MIIX Capital Research Weekly: Signs of Recovery After Volatility

TechFlow Selected TechFlow Selected

MIIX Capital Research Weekly: Signs of Recovery After Volatility

Compared to last week, the number of cryptocurrency market investments and financings has grown significantly. In terms of细分领域, investment amounts this week were concentrated in the infrastructure sector.

By MIIX Capital

Last week, as BTC price fell below the $40,000 mark—a psychological support level for most investors—BTC spot ETF trading volume surged past $2 billion again, while GBTC saw over $640 million in outflows on the same trading day. Beneath this seemingly calm surface, deeper market liquidity and structural dynamics appear to be undergoing significant shifts.

Data suggests that Grayscale's selling pressure appears to be easing day by day—an encouraging signal interpreted by the industry as a potential relief to the downward trend. JPMorgan even stated in its latest report that the profit-taking wave from GBTC has largely ended, bringing a glimmer of warmth to the market during this crypto winter.

1. Funding & Investment Overview

During the week of January 22–28, there were 35 blockchain-related funding events globally, with total capital raised exceeding $260 million:

-

DeFi sector recorded 6 deals, including VETA Finance, an on-chain financial platform, raising $2.85 million in a strategic round led by Matrixport Ventures;

-

NFT and Metaverse sectors had 3 deals, including Singular, a cross-chain NFT lending protocol, securing a $3 million seed round led by IOBC Capital;

-

GameFi sector saw 5 investments, including 3thix, a Web3 gaming monetization platform, raising $8.5 million;

-

Infrastructure and tools attracted 12 deals, including Polymer Labs, a Layer 2 development company, raising $23 million in a Series A round led by Blockchain Capital, Maven11, and Distributed Global, with participation from Coinbase Ventures, Placeholder, Digital Money Group, North Island Ventures, and Figment Capital;

-

Other Web3 and crypto projects accounted for 5 deals, including Wield, a Farcaster ecosystem project, announcing on X that it raised over $1 million in a Pre-Seed round led by Lemniscap;

-

Centralized finance (CeFi) recorded 4 deals, including Sygnum, a cryptocurrency bank, raising over $40 million at a $900 million valuation.

Compared to last week, the number of crypto investment deals increased significantly, with infrastructure emerging as the dominant recipient of capital. There were six deals exceeding $10 million, involving ETH historical data protocol Axiom, AI-powered brand protection platform Doppel, Web3 digital identity service Root Protocol, crypto bank Sygnum, mining hardware manufacturer Canaan Inc., and CryptoSafe, focused on improving capital efficiency in crypto markets.

2. Industry Data

FTX Asset Liquidation and Easing Pressure from Grayscale

According to BitMEX Research, as of January 27, U.S. BTC spot ETFs recorded their 11th trading day, with Grayscale’s GBTC seeing outflows of $255.1 million and 6,000 BTC transferred out. Over these 11 trading days, total GBTC outflows have exceeded $5 billion.

Private data reviewed by CoinDesk and two informed sources indicate that a large portion of these outflows stemmed from FTX’s bankruptcy asset liquidation, which sold nearly $1 billion worth of shares (22 million shares), reducing FTX’s GBTC holdings to zero. Theoretically, since FTX has completed substantial sell-offs, this source of selling pressure may now ease, given that bankruptcy liquidations are relatively unique events.

Like many major crypto trading entities, FTX exploited the price difference between Grayscale trust shares and the underlying BTC net asset value within the fund. According to a document dated November 3, 2023, FTX held 22.3 million GBTC shares valued at $597 million as of October 25, 2023. Additionally, Bloomberg analyst James Seyffart tweeted that he expects GBTC outflow rates to remain above 20% but not exceed 35%, noting that current outflows stand at around 13%. Bloomberg’s Eric Balchunas previously stated that approximately 35% of the capital exiting GBTC may be flowing into the other nine Bitcoin spot ETFs, particularly retirement accounts, where tax implications are less of a concern.

ETH Options Volume Hits Record High

Data from The Block shows that as of January 26, Ethereum options trading volume across major crypto derivatives exchanges reached a record high of $17.9 billion. Combined with GreeksLive options data, approximately 932,000 ETH options expired at 3:00 AM Eastern Time on January 26. The put-to-call ratio for open interest stood at 0.31, while Deribit’s Ethereum put-to-call ratio dropped to 0.3 before expiration—indicating widespread bullish sentiment in the market.

A put-to-call ratio below 0.7 is typically seen as a sign of bullish market sentiment, whereas a ratio above 1 suggests bearishness. When the put-to-call ratio falls below 1, it indicates more call options (buy options) relative to put options (sell options), signaling prevailing optimism in the market.

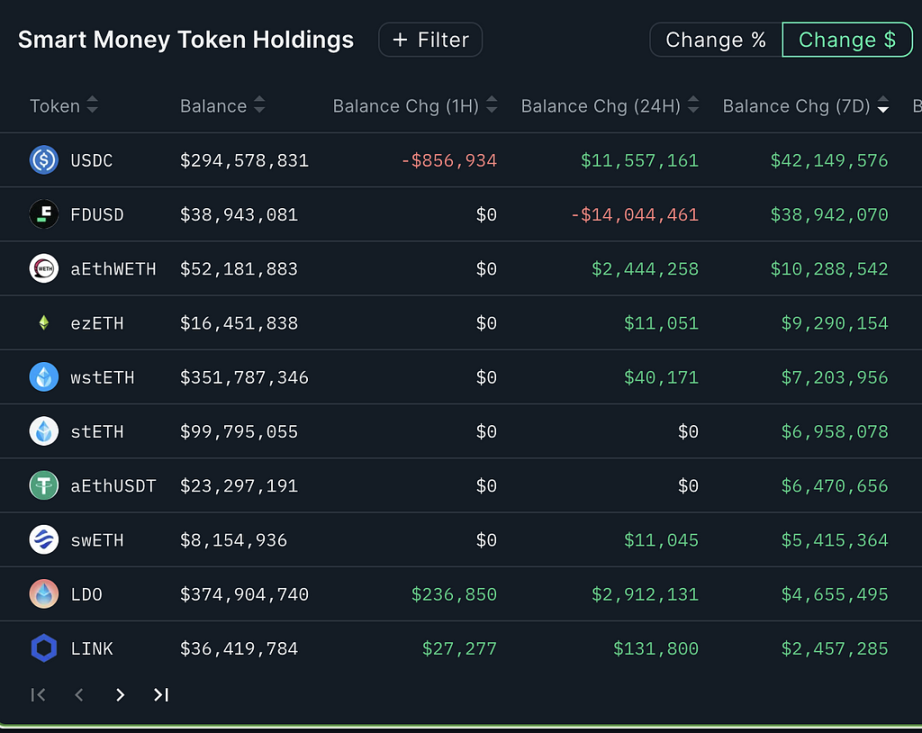

Smart Money Move: $ezETH

This week, Smart Money continued to flow heavily into the restaking sector, with $ezETH receiving increased attention in smart money token inflow data.

ezETH is the staking token issued by Renzo Protocol. On January 15, 2024, Renzo Protocol secured a seed round led by Maven11 at a $25 million valuation. Renzo is a liquid restaking derivative platform built on EigenLayer, serving as an interface to the EigenLayer ecosystem by securing active validation services (AVS) and offering higher yields than standard ETH staking. For every LST or ETH deposited into Renzo, an equivalent amount of ezETH is minted.

Multiplier Effect Fuels High Expectations for SSV

SSV currently has a market cap of $213 million and an FDV of $339 million. Based on SSV’s economic model, current valuation, and future expectations, SSV could achieve a multiplier of over 5x in this bull cycle.

SSV itself represents a chain, and SSV validators perform ETH staking on behalf of stakers, opening possibilities for diverse application scenarios. Moreover, SSV is essentially part of the EigenLayer ecosystem. If SSV launches multi-application staking pilots, it would significantly enhance the network value of SSV.

In discussions around the Pectra upgrade, concerns about Lido’s centralization have resurfaced. Lido currently holds a 32% market share, and if it exceeds 33%, it could exert strong influence over how ETH transactions are included. Potential solutions have been thoroughly discussed since 2023, including adopting DVT (Distributed Validator Technology) services such as Obol Network, SSV, and DIVA. These rely on splitting private keys to decentralize staking infrastructure.

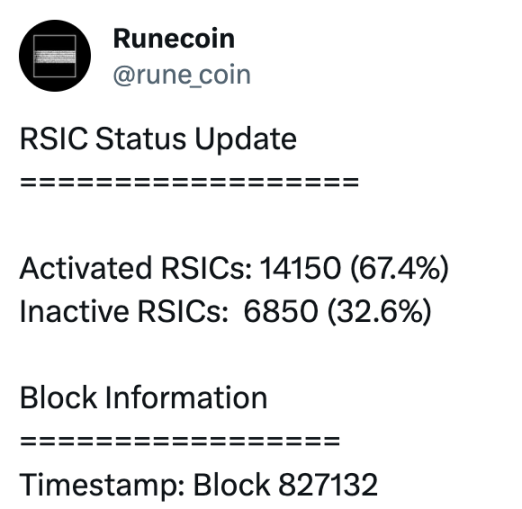

67.4% of RSIC Tokens Activated

According to official data, as of January 24, 14,150 Bitcoin Rune game tokens (RSIC) have been activated, accounting for 67.4% of the total supply. Some industry participants believe Runes could become a focal point for the market following the Ordinals craze.

RSIC (Rune Specific Inscription Circuits) is a peer-to-peer Rune distribution system built on Bitcoin. At its core, RSIC is a digital game where players manage and operate RSIC tokens to earn Runes, which will later be "inscribed" onto the Bitcoin network. The RSIC supply chain includes a "factory" that produces RSIC, a "distribution center" that distributes them, and a "furnace" used to inscribe Runes. A total of 21,000 RSIC tokens were created and freely distributed via the distribution center to the Ordinals community for Rune "mining." Players aim to activate and utilize RSIC to claim Runes, which are allocated to addresses holding activated RSIC in each Bitcoin block. Rune distribution follows four modes: flat, random, enhanced, and halving. Players can choose to mine Runes, sell RSIC on the market, or opt out entirely.

3. VC Portfolio Data

Note: Data sourced from https://platform.arkhamintelligence.com/, as of January 29, 2024, 12:00 AM (UTC+8).

4. This Week’s Watchlist

January 31

-

POLY migration from Ethereum to Polymesh Network (POLYX)

-

Launch of mainnet and token for Ethereum L2 network Frame

February 1

-

Ethereum Sepolia to undergo Dencun upgrade at 6:51 AM

-

Federal Reserve interest rate decision

February 2

-

U.S. January unemployment rate

-

U.S. Non-Farm Payrolls data release

5. Conclusion

Over the past week, global blockchain funding activity has shown marked vitality, with both the number of deals and total capital raised increasing. Capital markets and institutional investors are already positioning themselves early in key niche sectors. Meanwhile, with the conclusion of FTX’s asset liquidation, selling pressure from Grayscale has begun to ease.

Upcoming policy decisions and macroeconomic data releases—such as the Federal Reserve’s rate decision and U.S. Non-Farm Payrolls—warrant close attention, as they could significantly impact the cryptocurrency market.

The market remains influenced by a complex mix of factors. Although the period of volatility may be nearing its end and signs of recovery are emerging, we must maintain sharp vigilance over industry developments and remain prepared for unexpected market fluctuations.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News