Hidden LST New Liquidity Pool: A Deep Dive into the "Veteran DeFi" Balancer

TechFlow Selected TechFlow Selected

Hidden LST New Liquidity Pool: A Deep Dive into the "Veteran DeFi" Balancer

Deepening LST and the upcoming V3 could introduce a truly game-changing variable for Balancer.

By Jake Pahor

Translation: Frank, Foresight News

Little known is that Aave, Gyroscope, and Beethoven X share a common trait: they all leverage Balancer's technology stack. With the upcoming launch of version V3, Balancer may also be on the verge of introducing some truly game-changing variables.

This article presents crypto researcher Jake Pahor’s latest report on Balancer, offering an in-depth analysis of the protocol across multiple dimensions including use cases, mass adoption, project revenue, tokenomics, and more. The full text has been translated by Foresight News.

1. Overview

At its core, Balancer is a decentralized AMM protocol. However, upon closer inspection, it becomes clear that the Balancer team is building a robust technical stack aimed at becoming a liquidity hub:

-

Developing new AMMs/DEXs;

-

Yield-bearing assets;

-

DAO governance;

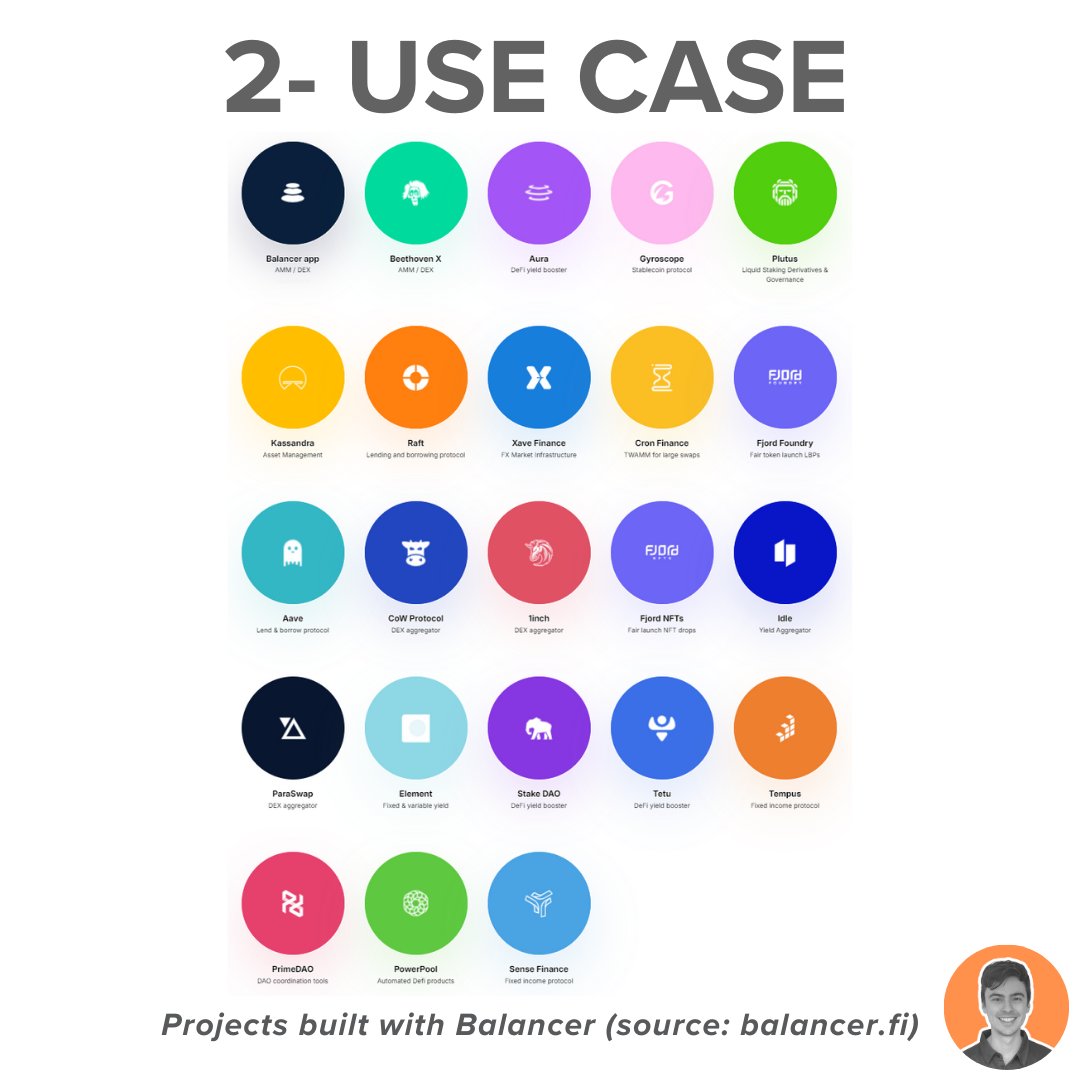

2. Use Cases

Balancer is not only a forward-thinking DEX but also foundational technology fostering future DeFi innovations. Its unique architecture streamlines the process of delivering distinctive financial services to market.

Currently, Aave, Beethoven X, Radiant, and Fjord are among those utilizing its tech stack.

What excites me most about Balancer is the anticipated release of its V3 version in Q2 2024, which promises to build upon V2 innovations and position Balancer as:

-

A yield hub for DeFi;

-

A launchpad for innovative AMM deployments;

3. Mass Adoption

Balancer currently holds $915 million in TVL, ranking 23rd among all DeFi protocols and 4th among other DEX protocols.

Although still 72% below its all-time high (ATH) of $3.31 billion in November 2021, Balancer’s TVL has shown a steady upward trend since July 2022, indicating solid growth in overall locked value.

4. Project Revenue

Over the past 30 days, the Balancer system has generated:

-

$1.5 million in fees;

-

$649,000 in revenue;

According to DefiLlama, it ranks 35th among all DeFi applications and 6th among DEXs. As of August 2023, the protocol charges 50% of swap fees and 50% of wrapped token yield fees on non-exempt pools.

5. Tokenomics

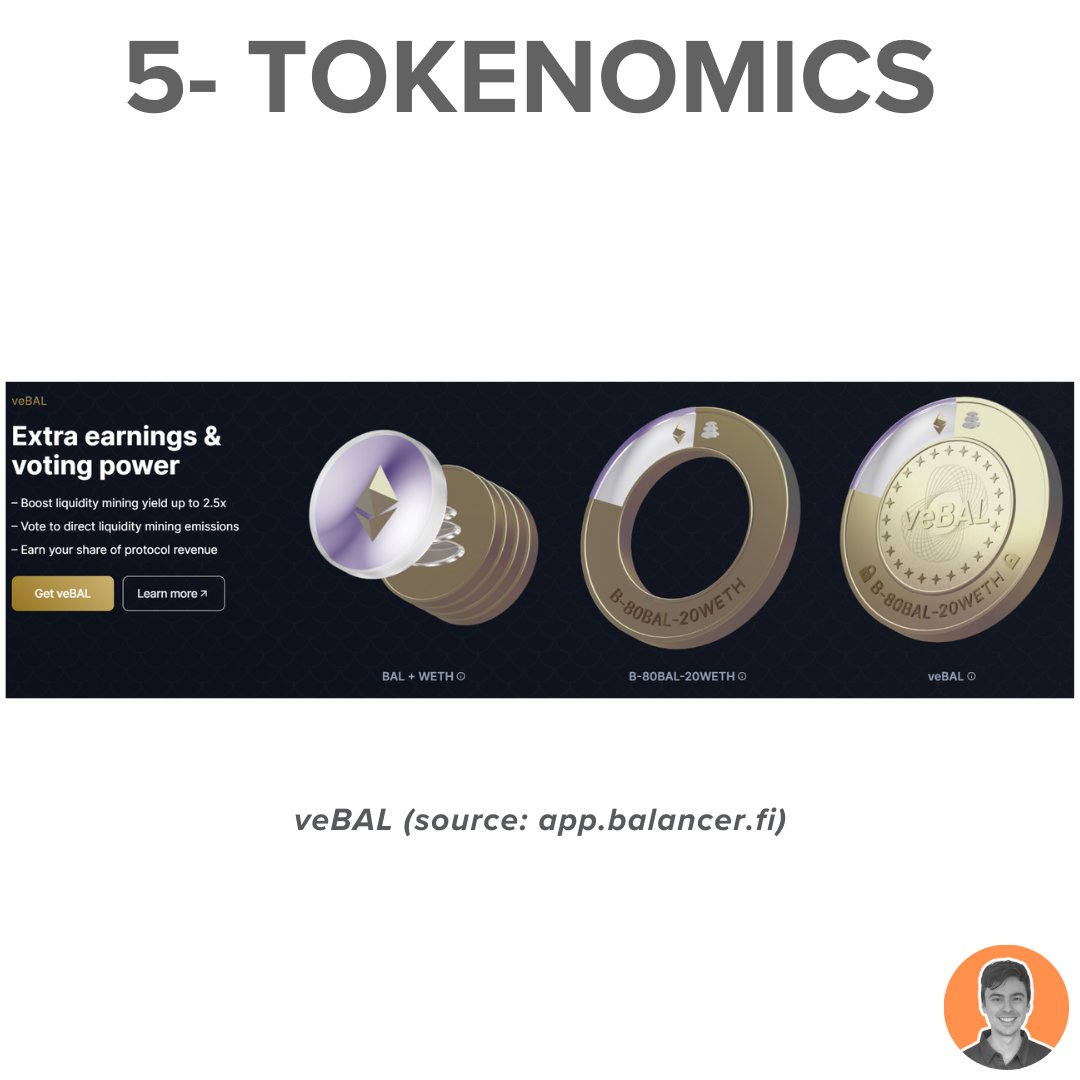

There are two primary tokens within the ecosystem:

-

BAL, the governance token;

-

veBAL, which is BAL locked for a fixed period via an 80:20 ratio of BAL/WETH;

Balancer’s proposed 80:20 ve model is an innovation designed to address certain issues arising from single-token staking models in DAO token economies (e.g., Curve).

Let’s examine some key differences:

-

Users earn veBAL by locking 80/20 BAL/WETH pool tokens instead of pure BAL, ensuring deep liquidity even when most BAL tokens are locked;

-

Maximum lock-up duration is one year, shorter than veCRV’s four-year maximum;

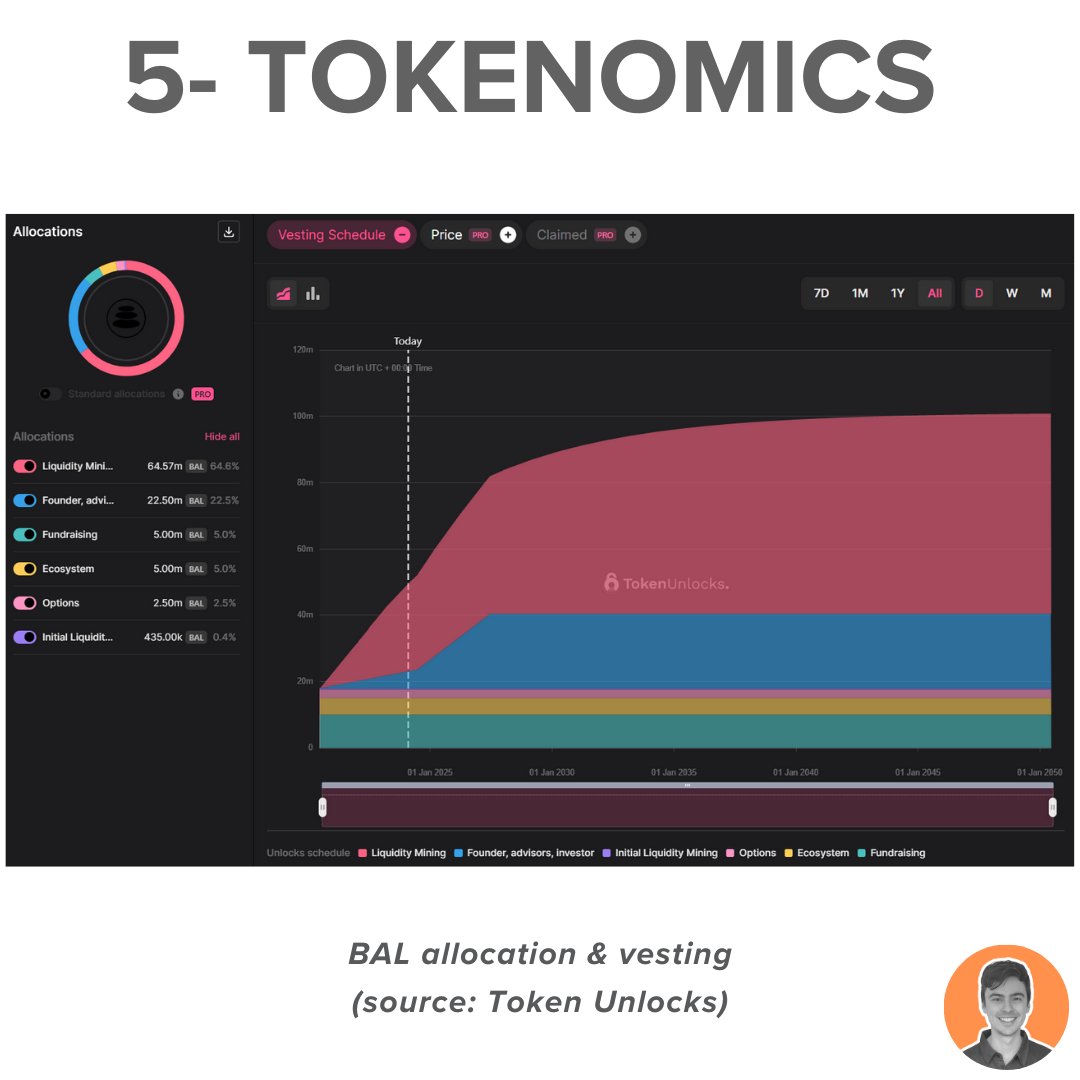

Current supply statistics:

-

Circulating supply: 54.78 million;

-

Max supply: 96.15 million;

-

Market cap: $195 million;

-

FDV: $342 million;

-

Market Cap / FDV: 57%;

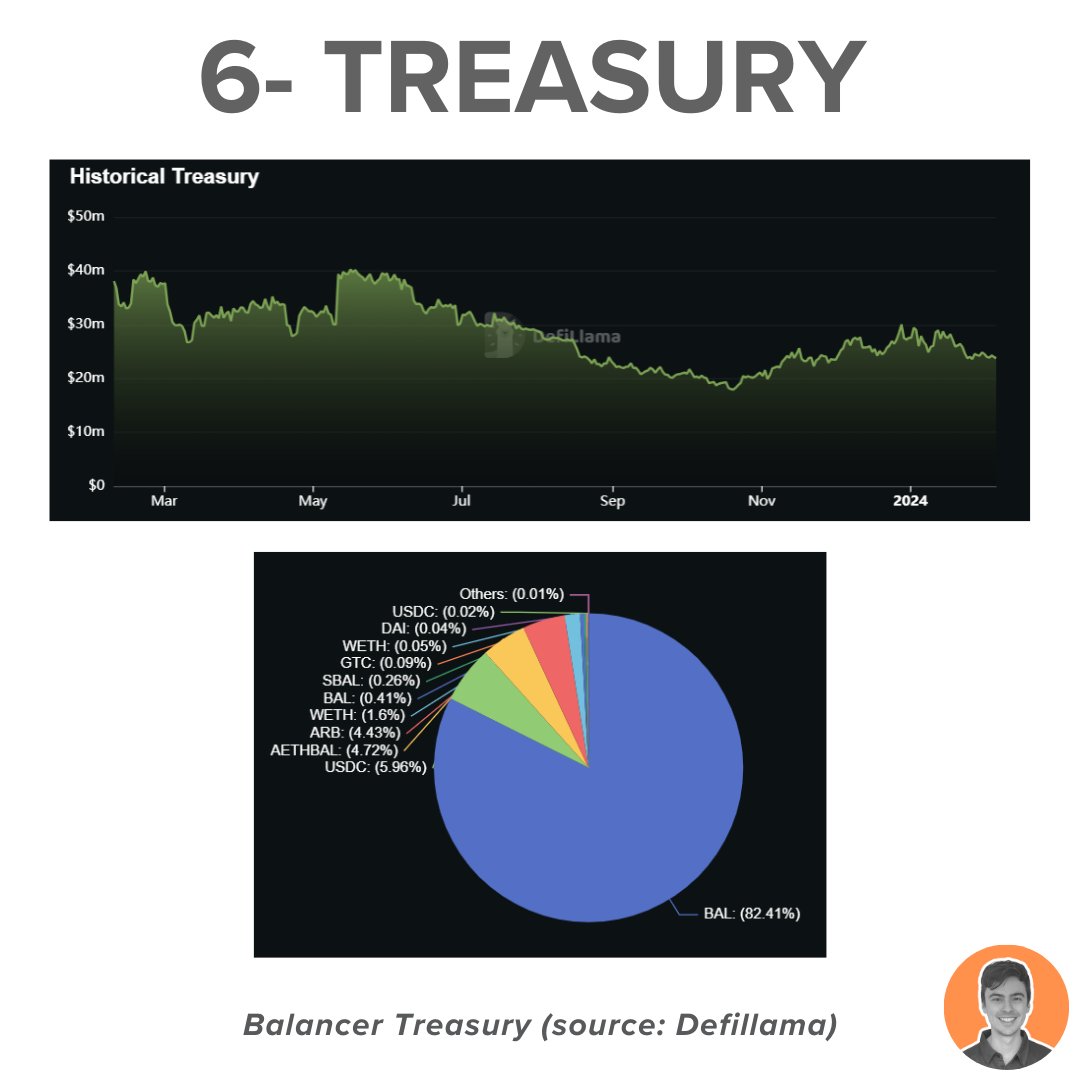

6. Treasury

Balancer’s treasury currently stands at $23.77 million, composed of:

-

$19.59 million in BAL;

-

Approximately $2.36 million in other tokens (ARB, AETHBAL);

-

$1.43 million in stablecoins;

-

$390,000 in major tokens (BTC and ETH);

These funds are currently held in a DAO multisig wallet.

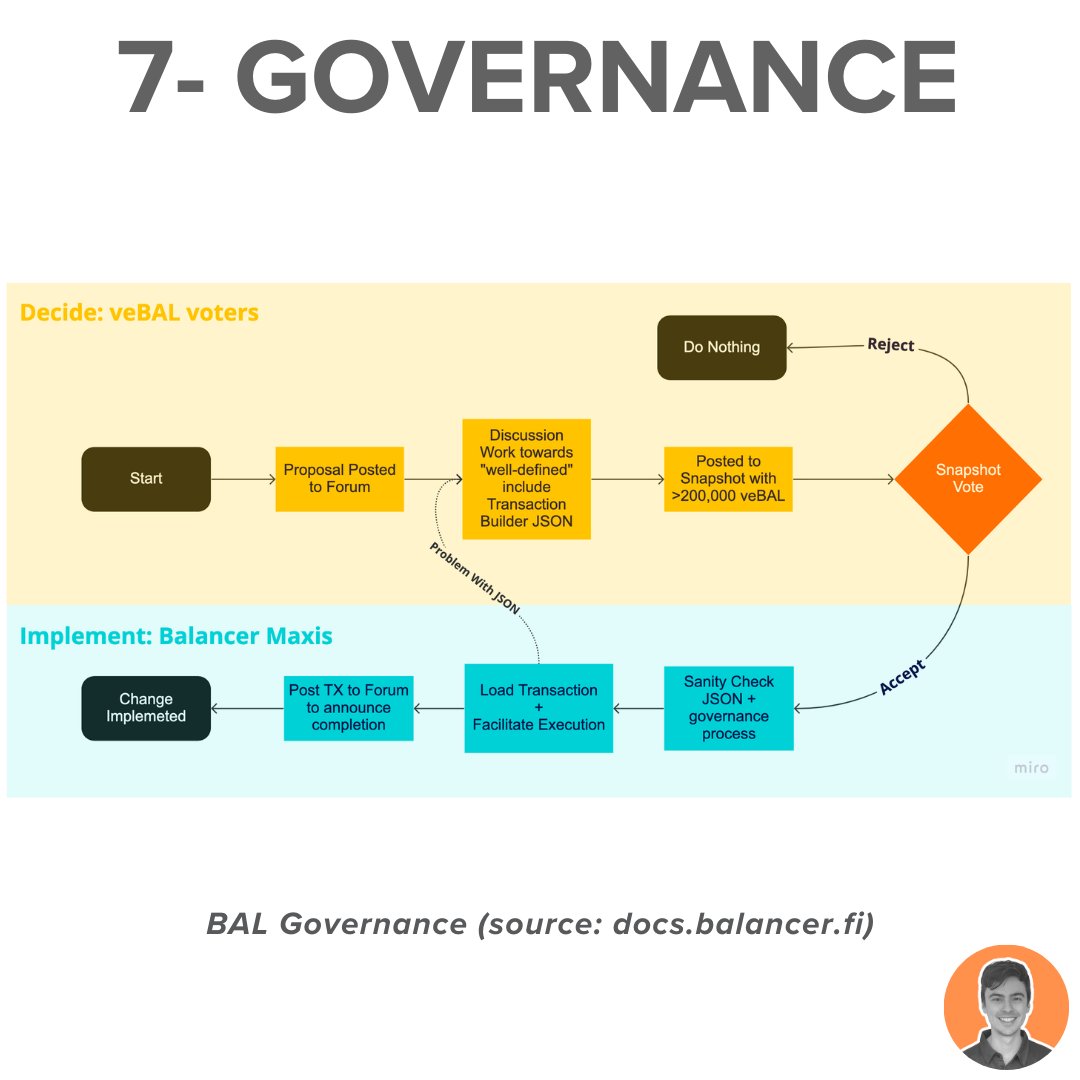

7. Governance

Balancer implements a robust decentralized governance process that has been operational for a significant period.

Additionally, they launched the ve (80/20) program, aiming to significantly enhance traditional DAO governance tokenomics design.

8. Team & Investors

Balancer was founded in 2018 by Fernando Martinelli and Mike McDonald. Since inception, Balancer has successfully raised $39.25 million.

Notable investors include Pantera Capital, Blockchain Capital, CoinFund, Fenbushi Capital, and the Arbitrum Foundation.

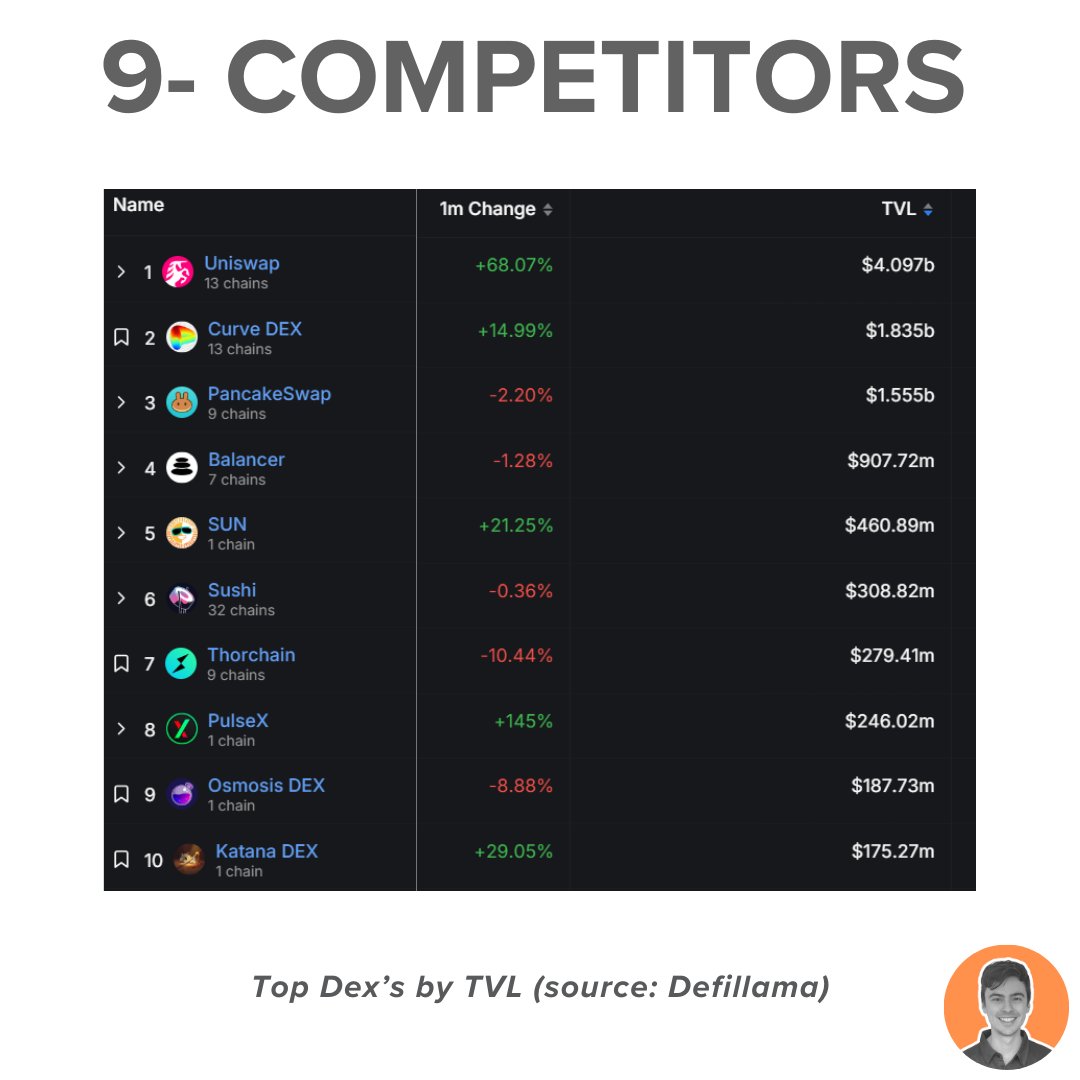

9. Competitors

Balancer is a well-known DEX competing with several platforms, including Uniswap, Curve, PancakeSwap, Sushi, and Thorchain.

However, Balancer positions itself as the optimal AMM and tech stack for new projects looking to rapidly scale and build.

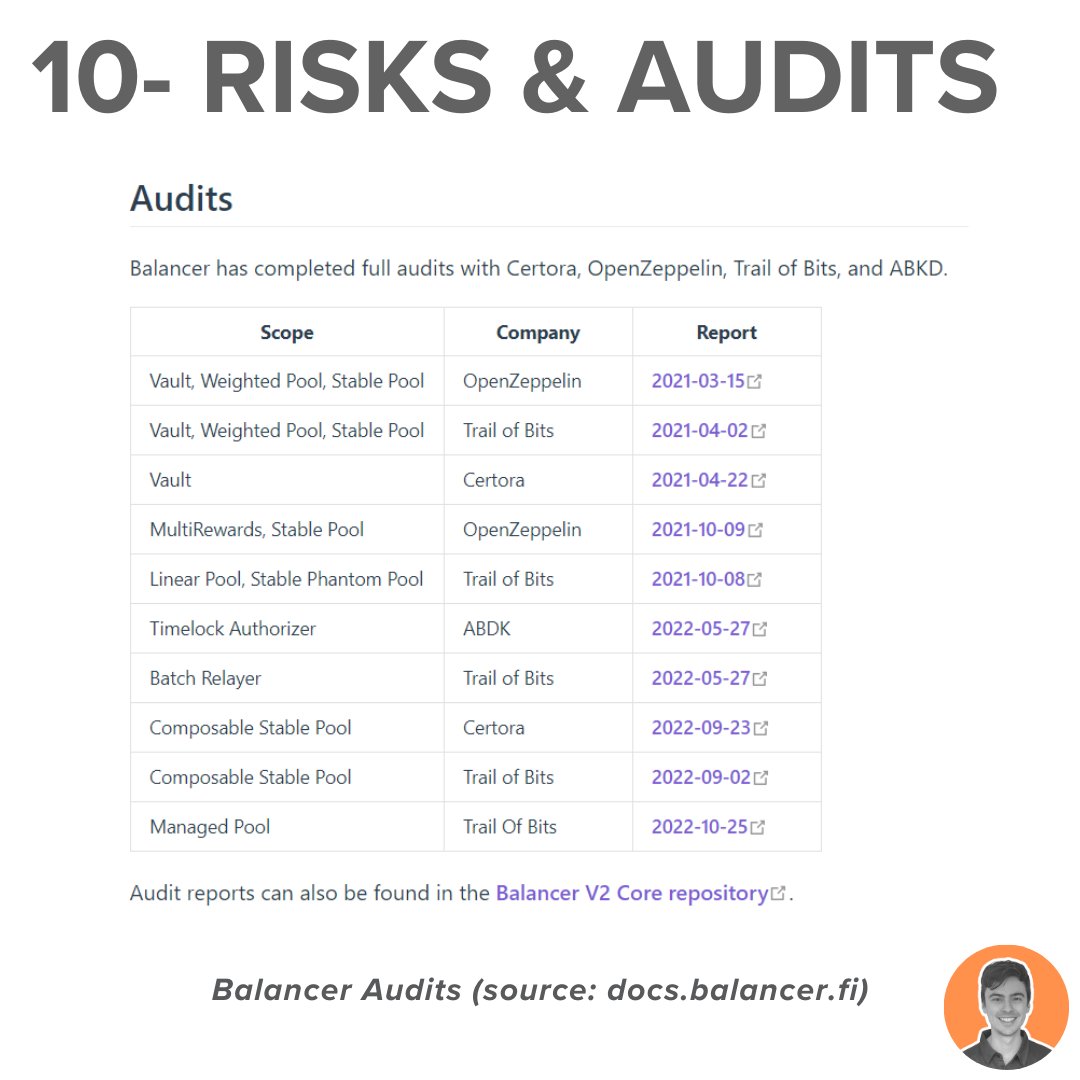

10. Risks & Audits

In 2023, Balancer experienced two major vulnerabilities—one affecting V2 pools and another involving a front-end attack.

Notably, Balancer has undergone multiple audits and launched a substantial bug bounty program (up to $1 million).

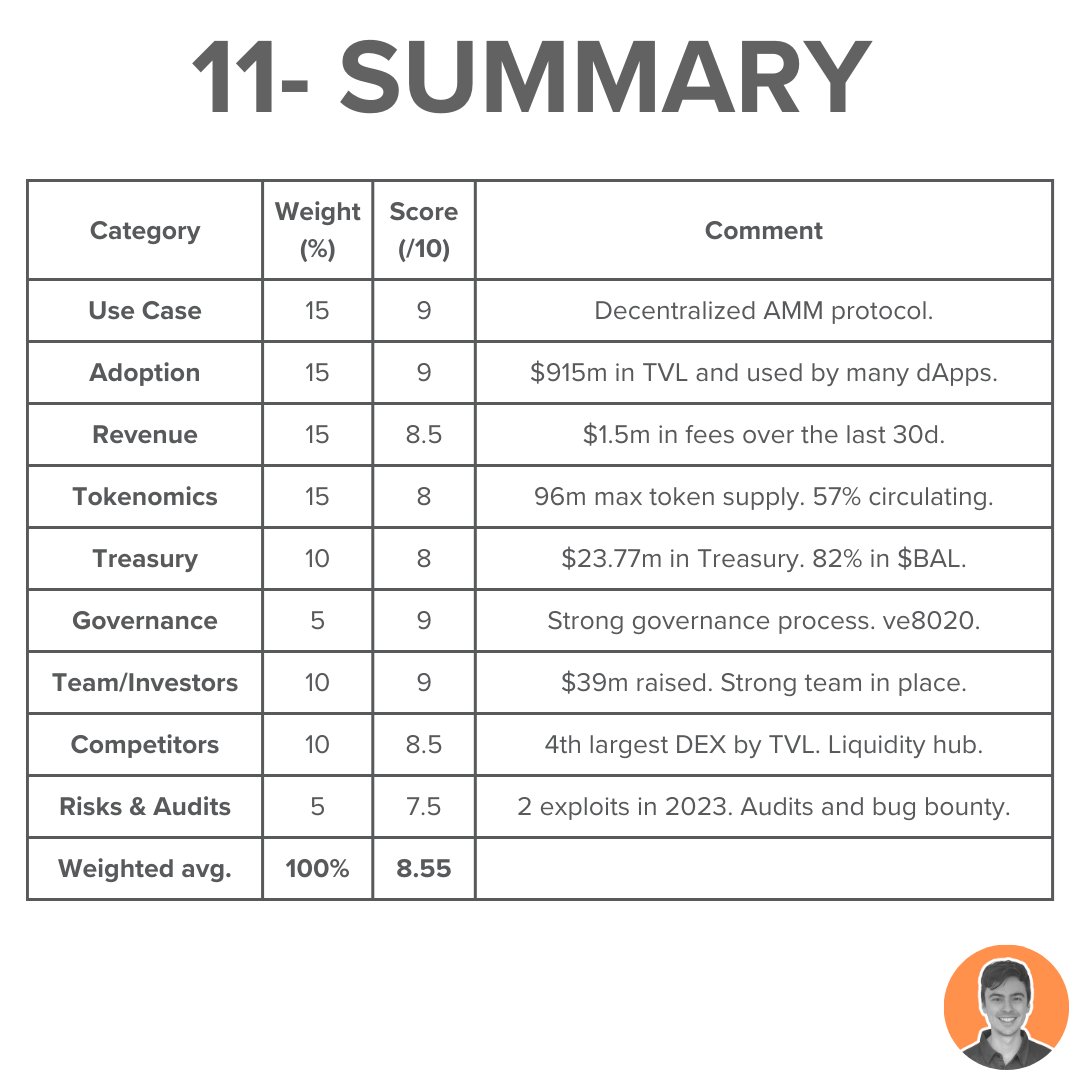

11. Summary

Balancer is quietly developing, with the team consistently launching innovative and practical products. Upcoming catalysts include:

-

Balancer V3 upgrade;

-

Growth in LST and stablecoin yields;

-

Governance tokenomics — ve80/20 liquidity pools;

Total weighted score = 8.55

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News