Analyzing DePIN: Is it a new hype or a new engine driving development?

TechFlow Selected TechFlow Selected

Analyzing DePIN: Is it a new hype or a new engine driving development?

Overview of the popular DePIN sector: Development potential, challenges, and key players.

The hotspots in the Web3 space keep rotating—DeFi summer, NFT boom, the year of Layer2... "Concept first" seems to have become one of the typical paradigms in the development of crypto. Under diverse and imaginative narratives full of creativity and imagination, the industry has experienced wave after wave of growth. But as the hype fades, questions arise: What tangible benefits can new Web3 use cases bring to the real world? Do we really need crypto networks?

To explore the real-world value of crypto networks, at the end of 2022, the renowned crypto research firm Messari launched a survey seeking an official name for "Web3 physical infrastructure." Options included Proof of Physical Work (PoPW), Token-Incentivized Physical Infrastructure Networks (TIPIN), EdgeFi, and Decentralized Physical Infrastructure Networks (DePIN). Ultimately, DePIN (Decentralized Physical Infrastructure Networks) emerged as the standard term for this promising Web3 sector.

What is DePIN? In short, it's a network that leverages cryptographic technology to connect digital and physical spaces in a decentralized manner. According to Messari researchers, "DePIN adoption will go beyond the early financial transaction use cases of crypto," potentially strengthening crypto’s role within the internet and advancing the development of the Web3 value network. To better understand the DePIN landscape, this article analyzes the following three aspects:

-

What is DePIN? How does it work?

-

Opportunities and challenges facing the DePIN sector

-

Current state of DePIN projects

DePIN in Practice: Crypto Technology Empowering Real-World Use Cases

DePIN builds upon the fundamental concept of the Internet of Things (IoT). Therefore, before explaining how DePIN works, let’s first understand IoT. The Internet of Things refers to connecting everyday physical objects to the internet. This concept dates back to 1980, when the world's first vending machine with an implicit IoT concept was created—it was connected to the network and could check inventory to confirm available drinks. With rapid advancements in internet and related technologies, IoT applications have expanded widely, including connected vehicles, smart homes, wearable devices, health monitoring systems, and remote surveillance equipment.

Understanding the Concept of DePIN

Decentralized Physical Infrastructure Networks (DePIN) refer to blockchain networks that use crypto assets to incentivize communities to build physical infrastructure networks. Two key points are worth noting: First, DePIN relies on decentralized networks and communities rather than centralized companies to conduct transactions and manage operations. Second, unlike most Web3 products, virtual assets on these networks can be used to purchase tangible real-world goods and services such as electricity, telecom services, and internet access. In summary, DePIN is designed to deliver actual value.

Based on differences in hardware, resources, goods, and services provided by the network, DePIN projects can be categorized into two main types:

-

Physical Resource Networks (PRN): PRNs encourage participants to deploy location-based hardware to provide unique real-world goods and services such as wireless networks, energy grids, and sensor networks.

-

Digital Resource Networks (DRN): DRNs incentivize participants to contribute hardware for interchangeable digital resources like cloud storage, bandwidth, or computational power.

Note: There is currently no consensus on the distinction between these concepts. If you'd like to test whether a project qualifies as DePIN or falls under PRN or DRN, visit this link.

DePIN Hardware Networks and Economic Operations

Unlike traditional centralized companies that invest heavily in time and money to build and maintain infrastructure, DePIN aims to outsource this process to a community motivated by crypto incentives. A typical DePIN network includes several key components:

-

Crypto Assets and Community Members: Project-specific tokens reward hardware operators for their services. Each token has distinct economic characteristics based on project design. These incentives drive community members to participate in building and maintaining infrastructure.

-

Hardware Devices: Physical components that link the network to the real world. For example, hotspots enable wireless networks, while spare hard drive space supports storage networks.

-

Hardware Operators: Users who purchase or lend hardware and connect it to the respective network.

-

End Users: Consumers who utilize the infrastructure supported by network hardware. For instance, users may prefer relying on a DePIN project rather than a corporation for Wi-Fi access and pay for the service received.

Thus, DePIN networks initially attract supply-side participants through crypto incentives. As supply grows, capital inflows increase the value of the crypto asset, enabling suppliers to offer competitively priced services. Once an attractive ecosystem is established, more developers, builders, and end users are drawn in.

As end-user adoption increases, structural demand for the network rises, boosting supplier revenue. Moreover, the crypto-economic model aligns token price with network utilization. As adoption grows, network value is captured, driving up token prices, attracting more participants and speculative capital, creating a positive feedback loop that draws in even more builders and users.

Image source: bitstamp

DePIN Development: Potential and Challenges Coexist

Although DePIN offers a paradigm integrating crypto technology with real-world applications, why should we change the status quo and adopt decentralized physical infrastructure networks? In reality, technological innovation must be grounded in clear market demand and business advantages to achieve sustainable growth. Below we examine both the potential and challenges of DePIN.

Potential of DePIN

On one hand, compared to the top-down, capital-intensive approach of traditional IoT, DePIN aims to create a fairer and more efficient way to develop infrastructure networks. Its advantages include:

-

Secure and Efficient: Leveraging blockchain technology, DePIN enables secure peer-to-peer payments without intermediaries charging fees. Through distributed physical infrastructure and community participation, DePIN can scale rapidly with significantly lower operational capital and costs—often just a fraction of those incurred by traditional firms. For example, telecom companies must invest billions in infrastructure and real estate and employ large teams, whereas DePIN incentivizes network members to host services profitably.

-

High Adoption: Community members can own the hardware forming the network and also use the services they provide—acting simultaneously as providers and consumers—which promotes network adoption. Trust in the network stems from aligned interests rather than reliance on a centralized company issuing quarterly reports.

-

Openness: Traditional infrastructure projects are often governed by centralized entities dictating terms and conditions, leaving users with little say. In contrast, DePIN is open, democratic, and accessible.

-

Censorship Resistance: Beyond being permissionless and open, DePIN is censorship-resistant—no party can deny access arbitrarily.

On the other hand, by leveraging blockchain technology, DePIN not only advances IoT but also fosters innovation across multiple Web2 and Web3 domains:

-

As a native Web3 network, DePIN allows participants direct access to various Web3 tools and DeFi services—for example, financing new hardware—potentially expanding user bases across multiple Web3 sectors.

-

By drastically reducing upfront capital requirements and lowering barriers to entry, DePIN empowers traditional industries in the real economy, introducing new competition into legacy sectors like telecommunications and energy, thereby encouraging broad innovation.

Challenges Facing DePIN

-

Incentive Burden: DePIN projects use cryptocurrencies to reward individuals who operate or maintain network-powered hardware. While highly diluted incentive models can sustainably attract contributors, excessive dilution risks eroding existing holders’ equity and destabilizing the project’s economic structure.

-

Development Costs: Compared to purely consumer-facing Web3 applications like games, DePIN applications require much longer development cycles and face greater technical hurdles.

-

Intense Competition: Should DePIN replace existing services or create entirely new ones? Despite the large market size, competing against Web2 giants like Amazon, Microsoft, and Google remains a formidable challenge.

In conclusion, disrupting traditional industries requires significant effort and specialized expertise—DePIN still has a long road ahead.

DePIN Projects: Current Landscape Overview

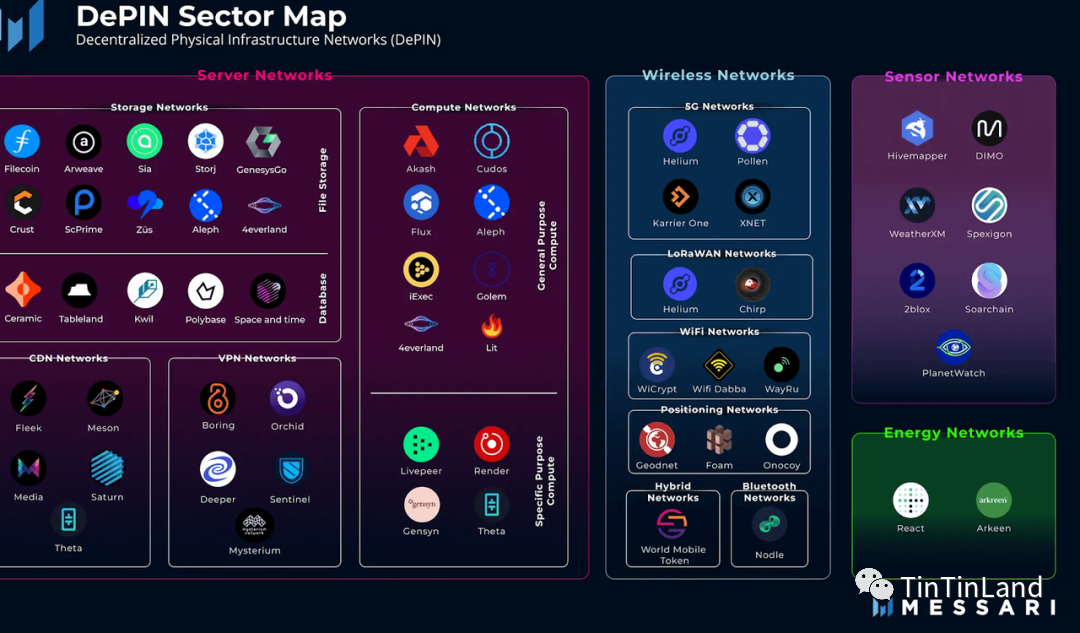

DePIN uses blockchain and crypto assets to deploy and incentivize real-world physical infrastructure. Although the DePIN ecosystem is still evolving, some projects have already made significant progress. Messari Research has compiled a comprehensive overview of current DePIN projects—see the figure below.

Among them, the top 10 DePIN companies include Filecoin, Arweave, Sia, and Storj—belonging to the Digital Resource Network (DRN) category under "server networks"; Helium and Pollen Mobile in the Physical Resource Network (PRN) category under "wireless networks"; Hivemapper and DIMO under "sensor networks"; and React Protocol and Arkreen under "energy networks." Below we highlight the development status of select projects. Readers interested in further details can visit the respective project websites.

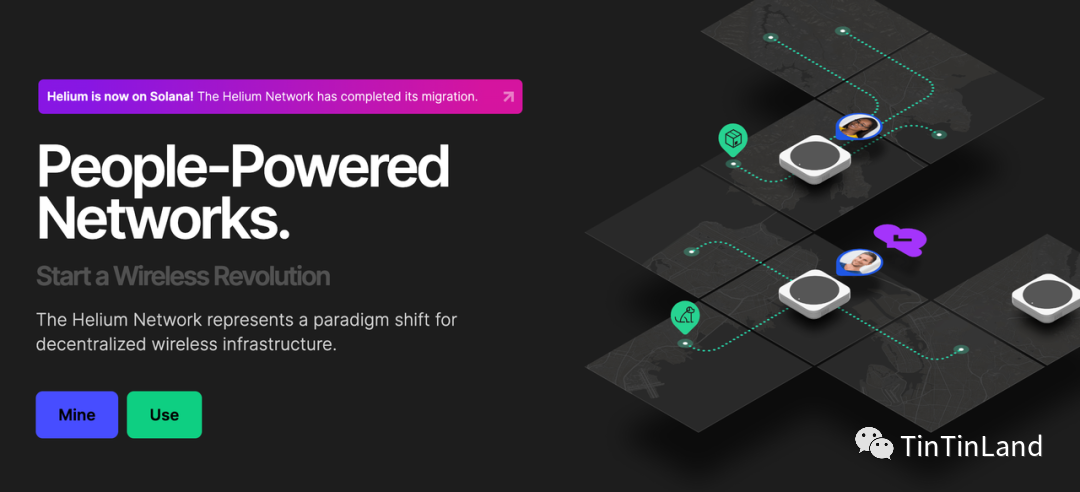

Helium

Helium is one of the pioneering DePIN projects. In July 2019, Helium led the DeWi movement with its LoRaWAN network designed to power IoT devices. Its initial goal was to create a low-power wide-area network (LoRaWAN) for IoT devices to communicate. As a unique offering at the time, it enjoyed first-mover advantage and partnered with projects focused on weather tracking, air quality monitoring, and GPS integration.

In 2022, the project shifted its strategic focus toward becoming a "network of networks," supporting other DePIN initiatives by developing decentralized solutions for Wi-Fi, 5G, and VPNs. To date, nearly one million hotspots have been connected to the Helium network. However, Web3 critic Liron Shapira argues that Helium’s use cases are overstated—most of its revenue comes from selling hardware to new network providers, supply is increasing, but actual demand for Helium’s services remains negligible.

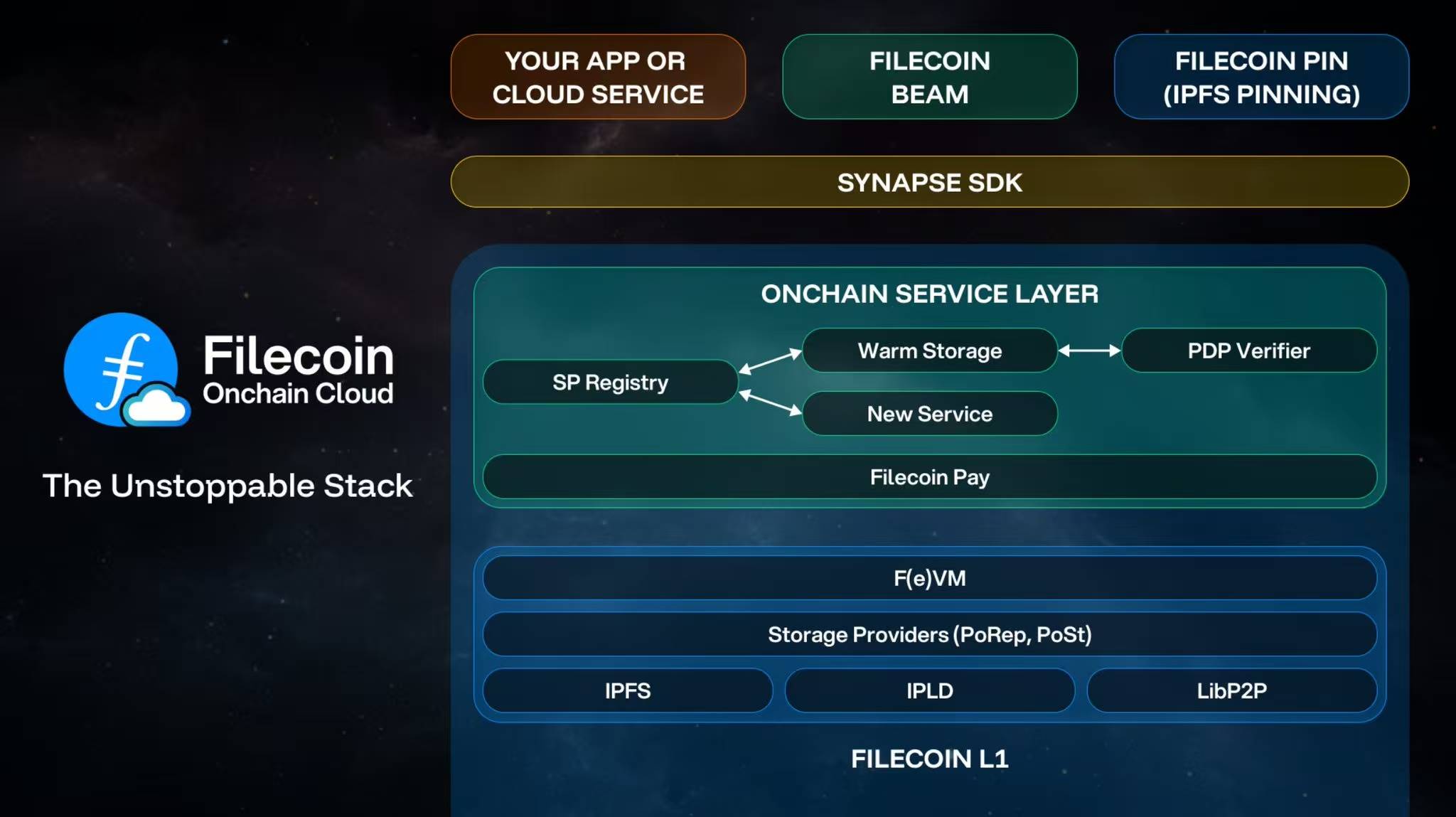

Filecoin

Launched in 2020, Filecoin provides cloud storage services similar to Web2 giants like Google Cloud and Amazon Web Services. However, unlike centralized providers, Filecoin offers a distributed storage solution secured by crypto-economic incentives. It connects users needing data storage with others who have spare hard drive space. Storage providers are paid in FIL tokens.

Currently, Filecoin’s monthly revenue has dropped sharply during the bear market. Researcher Domica believes that Filecoin’s scale and utility were overhyped following its expansion in summer 2021. The project has responded by launching Filecoin Plus—a new product offering free storage space to verified users—which has attracted significant adoption.

As a Web3 network powering the IoT economy, is DePIN merely a new hype cycle or a new engine for growth? Judging from leading projects, there remains a gap between vast market potential and actual DePIN service delivery. How to effectively apply crypto technology and incentive models to real-world use cases remains a critical unresolved issue. Yet from another perspective, compared to mature sectors like DeFi and NFTs, DePIN represents an untapped blue ocean market. We look forward to more developers leveraging technological innovation to advance the DePIN sector and realize the vision of a Web3 value network.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News