Interpreting Messari's 2023 DePIN Market Report: 650 Active Projects Flourish, Top Projects Expected to Emerge from Asia

TechFlow Selected TechFlow Selected

Interpreting Messari's 2023 DePIN Market Report: 650 Active Projects Flourish, Top Projects Expected to Emerge from Asia

Current status, applications, supply and demand dynamics, technological changes, and regional development disparities in the DePIN sector.

Recently, Messari and Escape Velocity (EV3) jointly released a research report titled "State of DePIN 2023," which comprehensively details the current state, applications, supply and demand dynamics, technological developments, and regional disparities within the DePIN sector.

Since the original report is in PDF format with lengthy English content, and each chart contains extremely high information density, TechFlow has compiled and translated the report, processed key charts, content, and insights from the original document, and presented them in a more readable format for interpretation.

Below is the content of the original report.

About the Authors:

Sami Kassab: Crypto Research Analyst at Messari, focusing on DePIN, artificial intelligence, and Bitcoin. Co-host of the Proof of Coverage podcast. Prior to joining Messari, Sami worked as an aerospace engineer at Raytheon and Honeywell.

Salvador Gala: Co-founder of Escape Velocity (EV3), also co-host of the Proof of Coverage podcast. Before joining EV3, Salv was an investor at Ribbit Capital and an investment banker at Goldman Sachs.

Definition, Current State, and Industry Landscape of DePIN

-

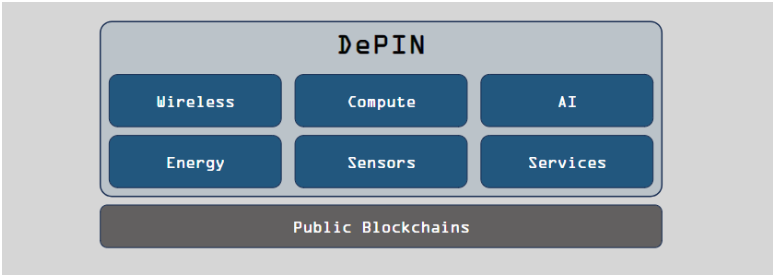

DePIN = Decentralized Physical Infrastructure Networks, using crypto incentives to efficiently coordinate the development and operation of critical infrastructure.

-

In general, DePIN can consist of the following components:

-

DePIN can be more efficient, resilient, and higher-performing than centralized infrastructure, making it the preferred method for scaling global infrastructure.

-

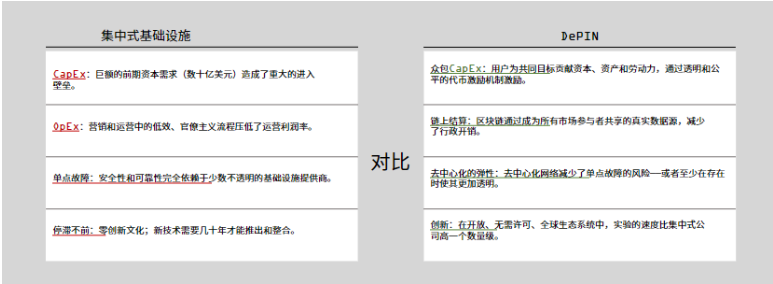

Comparison between DePIN and traditional centralized infrastructure is shown below:

-

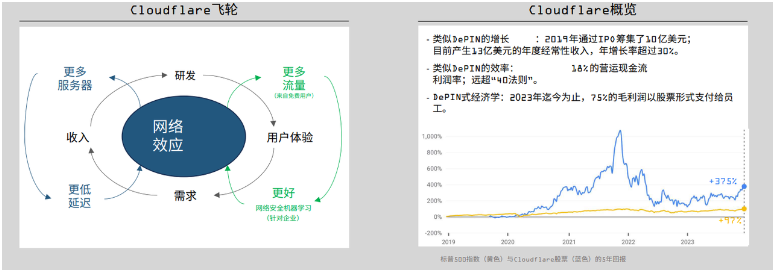

The DePIN flywheel = The infrastructure network becomes stronger as it scales.

-

The DePIN flywheel could add +$10 trillion to global GDP over the next decade, and +$100 trillion in the following decade.

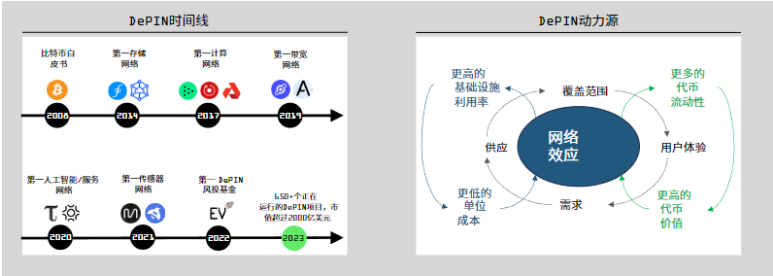

(Note: Due to a PDF translation issue, "first" in the above image should be interpreted as "the first one")

-

DePIN empowers and incentivizes citizens to improve public infrastructure around them.

-

In a world of untrusted institutions and incompetent bureaucrats, DePIN returns wealth and power back to citizens and communities.

-

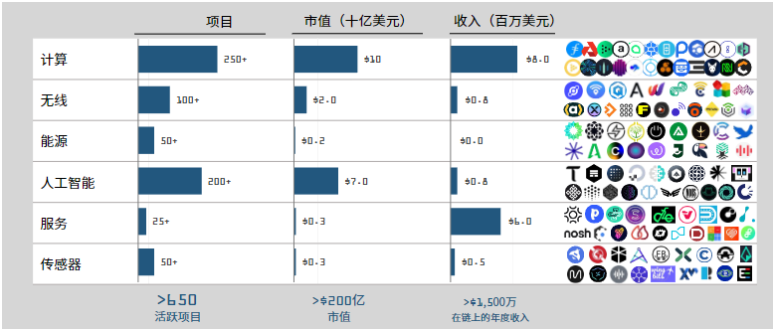

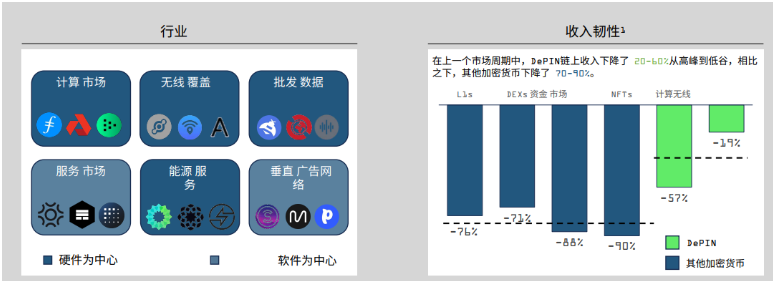

We divide DePIN into six categories, each disrupting an industry worth over $1 trillion.

-

RWAs (Real World Assets) and blockchain infrastructure networks (oracles and RPCs) are related areas to DePIN but fall outside the scope of this report.

-

Smart money in crypto is placing dozens of bets on the DePIN sector, and venture capital funds are raising substantial funding rounds.

-

Winners in DePIN infrastructure are starting to emerge, with Solana taking the lead.

-

Solana's integrated infrastructure and performance-focused developer community are attracting DePIN projects at all stages.

Demand, Revenue, and Typical Use Cases of DePIN

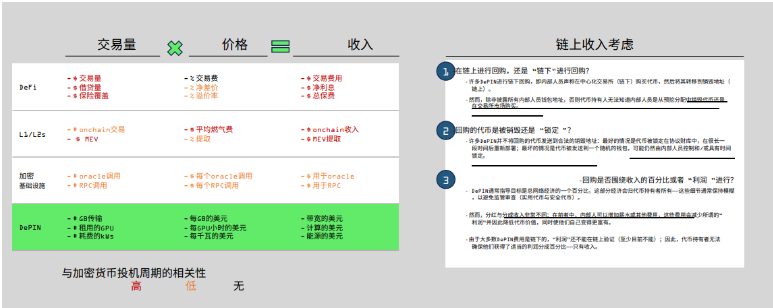

DePIN relies on on-chain verification and/or settlement to provide essential network resources to consumers, developers, and agents willing to pay for them.

-

DePIN’s North Star = revenue driven by utility — not speculation.

-

On-chain revenue means users exchange tokens through purchasing, locking, or burning to access products/services/goods.

DePIN generates over $15 million in annualized on-chain revenue across six core business models.

During the last cycle, DePIN's revenue demonstrated it was among the most resilient sectors in terms of on-chain earnings.

-

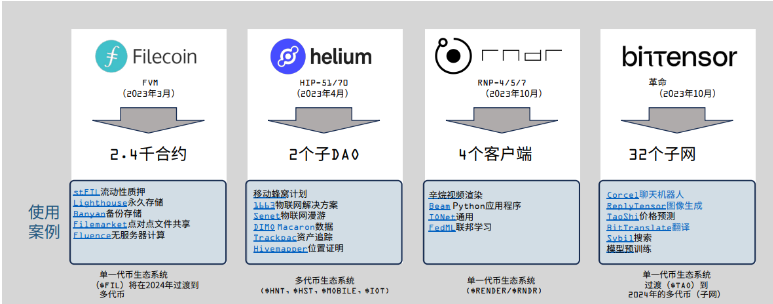

The largest DePINs are transitioning into platforms with diversified use cases.

-

These transitions are not overnight successes: platformization typically occurs between the 5th and 10th year of global decentralized network expansion.

Below are specific use case details across the six DePIN sectors:

Compute Markets

-

Compute markets are the oldest and most successful DePIN business model.

-

Storage networks need more demand; compute networks need more supply; retrieval networks require density to compete with Web2.

(Note: Due to a PDF translation issue, the text in the top-left corner of the image should be understood as: “Which features enabled by crypto”)

-

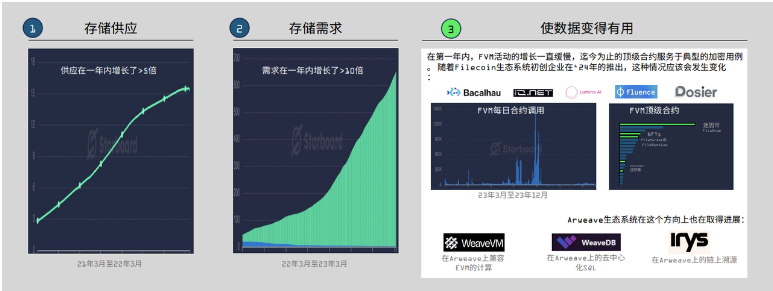

Data storage seems like an obvious use case for crypto, but progress has been slow.

-

So far, the best customers for decentralized storage networks have primarily been other crypto networks.

-

The endgame for storage has always been about data computation.

-

Filecoin's Mainnet Phase 3 began in Q1 2023, alongside the launch of the Filecoin Virtual Machine (FVM).

-

Unlike most DePINs, GPU cloud services are supply-constrained rather than demand-constrained.

-

However, price competition in GPU cloud services may happen faster than anything we've seen before.

(Note: In the chart, "tokens" in LLM pricing should be interpreted as "Token")

-

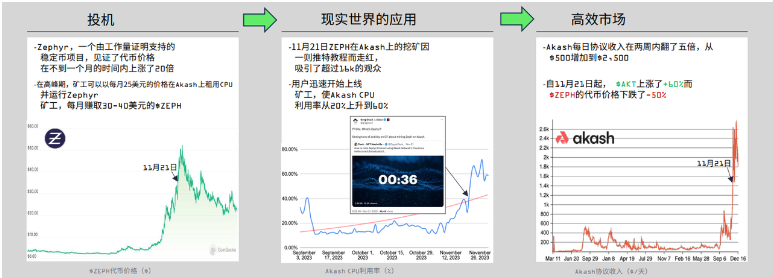

CPU cloud services are becoming an outlet for animal spirits in the crypto space.

-

Speculation on proof-of-work blockchains leads to wealth transfer from speculators to arbitrageurs and DePIN token holders.

-

Decentralized CDNs face intense competition: Cloudflare already enjoys a DePIN-like flywheel effect.

-

Cloudflare benefits from a DePIN-like flywheel via its free CDN service, supporting 20% of websites globally.

-

Retrieval is the hardest part of decentralization, but early signs show promise.

-

Results from early 2023 prove that decentralized CDNs have the potential to match or even surpass Web2 performance.

(Note: Saturn refers to Filecoin’s project name)

Wireless Coverage

-

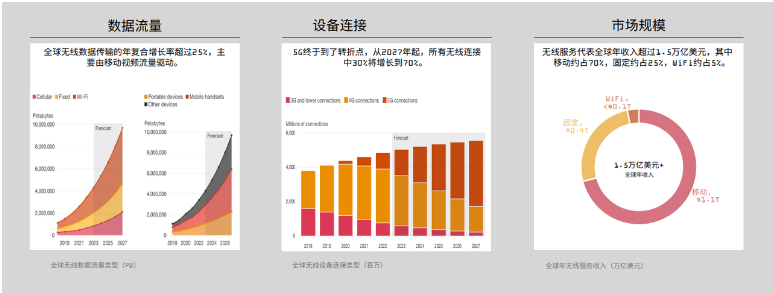

Globally, the wireless services market is larger than the compute market.

-

Over the past 25 years, global data transmission has grown at a compound annual rate of 30–35%, with no signs of slowing down.

-

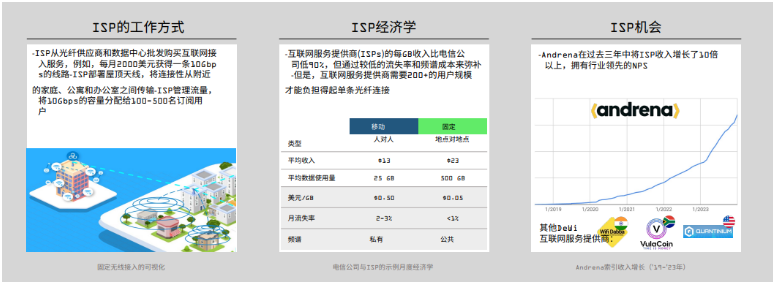

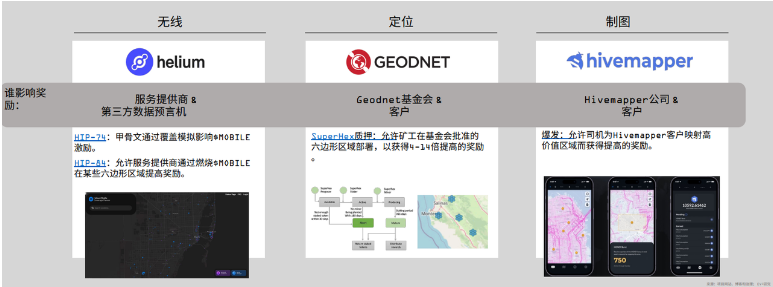

Each vertical in DeWi has different fundamental economic drivers.

-

The mobile market is currently the largest (in dollar terms), while fixed internet and WiFi dominate in usage volume (measured in GB and users).

(Note: DeWi stands for Decentralized Wireless; "key unlock" due to a PDF translation error should be understood as "the key to unlocking the problem")

-

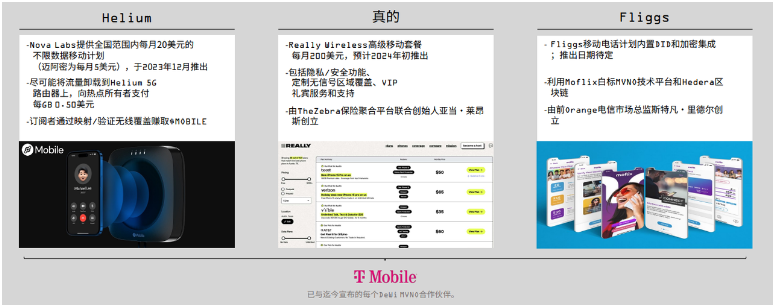

Crypto MVNOs (Mobile Virtual Network Operators) use tokens to fundamentally improve traditional wireless economics.

-

MVNOs acquire and manage customer relationships while paying traditional telecom operators (MNOs) wholesale network access fees.

(Note: In the image above, "really" should be "Really", a telecommunications service provider)

-

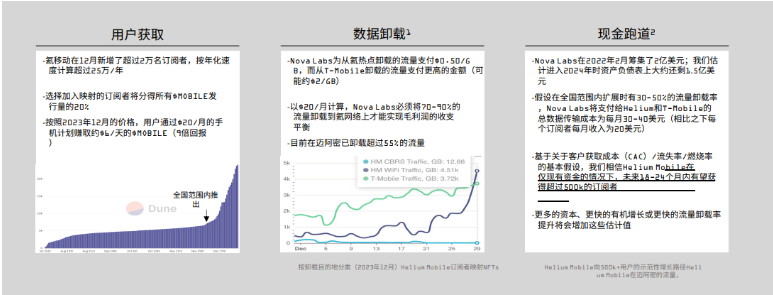

Early momentum from Helium Mobile shows a path toward millions of users.

-

The question is: Can Helium become profitable before running out of funds? ... We believe the answer is yes.

(Note: "Helium" refers to Helium; "data offload" means using supplementary network technologies to transmit data originally carried by cellular networks)

-

Mobile internet connects people to people; fixed internet connects places to places.

-

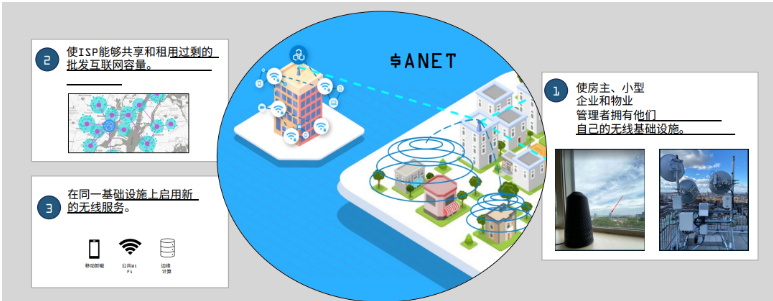

The number of ISPs (Internet Service Providers) in the U.S. will grow from 3,000 to over 15,000 in the next five years, with even greater global opportunities.

-

Fixed internet might be the most ambitious plan in DeWi.

-

Andrena’s testnet will enable consumers and small-to-medium enterprises to become micro-ISPs owning last-mile internet infrastructure.

-

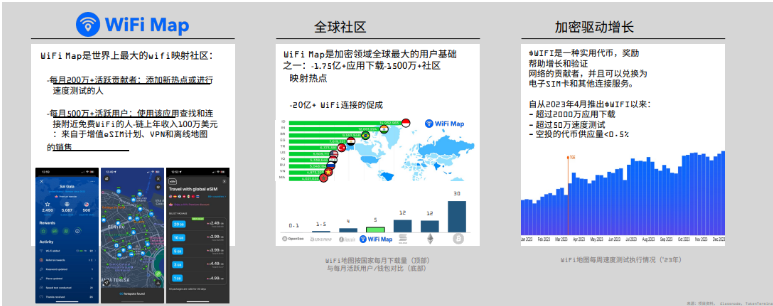

With billions of daily active users, WiFi is the most widely used connectivity protocol on Earth.

-

In 2023, WiFi Map airdropped $WIFI tokens to 225k of its most active contributors across 190 countries worldwide.

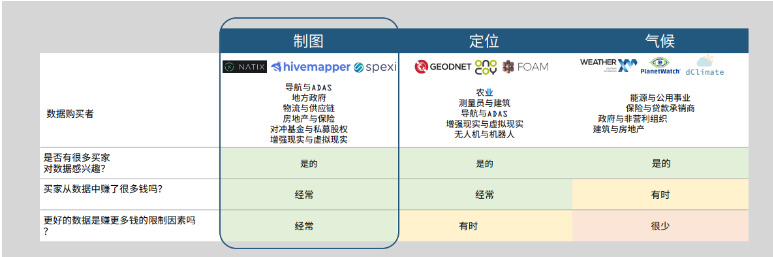

Wholesale Data

-

Data sales can take many forms, some more valuable than others.

-

Data is most valuable when:

1) There are many buyers who need it

2) These buyers earn significant profits from it

3) Better data is the limiting factor for earning more money.

Mapping is undoubtedly the most powerful real-world example of global crypto coordination.

Hivemapper community made more progress in supply, demand, and validation in 2023 than most networks achieve in 3–5 years.

-

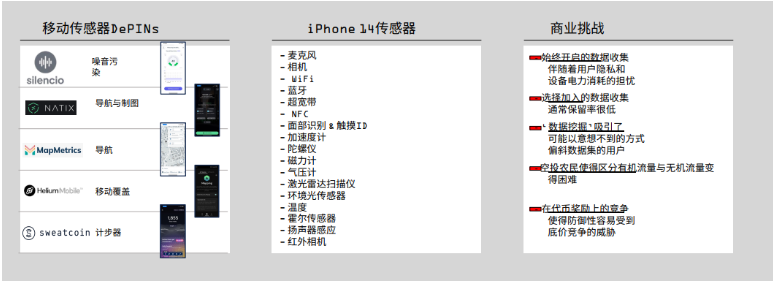

DePINs are beginning to tap into the potential of mobile sensors.

-

Mobile phones are powerful sensing devices... However, mobile data as a business faces several challenges, explained in detail below:

-

Conflict between data collection and privacy

-

Low retention rates

-

Data accuracy issues

-

Questionable value of high-value traffic

-

Token rewards may not be properly aligned

-

AI x Crypto creates an alternative path for DePIN sensor/data networks.

Networks can monetize valuable datasets through smart mining or computing beyond data markets, instead of competing upstream.

Service Markets

-

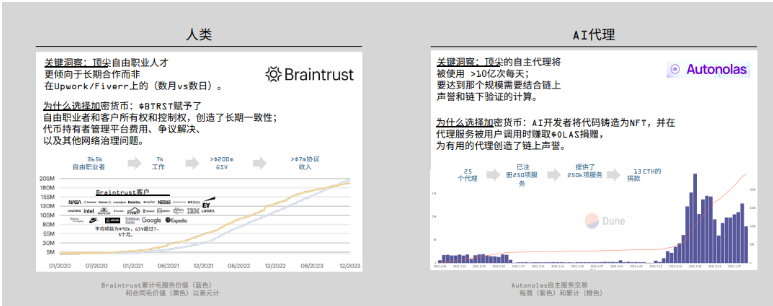

Horizontal service markets use crypto incentives to attract top global talent.

-

Whether human- or agent-based, great service markets:

1) Attract & retain top talent,

2) Efficiently match supply and demand.

-

Vertical service markets are disrupting Web2 gig economies.

-

Companies like Uber/Doordash are built on permanently extracting economic value from local economies; Web3 rewrites the script by returning ownership and control to local operators.

-

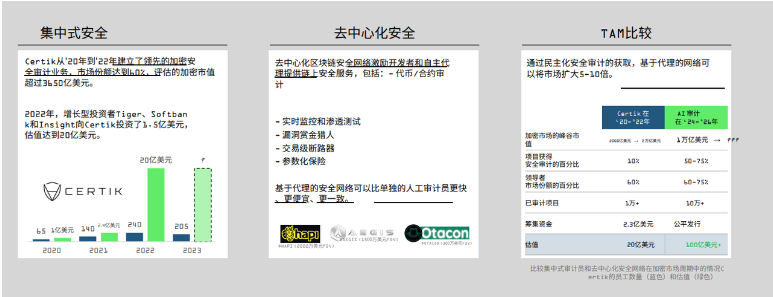

On-chain security services will become the most visible winners in '24–'25.

-

In the previous crypto cycle, Certik laid the blueprint for a $10+ billion on-chain security services market.

(TAM refers to Total Addressable Market)

Vertical Advertising

-

Vertical advertising networks return data ownership and control to users.

-

Great ad networks combine:

1) Viral user acquisition,

2) Proprietary, context-aware data streams,

3) Large end markets.

Energy

-

Decentralized energy supply chains may prove to be DePIN’s toughest challenge yet.

-

Regulatory overhead in the energy sector makes experimentation slow, difficult, and expensive… but the hardest challenges attract the most resilient entrepreneurs.

Supply, Tokenomics, and Incentive Models of DePIN

DePINs use crypto incentives to coordinate capital, equipment, and labor to scale critical global infrastructure.

-

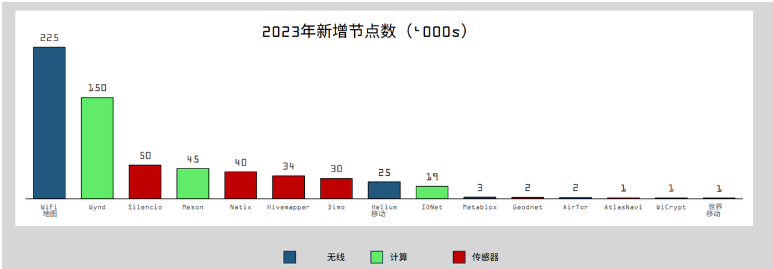

In 2023, DePINs added over 600,000 nodes across wireless, compute, and sensor networks.

-

Beyond those shown below, dozens of emerging DePINs added 100–500 nodes this year and are rapidly expanding into 2024.

-

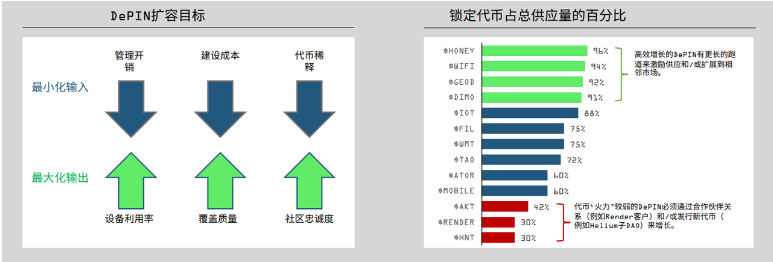

DePINs are becoming more efficient at expanding supply.

-

Newer DePINs focus more on capital efficiency—sometimes at the expense of decentralization.

-

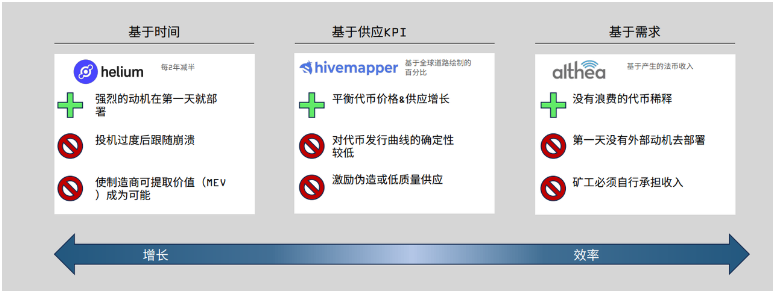

We’ve observed three token distribution models: time-based, supply-KPI-based, and demand-based.

-

Most DePINs combine these three strategies, using different issuance schedules for different tokens at different times.

-

Hardware DePINs work well with targeted mining reward bursts/incentives.

-

Capital-intensive DePINs benefit from using off-chain data & decisions to incentivize high-value deployments.

-

Software DePINs work well with points or credits that may eventually become tokens.

-

Leading software-based DePINs have scaled to tens or even hundreds of thousands of active users before launching their actual tokens.

-

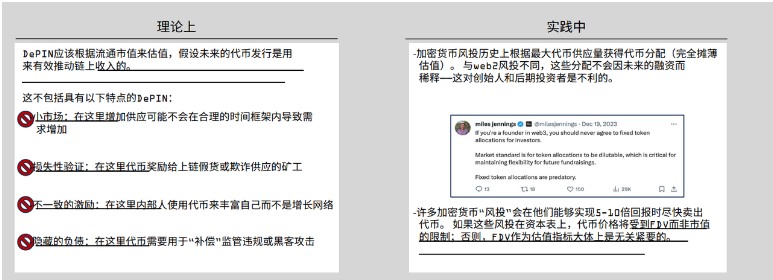

For DePIN investors, distinguishing between market cap and FDV works well.

-

Top-tier networks will trade primarily based on circulating market cap, while low-quality networks’ upside will be capped by FDV.

Looking Ahead: DePIN’s Convergence with Other Crypto Sectors in 2024

By 2024, we’ll see DePIN begin deeper experiments integrating new crypto primitives such as ZK, memes, on-chain AI, and on-chain gaming.

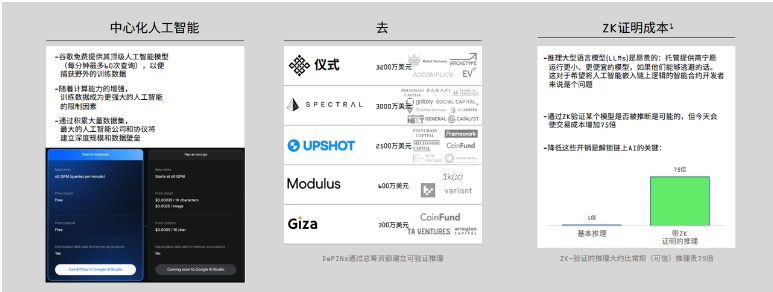

DePIN x Artificial Intelligence

ZK-verifiable GPU cloud computing is expected to enable an on-chain inference economy within 1–2 years, where centralized providers cannot compete.

(Note: Due to a PDF formatting issue, the second category in the image should be translated as “Decentralized AI”)

DePIN x Meme

Love it or hate it, meme coins are becoming genuine catalysts for mass adoption of DePIN.

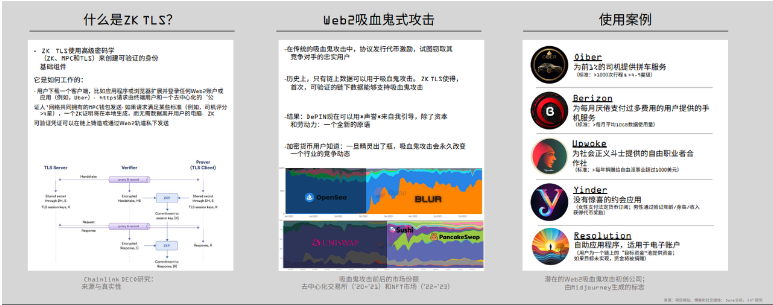

DePIN x ZK

-

Web3’s vampire attack on Web2 will become the next gold rush.

-

Developers now have the opportunity to build user-consistent clones of popular Web2 apps on emerging high-performance ZK infrastructure.

-

This infrastructure is being built by the following projects:

DePIN x Gaming

-

As more DePIN activity moves on-chain, the design space merging real-world infrastructure with on-chain gaming will grow faster than anyone expects.

DePIN x Privacy

-

ATOR will fork the Tor network in 2024, aiming to create a scalable, high-performance ecosystem for privacy-focused developers to build applications.

DePIN x Asia

-

DePIN is a global movement: Asia’s DePIN ecosystem is experiencing explosive growth.

-

We expect multiple top-10 DePINs to emerge from Asia in '24–'25.

-

Notable Asian institutions include FutureMoney, HashGlobal, Hashkey, and Distributed Capital.

(Note: FutureMoney is a leading blockchain venture capital and consulting research firm, investing across foundational public chains, application protocols, and financial services in the blockchain ecosystem, providing comprehensive post-investment support to portfolio companies.)

Appendix: Practical Resources for Understanding DePIN

-

On-chain data analysis: https://depin.ninja/

-

DePIN project screener: https://messari.io/screener

-

Research podcast: https://podcasters.spotify.com/pod/show/proof-of-coverage

-

Newsletters and events:

-

DePIN Summit: https://www.depinsummit.xyz/

-

Escape Velocity Blog: https://us21.campaign-archive.com/home/?u=d0453576cac1958c64f3c9e43&id=6196cdb18d

-

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News