SevenX Ventures: DePIN, False Hope or True Dawn?

TechFlow Selected TechFlow Selected

SevenX Ventures: DePIN, False Hope or True Dawn?

This article aims to provide a balanced critique of DePIN's historical shortcomings, exploring areas such as regulatory hurdles, insufficient demand, flawed token economics, and rug-pull risks.

Author: @Rui, investor at SevenX Ventures

With growing emphasis on real-world applications and the rise of Solana, DePIN has regained significant popularity in 2024, as shown by Google Trends. However, DePIN is not a new concept. In my view, the essence of DePIN lies in a token economic model that turns participants into stakeholders—not in creating new productivity.

During the previous bull market, projects like Arweave, Filecoin, and Helium stood out, while many others underperformed or even crashed to zero. Now, as we approach the next bull cycle, our challenge lies in distinguishing fleeting fads from truly sustainable innovations that will lead us into a new era of real-world applications.

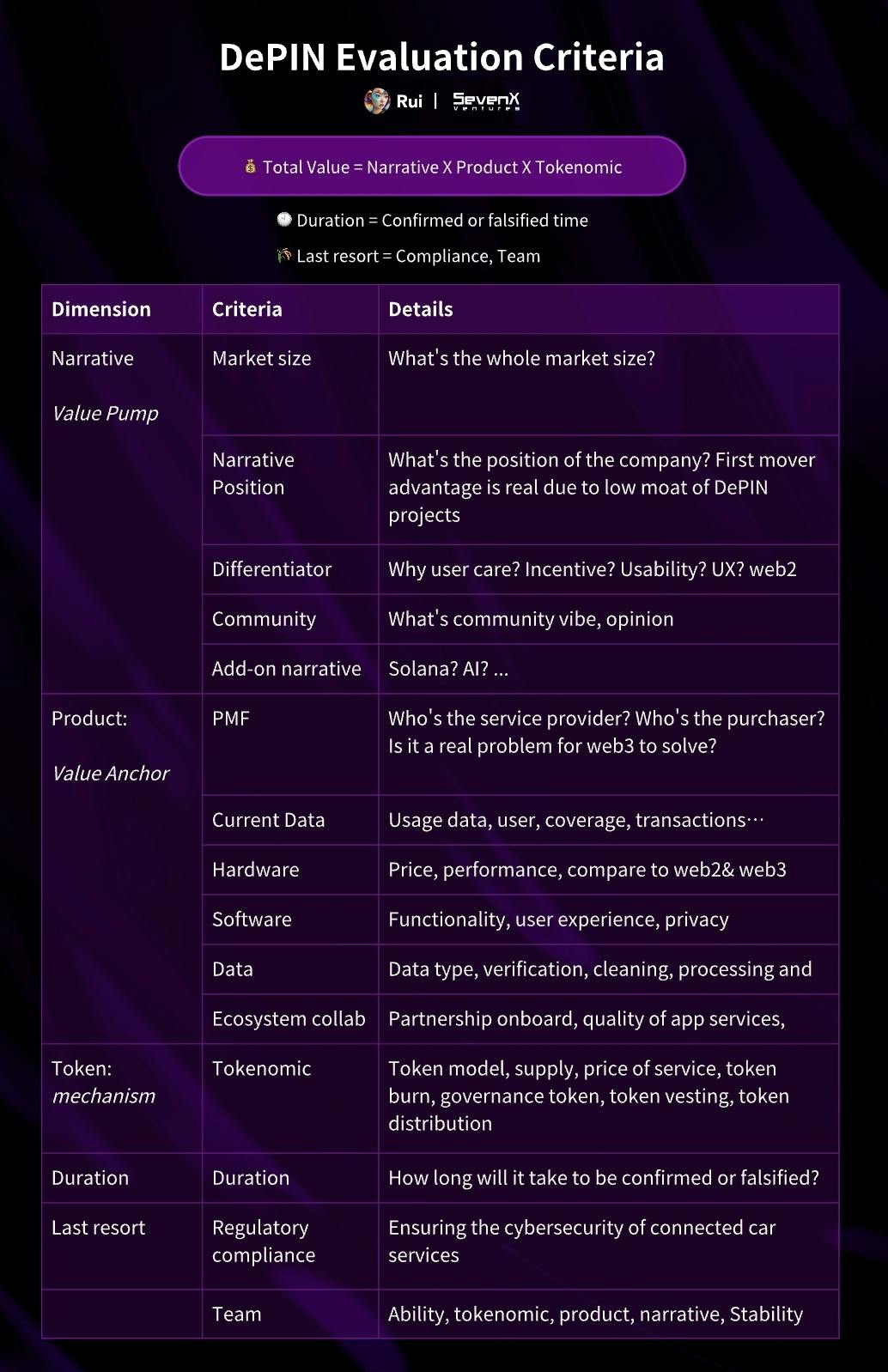

This article aims to offer a balanced critique of DePIN’s historical shortcomings, examining areas such as regulatory hurdles, insufficient demand, flawed tokenomics, and rug risks. Nonetheless, it also highlights the sector’s immense potential—including overcoming margin constraints, establishing value anchors, refining token incentives, and fostering strong community engagement. I will present a DePIN evaluation framework along with detailed case studies of DePIN projects. Hopefully, this piece equips readers with insights and tools to build, evaluate, and invest in the DePIN landscape.

Introduction

The blockchain space has long focused on infrastructure development—emphasizing scaling solutions (Layer2s, data availability), privacy enhancements (zero-knowledge), and user experience improvements (account abstraction)—laying the groundwork for broad adoption. Now, the need for mass real-world adoption is clearer than ever. Exchange efforts toward compliance and ETF approvals in traditional markets have made major strides and paved the way forward.

DePIN isn’t a specific vertical. The term, originally coined by Messari, stands for Decentralized Physical Infrastructure Networks. It represents a community-driven, token-incentivized decentralized hardware network. Its primary goal is to replace monopolistic coordinators and use native tokens to transform participants into network stakeholders. Since the last bull run, there has been notable expansion across high-value domains such as AI/ML, 5G, WiFi, bandwidth, vehicles, and energy.

So, what does DePIN bring that’s new?

Assets: Types, distribution, and transaction methods

-

Looking at successful crypto projects, they typically feature assets with universal properties, continuously refining their functionality and use cases. DePIN projects can integrate physical assets, transforming services provided or data collected by hardware into tokenized assets. This tokenization enables permissionless trading and staking, opening doors to broader financial activities.

Participants: Roles, numbers, stickiness, and relationships

-

DePIN enhances ecosystems through role diversification, creating a cohesive network of hardware manufacturers, miners, dApp developers, consumers, and more. Lowering entry barriers and expanding geographic reach attracts a broader participant base. More importantly, DePIN turns all parties into stakeholders via crypto assets, encouraging both labor contribution and consumption. This approach ensures sustained engagement, increases ecosystem stickiness, and goes beyond traditional, simplistic buyer-seller dynamics. By fostering complex interconnections, DePIN significantly strengthens its ecosystem's robustness and sustainability.

Use Cases: High value, frequency, and scalability

-

DePIN is grounded in real-world scenarios, meeting existing demands. Beyond appealing to crypto investors, a network’s general value can be derived from buyer count, transaction value, and transaction frequency. Success is possible if any two of these parameters perform well. For example, the 5G user base is massive—over 100 million people in the U.S. pay around $80 monthly. While individual AI company transaction volumes may be smaller compared to 5G users, high-frequency, high-value transactions driven by widespread demand highlight significant opportunities.

Beyond initial excitement, several key factors deserve attention: achieving product-market fit remains critical even with abundant supply; implementing protocol designs that ensure partition tolerance and censorship resistance is essential to avoid new forms of control; additionally, incentives must be carefully structured to prevent unsustainable inflation. We’ll explore these aspects in greater detail below.

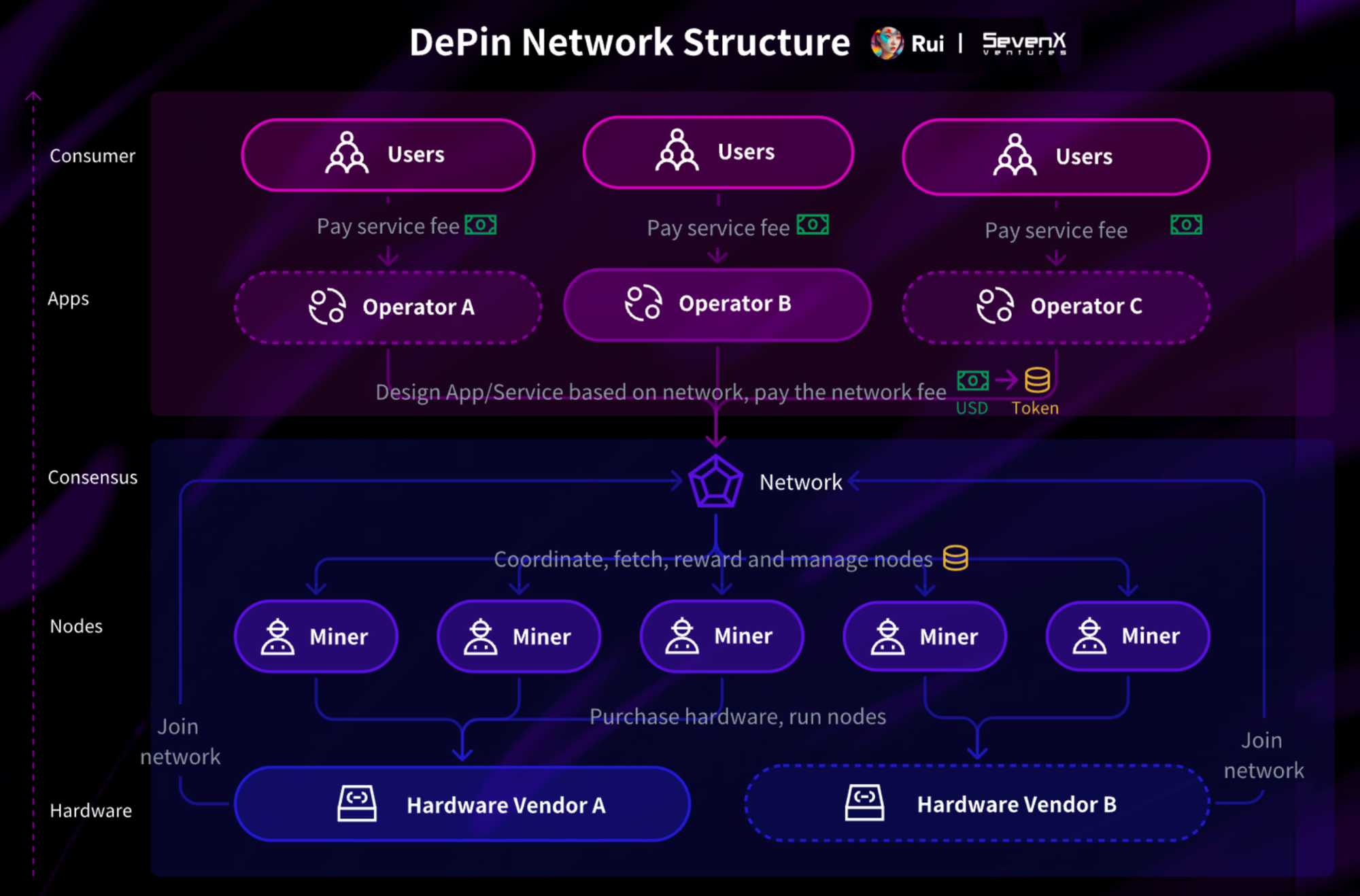

Participants

This section examines the roles and objectives of five main stakeholders: hardware manufacturers, custodians (referred to as "miners" for simplicity), network providers, operators, and end users.

Hardware Manufacturers: Physical devices providing services or collecting data

Manufacturer evolution:

Transitioning from centralized whitelisted manufacturers to a permissionless system is a natural progression. Initially, relying on a single entity to produce reliable hardware makes sense. However, to prevent a single supplier from becoming a monopoly threat or a bottleneck to network growth, opening the ecosystem to more qualified hardware manufacturers is advisable. Ultimately, an open market fosters healthy competition, delivering the best products at fair prices to miners (e.g., Helium HIP19).

Miners: Entities running hardware as nodes within the network

Cost considerations:

-

Miners consider total cost, including hardware, setup, maintenance, and operational (if applicable) expenses. Time and attention costs associated with network participation are also important.

Reward system:

-

Beyond belief in building a physical network, miners prioritize rewards, often calculating payback periods. Instant incentives during beta versions are attractive, but protocols should curb rampant inflation, incorporating strong deflationary designs and staking mechanisms to ensure long-term miner income. Many projects have adopted the Burn-Mint-Equilibrium (BME) model.

User experience:

-

The process should be simple and straightforward, aiming to lower the learning curve for participation, enabling low-barrier, scalable networks.

Protocol: The coordinating core of the network

Pricing structure:

-

Prices for commoditized services are fixed at the protocol level, but decisions must be made carefully to ensure sustainability. Take io.net's pricing model as an example: pricing is influenced by multiple dimensions including web2 competitor pricing, peak hours, hardware performance, network bandwidth, and crypto yields.

Rule transparency:

-

Rules such as reward mechanisms should be at least transparent and publicly accessible. Then, even if executed off-chain, results should be verifiable, with full automation eventually achieved. On-chain automation appears optimal, ensuring fairness, though it may sacrifice flexibility for dynamic adjustments.

Data integrity and honesty:

-

Establish transparent and verifiable procedures for retrieving data from hardware, uploading it to databases, and reflecting it in rewards.

Security measures:

-

Anticipate malicious behavior and implement measures such as random liveness checks and valid data verification. KYC might be involved, and reputation systems can reward honest behavior while penalizing dishonesty.

Privacy and compliance:

-

Collecting data from participants can improve protocol robustness and efficiency, but it also poses privacy risks. While collecting only necessary data, projects should consider implementing zero-knowledge proofs (ZKP).

Operators: Entities packaging network resources into services

Operator entity diversity:

-

Initially, a single operator emerging from the network foundation might set up a cold-start model. Over time, allowing more operators to join expands market reach, maximizes miner resource utilization, and enables healthy competition.

Revenue model:

-

In addition to paying miners for network costs, operators typically charge a premium for bundled services. Operators can use profits to increase marketing spend, subsidize users, etc.

Buyers: End users of the network

Goals and needs:

-

Different users have different goals—cost efficiency, time savings, security, accessibility, or performance. The network should effectively meet these primary needs.

User experience:

-

A seamless onboarding and payment process is crucial. Whether users need to understand crypto depends on service design, but the goal should be simplifying transactions, integrating fiat payment options with cryptocurrency.

Ecosystem Landscape

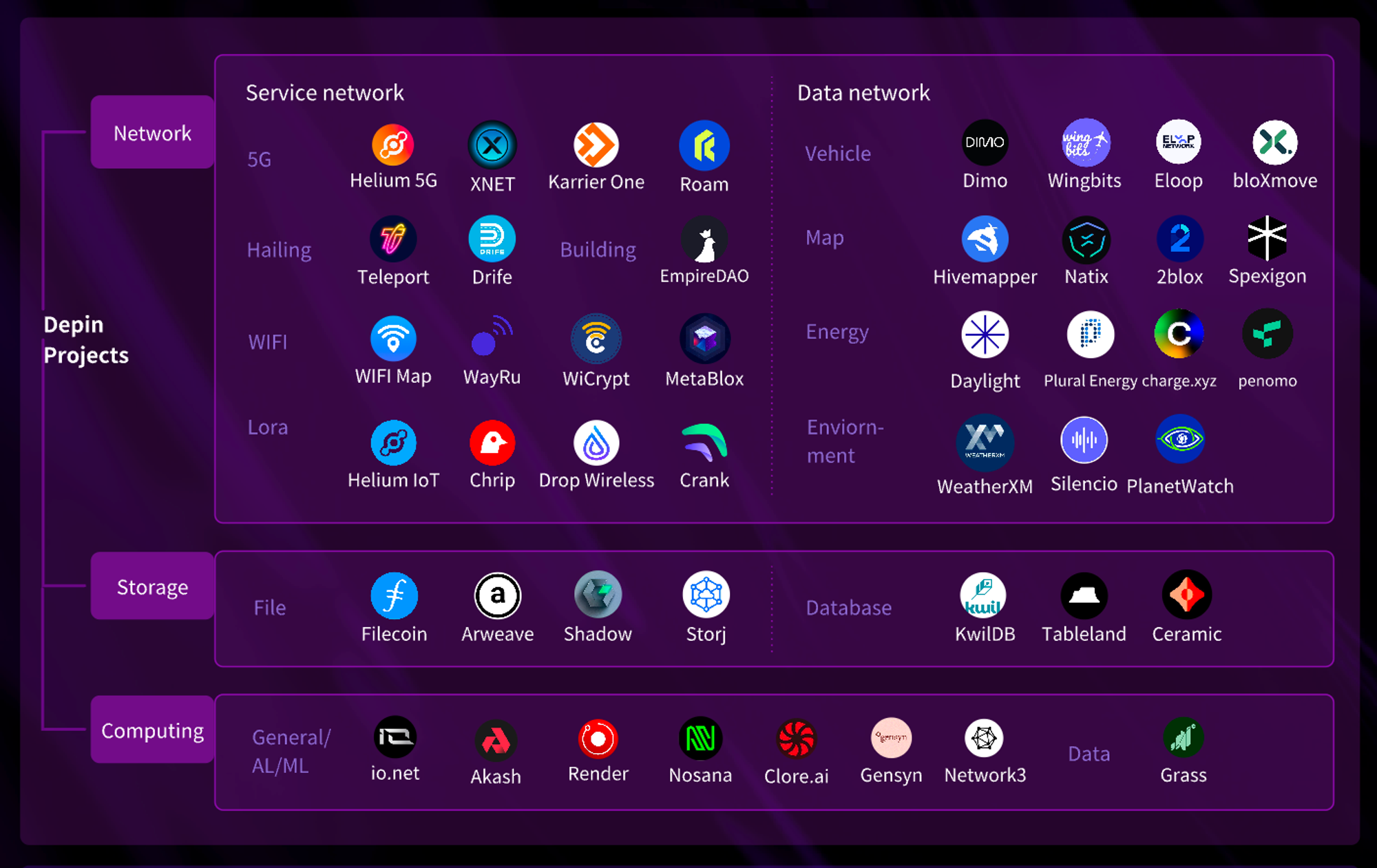

DePIN Networks

DePIN projects vary widely, but for better understanding, we can categorize them by purpose, type, and market.

Purpose

Computing:

-

This includes using computing systems to process and communicate information. For example, Rollups solve blockchain computing challenges, while decentralized GPU and CPU resources meet off-chain computing needs.

Storage:

-

Storage projects ensure data retention for future retrieval and use. This broader concept includes file storage solutions like Arweave and Filecoin, as well as databases like KwilDB.

Networking:

-

Networking projects facilitate access to and transmission of real-world data through networks, enabling communication between different nodes and connecting them to users. Typically, projects leverage IoT sensors and wireless networks to collect data and provide services.

Type

Service Networks: Core asset is service

-

The primary goal of service networks is to efficiently utilize idle or available resources to deliver services. The protocol aggregates user demand, matches it with miner resources, and assigns tasks accordingly. Examples include io.net, which connects GPU resources with AI companies; Helium, linking small cell hosts with 5G users; and Teleport, connecting drivers with passengers.

Data Networks: Core asset is aggregated datasets

-

Data networks incentivize data contributions to accumulate large datasets. They standardize data formats, ensure data validity and quality, and may involve data cleaning and training before packaging data into datasets, APIs, or other formats for commercial use. For example, DIMO collects vehicle data to generate insights valuable to insurance or gas companies; Hivemapper captures street images to create map data for delivery and smart city projects.

Market

AI and Machine Learning:

-

The global machine learning market is projected to grow from $26.03 billion in 2023 to $225.91 billion by 2030. Web3 opportunities in AI/ML lie in data, computing, and models. For data, projects like Grass allow large user bases to share bandwidth so AI companies can scale data acquisition; for computing, projects like io.net aggregate data center compute power at lower costs than web2; for models, projects like Bittensor enable model tokenization.

5G/Cellular:

-

The global 5G market reached $84.31 billion in 2023. Transitioning to 5G requires denser cellular networks, from which web2 monopolies extract substantial profit margins. DePIN 5G projects like Helium aim to build decentralized, affordable networks by leveraging small cells, free public spectrum bands in the U.S., and eSIM cards.

Automotive:

-

The automotive market is expected to grow from $145.24 billion in 2023. DePIN vehicle networks collect data through specialized hardware and software, generating valuable insights for insurance, maintenance, fuel, and other businesses. Projects like DIMO use token incentives to encourage driver data sharing.

Ride-hailing:

-

The global ride-hailing market reached $176.6 billion in 2023. DePIN ride-hailing services disrupt the rideshare market by using tokens to drive growth, offer fair pricing, and maintain lower transaction fees than web2 intermediaries. Notable projects include Teleport and Drife.

Maps: In 2022

-

The global digital map market was valued at $18.18 billion. DePIN mapping projects address data fragmentation and over-reliance on major tech firms by offering fair data-sharing models that reward community contributions with tokens. Examples include Hivemapper, 2blox, and Natix.

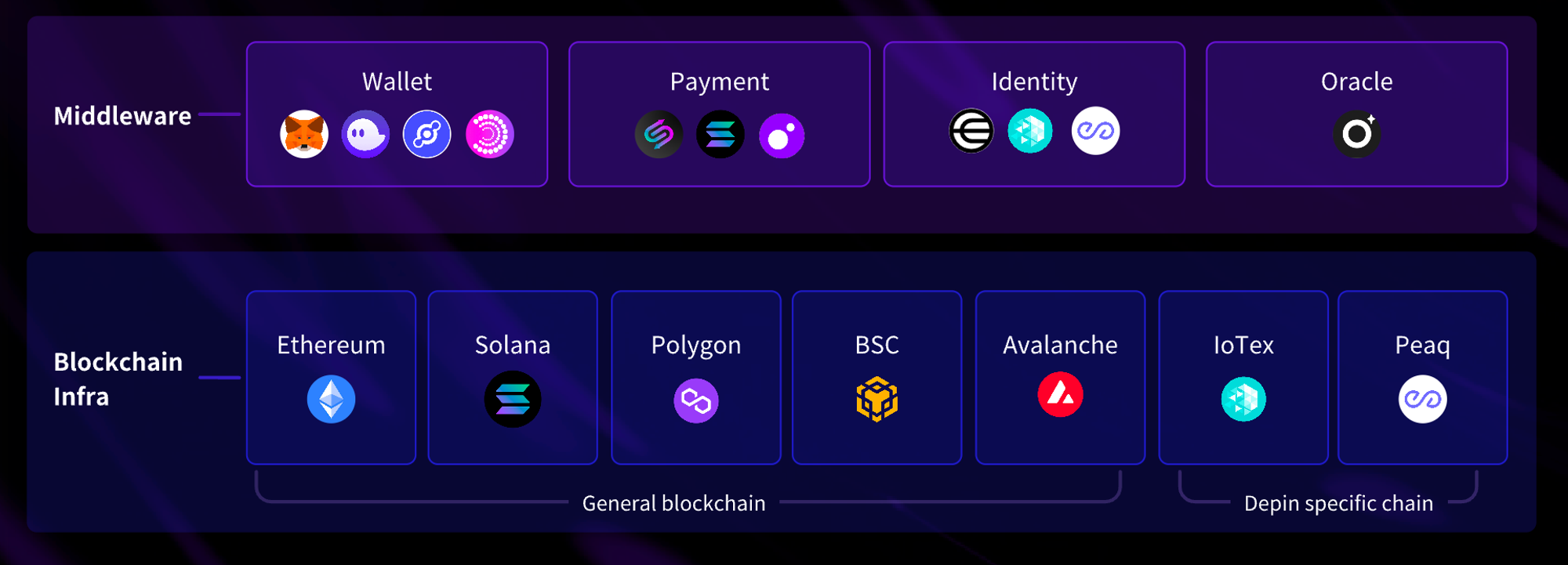

Blockchains and Middleware

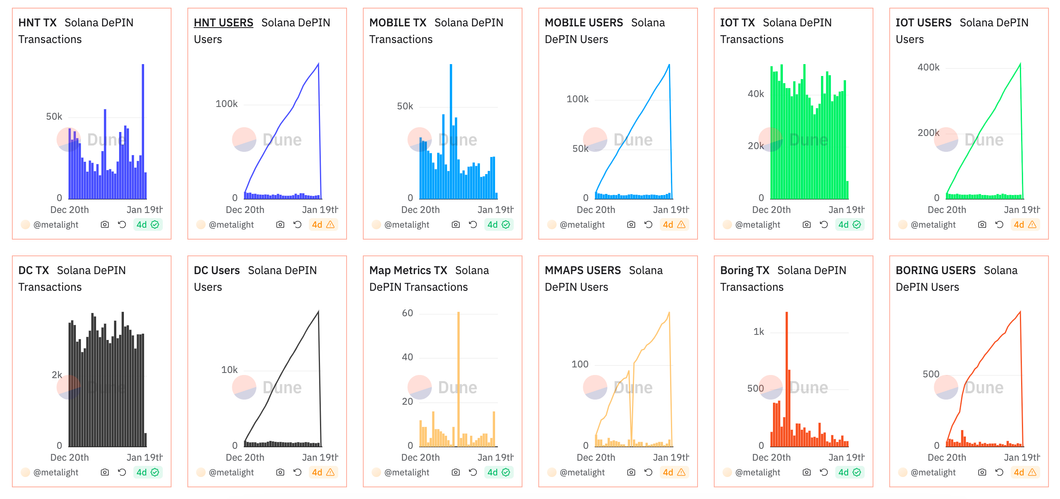

Currently, most DePIN projects only have their tokens on-chain, with the majority operating off-chain. Since April 2023, Helium has transitioned from its proprietary blockchain to Solana. This shift was motivated by the need to address maintenance costs and scalability challenges. The nature of DePIN projects—characterized by small, frequent transactions and timely rewards—demands blockchain infrastructure that is fast, cost-effective, and scalable.

For general-purpose blockchains, performance, cost, and ecosystem matter greatly:

-

Solana's DePIN market cap is around $2.4B, making it the preferred choice for major projects such as Helium, io.net, Teleport, Hivemappers, Render, Nosana, and others. Solana strongly aligns with DePIN projects’ need for fast, low-cost transactions thanks to its unique Proof-of-History (PoH) mechanism reducing computational load, and high hardware requirements enhancing processing performance. Scalability is equally crucial—for instance, Helium requires millions of transactions monthly and minted 900,000 NFTs for subscribers when migrating to Solana. Solana must remain resilient during peaks and enable rapid, low-cost mass minting. Projects benefit from interoperability with other Solana ecosystem initiatives, and Solana continues upgrading to better serve DePIN needs. Recently introduced token extension support allows advanced SPL customizations such as threshold transactions, privacy modes, and delegation, giving DePIN protocols greater flexibility in designing on-chain components.

On the other hand, DePIN-dedicated blockchains are gaining attention. These chains address critical issues such as data trustworthiness, identity management, and verifiability. By providing automated and verifiable data, DePIN projects can save on repetitive operational work, mitigate risks, and focus more on network development.

-

IoTeX, as a Layer1 blockchain, launched a Layer2 solution “W3bstream” that enables secure IoT data collection, leverages flexible data availability layers, and aggregates large volumes of off-chain data into verifiable zero-knowledge proofs (ZKPs) triggering on-chain transactions.

-

Peaq is a multi-chain Layer1 blockchain built for DePIN. With low costs and high transaction speeds, it offers modular DePIN features such as multi-chain machine IDs, payments, role-based machine access, three-tier data validation, AI agents, data storage, and indexing. Peaq integrates with Wormhole for liquidity and has established strong partnerships with relevant players like Bosch. Peakq will launch in 2024.

Why It Doesn't Work?

-

Regulatory difficulty: Managing networks in the physical realm requires compliance with countless regulations, with feasibility and costs varying across markets. For example, ride-hailing projects must manage mobility data, comply with local governance reporting requirements, and adhere to personal safety standards. Similarly, 5G projects are subject to differing spectrum licensing regulations across countries.

-

Helium’s LoRa specification demand failure: Supply-side growth doesn’t guarantee demand-side adoption. DePIN projects use tokens to rapidly incentivize miner expansion, with onboarding fees typically reinvested to increase network value. However, oversupply without corresponding usage can become problematic. To prevent this, ensuring each project’s product truly fits the market is crucial. Additionally, effective marketing, sales strategies, and business development are key to competing with large web2 providers.

DePIN Project Users

-

Tokenomics failure: DePIN projects usually launch with their own tokens from day one, and the design of their mechanisms is a key determinant of success. However, this tokenomics expertise poses a challenge for projects initiated by web2 manufacturers, who often rely on precedents to shape their token strategy. Sometimes they resort to massive incentives to attract participants, leading to unsustainable inflation. The Work token model (Stake for Access) is commonly used for commoditized services with fixed protocol-level fees. BME (Burn-Mint-Equilibrium) can adopt a dual-token system combining a tradable, value-seeking token with a fiat-pegged payment token, enabling fixed fiat-denominated service pricing.

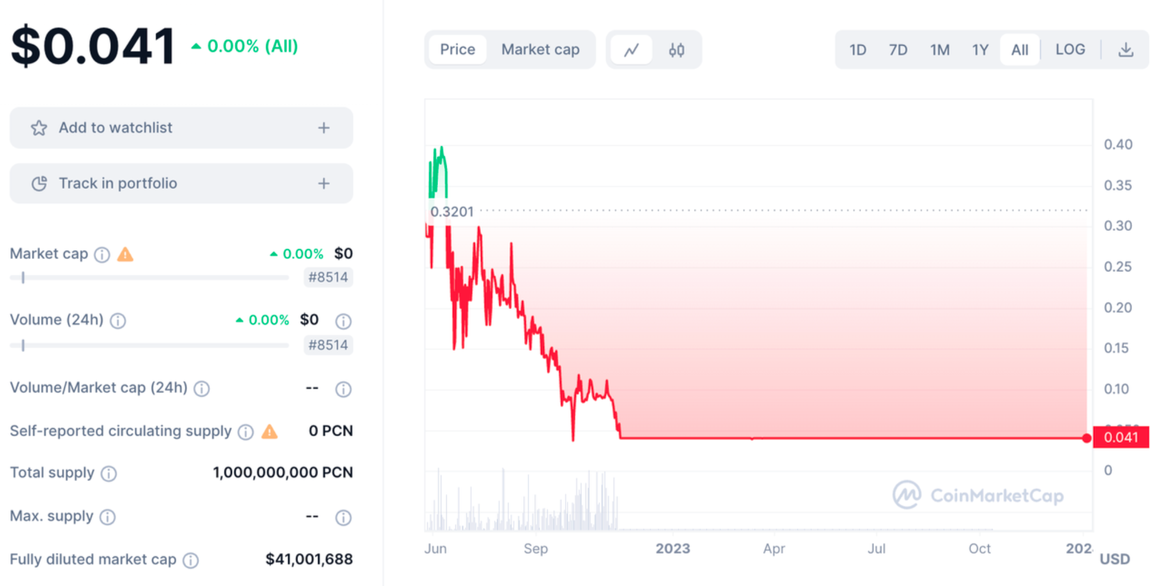

Token prices of previously prominent DePIN projects

-

Performance considerations: Centralization offers advantages in centralized coordination, adaptive management, and high-speed performance. Although decentralized projects can draw attention with lower fees, matching the performance of centralized services remains highly uncertain. Take shared GPUs as an example—GPUs distributed across locations make integrating them into a single cluster complex, potentially causing latency for intensive ML applications. If decentralized systems cannot match the performance of centralized services, their cost advantage won’t be enough to offer a competitive alternative.

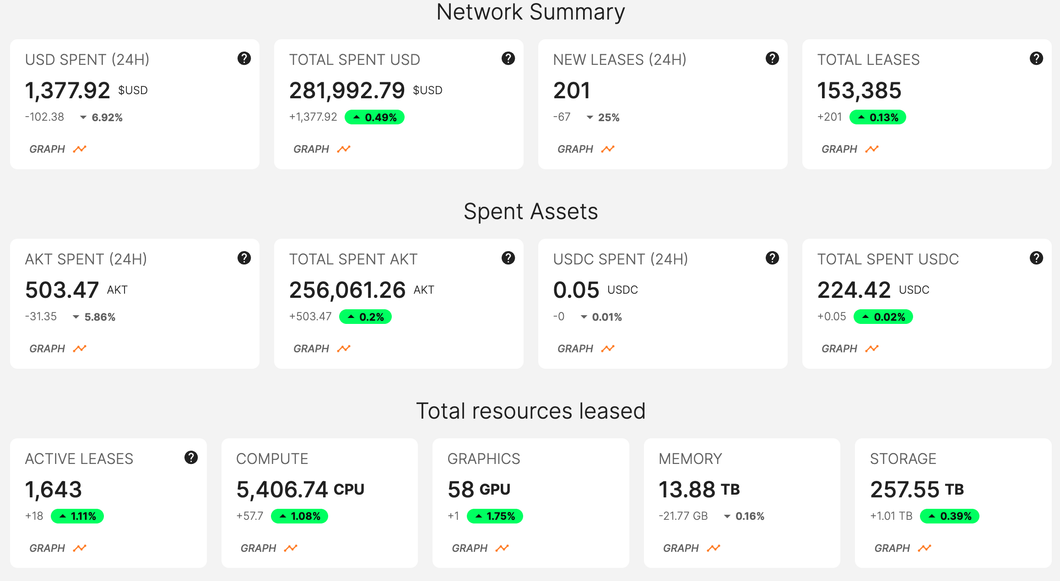

Akash Dashboard

-

Difficulty building moats: This challenge is especially severe in commoditized services, where standardized and interchangeable products allow suppliers and customers to easily switch networks for better revenue or lower fees. Even among web2 enterprises, this lack of strong moats is evident. However, certain factors can create competitive advantages: securing first-mover status to build brand recognition, delivering the best user experience, and developing proprietary, patent-protected software or hardware.

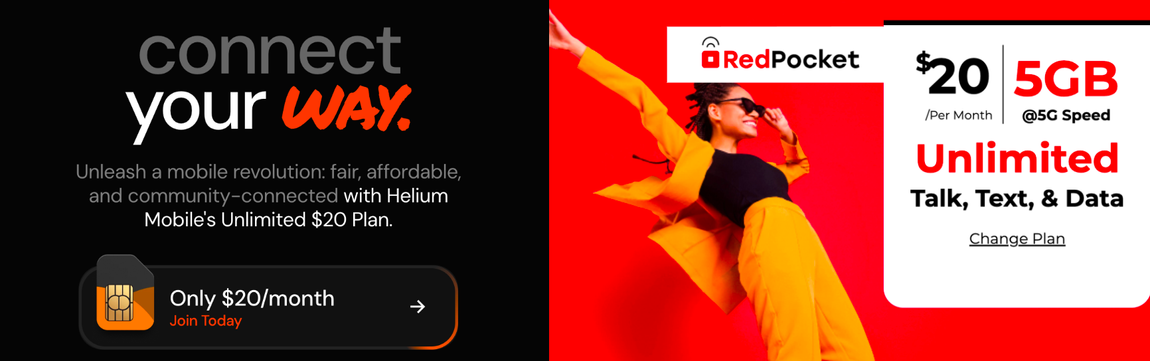

Helium 5G vs RedPocket 5G

-

RUG: Easy exit scams after narrative selling: Unlike other sectors, DePIN participants (miners) typically need to make significant upfront hardware investments before earning rewards, although this varies by use case. This creates potential fraud risk—foundations can release a promising roadmap, build a narrative, get influencers to promote and sell hardware, then suddenly rug and disappear.

Price of rug projects

Why There’s Still Hope

Your profit is my opportunity:

-

Web2 is FAT. In today’s web2 landscape, giants like Amazon and Microsoft enjoy high gross margins. DePIN can disrupt this by enabling individuals and small entities to compete with these behemoths. By tapping into this profit margin, DePIN can offer more cost-effective solutions, undermine legacy players’ high-margin models, and pass savings directly to users.

Value anchor minimizing bubbles:

-

DePIN delivers tangible value through hardware devices, services, and data. This utility acts as a stabilizing factor, anchoring the business model and mitigating speculative bubble risks. By providing real-world applications and benefits, DePIN ensures solid, sustainable growth.

Tokens as business accelerators:

-

Initial funding: DePIN can raise substantial capital from VCs, sell hardware, and launch narrative-driven tokens. This initial funding kickstarts the business.

-

Growth subsidies: Using part of the raised funds to subsidize service fees and reward users, DePIN can rapidly expand its network with more nodes and users, cultivating a strong, extensive community.

-

Sustainable scaling: While hardware coverage has limits (e.g., needing a certain number of hotspots to cover an area), a mature network can sustain itself long-term. Once initial funding is utilized, a mature network should become self-sustaining, driven by its own momentum and user base.

Community-driven, bottom-up approach:

-

By leveraging a community-driven model, DePIN can achieve more cost-effective and agile development compared to traditional top-down approaches. This grassroots strategy not only reduces costs but also increases user engagement and investment in the platform, creating a loyal and active community.

Evaluation Criteria

Case Studies

Helium 5G

In short, Helium Mobile is entering the vast U.S. 5G market—now expanded to Mexico—as a pioneer and one of the largest markets in the DePIN space. It’s a significant venture at the intersection of Solana, DePIN, and 5G innovation. Helium Mobile offers a $20/month 5G plan and currently serves over 43,000 users in the U.S. Its BME approach, deflationary token model, and pegged coin concept have set precedents for numerous projects.

Background:

-

Helium is a pioneer and one of the largest DePIN networks, initially launched in 2019 to tackle IoT challenges. Through effective token incentives, it became the world’s largest IoT network within two years, with over 100,000 hotspots across 182 countries. During the last bull market, its FDV peaked at $11.7 billion, marking it as a standout project. Despite criticisms about limited IoT demand highlighted, Helium continues to evolve. In 2022, it entered IoT and mobile domains through two sub-DAOs and began focusing on the 5G hotspot market. A partnership with T-Mobile enhanced network accessibility, and migration to Solana in 2023 cemented its status as a leading DePIN project on the platform. As of January 2024, Helium has deployed 8,000 5G hotspots and over 43,000 monthly 5G users.

Network:

-

How is community-driven 5G service possible?

Traditional 5G providers like AT&T, Verizon, and T-Mobile dominate the U.S. wireless market, having invested heavily in spectrum licenses and infrastructure. Yet DePIN 5G becomes feasible through three key opportunities: the rise of eSIM technology, enabling users to seamlessly switch to virtual providers; the availability of CBRS spectrum bands for public use without expensive licenses; and the emergence of small cells that individuals can host, providing sufficient coverage when densely deployed.

-

What is the goal of the Helium 5G network?

Considering the limited range of small cells—covering only 100 yards to a mile—it’s impractical to fully replace traditional 5G networks. Instead, Helium’s 5G network aims to act as a supplemental roaming service, particularly in densely populated areas, offering more affordable connectivity.

-

How does the Helium network work?

The network consists of five roles: hardware suppliers, miners, network, operators, and users. Suppliers manufacture and sell 5G hotspots; miners purchase and operate them at a cost of $1,000–$2,598, contributing to network coverage. Miners are rewarded for active, effective service. The network manages these nodes and maintains data prices at $0.5/GB. Operator Nova Labs packages this infrastructure into user-friendly services, offering users a $20/month 5G plan.

Tokens:

Token types:

-

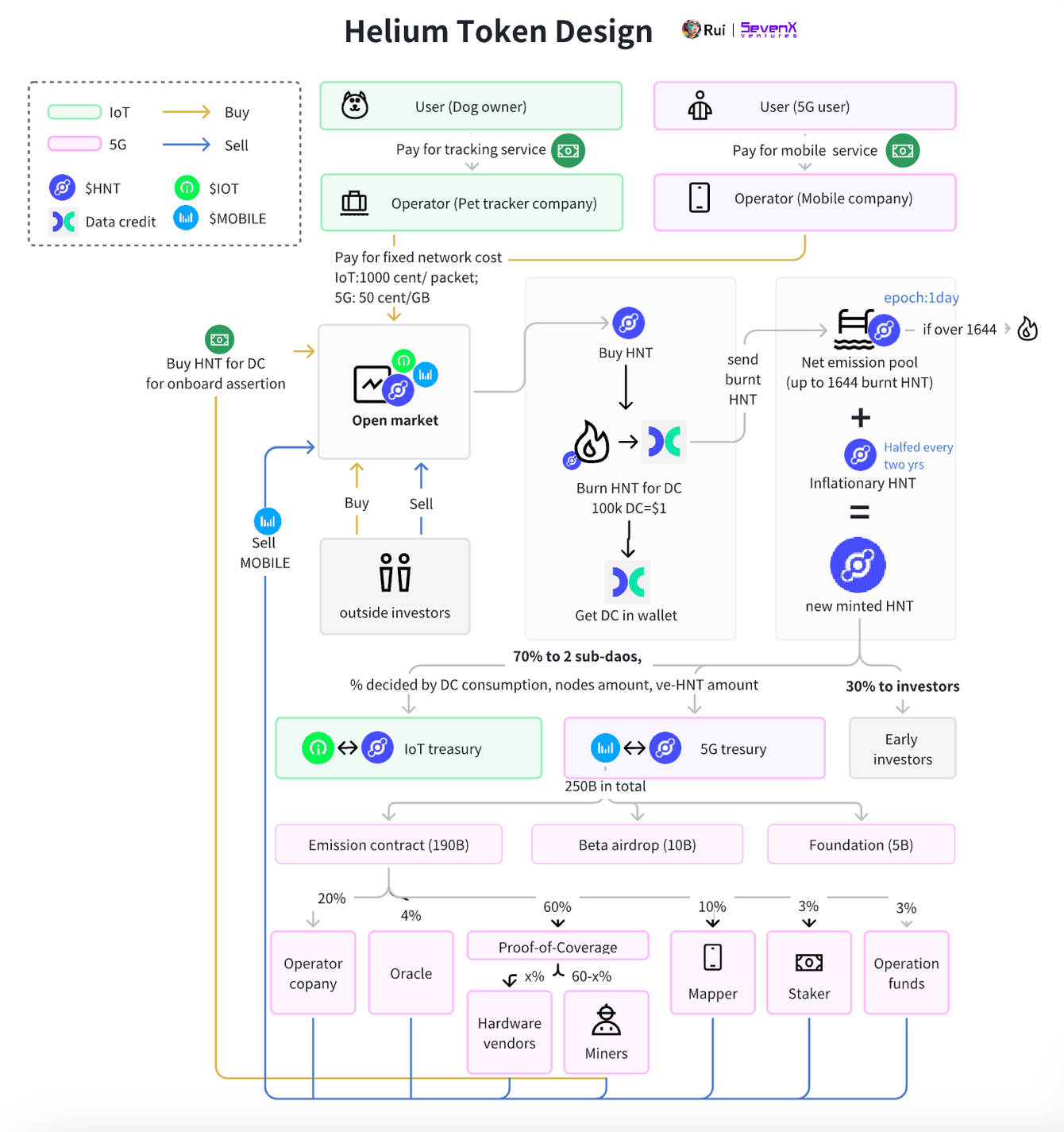

Helium uses $HNT for utility—users must burn $HNT to obtain Data Credits (DC), a dollar-pegged token used for network access—while $MOBILE and $IOT tokens reward participants in their respective sub-DAOs.

$HNT and BME:

-

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News

Add to FavoritesShare to Social Media