Bitcoin Layer2 Sees Investment Boom: Overview of 20 Early-Stage Projects

TechFlow Selected TechFlow Selected

Bitcoin Layer2 Sees Investment Boom: Overview of 20 Early-Stage Projects

This article systematically reviews current Bitcoin Layer 2 solutions, representative projects, and their progress.

Author: flowie, ChainCatcher

Editor: Marco, ChainCatcher

After the initial wave of ordinals activity subsided, Bitcoin Layer 2 solutions are now expected to carry forward the prosperity of the Bitcoin ecosystem.

Currently, Bitcoin Layer 2 projects are showing a trend similar to the flourishing diversity seen among Ethereum Layer 2s, attracting numerous entrepreneurs. Beyond long-standing protocols like Lightning Network, Liquid Network, and Stacks, a new wave of projects—such as B² Network, BEVM, Dovi_L2, and Map Protocol—have emerged, each claiming to be a Bitcoin Layer 2.

Du Jun, co-founder of Huobi and partner at ABCDE Capital, announced he will personally commit $50 million to participate in Bitcoin ecosystem development, with Bitcoin Layer 2 being his top investment focus.

Bitcoin Layer 2 projects are also experiencing a surge in funding and investor interest.

Recently, Bitfinity, a Bitcoin Layer 2 network, raised $7 million in a token round at a $130 million valuation, with participation from Polychain Capital and others.

Domo, founder of Bounce Finance and BRC-20, participated in the angel round of Nubit, a data availability layer for Bitcoin. Some crypto users view Nubit as the "Celestia of the Bitcoin ecosystem."

Following the ordinals boom that introduced a new asset issuance model, how can Bitcoin Layer 2s expand Bitcoin’s functionality beyond payments and replicate the success of Ethereum's Layer 2 ecosystem?

ChainCatcher has systematically reviewed current Bitcoin Layer 2 approaches and representative projects. This article is divided into two parts. In the first part, titled “Bitcoin Layer 2 Flourishes: An Overview of Six Major Protocols,” we covered leading Bitcoin Layer 2 developments. This second part summarizes 20 early-stage Bitcoin Layer 2 projects.

20 Early-Stage Bitcoin Layer 2 Projects Worth Watching

In mid-2023, Ethereum co-founder Vitalik Buterin suggested during a Twitter Space on the Bitcoin ecosystem that Bitcoin should not just serve as a payment method—it needs scaling solutions like Plasma or ZK Rollups. He cited Optimism and Arbitrum as successful rollup examples that could serve as case studies for Bitcoin.

Indeed, many recent Bitcoin Layer 2 projects have adopted rollup-based scaling solutions. Several emphasize EVM compatibility, while others integrate AI narratives.

1. Rollup

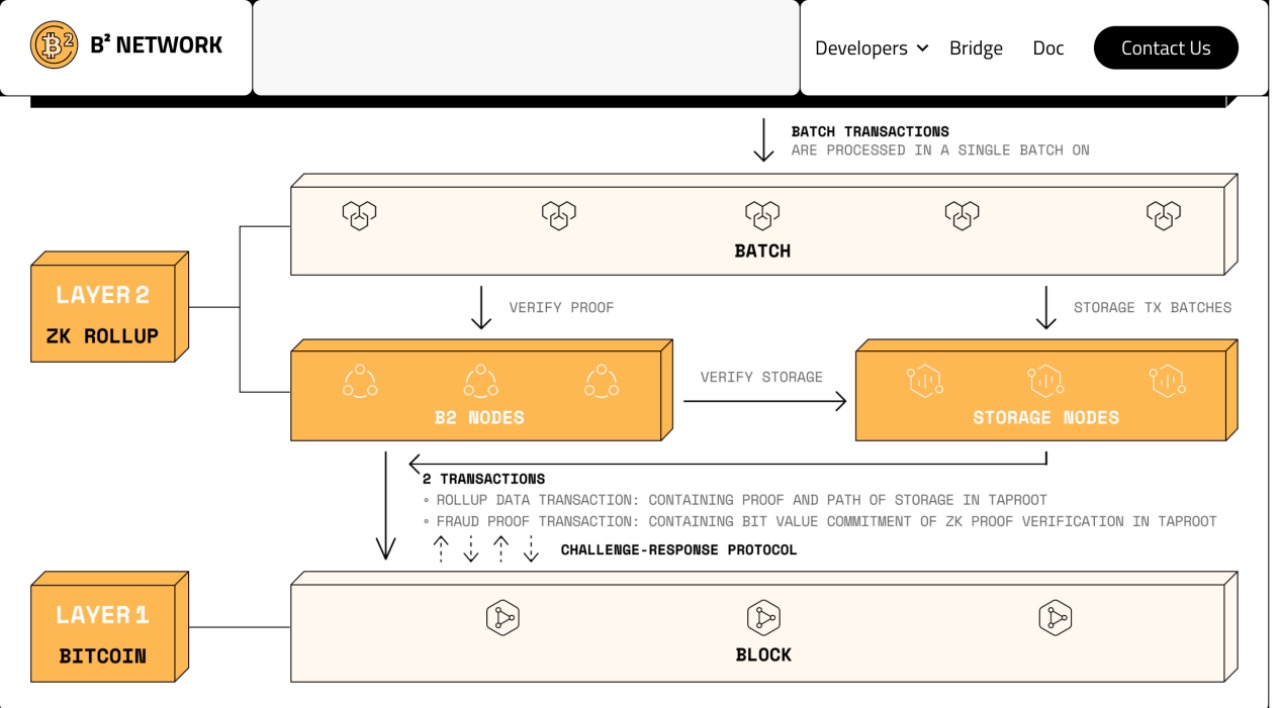

Founded in 2022, B² Network is a ZK-Rollup-based Bitcoin Layer 2 that is EVM-compatible, enabling seamless deployment of DApps by developers from the EVM ecosystem.

B² Network participated in ABCDE’s Bitcoin ecosystem project pitch event in November 2023 and ultimately received investment. According to ABCDE, B² Network’s core technical team consists of active contributors to major Web3 open-source communities such as Ethereum, Bitcoin, Cosmos, and Sui, supported by multiple grants. The team specializes in Layer 1, Layer 2, cross-chain, account abstraction, and other Web3 infrastructure products, with strong engineering capabilities.

On December 18, 2023, B² Network launched its Alpha testnet MYTICA for partners and began recruiting ecosystem developers, allowing partners and developers to deploy DApps on the testnet.

Meson, a cross-chain protocol within the B² Network ecosystem, has already deployed USDC stablecoin on the B² Network Alpha testnet. Meson focuses on fast, stable, secure, and low-cost cross-chain transfers, supporting free circulation of major digital assets like ETH, BNB, USDC, and USDT between B² Network and over 30 mainstream public chains.

On January 3, B² Network announced a $1 million grant program to incentivize ecosystem builders.

BL2 (BL2T)

BL2 is a Bitcoin ZK-Rollup Layer 2 built on a general-purpose VM protocol and Celestia’s DA layer. It brings ZK-Rollup technology to Bitcoin, enabling multi-node ZK verification on the Layer 2 network, and supports inscription on-chain backup and cross-chain functionality.

BL2 launched the BRC-20 token $BL2T with a total supply of 21 million. The token serves as governance for BTC L2, with 20% of gas fees permanently burned. On January 8, BL2 conducted an IDO on Turtsat at 30 Sats (approximately $0.013).

Founded in 2022, Chainway is a blockchain infrastructure company focused on Bitcoin, Ethereum, and zero-knowledge technologies. Chainway has developed a Bitcoin ZK Rollup, the browser extension OrdinalSafe, and the zk tool Proof of Innocence.

Recently, Chainway announced plans to launch its public mainnet for Bitcoin ZK Rollup in 2024 and build a dedicated community around it.

Launched in 2023, Bison is a native Bitcoin zk-rollup designed to accelerate transaction speeds and enable advanced functionalities on native Bitcoin. Developers can use zk-rollup to create innovative DeFi solutions such as trading platforms, lending services, and automated market makers.

Bison also participated in ABCDE’s Bitcoin ecosystem pitch event. Its solution leverages zero-knowledge proofs and Ordinals for fast, secure transactions, with all data anchored back to Bitcoin for enhanced security. Bison claims to achieve up to 2,200 transactions per second at one-thirty-sixth the cost of Bitcoin transactions.

The Bison team includes core contributors from Starknet.

Founded in 2023 and developed by Syscoin (SYS), a Layer 1 blockchain, Rollux is an EVM-equivalent Optimistic rollup that inherits security from Bitcoin’s mining network and Syscoin’s Layer 1 data availability.

Syscoin previously announced in June 2022 a $20 million ecosystem development fund from cryptocurrency exchange MEXC.

Rollux launched its mainnet in June 2023 and plans to transition from Optimistic Rollup to a ZK-based Rollup. Rollux does not issue a new token but uses Syscoin as its gas token.

BOB (Build On Bitcoin), founded in 2020, is an EVM rollup stack with native Bitcoin support, enabling developers to build decentralized applications atop Ordinals, Lightning, and Nostr.

BOB currently operates a public testnet running live on the Sepolia Ethereum testnet. According to BOB’s official roadmap, it will first integrate Bitcoin’s security via PoW restaking and later upgrade its Optimistic Rollup to ZK proofs.

Founded in 2022, Hacash.com offers a solution that combines state channels with multi-layer scaling, making it somewhat of an “ultimate Frankenstein” (in a positive sense) compared to sidechains or pure OP/ZK Roll-ups. Unlike bidirectional sidechains, Hacash enables one-way transfer of Bitcoin from Layer 1 to the Hacash chain without changing user private keys, then performs payment operations through state channels deployed on Layer 2. The team has also proposed a Layer 3 concept for further ecosystem expansion.

Hacash Layer 1 has been running since 2019 using PoW consensus, supported by three PoW currencies—HACD, BTC, and HAC—that form a self-regulating supply system for coin issuance, distribution, and settlement, aiming to address Bitcoin’s lack of monetary attributes. Layer 2 serves as a payment settlement channel chain, optimized for high-volume payments and acting as infrastructure for Layer 3. Layer 3 supports multi-chain interactions, application development, asset issuance, smart contract execution, on-chain data interaction, and cross-chain capabilities.

Ken You, co-founder of Hacash.com, published an article titled "ZK-Rollups Top Three Possibilities for Scaling Bitcoin," where he used the example of building a new chain with ZK roll-up, suggesting the team may be considering implementing ZK Roll-up for a new chain.

BeL2 is a Bitcoin Layer 2 launched by Elastos (ELA), a Layer 1 blockchain. This BTC Rollup allows Bitcoin to support smart contracts and irreversible digital agreements. These smart contracts can be fully defined, managed, tracked, and modified directly on Bitcoin without intermediaries.

The network also allows users to stake their Bitcoin holdings and earn yield when interacting with applications built on BeL2.

Elastos plans to announce partnerships and use cases in financial services, entertainment, and real-world assets (RWA) supporting BeL2 in the coming months.

2. Bitcoin Sidechains

Libre (LIBRE)

Founded in 2022, Libre is a Bitcoin L2 sidechain aimed at enhancing Bitcoin’s speed and usability to scale its performance.

Libre launched its mainnet on July 4, 2022. Shortly after, it distributed a 10 million LIBRE airdrop, though only 277,000 were claimed. In addition to its Layer 2 blockchain, Libre has released a test version of a BRC-20 DEX and a mobile app to facilitate inscription trading.

3. Bitcoin Data Availability Layer

Founded in 2023, Nubit is a data availability layer for the Bitcoin ecosystem, aiming to transform how transactions are processed on Bitcoin. Developed by the Riemann team, it proposes BRC-1310—a specialized Bitcoin-native data availability standard—leveraging advanced technologies including Bitcoin-native staking, data availability sampling, on-chain data proofs on Bitcoin, and decentralized bridges.

On January 4, Bitcoin Layer 2 protocol Nubit announced it secured an angel round investment from domo, founder of Bounce Finance and BRC-20.

4. AI Integration

x.TAI is a Bitcoin Layer 2 network based on AI-powered cryptographic algorithms. In December 2023, x.TAI announced the upcoming release of xTAI Network, a Layer 2 inscription chain built on its XRC20 protocol. The BRC-20 inscription "xtai" will serve as the ecosystem’s governance token.

According to x.TAI’s official Twitter, details of xTAI Network were originally scheduled for release on January 1, but the announcement was delayed with no new timeline provided.

AiPTP (ATMT)

Founded in 2023, AiPTP is a decentralized AI network built on blockchain. It aims to construct a dual-Layer 2 architecture for Bitcoin: a PoS-based Bitcoin L2 (tentatively AIS) to support AiPTP’s training models, and a PoW-based Bitcoin L2 (tentatively AIW) for inference models. Bitcoin and ATMT tokens can be transferred across all three chains—using burn+mint for ATMT, and staking on chain A to release on chain B for Bitcoin cross-chain swaps.

5. Others

Founded in 2023, BEVM is a decentralized, EVM-compatible Bitcoin L2. Leveraging technologies enabled by the Taproot upgrade—such as Schnorr signatures—BEVM allows BTC to be bridged from Bitcoin mainnet to Layer 2 in a decentralized manner. Due to EVM compatibility, all DApps running on Ethereum can operate on this BTC Layer 2 using BTC as gas.

On November 29, 2023, BEVM released its whitepaper.

BEVM has launched its precursor network, ChainX. BEVM’s 2023 annual report for the precursor network shows: total transactions reached 2.77 million, active addresses totaled 55,000; TVL reached 119.56 BTC (approximately $5.09 million); total bridge volume between Ethereum L2 reached $11.53 million. Recently, BEVM’s precursor network launched Bevscriptions, its first inscription protocol, processing 3 million transactions within 6 hours at around 150 TPS.

In December 2023, BEVM completed its first Odyssey campaign. Founder Gavin (@gguoss) announced the second phase would begin on January 15, inviting 10–20 ecosystem projects. The name “Odyssey” will be retired, replaced with “Helsinki”—named after the location of Satoshi Nakamoto’s first mined Bitcoin block.

Currently, the BEVM ecosystem includes over 20 projects such as OmniSwap (a cross-chain BTC DEX) and Bool Network (a decentralized signature protocol).

Dovi (DOVI)

Founded in 2023, Dovi is an EVM-compatible smart contract platform on Bitcoin Layer 2. In November 2023, Dovi officially released its whitepaper, which outlines integration of Schnorr signatures and MAST structures to enhance transaction privacy, optimize data size, and streamline validation. It provides a flexible framework for issuing various asset types beyond Bitcoin and enables cross-chain asset transfers.

KuCoin Labs announced a strategic investment in Dovi in December 2023, and its native token DOVI was listed on KuCoin on December 12. DOVI followed a fair launch model, with all 15 million tokens claimed within four hours of listing. As of January 15, DOVI’s fully diluted market cap was approximately $9.4 million. Users can currently stake DOVI on the official website to earn rewards.

According to Dovi’s official site, next steps include launching a testnet, building a developer community and ecosystem support, and releasing Dovi V1.

Founded in 2022, ZeroSync aims to scale Bitcoin using zero-knowledge proofs (ZK-Proofs, ZKP). Its primary application is enabling near-instant blockchain synchronization and verification across nodes globally via Blockstream satellites. By the end of 2023, team member @lucidLucky broadcast the first chain state proof through the @Blockstream satellite into space.

ZeroSync uses STARK proofs and the Cairo programming language created by StarkWare. It will roll out in three phases: header chain proofs, validity-asserted chain proofs, and full chain proofs. The first two prototypes have already been completed. The ZeroSync Toolkit will provide Bitcoin developers with tools to apply zero-knowledge proofs in their own products and services. Development is supported by StarkWare, OpenSats, Spiral, and Geometry.

On October 9, 2023, ZeroSync lead Robin Linus published a whitepaper titled “BitVM: Compute Anything On Bitcoin,” sparking widespread discussion about enhancing Bitcoin’s programmability. BitVM, or “Bitcoin Virtual Machine,” aims to allow developers to run complex contracts on Bitcoin.

Founded in 2019, Map Protocol is a peer-to-peer cross-chain interoperability Layer 2 for Bitcoin. By leveraging Bitcoin’s security mechanisms, Map Protocol enables assets and users from other public chains to interact seamlessly with the Bitcoin network, enhancing security and enabling BRC-20 cross-chain capabilities.

Map Protocol recently announced strategic investments from DWF Labs and Waterdrip Capital.

MAP and MAPO are both native tokens of Map Protocol—they represent the same token but use different ticker symbols depending on the chain. On December 18, Map Protocol initiated a large-scale token burn of 133,886,020 MAP/MAPO tokens, representing 5.9% of circulating supply. As of January 15, Map’s fully diluted market cap was approximately $260 million.

Founded in 2017, Tectum is a distributed ledger protocol management platform, with an ecosystem comprising Tectum Blockchain, Tectum Wallet, Tectum Token (TET), Tectum SoftNote, and a 3FA identity authentication app.

Tectum SoftNote is a non-custodial Bitcoin Layer 2 capable of scaling Bitcoin transaction throughput to hundreds of thousands—or even over a million—transactions per second.

Tectum’s native token is TFT, used for minting SoftNotes, paying reduced merchant fees, minting T12-20 standard project tokens, and accessing other Tectum/CrispMind products. TET is now live for mainnet staking. As of January 15, TFT’s fully diluted market cap stood at $275 million.

Bitfinity (formerly InfinitySwap), founded in 2021, is an EVM-compatible Bitcoin Layer 2 built on the Internet Computer. Initially, InfinitySwap aimed to mainstream BTC staking via AMM, earning the nickname “Uniswap of the ICP blockchain.”

Recently, Bitfinity raised $7 million in a token round at a $130 million valuation, with investors including Polychain Capital, ParaFi Capital, Dokia Capital, and Draft Ventures. In 2021, Bitfinity also secured a $1.5 million seed round from Polychain, a16z Crypto, Internet Computer, Dfinity, and Draft Ventures.

Currently, Bitfinity is in testnet phase, with mainnet launch date unannounced.

BitBolt Network is a Bitcoin Layer 2 utilizing account abstraction and threshold ECDSA, focusing on Bitcoin payments and the Ordinals ecosystem. BitBolt enables lightning-fast Bitcoin transactions with low fees and smart contract functionality. The Thunder testnet is already live.

In July 2023, BitBolt conducted an IDO, but later announced it failed to meet its fundraising goal of 3 BTC and decided to refund all participating addresses.

DFS Network is a Bitcoin Layer 2 that announced mainnet launch on January 1 and began mining its mainnet token DFS on January 3. The initial mainnet version is quite basic, offering only Swap, liquidity mining, an on-chain social feed, node voting, and cross-chain deposit/withdrawal for major BRC-20 inscriptions.

According to official information, DFS is the mainnet token of DFS Network, used for governance and partial fee buyback/burn on the DEX. Total supply is 10 million: 1 million DFSN were fairly distributed on the BTC chain, and 2.5 million DFS on EOS, both to be 1:1 mapped and airdropped to DFS Network. The remaining 6.5 million will be fairly released via liquidity mining. Relationship between DFSN and DFS: 1 DFS = 1 DFS, 1 DFSN = 1 DFS + 1 meme (BRC-20). 0.05% of swap fees will be used to burn DFS.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News