Why On-Chain Communities Matter in the Attention Economy Era

TechFlow Selected TechFlow Selected

Why On-Chain Communities Matter in the Attention Economy Era

Economic incentives will change how we perceive the term "community" in Web3.

By Joel John

Translated by Luffy, Foresight News

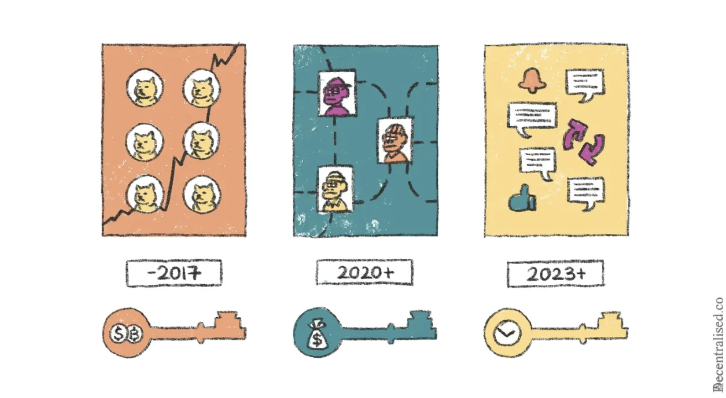

During the ICO boom of 2017, we witnessed an explosion of on-chain communities. People sent ETH to Web3 projects in exchange for newly issued tokens. Financial primitives—such as tokens—are powerful tools for building communities because they give people a shared purpose, goal, and interest. But a year later, when token prices dropped, these communities faltered. Now, we’re seeing this trend reemerge within memes.

Three Eras of Web3 Incentives

Most airdrops in Web3 are simply mechanisms that tie future incentives (tokens) to current community participation. Once a token captures users’ imagination, a crowd rushes in.

In 2020, as NFTs in games like Axie Infinity and NBA Top Shot began gaining traction, the market recognized a new primitive for community-building. Instead of issuing tokens, you could launch NFTs with a capped supply. As long as there was some form of scarcity, the value of NFTs increased.

Interests would once again bind communities, and through them, value. Yuga Labs and Animoca Brands are two companies that created billions in value using these primitives. Artists like Beeple earned life-changing wealth through on-chain representations of art and content.

As tools evolve in the Web3 industry, I believe communities will benefit from integrating NFTs and tokens into their workflows. Over the past few weeks, I’ve been exploring how this model might work—and this article is my answer.

Community and Scale

In a 2014 article, Ben Thomson unpacked a major paradox faced by newspaper publishers. Their ad revenues were as high as they had been in the 1950s. This was because what they lost in local distribution (print media) was compensated by a global audience. The problem? Now every publisher on the internet has the same advantage.

Thomson highlighted a key issue in today’s internet:

The internet is a world of abundance, where a new kind of power matters: understanding this abundance, indexing it, finding needles in the proverbial haystack. That power lies with Google. So even though the audiences advertisers seek are now scattered across an infinite number of publishers, the readers they want to reach must start from the same place—Google—and that’s where the ad dollars go.

You can see a version of this in communities. In the 1900s, your grandfather might have attended a local church, supported a favorite sports team, and had regular dinner spots. By 2024, his Gen Z descendant may be active in 50 Discord servers, watch TikTok highlights, and rarely go out for dinner.

We once formed our identities based on the tribes we belonged to. Today, we derive identity from countless chats or Reddit subforums—pixels on a screen now form the basis of our identity.

Newspapers earn more revenue but, due to dependence on Google, have less control over where that money flows. Communities have more members, but due to platform dependency, they have less say over how much time members can dedicate.

On Twitter, you might attract 100,000 users with a single post, but you’re competing for attention with a hundred others. On Telegram, you can run a large community alongside 50 other chat groups, all generating similar pings. So even though you’re part of more communities now, you’re less likely to feel deeply connected to any one of them. The internet gives you scale—but at the cost of fragmented attention.

Blockchains enable value flow between communities and members in ways today’s internet platforms cannot. They can create open reputation graphs anyone can participate in. As Web3-native social networks emerge, this will be a critical factor to remember.

Let me explain: today’s communities struggle to identify or incentivize their most active members. The primary incentive today is status or rank. This works when people work closely together, like in the military. But for internet-based pixels—like “mods” on Reddit—it doesn’t. If contributors were mapped on-chain, brands could directly engage communities without relying on platforms like Reddit or Google.

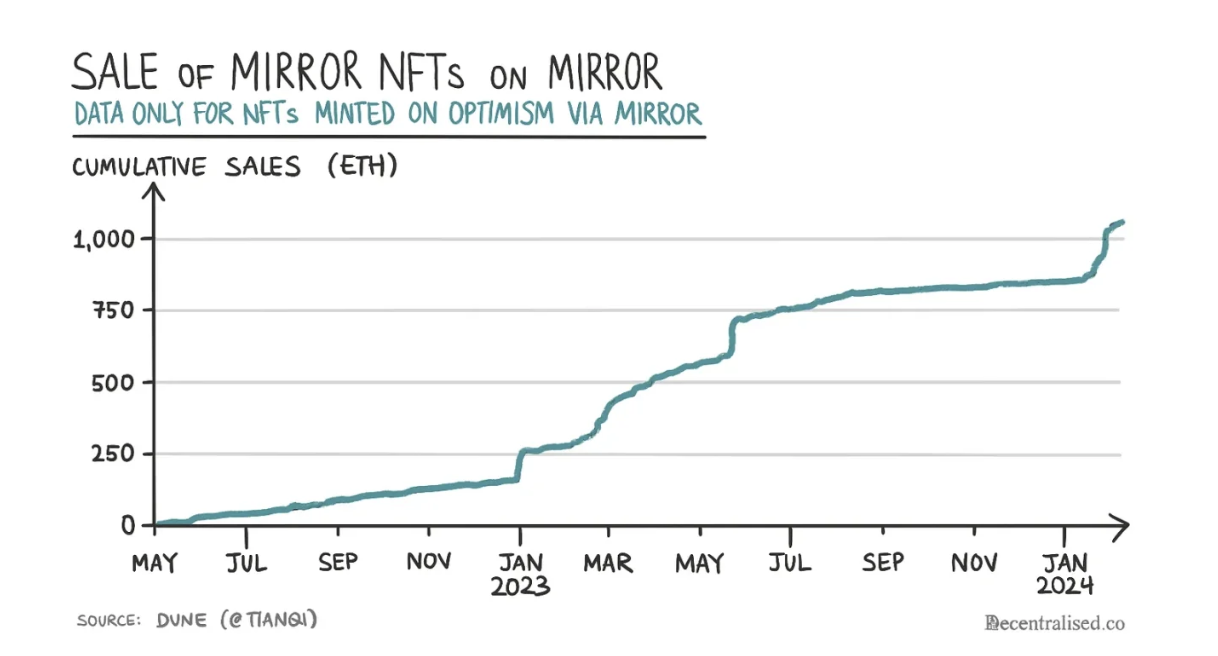

This may sound far-fetched, but I’ve observed early signs. In the last cycle (2021), audiences used NFTs to signal core allegiance. For example, you could mint an NFT of your favorite author on Mirror.

Source: Tianqi on Dune

Now imagine if an NFT rewarded you simply for reading content. Or if an NFT could be minted directly from a feed. Farcaster’s Frames have been asking this question of their roughly 400,000 users.

Feeds Connected On-Chain

Frames allow users to perform on-chain actions (like collecting NFTs) directly from their feeds. Creators can subsidize mints. For instance, last week I used LensPost to view some of our content and noticed it allows creators (like us) to cover on-chain transaction fees.

Previously, users had to go to third-party platforms to mint tokens. Even if creators subsidized transactions on Ethereum, scaling this model would cost tens of thousands of dollars. Last week on Base, we spent about $5,000 subsidizing 10,000 mints.

In other words, we can build a social graph of 10,000 people engaging with our content, each costing less than 50 cents. Why does this matter? Once users interact with content via reliable on-chain proof (by holding NFTs or tokens), you can deliver value to your audience in multiple ways. Historically, such community connections depended on platforms.

We might detach from Telegram and lose the entire community there. You no longer rely on a single platform to interact with or deliver value to your audience.

Why is this important? If your audience maps to wallet addresses, you can measure their skills and economic interactions. Yes, privacy concerns exist, but this offers a way to assess audience value. Suddenly, you’re not talking about likes, views, or retweets—all easily gamed. You can meaningfully measure audience balances, transaction frequency, and transaction size.

For micro-niche markets, this method is a goldmine because:

-

You can objectively prove community engagement.

-

You can verify participation via transaction history.

-

You can also see where else these members transact, enabling better brand partnerships.

But measuring audience value this way is a double-edged sword. On one hand, you can design ways to incentivize community members—via token airdrops or NFTs granting early product access. On the other, it makes your product vulnerable to vampire attacks.

Communities must not only design methods to attract and incentivize users but also cultivate cultures that keep them engaged longer. Future community managers must design incentives (in tokens, NFTs, or SBTs) and understand member dynamics.

Note: I’m discussing crypto-native communities here. I doubt economic incentives alone could turn a soccer club’s members into die-hard fans of another club.

What would that look like? To answer, I examined analytics data available from large NFT collections like Bored Ape Yacht Club. Previously, the best way to find asset balances in NFT-linked wallets was querying platforms like Dune. That’s changing, with new solutions emerging to track wallet behavior.

The screenshot below from Bello neatly breaks down the types of insights that arise when building communities around on-chain primitives.

For example, the median net worth of wallets holding Pudgy Penguin NFTs is about $171,000. They’ve been active for roughly two years on average. NFT holders tend to be most active on Fridays, and based on past on-chain behavior, the optimal price for today’s NFT drop would be 0.231 ETH.

According to Bello, about 1.63% of BAYC holders are active on Lens, while 1.76% are active on Farcaster. BAYC holders have collectively made about 34,000 reposts on Farcaster. These are key data points for building on-chain activity.

Don’t get me wrong: Web2 perfected user data collection over the past decade. What fascinates me is calculating a community’s actual net worth based on its on-chain behavior. Why does this matter for micro-niches? Suddenly, you have a tool to break the historical relationship between platforms, creators, and audiences.

Previously, you had to pay platforms like Meta or Google because they aggregated channels for audience interaction. In my view, this relationship is about to break as protocols like Farcaster mature—because data once locked in centralized databases will now be public.

Soon, we’ll map the most active on-chain users and see where interests intersect. For example, today you can track Bored Apes users who completed over 100 transactions on Uniswap last month. As communities go on-chain, you could search Ronin Network for players who read game theory articles from Farcaster creators.

The ability to mix and match interest segments across community members will lead to composable communities.

What does this mean for creators? Driphaus offers clues. They organize active users on Solana and let them collect NFTs from favorite artists. Users on Drip typically don’t collect rare, limited-supply NFTs—they collect unlimited ones. Users can “subscribe” to favorite creators on DripHaus for $1. Thirty percent goes to Driphaus, generating solid income for artists.

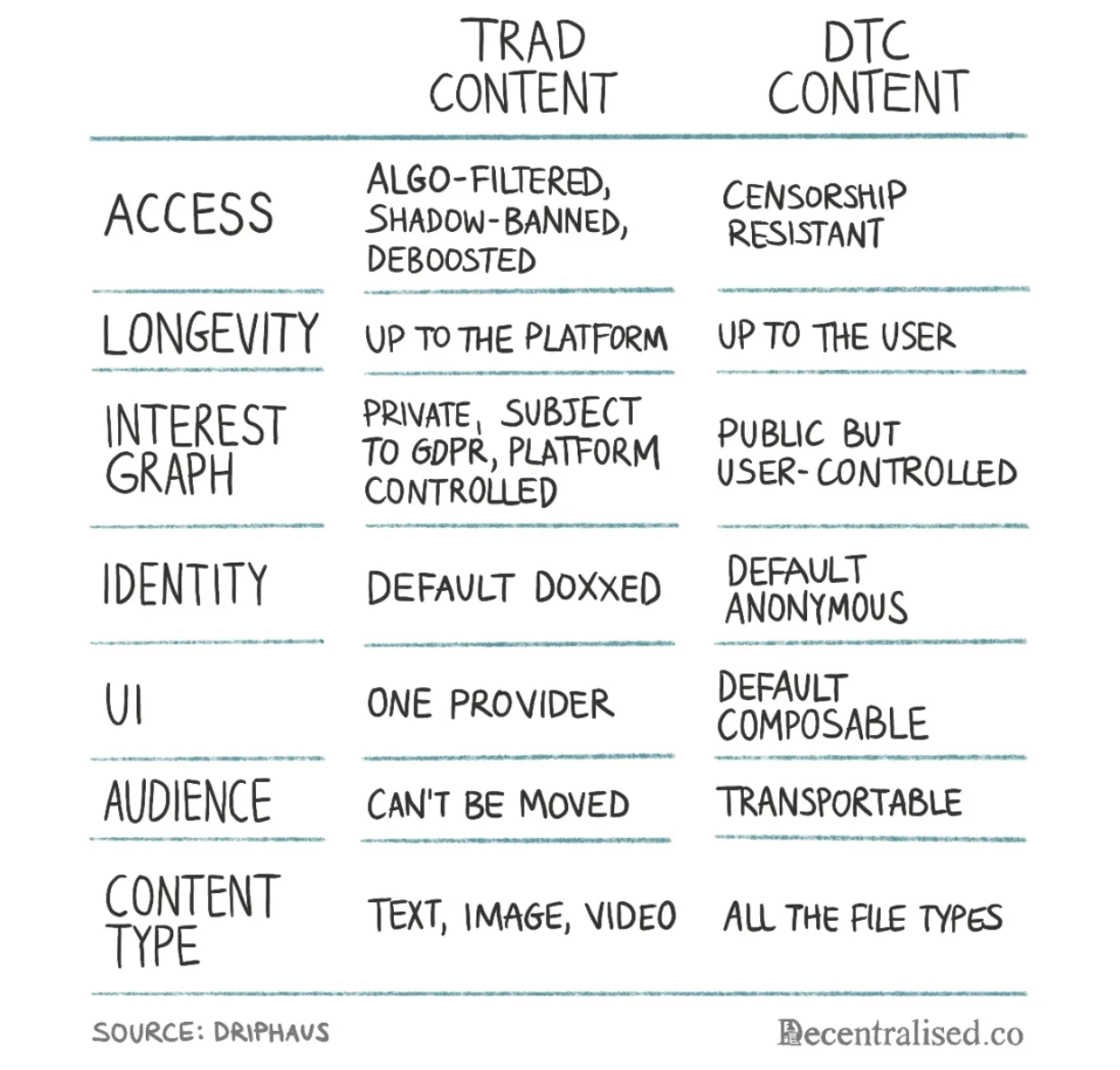

The table below originally came from Vibhu’s seed deck for Driphaus, shared on Twitter. It effectively analyzes differences between content on platforms versus on-chain.

Last month, 60% of creators on Driphaus earned over $1,000. According to Vibhu (Drip’s founder), the average donation on Driphaus is $0.05. While microtransactions and NFT mints are interesting, what excites me more is how value flows back to users. For example, once an artist builds enough audience, they can whitelist those wallets for early access to new products.

Or creators could offer these users airdrops from partnered brands. Part of Pudgy Penguins’ recent rise stems from airdrops received by holders.

Dancing with Creators

Driphaus is fascinating because it enables creators to map their communities with relatively little effort. Creators grow increasingly important as communities evolve, since quality content remains where attention congregates on today’s internet. We recognize each other through shared affinities—favorite bands, writers, or films.

Communities built with on-chain primitives are composable. This means users can interact and co-create value for the whole community. Today’s community interactions are largely top-down—relying on creators to constantly generate new value for audiences. But what if audiences could coordinate on behalf of creators?

At scale, this enables communities to actively participate in content creation.

These aren’t new ideas, but I mention them now for a reason.

-

Feeds like those on Farcaster allow algorithmic discovery of on-chain content.

-

Primitives like soulbound tokens enable permanent records of user engagement.

Step back: you used to create content on Mirror and issue NFTs. But content discovery still relied on social graphs from third-party platforms like Twitter. Now, the shift comes from crypto-native audiences gathering on Web3-native social networks.

In turn, these feeds let users mint or donate directly without leaving the interface—just click a button for commercial interaction between creator and audience.

Being able to pay creators isn’t powerful by itself. In 2019, you could tip creators as little as $0.10 on Medium. The difference now is you can collect wallet details and create new sets of user experiences while algorithms enhance your content. Previously, you either relied on algorithms (like on Twitter) or financial toolkits provided by platforms like Mirror. Today’s tools (like Warpcast) combine on-chain primitives with large audience subsets. This means you can grant content access to wallets with specific traits. For example, I might only want to release research to the first 1,000 wallets that interacted with Uniswap.

Why does this matter? As a creator, you need to know which audience segments you want to attract. Wallets with niche skills (e.g., building and running complex machine learning models on Numeraire) may be more valuable than early adopters of niche tokens. If a creator writes about AI, they might want to incentivize the former to mint their token.

Previously, niche communities were dark pools of attention. As a creator, you knew little about who engaged with your content. If you had wallet histories and credentials in the form of SBTs, you could prove your audience’s higher value with verifiable evidence.

An early version of this is visible today on YGG. Players of YGG-integrated games can earn Soulbound Tokens by completing the Guild Advancement Program (GAP). Currently, about 220,000 holders have SBTs marking their skill levels in games like Pixels Online and Axie Infinity. Why does this matter? YGG has taken some of the earliest steps toward creating an open graph of verifiably skilled users.

Whenever a new game launches, they might target players who’ve spent countless hours coordinating resources and providing feedback—otherwise risking deception by anonymous wallets.

Beyond Community

So far, I’ve painted a vision of the future: niche communities built around verifiable identities and proven engagement with creators will yield better outcomes for every participant. This future may arrive sooner than we think, as feeds on platforms like Warpcast now allow on-chain primitives like NFT minting.

But this still centers on creator-audience relationships. This vision is already materializing in products.

For example, you can examine Layer3’s user base—historical behaviors and most-used products. Third parties using Layer3 to drive users don’t need to prove user proficiency. Just check a user’s wallet address and review their history. In fact, you can use Airstack to obtain a full list of users and their on-chain handles. Companies targeting these users don’t even need to negotiate with Layer3. This creates massive added value for Layer3 users. Once their reputation is established, any product can deliver value to them—without depending on Layer3.

Meanwhile, users have strong reasons to stay loyal to Layer3, as it serves as a curation engine for discovering and sharing major on-chain opportunities.

Similarly, Boost Protocol has built a permissionless protocol around users. Last month, they released a tool to check users’ gas spending across chains like Optimism, Arbitrum, and Base, allowing users to mint passes. These passes rank users based on gas expenditure. Boost Inbox is a tool that lets products precisely locate users who’ve spent a specific amount of gas.

I don’t find it far-fetched that the protocol adds extra verification layers, similar to Gitcoin’s upcoming Passport feature. As I write this, Boost Protocol’s treasury holds about $180,000, with 47,000 Boost mints held.

I believe the arrival of commercial incentives will transform how we perceive the term “community” in Web3. If you can verify the quality and engagement of a user base, well-run communities will gain value. We may still be several quarters away from seeing fully on-chain media brands scale. Unlike traditional media networks, these will be able to verifiably quantify how much economic activity their audiences have performed.

In an era of scarce attention, economic incentives will help engineers focus.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News