Can the Bitcoin-powered public blockchain Core become the optimal solution for BTCFi?

TechFlow Selected TechFlow Selected

Can the Bitcoin-powered public blockchain Core become the optimal solution for BTCFi?

The Core chain consensus mechanism uses Bitcoin's PoW and will introduce Bitcoin staking in Q2.

By angelilu, Foresight News

Bitcoin has just celebrated its 15th birthday, with its fourth halving approaching and 92% of its total 21 million token supply already mined. At this historic moment, applications like inscriptions and Bitcoin NFTs have exploded in the market over the past six months, reigniting interest in Bitcoin smart contract ecosystems such as Stacks. For Bitcoin today, DeFi remains a relatively underdeveloped area but one with immense potential.

The search continues for a solution that fully inherits Bitcoin’s security while enabling decentralized finance (BTCFi) on the Bitcoin ecosystem. This article explores how the blockchain Core proposes to address BTCFi.

What is Core Chain?

Core Chain is a Bitcoin-powered, EVM-compatible Layer 1 blockchain. The term "Bitcoin-powered" refers to Core Chain's ability to inherit Bitcoin's network security, which is fundamentally reflected in its consensus mechanism.

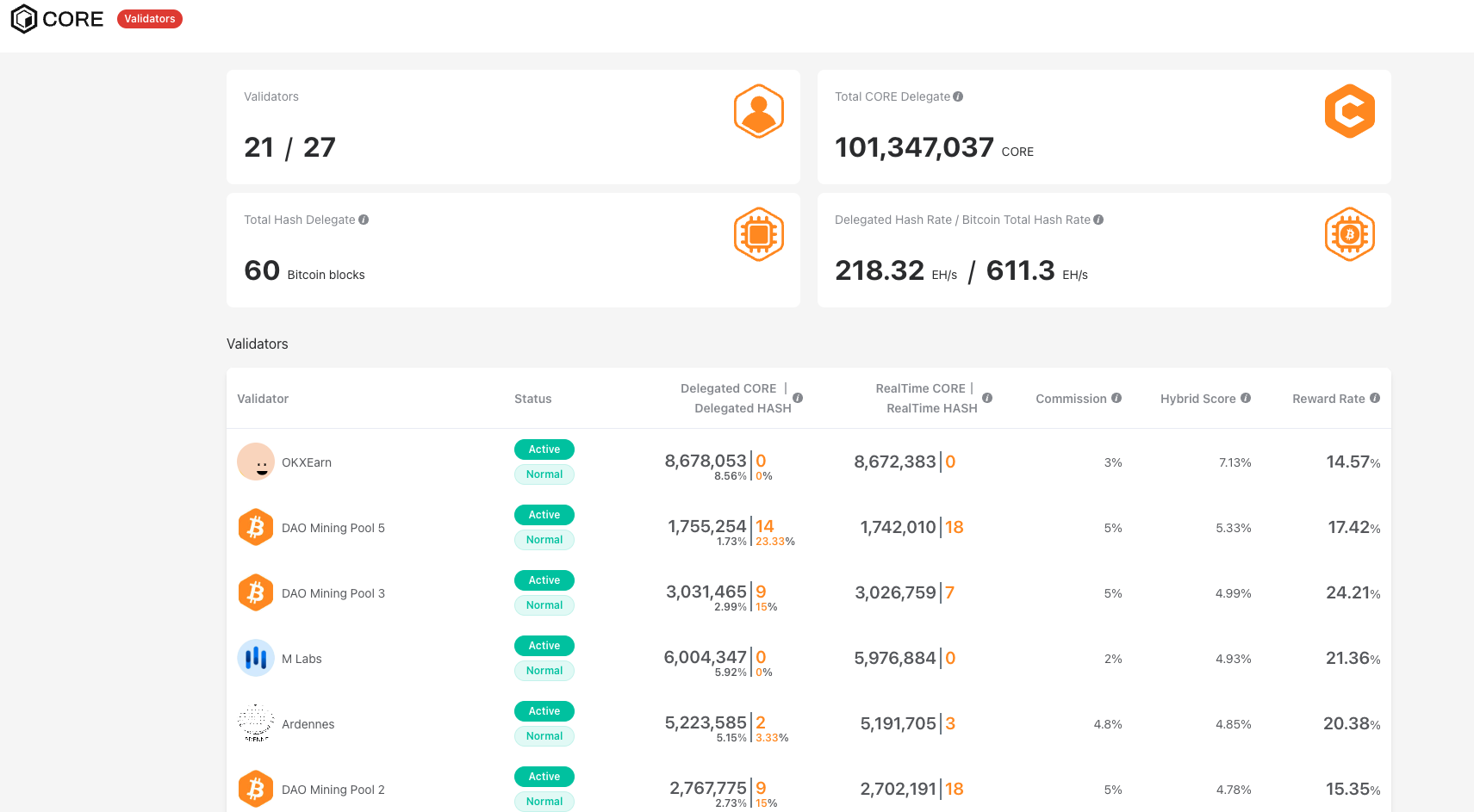

Core Chain’s consensus mechanism integrates Bitcoin’s Proof-of-Work (PoW). Specifically, Core’s 21 validator nodes are selected through a hybrid scoring system based on two primary factors: the amount of Bitcoin hash power staked to the node and the quantity of Core’s native token, CORE, pledged. In the future, direct Bitcoin staking is also planned to become one of the criteria for node evaluation.

Can It Become the Optimal BTCFi Solution?

As a newcomer in the BTCFi space, whether Core Chain can emerge as the optimal solution remains to be validated by the market. However, its use of Bitcoin PoW in consensus and the upcoming introduction of Bitcoin staking provide strong support for its security and decentralization.

Core Chain’s Consensus Is Based on Bitcoin PoW

The key difference between Core Chain and other current Bitcoin ecosystem projects lies in its direct integration of Bitcoin’s PoW into its consensus mechanism. Bitcoin’s PoW is currently the most secure and decentralized ledger mechanism ever proven over time. By incorporating Bitcoin’s PoW into its own consensus, Core Chain adds a secure “protective shell,” allowing PoW to safeguard both Bitcoin and Core Chain simultaneously.

For Bitcoin miners, Core Chain’s consensus offers a way to earn additional revenue without increasing energy or time costs—providing diversified income opportunities amid continuously declining block rewards.

According to Core Chain’s official website, the hash power currently delegated to Core’s validator nodes stands at 218.32 EH/s, accounting for 35% of Bitcoin’s total hash rate of 611.3 EH/s. This figure even reached 40% in August 2023. Major exchanges including Huobi, OKX, and Bitget have joined as validator nodes, collectively securing the network.

Bitcoin Staking Launching in Q2 2024

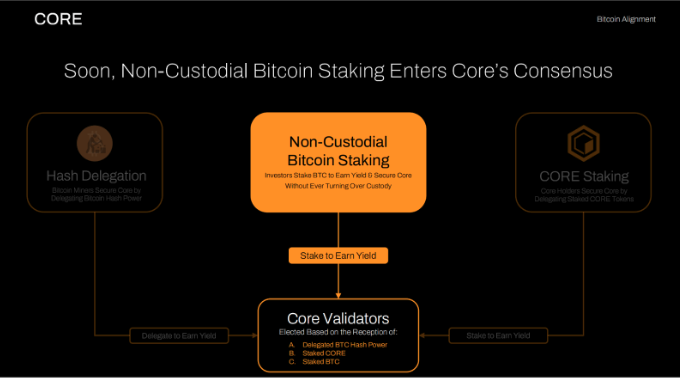

Building upon its integration of Bitcoin PoW, Core Chain plans to introduce native Bitcoin staking into its consensus mechanism in Q2 of this year. This means that validator node scores will soon be determined by three weighted factors: Bitcoin hash power, staked CORE tokens, and staked Bitcoin.

Bitcoin is the cryptocurrency with the highest market cap and strongest consensus. By introducing Bitcoin staking—combined with using Bitcoin PoW at the base layer to maintain decentralization and security—Core Chain is well-positioned to unlock a thriving BTCFi ecosystem.

For Bitcoin holders and investors, Core’s new Bitcoin staking feature presents a fresh and competitive investment option. The process is non-custodial, making it more secure compared to centralized custodial services. The participation of Bitcoin stakers could usher in a BTC 2.0 era, where Bitcoin stakers, hash power stakers, and CORE stakers all earn ongoing rewards, forming a mutually reinforcing economic cycle.

With this, the explanation of Core’s consensus mechanism is complete. Core is an EVM-compatible public chain capable of fully inheriting Bitcoin’s security, creating ideal conditions for developing Bitcoin DeFi and providing the infrastructure needed for existing DeFi projects to migrate and build a robust Bitcoin DeFi ecosystem.

Introducing stCORE to Advance BTC DeFi

Liquid staking is currently the largest segment in DeFi by TVL, offering simplicity and enhanced token utility compared to more complex DeFi activities. Therefore, Core’s initial exploration into Bitcoin DeFi focuses on liquid staking. Recently, Core announced the launch of stCORE, a liquid staking token designed to solve the issue of illiquidity after staking CORE. Users who stake CORE receive an equivalent amount of stCORE, which remains tradable, sellable, or usable across other DeFi protocols, significantly improving liquidity.

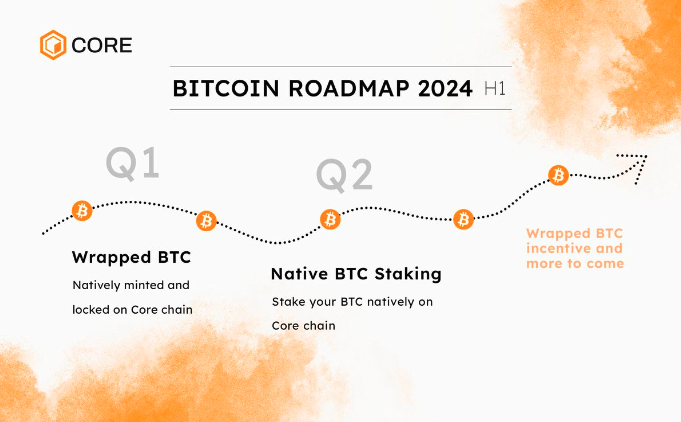

Additionally, Core Chain’s 2024 Bitcoin staking roadmap includes launching Wrapped BTC minted and locked on Core, native Bitcoin staking on the Core Chain, and incentive mechanisms for Wrapped BTC—all aimed at enhancing Bitcoin’s utility within the Core ecosystem.

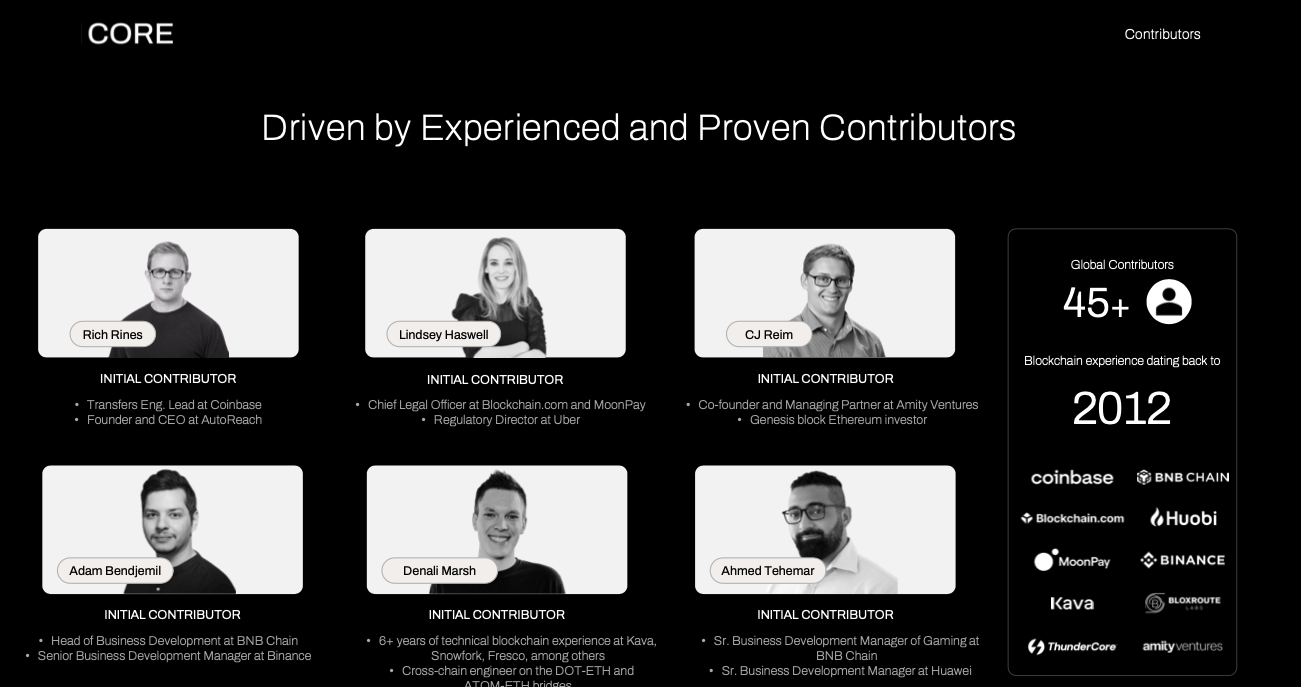

Core Team and Background

Having understood Core Chain’s consensus mechanism and its vision for building a Bitcoin DeFi ecosystem, learning about the team behind it provides further insight. The Layer 1 blockchain Core is operated by the decentralized organization Core DAO, which currently has over 45 members globally. Key contributor Rich Rines brings three years of experience from Coinbase, where he served as a lead engineer responsible for financial operations. Other team members come from prominent industry institutions such as Blockchain.com, MoonPay, and BNB Chain, holding senior positions.

The strong background of Core DAO contributors is reflected in their community traction. On X (formerly Twitter), Core DAO has surpassed 2.1 million followers, while its Discord community exceeds 250,000 members, indicating a substantial and engaged user base.

Core Token CORE

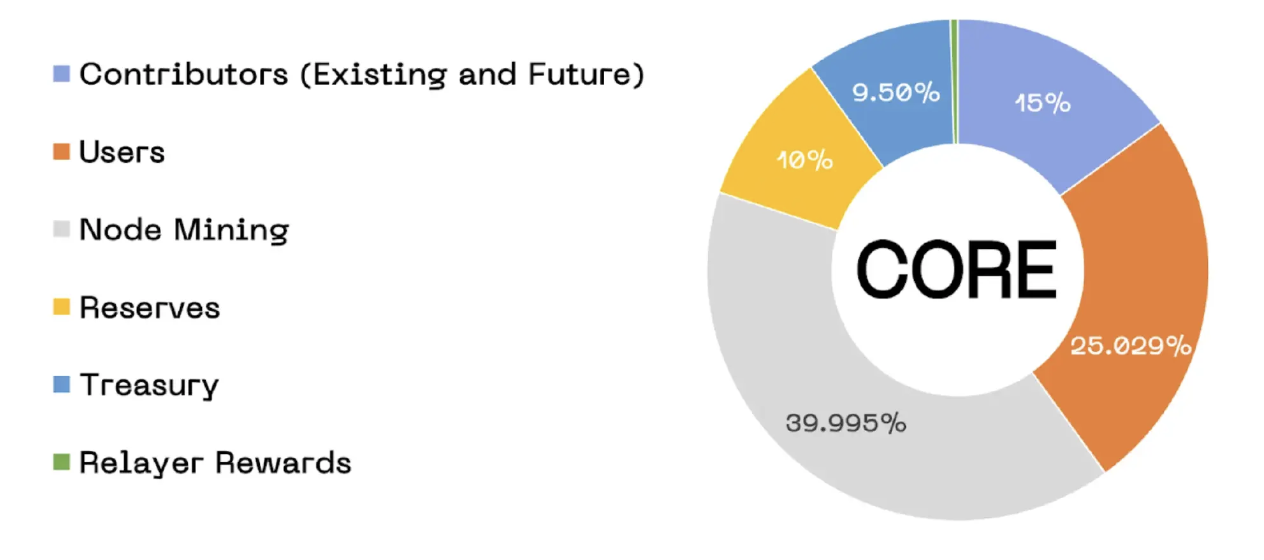

CORE is the utility and governance token of Core Chain, used for paying gas fees, staking on the Core network, and participating in governance. Launched in February 2023, CORE has a total supply of 2.1 billion tokens. Its tokenomics distribution is as follows:

-

39.995% (~840 million) allocated to node mining rewards;

-

25.029% (~525 million) for user incentives;

-

15% (~315 million) distributed to project contributors;

-

10% (~210 million) reserved as treasury funds;

-

9.5% (~200 million) allocated to the ecosystem treasury to support development;

-

0.476% (~10 million) designated for relay node rewards.

As shown above, the largest allocation goes to node mining. The 39.995% reward pool will be distributed over approximately 81 years, with block rewards decreasing by 3.6% annually.

Summary

Every aspect of Core Chain is designed around building a BTCFi ecosystem—from its innovative PoW-integrated consensus mechanism and broad user base to its EVM compatibility. In 2024, Core aims to leverage these strengths to expand and enrich the Bitcoin DeFi landscape. At the same time, Bitcoin’s powerful network and high security will reciprocally support Core Chain’s stable and secure operation—an interdependent relationship driving mutual reinforcement and co-evolution.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News