Analyzing the Synchronized Multi-chain Liquidity Solution Behind Blitz, a Blast Ecosystem Project

TechFlow Selected TechFlow Selected

Analyzing the Synchronized Multi-chain Liquidity Solution Behind Blitz, a Blast Ecosystem Project

Blitz is the first spot/perpetual contract DEX built on Vertex Edge.

Author: SANYUAN Labs

The Blast mainnet has launched, with a total value locked already at $1.68 billion! Taking a look at its ecosystem projects, one DEX stands out—Blitz, a winner in Blast’s Big Bang Competition (selected as one of 46 from over 3,000 entries). What's more, their approach is commendable: they are distributing all $BLAST tokens allocated to developers entirely back to the community. After deeper research, we found that Blitz is the first spot and perpetual futures DEX built on Vertex Edge. Vertex Edge is Vertex’s newly launched cross-chain synchronized orderbook liquidity layer.

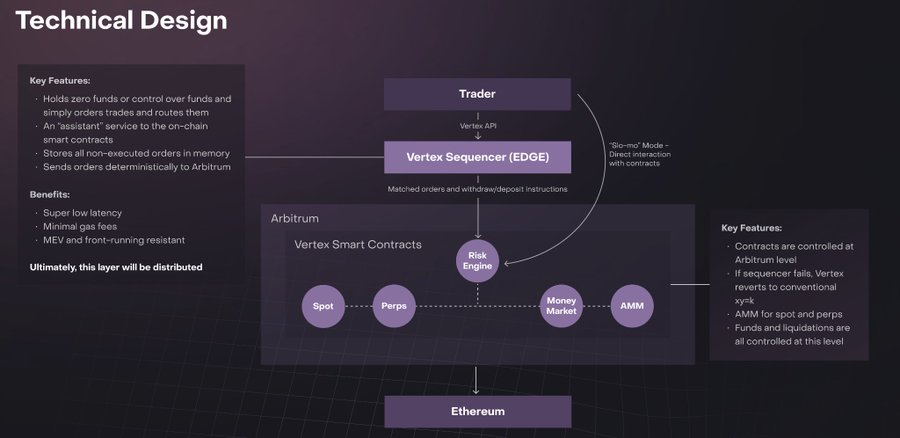

First, let’s talk about Vertex—a vertically integrated DEX on Arbitrum featuring spot trading, perpetuals, and a unified money market. Its biggest highlight is speed. This is enabled by its innovative hybrid architecture combining a centralized limit order book (CLOB) with an integrated automated market maker (AMM), known as the hybrid orderbook-AMM model. Refer to the diagram from the whitepaper below:

Vertex’s off-chain sequencer acts as a high-performance central limit order book (CLOB), reducing MEV exposure. As an independent node, the V2 version will be decentralized via Vertex governance. The CLOB enables users to enjoy a CEX-like trading experience. The off-chain sequencer connects with the on-chain integrated AMM, automatically sourcing the best available liquidity so users can trade against on-chain liquidity sources. Thanks to the integrated AMM design, liquidity is more abundant, and Vertex V2 introduces multi-chain liquidity support.

Some might question the reliability of an off-chain sequencer. To address this, Vertex implements an on-chain risk engine. When the off-chain sequencer undergoes maintenance, downtime, or faces unforeseen issues, the on-chain AMM layer serves as a fallback mechanism, allowing users to trade directly against the AMM without relying on the orderbook—albeit at slower speeds. This mode is referred to as "Slo-mo" mode.

Regarding asset security, the off-chain sequencer only matches orders; user assets remain self-custodied and require user signatures for any on-chain operations.

For performance reasons, Vertex uses Stork as its oracle solution, ensuring reference prices are delivered in milliseconds—on par with data speeds used by CEXs and traditional financial exchanges.

Having covered the technical architecture, let’s examine the trading mechanism design:

Vertex defaults to using a universal cross-margin system, where a user’s trading account consolidates liabilities and offsets positions across portfolios. In other words, a user’s entire portfolio can serve as collateral for multiple open positions. This design reduces margin call risks and eliminates isolated position liquidations, offering greater flexibility—especially useful when managing multiple positions simultaneously, enabling easier evaluation of overall leverage.

On liquidations, Vertex collects 25% of the liquidator’s profit and deposits it into an insurance fund, which covers potential bad debt within the system.

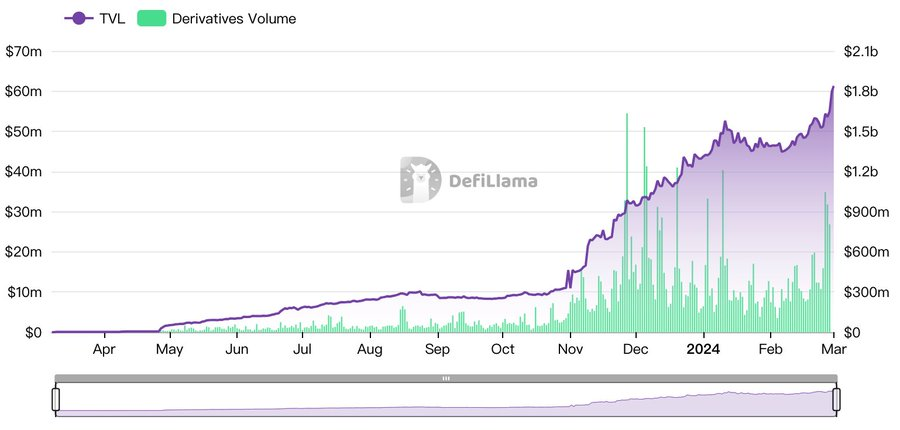

According to DefiLlama data, since launching its incentive program last November, Vertex has seen growing activity, with daily trading volume peaking above $1.6 billion.

After discussing Vertex at length, what exactly is Vertex Edge, the synchronized orderbook liquidity layer? Simply put, it's the cross-chain shared orderbook introduced in Vertex V2, focused on cross-chain order and liquidity matching. Developers can build their own front-end applications on top of it.

Blitz is the first DEX application built on Vertex Edge—it could also be called an instance of Edge.

If Edge handles cross-chain liquidity matching, won’t efficiency drop? Edge addresses this through various optimization techniques to achieve high TPS. For example, modeling the EVM as a tree structure enables parallelization—an important upgrade to Vertex’s sequencer. Co-founder @AlwinPeng detailed this extensively on Twitter: https://twitter.com/AlwinPeng/status/1737471187465211979…

The sequencer state is sharded across multiple supported chains, receiving and cloning incoming orders from each chain. Then, independent orders from one chain are matched against liquidity from multiple chains. After successful trades, Edge automatically hedges and rebalances backend liquidity across chains.

Therefore, Edge can also be viewed as an Omni-layer, efficiently aggregating multi-chain liquidity. Beyond significantly enhancing liquidity availability, it improves user experience by eliminating the need to manually bridge assets across chains for liquidity access—and better supports long-tail assets.

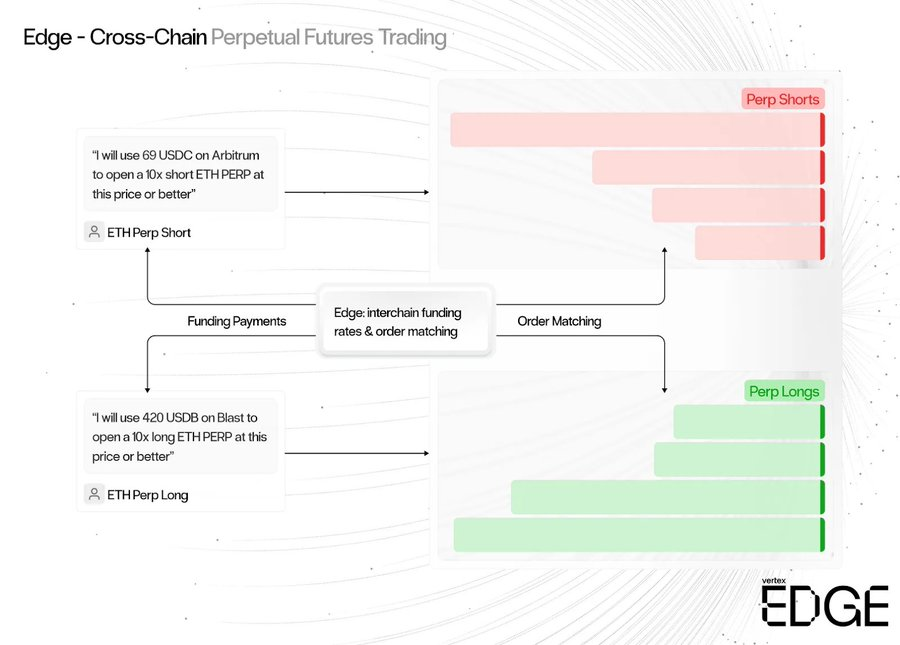

Notably, Edge’s cross-chain liquidity aggregation does not require complex or time-consuming asset bridging—only order matching. Take the perpetual contract example from the official documentation:

Alice wants to go long ETH-PERP at price X on Blitz, deployed on Blast.

After checking aggregated orders across Vertex instances, the sequencer (Edge) identifies John on Arbitrum as offering the best counter-order (shorting). Edge then immediately opens a short position on Blast and a long position on Arbitrum.

Over time, Edge accumulates long and short positions across native chains. Periodic aggregation and backend settlement across chains suffice—this asynchronous processing is one reason for its high efficiency.

Additionally, to seamlessly enable such multi-chain liquidity aggregation, funding rates and interest rates must be consistently priced across chains. Therefore, Edge adopts unified funding rates and a unified money market interest rate.

In summary, liquidity and efficiency are crucial aspects of DEX trading experience—and Edge solves both in one go.

Blitz offers a user experience very similar to Vertex, and since both operate on Vertex Edge, Blitz users can immediately tap into Vertex’s liquidity on Arbitrum. Currently, Blitz has also announced liquidity integration plans with several leading DeFi projects: Juice Finance will integrate with Blitz, providing leveraged liquidity vaults with custom Elixir pools to boost yields for Blitz orderbook pairs; Range Protocol will also partner with Blitz, bringing perpetual vaults and automated liquidity strategies.

With Blast now live, Blitz’s standalone points program will soon be announced—worth keeping an eye on. Also, consider completing tasks on Galxe, as even the official team has mentioned them.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News