dYdX Solidifies Its Lead in Decentralized Perpetual Contracts: What Did dYdX Chain Get Right?

TechFlow Selected TechFlow Selected

dYdX Solidifies Its Lead in Decentralized Perpetual Contracts: What Did dYdX Chain Get Right?

Since its launch, the dYdX Chain has gradually demonstrated stronger competitiveness compared to the original v3 version.

By Jiang Haibo, PANews

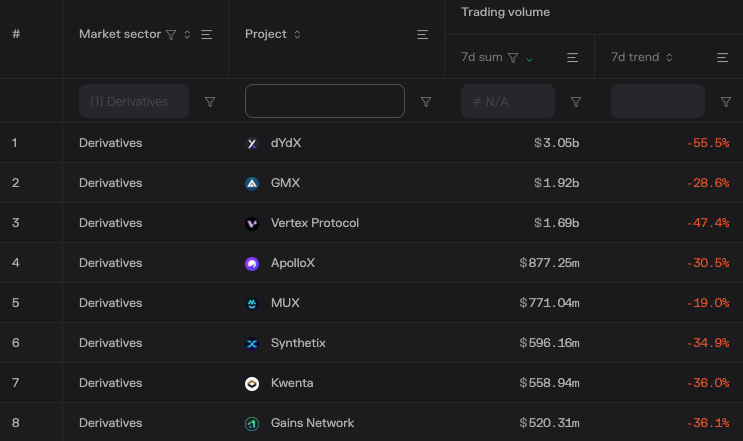

Competition in the decentralized perpetual contracts space is intensifying, with dYdX remaining the leader in this sector and recently solidifying its top position in trading volume.

According to Token Terminal data, as of January 24, 2024, even when only including Starkware Layer-2 (dYdX v3) data, dYdX's trading volume far surpasses that of other derivatives protocols. Currently, dYdX v4’s trading volume has already reached parity with v3 and may hold greater potential when combined with incentive programs.

The dYdX Chain, also known as version v4, launched on October 26, 2023, achieving full decentralization including order books and matching engines. It has also begun distributing transaction fees to DYDX token stakers.

Fully Decentralized dYdX Chain

dYdX is a leading decentralized perpetual exchange founded in 2017 by Antonio Juliano, who raised a $2 million seed round led by Andreessen Horowitz and Polychain the same year. Prior to founding dYdX, Antonio Juliano worked at Coinbase and later developed a decentralized search engine full-time, though it attracted few users.

Initially, dYdX offered a margin trading protocol (v1 and v2), enabling leveraged cryptocurrency trading through borrowed funds. However, this product was inefficient and suffered from high gas fees on Ethereum.

Starting with v3, dYdX established an order book-based trading system. After building its Ethereum Layer-2 solution using Starkware and launching the DYDX token, dYdX experienced exponential growth in trading volume, surpassing $1 trillion in cumulative volume by July 14, 2023.

Currently, the officially promoted dYdX Chain is an independent blockchain built using the Cosmos SDK and Tendermint PoS consensus mechanism, which went live on October 26, 2023, supporting up to 2,000 transactions per second.

While dYdX v3 could support high-performance perpetual contract trading, it was not fully decentralized. In v3, the entity company dYdX Trading operated the order book, collected trading fees, and centrally decided which tokens to list. In contrast, under v4, the frontend is managed by the dYdX Operations SubDAO, the order book and matching engine are maintained by globally distributed active validators, and token listings are determined via on-chain governance.

Fees Fully Distributed to Stakers and Validators

Regarding revenue distribution—the aspect most users care about—all fees generated on dYdX Chain are currently allocated entirely to validators and stakers. These fees consist primarily of trading fees denominated in USDC, along with gas fees paid in either DYDX or USDC.

Fees accumulate gradually per block, with a new block produced approximately every 1.08 seconds, and must be manually claimed by users. Since rewards are mainly paid in USDC, delayed claims do not expose users to market volatility risks.

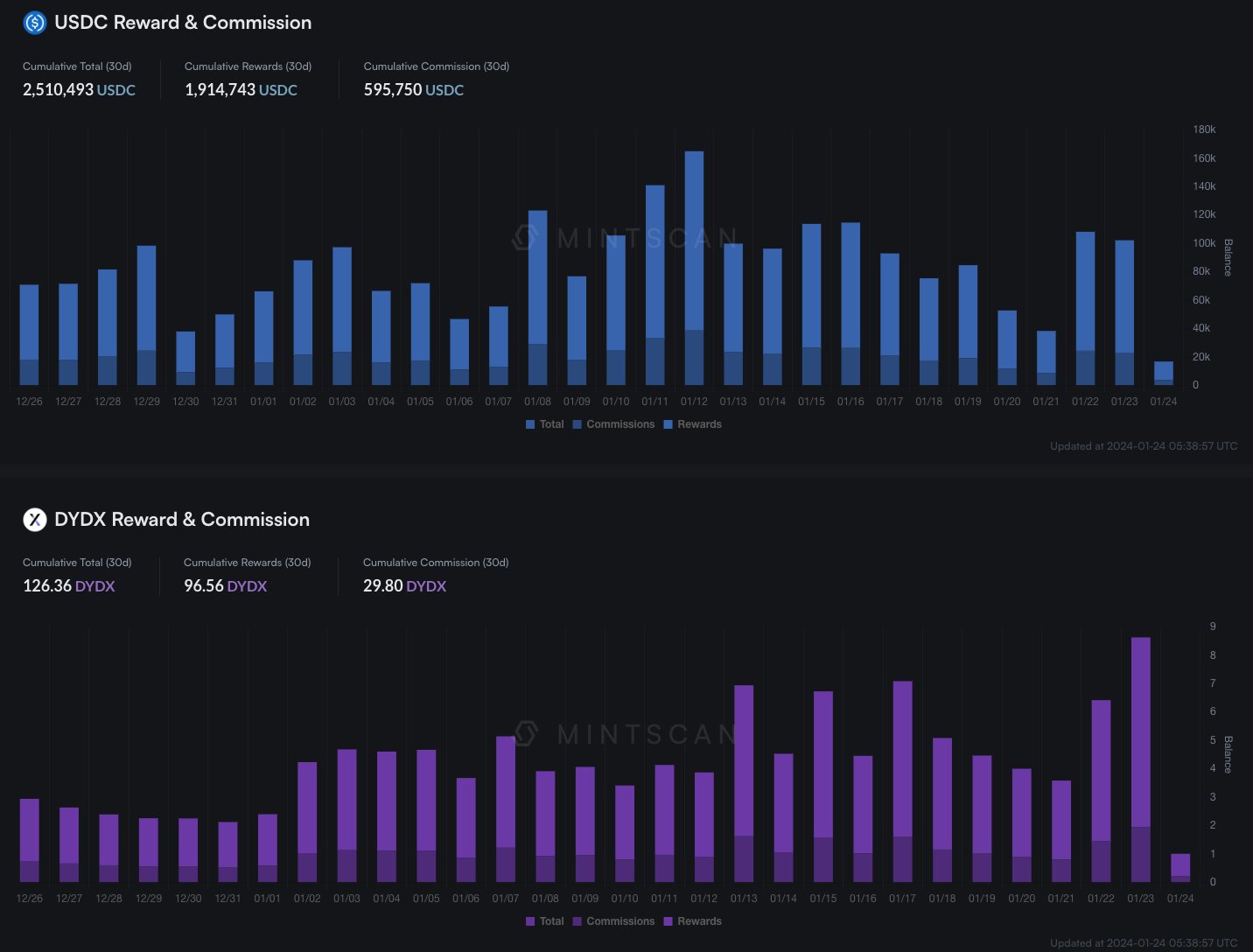

According to Mintscan data, over the past 30 days, a total of 2.51 million USDC and 126 DYDX in rewards were distributed. Validators charge commissions ranging from 5% to 100%. Users can stake their DYDX via Keplr or other wallets to active validators to earn rewards, with 60 active validators currently operating.

As of January 24, the daily staking yield over the past 30 days ranged between 6.2% and 29.06%, with an average annualized staking yield of 14.97%. The total value of staked DYDX stands at $212 million, remaining stable over the past month.

Hardware wallet Ledger has also integrated with Keplr, allowing users storing funds in Ledger devices to connect via Keplr to Cosmos applications for staking and related operations. Refer to Ledger’s official guide for instructions.

Additionally, due to DYDX’s significant market cap and influence, Stride—Cosmos ecosystem’s leading liquid staking provider—has launched a liquid staking service for DYDX. Users staking DYDX through Stride receive stDYDX tokens, and staking rewards are automatically reinvested, resulting in more DYDX upon redemption. Early stDYDX holders are also eligible for STRD airdrops.

Multiple Measures Driving dYdX Chain Trading Volume Growth

Official dYdX data shows certain metrics of v4 have already surpassed those of v3. Over the past 24 hours, dYdX v4 recorded $688 million in trading volume compared to v3’s $546 million; v4 processed 635,791 trades versus v3’s 161,337. However, open interest still lags behind, with v4 at $38.88 million compared to v3’s $251 million.

The rise of dYdX v4 owes much to dYdX’s incentive initiatives. Before launching dYdX Chain, dYdX designed a strategy to gradually shift trading volume from v3 to v4, while phasing out existing v3 incentives.

The dYdX DAO has approved governance authorization for Chaos Labs to run a six-month launch incentive program, allocating $20 million worth of DYDX tokens to early adopters of dYdX Chain to encourage migration to v4.

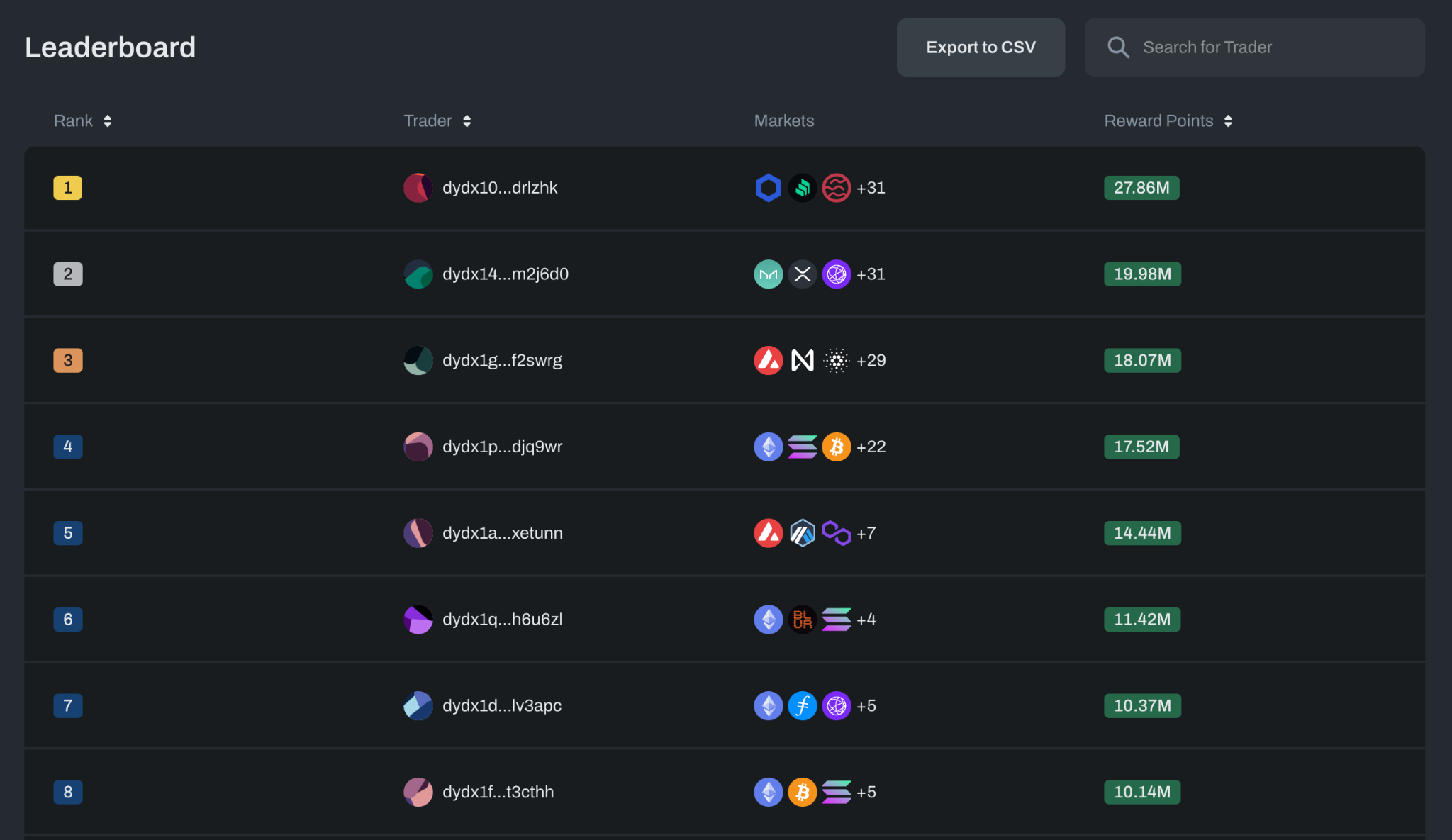

The entire incentive program is divided into four phases ("Trading Seasons"). Season 2 is currently underway and will last until sometime between February 14 and February 24. Users earn points for trading on dYdX, and DYDX rewards are distributed at the end of each season based on accumulated points. As shown in the image below, Chaos Labs has also provided a dashboard where participants can check their points and rankings for each season. Each subsequent season refines the incentive structure based on feedback from the previous one. For example, Season 2 introduced performance rewards in addition to trading and market-making incentives from Season 1, allocating 20% of trading rewards ($800,000) to top-performing traders to incentivize profitable trading.

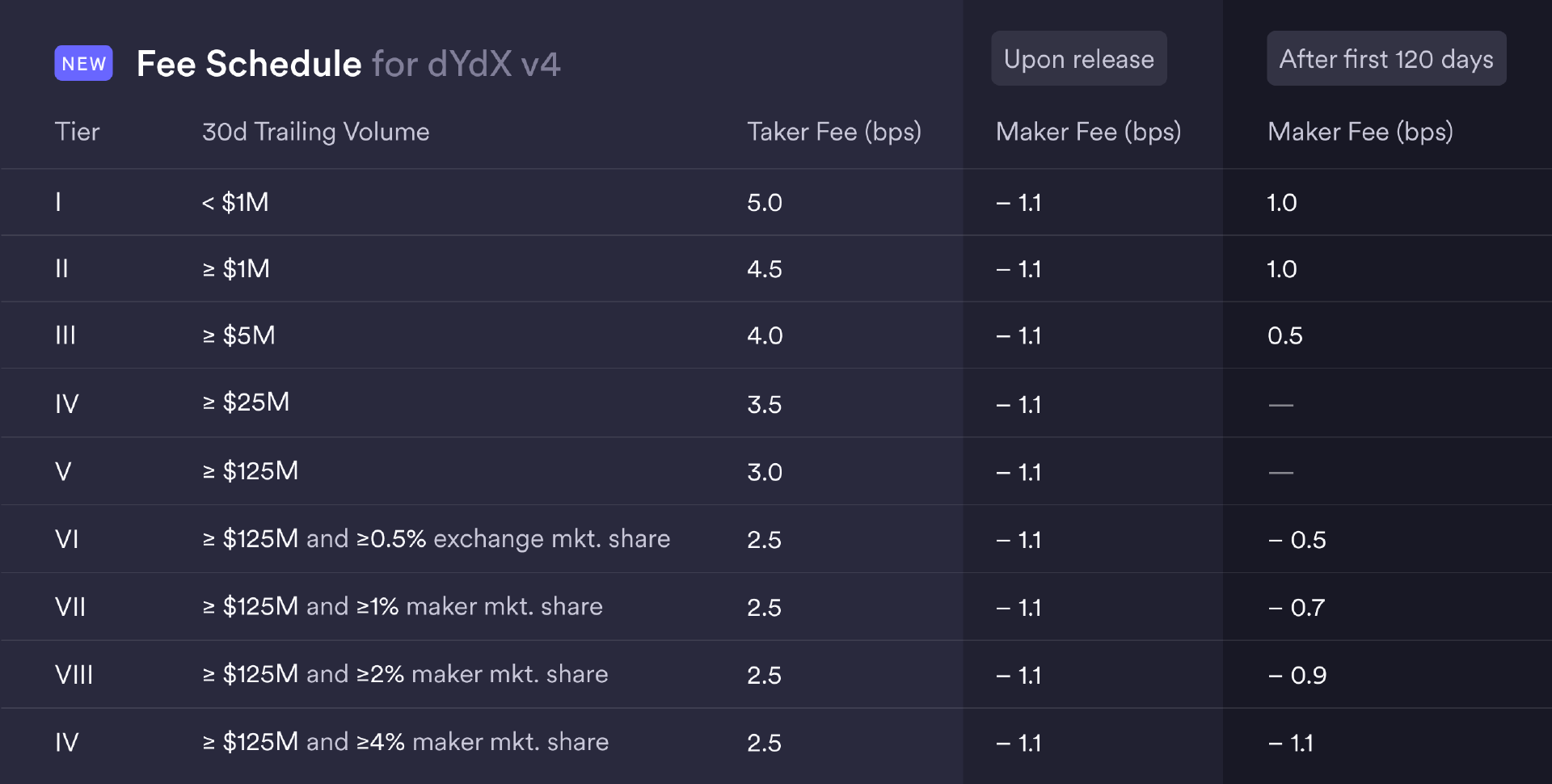

To attract trading volume and liquidity, dYdX Chain offers reduced trading fees, making them slightly lower than those of centralized exchanges like Binance. For makers, fees are capped at 1 bps (0.01%) after the first 120 days; for takers, fees are capped at 5 bps.

For user access, traders can still use a range of wallets including MetaMask, and deposit funds via Arbitrum, Optimism, Avalanche, and others. Circle has also issued native USDC on Noble, simplifying deposits to dYdX going forward. Within the dYdX Chain environment, market orders now execute more smoothly than before.

Summary

dYdX remains the leader in the decentralized perpetual contracts space. Since its launch, dYdX Chain has progressively demonstrated stronger competitiveness compared to the original v3 version, with recent v4 trading volumes exceeding those of v3.

dYdX Chain achieves comprehensive decentralization, covering both frontend and matching engine components. Notably, transaction fees—of particular interest to the community—are now fully distributed to DYDX stakers and validators. A series of ongoing initiatives continue to drive v4 trading volume growth, including maker rebates, trading incentives, and performance rewards, potentially further boosting trading activity and open interest on dYdX Chain.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News