DeWi: The Game-Changer of Traditional Communication Networks, a New Narrative for Next-Gen Internet Infrastructure

TechFlow Selected TechFlow Selected

DeWi: The Game-Changer of Traditional Communication Networks, a New Narrative for Next-Gen Internet Infrastructure

What advantages does DeWi have compared to TradWi networks?

Written by: Kadeem Clarke

Compiled by: TechFlow

Wireless networks serve as gateways to the internet, yet they remain opaque—an issue that could soon change. For decades, telecommunications providers have controlled communication infrastructure. As the internet evolves—carrying 4K video and millions of IoT sensors—questions arise about whether traditional telecoms can meet the demands of next-generation internet users.

Conventional wireless networks are constrained by bandwidth limitations, congestion, service delays, and outages. Beyond dealing with these issues, customers must also navigate complex and often costly coverage decisions, leaving many entirely without internet access. A Cornell University study found that "network coverage in low-income areas is nearly 15% lower than in wealthier regions," contributing to a mobile divide. Since many in low-income communities rely primarily on smartphones for internet access, adequate coverage is critical. This is where decentralized wireless (DeWi) enters the narrative.

Decentralized wireless (DeWi) aims to revolutionize how communication networks are built, operated, and owned by incentivizing individuals to deploy and maintain telecom hardware in exchange for token rewards.

Thanks to mobile phones, 66% of the world’s population now has easy access to the internet—up from just 7% in 2000. As internet usage and global connectivity expand, so does the volume of data generated.

Emerging technologies such as autonomous vehicles, IoT devices, smart cities, and virtual reality environments are increasing global demand for higher bandwidth and lower latency networks. Traditional wireless (TradWi) operators struggle to meet this growing demand.

Before delving into DeWi, it's essential to understand traditional telecom infrastructure. Notably, telecom companies typically roll out new wireless networks only once every ten years.

This process generally involves the following steps:

-

Taking on tens of billions of dollars in debt to fund capital expenditures and operating costs.

-

Purchasing licenses from governments.

-

Using third-party manufacturers to produce proprietary hardware.

-

Identifying property owners willing to host towers and radios.

-

Deploying large teams of field technicians to install and maintain complex equipment.

The top-down network deployment model used by telecom companies is ill-suited for next-generation wireless networks. New technologies like 5G require a dense array of radios and antennas—something telecoms cannot afford at scale. Historically, this model prioritizes coverage in densely populated urban areas while neglecting rural and less populated regions.

Several exciting developments have recently reshaped telecom services. Three key shifts now make DeWi adoption feasible: the mainstreaming of eSIMs, the opening of wireless spectrum, and advances in blockchain technology and wireless hardware.

Last month, Apple's release of the iPhone 14 marked a significant shift: the removal of the physical SIM card slot. The latest iPhone supports eSIM, a digital alternative activated by scanning a QR code. This is a major advancement for DeWi cellular networks, reducing carrier switching costs to nearly zero. With six eSIM slots, iPhone 14 users can run both a traditional carrier eSIM and a DeWi eSIM simultaneously.

The Helium Network is a new decentralized network addressing systemic, costly, and inequitable issues by introducing coverage powered by a community of nodes, each transmitting radio frequencies from their respective locations. Hundreds of thousands of people can earn rewards, gain more reliable connectivity, and contribute to building a robust network by simply participating with a hotspot.

While the Helium Network offers a revolutionary approach to network building—opening up the space much like the open-source movement did for the internet—it is not a one-size-fits-all technological solution.

Telecom companies aim to cater fully to consumers with faster speeds and broader coverage, but their contracts are overly restrictive and lack trustworthiness. They fail to offer sufficient cost or coverage flexibility for businesses using IoT devices and cannot support low-power, long-range networking needs.

How Does It All Come Together?

The Helium Network operates using a proprietary algorithm called "Proof-of-Coverage" (PoC), which verifies that hotspots are located where they claim to be. PoC continuously confirms that hotspots provide wireless coverage from specific geographic locations, using radio frequency (RF) technology to generate verifiable evidence that supports network operations.

According to the company, Proof-of-Coverage relies on three key metrics: RF distance, RF strength, and RF speed. They use a PoC challenge algorithm to audit hotspots, ensuring they broadcast coverage from their declared locations.

A "challenge" consists of a challenging hotspot, a receiving hotspot, and nearby "witnesses" that report the challenge to the network. The challenger hotspot first generates a public/private key pair for the challenge. The SHA256 hash of this key pair is submitted as a Proof-of-Coverage request to the blockchain. If valid, the blockchain accepts the request and creates a new block containing the challenger’s identity and public key hash. Hotspots issue a Proof-of-Coverage challenge every 360 blocks and receive $HNT—the Helium token—as a reward. Once verified, the hotspot’s data is stored on the Helium blockchain.

Nova Labs, the company behind Helium, has announced plans to transform Helium into a decentralized platform capable of supporting any type of telecom network. This strategy positions Helium as a “network of networks.” The processes that enabled rapid expansion of LoRaWAN can now be replicated across other network types such as 5G, Wi-Fi, VPNs, and CDNs.

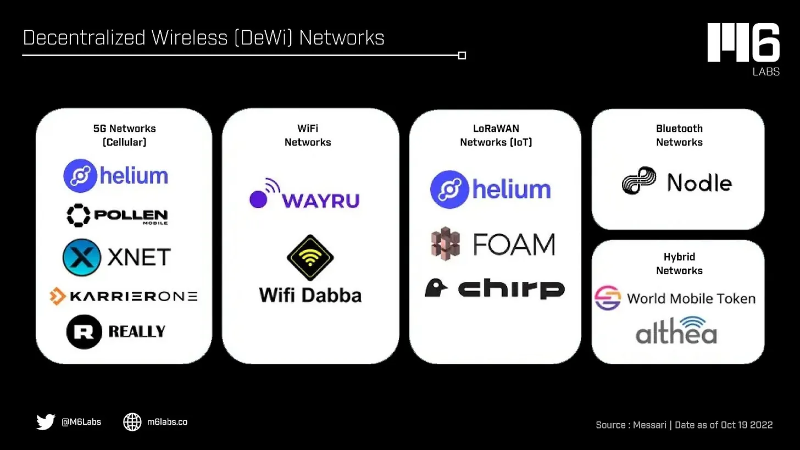

Following the success of Helium’s LoRaWAN network, numerous new DeWi networks based on the Helium model have emerged. There are now over 14 active DeWi networks, spanning cellular, Wi-Fi, LoRaWAN, Bluetooth, and hybrid models:

-

5G Networks (Cellular): Helium 5G and Pollen Mobile, both utilizing CBRS spectrum, are leading players in this category. Among all DeWi segments, cellular networks represent the largest market opportunity.

-

Wi-Fi: DeWiFi networks aim to create a globally shared Wi-Fi network, allowing free public access. Early projects in this space include WayRu and WiFi Dabba.

-

LoRaWANs (IoT): LoRaWAN is a low-power, long-range wireless protocol ideal for transmitting small data packets—such as sensor readings—making it the preferred choice for IoT devices. Key players include Helium and Foam.

-

Bluetooth Low Energy Networks: BLE networks suit low-power, short-range applications. Nodle operates a mesh network using smartphones and BLE routers to connect IoT devices to the internet.

-

Mixed Networks: Decentralized internet access via hybrid solutions combines multiple wireless technologies. Examples include Althea and World Mobile Token.

HNT: The Helium Network Token

At the time of writing, HNT trades at $6.64, with a market cap of $1.5 billion and a circulating supply of 100 million HNT.

The percentage of HNT rewarded depends on the node’s role—challenger, challenged, or witness—and the type of work performed (validation, data transfer, publishing new blocks to the network).

Moreover, HNT is mined using radio technology, unlike traditional cryptocurrencies that rely on GPUs.

In contrast, DeWi networks employ a novel token distribution mechanism that rewards participants for verifiable real-world work. This incentive system drives an economic flywheel, enabling networks to bootstrap without centralized coordination.

Protocols can incentivize early participants to build network supply until coverage becomes sufficient for end users. This initial momentum helps protocols achieve adoption and compete with centralized telecom services. Operators gain ownership stakes in the network by contributing to its growth, aligning their interests with the network’s success.

Advantages of DeWi Over TradWi Networks

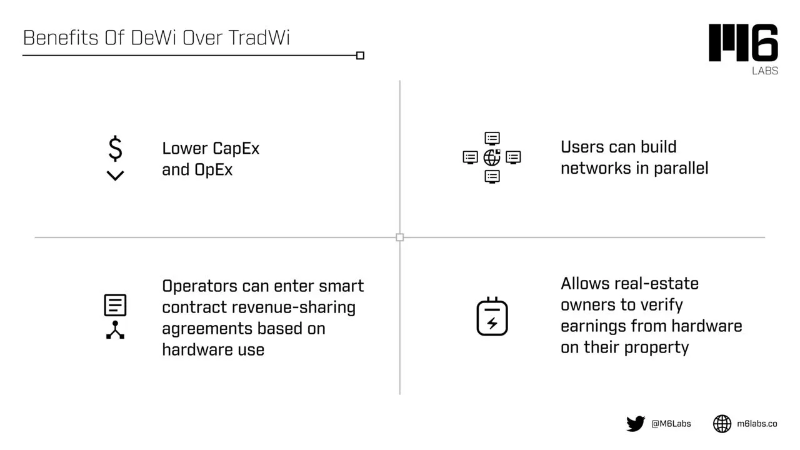

The most significant advantage of DeWi over traditional networks is drastically lower capital and operational expenditures. Building a traditional network requires a central entity to spend tens of billions on spectrum licenses, proprietary hardware, land leases, large technical crews, and extensive backend systems for billing, planning, and customer support.

With DeWi, operators can establish automated revenue-sharing agreements based on income generated per hardware device. In contrast, TradWi deployments involve fixed payments to property owners. DeWi’s revenue-sharing model is not only more efficient but also allows property owners to verify earnings from hardware on their premises, ensuring transparency in payouts.

Next-generation wireless networks require an alternative to traditional deployment models. Historically, macrocell radio stations mounted on tall towers provided broad geographic coverage. However, macrocells operate on low-frequency bands, whereas 5G requires higher frequencies to deliver greater bandwidth—a fundamental mismatch.

DeWi offers a more cost-effective solution for deploying 5G networks.

Rather than replacing TradWi, DeWi can complement it. DeWi enables users worldwide to build networks in parallel, significantly accelerating deployment compared to centralized approaches. Local participants with regional knowledge can focus on infrastructure tailored to local demand.

By combining TradWi’s macro-coverage with DeWi’s small-cell coverage, 5G could become far more widespread globally.

The Future of Networks and Final Thoughts

Decentralized networks represent the future of telecom services. Nova Labs is well-positioned to expand and strengthen Helium’s coverage footprint.

The DeWi space is still in its infancy, but its potential to transform the telecom industry is undeniable.

The rapidly growing number of protocols competing for DeWi cellular market share signals vast opportunities ahead.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News