Where is Pyth Now | Outlook 2024

TechFlow Selected TechFlow Selected

Where is Pyth Now | Outlook 2024

This article summarizes Pyth's achievements in 2023 and how they will impact development and ecosystem plans in the new year.

Author: Pyth Network

2023 was the year Pyth Network finally hit its stride.

Now is the best time to act. Data will become increasingly valuable and harder to obtain for free. The open internet is shrinking, and public datasets are being siphoned off by services like LLMs. Data that was once publicly accessible is now shifting toward paid models.

For the DeFi industry in particular, this trend means traditional reporting oracles relying on public sources will have access to fewer resources each year. We urgently need a new solution. Enter Pyth Network—a data oracle designed from first principles around storing and incentivizing data ownership.

Pyth Network is a universal data primitive committed to making smart contract applications across every blockchain more advanced. Pyth differs fundamentally from traditional oracles in how it acquires and delivers financial market data. Instead of extracting data off-chain and delivering it to blockchains, Pyth incentivizes valuable market data creators and owners to contribute their data directly to on-chain applications. This design makes Pyth the true source of financial data at t(0), or the initial moment. All the world’s data is destined to flow on-chain through the Pyth oracle.

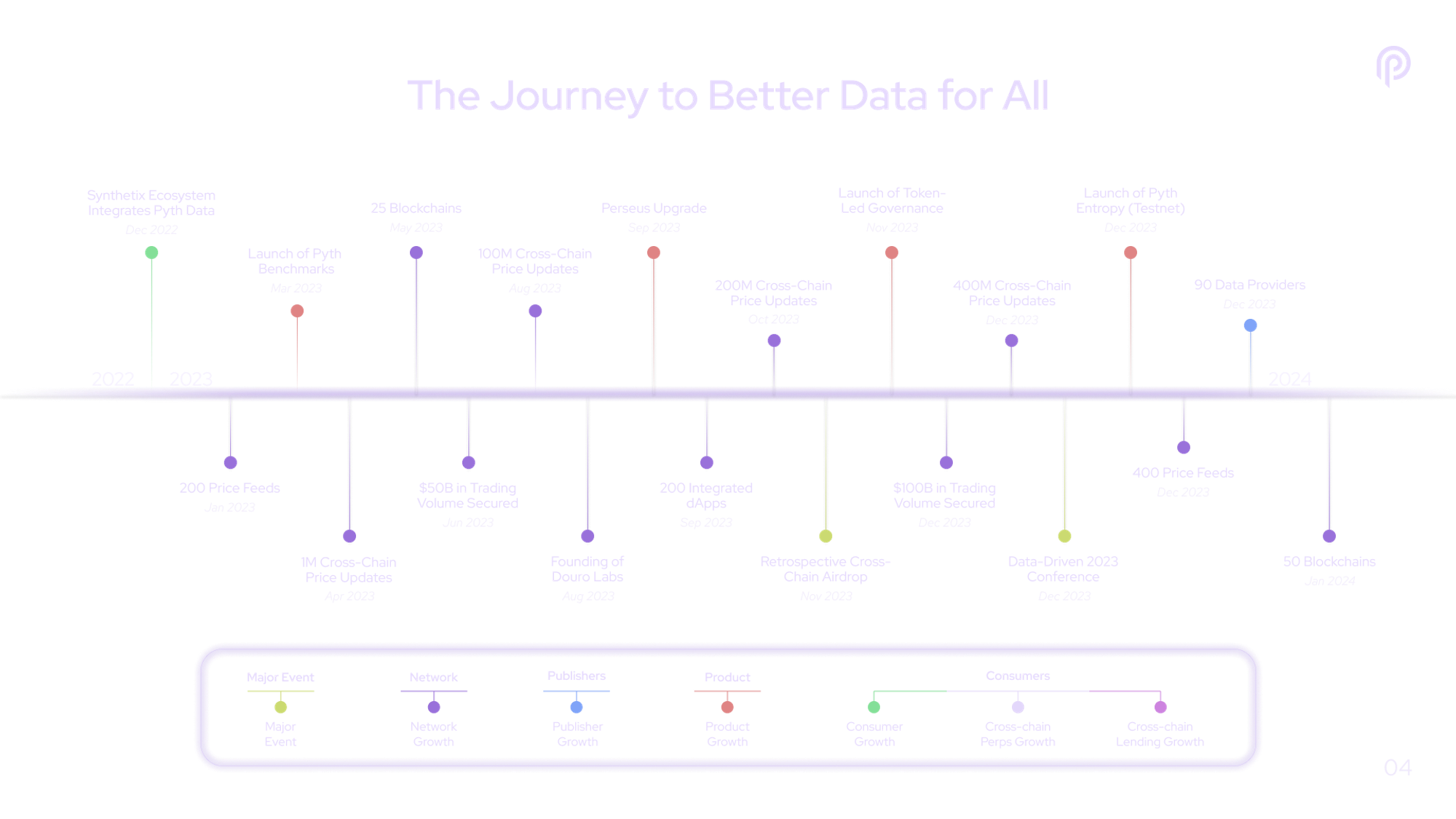

Since April 2021, Pyth contributors have been leading the network toward this vision. This early phase included welcoming new data providers, deploying real-time oracle price feeds for the first DeFi protocols, and ultimately launching a scalable cross-chain pull-model oracle supporting applications across EVM, Move, and Cosmos ecosystems.

These efforts created a positive feedback loop between exclusive financial data owners and on-chain users of that data. Opening new markets for DeFi applications attracts more users and trading volume, which in turn incentivizes more data owners to join Pyth Network and contribute their pricing data.

In Q4 2023, Pyth Network launched its permissionless mainnet. Looking ahead, on-chain governance will guide protocol development through discussions and decisions made by token holders. On-chain governance empowers the community to steer the evolution of the Pyth protocol—from oracle fee structures to reward distributions for data publishers. Governance will be a primary focus for the Pyth ecosystem in 2024 and beyond.

This article summarizes Pyth’s achievements in 2023 and how they will shape developments and ecosystem plans in the new year. It aims to serve as a comprehensive guide for the Pyth community to fulfill our shared mission—building a decentralized, sustainable oracle safeguarding the future of global on-chain services.

Oracle Network Development

2023 saw the launch of Pyth Network’s permissionless mainnet and token-driven governance system. This deployment means the Pyth protocol is now directly controlled by the Pythian community. The technical layer of the Pyth governance system has gone live: on-chain proposals can now pass with attached executable code to shape the network’s evolution. The Pyth governance system is expected to help determine key attributes such as:

- The structure and amount of oracle update fees.

- Reward distribution mechanisms for data publishers.

- Software updates for Pyth’s on-chain programs on any blockchain.

- Which price feeds and data sources should be onboarded to Pyth.

- Approval of data publishers authorized to submit data for each price feed.

The social layer of the Pyth governance system is also coming soon—the social protocol where proposals will be discussed by the community, submitted on-chain, and voted upon.

On January 9, 2024, the first draft of the Pyth DAO Constitution—the social layer document defining how the Pyth governance system operates—was published publicly for feedback. Community members can discuss it in the official Discord community.

The Largest Cross-Chain Airdrop in History

In November, the Pyth Network retroactive airdrop successfully launched, setting the record for the most extensive cross-chain airdrop to date.

Spanning 27 blockchains across EVM, Rust, Cosmos, and Move ecosystems, the airdrop reached over 90,000 eligible wallets and 200 dApps. A shared vision for the future of decentralized finance and Web3 at large united Pyth contributors: building seamless cross-chain experiences and simplifying the complexity and fragmentation inherent in today’s blockchain industry.

Data-Driven 2023

On December 5, Pyth contributors hosted a two-day virtual summit, bringing together leaders, thought leaders, and dApp builders from the Pyth oracle ecosystem. This year’s Data-Driven Conference focused on Web3 capital markets and ensuring secure on-chain availability of global financial data to enable a new era of high-throughput DeFi.

Mike Cahill and Jayant Krishnamurthy from Douro Labs delivered keynote presentations covering Pyth Network’s journey, product roadmap, and on-chain governance.

Longstanding Pyth ecosystem partners—including Synthetix, Injective, Movement Labs, Vela Exchange, SynFutures, Composability Labs, Matter Labs, HMX, Backpack, Helius, Gelato Network, and others—shared updates and roadmaps.

Attendees enjoyed exclusive workshops led by market leaders such as VanEck, OKX, Gate Ventures, Auros, LTP, Flowdesk, Kronos Research, Alphalab Capital, Selini Capital, and Solana Foundation. Supporters of Pyth Network including Multicoin Capital, Castle Island Ventures, Borderless Capital, Delphi Digital, Bodhi Ventures, and Wintermute also hosted their own industry panels.

Video replays of all sessions are available on the YouTube channel.

Pyth Entropy: A Disruptive New Force

During his keynote at Data-Driven 2023, Douro Labs CTO Jayant Krishnamurthy announced the launch of Pyth Entropy, a secure on-chain random number generation protocol.

On-chain randomness has been one of the most frequently requested features from Pyth Network, as this service supports a wide range of Web3 use cases—from NFTs to gaming.

Traditional oracle providers introduced solutions based on VRF (Verifiable Random Functions) or secure enclaves. However, these approaches come with complexities at the cryptographic or hardware level.

Pyth Entropy changes the current landscape with a different approach. Entropy implements a bilateral commit-reveal protocol, a well-known cryptographic method for generating random numbers. Its advantages include low latency and easy integration. The Entropy solution is already live on several testnets.

Better Price Feeds

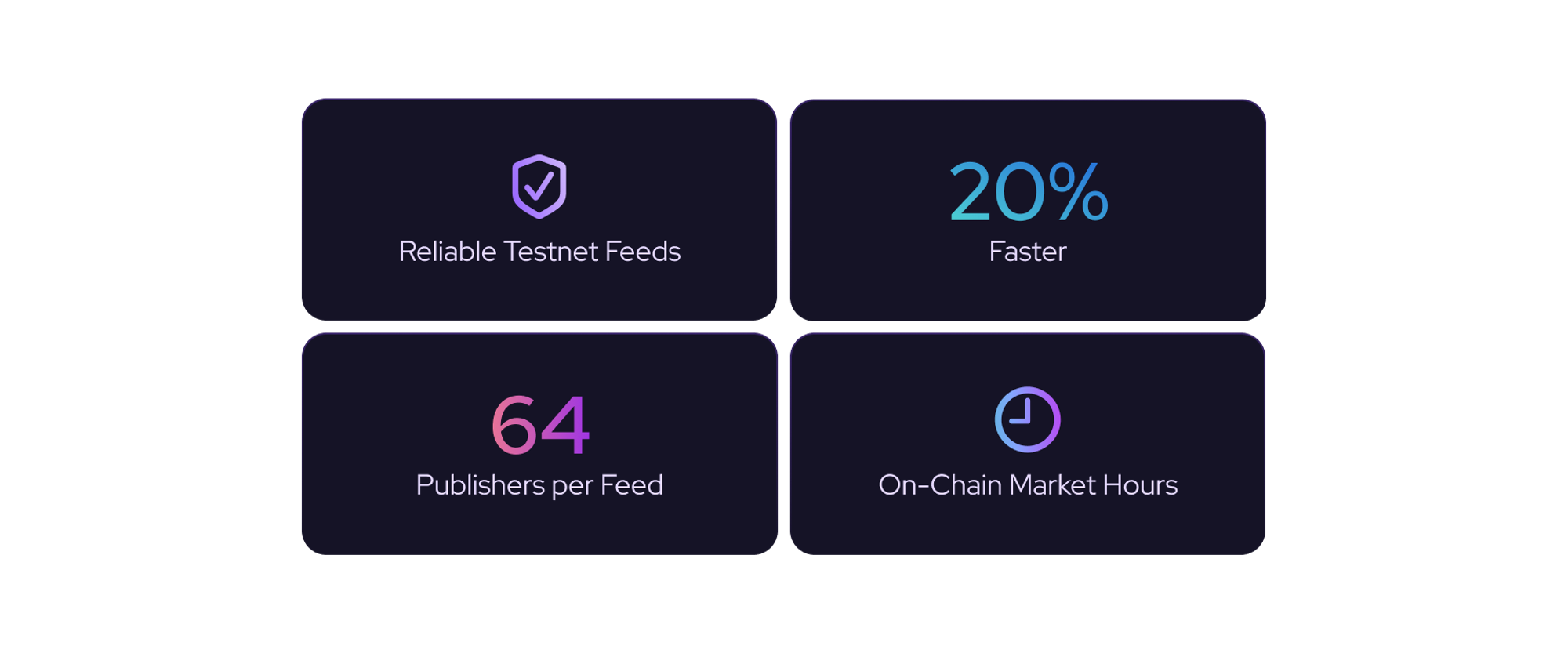

In Q4 2023, Pyth contributors released a series of core improvements to the Pyth price feeds. These upgrades were driven by user feedback and the oracle network’s growing role in supporting the expanding DeFi ecosystem.

Pyth price feeds are faster than ever.

Pyth contributors identified and eliminated several sources of latency in the oracle protocol. As a result, all Pythnet price feeds now experience 20% lower latency. Lower latency enables finer-grained price updates, leading to safer and more accurate on-chain transactions.

Each Pyth price feed now supports up to 64 data publishers.

Pyth Network hosts over 90 data publishers who contribute data to various price feeds based on the assets they support. Each Pyth price feed aggregates data from multiple publishers to ensure continuous uptime and accurate output. Previously, price feeds could draw from a maximum of 32 data publishers—an already high threshold among oracle systems.

The publisher limit per price feed has now been doubled from 32 to 64. This increase significantly enhances the reliability and security of Pyth price feeds. More publishers further improve feed liveness and raise the bar for collusion among ecosystem participants.

The era of on-chain market trading hours has arrived.

One of Pyth Network’s key advantages over other oracles is its ability to deliver real-time on-chain price feeds for traditional and real-world assets—such as U.S. equities.

However, in TradFi or Web2 worlds, assets do not trade 24/7 like cryptocurrencies. Traditional assets trade only during specific market open hours. There are times when these assets do not trade and thus have no price data. This characteristic of traditional finance has long been a concern for developers using Pyth’s traditional asset price feeds, who previously had to build separate systems to track external market hours.

Pyth Network now supports on-chain market open hours for all price feeds. Smart contracts can now read on-chain whether a given asset is within market hours and incorporate this information into their price feed integration logic—greatly reducing friction for developers building real-world asset applications on-chain.

A better testnet for all developers.

In response to developer community feedback, the Pyth testnet received additional upgrades. Mainnet Pyth data is now **available across all supported testnet environments**. Smart contract developers can now test using the same price data as mainnet, streamlining QA and stress testing processes.

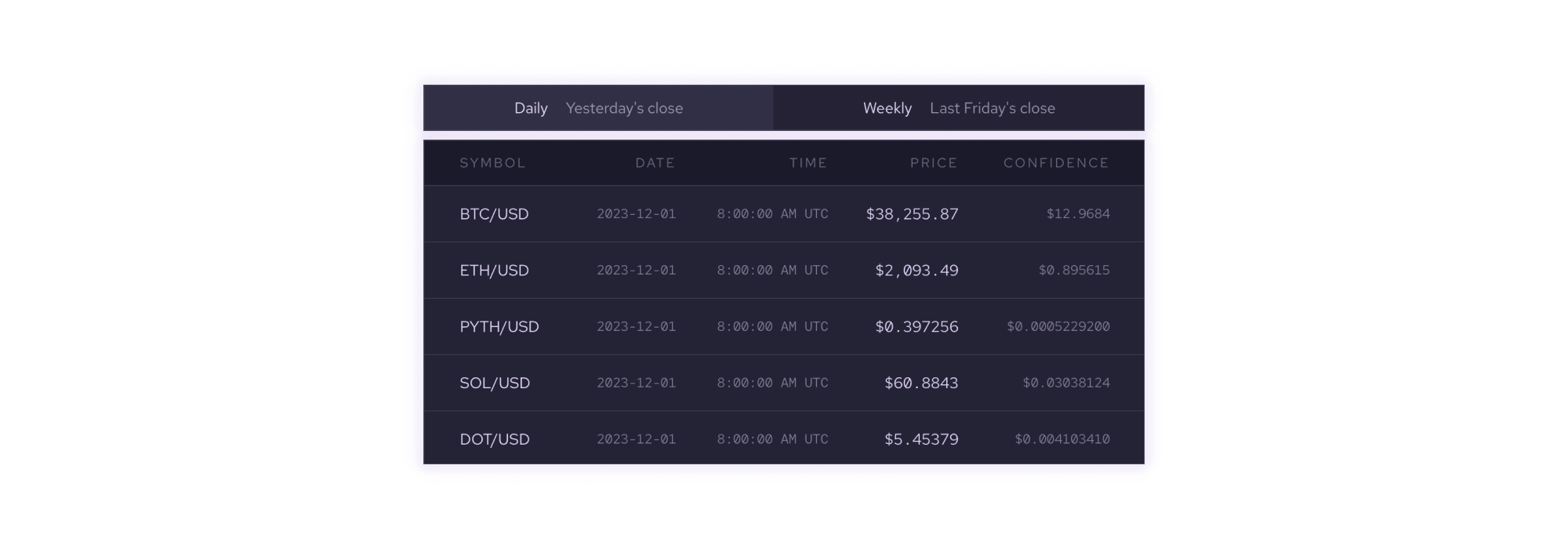

Better Benchmarks

Pyth Benchmarks allow users to integrate historical asset prices for specific dates and times. Benchmarks provide a crucial service—standardized historical pricing for digital and traditional assets—a capability entirely new to Web3, though foundational in traditional finance.

Pyth contributors rolled out two core enhancements to Pyth Benchmarks:

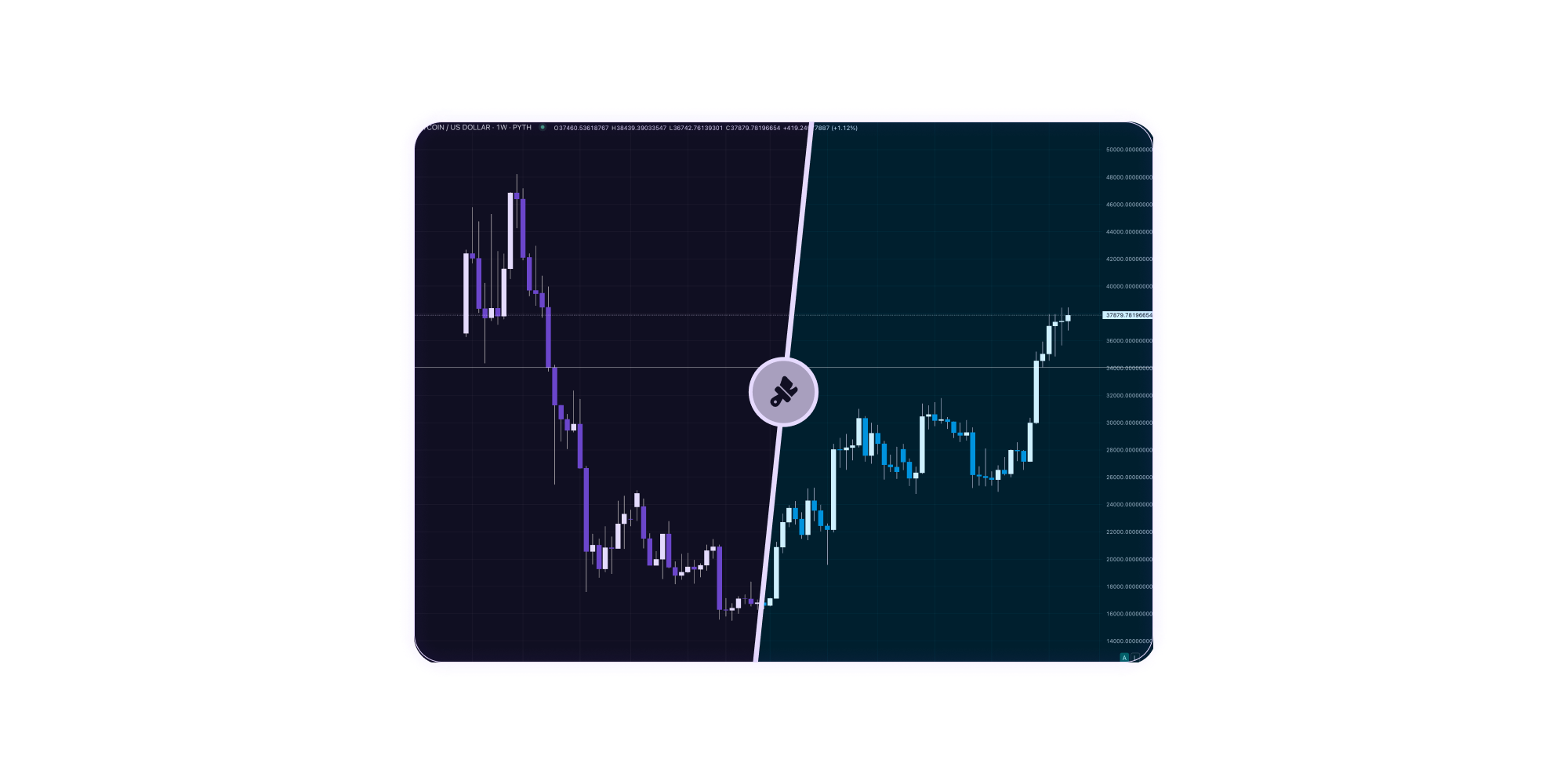

Better Pyth: Charting library integration.

A new simplified integration is now available for Python-based benchmark charting. Pyth Data users can now generate Instagram-ready, custom multi-color candlestick charts.

A brand-new charting library integration for Pyth Benchmarks has launched. Users can now easily create customized, colorful, and beautiful candlestick charts with minimal effort.

The charting library, developed by TradingView, allows developers to easily create custom skins and colored candlestick charts. Integrating the charting library with Pyth Data used to be complex. This new integration abstracts away the initial complexity into just a few lines of code. Smart contract developers can now leverage the Pyth Benchmarks API endpoint to visualize data that matches their aesthetic and branding!

Provably unique price updates.

Decentralized options vaults, structured products platforms, and perpetual contracts often integrate with Pyth Benchmarks for on-chain settlement and to prevent frontrunning and lagging trades by backfilling prices to historical timestamps.

Pyth Benchmarks allow users to retrieve provably unique prices for any timestamp. Data users can now easily fetch signed price data packets for specific times via HTTP endpoints. Signed price data packets are unique at any point in time.

Each Pyth price data packet spans a time interval defined by start and end timestamps. This interval lies within the signed price data packet and divides the timeline into non-overlapping segments.

The intervals within signed price data packets are verifiable. This proof ensures that at any given moment, there exists exactly one unique price.

Unique price data packets are designed to improve how on-chain settlement applications are built, as these applications require precisely this type of verification service.

Hermes’ Blessing: Simpler Data Access

**Hermes** is a web server that packages data generated on the Pythnet appchain along with Wormhole signatures for downstream protocols to use.

While Hermes is a permissionless service that anyone can run, operating it continuously presents operational challenges. The Pyth Data Association currently offers a public instance, but there remains room for added functionality and use cases.

Triton One and P2P have now launched their own independently operated, permissionless Hermes offerings. Integration is as simple as using an RPC node on your native blockchain.

Highlights

Day by day, year by year

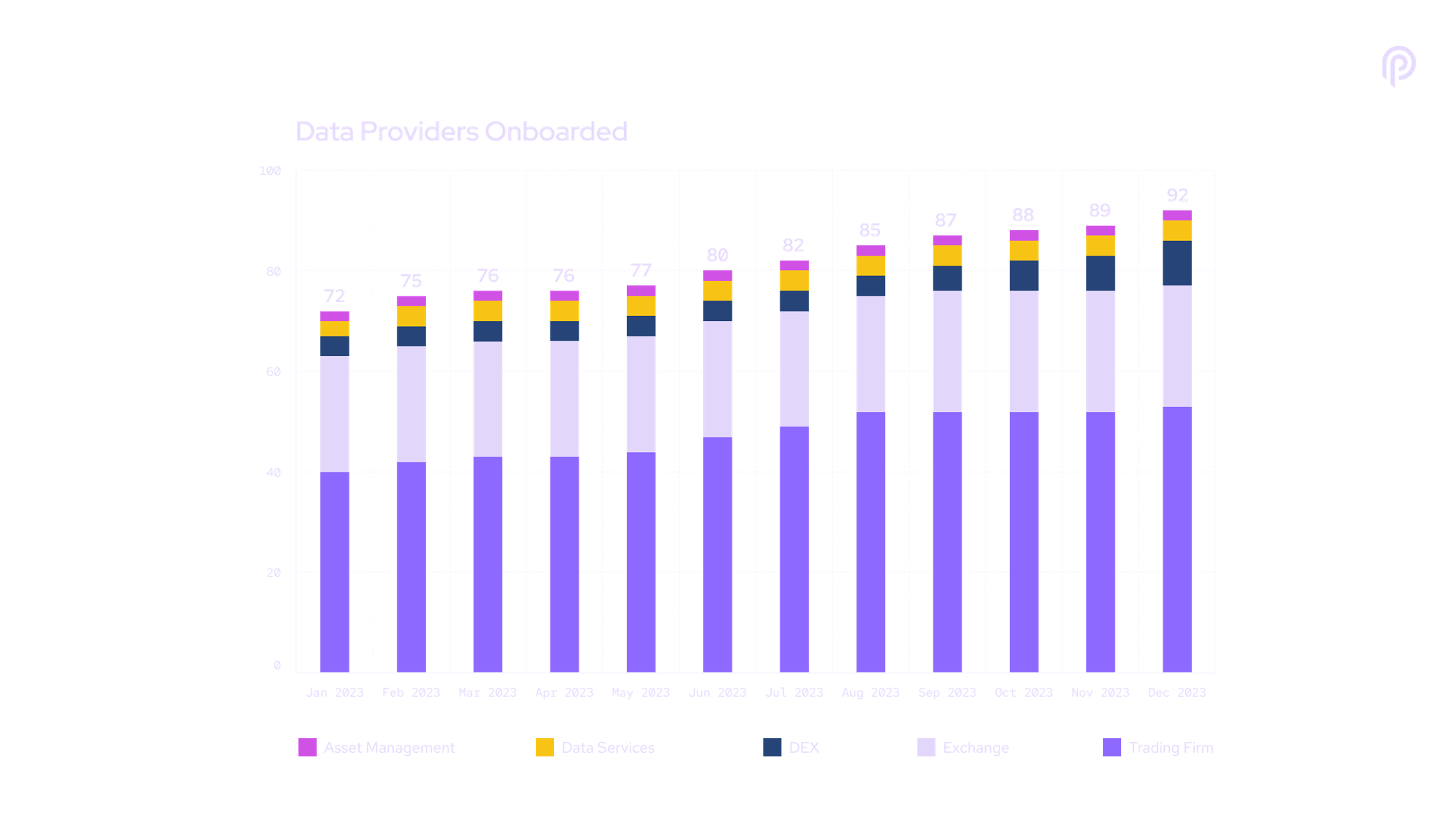

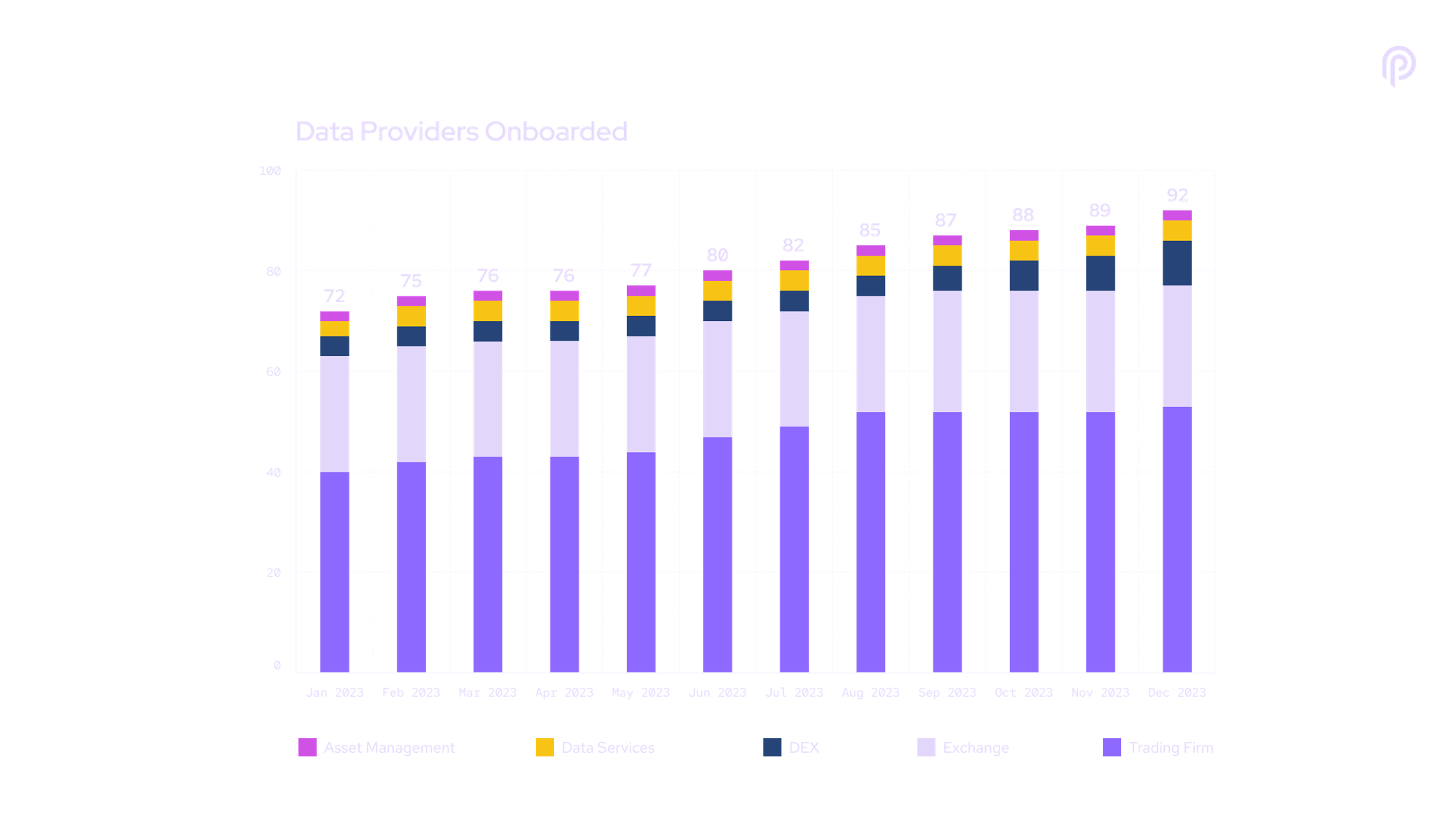

The KPI metrics in this section offer a visual perspective on Pyth ecosystem growth throughout 2023. These key indicators reflect year-over-year growth, market share expansion, and current market position.

Answering the Call of Pythia

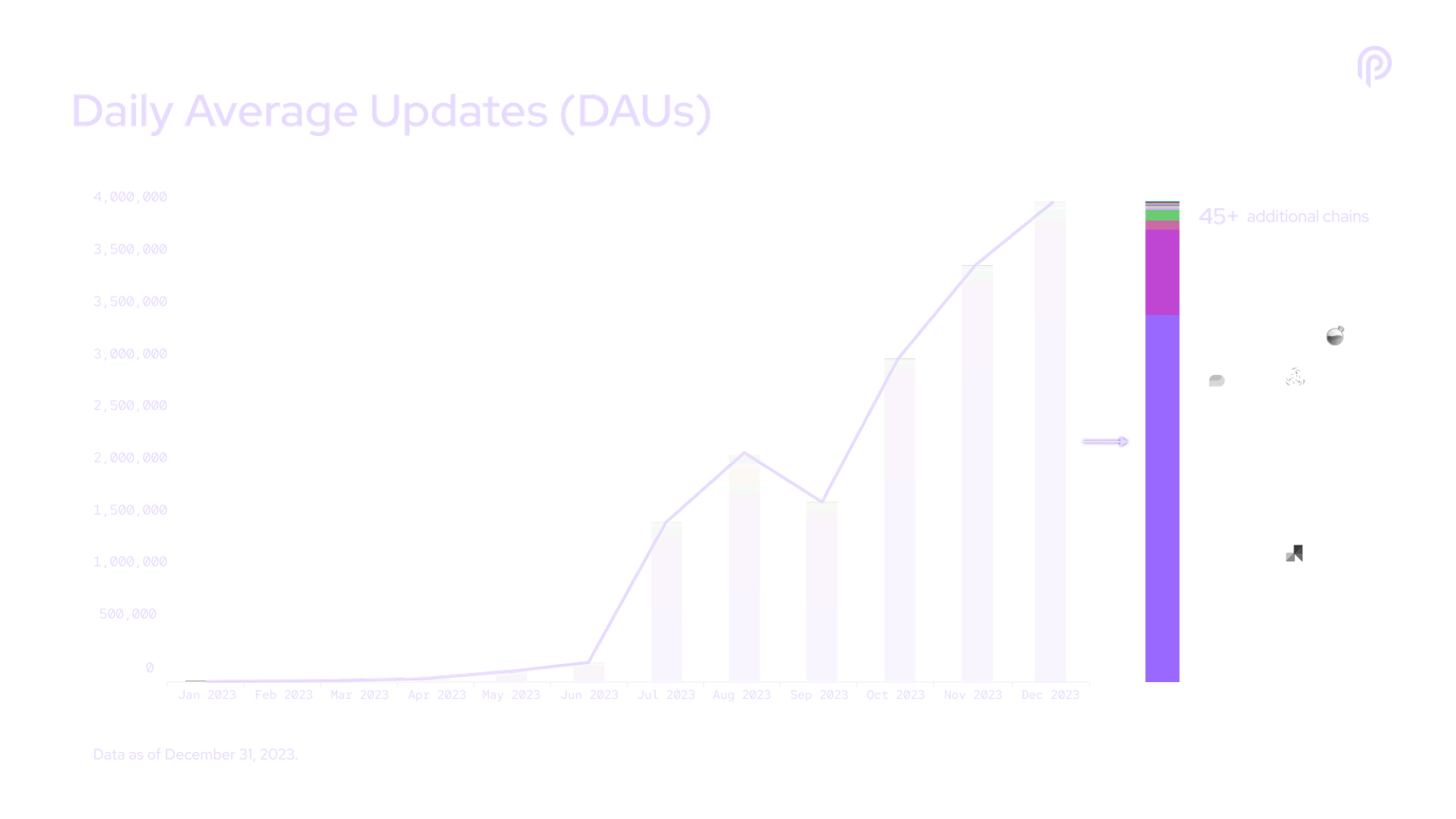

Pyth introduced a major improvement over traditional oracle architectures. Unlike traditional push-model oracles that rely on gas fees to continuously push data on-chain, Pyth runs a pull-model oracle that allows protocols to request—or pull—price updates only when needed.

This architecture’s gas efficiency enables Pyth oracles to deliver lower-latency, higher-frequency, and higher-resolution price data to DeFi users. These benefits make DeFi safer and more precise. Additionally, Pyth oracles can scale to support any number of blockchains, with new Pyth price feeds launching simultaneously across all supported chains.

Each time an application or ecosystem participant calls (pulls) a price update from Pyth, they pay the Pyth protocol a small data fee.*

Daily Average Updates (DAUs) refer to the number of oracle price updates requested from Pythnet and transmitted cross-chain via Wormhole. In December 2023, DAUs peaked at 4 million paid updates per day. DAUs correlate directly with DeFi application activity, as protocols need to pull real-time prices on-chain to settle trades and compute positions.

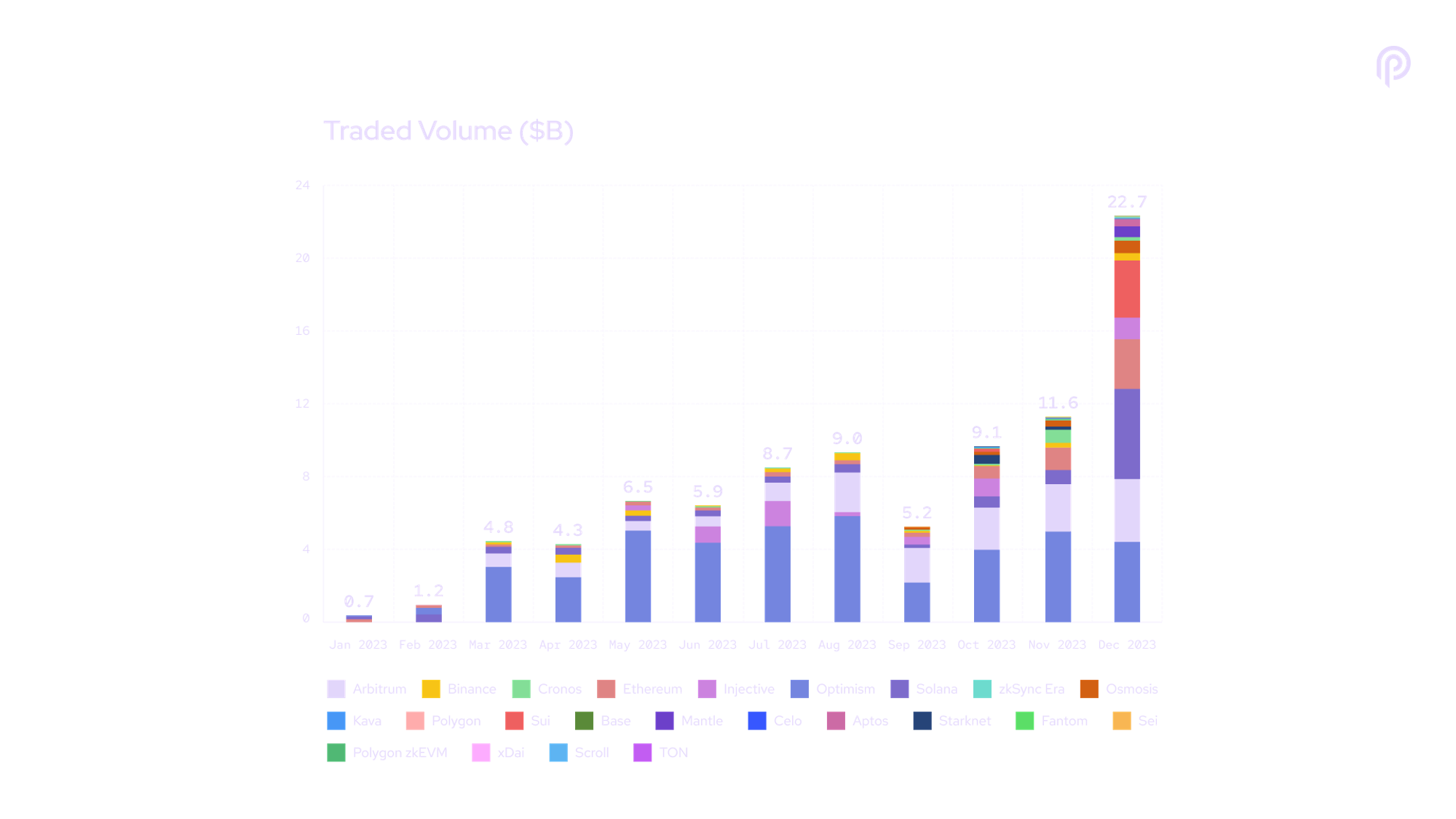

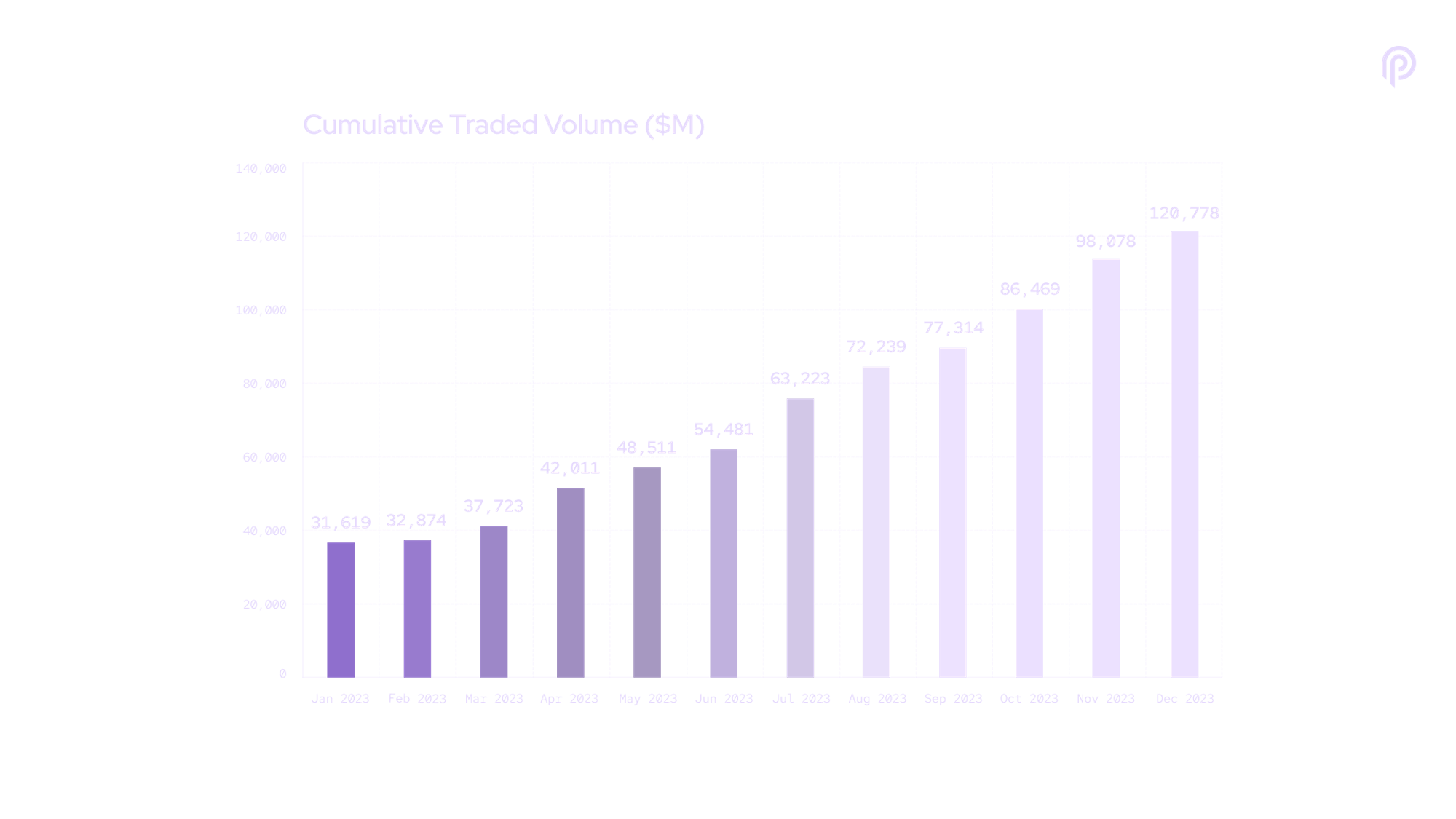

Milestone: $100 Billion in Transaction Volume

December was an exceptionally active month for on-chain trading, reflected in the surge of transaction volume powered by Pyth data. That month, monthly transaction volume surged to $22.7 billion. By year-end, cumulative transaction volume reached $120 billion.

Given the prominence of perpetual contracts in the DeFi industry and their rapid multi-chain deployment throughout 2023, transaction volume is the clearest indicator of Pyth price feed usage in perpetual protocols.

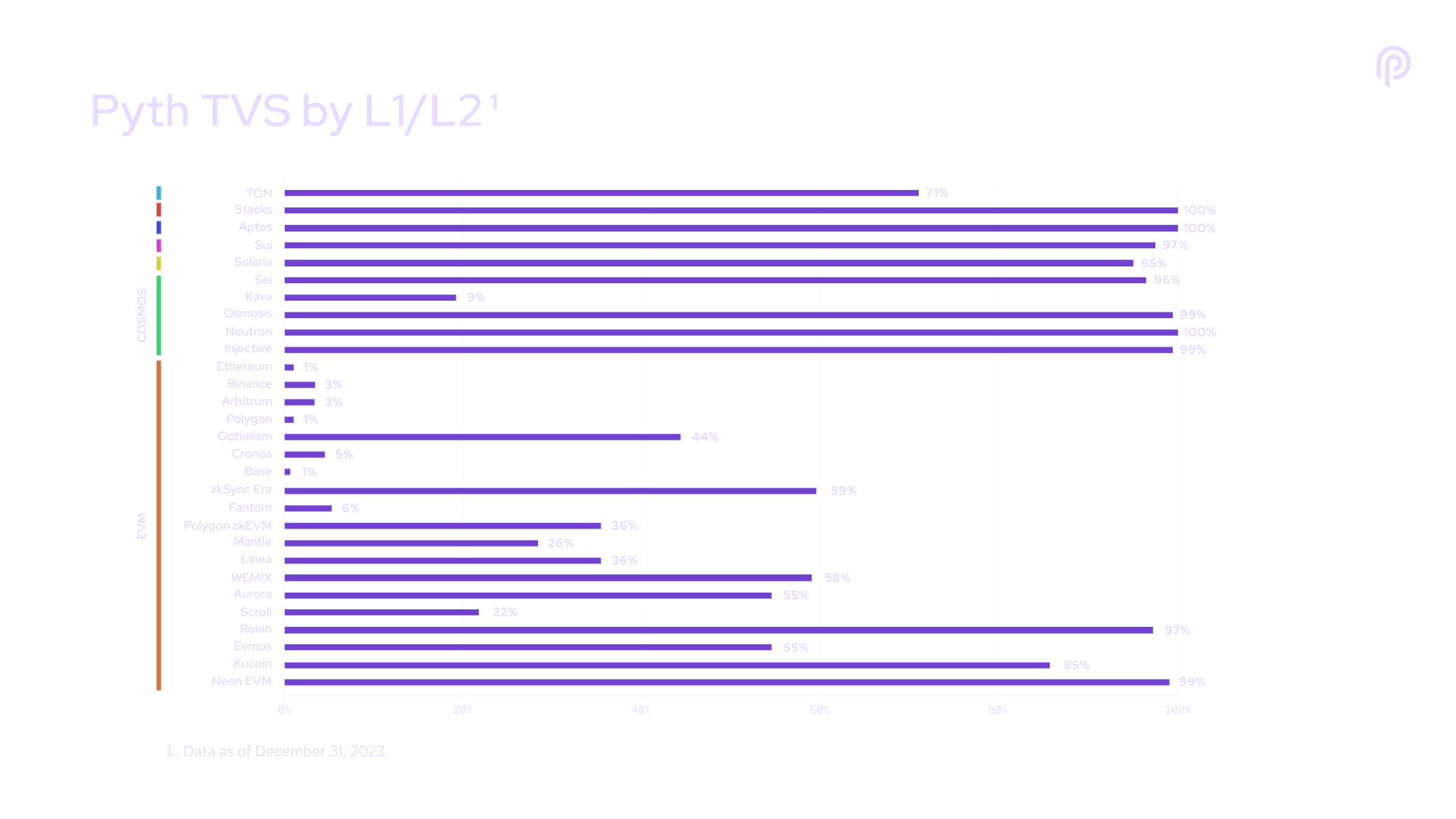

Revitalization: Total Value Secured (TVS)

The Total Value Secured (TVS) metric—also known as oracle-secured Total Value Locked (TVL)—highlights past cycles of value locking, with this latest surge tied to explosive adoption across new L1 and L2 blockchains.

We can use TVS as a proxy for market share on any chain, since it represents the portion of a blockchain’s DeFi value secured by oracles. Close inspection of TVS across chains reveals Pyth’s dominance, particularly within emerging EVM and Cosmos ecosystems focused on high-throughput financial activity.

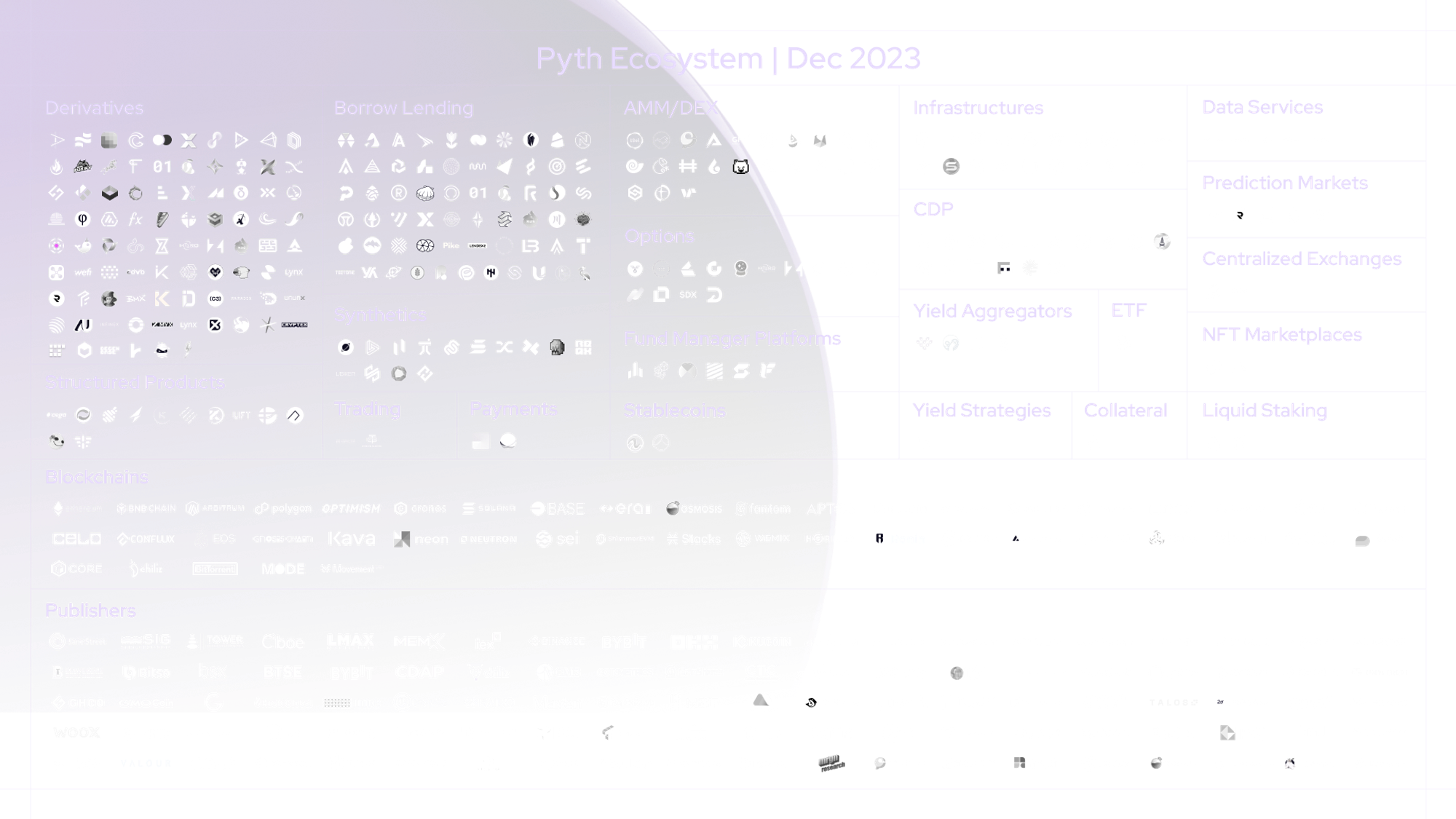

New Users: Welcome to Pyth

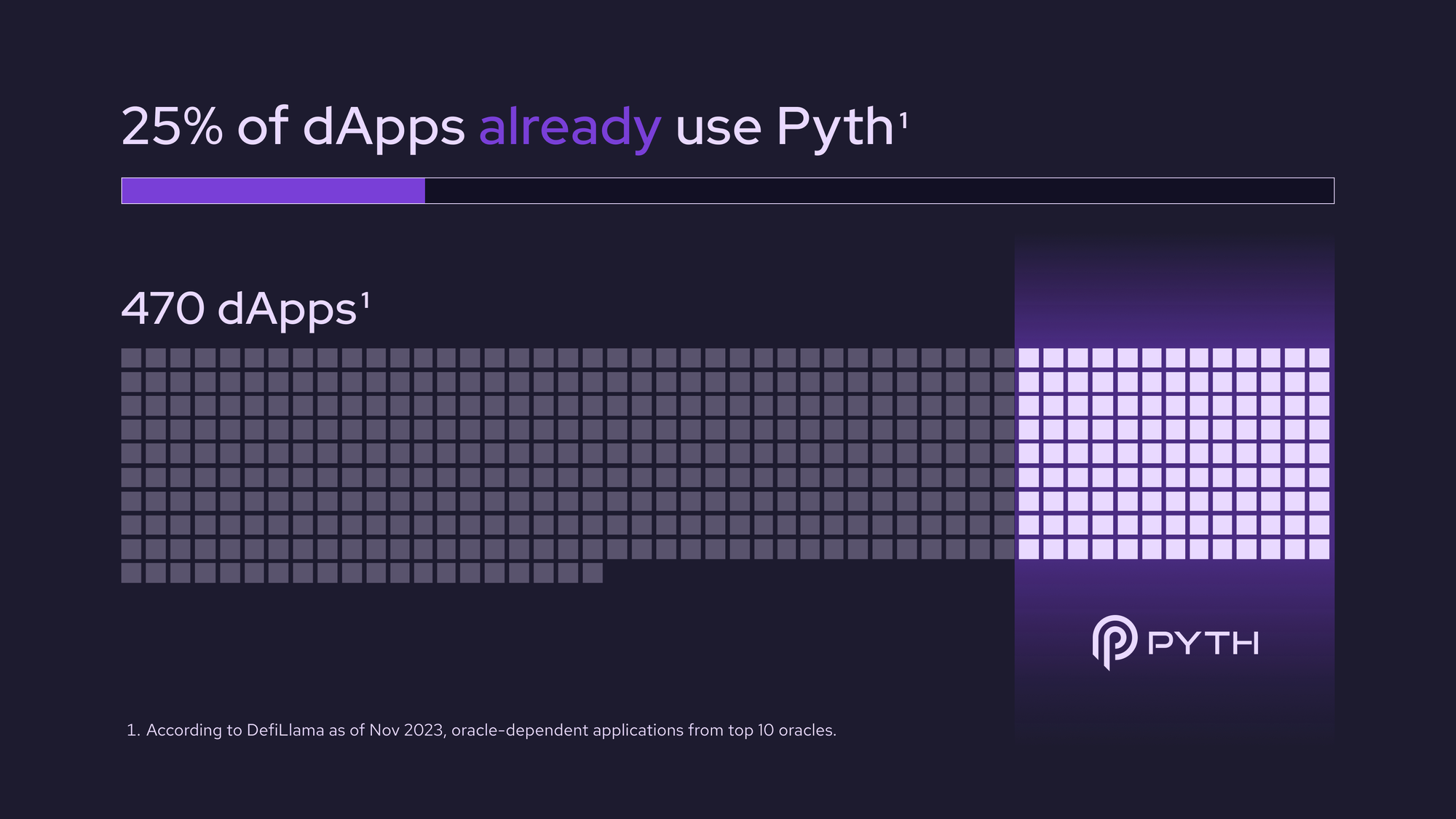

It’s becoming increasingly difficult to use DeFi without interacting with Pyth data. According to DefiLlama, one out of every four dApps is already #PoweredByPyth.

The following dApp statistics represent a conservative count of applications integrated with Pyth data. In the Web3 world, integrating Pyth price feeds and Pyth Benchmarks is permissionless—you don’t need to talk to a sales team or sign any agreements.

Previous quarterly summary blogs listed all new integration partners. Due to space constraints, we won’t repeat them here. You can find full details in the December progress update blog post.

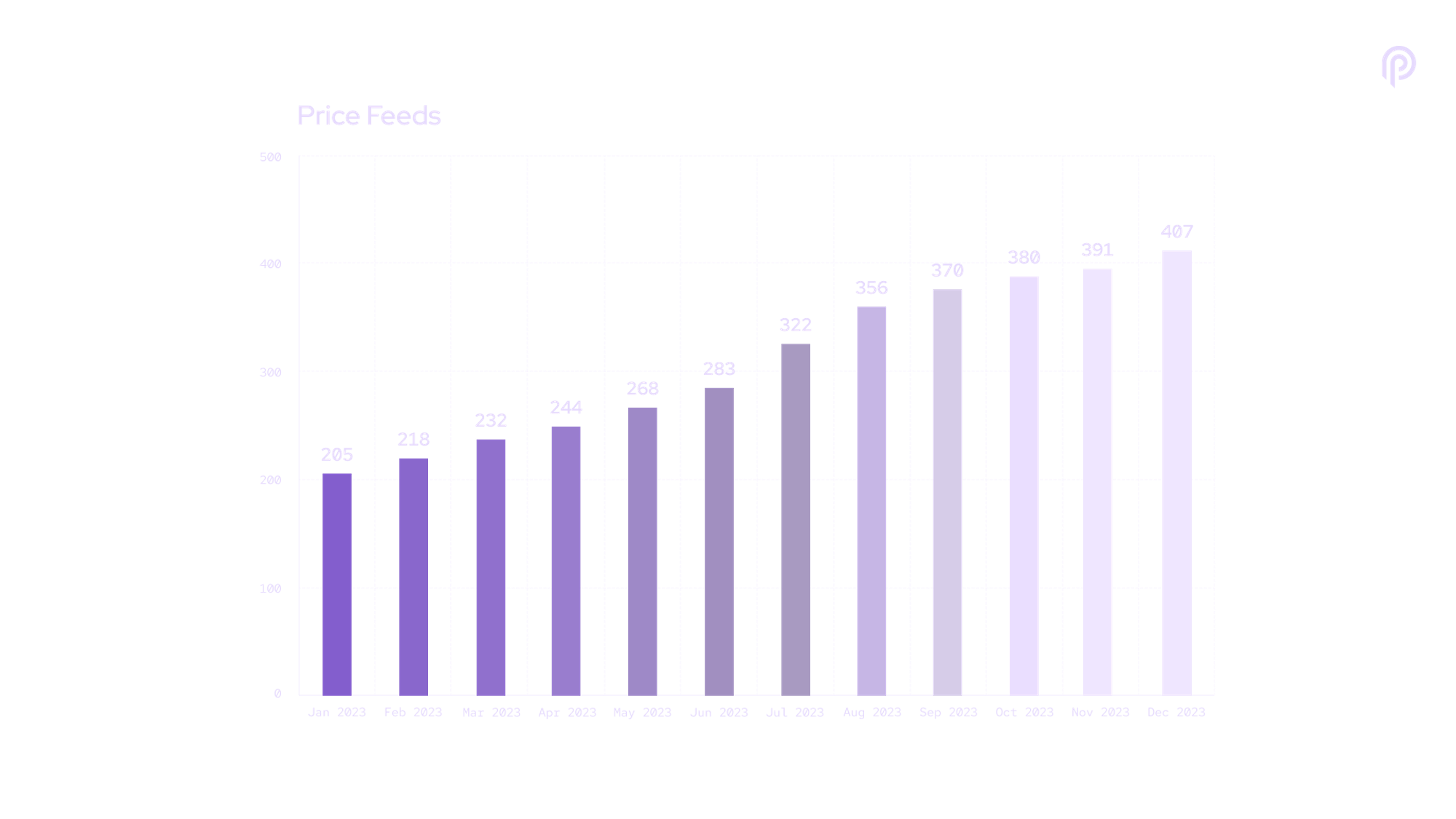

New Price Feeds: Meeting Highest Demand

One of the most powerful benefits of Pyth’s pull-model oracle is that all Pyth price feeds are instantly available across every supported blockchain.

For example, a development team on Arbitrum may want to expand their protocol to Base. On Base, the protocol can use the exact same set of Pyth price feeds to offer users the same trading markets they know and love. DeFi participants don’t need to wait for new Pyth price feeds to be deployed individually on new blockchains. Pyth’s rapid scalability lays the foundation for a more unified, multi-chain Web3 experience.

Pyth now supports price feeds for over 400 assets, including cryptocurrencies, forex pairs, precious metals, U.S. stocks, and ETFs. Going forward, the list of new price feeds will become a community-managed process.

New Publishers: True Data Ownership in Web3

Pyth Network would not exist without the contributions of its institutional-grade, decentralized publisher community. These publishers are active participants in price discovery; whether liquidity venues or trading entities, their daily operations generate valuable, timely, granular price data.

More publishers mean more price feeds and broader asset coverage across Pyth. Greater asset coverage enables support for new markets on DeFi platforms, encouraging further use and demand for Pyth data. This demand reinforces Pyth Network’s appeal as a decentralized marketplace for proprietary price data. Discussions around on-chain reward flows are another critical topic within the scope of Pyth governance.

Conclusion

2023 was Pyth Network’s final proving ground. Pyth’s mission—to bring all valuable data on-chain—is focused squarely on solving the most common pain points faced by blockchain developers.

By focusing on first-party data publishers* (original data sources)*, Pyth oracles deliver high-resolution price data that tracks markets more accurately than competing solutions. Thanks to its pull-model oracle architecture, Pyth can support real-time price feed updates for thousands of smart contracts across any number of blockchains. Slow, inaccurate, and fragmented price feeds are giving way to high-frequency, high-fidelity, universally accessible oracle solutions.

While Pyth Network’s goals remain unchanged this year, 2024 marks a new chapter of community-led decision-making.

We want to hear from you! Join the Pyth Discord and Telegram, follow us on X, and be the first to learn about the latest developments in the Pyth ecosystem. You can learn more about Pyth here.

Due to legacy development issues, Pyth price feeds on Solana mainnet-beta are still delivered via independent pushes. Pull-model deployment for Solana is under development.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News