A $9 billion scale: old and new applications dancing together in the DePIN sector

TechFlow Selected TechFlow Selected

A $9 billion scale: old and new applications dancing together in the DePIN sector

This article will categorize by specific scenarios to help you understand what DePIN really is and where the opportunities lie.

Author: Weilin

DePIN, a new term from the Web3 space, emerged at the end of 2023 and is attempting to capture market attention in 2024.

You're probably already familiar with the concept—translated as "Decentralized Physical Infrastructure Networks." For example, Filecoin, a decentralized storage project, belongs precisely to this category. However, when Filecoin was gaining popularity, the term DePIN hadn't yet been coined by crypto research firm Messari.

In fact, even after Messari first introduced the DePIN concept at the end of 2022, discussion around it lasted only about a month.

It wasn't until December 2023, when token prices for Helium (MOBILE), focused on mobile devices, and Hivemapper (HONEY), focused on automobiles, surged dramatically, that investor interest in the crypto market was reignited. Only then did the DePIN concept gain real traction, expanding its application scenarios beyond the previously dominant "storage" use case into richer, more diverse domains.

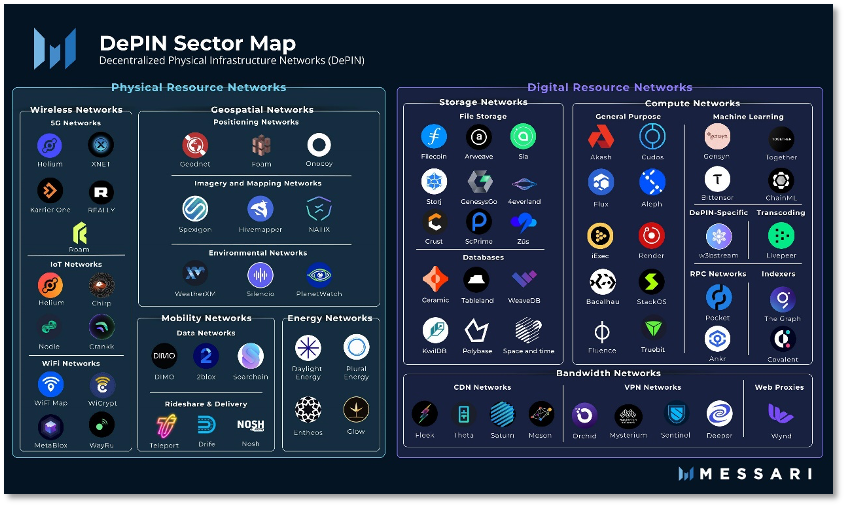

Overview of DePIN Projects (Image courtesy of Messari)

Currently, the DePIN sector has a valuation of approximately $9 billion. According to estimates by Messari, this sector could grow to a $3.5 trillion market by 2028.

Simply put, DePIN uses token incentives to encourage individuals to share network or hardware resources, including computing power, wireless networks (WiFi), servers, sensors, blockchain node equipment, and AI-related resources that have gained popularity over the past year.

Compared to traditional centralized infrastructure, DePIN offers the following key advantages:

-

Breaks the limitations imposed by monopolistic control over information and communication technology infrastructure

-

Enables users to collectively bear costs such as capital, assets, and labor for shared goals, reduces management overhead via blockchain ledgers, and enables revenue sharing through token incentives

-

Decentralized, distributed networks are more resilient and reduce single points of failure

-

In open, permissionless global ecosystems, potential speeds can exceed those of centralized systems by an order of magnitude

Currently, Ethereum is the primary blockchain network for deploying DePIN projects, though Solana, one of its competitors, is beginning to show strong adaptability for DePIN applications. The market features both established and emerging players—Filecoin and Theta Network are well-known names, while Helium and Hivemapper are rising toward top-tier status.

This article categorizes DePIN applications by specific use cases to help you understand what DePIN really is and where the opportunities lie.

Storage

Filecoin (FIL)

Filecoin is a peer-to-peer network for storing files, featuring built-in economic incentives and cryptographic techniques to ensure files are reliably preserved over long periods. Its architecture is based on the IPFS protocol.

On the Filecoin network, users pay to store files in a distributed, shared space. Filecoin supports various use cases, including not only Web2 data but also NFTs and Web3 gaming assets, offering a more economical, reliable, and diverse alternative to traditional centralized cloud storage.

-

Total supply of FIL: 1,960,979,373 FIL

-

Circulating supply: 496,332,000 FIL

-

Current price: $6.22

-

All-time high: $237.24

-

All-time low: $1.83

Theta Network (THETA)

Theta Network is a blockchain network dedicated to storing streaming content. Originally launched on Ethereum, it later developed its own native blockchain.

On Theta Network, video and media platforms can reduce content delivery costs. End users earn rewards by sharing storage space or bandwidth from personal computers, mobile devices, smart TVs, or IoT devices. Theta supports Turing-complete smart contracts and is fully compatible with Ethereum. Use cases include NFTs, DApps, and decentralized autonomous organizations (DAOs).

-

Total THETA supply: 1,000,000,000

-

Circulating supply: 1,000,000,000

-

Current price: $1.13

-

All-time high: $15.90

-

All-time low: $0.03977

Arweave (AR)

Arweave aims to permanently store files using a distributed computing network. It leverages a novel, blockchain-like data structure to challenge market dominance by existing storage giants like Google, Amazon, and Microsoft.

It shares many similarities with Filecoin. Arweave uses its native token AR to support services. When users spend AR to store data, node operators (miners) maintaining the network earn AR. During on-chain transactions, AR is allocated to an endowment fund, which slowly releases rewards indefinitely through technical mechanisms—ensuring perpetual storage.

-

Total AR supply: 65,454,185 AR

-

Circulating supply: 65,454,185 AR

-

Current price: $9.40

-

All-time high: $90.94

-

All-time low: $0.4854

Computing

Render Network (RNDR)

Render Network is the first decentralized GPU rendering platform, built on the Ethereum blockchain. It allows complex GPU-based rendering tasks to be processed and distributed across a peer-to-peer network, simplifying transactions for rendering 3D environments, models, and objects for end users.

Node operators with idle computing capacity can contribute their unused GPUs to the network and earn RNDR by fulfilling user rendering requests.

-

Total RNDR supply: 530,962,615

-

Circulating supply: 371,908,453

-

Current price: $4.02

-

All-time high: $8.76

-

All-time low: $0.03676

Akash (AKT)

Akash is a fully autonomous proof-of-stake (PoS) blockchain built on Cosmos Hub—an open-source supercloud. It enables users to securely and efficiently buy and sell computing resources, designed specifically for public use.

With Akash Cloud, users can deploy infrastructure or sell their unused cloud resources to others. Developers can purchase cloud resources to deploy and run applications.

-

Total AKT supply: 224,981,645

-

Circulating supply: 224,981,645

-

Current price: $2.93

-

All-time high: $8.08

-

All-time low: $0.1672

Wireless Networks

Helium (HNT, IOT, MOBILE)

Helium Network is a decentralized, blockchain-based wireless network infrastructure that allows individuals and organizations to earn incentives by sharing wireless connectivity. Currently, Helium has expanded from its own Layer 1 blockchain to Solana. The primary network-driving token is HNT, while IOT and MOBILE tokens support LoRaWAN and 5G networks respectively.

Hotspots in Helium allow people to own and operate wireless networks supporting various IoT devices, including smart pet collars, food delivery systems, smart bicycles and electric vehicles, tracking devices, cooling systems, smart lighting systems, and more.

-

MOBILE total supply: 80.56B

-

Circulating supply: 80.56B

-

Current price: $0.002844

-

All-time high: $0.007791

-

All-time low: $0.0000704

Internet of Things (IoT)

IoTeX (IOTX)

IoTeX is a Layer 1 blockchain network designed to secure interactions between IoT devices and users, aiming to help users securely access data.

Currently, the IoTeX ecosystem includes a decentralized network of users, developers, and enterprises who jointly govern the entire ecosystem. IoTeX is driving real-world products onto the blockchain, such as blockchain-enabled cameras and supply chain optimization devices. It claims to be fast, secure, and scalable, and is already compatible with the Ethereum Virtual Machine (EVM).

-

Total IOTX supply: 9,441,378,959

-

Circulating supply: 9,441,378,955

-

Current price: $0.04564

-

All-time high: $0.2611

-

All-time low: $0.001239

Hivemapper (HONEY)

Hivemapper is a decentralized digital mapping network built on the Solana blockchain. It creates maps by enabling drivers to capture images of roads using specialized dashcams—acting like "mining rigs" to earn HONEY rewards for contributing imagery. Anyone can view the current state of the map via a website called Hivemapper Explorer.

Hivemapper dashcams provide data for Web3 maps

-

Total HONEY supply: 6,200,807,534

-

Circulating supply: 608,048,086

-

Current price: $0.2024

-

All-time high: $0.4315

-

All-time low: $0.0085

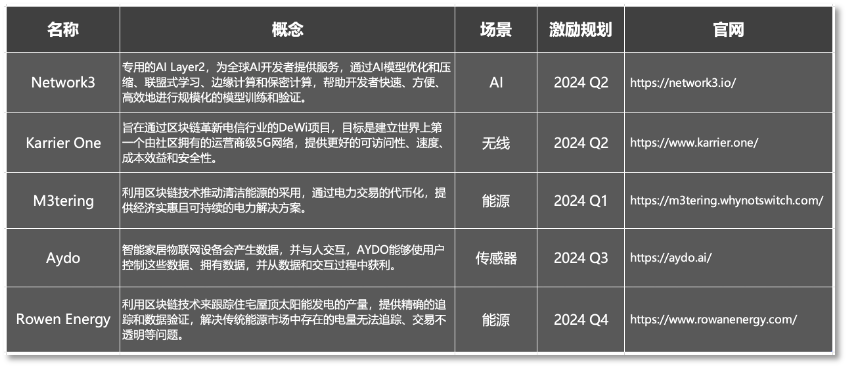

New DePIN Applications

Beyond the above DePIN projects, new promising applications are emerging in the sector, extending into areas like AI compute power and even energy. Their incentive programs and economic models are already taking shape.

New Applications in the DePIN Sector

As a user, if you possess resources that these DePIN projects need, consider contributing—but make sure to evaluate whether the projects offer a secure environment for sharing. Also analyze whether the incentives hold real value, such as whether investing in the project's branded hardware is worthwhile.

Don’t forget—the Filecoin miner losses due to several FIL price crashes between 2021 and 2022 remain fresh in memory.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News