Bitcoin Core Developers Want to Remove Inscriptions: A Multi-Sided Game Among Miners, Developers, and Users

TechFlow Selected TechFlow Selected

Bitcoin Core Developers Want to Remove Inscriptions: A Multi-Sided Game Among Miners, Developers, and Users

On this old ground of Bitcoin, the term "consensus" carries the most weight.

Written by: TechFlow

Where there is interest, there is controversy.

Bitcoin Ordinals—the centerpiece of the latest crypto narrative—has recently sparked a heated debate on social media, centering around technology and interests.

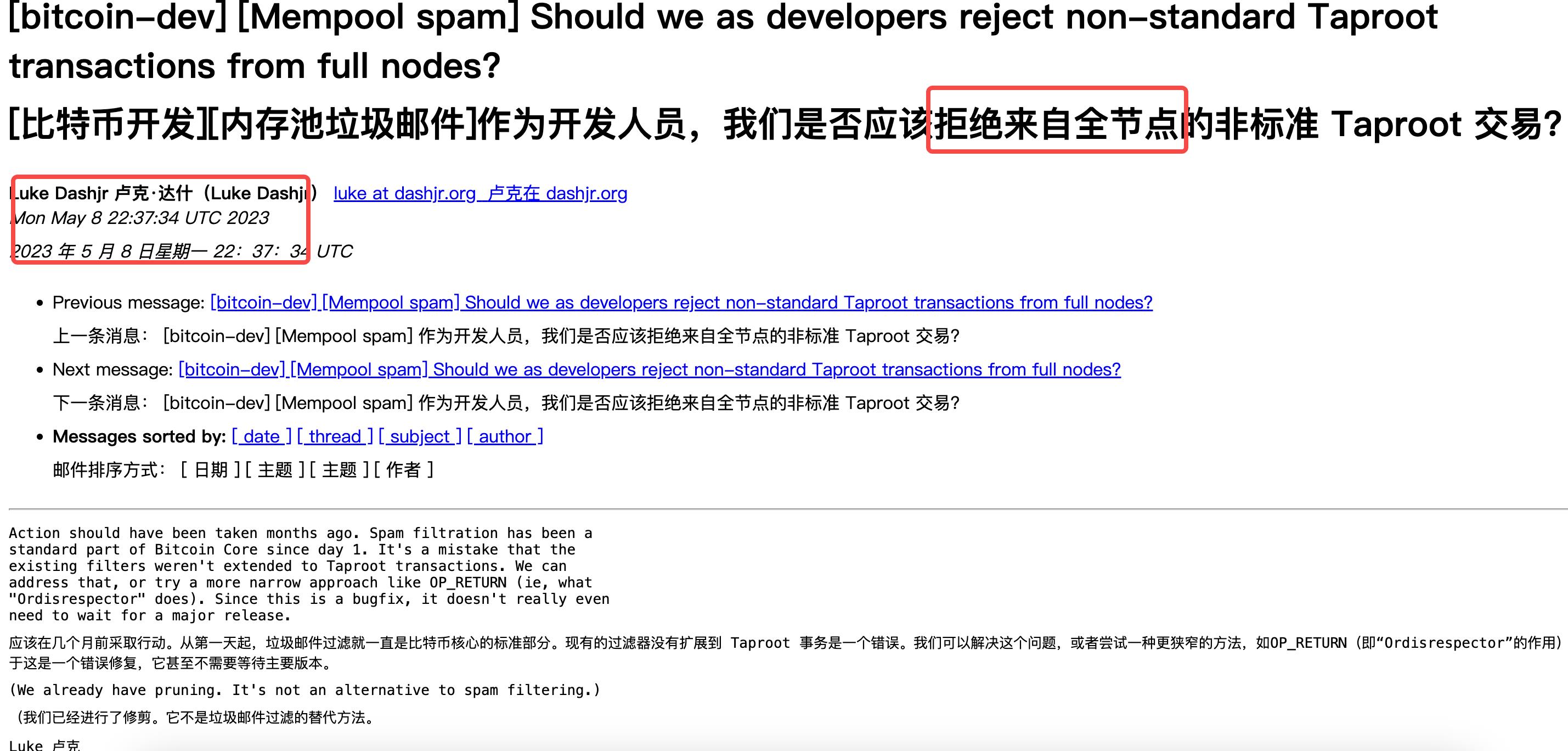

The controversy began with a post from Bitcoin Core developer Luke Dashjr:

“‘Inscriptions’ exploit a vulnerability in Bitcoin Core to spam the Bitcoin blockchain. Since 2013, Bitcoin Core has allowed users to include extra data in transactions they propagate or mine. Inscriptions bypass Bitcoin Core’s restrictions by hiding this extra data as program code.”

Additionally, the post noted:

“The vulnerability still exists in the upcoming v26 release of Bitcoin Core and hopefully will be fixed before next year’s v27 version.”

In plain terms, the claim is that the Ordinals system operates by exploiting a bug—and that this bug should be fixed.

At first glance, this appeared to be just a technical discussion and didn’t attract much attention. But things changed when Luke posted a critical reply in the comments:

“If the vulnerability is fixed, does that mean Ordinals and BRC-20 tokens will cease to exist?”

“Yes.”

Fewer words often carry more meaning. The core issue here is that inscriptions consume excessive block space, potentially degrading network efficiency and exposing it to spam transaction attacks.

From a developer's perspective, bugs should be fixed—it’s purely a technical matter.

But beyond the code, inscriptions are more than just data strings.

As a key narrative driving the current mini bull market, Bitcoin inscriptions have already demonstrated significant wealth creation potential. Moreover, they’re no longer just a technical experiment—they now involve the interests of various stakeholders across the ecosystem.

According to Luke’s post and response, since every BRC-20 token transfer requires an inscription operation, fixing this bug would deliver a fatal blow to the entire BRC-20 system.

Cutting off someone’s income stream is like killing their parents. Those deeply invested in the inscription economy naturally won’t accept such a change lightly.

Bitcoin Core ≠ Centralized Developer Authority

Most readers likely understand what Bitcoin inscriptions are, but newer participants may not be familiar with Bitcoin Core.

What exactly is Bitcoin Core?

In reality, Bitcoin Core is a long-standing open-source client software that implements the Bitcoin protocol. It enables nodes to join the Bitcoin network, maintain a full copy of the blockchain, and validate all transactions and blocks.

Bitcoin Core regularly releases updates, which may include new features, security patches, performance improvements, etc. Users must manually upgrade their clients to benefit from these changes.

But returning to the issue at hand: do Bitcoin Core developers have the authority to patch vulnerabilities in a way that disables inscriptions?

This leads us to examine the relationship between Bitcoin clients and the Bitcoin network, and how protocol changes are ultimately decided:

-

First, the Bitcoin network is a decentralized network composed of globally distributed nodes. Bitcoin Core is merely one of several possible client implementations. Therefore, the name “Core” does not imply centralized control or “core” decision-making power over Bitcoin.

-

Any major change to the Bitcoin protocol—such as fixing a vulnerability or adding functionality—requires consensus from the majority of nodes on the network. This is typically achieved through soft forks or hard forks.

-

While Bitcoin Core holds influence, it does not control the Bitcoin network. Changes to the network depend on collective decisions made by the community, including developers, miners, merchants, and ordinary users.

In other words, Luke’s post expresses a technical concern—but he lacks the unilateral authority to terminate inscriptions or BRC-20 tokens.

Moreover, this isn’t the first time Luke Dashjr has raised such concerns.

In previous mailing list discussions and forums, he has repeatedly voiced worries about the risks posed by inscriptions. His consistent stance reflects a longstanding technical position and his concern for the health of the Bitcoin ecosystem.

Yet this concern appears somewhat rigid.

According to prior reporting by Wu Shuo, although Luke is not among the core developers with direct code commit rights to Bitcoin Core, his views reflect those of many Bitcoin developers and purists who advocate for Bitcoin as solely a “payment + store of value” system and oppose token issuance as redundant reinvention.

Interest博弈: Where Are Bitcoin Inscriptions Headed?

The future of inscriptions depends not only on technical decisions by developers but also on the influence of miners, users, investors, and others. Each group has its own interests and level of influence, and their interactions and negotiations will largely determine the fate of the inscription functionality.

As the impact of the event continues to grow, various players across the industry have shared their perspectives.

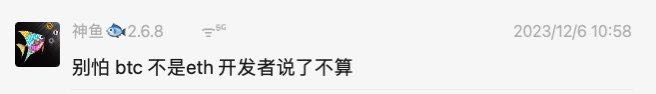

For example, Shen Yu stated, “Bitcoin is not Ethereum—developers don’t call the shots,” reflecting the divergent interests between miners and developers. That said, it’s not that developers have no say; rather, their influence is not absolute.

Inscriptions generate substantial transaction demand, which directly benefits miners through increased transaction fees. At the same time, miners earn profits while actively maintaining Bitcoin nodes, ensuring ledger consistency and network security.

Thus, while developers instinctively aim to fix bugs, miners are driven by commercial incentives to preserve profitable activities. When these instincts clash, conflict is inevitable.

Additionally, well-known influencer Chen Mo believes that miners, developers, and capital form a balanced triad in the Bitcoin world, with no single party holding monopolistic control.

Indeed, within the Bitcoin ecosystem, no individual or organization possesses unilateral decision-making power. This is precisely where Bitcoin, as the leader of the crypto market, best embodies decentralization.

If developers insist on upgrading to patch the vulnerability, we might witness another Bitcoin fork—one version supporting inscriptions, the other rejecting them.

But who wins and who loses will ultimately depend on consensus.

The market热度 of inscriptions reflects their commercial value, but also raises debates over resource allocation.

Miners may support inscriptions due to fee revenue, while long-term investors and developers may worry about potential threats to network security. These differing positions and interests will collide in community discussions, collectively shaping the protocol’s evolution.

Although Luke’s post has drawn community attention, any update or vulnerability fix in Bitcoin requires broad network consensus—including agreement from miners, developers, investors, and everyday users.

@CryptoNerdcn took it further, offering a thought-provoking idea: the “51% struggle beyond hash power.”

When conflicts arise, Bitcoin’s protocol—and the role of inscriptions—must eventually take a direction. But in this decision-making process, the main actors aren’t just core developers and miners; full nodes across the entire Bitcoin network play a crucial role.

Everyone votes together to determine the final outcome.

This battle is not just about code and hash power—ultimately, it may come down to the people’s choice.

Each group has its own interests, and the decision-making process usually takes time to reconcile these differences. Based on past experience, the Bitcoin Core team and community tend to proceed cautiously in handling disputes, emphasizing transparency and broad participation.

Meanwhile, historical precedent shows that none of Bitcoin’s forks have ever matched the original Bitcoin’s momentum.

Amid this whirlwind of conflicting inscription-related interests, decentralization brings chaotic disagreement—but also reveals its inherent charm:

On this old ground called Bitcoin, the word “consensus” carries the most weight.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News