MT Capital Research Report: Dissecting the DA Sector – A Comparative Study of Celestia and EigenDA

TechFlow Selected TechFlow Selected

MT Capital Research Report: Dissecting the DA Sector – A Comparative Study of Celestia and EigenDA

In the future, Celestia will benefit from the incremental market growth driven by the dual trends of modularity and app-specific chains, while EigenDA will capture more of the existing Ethereum ecosystem market that demands higher security.

Authors: Xinwei, Severin, Ian, MT Capital

TL;DR

-

Celestia currently demonstrates robust staking trends, with a staking rate of 48.88% and an annual percentage rate (APR) of 15.74%. It is projected to reach its ideal staking limit by the end of 2024. With no new token unlocks expected before November 2024, the actual circulating supply is anticipated to continuously decrease, creating positive price pressure. Meanwhile, the Celestia network currently maintains 100 active nodes.

-

Celestia's current data usage stands at only 0.1% of its daily total capacity, yet activity is growing compared to Ethereum. As data usage increases, fees could rise significantly. If full-year daily data capacity reaches 46,080 MB, annual fees could amount to approximately $5.2 million—65 times higher than current Ethereum data fees. Demand is expected from high-TPS applications and gaming, with numerous chains leveraging Celestia’s RaaS expected to emerge in the coming months.

-

EigenDA’s adoption of erasure coding, KZG commitments, ACeD, and decoupling data availability (DA) from consensus enables superior performance over Ethereum’s DA solutions in transaction throughput, node load, and DA cost. Compared to other DA solutions, EigenDA also offers advantages in lower setup and staking costs, faster network communication, quicker data submission, and greater flexibility.

-

Comparing Celestia and EigenDA, Celestia holds a competitive edge in extremely low data availability costs and higher data throughput, making it more attractive to small-to-medium L2s and appchains. EigenDA’s strengths lie in potentially higher security and Ethereum-native legitimacy, positioning it as a rational choice for larger L2s seeking cost efficiency. Going forward, Celestia is poised to benefit from the combined growth waves of modularization and appchains, while EigenDA is likely to capture more of the existing Ethereum ecosystem where security demands are higher.

-

The NEAR Protocol enhances scalability and decentralization through sharding and stateless validation, simplifying data management for L2 projects. Avail optimizes blockchain data processing and storage via a modular system, supports asynchronous interactions between appchains, improves network performance, and enables light clients to efficiently verify data integrity. These technologies collectively advance user-friendliness and drive progress toward a decentralized digital world.

Introduction

Data availability layers have become a critical component within modular architectures, with DA increasingly emerging as one of the hottest sectors in 2024. Discussions around Ethereum DA, Celestia, and alternative DA solutions continue to proliferate. This article provides an in-depth analysis of the core mechanisms, features, comparisons, and future outlooks for leading players in the DA space—Celestia and EigenDA—while scanning other key competitors to help readers understand the current landscape and competitive dynamics of the DA sector.

Celestia

Celestia is the first modular data availability (DA) network designed to scale securely with growing user demand. This modularity allows anyone to easily launch independent blockchains.

Celestia Technical Features

-

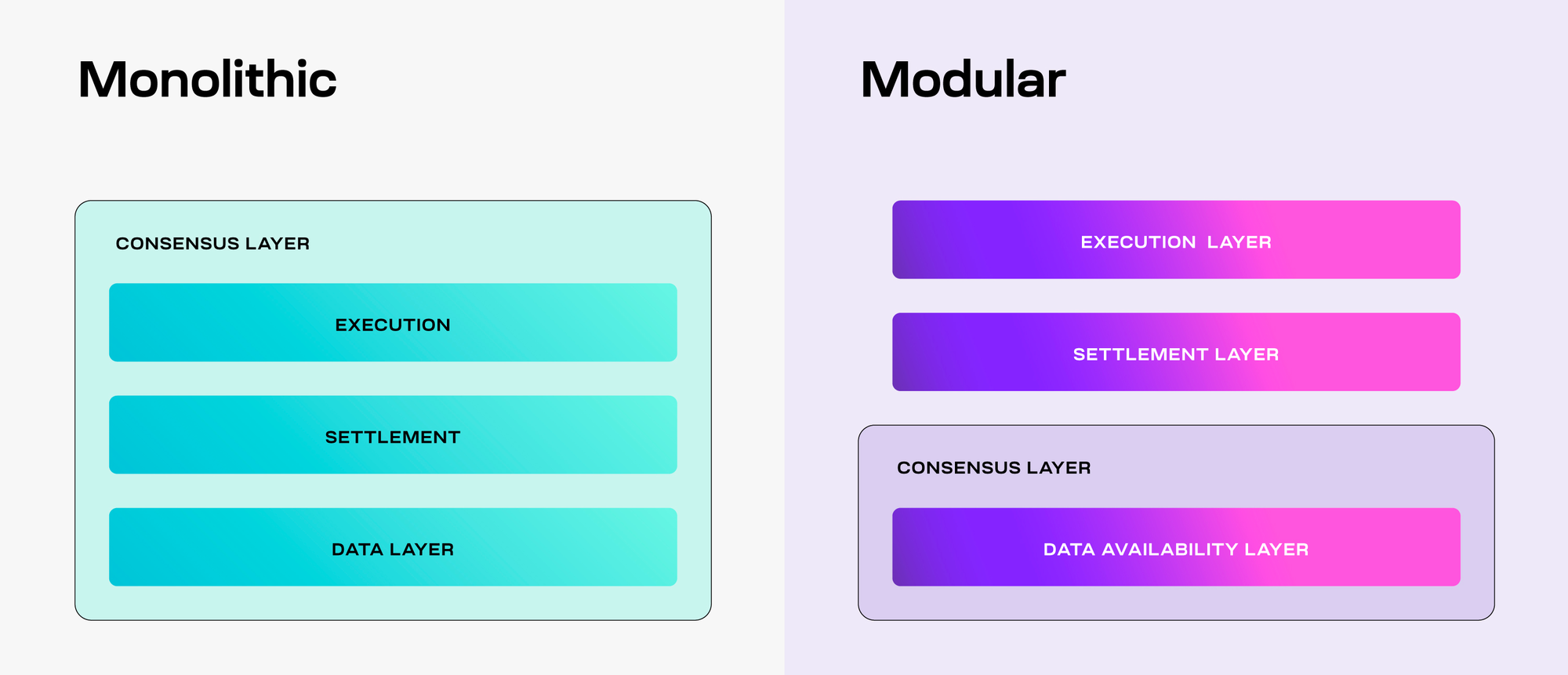

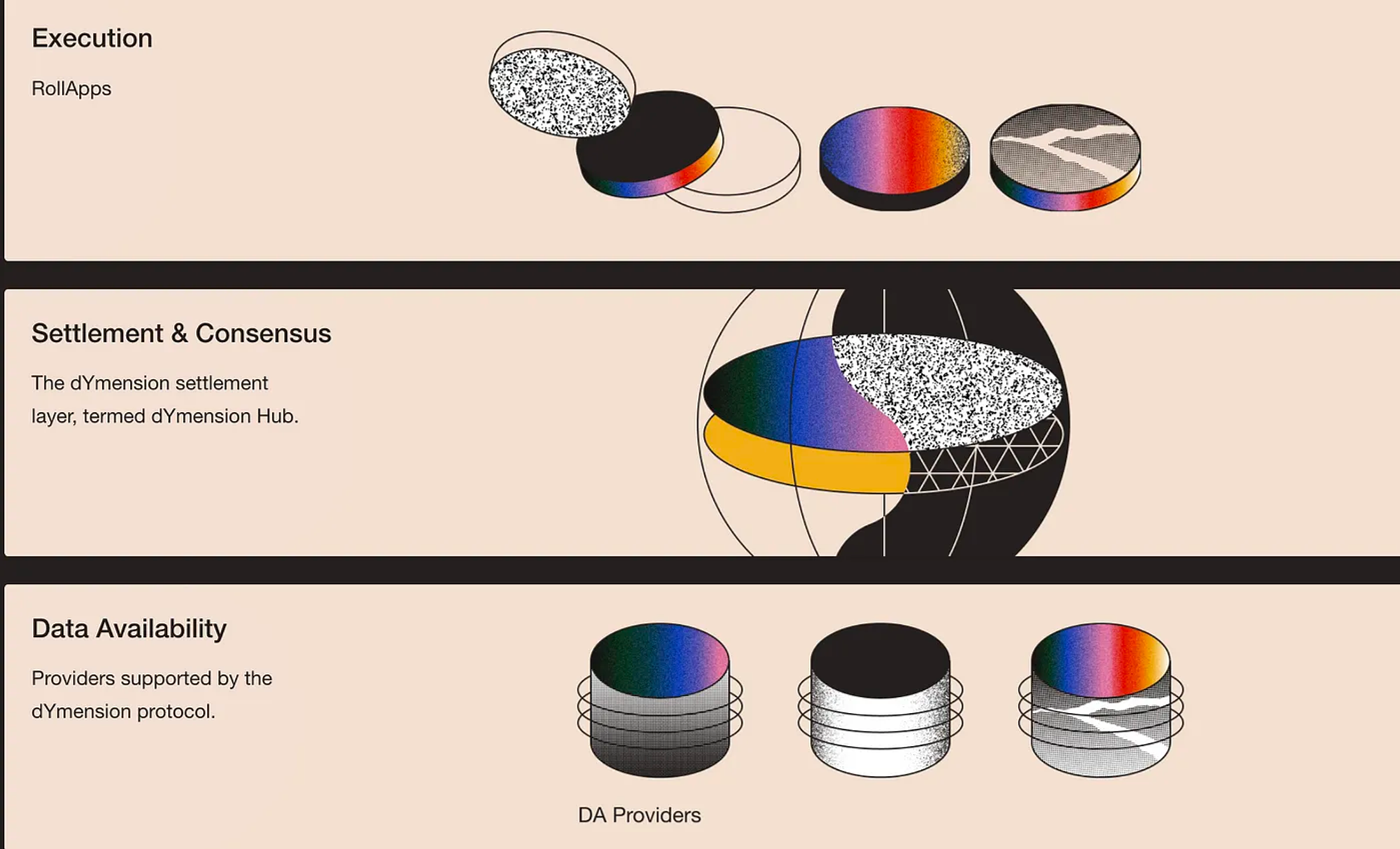

Modular DA Network

Celestia separates execution, consensus, settlement, and data availability. This modular structure enables specialization and optimization at each layer, improving overall network efficiency and scalability.

source:https://docs.celestia.org/learn/how-celestia-works/monolithic-vs-modular

-

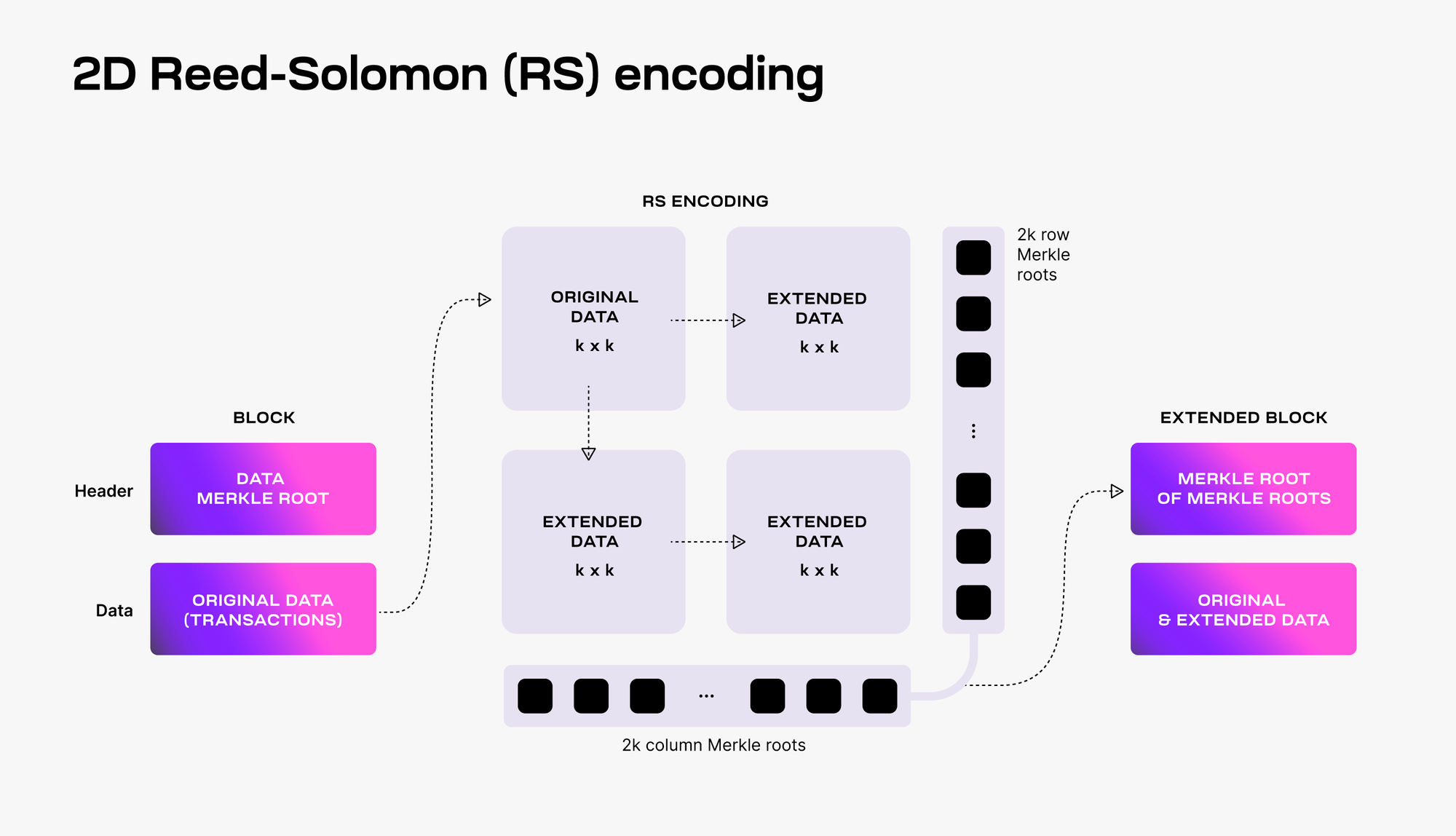

Data Availability Sampling (DAS)

DAS allows light nodes to verify data availability without downloading entire blocks. Light nodes randomly sample data chunks; if these samples can be successfully retrieved and verified, the entire block’s data is deemed available.

source:https://docs.celestia.org/learn/how-celestia-works/data-availability-layer

-

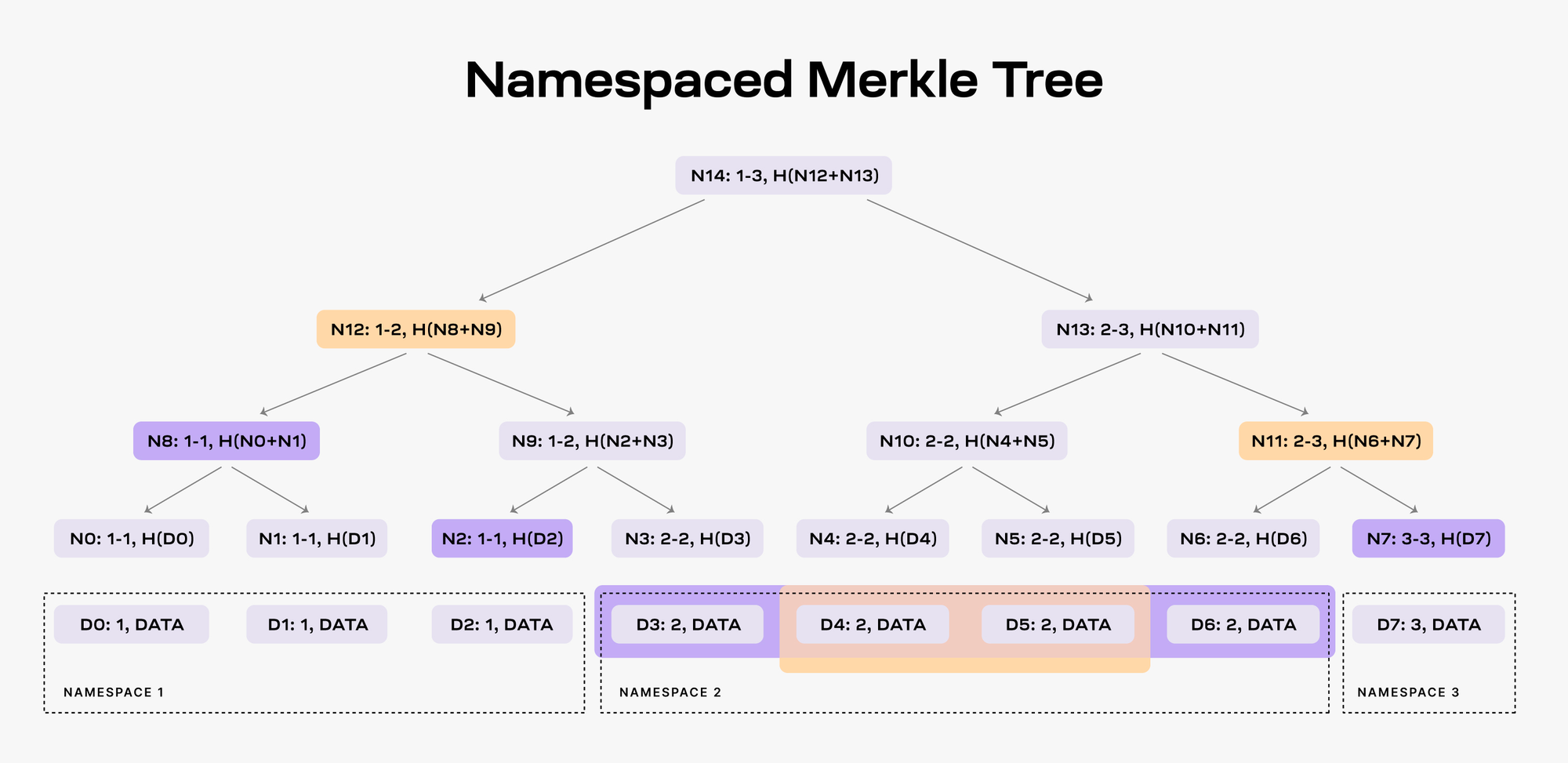

Name-Spaced Merkle Trees (NMTs)

NMTs allow block data to be partitioned into separate namespaces for different applications. This means apps only need to download and process relevant data, greatly reducing data handling requirements.

source:https://docs.celestia.org/learn/how-celestia-works/data-availability-layer

-

Scalability Through Light Nodes

The more light nodes participating in DAS, the more data the network can handle. This scalability feature is crucial for maintaining efficiency during network growth.

-

Fraud Proofs for Erroneous Data Expansion

To address potential erroneous data expansion by block producers—whether intentional or not—fraud proofs enable verification and rejection of blocks containing invalid data, enhancing network security.

-

Building a PoS Blockchain for Data Availability

Celestia uses a PoS blockchain called celestia-app to facilitate transactions and data availability. This layer is built on top of celestia-core, an improved version of the Tendermint consensus algorithm tailored to meet the unique needs of the DA layer.

-

Scalability

Two factors determine scalability: the volume of data subject to collective sampling (i.e., how much data can be sampled), and the target block header size for light nodes (which directly affects overall network performance and scalability).

Addressing these, Celestia leverages collective sampling—where many nodes participate in partial data sampling—to support larger data blocks (i.e., higher TPS). This approach scales network capacity without sacrificing security. Additionally, in the Celestia system, the light node block header size grows proportionally to the square root of the block size. Thus, to maintain near-full-node-level security, light nodes face bandwidth costs proportional to the square root of the block size.

Characteristics of the Modular Celestia Stack

1. Sovereignty

Celestia rollups differ from Ethereum rollups in that their canonical state is independently determined when running on Celestia. This increases autonomy, allowing nodes to freely decide operational parameters via soft or hard forks. This sovereignty reduces reliance on centralized governance and fosters experimentation and innovation.

2. Flexibility

Celestia’s execution-agnostic design means its rollups aren't limited to EVM-compatible frameworks. This openness creates broader opportunities for VM innovation, driving technological advancement.

3. Easy Deployment

Celestia simplifies blockchain deployment. Using tools like Optimint, developers can quickly launch new chains without dealing with the complexity and high costs of consensus mechanisms.

4. Efficient Resource Pricing

Celestia separates active state growth from historical data storage, enabling more efficient resource pricing. This reduces cross-environment interference and improves user experience.

5. Trust-Minimized Bridges

Celestia’s architecture supports trust-minimized bridges, enabling secure interconnectivity between different chains. This strengthens security and interoperability across blockchain clusters.

6. Minimal Governance

Celestia’s modular design reduces the need for centralized governance. Execution layers can evolve rapidly and independently, while the consensus layer remains stable, minimizing complex social coordination.

7. Decentralized Block Verification:

Celestia emphasizes decentralized block verification, not just block production. This approach enhances network security and trustworthiness.

8. Simplicity

Celestia builds on simple, mature technologies like Tendermint, avoiding unnecessary complexity. This simplicity benefits system stability and scalability.

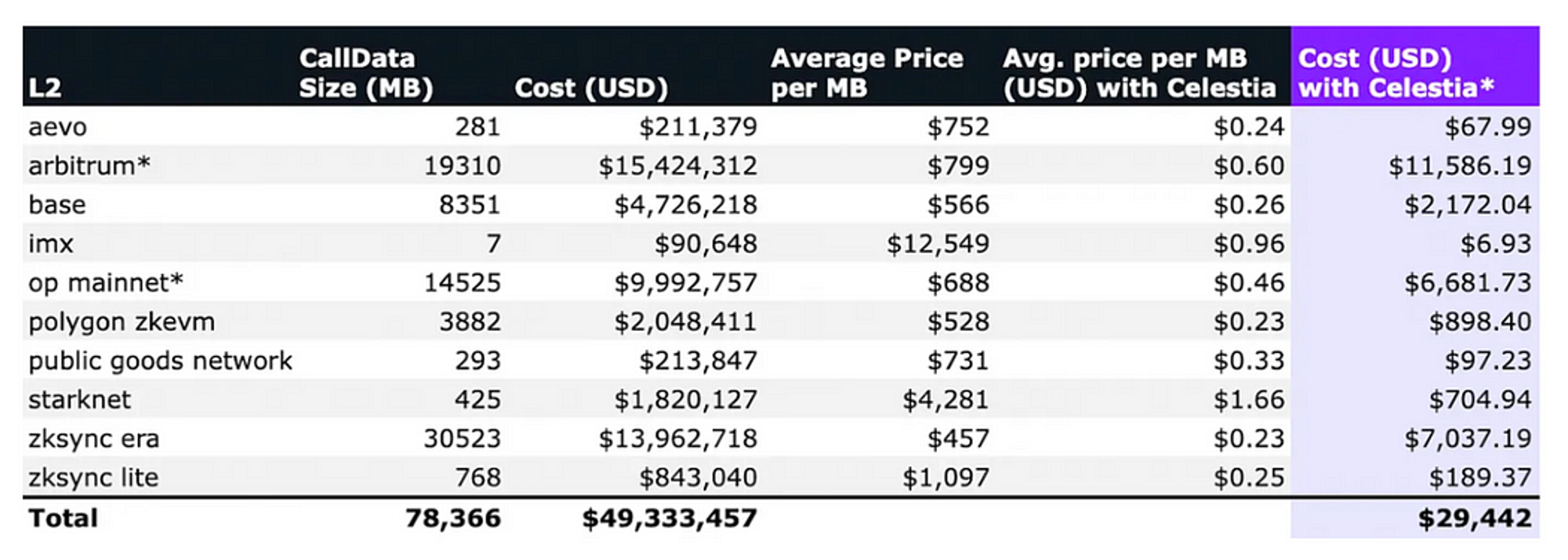

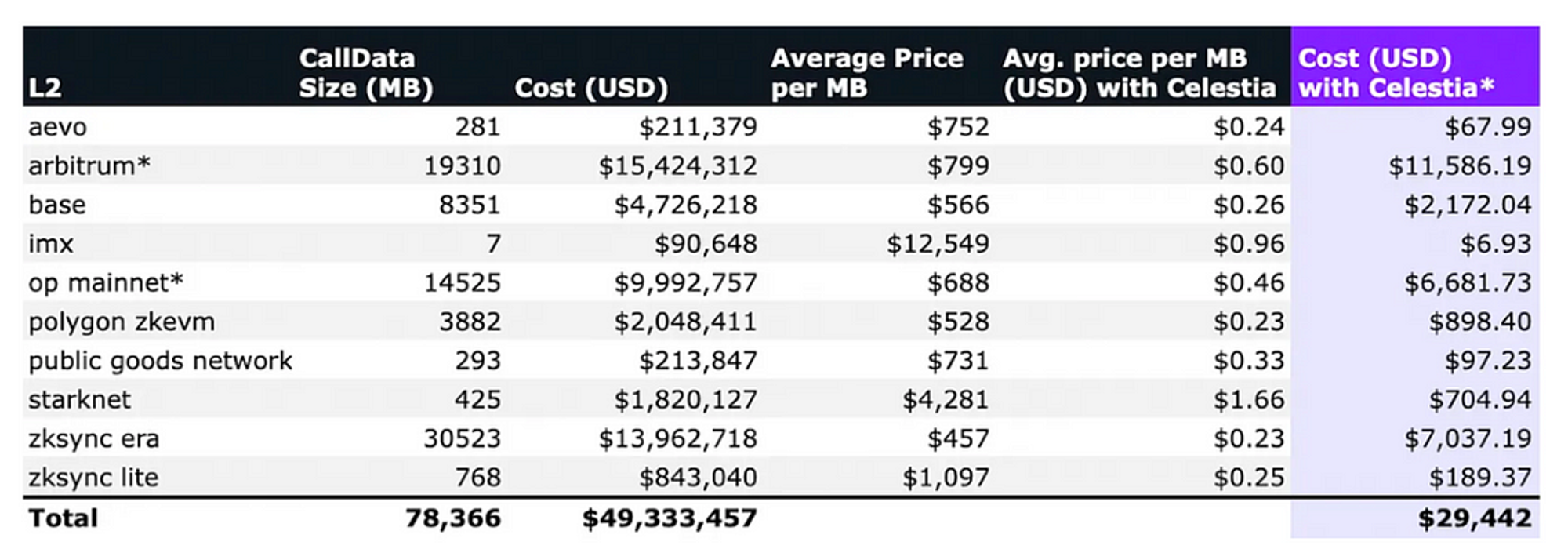

Celestia’s Data Costs

Numia Data recently published a report titled “The impact of Celestia’s modular DA layer on Ethereum L2s: a first look,” comparing the costs incurred by various Layer 2 (L2) solutions on Ethereum for publishing CallData over the past six months, versus hypothetical costs if they used Celestia as their data availability (DA) layer (assuming a TIA price of $12). The report clearly illustrates the significant economic benefits of dedicated DA layers like Celestia in reducing L2 gas fees.

Tokenomics

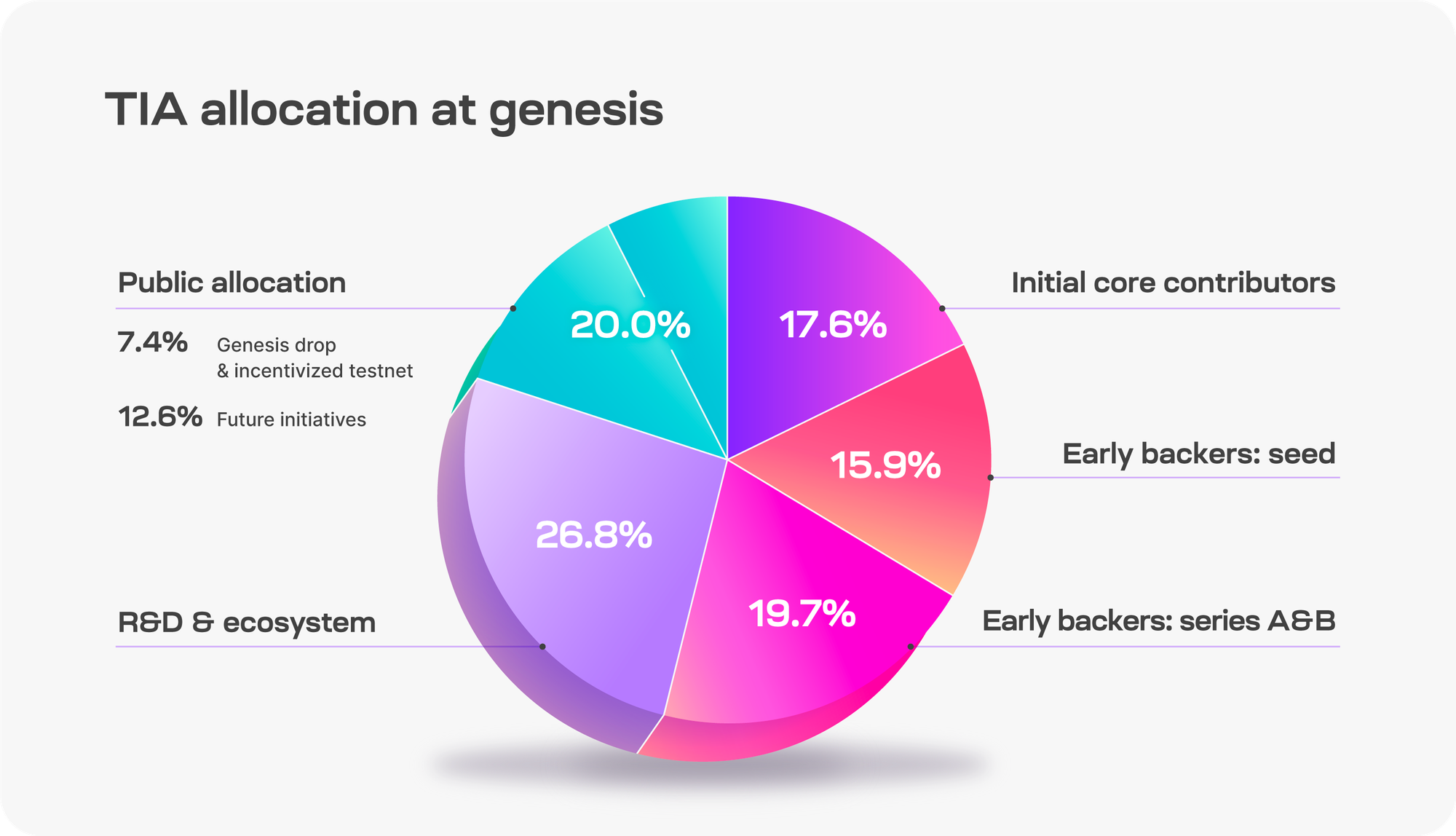

Total Supply at Genesis: 1 billion TIA.

TIA Distribution at Genesis

source:https://docs.celestia.org/learn/staking-governance-supply

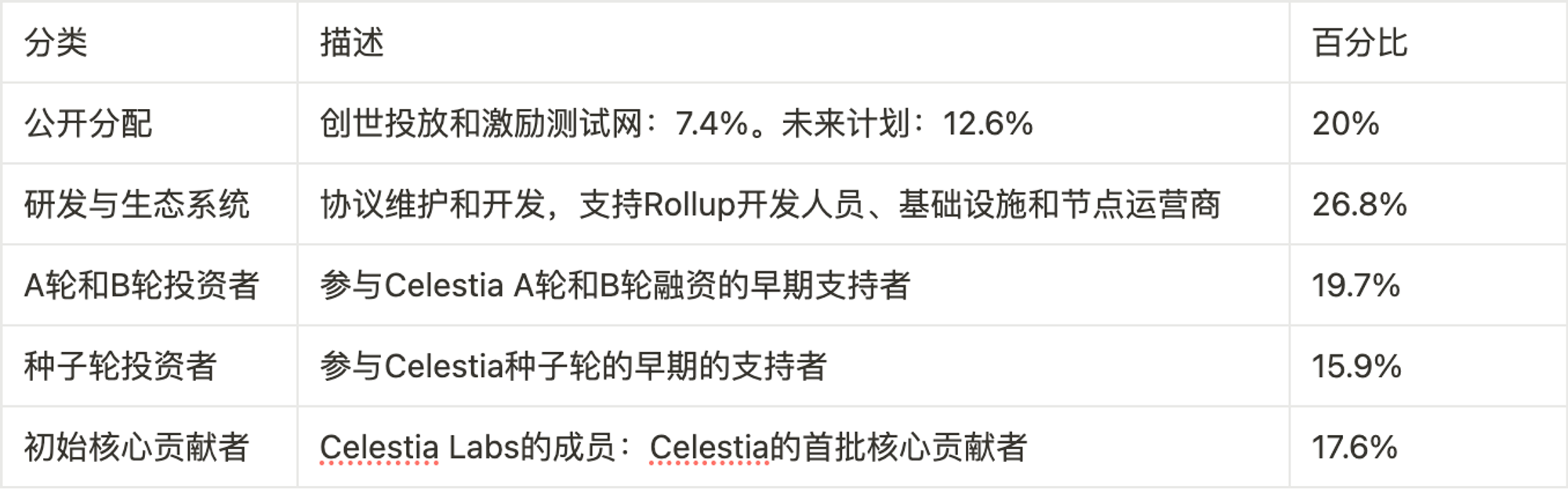

Inflation Schedule: Starts at 8%, decreasing by 10% annually until reaching a minimum of 1.5% per year.

source:https://docs.celestia.org/learn/staking-governance-supply

TIA Token Utility

-

Paying for Data Space: Developers submit PayForBlobs transactions on Celestia using TIA to pay for data availability services.

-

Bootstrapping New Rollups: Developers can use TIA as gas and currency to launch new blockchains, similar to ETH in Ethereum-based rollups. This helps focus development on application or execution layers without immediately issuing new tokens.

-

Proof-of-Stake: Built on Cosmos SDK, Celestia uses PoS for consensus security. Users can delegate TIA to validators and earn a portion of staking rewards.

-

Decentralized Governance: TIA holders participate in governance, voting on network parameters and managing the community pool, which receives 2% of block rewards.

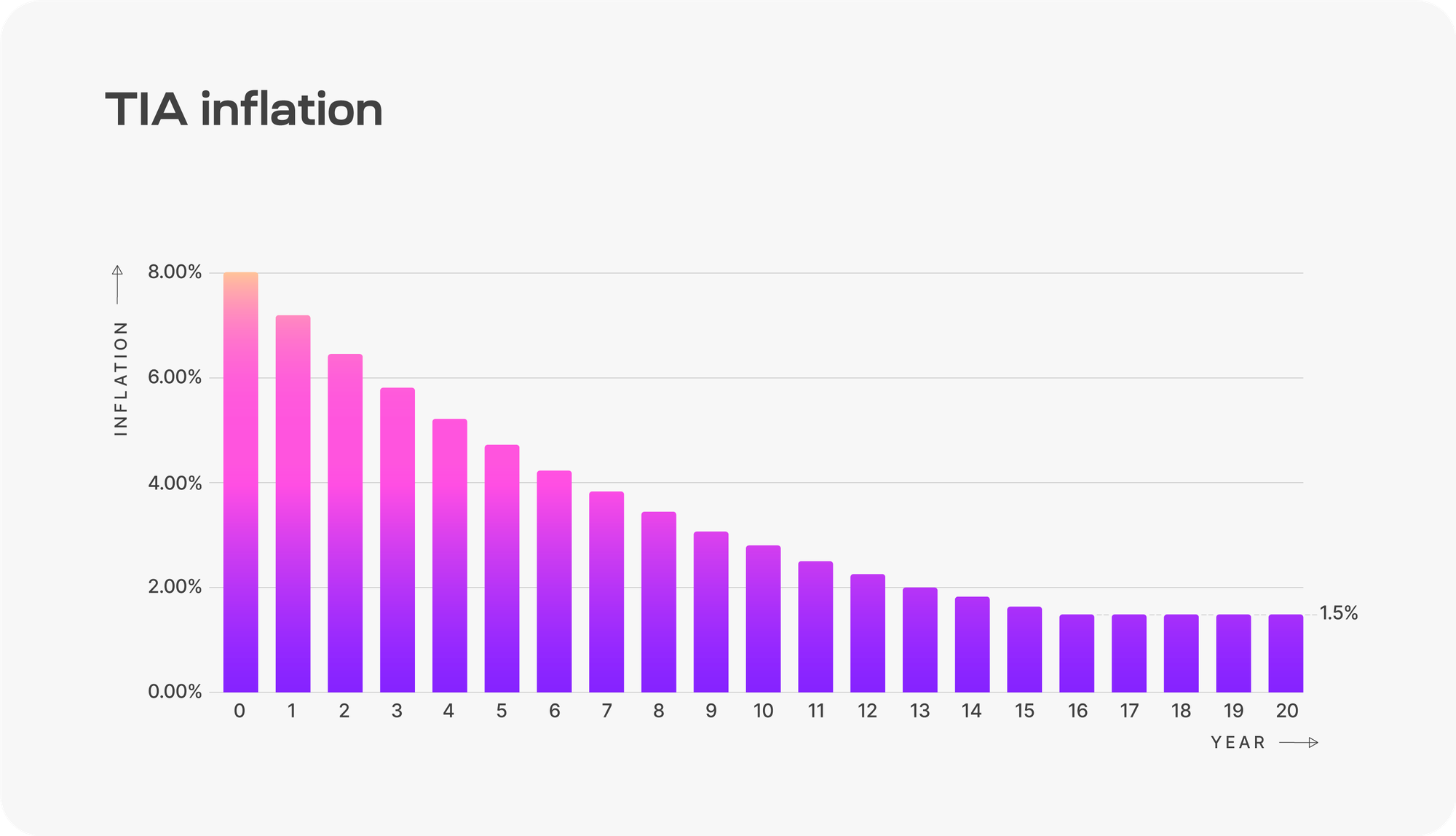

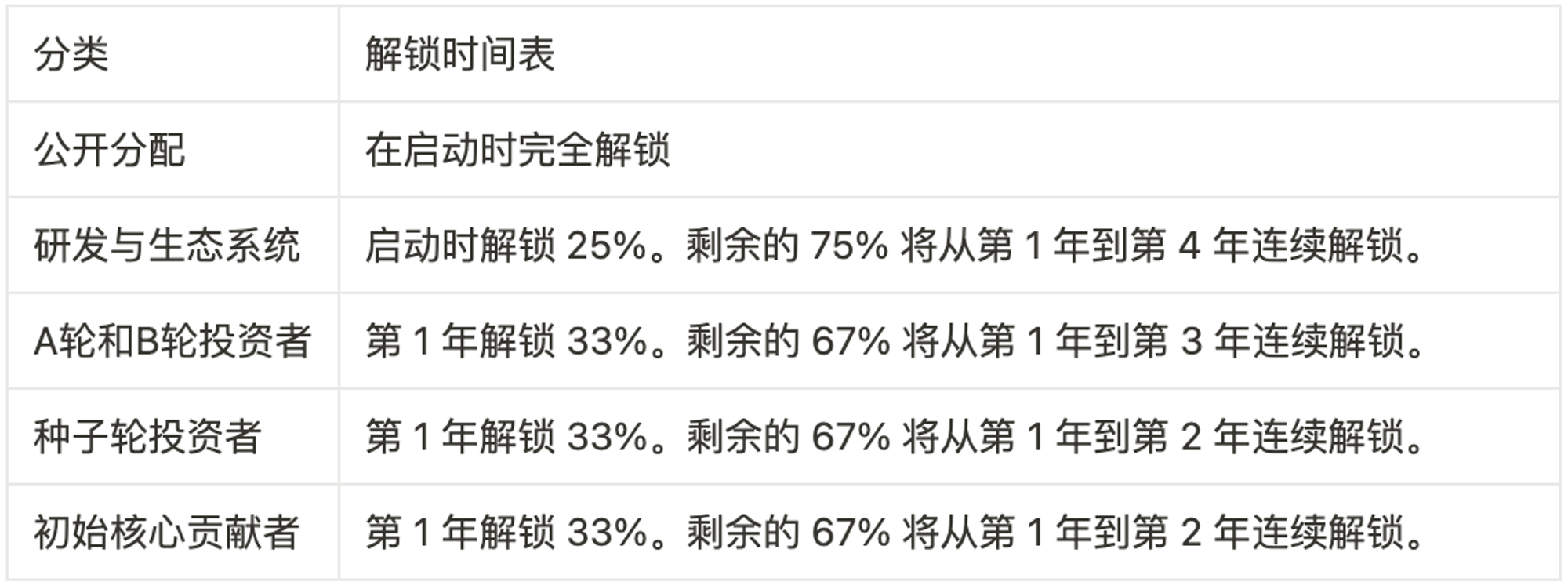

Token Unlock Schedule

source:https://docs.celestia.org/learn/staking-governance-supply

Staking Status

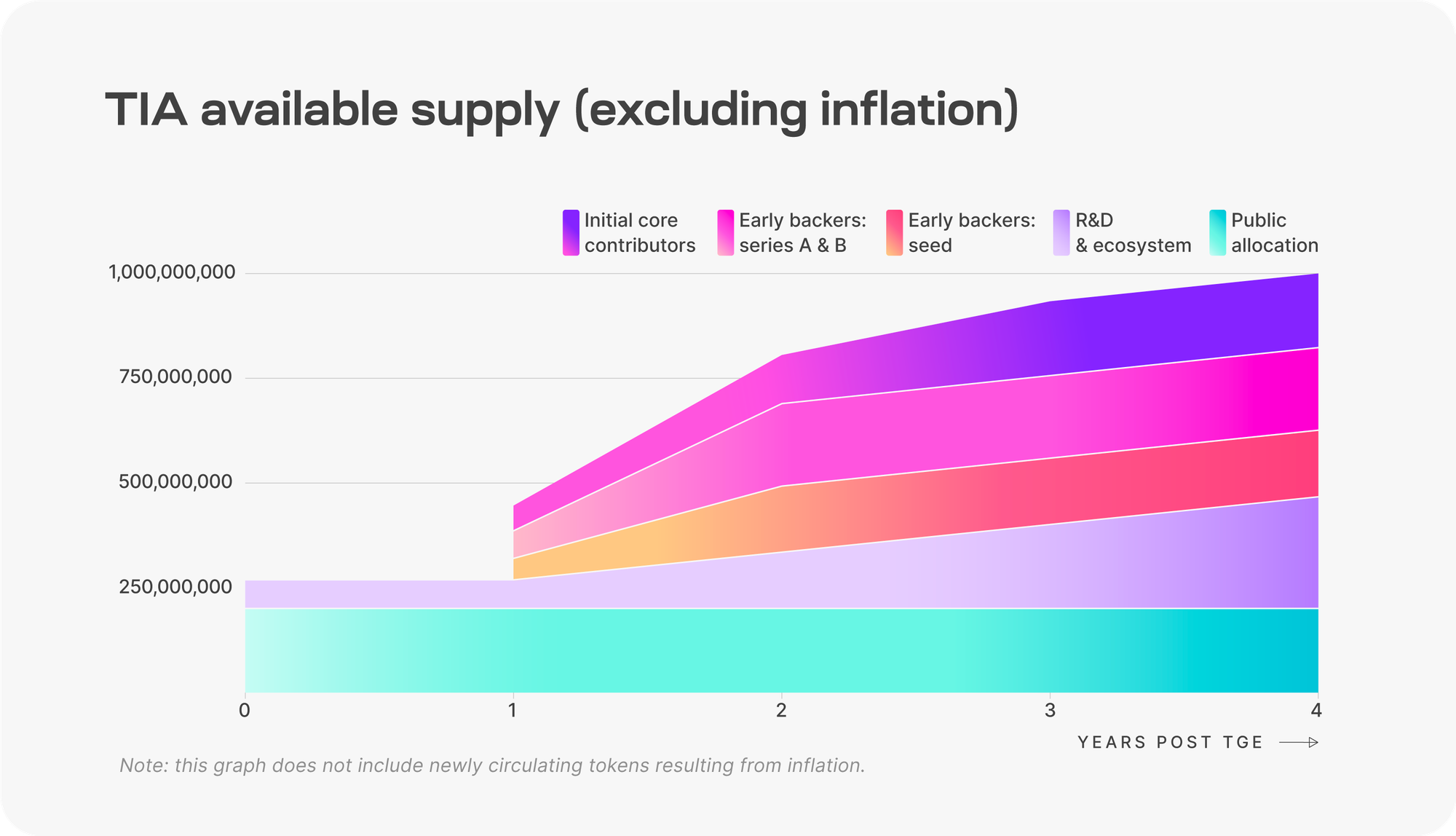

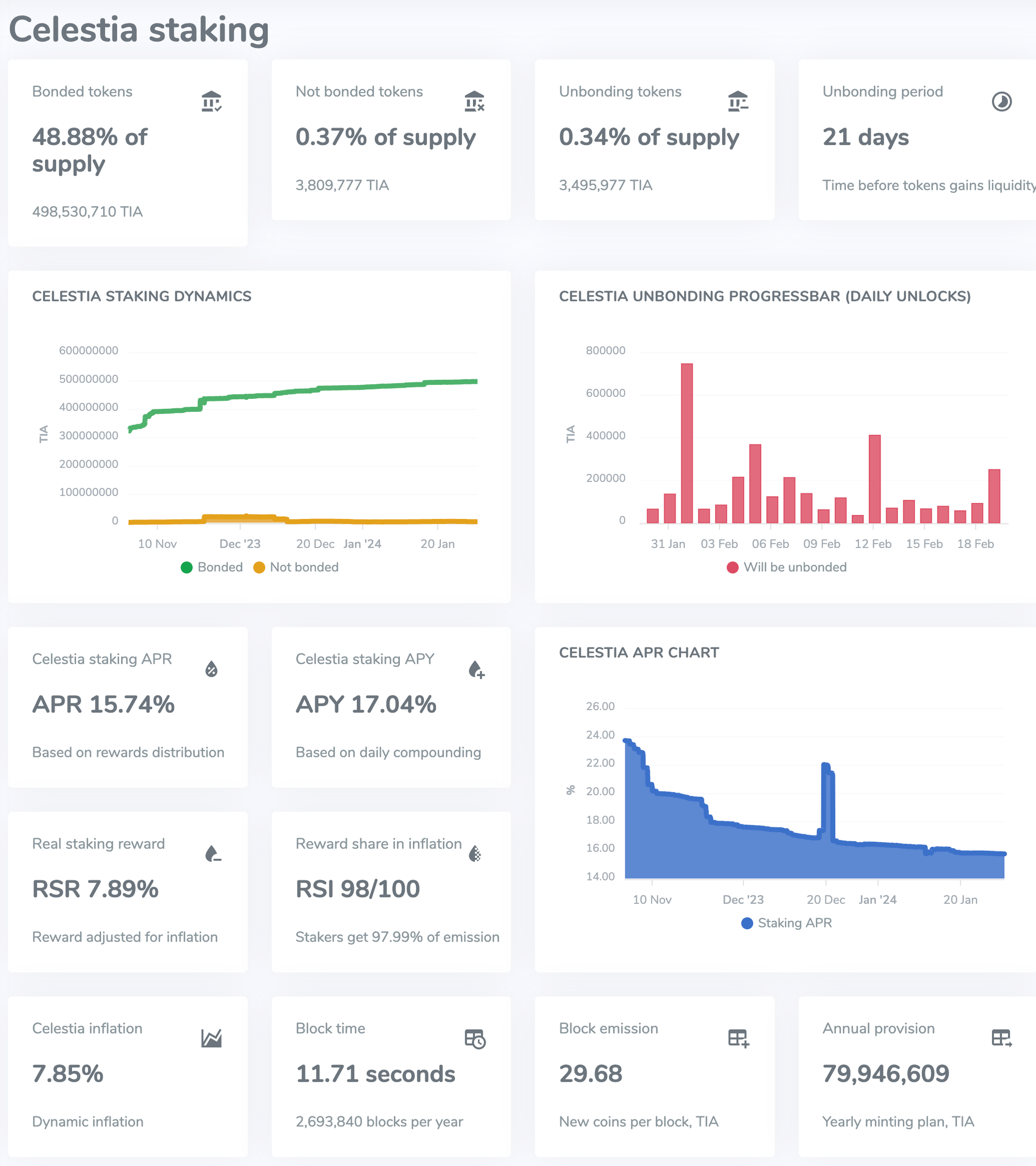

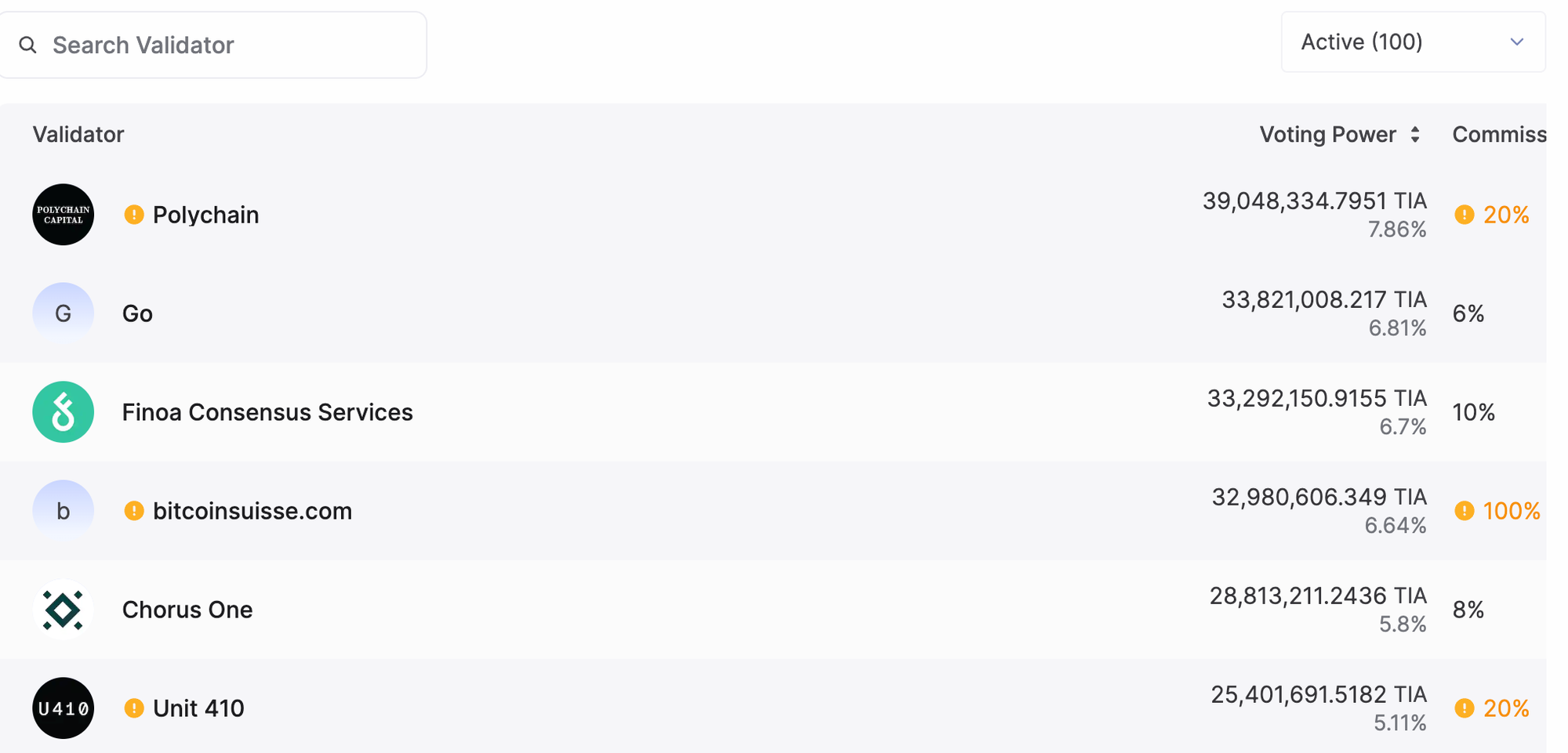

Celestia currently has a staking rate of 48.88% and a staking APR of 15.74%.

source:https://staking-explorer.com/staking/celestia

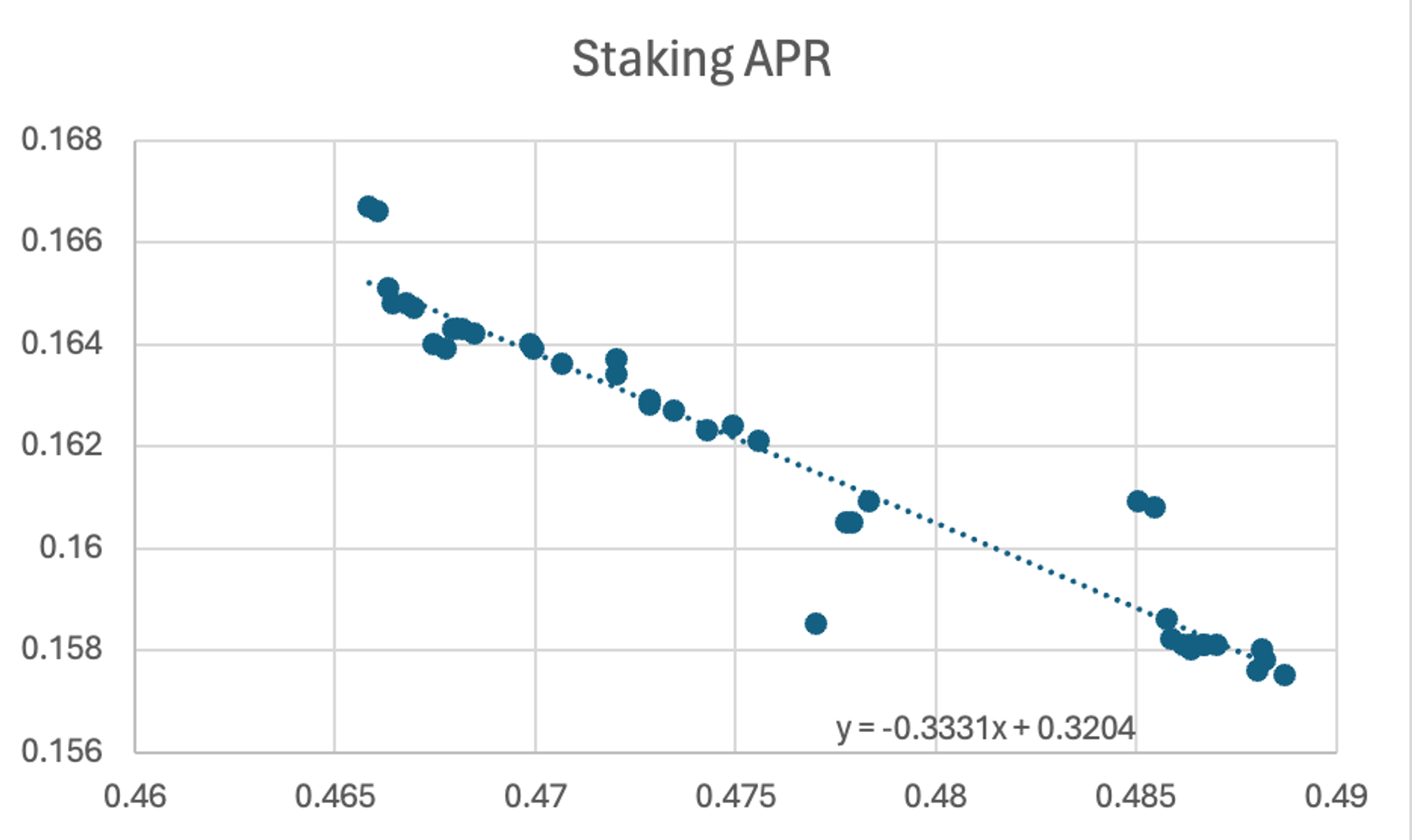

Based on the current relationship between staking APR and staking rate, the following linear relationship was fitted:

Staking APR = -0.3331 × Staking Rate + 0.3204

source: MT Capital

Given that Celestia’s minimum staking APR equals its inflation rate of 7.85%, the ideal staking rate cap is calculated at 72.6%.

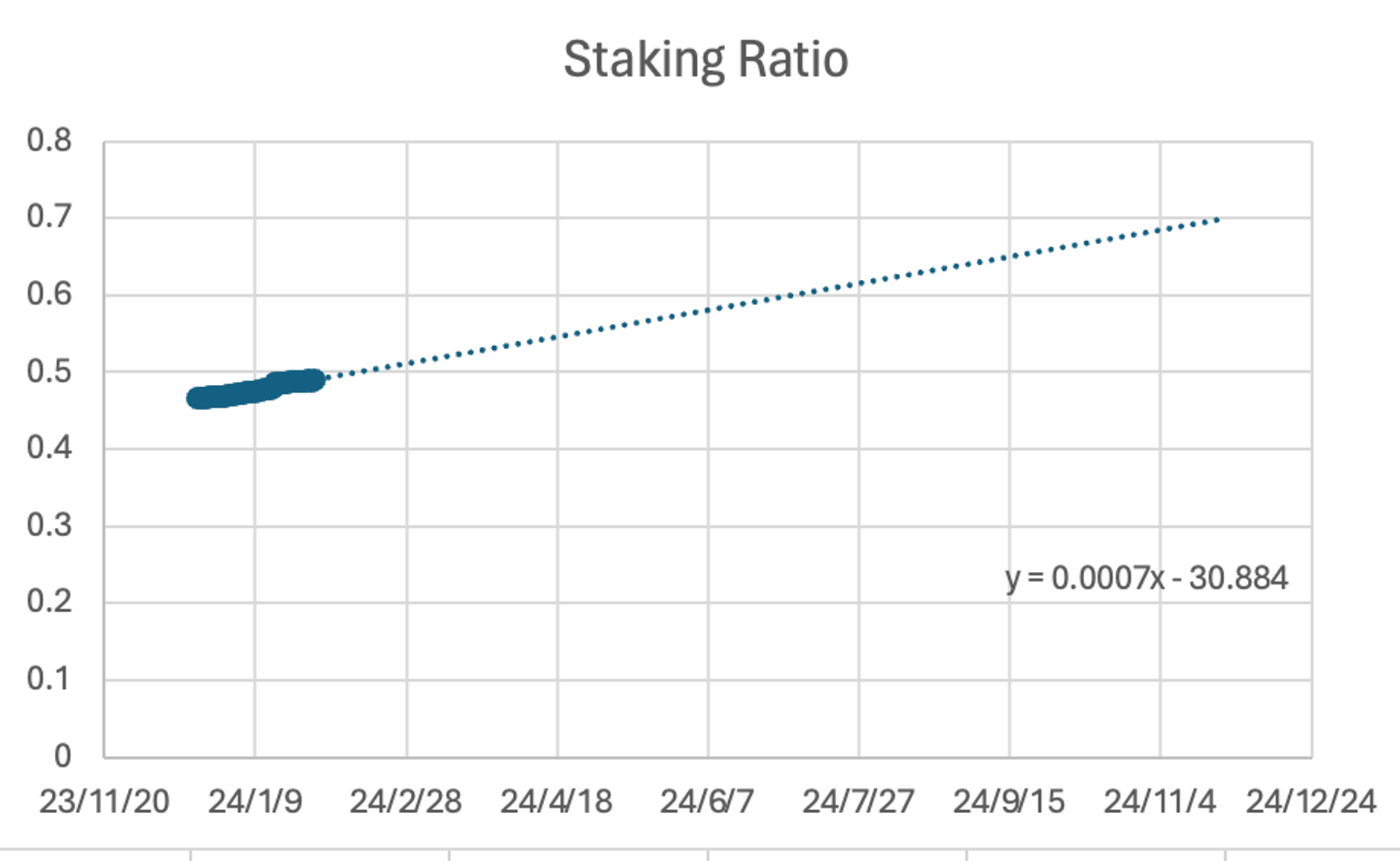

Fitting staking rate data over time suggests this limit will be reached around the end of 2024.

source: MT Capital

Additionally, since there will be no new token unlocks before November 2024, we believe Celestia’s actual circulating supply will continue to shrink until then, leading us to maintain a bullish outlook on Celestia’s token price during this period.

Currently, Celestia has 100 active nodes.

source:https://wallet.keplr.app/chains/celestia

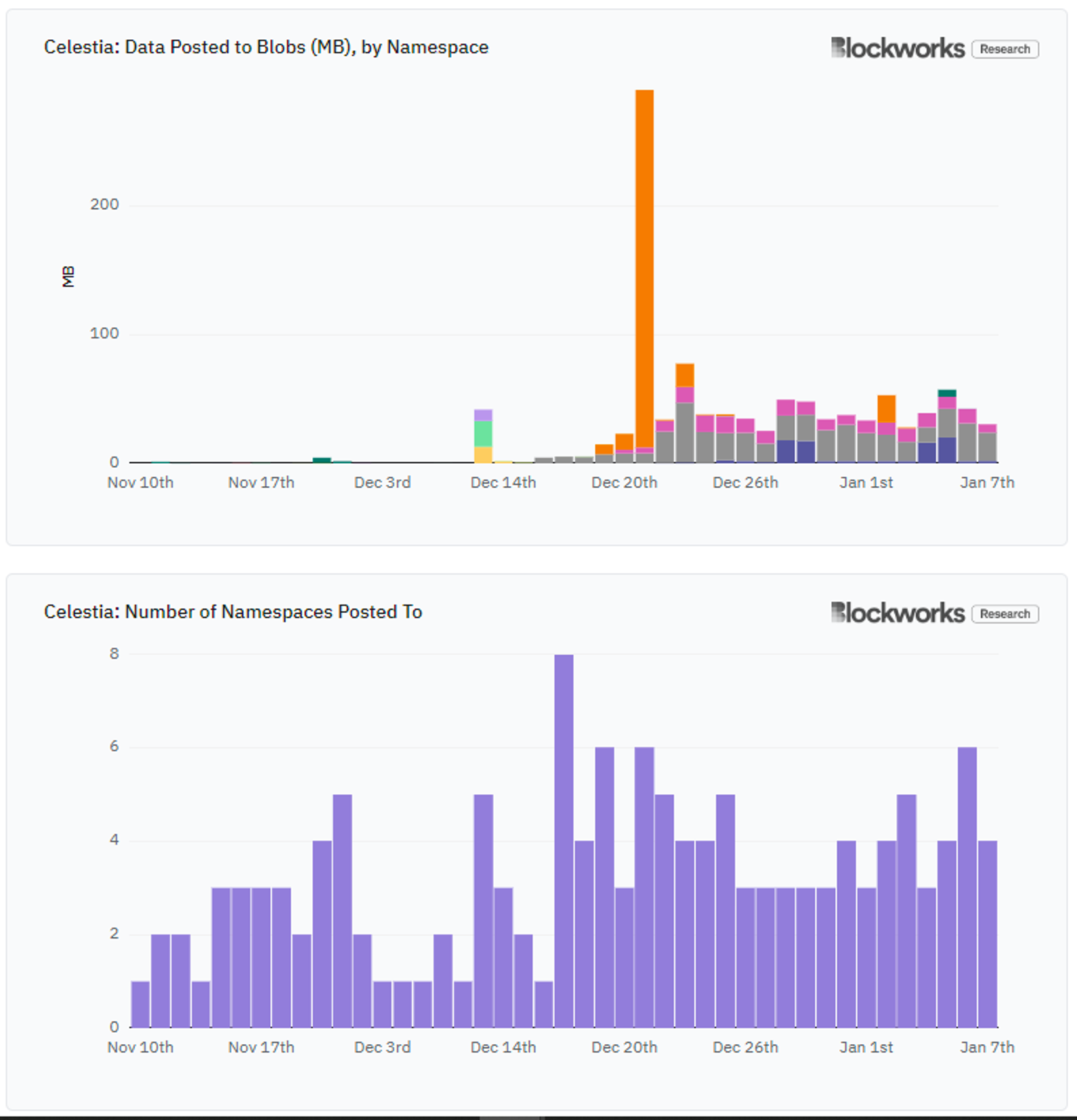

Compared to Ethereum mainnet, Celestia reduces data costs by 99.9%. Users can publish data into blobs with namespaces and access data by filtering specific namespaces. Over two months of operation, users have published large amounts of data into various namespaces, though 87% is concentrated in just three primary ones.

source:https://twitter.com/smyyguy/status/1744419436449222864

Celestia currently utilizes only 0.1% of its daily data capacity, far below its maximum capacity of 46,080 MB per day. Nonetheless, activity continues to grow compared to Ethereum’s current 15 rollups processing about 700 MB daily.

Currently, Celestia fees remain relatively low, but could increase significantly with higher data usage. If Celestia achieves full daily capacity of 46,080 MB at a TIA price of $13, annual revenue could reach ~$5.2 million—65 times higher than current Ethereum data fees. Such fee structures may trigger bidding wars among users, further driving up costs.

Future demand may come from high-TPS general-purpose chains, specialized applications, or games. While exact sources are uncertain, gaming and high-TPS rollups are likely key drivers. In the coming months, we expect a surge of new chains leveraging Celestia’s RaaS.

source:https://twitter.com/smyyguy/status/1744419436449222864

A New Valuation Model for Celestia

Considering Celestia as the first modular public chain DA layer, and given the generous airdrops from the Cosmos community to Celestia stakers (such as Dymension already covering staking costs), many upcoming modular blockchain-related projects are expected to airdrop to Celestia stakers. This leads to the following valuation framework:

Price(TIA) = Value accrual from DA layer + Monetary premium of TIA as "modular money" + Value of all future airdrops

Celestia Ecosystem Projects

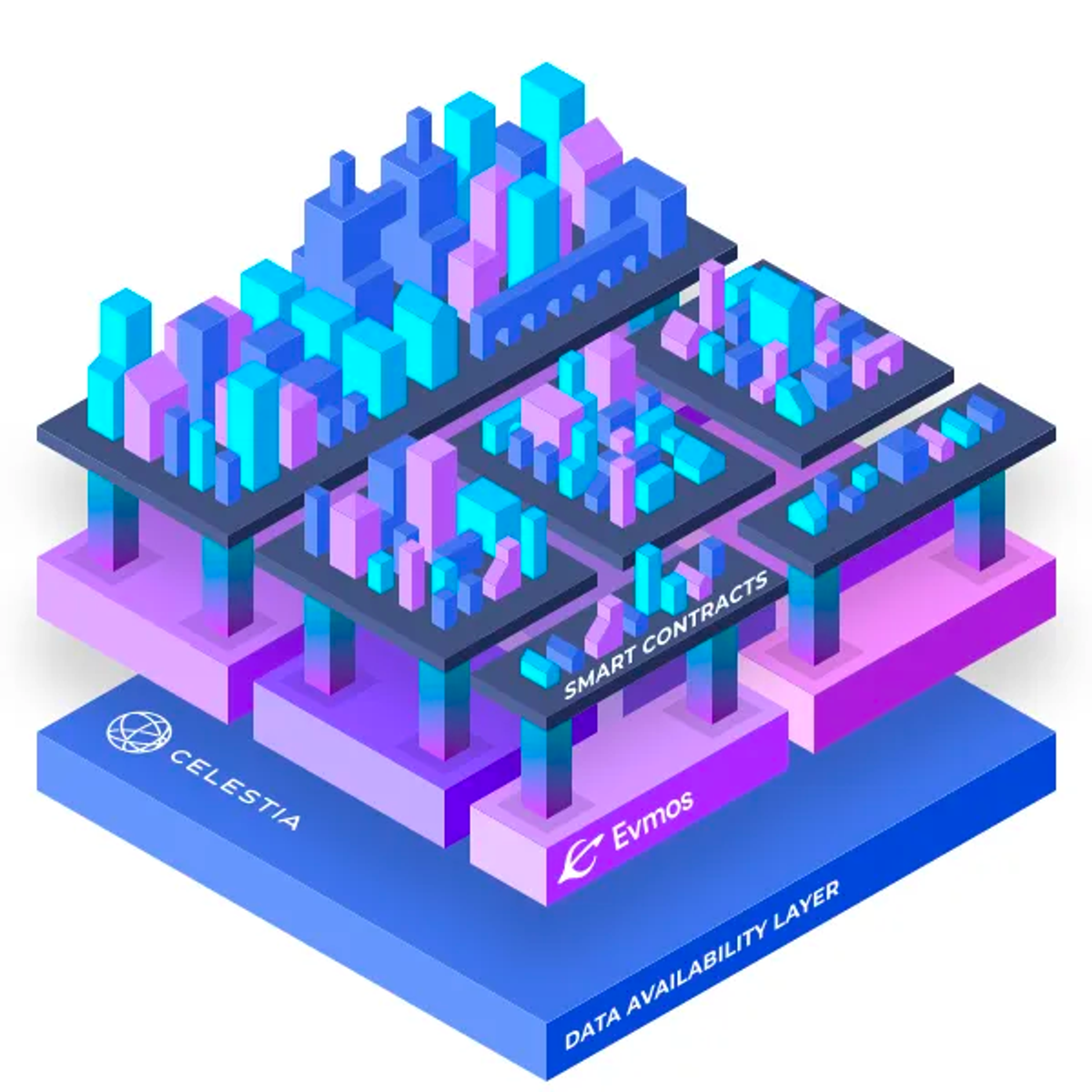

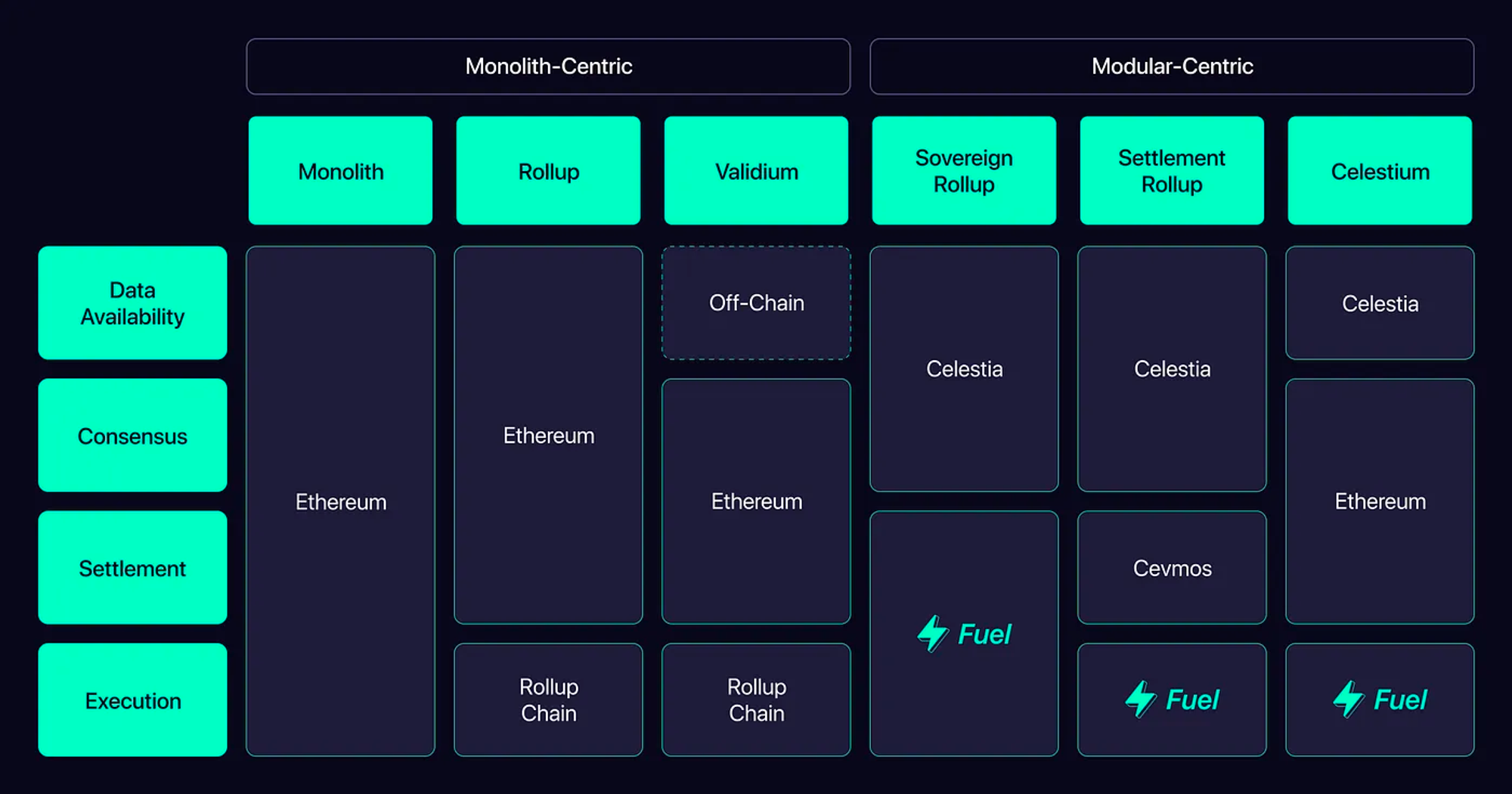

Cevmos

Cevmos is a rollup stack jointly developed by Cosmos EVM chain Evmos and Celestia, aiming to provide an optimal settlement layer for EVM-based rollups on Celestia. The name combines elements from Celestia, Evmos, and Cosmos. Cevmos aims to offer a dedicated settlement layer to reduce costs and improve efficiency as part of a forced settlement rollup scheme. Built on Evmos, Cevmos implements recursive EVM rollups on top. Unlike existing Tendermint Core consensus engines in Cosmos, Cevmos adopts Optimint (Optimistic Tendermint), an alternative to Tendermint BFT that allows developers to leverage existing consensus and data availability (e.g., Celestia) for rollup deployment. Since Cevmos itself is a rollup, all rollups built on it are collectively referred to as settlement rollups. Each connects via minimal bidirectional trust bridges, enabling redeployment of existing Ethereum rollup contracts and apps with reduced migration effort. All rollups use calldata on the Cevmos rollup, which batches data via Optimint and posts it to Celestia.

As a constrained EVM environment, the Cevmos rollup also experiments with single-round fraud proofs for challenges. By avoiding complex consensus design and maintenance, Cevmos brings rollup efficiency and EVM interoperability to the entire Cosmos ecosystem, offering a practical modular solution for broader adoption.

Dymension

Dymension is a Cosmos-based sovereign rollup platform designed to dramatically simplify the development of application-specific custom rollups (called rollApps) through its Dymension Chain (settlement layer), RDK (RollApp Development Kit), and IRC (inter-rollup communication) capabilities.

Dymension builds its own settlement layer, the Dymension hub—a PoS chain using the Tendermint Core state replication model. RollApps built on the Dymension hub inherit the hub’s security and achieve inter-app communication via the RDK and dedicated modules supported by the hub.

RollApps consist of two key components: client and server. The server side handles custom business logic and pre-packaged RDK modules for RollApp development. The client component, dymint, derived from Celestia’s Optimint, serves as a direct replacement for Tendermint, responsible for block production, peer-to-peer message propagation, and inter-layer communication. Since RollApps offload consensus, dymint delivers low-latency performance suitable for modern applications.

Like Cosmos, Dymension RollApps aim to create application-specific blockchains to minimize consensus overhead. The RDK adds new modules and modifies existing ones atop the Cosmos-SDK to ensure compatibility with the Dymension protocol while remaining compatible with other Cosmos ecosystem tools. RollApps can interact with any IBC-enabled chain via the Dymension Hub, integrating them into the broader Cosmos ecosystem.

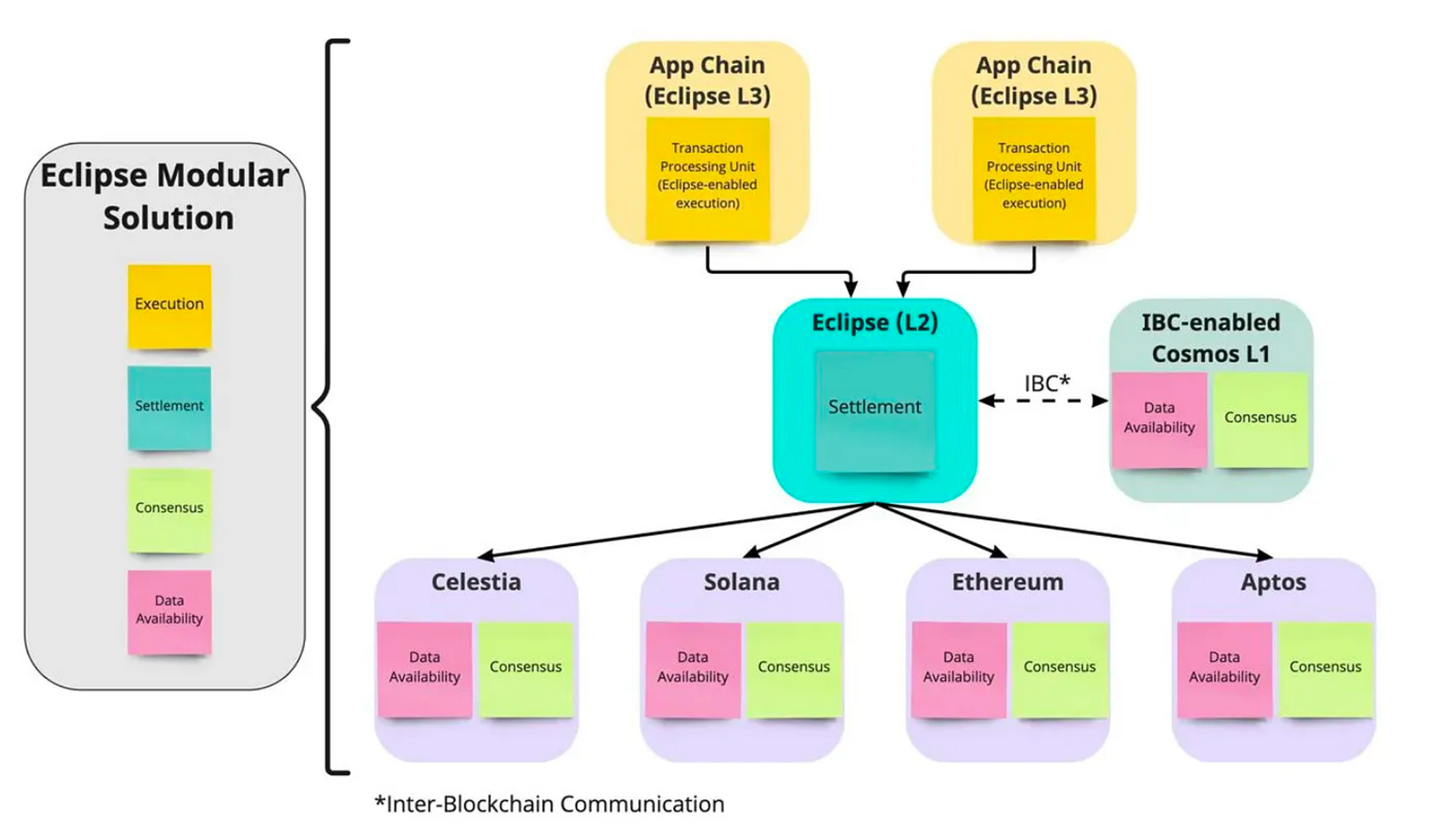

Eclipse

Eclipse is a sovereign rollup project within the Cosmos ecosystem, uniquely enabling customizable modular rollup settlement layers using Solana VM on any chain. Initially, Eclipse plans to use Celestia for consensus and data availability (DA), while adopting Solana VM for execution and settlement. Its ultimate goal is to provide customized rollup execution layers for heterogeneous Layer 1 blockchains, connecting diverse chains through modular approaches. Additionally, Eclipse intends to evolve its Solana VM-based settlement rollups into Optimistic and zk rollups, expanding functionality and applicability.

Fuel

Fuel shares similarities with Celestia but has distinct differences. While Celestia focuses on optimizing data availability and consensus for data ordering, Fuel positions itself as a modular execution layer.

A key distinction is Fuel’s entirely new virtual machine architecture—FuelVM—alongside the Sway language and toolchain. FuelVM is a custom VM designed specifically for smart contract execution, capable of parallel transaction processing and inherently fraud-resistant, ideal for Optimistic rollup execution layers.

FuelVM integrates features from WASM, EVM, and Solana’s Sealevel, but uniquely adopts a UTXO model instead of an account model. This requires every transaction to explicitly specify the UTXOs it accesses. Because the execution engine precisely identifies affected states, it can easily identify and process non-conflicting transactions in parallel. This design makes FuelVM more efficient and secure in transaction processing.

Celestia Summary and Future Outlook

As the first modular DA network, Celestia specializes in secure scaling alongside user growth. Its modular design simplifies launching independent blockchains. Core technologies include Data Availability Sampling (DAS) and Namespaced Merkle Trees (NMTs)—the former allows light nodes to verify data without downloading full blocks, while the latter enables apps to process only relevant data, drastically reducing data handling needs.

Based on current staking rates and APR relationships, Celestia will see no new unlocks before November 2024. Given ongoing staking trends, the staking rate is expected to keep rising, while the actual circulating supply continues shrinking—suggesting sustained upward pressure on token price. Moreover, Celestia reduces data costs by 99.9% compared to Ethereum mainnet, with current daily usage at just 0.1% of its 46,080 MB/day capacity, revealing vast expansion potential.

TIA’s value extends beyond blockchain innovation to include potential airdrop value. As blockchain technology and modular chains gain wider adoption, Celestia and its TIA token may demonstrate even greater potential and value.

Within the Celestia ecosystem, innovative projects like Cevmos, Dymension, Eclipse, and Fuel leverage Celestia’s modularity to deliver tailored solutions for specific applications, highlighting Celestia’s significance and growth potential in the blockchain space.

Given its unique approach and technical innovations, Celestia is well-positioned to play a pivotal role in the blockchain industry. Its focus on solving the blockchain trilemma—particularly scalability—without compromising security or decentralization makes it a key player in the evolving blockchain ecosystem.

EigenDA

EigenDA Overview

EigenDA is the first AVS product under EigenLayer. Leveraging Ethereum’s security, EigenDA enables restaked nodes to serve as EigenDA validators, allowing rollups to post data to EigenDA for lower-cost, higher-throughput data availability services.

EigenDA Technical Architecture

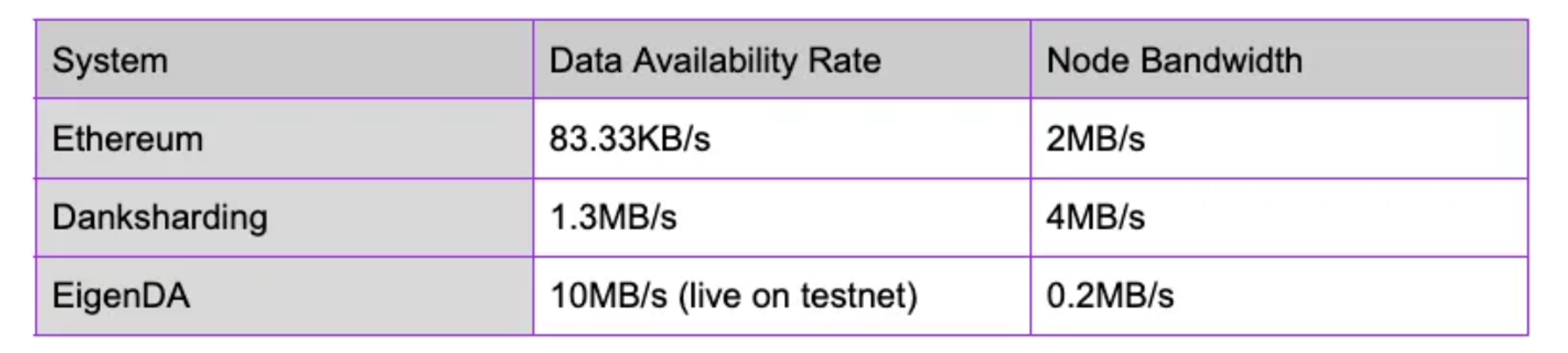

EigenDA closely follows Ethereum’s final scalability path via Danksharding, meaning its DA layer technology aligns closely with Ethereum’s Danksharding roadmap. Furthermore, EigenDA’s adoption of erasure coding, KZG commitments, ACeD (Authenticated Coded Dispersal), and decoupling DA from consensus enables superior performance over Ethereum’s native DA solution in transaction throughput, node load, and DA cost.

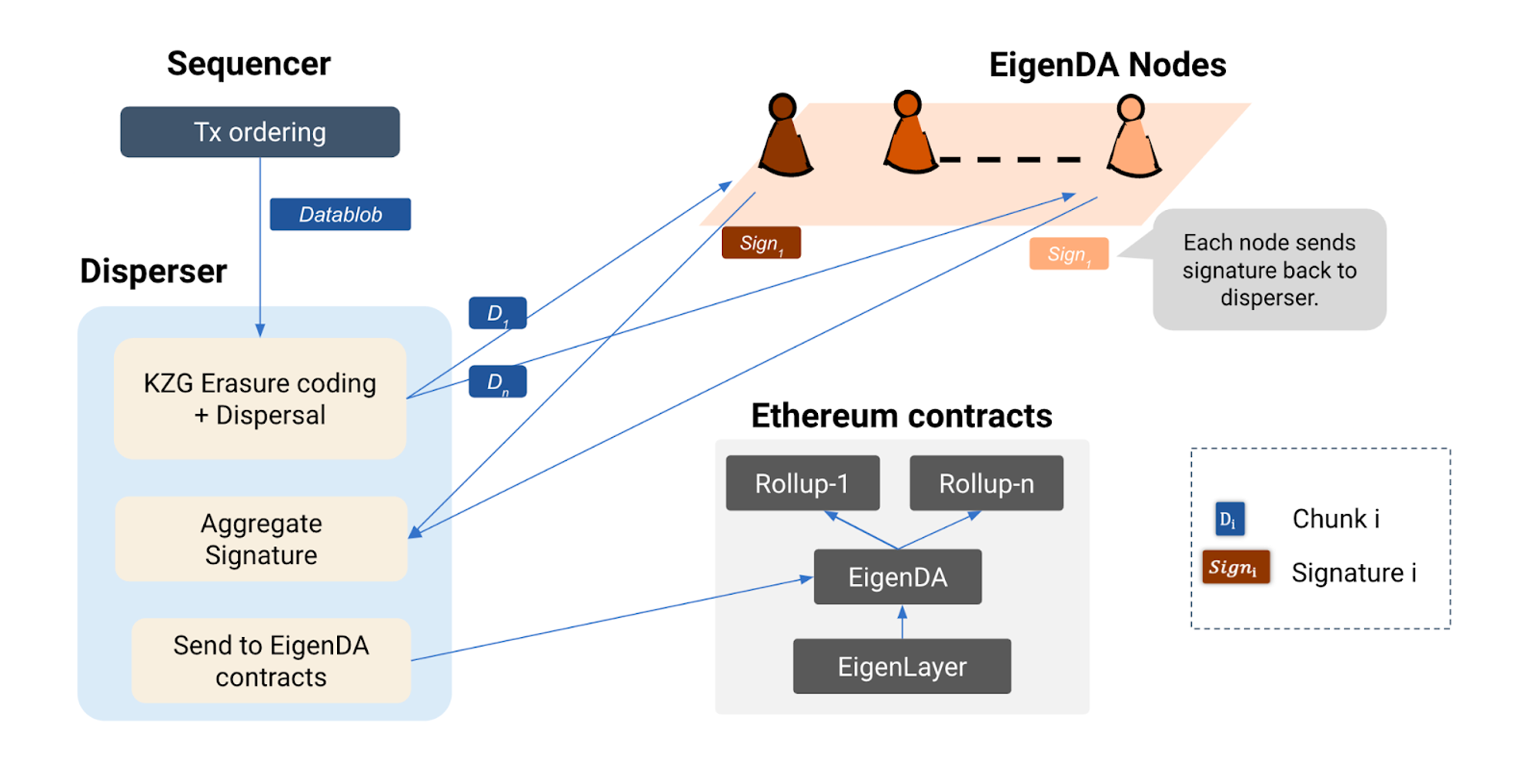

The specific implementation flow of EigenDA is as follows:

-

First, after the rollup sequencer creates a data blob, it sends a request to the Disperser to split the blob. (The Disperser can be operated by the rollup itself or a third party like EigenLabs.)

-

Next, upon receiving the data blob, the Disperser splits it into smaller chunks, uses erasure coding to generate redundant data blocks, and computes corresponding KZG commitments and KZG multi-reveal proofs.

-

Then, the Disperser distributes the data chunks, KZG commitments, and KZG multi-reveal proofs to different EigenDA nodes (Ethereum restakers registered as EigenDA nodes). Each EigenDA node must use the KZG multi-reveal proofs and KZG commitments to verify data chunk validity. Upon successful verification, the node stores the data and sends a signature back to the Disperser.

-

Finally, the Disperser aggregates the signatures and submits them to the EigenDA contract on Ethereum mainnet. The signatures are further validated within the contract—once confirmed, the process completes.

source:https://www.blog.eigenlayer.xyz/intro-to-eigenda-hyperscale-data-availability-for-rollups/

Similar to other DA solutions, EigenDA’s core idea is using DAS to reduce individual node storage and verification load while increasing global DA consensus throughput, relying on erasure-coded redundancy for data security. However, EigenDA differs in its technical choices—adopting KZG commitment verification aligned with Ethereum’s upgrade path. Additionally, EigenDA does not rely on consensus protocols or P2P networks but uses unicast to further accelerate consensus speed.

Moreover, EigenDA includes more refined designs for ensuring node data storage and validation.

EigenDA ensures nodes genuinely store data via Proof of Custody. Each EigenDA node must periodically compute and submit a function value that can only be derived by storing the corresponding data chunk. Nodes failing Proof of Custody face ETH slashing penalties.

EigenDA employs Dual Quorum to further enhance DA consensus validity. There are at least two independent quorums proving data availability—one composed of ETH restakers, another of rollup-native token stakers. Only when both quorums independently validate the DA is it considered valid.

EigenDA Feature Analysis

To better distinguish EigenDA from Ethereum DA and other DA solutions, we compare them separately.

Compared to Ethereum DA, EigenDA:

-

EigenDA nodes do not need to download or store all data—only small data chunks—significantly reducing node operational costs.

-

By decoupling DA from consensus, EigenDA nodes avoid waiting for serialized ordering processes and can process data availability proofs in parallel, greatly improving network efficiency. Combined with erasure coding and KZG commitments, nodes only download small data segments for storage and verification, enabling higher network throughput.

-

Since EigenDA inherits only a subset of Ethereum’s security, it is objectively less secure than Ethereum DA.

Compared to other DA solutions, EigenDA:

-

EigenDA nodes are a subset of the EigenLayer restaking network—joining requires no additional staking cost.

-

By decoupling DA from consensus and using unicast, data dissemination bypasses limitations of consensus protocols and P2P network throughput, drastically reducing communication latency, confirmation time, and accelerating data submission.

-

EigenDA inherits partial Ethereum security, generally offering higher security than other DA solutions.

-

EigenDA supports flexible configuration options for rollups—including choice of staking token models, erasure code ratios—providing greater flexibility.

-

Because EigenDA’s final confirmation depends on the EigenDA contract on Ethereum mainnet, its finality time overhead is significantly higher than other DA solutions.

Latest Developments and Use Cases of EigenDA

EigenDA launched its testnet in mid-November 2023. Initially, the number of testnet node operators was capped at 30, with a target throughput of 1 Mbps. EigenDA plans to gradually expand operator count to eventually approach a target throughput of 10 Mbps.

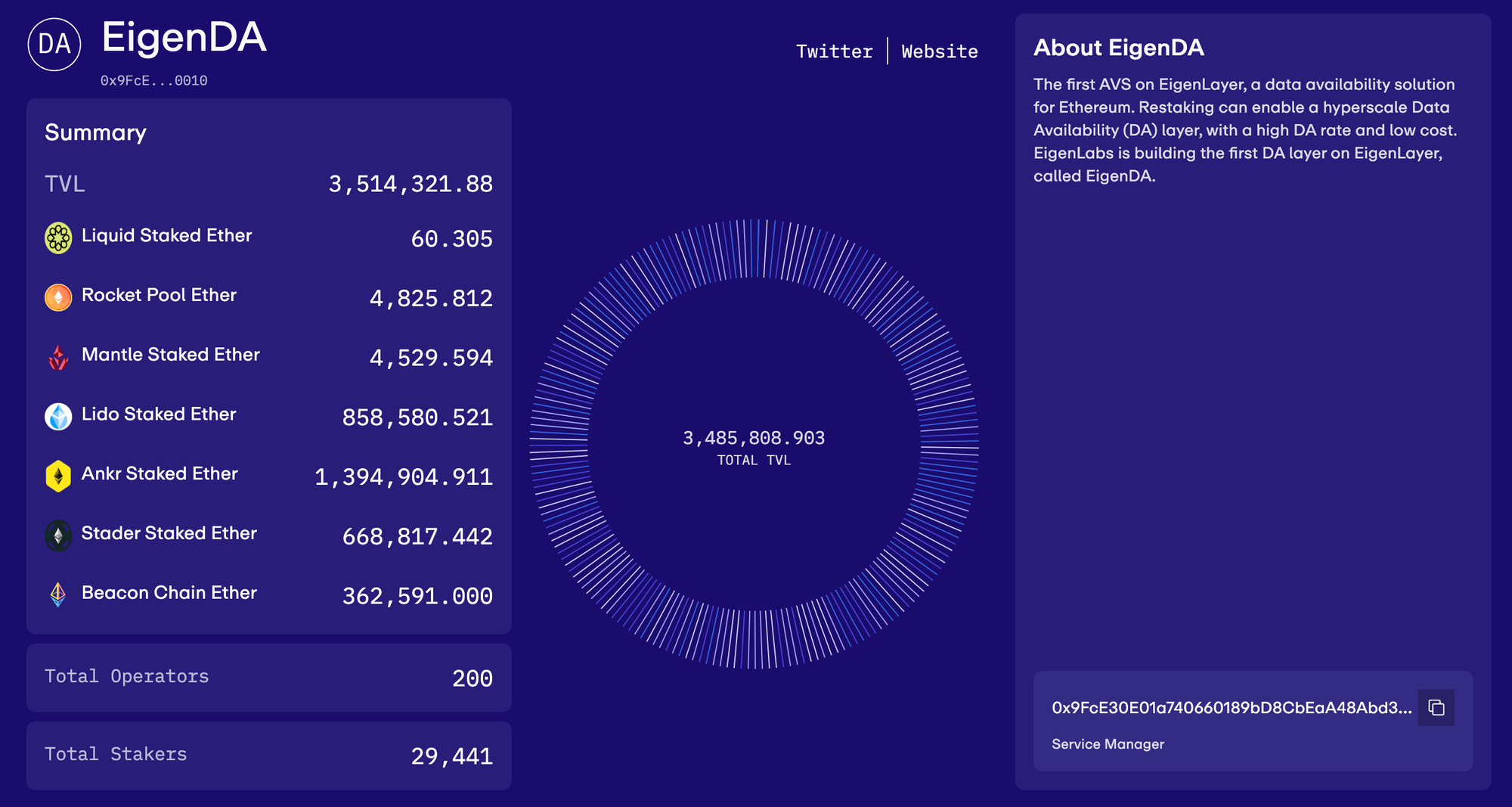

Currently, according to EigenDA testnet data, the number of node operators has grown to 200, but the average network throughput over the past seven days is only 0.45 Mbps, falling short of the initial 1 Mbps target.

source:https://blobs-goerli.eigenda.xyz/?duration=?P7D

Currently, the total TVL on the EigenDA testnet is approximately $3.5M, with Ankr, Lido, and Stader’s LST being the top three staked assets. The total number of node operators has reached 200, with 29.4k stakers.

source:https://goerli.eigenlayer.xyz/avs/eigenda

Although EigenDA remains in testnet phase, we can still draw preliminary comparisons between current testnet metrics and Ethereum data to gauge how far EigenDA is from its ultimate vision.

-

Security inheritance from Ethereum:

-

Current EigenDA testnet TVL is ~$3.5M, while Ethereum’s FDV is ~$264B. From an asset value perspective, EigenDA inherits only 0.001% of Ethereum’s security.

-

Current EigenDA testnet has 29.4k staking validator nodes, versus 904k on Ethereum. In terms of validator count, EigenDA inherits about 3.2% of Ethereum’s security.

-

-

Network throughput improvement:

-

Current EigenDA testnet throughput is ~0.45 Mbps, compared to ~0.083 Mbps on Ethereum. Although still far from the ideal range of 1–10 Mbps (and ultimately 1 Gbps), EigenDA already achieves roughly 5x higher throughput than Ethereum.

-

Currently, EigenDA has initiated a partner program, with eight projects—AltLayer, Caldera, Celo, Layer N, Mantle, Movement, Polymer Labs, and Versatus—already collaborating to adopt EigenDA’s data availability services.

Summary

EigenDA’s adoption of erasure coding, KZG commitments, ACeD, and decoupling DA from consensus enables superior performance over Ethereum’s DA solution in transaction throughput, node load, and DA cost. Compared to other DA solutions, EigenDA also offers advantages in lower setup and staking costs, faster network communication, quicker data submission, and greater flexibility. EigenDA is poised to absorb part of Ethereum’s DA workload and emerge as a strong new contender in the DA market.

Celestia vs. EigenDA: Comparison and Future Outlook

DA Comparison:

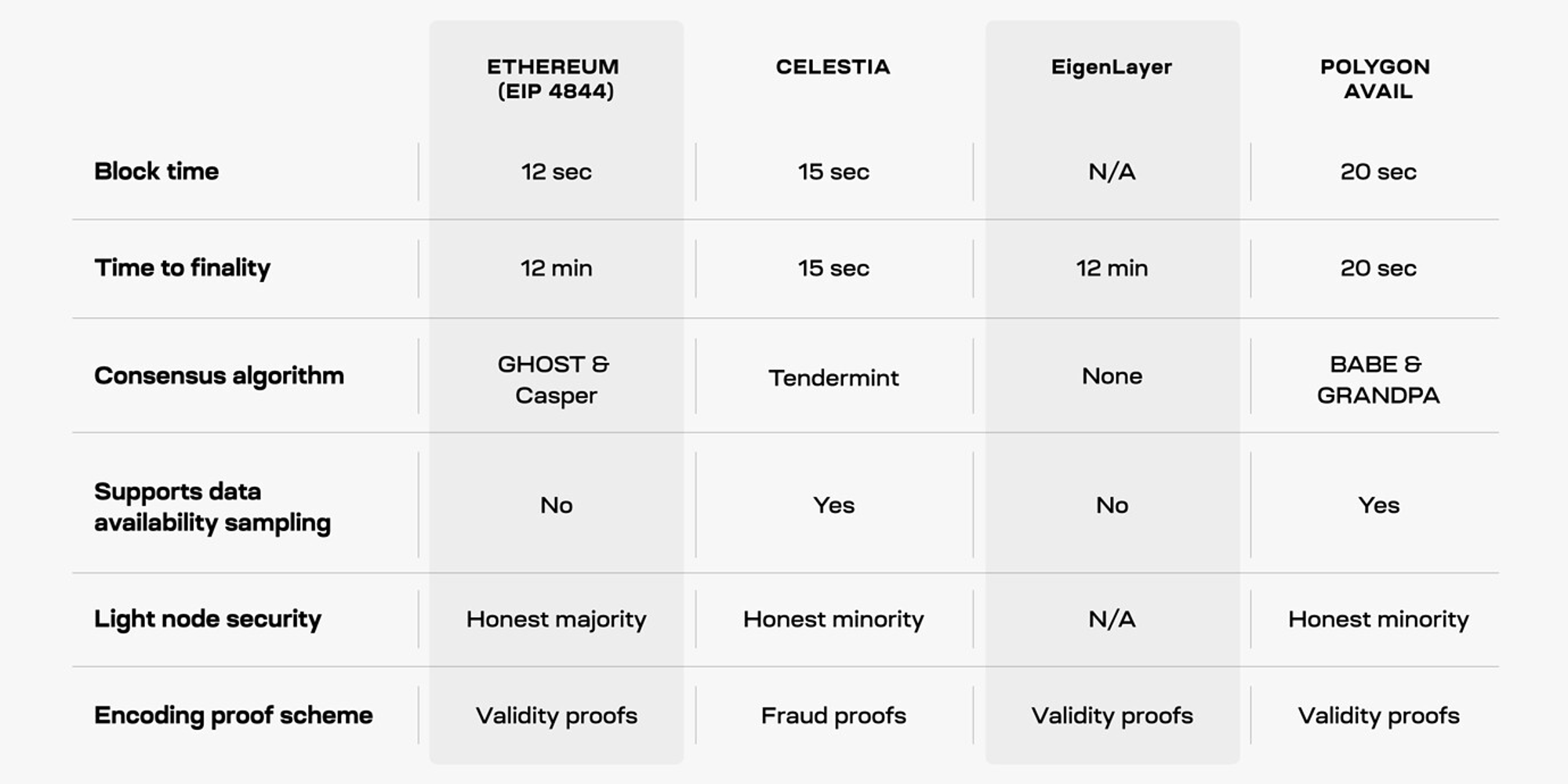

Data Availability Sampling:

Celestia supports data availability sampling, enabling light nodes to randomly sample and verify data chunks. EigenDA does not support DAS. Supporting DAS allows Celestia to securely increase block size through more light nodes, maintaining minimal node verification requirements without increasing node burden. Higher numbers of light nodes also improve network decentralization.

Encoding Proof Scheme:

Celestia uses fraud proofs to ensure correct original data encoding, while EigenDA uses KZG commitments for validity proofs. Fraud proofs have a lower deployment threshold and higher technological maturity, avoiding the extra cost of generating KZG commitments. However, EigenDA verifies data accuracy faster than Celestia because under fraud proof schemes, light nodes must wait briefly to receive fraud proofs from full nodes.

Consensus Mechanism:

Celestia uses the Tendermint consensus mechanism, requiring peer-to-peer network communication. EigenDA decouples DA from consensus and uses unicast, freeing data dissemination from consensus and P2P network throughput limits, resulting in faster communication and confirmation times.

However, EigenDA relies on the EigenDA contract on Ethereum mainnet for final validation and confirmation. As a result, Celestia achieves finality in just 15 seconds—significantly faster than EigenDA’s 12 minutes.

source:https://forum.celestia.org/t/a-comparison-between-da-layers/899

Node Load:

Since Celestia full nodes must handle broadcasting, consensus, and validation, they require 128MB/s download and 12.5MB/s upload bandwidth. In contrast, EigenDA nodes do not manage broadcasting or consensus, so their bandwidth requirement is very low—just 0.3MB/s.

Throughput:

Celestia’s data throughput is approximately 6.67 MB/s. EigenDA’s current testnet throughput is 0.45 MB/s, still short of its 1–10 MB/s target. At present, Celestia holds a clear advantage in throughput over EigenDA.

Setup Cost:

Celestia’s DA solution heavily relies on the security of its PoS network, so becoming a Celestia node requires staking sufficient TIA tokens. Thus, Celestia’s DA solution involves a certain setup cost.

EigenDA inherits security from Ethereum. Becoming an EigenDA node only requires registration as a restaker—no additional staking cost is needed, eliminating initial setup barriers.

Usage Cost:

Celestia currently charges Manta $3.41/MB for DA. Based on EigenDA testnet data, current usage cost is ~0.024 Gas/Byte. In comparison, Celestia’s DA solution still holds a massive cost advantage over EigenDA.

Security:

Celestia’s security is backed by its network value. The higher the network value, the more costly an attack becomes, reducing success probability. Currently, Celestia’s staked value is ~$1.2B, meaning attackers would need to spend over $0.8B to compromise the network.

EigenDA’s security is a subset of Ethereum’s. Its level depends on the value of restaked assets in the EigenDA network and the proportion of node operators on Ethereum mainnet. From a TVL perspective, based on testnet data, EigenDA inherits only 0.001% of Ethereum’s security. For EigenDA to exceed Celestia’s current security level, restaked asset value in EigenDA must surpass 0.45% of Ethereum’s total value. Currently in testnet phase with limited deposits enabled by EigenLayer, we expect a sharp increase in restaked asset value once EigenDA mainnet launches and EigenLayer fully opens up—potentially surpassing Celestia in network security.

Node count is another non-negligible factor in network security. Celestia currently has ~100 staking validator nodes, while EigenDA testnet has 200. From a node count standpoint, EigenDA already shows stronger security than Celestia.

source: MT Capital

While Celestia and EigenDA currently employ different approaches to data availability sampling and encoding proof schemes, as DAS and KZG technologies mature, their choices may converge. According to @sreeramkannan, EigenDA may consider introducing DAS in the future to support more light nodes. @likebeckett has also indicated that if KZG-based validity proofs become more appealing than fraud proofs, Celestia could change its encoding proof scheme. Therefore, future architectural differences in DA may not become core differentiators.

The most significant future differences are more likely to revolve around gaps in network security, usage cost, and throughput.

Future Outlook for DA:

Based on our earlier comparison of Celestia and EigenDA, network security, usage cost, and throughput are likely to become key decision factors for projects choosing between DA solutions. Additionally, EigenDA’s inherent Ethereum legitimacy remains a critical factor.

Regarding network security, although EigenDA testnet currently lags behind Celestia, we believe that with EigenDA mainnet launch, EigenLayer lifting deposit restrictions, and the anticipated explosion of restaking narratives in the second half of the year, the value of assets staked in EigenDA will grow exponentially, and node counts will significantly increase. Ultimately, EigenDA’s network security could far exceed Celestia’s. Projects with higher security requirements may thus favor EigenDA.

-

Currently, Ethereum’s FDV is ~$277B. Only 0.4% participation in EigenDA would surpass Celestia’s security—a clearly achievable target.

In terms of usage cost, Celestia currently offers significantly lower prices than EigenDA. Smaller L2s and appchains sensitive to profitability may prefer Celestia’s DA solution. The migrations of Lyra and Aevo to Celestia DA exemplify this trend. Profitability is a primary concern for every small-to-mid-sized L2. In early stages without a thriving ecosystem for revenue generation, cost control is the wisest strategy—blindly chasing Ethereum’s “brand premium” might hinder development. For appchains, lower costs free up capital allocation, enabling more flexible incentive programs for distribution, liquidity, and user engagement, guiding the growth of their value networks.

-

For example, migrating to Celestia reduces Aevo’s data availability costs by over 90%.

Regarding throughput, based on current Celestia data and EigenDA testnet figures, Celestia holds a clear advantage of over 10x. Higher-throughput Celestia naturally attracts performance-demanding appchains. Moreover, Celestia can flexibly increase block sizes based on real needs, offering appchains greater scalability and transaction throughput. That said, EigenDA testnet results are still indicative—EigenDA has occasionally achieved 6–8 MB/s performance. A fairer assessment awaits mainnet launch and sustained operations.

On Ethereum legitimacy, projects using EigenDA retain recognized Ethereum lineage. However, as modular concepts deepen, stigma against using Celestia DA is expected to fade, and the notion of Ethereum orthodoxy will blur amid the wave of countless L2s and appchains. In the short term, however, major Ethereum DeFi leaders and L2 giants are unlikely to migrate—their connection to Ethereum remains a core narrative.

In summary, Celestia’s extremely low DA costs and superior throughput make it highly attractive to small-to-medium L2s and appchains. Saving on expensive DA costs gives these chains more capital flexibility to allocate profits toward ecosystem and liquidity development. In contrast, EigenDA’s competitive edge lies primarily in inheriting Ethereum’s security and legitimacy. In the short to medium term, compared to expensive Ethereum DA, EigenDA may represent a more rational choice for larger L2s.

Therefore, after thorough comparison, we conclude that Celestia is better positioned to capture incremental market gains driven by the dual trends of modularization and appchains, while EigenDA is likely to capture more of the existing Ethereum ecosystem where higher security is required.

Currently, competition between Celestia DA and Ethereum-aligned DA solutions has become a focal point in market discussions. Beyond these, third-party DA solutions such as Near DA and Polygon Avail are also emerging. This article continues by examining these alternative DA players—Near DA and Polygon Avail—to explore other development paths in the DA landscape.

Near DA

Cost Efficiency

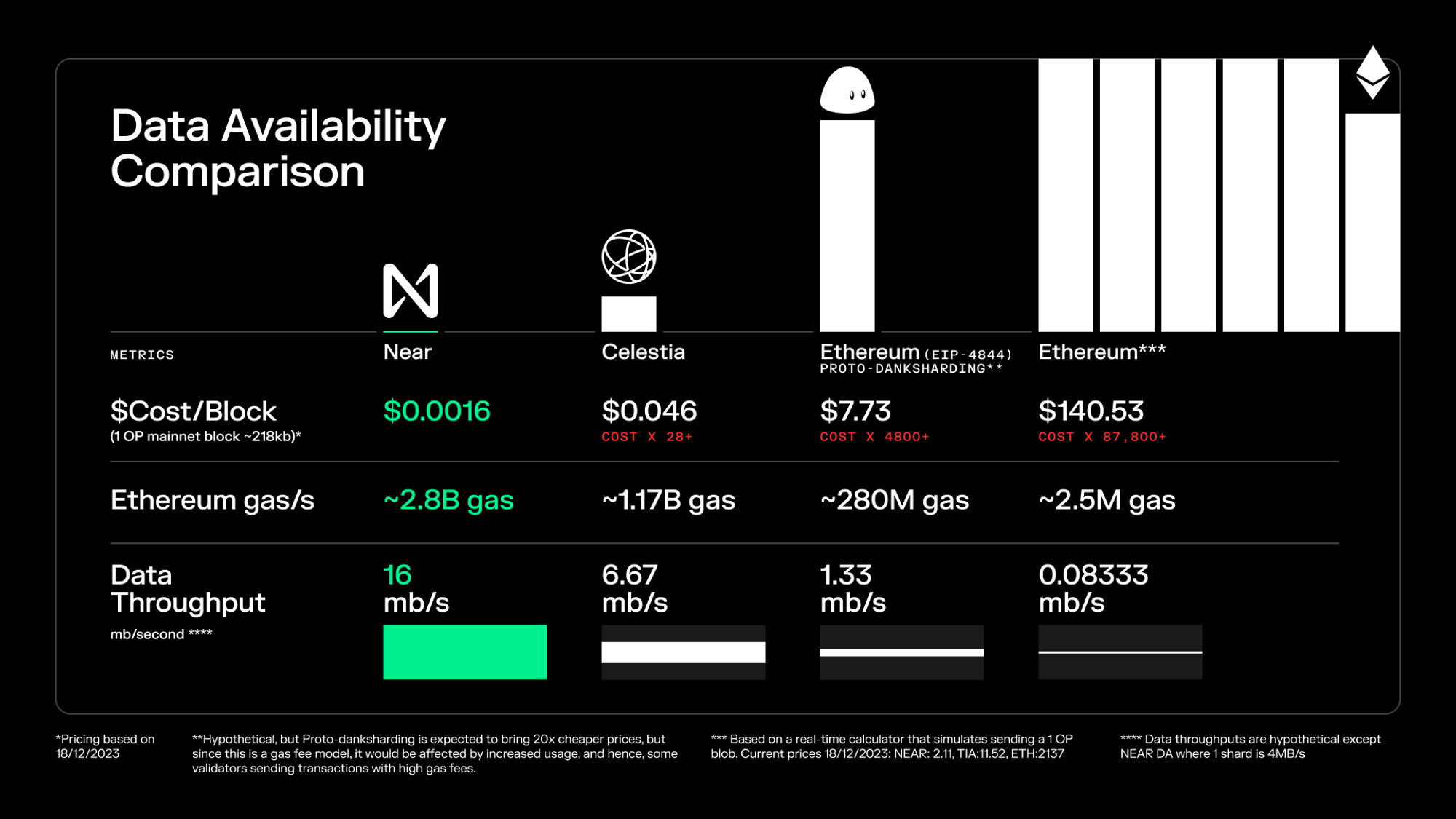

Using NEAR DA significantly reduces data storage and transmission costs. Publishing a block’s calldata on NEAR costs only $0.0016, compared to ~$7.73 for the same amount on Ethereum L1 (post-Cancun upgrade), indicating NEAR’s cost efficiency is ~5,000x higher.

source:https://near.org/data-availability

Technical Principles

The Blob Store contract is a key component on the NEAR blockchain, specifically designed to handle and store DA blobs. The Blob Store contract leverages NEAR’s consensus mechanism to store blobs—when a block producer processes data, consensus forms around that data.

Join TechFlow official community to stay tuned Telegram:https://t.me/TechFlowDaily X (Twitter):https://x.com/TechFlowPost X (Twitter) EN:https://x.com/BlockFlow_News