Ethena Points Guide: How to Properly Join the Last Train

TechFlow Selected TechFlow Selected

Ethena Points Guide: How to Properly Join the Last Train

Ethena Labs offers various types of points mining with different point multipliers. This article will directly recommend the optimal strategies under different return and liquidity requirements.

By CapitalismLab

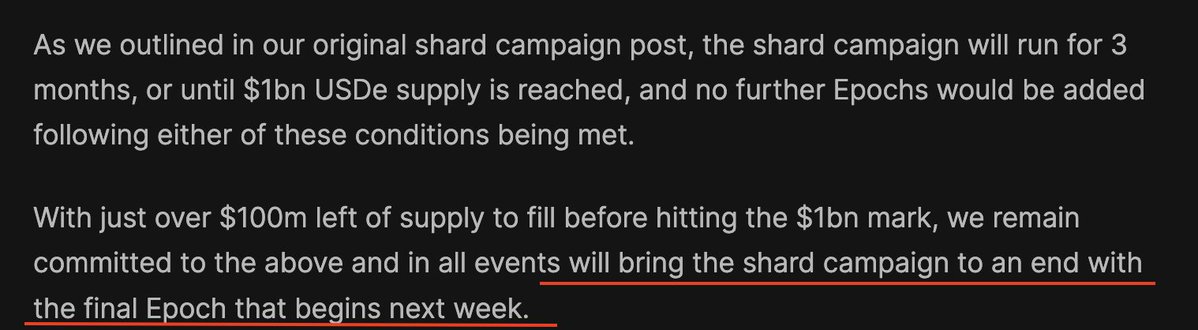

Ethena's blog post almost explicitly signals the imminent end of its points program, while on Pendle, the implied APY for USDe has reached a staggering 170%! This indicates strong market recognition of this sky-high, peerless yield.

In response, we’ve quickly put together this ultimate guide—“The Best Strategy for Ethena Points Farming”—to help you understand how to properly hop on this final train before it departs.

First, a brief introduction to Ethena: you deposit USDT/USDC (referred to as "U") and the project uses it to purchase LSD assets like stETH on exchanges. It then hedges by shorting ETH, capturing both ETH staking yields and funding rate income from the short position. During bull markets, funding rates are high, which leads to elevated returns for Ethena.

Ethena offers two tokenized products:

-

sUSDe – earns native yield, reflected in an increasing sUSDe/USDe exchange rate over time. Requires a 7-day unstake period to convert back to USDe.

-

USDe – non-interest-bearing, designed for DeFi composability and liquidity provision. The underlying asset yield flows to sUSDe, boosting its returns. Most points rewards are distributed based on USDe usage. Note that regular users can only swap between USDe and USDC/USDT via DEXs, resulting in minor slippage costs when entering or exiting.

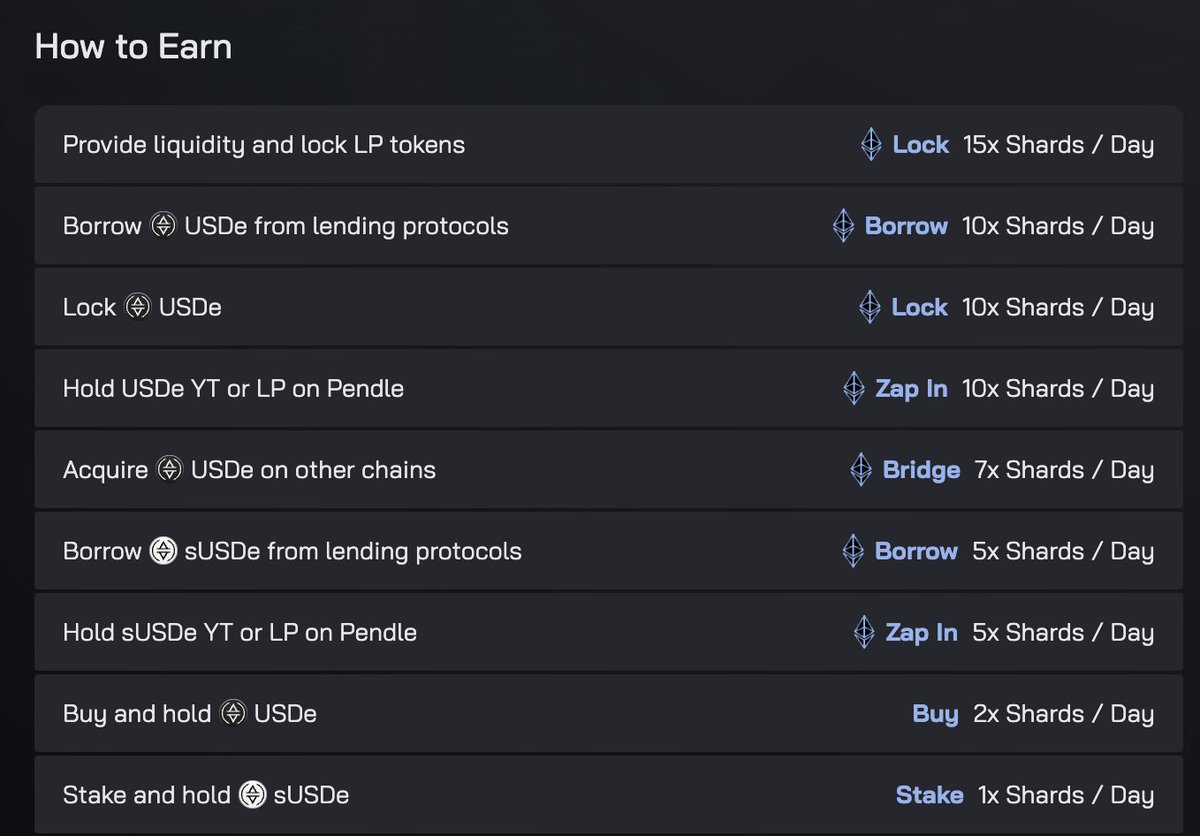

Ethena Labs offers various types of points mining with differing multiplier levels. Below, we directly recommend optimal strategies tailored to different yield and liquidity needs.

Use our referral link:http://app.ethena.fi/join/wogwi

1. Zircuit + USDe – Highest-yielding option with no lock-up period and available capacity.

Deposit USDe into @ZircuitL2

You’ll earn 7x points multipliers plus Zircuit’s own points rewards, with instant withdrawal capability. Zircuit is a well-known L2 backed by prominent VCs.

https://stake.zircuit.com/?ref=3yn4f8

2. Locked USDe – Largest capacity, moderate yield and liquidity.

Directly locking USDe grants a 10x points multiplier, with a 7-day unlock period. Remaining capacity is still relatively ample.

3. Locked Curve USDe LP – High yield, poorest liquidity, limited capacity.

Locking the LP tokens shown on the http://app.ethena.fi/liquidity page offers a 15x points multiplier. However, it requires a 21-day unlocking period during which no rewards accrue. Given the points program is likely ending soon, the opportunity cost is significant. Only consider this if you believe future farming opportunities won’t come close to matching this one. Currently, capacity is nearly full—monitor availability and act when slots open up.

4. Holding sUSDe – High USD-denominated yield, minimal points rewards.

Only 1x points multiplier, but offers up to 67% native yield (i.e., USD-based return). However, unstaking takes 7 days, liquidity is moderate, and you may also sell at a discount via DEXs.

5. Pendle/Gearbox USDe – Theoretically high returns but completely out of capacity.

On Pendle, using YT tokens could enable up to 200x points multipliers, but all quotas are filled.

On Gearbox, looping leveraged borrowing against USDe can achieve up to 90x points multipliers, but capacity is extremely scarce and borrowing costs must be factored in.

Both options carry notable risks of loss and are recommended only for experienced users who fully understand the mechanisms.

Other strategies generally offer either lower yields than the above at similar liquidity levels, or worse liquidity for comparable yields. Therefore, simply choose among the above options according to your specific liquidity preferences.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News