Sei's rapid rise: Beyond parallel EVM, what other catalysts are worth watching?

TechFlow Selected TechFlow Selected

Sei's rapid rise: Beyond parallel EVM, what other catalysts are worth watching?

This article provides an in-depth exploration of Sei from multiple perspectives, including use cases, adoption, project revenue, and token economics.

Author: Jake Pahor

Translation: TechFlow

Recently, Sei has seen significant price gains. On January 6, SEI reached an all-time high of $0.88. Despite broader market declines following the Bitcoin ETF "sell the news" event, SEI's price performance remained strong, quickly recovering after dips. At the time of writing, Sei is trading at $0.80 with a 24-hour gain of 9.35%.

Crypto researcher Jake Pahor conducted an in-depth analysis of Sei, exploring its use cases, adoption, project revenue, tokenomics, and more. TechFlow has translated the full report.

Overview

Sei is a Layer 1 blockchain specifically designed for trading digital assets, covering gaming, social, NFTs, and DeFi.

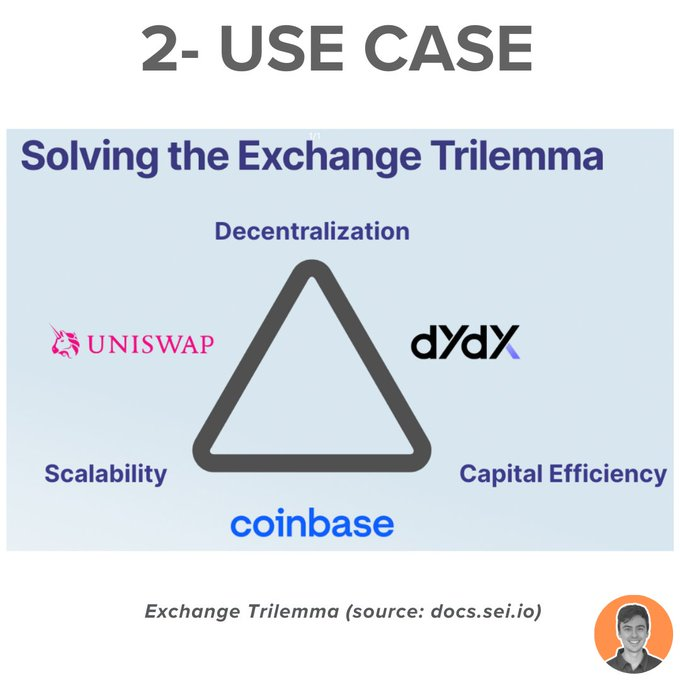

It claims to be the fastest blockchain in the industry, with a transaction settlement time of 380 milliseconds, built using the Cosmos SDK.

Use Cases

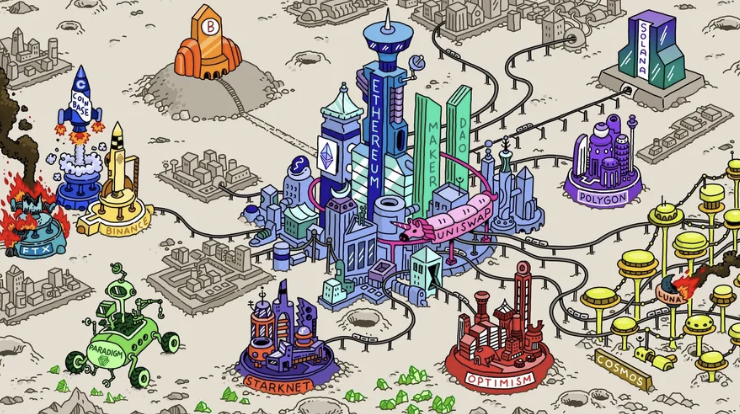

Exchanges built on current L1s face serious scalability issues. The exchange trilemma states that they cannot simultaneously achieve decentralization, scalability, and capital efficiency.

Sei solves exchange scalability issues through a specialized trading-focused L1.

By optimizing every layer, Sei provides superior infrastructure for digital asset exchanges. Sei offers:

-

The fastest chain to achieve finality

-

Twin Turbo consensus

-

Market-based parallelization

-

Native matching engine

-

Front-running protection

Adoption

Sei’s TVL is currently $11.4 million, which is relatively low considering the project’s market cap. However, Sei is a relatively new project/chain, with its mainnet launching in August 2023.

As the ecosystem continues to grow, I expect substantial inflows into TVL.

Revenue

The SEI token captures revenue/fees in multiple ways:

-

Transaction fees on the Sei blockchain

-

Validator tips for prioritized transactions

-

Trading fees from exchanges built on the Sei blockchain

Investors who stake SEI with one of the validators can earn approximately 4.59% APY.

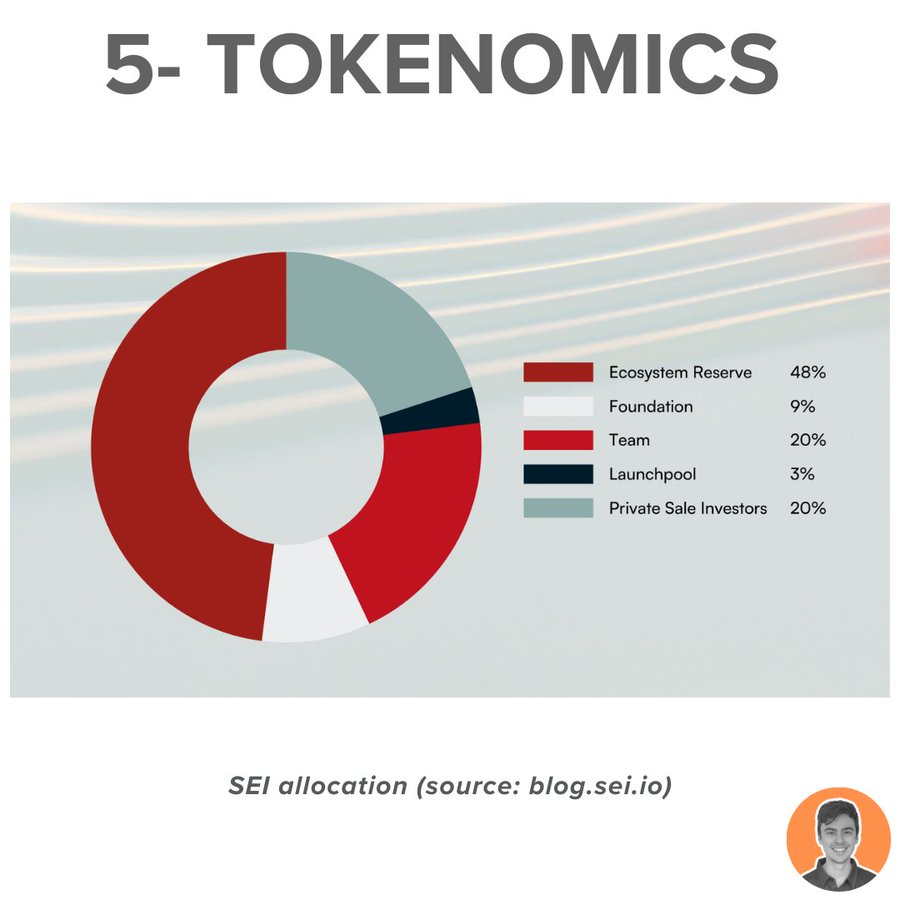

Tokenomics

Sei operates as a decentralized Proof-of-Stake (PoS) blockchain powered by the SEI token, which serves multiple functions:

-

Network fees

-

DPoS validator staking

-

Governance

-

Native collateral

-

Fee markets

-

Transaction fees

The total supply of SEI is capped at 10 billion tokens.

Approximately 3% of SEI tokens were airdropped to early users on Solana, Ethereum, Arbitrum, Polygon, Binance Smart Chain, and Osmosis.

Here are some current statistics:

-

Circulating supply: 242.5 million

-

Max supply: 10 billion

-

Market cap: $1.9 billion

-

FDV: $7.8 billion

-

Market cap/FDV: 0.24

Treasury

According to the token allocation, 9% of tokens (900 million SEI) were allocated to the Sei Foundation treasury. At today’s value, this amounts to $700 million, providing ample funding for project development.

Governance

The SEI network is secured by over 39 active validators, ensuring accuracy through Sei’s Twin Turbo consensus mechanism.

Token holders can participate in governance by submitting on-chain proposals. However, the formal governance process has not yet been fully detailed.

Team and Investors

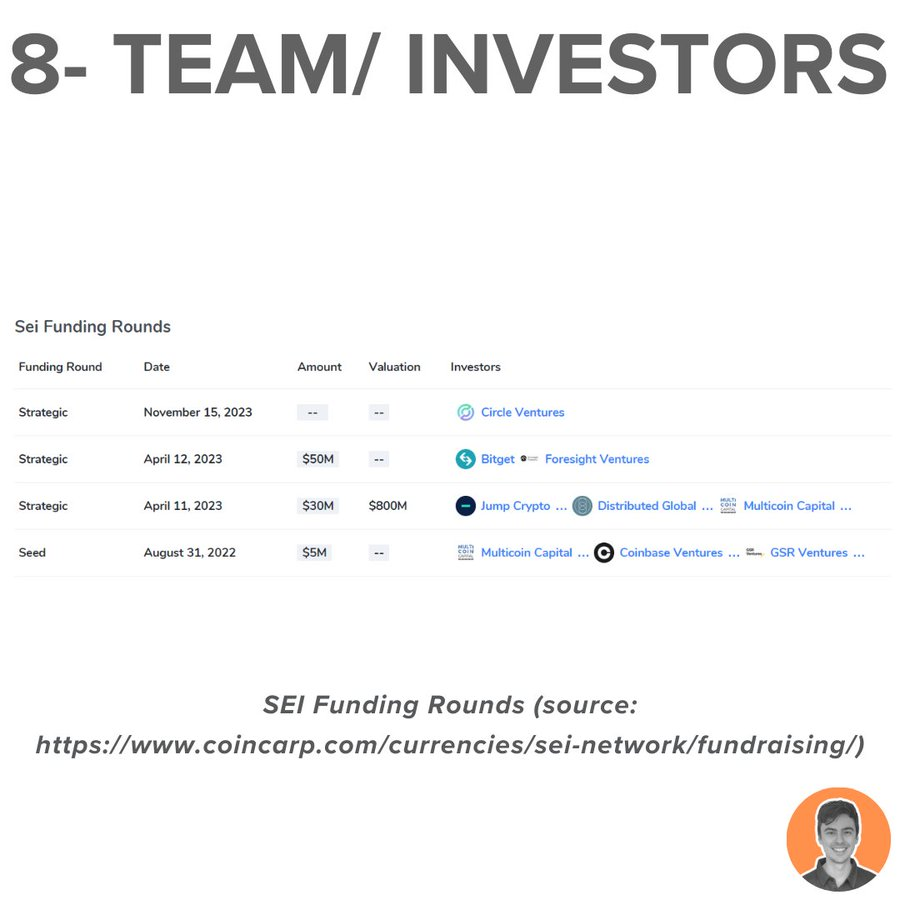

Sei was founded in 2022 by Jay Jog (former Robinhood employee) and Jeff Feng (former Goldman Sachs employee).

Over the past two years, it has raised over $85 million through multiple funding rounds.

Investors include Multicoin Capital, Coinbase Ventures, Jump Crypto, and Delphi Digital.

Competitors

Several projects are competing with Sei to build the best trading Layer 1. These include Aptos, Injective, Kujira, Sei, Sui, and Solana.

However, Sei stands out as a strong contender, boasting incredibly fast transaction speeds and a rapidly growing ecosystem.

Risks

Sei underwent an audit by CertiK in July 2023. One critical risk was identified and resolved, along with four major risks acknowledged.

CertiK assigned Sei a security score of 90.39, placing it in the top 10% among protocols they have reviewed.

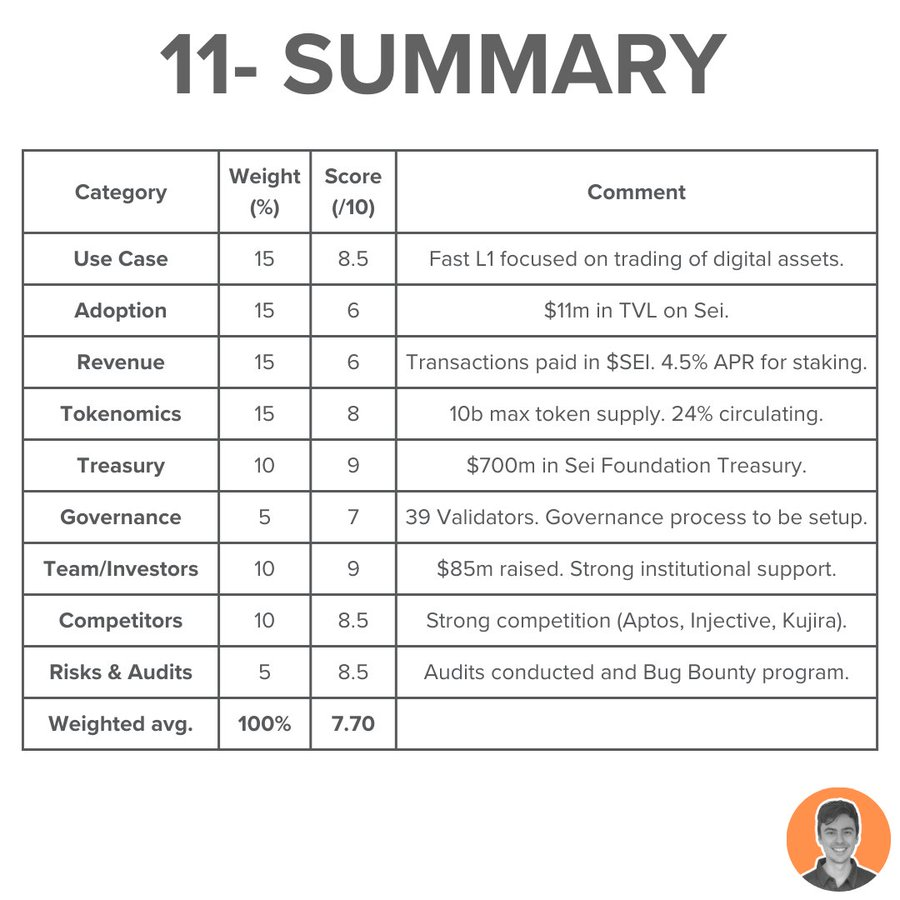

Summary

Sei has attracted significant attention and possesses some impressive technology. The project holds substantial potential.

Upcoming catalysts for Sei include:

-

Sei v2 – Parallelized EVM blockchain

-

$120 million SEI ecosystem fund

-

Sei Launchpad program

-

Tokenized RWAs

Overall, if scored out of 10, I would give Sei a 7.7.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News