate videos from text prompts, but these outputs rarely qualify as finished products. This gap may be acceptable to casual users, but professionals typically cannot treat them as final deliverables.

This limitation means creative tools remain indispensable—AIGC only solves the first step. This dynamic has already played out with text-to-image models; given video’s greater complexity, the gap may be even wider.

Therefore, just as DALL-E became commoditized, Sora may follow suit. But Adobe controls the entire content supply chain—from generation to editing. This ecosystem is deeply entrenched with professional users and enterprise clients, where most monetization opportunities exist.

At least for now, most of Adobe’s competitors treat creative tools as value-added features. Apple and Google are enhancing hardware, operating systems, and related software—but not monetizing creative tools as standalone products.

Adobe’s content supply chain strategy and the commercial success of Firefly have prepared it well for competitive pressures.

Second, Adobe believes that while AI boosts productivity, the explosion of content creation will expand overall value. Even if AI slows (or reduces) subscriber growth, part of this "demand decline" could be offset by higher per-user revenue driven by AI-enabled features.

Moreover, Adobe is actively responding to challenges. In November 2023, it successfully acquired Rephrase.ai, an AI startup offering a platform that converts text scripts and user avatars into personalized videos for marketing, customer communication, and greetings. This marks Adobe’s first acquisition in the AI space, signaling its intent to integrate promising new tools into its product portfolio.

4. Adobe’s Latest Quarterly Results and Outlook

Adobe’s third-quarter performance was solid, with both revenue and profit exceeding expectations. Revenue rose 11.6% year-over-year to $5.0 billion, net income reached $1.5 billion, and profit margins improved by 3.4% year-over-year and 0.7% quarter-over-quarter.

While growth slightly accelerated, it remains underwhelming. When discussing its 2024 outlook, management set conservative targets—projecting full-year revenue growth of 10.2% and flat margins—far below the double-digit growth rates investors were accustomed to before 2022.

In contrast, another AI powerhouse—Microsoft—achieved 17.6% revenue growth in the three months ending December, with AI products making measurable, tangible contributions to revenue.

Market expectations for Adobe’s fourth quarter include revenue of $5.145 billion (up 10.53% YoY) and EPS of $3.37 (up 24.52% YoY).

The focus will be on Adobe’s growth momentum and the integration of AIGC across its product suite. Adobe has already embedded AI into its offerings—including Firefly in Creative Cloud and AI services in Experience Cloud—but the key question remains: can it meaningfully monetize Firefly? Markets are eager to see how these AI capabilities translate into customer engagement and financial performance.

Additionally, Adobe has officially terminated its planned acquisition of Figma. While this saves $20 billion in cash, it may dampen future growth expectations. Adobe must now develop a competitive alternative to counter Figma—an uncertain endeavor. The net impact on Adobe remains unclear.

5. Conclusion

In the long run, will the AI wave benefit or harm Adobe? If DALL-E was the first test, the market clearly overestimated the threat in the short term. After all, Adobe quickly responded with Firefly and retained control over the entire value chain.

The RockFlow team remains confident in Adobe’s pricing power and the long-term value of Firefly. We believe Adobe will continue to benefit from AI and strengthen its long-term market position.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News