The Ultimate DePIN Guide: How Far Are We from a Trillion-Dollar Market?

TechFlow Selected TechFlow Selected

The Ultimate DePIN Guide: How Far Are We from a Trillion-Dollar Market?

We've only scratched the surface of AI + Crypto, and more synergies and use cases may emerge in the future.

Written by: Miles Deutscher

Translated by: Frank, Foresight News

Artificial intelligence will be one of the best-performing sectors in crypto during this bull market. However, instead of randomly buying AI-related tokens, I'm focusing on a primary beneficiary: the DePIN sector.

The DePIN industry is projected to reach $3.5 trillion by 2028. In this article, I’ll detail:

-

How DePIN works;

-

Why DePIN is poised for significant growth in 2024 (and beyond);

-

The specific DePIN projects I’m investing in;

Let’s dive in.

What is DePIN?

DePIN stands for "Decentralized Physical Infrastructure Networks." These are blockchain protocols that incentivize decentralized communities to build and maintain physical hardware—users contribute hardware or software resources to the network and earn token rewards in return.

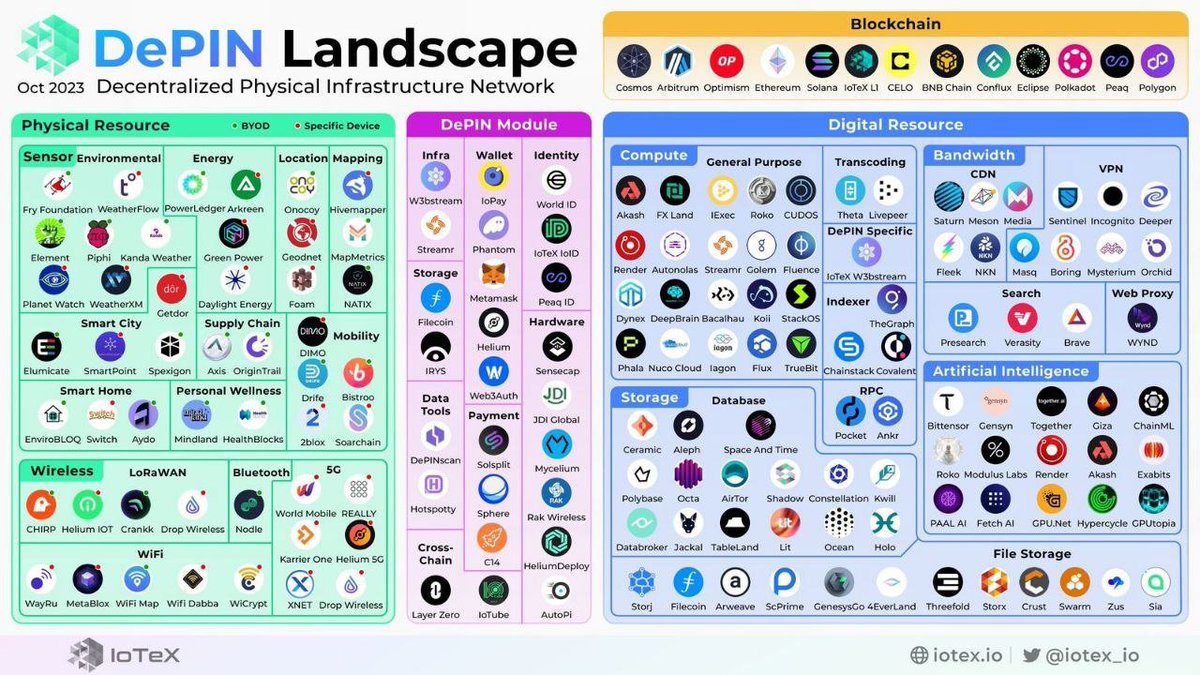

The DePIN market landscape is broad, spanning multi-billion-dollar hardware domains including:

-

Cloud storage;

-

Computing power;

-

Wireless sensor networks;

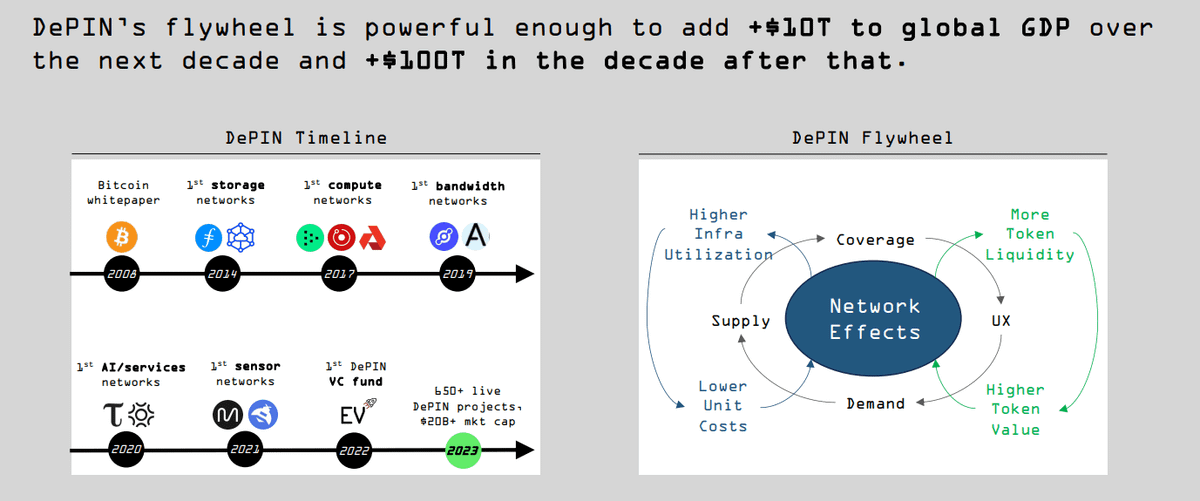

Messari predicts that DePIN could add $10 trillion to global GDP over the next decade (reaching $100 trillion ten years from now).

Physical infrastructure has historically been monopolized by large tech companies because it requires massive capital to build and high ongoing maintenance costs—barriers too steep for smaller players. As a result, internet giants like AWS often exploit this to charge premium prices for their services.

However, DePIN offers many advantages over centralized solutions because it can:

-

Reduce costs;

-

Scale horizontally;

-

Reward network contributors;

-

Enhance security;

How DePIN Works

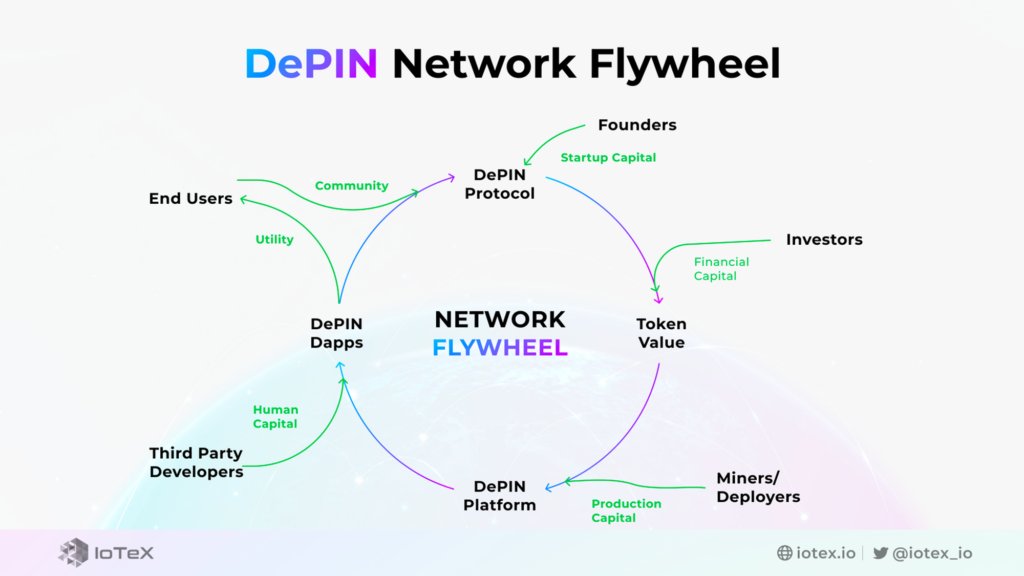

-

Suppliers (users) contribute their resources to the network in exchange for token rewards;

-

These rewards incentivize participants to deploy more decentralized infrastructure;

As infrastructure grows, it attracts greater demand from end users, increasing network activity. Network growth leads to higher returns, which further motivates more suppliers (users) to join.

So as we can see, DePIN has an inherent flywheel effect that helps projects gain momentum as they scale.

Messari Crypto estimates the DePIN sector will reach a total market size of $3.5 trillion within the next four years. Long-term, I expect this number to be even higher due to the strong inertia of the aforementioned flywheel effect.

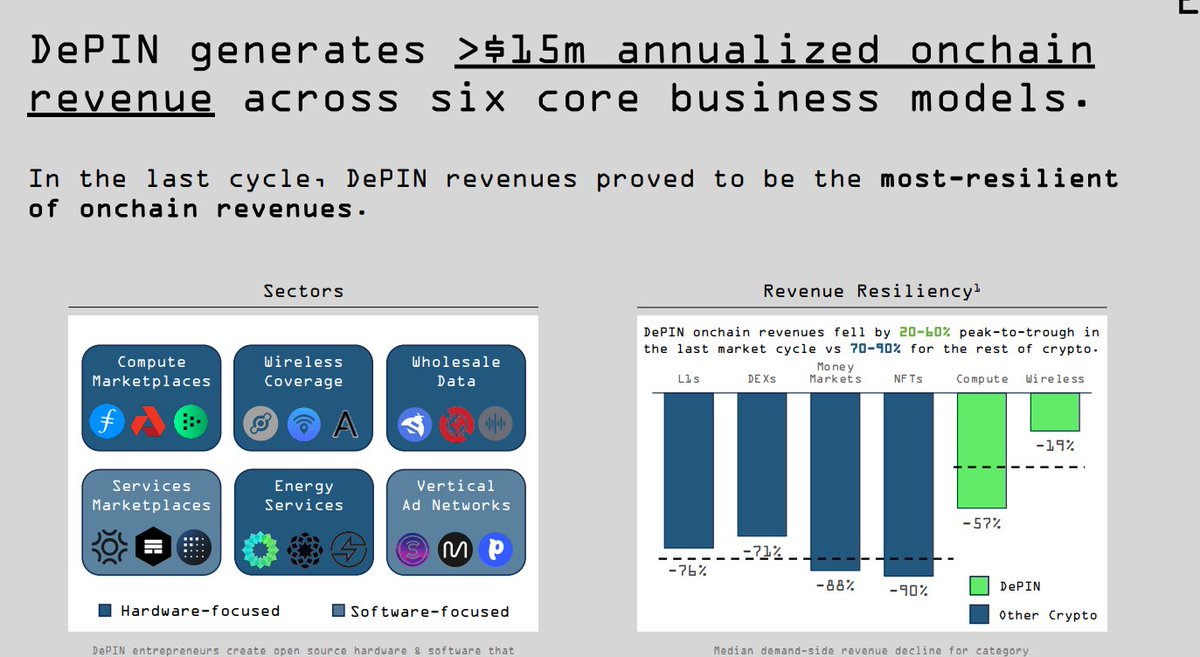

Unlike many other crypto sectors, this is already a proven, revenue-generating model—DePIN generates over $15 million in on-chain revenue annually, and this figure is set to grow rapidly in the coming years.

Broad Categories Within the DePIN Ecosystem

Broadly speaking, DePIN projects fall into three categories:

-

Physical Resource Networks (sensors, wireless);

-

Digital Resource Networks (computing, bandwidth, AI, storage);

-

DePIN Middleware;

Each sub-sector has the potential to disrupt industries worth tens of trillions of dollars, meaning the growth potential for DePIN is enormous.

Let’s break down some of these sub-sectors further.

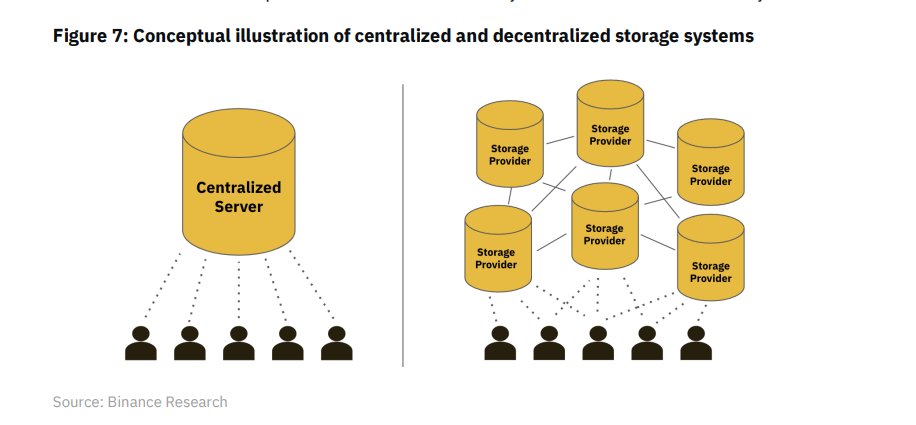

1. Decentralized Storage

These projects create a new market for underutilized storage capacity:

-

Storage providers supply computing resources in exchange for token incentives;

-

Projects encrypt and split user data across the storage network;

-

Users pay the network to store and retrieve their data;

Storage is a key vertical for DePIN adoption due to its perfect product-market fit.

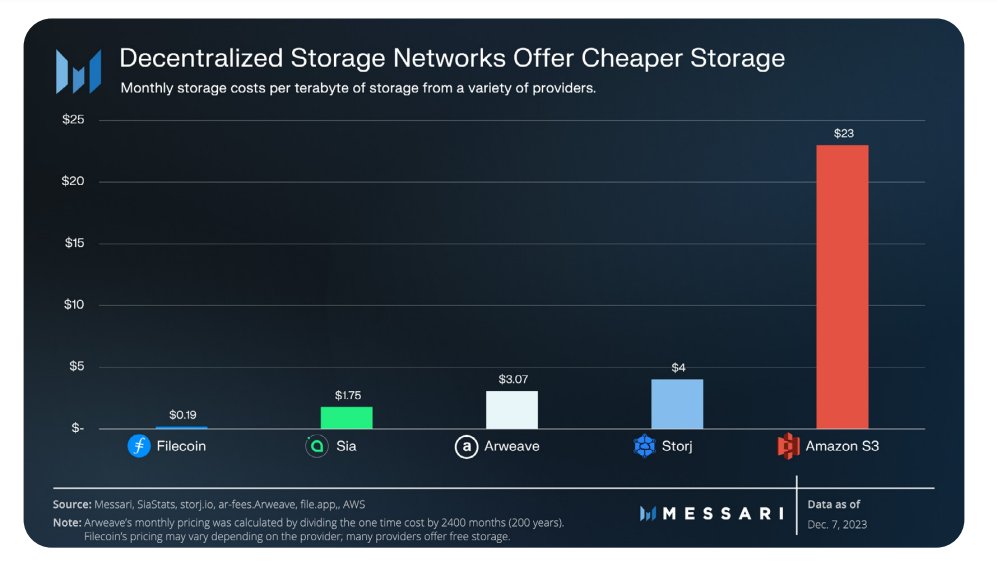

For example, splitting data eliminates single points of failure, improving accessibility and security. These networks are also 78% cheaper than centralized alternatives.

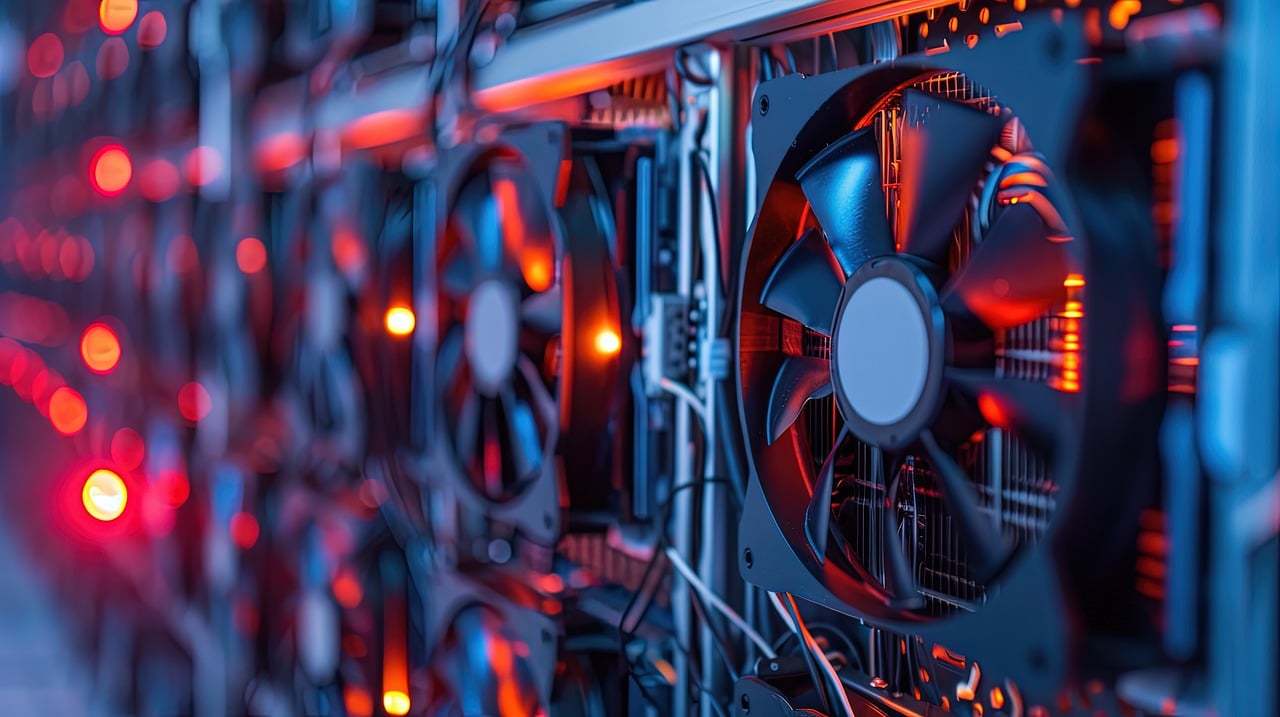

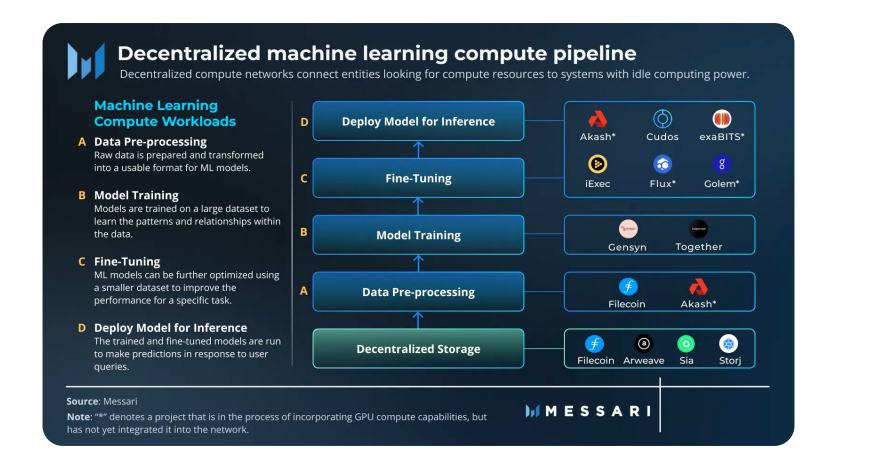

2. Decentralized Computing

Decentralized computing networks allow us to tap into GPU power in the cloud to run complex computations—including driving AI innovation, rendering high-end graphics, or running blockchain nodes.

The traditional computing market is currently valued at $5 trillion. Even if DePIN captures just 1% of this market, utilization could grow tenfold.

3. Artificial Intelligence Infrastructure

AI's exponential growth over the past decade has exposed several critical scalability challenges:

-

Lack of specialized hardware;

-

Inefficient collaboration;

-

Data storage bottlenecks;

-

Low efficiency;

DePIN can address these and many other issues.

For instance, compute networks like AKT can alleviate hardware shortages by crowdsourcing GPU resources; similarly, TAO gamifies research collaboration through cryptographic incentives.

These are just a few examples—DePIN also has numerous applications across the broader machine learning (ML) landscape.

Honestly, we've only scratched the surface of AI + crypto. As the sector matures, we'll see far more synergies and use cases emerge.

Now that you have a deeper understanding of what DePIN is and how it works, let’s explore the specific projects I’m watching closely in this space.

Specific DePIN Projects

Akash

AKT brands itself as “Airbnb for server hosting,” where users buy and sell decentralized cloud computing resources on its marketplace.

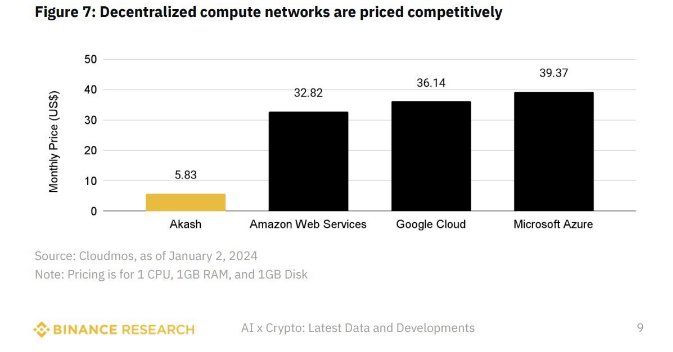

Currently, the Akash network is powerful enough to host websites, blockchain nodes, and video game servers—all at less than one-sixth the cost of Azure.

Render Network

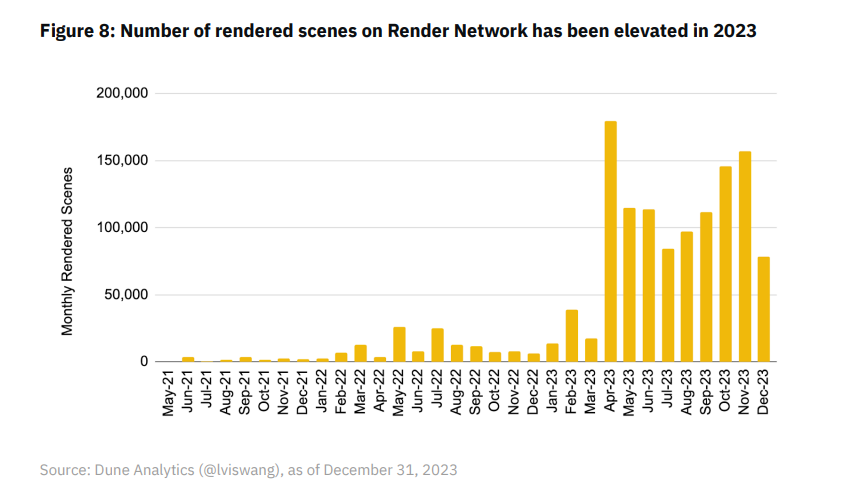

RNDR leverages unused GPU power to unlock next-generation AI and 3D rendering services. At the time of writing, network activity is on a consistent upward trend month-over-month.

Aethir Cloud

Aethir is an upcoming project generating significant excitement, boasting:

-

20x the GPU capacity of the RNDR Network;

-

45x the TFLOPS (computational power) of Akash Network;

-

31x the infrastructure capital investment compared to the combined total of Akash and RNDR Networks;

They’ve also formed partnerships with major players in telecom, gaming, and cloud computing. Numerous major updates and announcements are expected in the coming months.

Filecoin

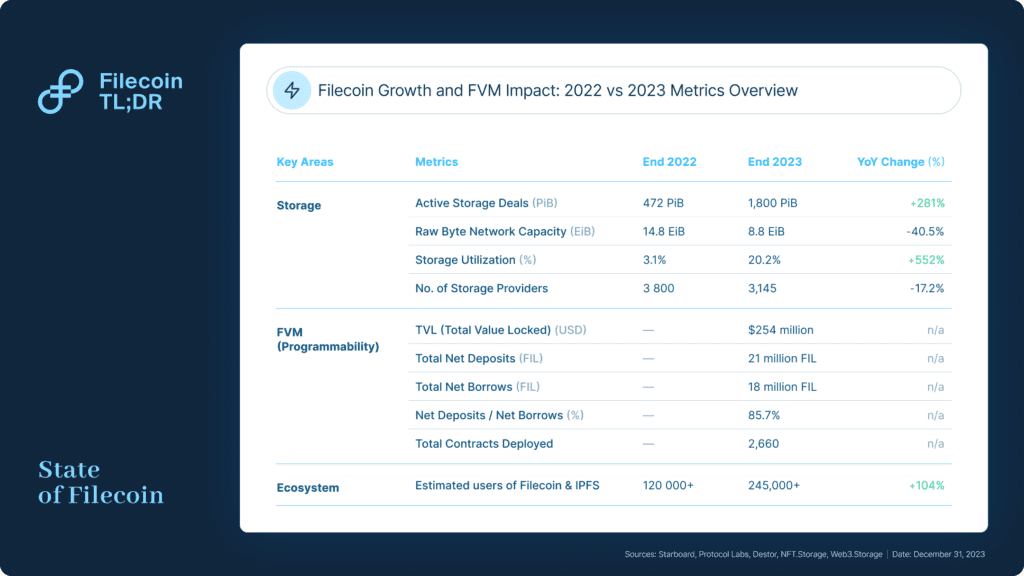

Filecoin is my favorite representative project in the decentralized data storage space, currently growing across three key verticals:

-

Storage (up 2.8x year-over-year);

-

FIL Virtual Machine (FVM) ($254 million TVL);

-

Projects built on Filecoin (254,000 users);

At the time of writing, Filecoin offers the lowest usage fees in the entire storage sector.

Arweave

Arweave enables users to store data permanently on the blockchain with a one-time payment, making it ideal for metaverse, DeSci, and social media applications requiring long-term data preservation.

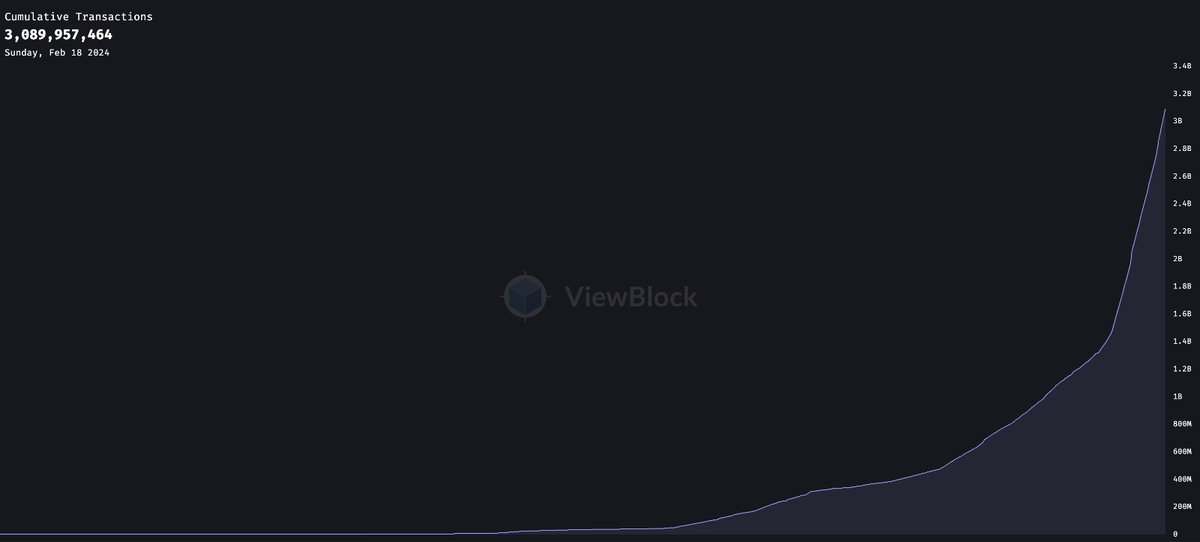

At the time of writing, the Arweave network has just reached a milestone of 3 billion transactions, with overall TPS reaching 300.

Ator Protocol

ATOR serves as a scalable privacy middleware for DePIN and other crypto projects. It routes application traffic through the TOR network using relays to preserve anonymity. Additionally, its new hardware provides users with full privacy while offering reward incentives.

Other notable projects include Bittensor, Helium, Hivemapper, Storj, and more.

In summary, the DePIN space is vast and continuously evolving, with clear real-world adoption across multiple verticals.

Long-term, DePIN represents one of the most tangible use cases for decentralization, and I expect it to become one of the highest-growth sectors in crypto.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News