After a period of silence, the flywheel of Helium Mobile begins to spin again

TechFlow Selected TechFlow Selected

After a period of silence, the flywheel of Helium Mobile begins to spin again

This article will discuss Helium Mobile from the perspectives of its market potential, mining rules, relationship with HNT, and token economics.

Author: FMGResearch

TL; DR

1. Helium Mobile has surpassed 50,000 users; annualized projections suggest it could reach 530,000 users this year;

2. Users participating in Mapping can earn 2,000 MOBILE tokens per day—recovering the $20 cost in just three days at current prices;

3. The price of MOBILE is closely tied to HNT—overall, rising HNT prices will drive up MOBILE prices and create a positive flywheel effect;

4. The MOBILE token halves every two years, placing it in a state of overall deflation;

5. Massive user growth potential ensures that the MOBILE token will remain in long-term supply shortage for the foreseeable future.

Introduction

To explore the development potential of Helium Mobile, we must first examine its inherent characteristics. Undoubtedly, Helium Mobile ranks among the projects with the greatest breakout potential on FutureMoney Group’s radar—poised to become one of the most promising examples of Web3 mass adoption in the real world. We are highly optimistic about its future trajectory, believing that despite past setbacks in token price, it is now re-emerging and may eventually surpass the impact of Axie Infinity and Stepn.

This article analyzes Helium Mobile from the perspectives of market potential, mining rules, its relationship with HNT, and tokenomics.

Market Potential and Dual Narrative of Solana & DePIN

Helium Market Potential

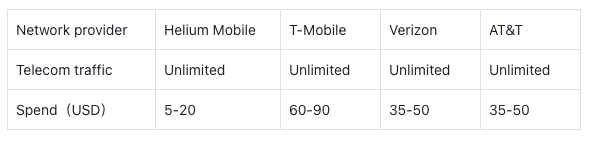

According to J.D. Power, in 2023, U.S. consumers spent an average of $157 monthly on telecom plans. Helium Mobile's $20 plan offers significant pricing advantages.

In terms of market strategy, Helium Mobile echoes early Uber tactics—using aggressive pricing to capture market share. However, thanks to its tokenomic design, Helium Mobile avoids bearing actual high operational costs—a structural advantage traditional telecom companies cannot replicate.

The key differentiator between Helium Mobile and traditional carriers lies in its business model: users contribute to infrastructure and gain potential token rewards. Through effective token incentives and competitively priced mobile plans, Helium 5G has achieved in months what some of America’s largest CBRS networks took years to accomplish—deploying over 7,000 small-cell radios across more than 1,200 cities in the U.S.

One common challenge for many projects is difficulty initiating network effects due to low initial user counts. Helium Mobile bypasses this by partnering with T-Mobile, a major U.S. telecom provider, under a five-year agreement that ensures broader user access and improved service quality. When Helium Mobile users enter areas without Helium coverage, their devices automatically switch to T-Mobile’s network.

For end users, Helium Mobile offers both affordable plans and additional earning opportunities. The strategic partnership with T-Mobile guarantees stable network services, enabling further market expansion and ensuring reliable user experience.

Rapid Data Growth of Helium Mobile

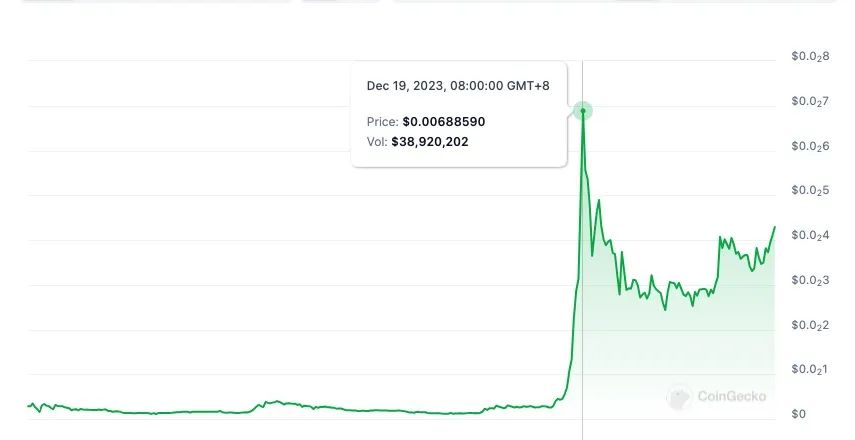

On February 26, 2024, Coinbase listed MOBILE, marking Helium Mobile’s official entry into mainstream crypto markets. From a historical low of $0.000076, MOBILE has since surged by as much as 102x. In terms of growth speed, Helium Mobile shows strong momentum: the number of active 5G nodes stands at 12,398—nearly doubling from 6,400 nodes in August last year, growing at approximately 1,000 nodes per month.

In terms of actual users, Helium Mobile exceeded 30,000 subscribers by January 5 this year. By February 27, daily new subscriptions reached 1,444. Based on this growth rate, total users are estimated to have surpassed 50,000.

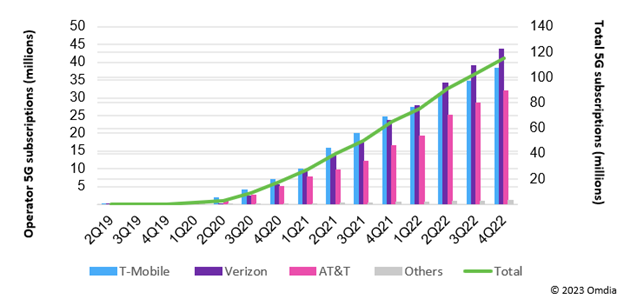

If projected annually, Helium Mobile could add nearly 530,000 new subscribers this year—rivaling Verizon and AT&T’s combined 545,000 net additions in 2023.

The rapid user growth of Helium Mobile stems directly from its low-cost $20 telecom plan.

On January 25, Telefónica (TEF), one of the world’s leading telecom operators, partnered with Helium Mobile to launch services in Mexico, a country with a population of 126.7 million.

Given Mexico’s average monthly income of $327 and traditional telecom plans costing $99.99 for 275MB data, Helium Mobile’s $20 plan presents a compelling value proposition that can quickly penetrate the market.

Dual Narrative: Solana + DePIN

Another critical factor driving Helium Mobile’s resurgence is its alignment with two powerful narratives: Solana and DePIN.

On April 20, 2023, Helium completed its migration to the Solana network, becoming a leading project in Solana’s DePIN ecosystem. Solana’s high-performance blockchain infrastructure provides fertile ground for Helium Mobile’s scalability and efficiency.

Helium Mobile is actively integrating with the Solana ecosystem.

At Solana’s Breakpoint 2023 conference, Helium Mobile was frequently cited as a flagship use case. In November 2023, Nova Labs announced SIM cards and free trial services for Saga phone users—approximately 50,000 people. These phones are Solana’s flagship Android devices, deeply integrated with the Solana blockchain.

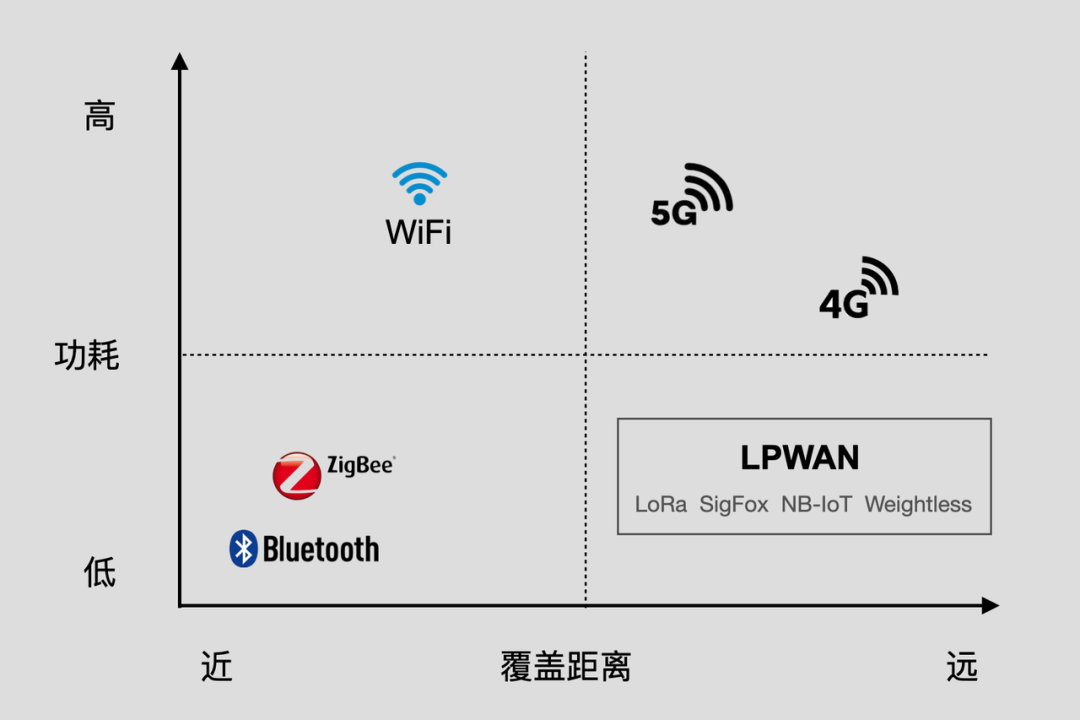

As Bitcoin ETFs gain approval and crypto enters the mainstream, DePIN represents a pivotal narrative—the convergence of token economics with real-world physical infrastructure.

By focusing on mobile devices and communication—the most essential tools in daily life—Helium Mobile enables smoother adoption and wider acceptance in society.

Revised Mining Rules for Helium Mobile

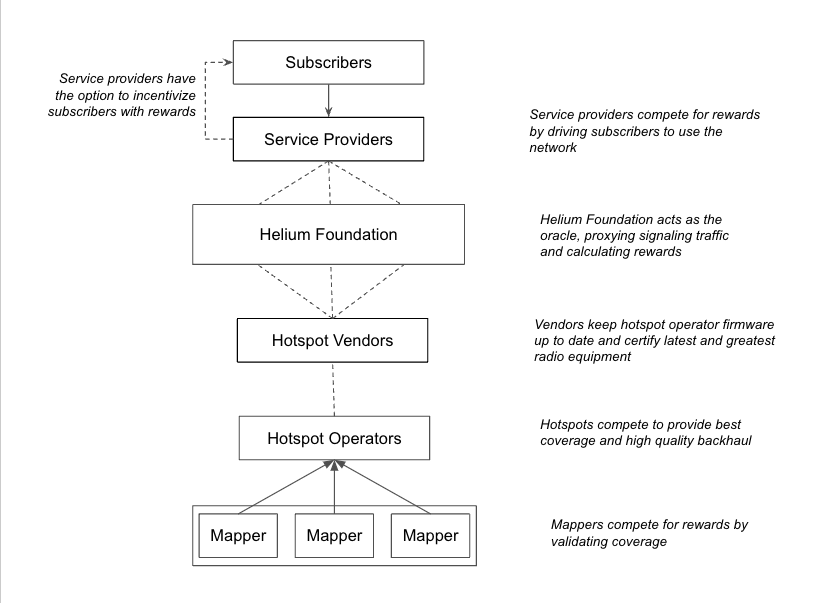

The Helium Mobile network consists of four key roles:

-

Hardware Suppliers: manufacture and sell 5G hotspot devices

-

Hotspot Operators (Miners): purchase hotspot devices, contribute to network coverage, and earn token rewards

-

Operator Nova Labs: provides end-users with a $20/month 5G plan

-

Users: purchase 5G plans via credit card or tokens, and earn rewards by sharing location data

In simple terms, Helium Mobile offers two forms of “mining” centered around hardware and telecom plans: hardware holders deploy hotspots to provide connectivity and earn tokens; plan subscribers use the service and share location data to earn rewards.

Strictly speaking, MOBILE can indeed be classified as a mineable token, following classic paths seen with BTC, ETH, and FIL: rising MOBILE prices increase demand for hardware and plans, giving the team more funds for market-making and further price appreciation.

However, mineable tokens face a fundamental challenge: increased miner demand often leads to greater selling pressure. Market sentiment may outpace any buy-side support. Additionally, hardware deployments often suffer from “ghost mining”—where large numbers of hotspots are clustered in data centers, or users hold multiple $20 plans without serving real users.

Such inefficiencies ultimately lead to severe imbalances in supply and demand, culminating in price collapse.

To address these issues, Helium Mobile implemented two key adjustments:

1. Hotspot rewards are now based on actual usage—only when real users connect to a hotspot does the operator earn rewards;

2. Revised mapping mining rules: new subscribers must wait eight days before claiming rewards, and location updates only occur intermittently (device must move more than 200 feet). Only genuine contributors receive rewards. Each account receives only one Mapping reward regardless of how many devices are linked.

Currently, users participating in Mapping can earn over 2,000 MOBILE tokens per day. With a $20 monthly plan, users effectively start mining immediately. At current rates, users recover their subscription cost within two days.

Following the rule changes, MOBILE’s price initially peaked and then declined—a direct reflection of market recalibration. Nevertheless, at the current price of $0.0037, users still recover their $20 subscription fee in just three days.

Synergy Between MOBILE and HNT

Helium Mobile is a SubDAO token of Helium, part of the Helium LoRaWAN long-range wireless technology ecosystem, alongside Helium IoT (low-cost, wide-coverage IoT network) and 1633 (enterprise IoT solutions), collectively forming Helium’s wireless communications “empire.” As sub-tokens of the ecosystem, IOT and MOBILE maintain close value linkages with HNT.

Among these three use cases, Helium Mobile is currently experiencing the strongest momentum. Comparing the economic models of Helium Mobile and Helium reveals that MOBILE’s value foundation is inseparable from HNT.

HNT employs a Burn-and-Mint Equilibrium (BME) mechanism to create deflationary pressure. In terms of token distribution, aside from ~33% allocated to investors, another 33% goes to hotspot operators and miners who provide network coverage, and 33% covers network data transfer fees. As a downstream token of HNT distribution, 6% of MOBILE’s emissions go to veHNT, making it inevitably sensitive to HNT’s supply-demand dynamics.

That is, the ratio between total HNT in circulation and total MOBILE supply. A rise in HNT price will also push up the price of MOBILE.

When analyzing factors affecting MOBILE’s price, beyond mining sell-offs versus demand, we must also consider the overall health of the HNT ecosystem.

The MOBILE price spiral is influenced by three dimensions:

1. Miners mint new tokens, creating selling pressure;

2. Growing subscriber base using MOBILE tokens to pay for the $20 plan. According to J.D. Power, U.S. users spend an average of $157 monthly on telecom—giving Helium Mobile a strong pricing edge. Increased plan adoption drives MOBILE demand and indirectly boosts HNT prices;

3. Rising HNT prices increase MOBILE prices, enhancing rewards for miners and mappers, attracting more participants. This intensifies HNT burning, further pushing up HNT prices, which in turn lifts MOBILE—creating a self-reinforcing flywheel.

Overall, if the broader DePIN sector gains traction, Helium’s ecosystem remains healthy, HNT prices rise, and growing Helium Mobile adoption positively impacts HNT, these forces can offset—and even far exceed—the downward pressure from miner sell-offs. This supports MOBILE’s price. Shorter miner payback periods encourage network expansion, improving service quality and user value, fueling further user growth.

Tokenomics: Net Deflationary

MOBILE is the protocol token of Helium Mobile and the governance token of Helium SubDAO. Key details on MOBILE supply:

1. Maximum supply of MOBILE is 230 billion, with 84.4 billion currently in circulation.

2. 50 billion MOBILE were pre-mined at network launch and allocated to the Helium Foundation-managed Network Operations Fund. A portion has already been distributed to early Mobile Network hotspot operators.

3. MOBILE emissions began on August 1, 2022, with the first token minted on August 12, 2022. Emissions halve every two years.

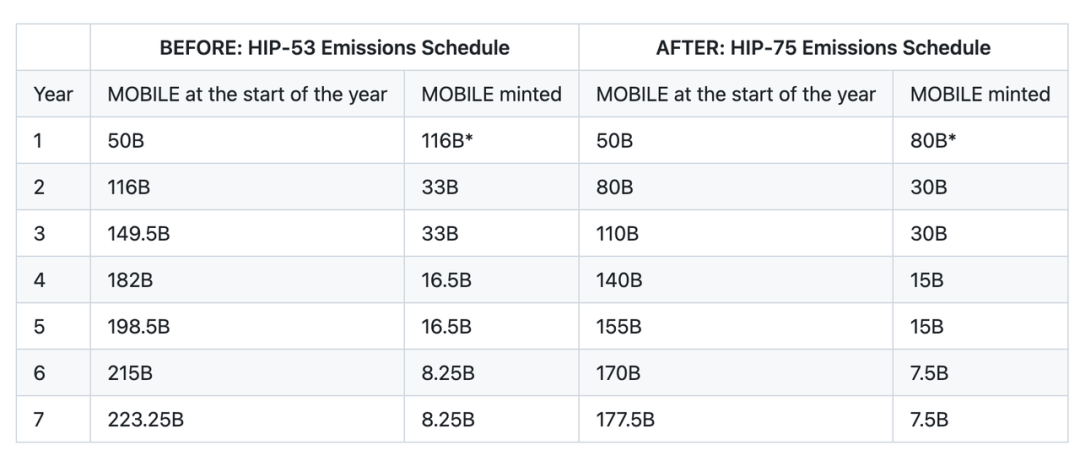

The emission schedule was proposed in HIP53: starting February 1, 2023, 5G hotspot owners received 6.6 billion MOBILE monthly, incentivizing sign-ups, data sharing, and other valuable behaviors to grow the network. Compared to genesis phase rewards, this doubled incentives while keeping PoC algorithms unchanged. Later updated through HIP-75 and HIP-77, the final emission plan was formalized in HIP-79 on March 19, 2023.

Under the revised plan, total MOBILE supply caps at 230 billion. Approximately 3 billion MOBILE will continue to be issued monthly to 5G hotspot owners until the next halving event.

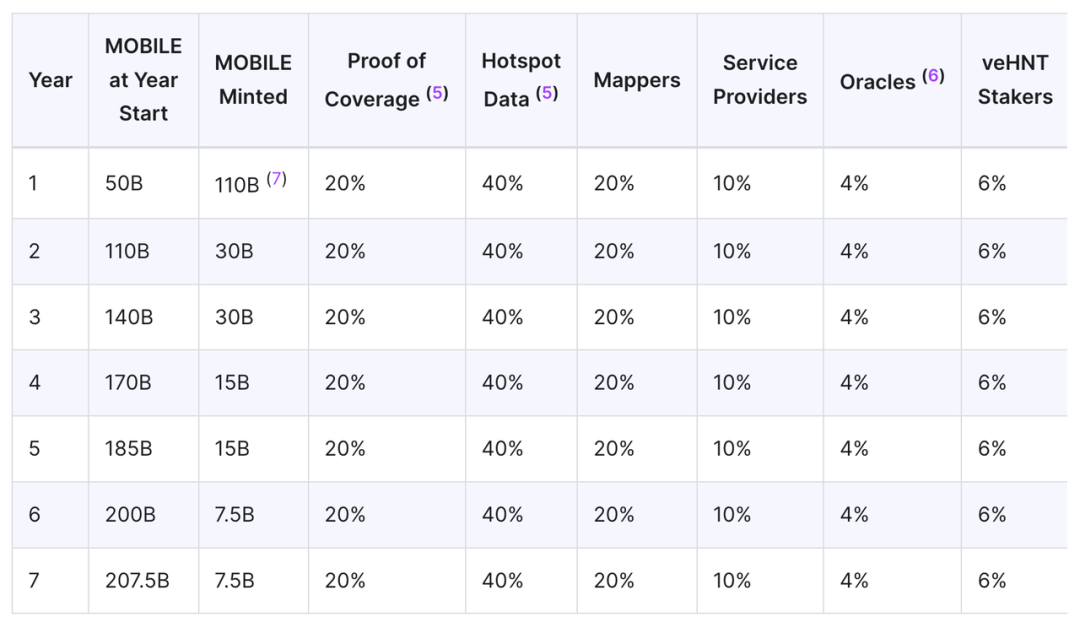

HIP-79 Proposal – Updated Allocation:

-

20% to Proof-of-Coverage (PoC);

-

40% to hotspot data transmission, with unallocated portions reverting to PoC rewards;

-

20% to map data contributors (increased from previous 10%);

-

10% to the operator (Nova Labs);

-

4% to oracles, distributed only after external oracle operators deploy services;

-

6% to veHNT.

Key Milestones of Helium Mobile

1. July 2022: Helium launched the MOBILE token to reward 5G hotspot operators and expand 5G coverage.

2. August 2022: Nova Labs unveiled its crypto-native carrier, Helium Mobile.

3. August 2023: After launching a $5 unlimited talk, text, and data plan pilot in Miami, MOBILE’s price began to rise.

4. November 2023: Nova Labs offered SIM cards and free trials to Solana Labs’ new Saga phone users. Under the deal, Saga phones sold in the U.S. receive 30 days of free Helium Mobile service.

5. December 2023: Helium Mobile officially launched its $20/month unlimited plan in the U.S., covering data, texts, and calls.

6. January 2024: Spanish telecom giant Telefónica announced a partnership with Nova Labs to deploy Helium Mobile hotspots in Mexico City and Oaxaca.

7. February 26, 2024: Coinbase listed MOBILE.

Conclusion: Helium Mobile on the Brink of Explosion

At the end of 2023, after a 1.5-year dormancy, Helium Mobile experienced a surge following the launch of its $20 unlimited plan. Although subsequent mining rule changes triggered a sharp price drop from a peak of $0.00777—sparking community frustration—the fundamentals remain strong.

As an infrastructure network incentivizing retail participation through token rewards, Helium Mobile has pioneered a highly innovative business model—one that overcomes the traditional barriers of capital-intensive infrastructure and long payback cycles, while allowing ordinary users to participate in industry transformation and earn rewards.

By rewarding hotspot providers to build a decentralized 5G network and offering ultra-low-cost telecom plans to attract end users, Helium Mobile creates a flywheel effect among miners, tokens, and users—driving concurrent growth in network scale, user base, and token value.

Currently, Helium’s FDV stands at around $2.1 billion, while Helium Mobile’s FDV is $900 million, with a circulating market cap of just $300 million. Current user numbers range between 30,000 and 50,000. If this figure grows tenfold—to 500,000 users—Helium Mobile’s valuation could increase 10x to 20x from current levels.

Within this bull cycle, where DePIN is a dominant narrative, Helium Mobile stands out: backed by strong legacy resources, low entry barrier ($20), high breakout potential, built-in halving mechanism, net deflationary supply, and a self-sustaining flywheel linking token price, hardware, and users. In our view, it is one of the most promising DePIN projects with true mass adoption potential—poised to ignite during the bull run.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News