MT Capital: bitSmiley, pioneer of Bitcoin-native stablecoin protocols

TechFlow Selected TechFlow Selected

MT Capital: bitSmiley, pioneer of Bitcoin-native stablecoin protocols

bitSmiley's business model, combining stablecoins and decentralized lending, is also known as the "MakerDAO + Compound" of the Bitcoin ecosystem.

Author: Severin, MT Capital

bitSmiley Fills the Gap in BTC Ecosystem Stablecoin Market

Since the second half of last year, the boom in inscriptions has brought substantial capital and user traffic to the Bitcoin network, driving forward the development of the Bitcoin ecosystem. Demand for inscription trading has given rise to numerous Bitcoin wallets and marketplace infrastructure. The limitations on transaction throughput and high gas costs on the Bitcoin network have gradually shifted developers' focus toward Bitcoin scaling solutions. Inscriptions holding significant capital are seeking new utility and yield opportunities, while capital from other ecosystems is eager to capture upside gains from inscriptions, leading to a surge in cross-chain projects.

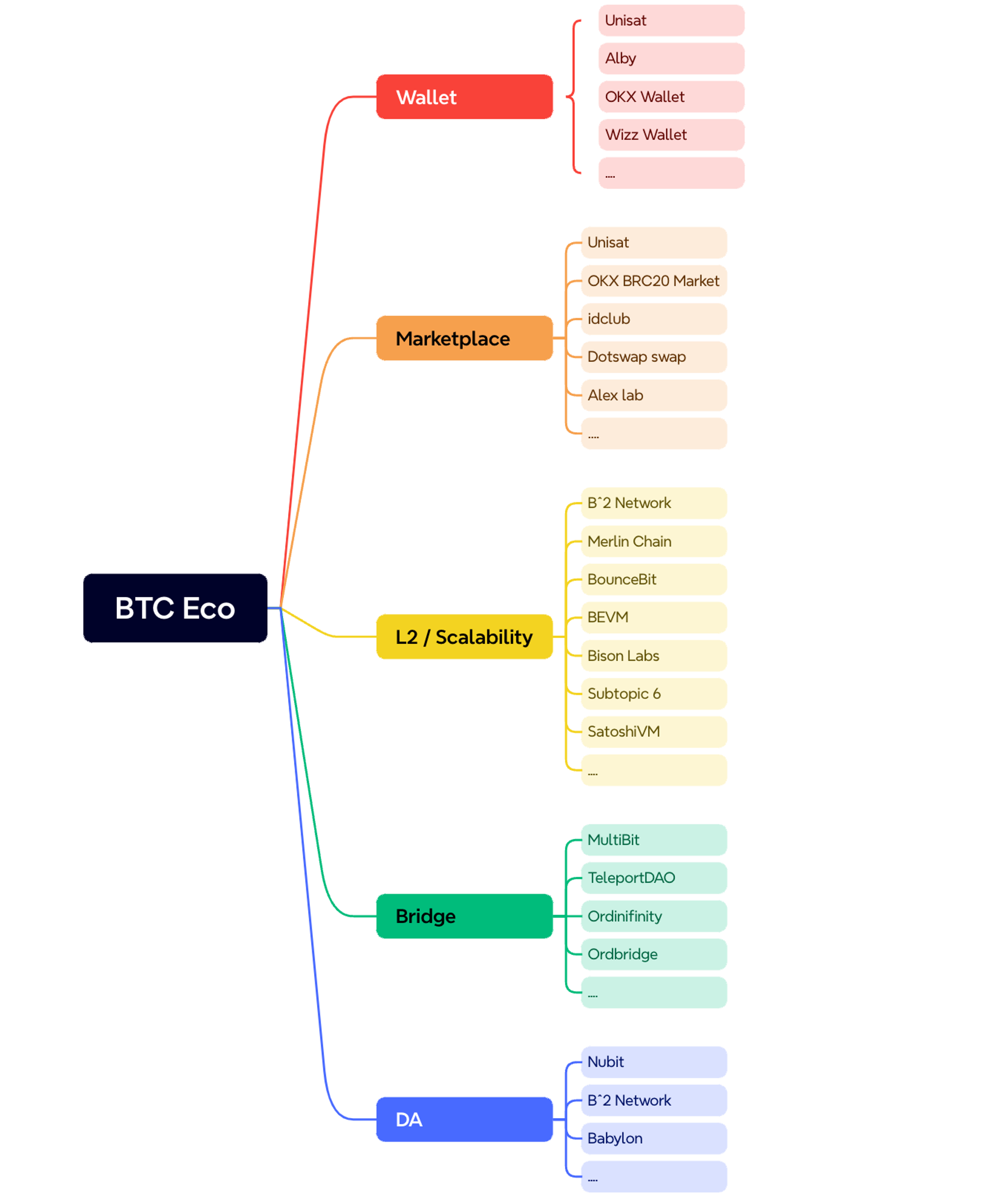

To date, although the Bitcoin ecosystem remains in a very early stage overall, a number of high-quality infrastructure projects have emerged to fill market gaps. For example:

-

Wallets: Unisat, Alby, OKX Wallet, Wizz Wallet…

-

Marketplaces: Unisat, OKX BRC20 Market, idclub, Dotswap, Alex Lab…

-

L2 / Scalability: B^2 Network, Merlin Chain, BounceBit, BEVM, Bison Labs, SatoshiVM…

-

Bridges: MultiBit, TeleportDAO, Ordinifinity, Ordbridge…

-

DA: Nubit, B^2 Network, Babylon…

source: MT Capital

The recent excitement in the Bitcoin ecosystem evokes memories of Ethereum's DeFi Summer. However, compared to that period, decentralized exchanges (DEXs), lending platforms, and stablecoin projects remain severely underdeveloped in the Bitcoin ecosystem. In particular, the crown jewel of DeFi—the native stablecoin market—remains largely untapped. With the rollout of BTC L2s, their ecosystems will require stablecoins to leverage BTC-based DeFi and unlock liquidity from the Bitcoin mainnet. As the initial hype around inscriptions subsides and the market becomes more rational, the capital remaining on the Bitcoin network will need new avenues for yield and utility. Stablecoins represent the optimal solution. Therefore, we have turned our attention to bitSmiley, the first stablecoin project in the Bitcoin ecosystem based on an over-collateralized bitRC-20 token standard. bitSmiley has the potential to fill the void in the BTC ecosystem’s stablecoin market and become a core component in the next wave of BTC-native innovation.

BTC's "MakerDAO + Compound"

bitSmiley consists of two core components: bitUSD, a stablecoin minted via over-collateralization of BTC, and bitLending, a decentralized lending platform built on bitUSD. This combination of stablecoin and decentralized lending has earned it the nickname “MakerDAO + Compound” of the Bitcoin ecosystem.

source: https://medium.com/@bitsmiley_labs/who-we-are-92e02a0c4b27

bitUSD

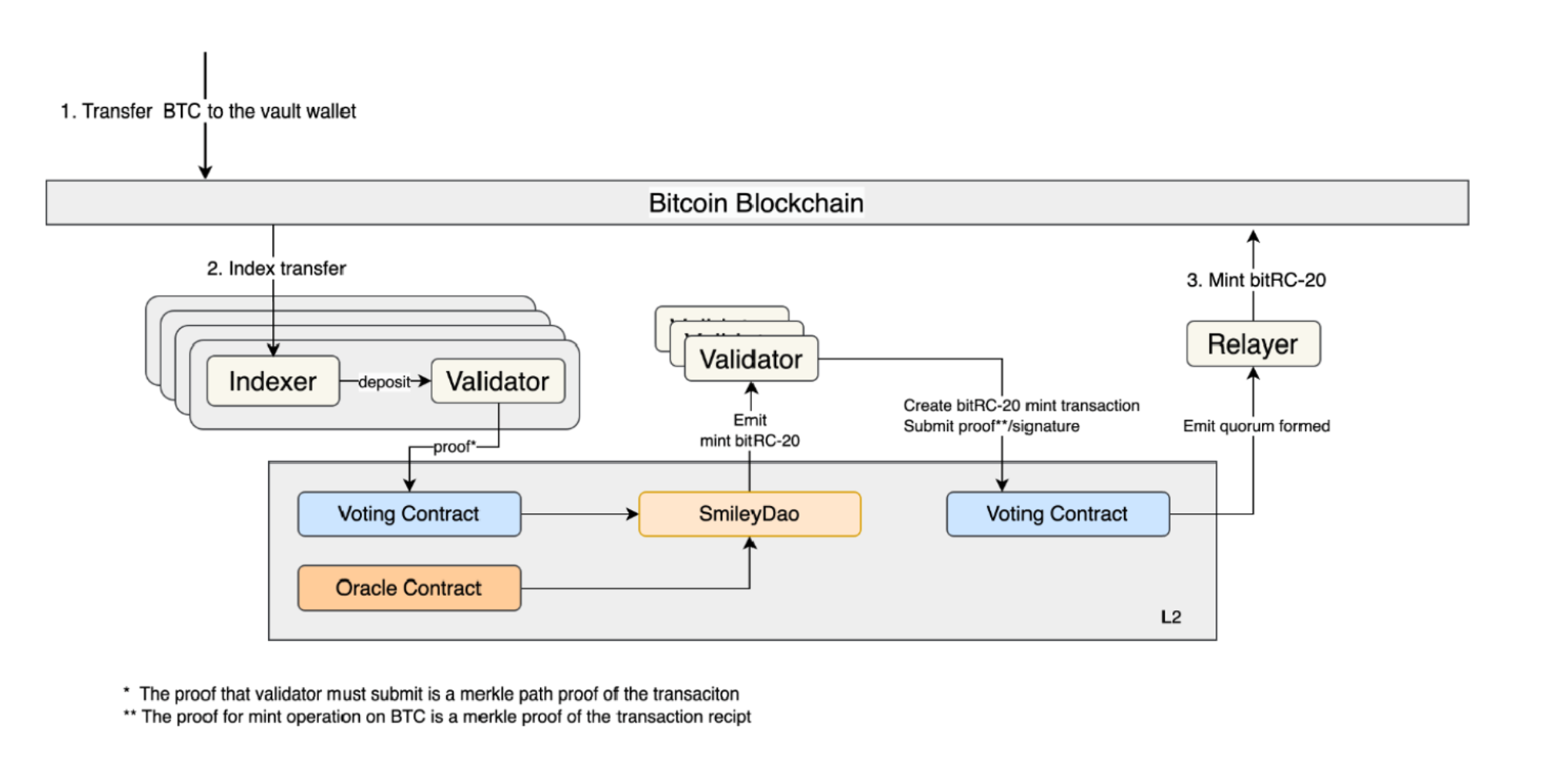

bitUSD is the core of the bitSmiley ecosystem. Since BRC-20 tokens offer limited functionality, bitSmiley has enhanced the standard by introducing bitRC-20—a reinforced version compatible with BRC-20 but supporting additional operations such as Mint and Burn, which are essential for stablecoin issuance and redemption.

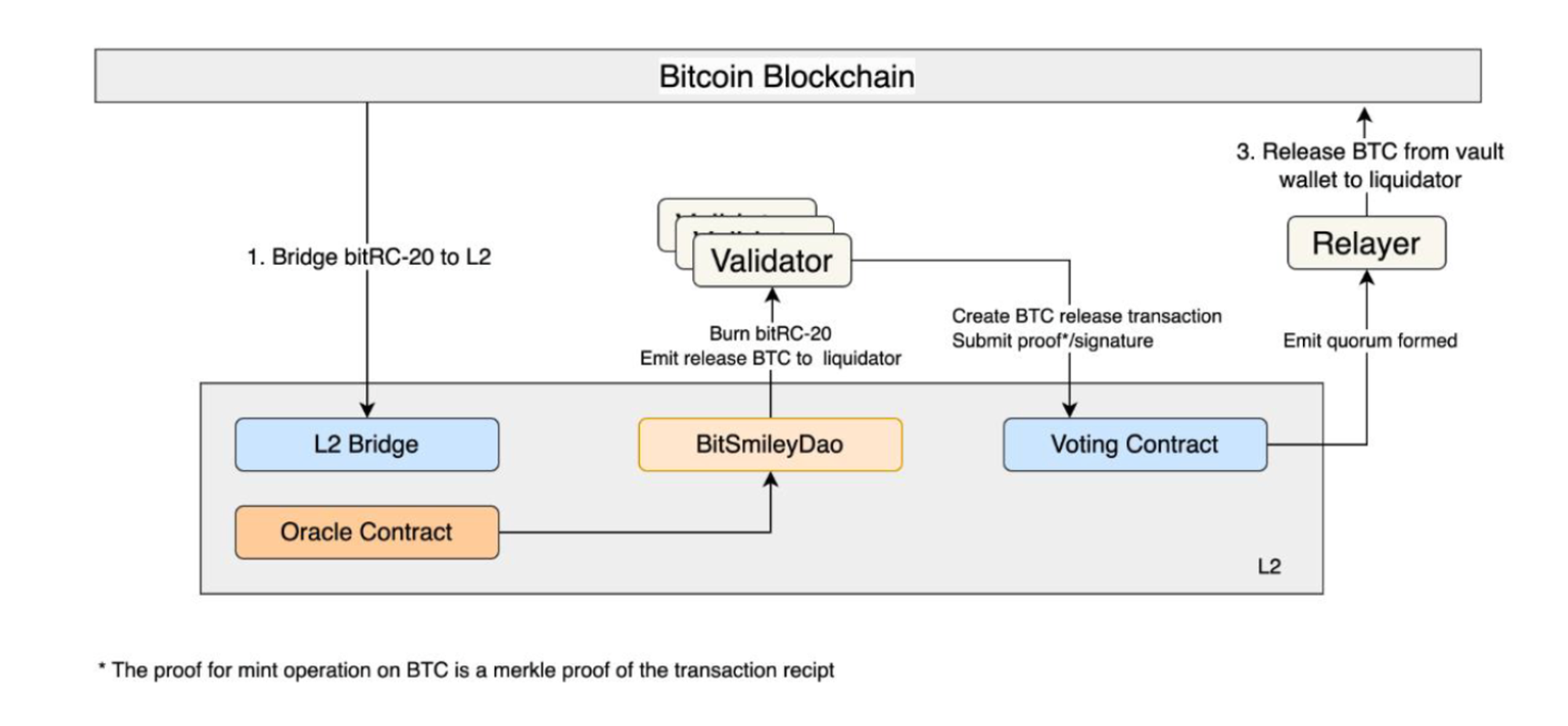

The overall minting logic of bitUSD closely resembles that of MakerDAO. First, users must over-collateralize BTC on the Bitcoin mainnet. Then, oracles relay this information to Layer 2. After receiving and validating the oracle data through consensus, bitSmileyDAO deployed on L2 sends a signal to validators on the Bitcoin mainnet to mint bitUSD, thereby issuing bitUSD on the Bitcoin network.

source: https://github.com/bitSmiley-protocol/whitepaper/blob/main/BitSmiley_White_Paper.pdf

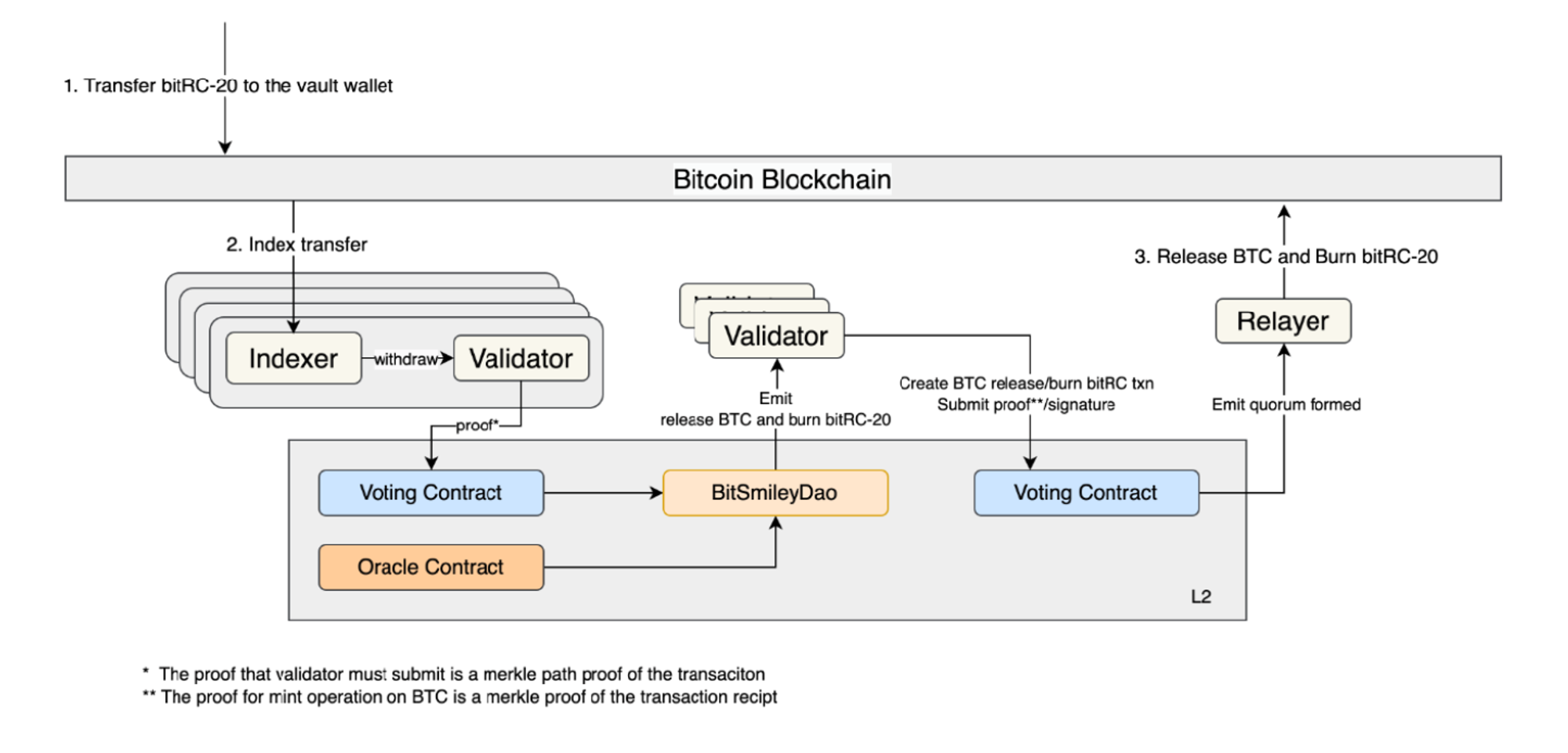

The redemption process mirrors minting: once users reclaim their collateral, the corresponding amount of bitUSD is burned.

source: https://github.com/bitSmiley-protocol/whitepaper/blob/main/BitSmiley_White_Paper.pdf

In cases where the collateral ratio falls below the threshold, bitSmiley triggers a liquidation process to auction off the collateral. Similar to MakerDAO’s mechanism, bitSmiley uses a Dutch auction model, starting at a high price and gradually decreasing. Furthermore, 90% of stability fees and auction proceeds are allocated to a liquidation buffer to enhance system security. Additionally, if the liquidation buffer is insufficient to cover debts, bitSmiley will use future platform revenues as collateral in debt auctions, minimizing bad debt and strengthening resilience against extreme market volatility.

source: https://github.com/bitSmiley-protocol/whitepaper/blob/main/BitSmiley_White_Paper.pdf

The concept of decentralized over-collateralized stablecoins pioneered by MakerDAO has been validated by the market. bitSmiley thoughtfully adopts this proven framework and introduces refined innovations in token standards and liquidation mechanisms, better aligning with the specific needs of the Bitcoin ecosystem.

bitLending

Beyond stablecoin demand, bitSmiley has also identified a strong need among Bitcoin users for liquidity and lending services. To address this, bitSmiley offers native decentralized lending on Bitcoin.

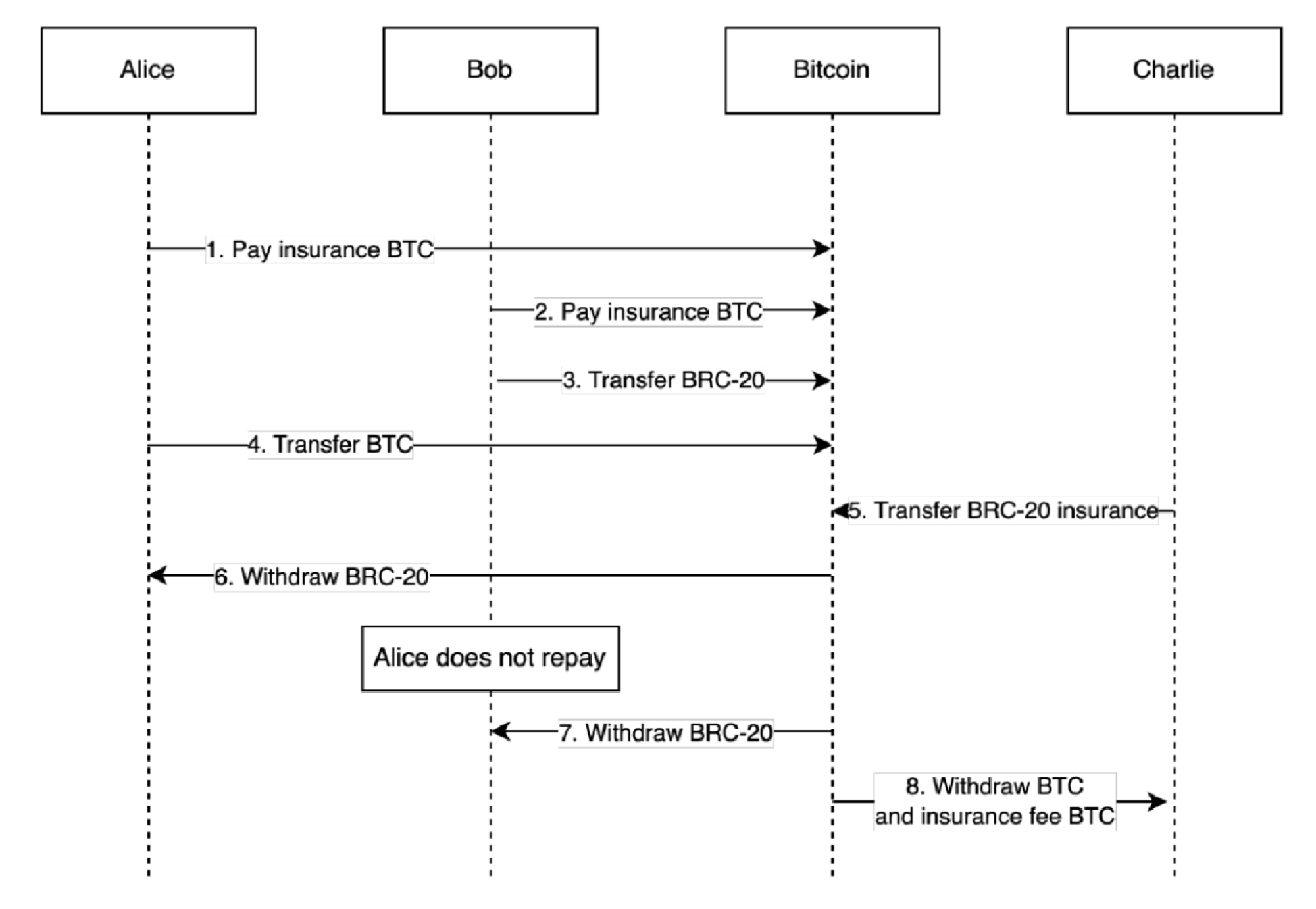

The design of bitLending is similar to peer-to-peer lending protocols in other ecosystems. Lenders can post loan offers on bitLending specifying the type and amount of bitRC-20 tokens they are willing to lend, along with loan duration and interest rate. Borrowers can then accept suitable offers. Once matched, bitLending generates a multisig address for fund transfer. Both borrower and lender must deposit assets into the multisig address and await network consensus confirmation. Upon confirmation, the borrower can withdraw the loaned funds.

Due to Bitcoin’s long block times, bitLending cannot rely on oracles for real-time liquidations like other lending protocols. If the value of a borrower’s collateral drops sharply, they may default, exposing lenders to significant losses. To mitigate this risk, bitLending introduces lending insurance. Before transferring loan funds and collateral, both borrowers and lenders must deposit an insurance fee into the multisig address. Third-party guarantors can claim these fees and choose to backstop potential lender losses. In the event of borrower default, the guarantor’s funds in the multisig address are used to compensate lenders, protecting their interests.

source: https://github.com/bitSmiley-protocol/whitepaper/blob/main/BitSmiley_White_Paper.pdf

As the protocol matures, bitSmiley plans to further optimize bitLending by enabling order splitting and merging, improving capital efficiency. Additionally, bitSmiley intends to introduce CDS (Credit Default Swap) products tailored for bitLending, bringing more sophisticated financial instruments from traditional finance into the Bitcoin ecosystem.

In summary, bitSmiley not only brings stablecoin and lending functionalities into the DeFi space but also implements fine-grained optimizations tailored to Bitcoin’s unique constraints. As BTC L2s launch and bitSmiley’s operations mature, its integrated stablecoin and lending model could become the liquidity hub of the Bitcoin network—aggregating liquidity, enhancing capital efficiency, and injecting vitality into the ecosystem. bitSmiley’s first-mover advantage may establish bitUSD as the dominant medium of exchange on Bitcoin, leveraging network effects to build robust ecosystem moats and achieve a decisive competitive edge over alternatives.

Recent Developments

Beyond its strong founding team and solid product fundamentals, bitSmiley has also demonstrated notable strength in marketing, community engagement, and campaign execution. Recently, bitSmiley has ramped up promotional efforts, publicly announcing funding partners and collaborations on Twitter, actively hosting AMAs and Twitter Spaces. Discussions about bitSmiley within the community and user interest have steadily grown. To further strengthen community engagement, reward early supporters, and attract new users, bitSmiley has launched a series of NFT campaigns.

First, bitSmiley introduced a limited edition OG NFT called bitDisc-Gold, with only 100 copies distributed exclusively to Bitcoin OGs and industry leaders. Holders of bitDisc-Gold gain access to a private Bitcoin OG Club and receive priority access to all bitSmiley products and future exclusive benefits.

Second, bitSmiley launched the bitDisc-Black NFT series, limited to 10,000 editions, aimed at rewarding regular users, early supporters, and contributors. Owners of bitDisc-Black NFTs enjoy perks such as early product access, potential airdrops, and other exclusive benefits.

source: https://medium.com/@bitsmiley_labs/btc-leading-protocol-introduces-og-nft-bitdisc-6b3684a59615

Currently, bitSmiley has conducted a snapshot of the first 1,999 community followers. Additional whitelist spots will be distributed through upcoming events. Influencers on Twitter have already started retweet campaigns to give away whitelist allocations. Moreover, bitSmiley has launched a new Discord activity campaign, encouraging users to join the Discord server and engage actively to earn whitelist eligibility.

Conclusion

After thorough research and analysis, MT Capital is highly confident in bitSmiley’s growth potential and has participated in its latest funding round. bitSmiley demonstrates sharp insight into the unmet demand for stablecoins and lending products in the Bitcoin ecosystem. By launching innovative, native Bitcoin over-collateralized stablecoins and decentralized peer-to-peer lending solutions, bitSmiley has achieved strong product-market fit. Beyond providing a new value anchor and medium of exchange on Bitcoin, bitSmiley’s lending products open new utility and value dimensions for these stablecoins. We believe that with its first-mover advantage, bitSmiley will rapidly build formidable ecosystem moats and emerge as a leading DeFi platform in the Bitcoin ecosystem through its unique combination of stablecoin and lending offerings.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News