Bitcoin L2 New Opportunity? A Detailed Look at SatoshiVM and Testnet Interaction Process

TechFlow Selected TechFlow Selected

Bitcoin L2 New Opportunity? A Detailed Look at SatoshiVM and Testnet Interaction Process

SatoshiVM, a decentralized Bitcoin ZK Rollup Layer 2 solution.

Bitcoin, L2, ZK—combined, these high-value concepts easily trigger FOMO. The project is currently gaining significant traction on Twitter, though it remains unclear whether this reflects coordinated marketing or genuine collective value discovery.

Nevertheless, heightened attention at least suggests potential short-term opportunities.

We’ve therefore reviewed the project’s documentation and compiled publicly available information on testnet interactions and initial token issuance to provide reference insights.

Bitcoin, L2, ZK—combined, these high-value concepts easily trigger FOMO. The project is currently gaining significant traction on Twitter, though it remains unclear whether this reflects coordinated marketing or genuine collective value discovery.

Nevertheless, heightened attention at least suggests potential short-term opportunities.

We’ve therefore reviewed the project’s documentation and compiled publicly available information on testnet interactions and initial token issuance to provide reference insights.

What is SatoshiVM?

SatoshiVM connects the EVM ecosystem with Bitcoin, enabling asset issuance and application development within the Bitcoin ecosystem. The name clearly pays homage to Satoshi Nakamoto, while "VM" refers to virtual machine functionality—enabling smart contracts and asset creation, thus addressing Bitcoin’s current limitations in scalability. The most critical aspect lies in SatoshiVM’s implementation of ZK Rollup technology. By bundling multiple transactions into batches and verifying them as a single transaction on the Bitcoin mainnet, Rollup ensures the same level of security as the Bitcoin network, guaranteeing data validity and availability. Additionally, using technologies like Taproot and Bitcoin Script, SatoshiVM performs on-chain contract validation without altering Bitcoin’s consensus rules, enabling validity proofs computation. Put simply, just as ZK Rollups serve as L2 solutions for Ethereum, they can also function for Bitcoin. More通俗ly, most L2 operations occur off the main chain and are later submitted on-chain. In theory, transactions can be executed off-chain and their results batched and posted on-chain.

L2 executes transactions; L1 handles settlement—the only difference being that here, the base layer is Bitcoin.

Notably, SatoshiVM uses native BTC as gas for the EVM. As the project grows and more applications are built on this L2, increasing ecosystem activity will naturally attract greater miner support.

To dive deeper, let's examine SatoshiVM’s architectural design:

More通俗ly, most L2 operations occur off the main chain and are later submitted on-chain. In theory, transactions can be executed off-chain and their results batched and posted on-chain.

L2 executes transactions; L1 handles settlement—the only difference being that here, the base layer is Bitcoin.

Notably, SatoshiVM uses native BTC as gas for the EVM. As the project grows and more applications are built on this L2, increasing ecosystem activity will naturally attract greater miner support.

To dive deeper, let's examine SatoshiVM’s architectural design:

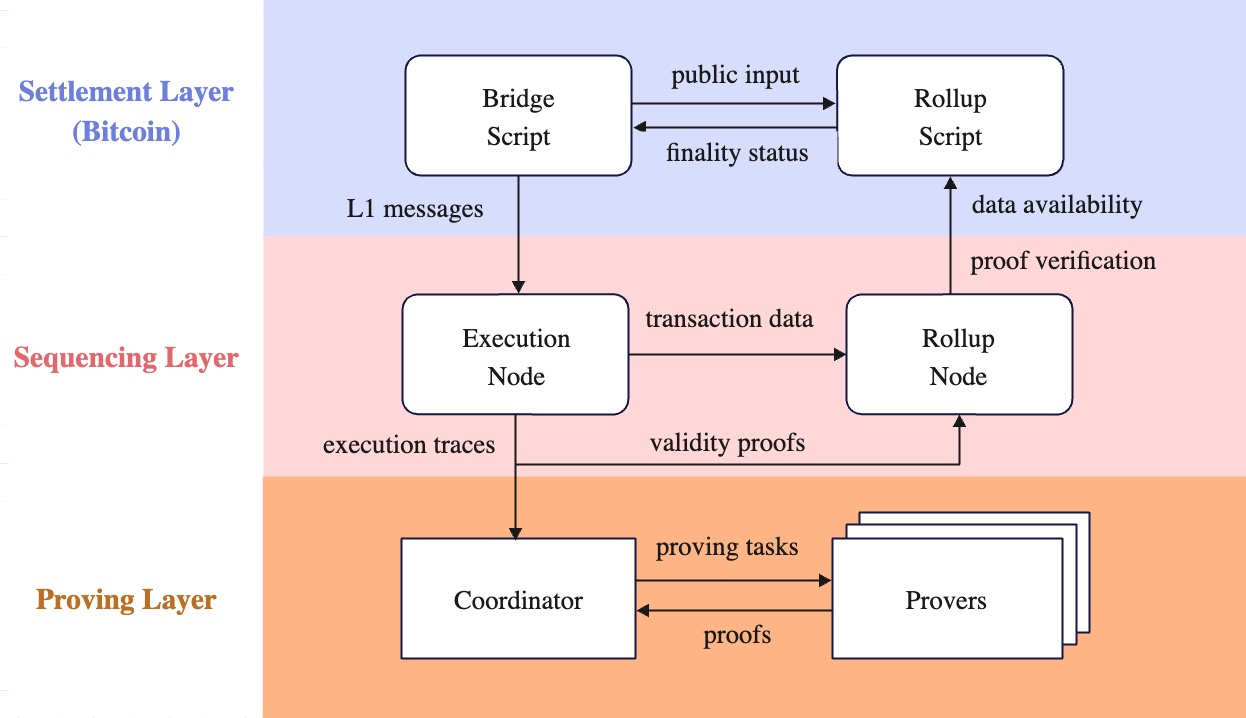

Settlement Layer

This layer provides data availability, transaction ordering, and proof verification for the SatoshiVM chain. It enables users and dApps to transfer messages and assets between Bitcoin and SatoshiVM. Bitcoin acts as the settlement layer, with bridges and rollup scripts deployed on the Bitcoin network.

Sequencing Layer

Comprised of an execution node responsible for processing transactions sent to the SatoshiVM sequencer and those submitted to the L1 bridge script, generating L2 blocks. It also includes a rollup node that batches transactions, publishes transaction data and block information onto Bitcoin for data availability, and submits validity proofs to finalize outcomes on Bitcoin.

Verification Layer

Includes a coordinator that assigns proof-generation tasks to provers and forwards generated proofs to the rollup node for finality confirmation on Bitcoin. Also features a prover pool responsible for generating zero-knowledge proofs validating the correctness of L2 transactions.

Settlement Layer

This layer provides data availability, transaction ordering, and proof verification for the SatoshiVM chain. It enables users and dApps to transfer messages and assets between Bitcoin and SatoshiVM. Bitcoin acts as the settlement layer, with bridges and rollup scripts deployed on the Bitcoin network.

Sequencing Layer

Comprised of an execution node responsible for processing transactions sent to the SatoshiVM sequencer and those submitted to the L1 bridge script, generating L2 blocks. It also includes a rollup node that batches transactions, publishes transaction data and block information onto Bitcoin for data availability, and submits validity proofs to finalize outcomes on Bitcoin.

Verification Layer

Includes a coordinator that assigns proof-generation tasks to provers and forwards generated proofs to the rollup node for finality confirmation on Bitcoin. Also features a prover pool responsible for generating zero-knowledge proofs validating the correctness of L2 transactions.

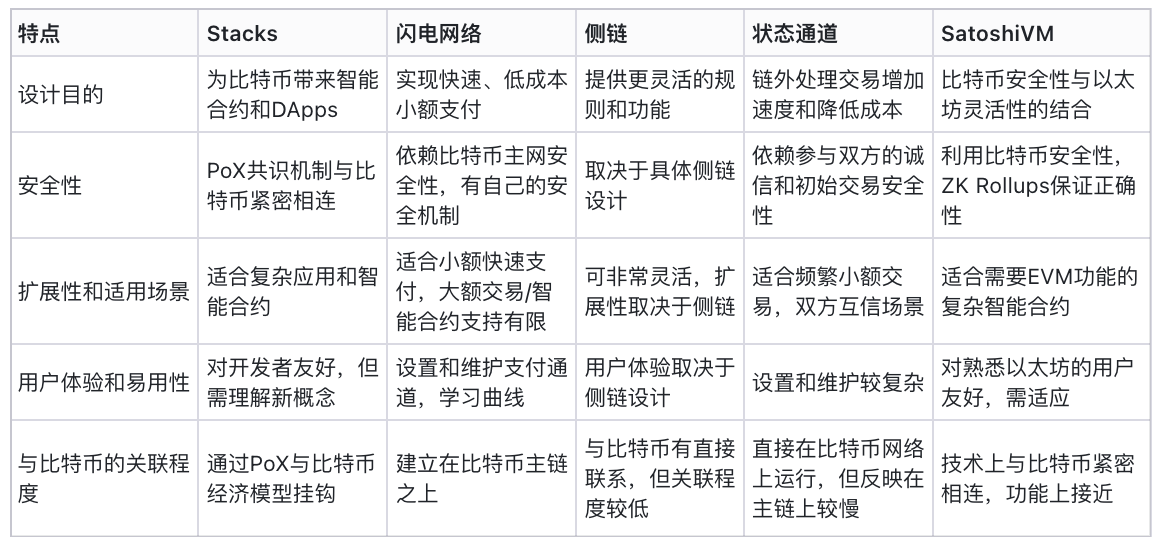

How Is SatoshiVM Different From Other Bitcoin L2s?

Strictly speaking, SatoshiVM is less of an L2 and more of a “bridge.” Here, “bridge” means introducing Ethereum-style development formats and execution methods, allowing Ethereum-like activities such as issuing new digital assets or building applications, while relying on the Bitcoin network for payments and transaction processing. Previously, due to Bitcoin’s inherent design limitations, various broad L2 approaches—such as the Lightning Network, sidechains, and state channels—have been active, primarily focusing on internal optimizations: That is, making Bitcoin itself faster and more efficient, or enabling Bitcoin to handle certain transaction functions under specific conditions. Later came Stacks, which aimed to enable Bitcoin to support smart contracts and DApps, thereby expanding its functional capabilities. Note: performance and functionality are two distinct concepts. With that distinction clear, SatoshiVM should be compared primarily with Stacks in terms of objectives. Let’s compare the two from technical implementation and integration with Bitcoin. Technical Implementation and Compatibility: - SatoshiVM: Supports Ethereum-compatible smart contracts and uses native BTC as fuel. - Stacks: Uses different technology, featuring its own Proof of Transfer (PoX) consensus mechanism and Clarity smart contract language. It does not directly support EVM but offers an alternative approach to creating smart contracts and apps on Bitcoin. Integration with Bitcoin: - SatoshiVM: Integrates with Bitcoin’s main chain at the Layer 2 level via ZK Rollup technology, maintaining EVM compatibility so developers can use familiar Ethereum tools and languages. - Stacks: Builds directly atop Bitcoin’s security model using its unique PoX consensus, adding smart contract and DApp functionality natively. An imperfect analogy: SatoshiVM is more like a universal solution—its L2 design could serve Bitcoin, Ethereum, or even other L1s—but gains momentum by aligning with Bitcoin’s narrative. In contrast, Stacks is a specialized remedy—designed specifically to fix structural issues in Bitcoin, which may not translate well to other L1s. We’ve also compiled a comprehensive comparison of all aforementioned Bitcoin scaling solutions below:

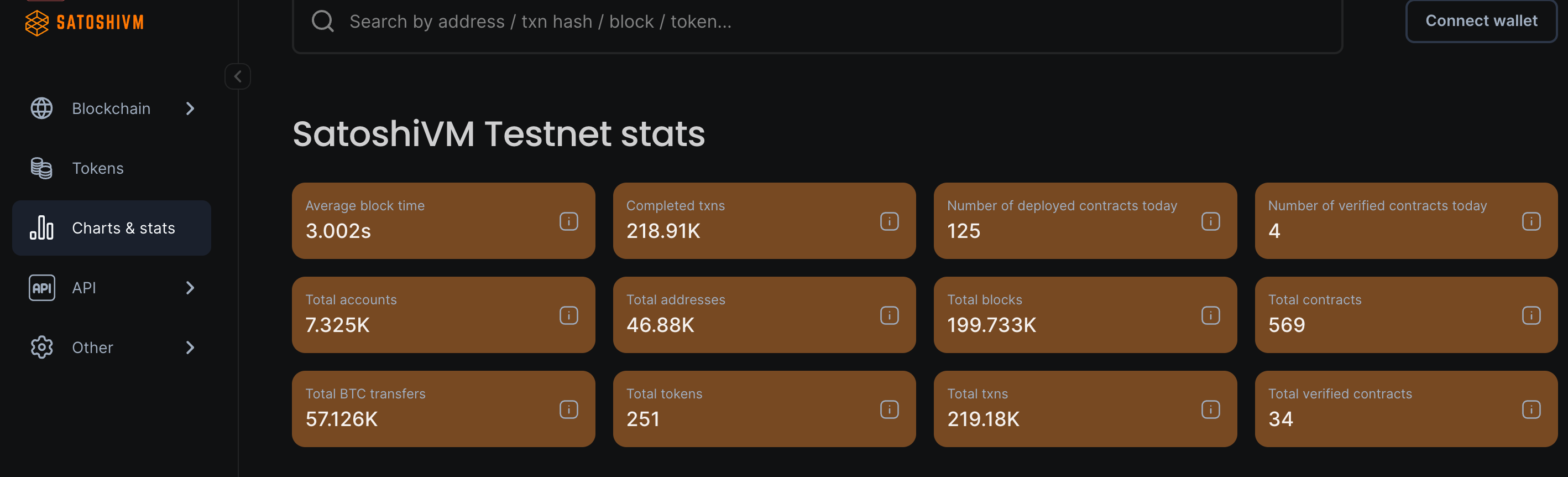

Current Testnet Status and Participation Opportunities

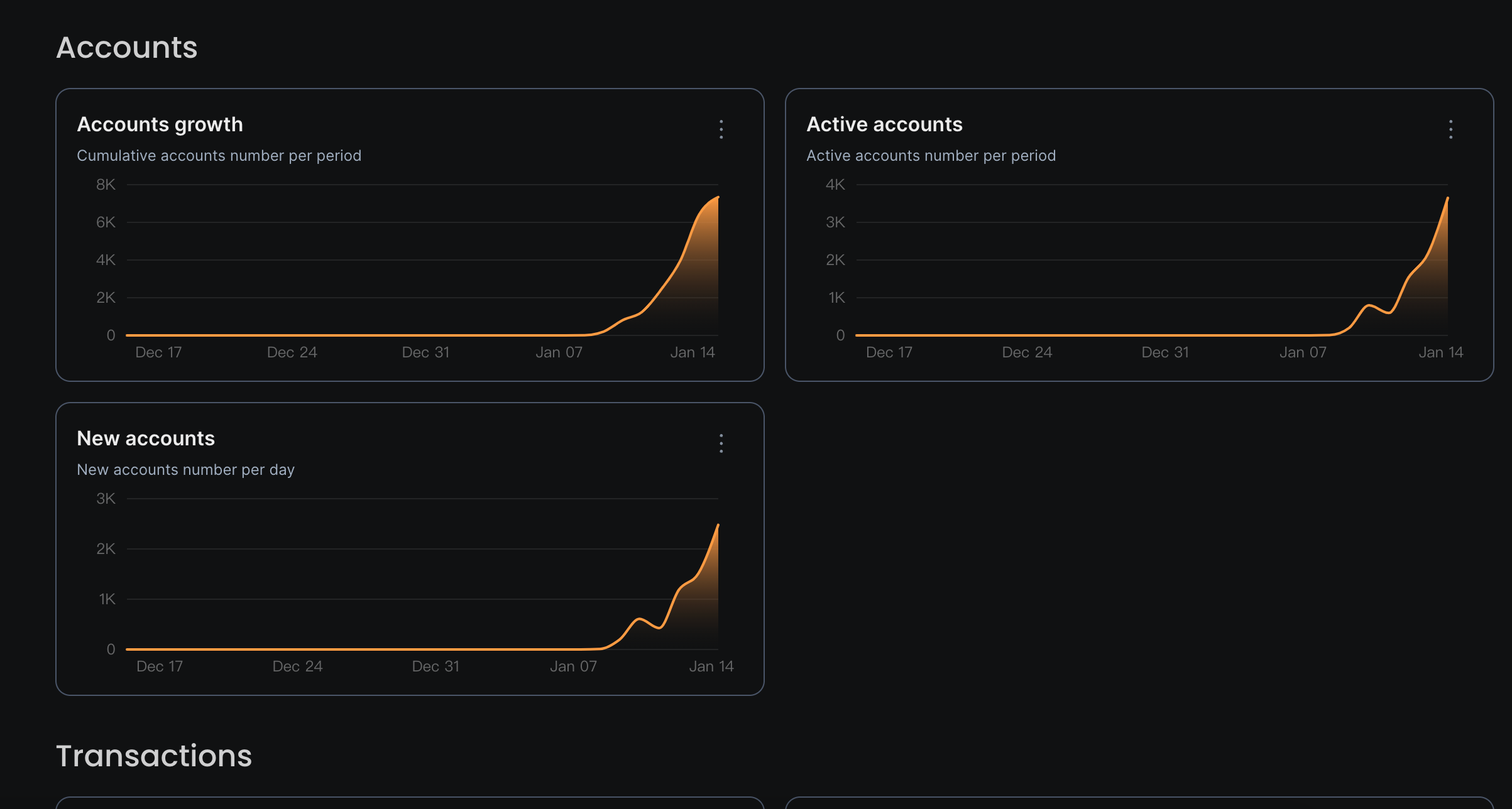

Currently, SatoshiVM’s testnet is live. Users can participate using Unisat or MetaMask wallets by interacting with the testnet through actions like token transfers and swaps. Data indicates over 7,000 accounts have interacted with the testnet, involving 46,000 unique addresses and approximately 200,000 total transactions. Although SatoshiVM has not officially confirmed or hinted at future airdrops, growing discussions on Twitter have led to sharp increases in daily new and active accounts—reflecting clear market FOMO.

On the flip side, rising popularity intensifies competition. Those who interact more will inevitably outperform passive participants.

However, considering the testnet’s “zero-cost” nature, participating involves no risk. Engaging at zero cost for potential small gains remains a sound strategy.

Although SatoshiVM has not officially confirmed or hinted at future airdrops, growing discussions on Twitter have led to sharp increases in daily new and active accounts—reflecting clear market FOMO.

On the flip side, rising popularity intensifies competition. Those who interact more will inevitably outperform passive participants.

However, considering the testnet’s “zero-cost” nature, participating involves no risk. Engaging at zero cost for potential small gains remains a sound strategy.

Below are detailed participation steps for interested users (images sourced from Twitter user @FareaNFts):

Below are detailed participation steps for interested users (images sourced from Twitter user @FareaNFts):

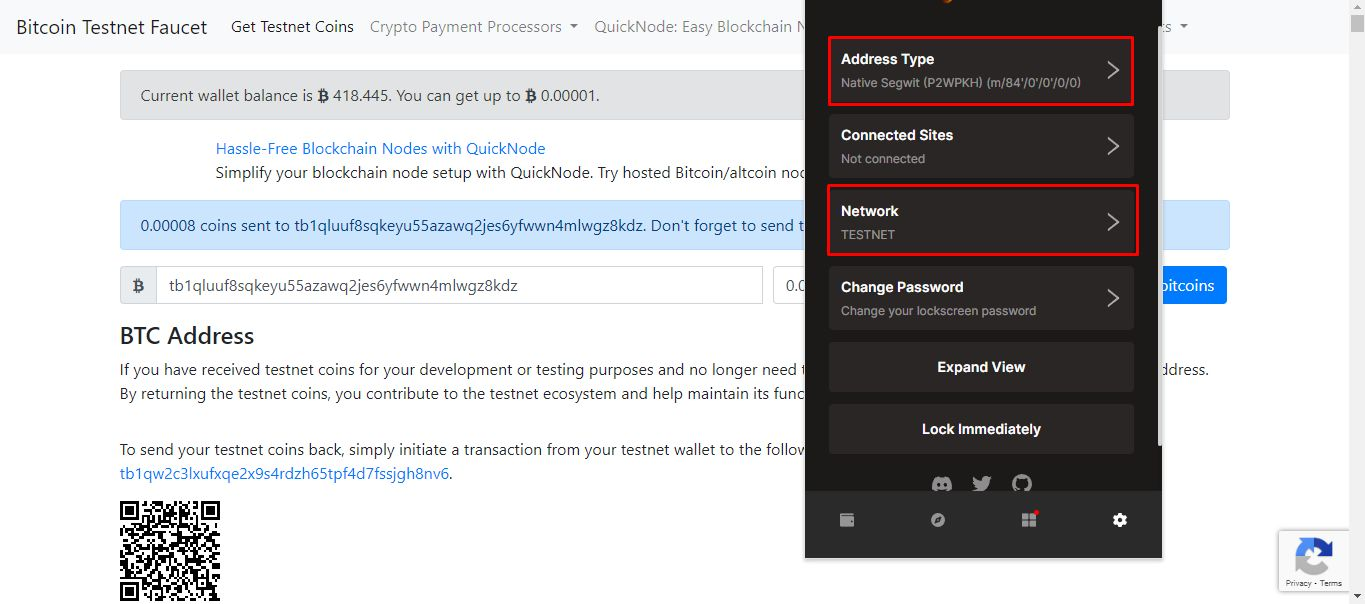

- Download the Unisat wallet. In the final settings menu (gear icon), switch the network to Testnet.

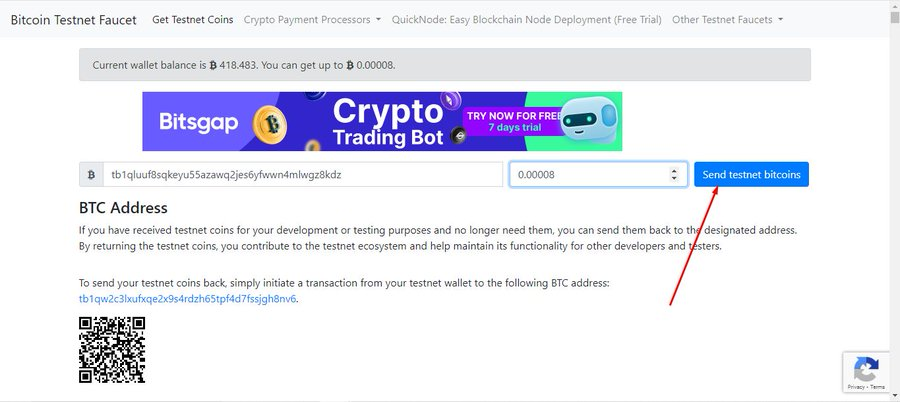

- Visit a faucet to claim testnet BTC (tBTC). Enter the amount and your Unisat address:

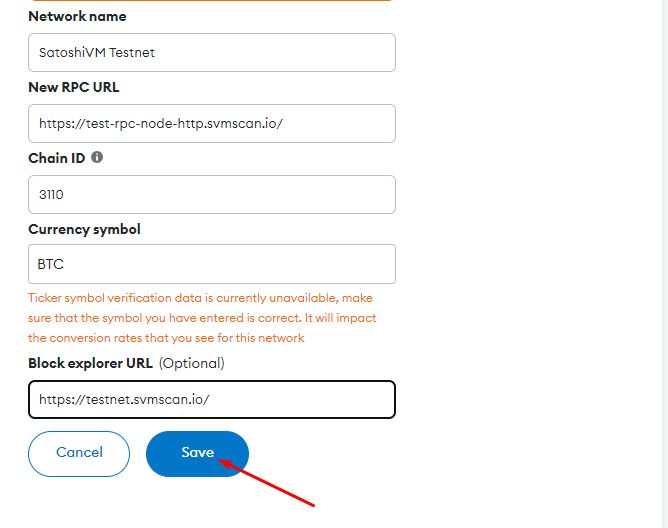

- Add SatoshiVM network details to MetaMask following the instructions below:

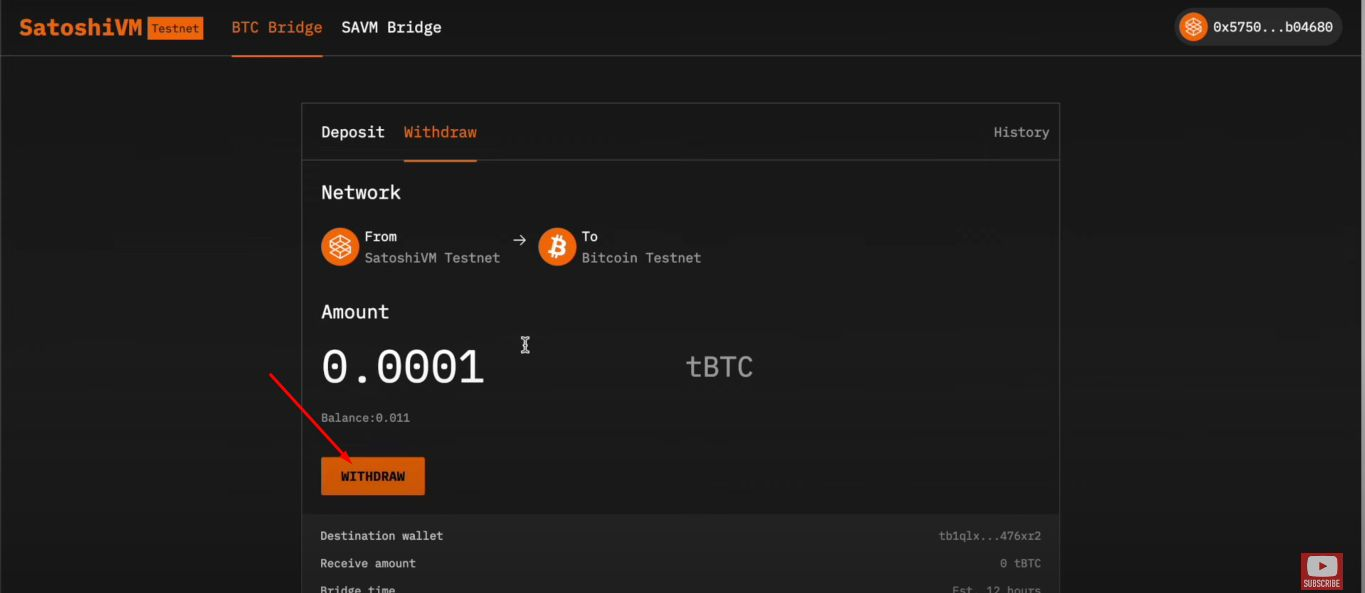

- Complete BTC transfers across networks

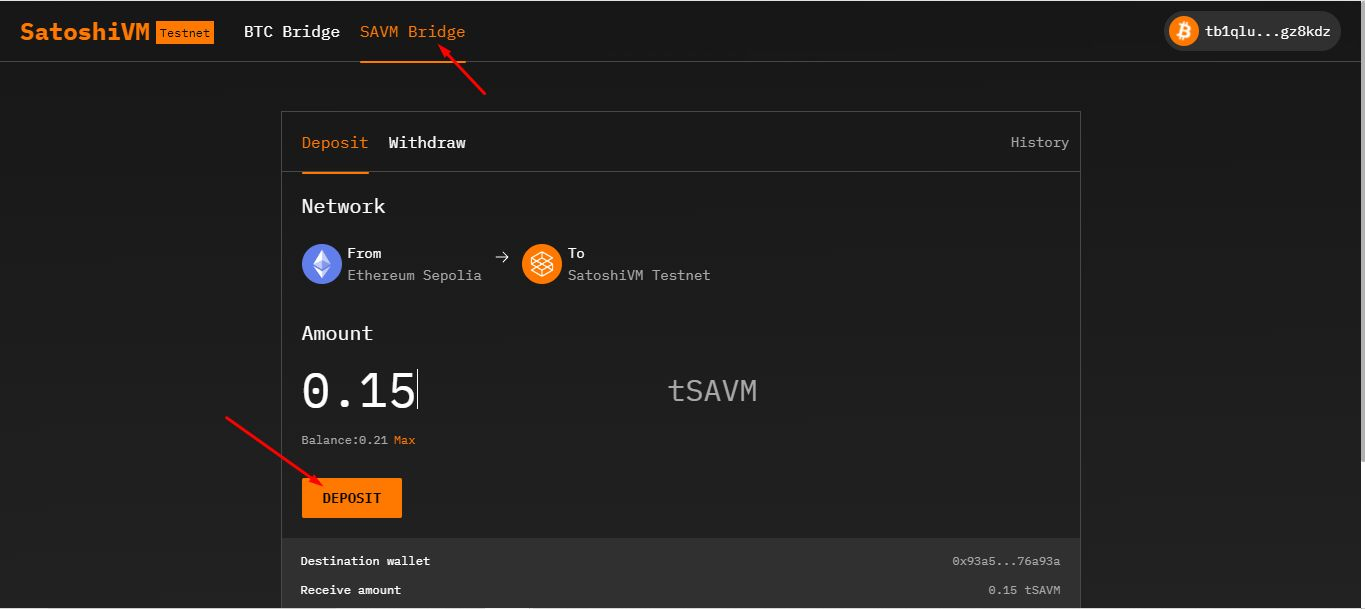

- Transfer SAVM tokens (the project’s future official token)

Additionally, SAVM’s mainnet token will officially launch on the 19th.

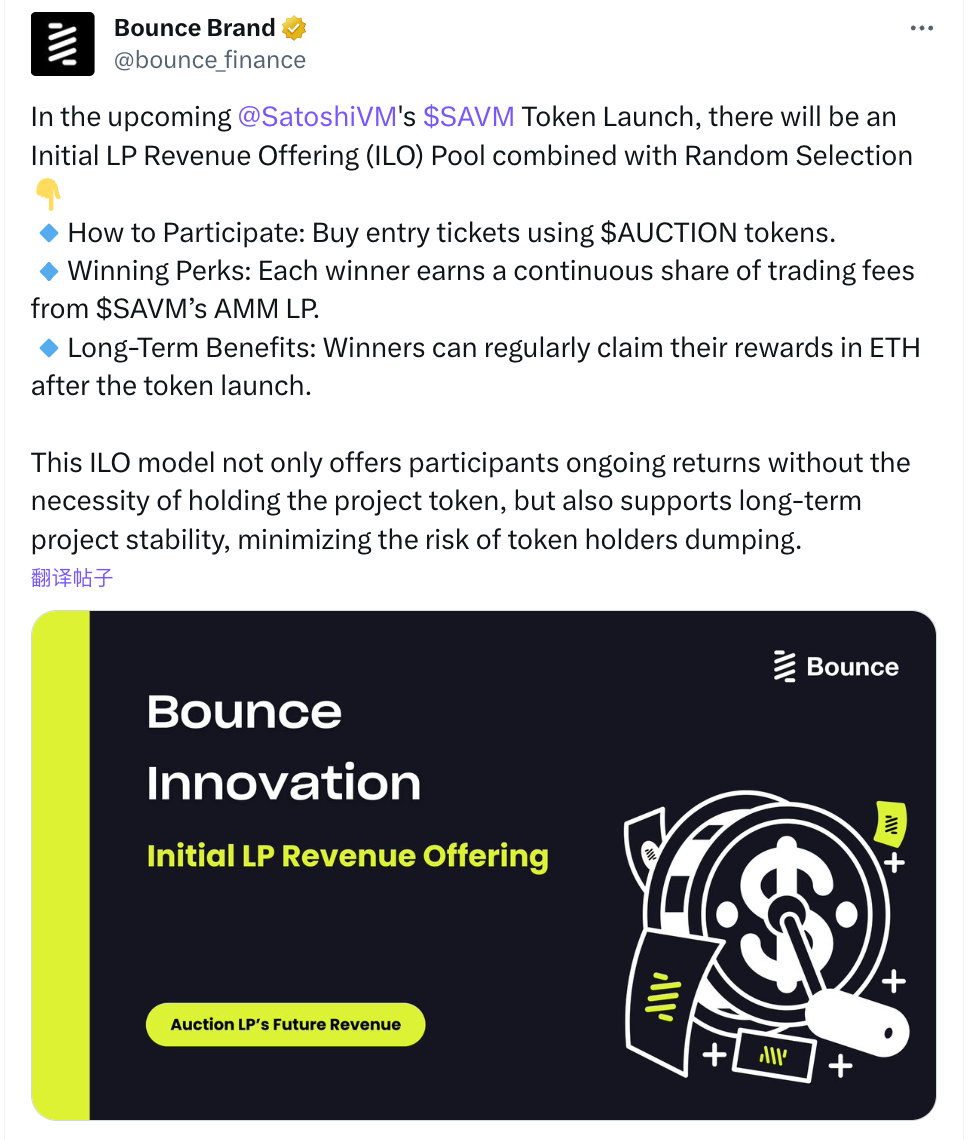

In terms of issuance design, SAVM will be supported by Bounce—a well-known Bitcoin ecosystem project—with its corresponding token AUCTION. Bounce utilizes an Initial Liquidity Offering (ILO), meaning SAVM will debut with an AMM-based initial liquidity pool, allowing participants to swap tokens upon launch.

To participate in the ILO, users must hold AUCTION tokens. There is a random chance of being selected to gain trading access. Participants can also earn ongoing fee shares from the liquidity pool and receive ETH rewards—an appealing, lower-risk alternative for those wary of direct AMM exposure.

Additionally, SAVM’s mainnet token will officially launch on the 19th.

In terms of issuance design, SAVM will be supported by Bounce—a well-known Bitcoin ecosystem project—with its corresponding token AUCTION. Bounce utilizes an Initial Liquidity Offering (ILO), meaning SAVM will debut with an AMM-based initial liquidity pool, allowing participants to swap tokens upon launch.

To participate in the ILO, users must hold AUCTION tokens. There is a random chance of being selected to gain trading access. Participants can also earn ongoing fee shares from the liquidity pool and receive ETH rewards—an appealing, lower-risk alternative for those wary of direct AMM exposure.

That said, holding AUCTION carries its own price volatility risk—the return on investment ultimately depends on individual judgment.

That said, holding AUCTION carries its own price volatility risk—the return on investment ultimately depends on individual judgment.

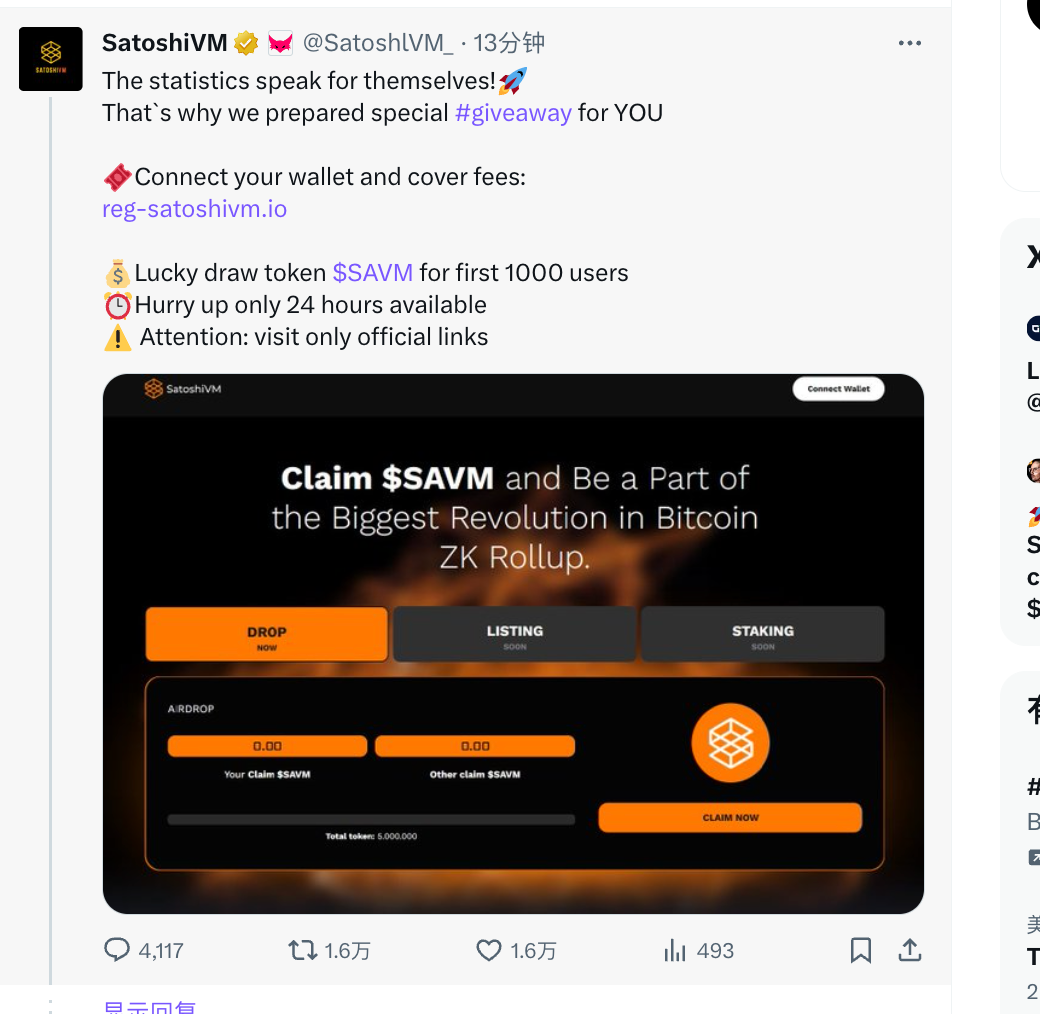

Key Concerns to Watch

Finally, while SatoshiVM’s concept, technology, and narrative appear promising, several concerns emerged during our research. First, as an L2, is the sequencer centralized or decentralized? Who will act as validators? What are the rules for becoming a node? These aspects remain opaque, giving the impression of token-first, details-later. This is common among meme projects but seems premature for an infrastructure initiative. Second, the team behind the project has not disclosed any public information. Given that L2 systems handle large volumes of transactions, security and stability are paramount. Lack of team transparency raises red flags—even though Bitcoin’s ecosystem is largely retail-driven, critical infrastructure lacking experienced teams invites skepticism. Third, the project’s GitHub contains no substantive code, leaving the open-source status of the L2 unknown. Lastly, rampant scams exploiting FOMO around SatoshiVM have surfaced—including fake verified (“gold check”) Twitter accounts with more followers than the official account, distributing phishing links for fake airdrops. Many blue-check accounts actively participate in coordinated fraud, preying on users’ desire for free tokens to steal wallet assets. At a time when the Bitcoin L2 space is heating up, staying cautious and seeking non-consensus opportunities remains the more sustainable path.

At a time when the Bitcoin L2 space is heating up, staying cautious and seeking non-consensus opportunities remains the more sustainable path.Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News