USDe, the Next Stablecoin to Reach $1 Billion in Scale?

TechFlow Selected TechFlow Selected

USDe, the Next Stablecoin to Reach $1 Billion in Scale?

Ethena is expected to officially launch in late January and may announce its airdrop plan.

Text: THOR HARTVIGSEN

Translation: Luffy, Foresight News

Historically, on-chain stablecoins have faced tough competition against centralized counterparts. As a result, USDC and USDT dominate the stablecoin landscape with over 95% of total market share. The challenge for on-chain stablecoins is either difficulty scaling due to over-collateralization or failing to maintain their peg due to under-collateralization.

In March 2023, Arthur Hayes wrote an article titled “Dust on Crust,” discussing the rise of stablecoins and their use among traders and market makers. He then proposed a concept for a fully decentralized, on-chain stablecoin called “Nakamoto Dollar”—a delta-neutral, 1:1 collateralized synthetic dollar backed by equal long spot and short futures Bitcoin exposure.

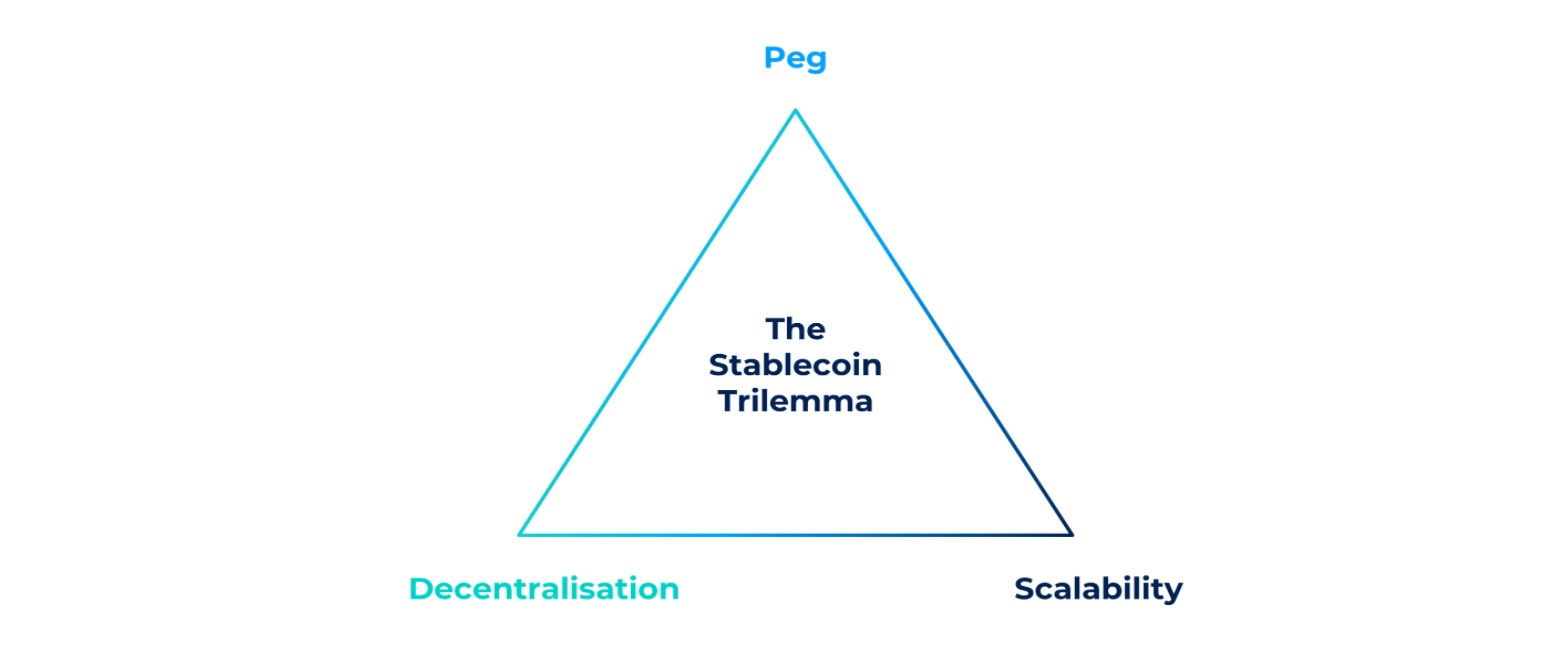

This idea has now been realized by Ethena Labs, which is building USDe—a synthetic dollar backed by ETH staking yield and perpetual swaps. In short, USDe is 1:1 collateralized by ETH LSTs (e.g., Lido’s stETH), with risk hedged by shorting an equivalent amount of ETH perpetual futures. USDe generates high yields (currently above 20%) and is branded as the “internet bond.”

Ethena is backed by Dragonfly, Wintermute, OKX Ventures, and investors including Cobie, Arthur Hayes, and Anthony Sassano. I was excited to speak with Ethena founder Guy to learn more about the underlying design and upcoming roadmap, including mainnet launch, DeFi integration, and an upcoming airdrop program.

Dissecting USDe and Ethena

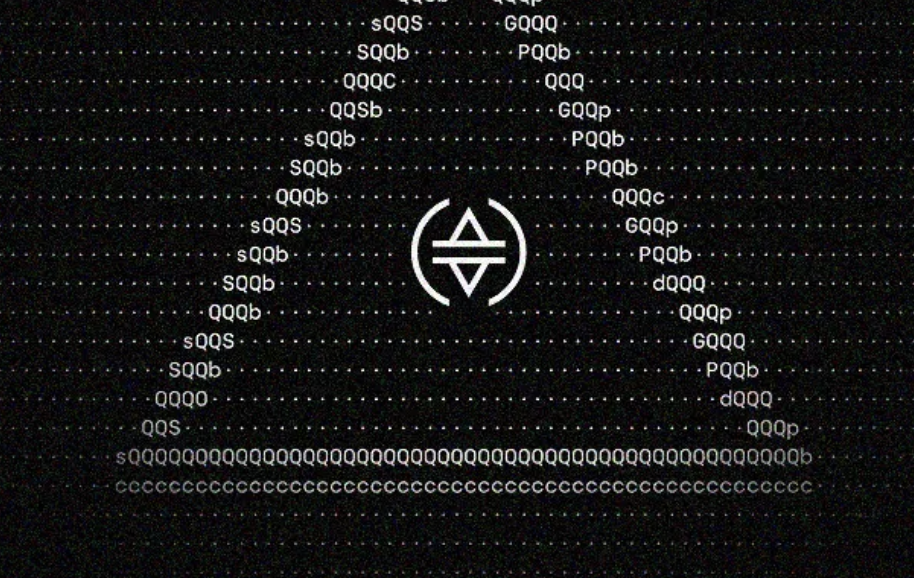

The “stablecoin trilemma” was introduced years ago, stating that a stablecoin cannot simultaneously achieve all three of the following properties:

-

Maintain its peg to the underlying asset

-

Be scalable

-

Be decentralized

-

Stablecoins like USDC and USDT are scalable and maintain their dollar peg but are not decentralized.

-

On the other hand, Liquity’s LUSD is highly decentralized and maintains its dollar peg well but struggles to scale due to over-collateralization.

-

Terra’s UST was both decentralized (to some extent) and highly scalable but failed to maintain its peg.

Ethena’s USDe aims to satisfy all three properties, thus solving the stablecoin trilemma. USDe is not yet publicly released (only whitelisted users can access it during the pre-launch phase), but in just over a month, its supply has already grown to over $115 million. Here’s how it works:

Users can obtain USDe in two ways. First, by purchasing it on decentralized exchanges such as Uniswap or Curve. Second, by minting it through the Ethena protocol. Upon public release, users will be able to mint USDe via the Ethena frontend using various assets, which are converted into ETH LSTs (such as stETH, mETH, and wbETH) on the backend. These are then deposited as collateral with custodians and used to create short ETH positions on centralized exchanges. This hedge creates a dollar-denominated position, and USDe is issued against this dollar value.

The short side of the collateral is unleveraged because USDe focuses on being a secure base layer:

“The idea behind the product is to make it as safe as possible at the base layer. You can later leverage it in interesting ways to boost returns, but our primary goal is to build a solid foundation that others can build upon—whether through money markets or perpetual DEXs.”

USDe maintains its peg through arbitrage. If USDe trades below its peg on exchanges like Curve, Uniswap, or Binance, arbitrageurs can buy USDe and redeem the underlying collateral at $1 via the Ethena frontend for profit. If USDe trades above the peg, arbitrageurs can mint USDe on Ethena and sell it on exchanges. As long as USDe remains 1:1 collateralized, the peg stays intact.

Growing Dollar Liquidity

Liquidity is crucial for a stablecoin to maintain its peg. Ethena aims to increase USDe liquidity across various decentralized exchanges, particularly Curve Finance—the leading DEX for stable assets. With the public launch expected in late January, Ethena will implement incentives to ensure deep liquidity for USDe on Curve. At the time of writing, several USDe liquidity pools already exist on Curve, including USDe/USDC, USDe/FRAX, and USDe/crvUSD.

The Yield Flywheel

As previously outlined, both the long and short sides of USDe collateral generate yield, which is distributed to users who stake USDe. The sources of yield are:

-

Spot long: Ethereum staking yield (consensus layer and execution layer rewards).

-

Futures short: Funding fees and basis earned from derivative positions.

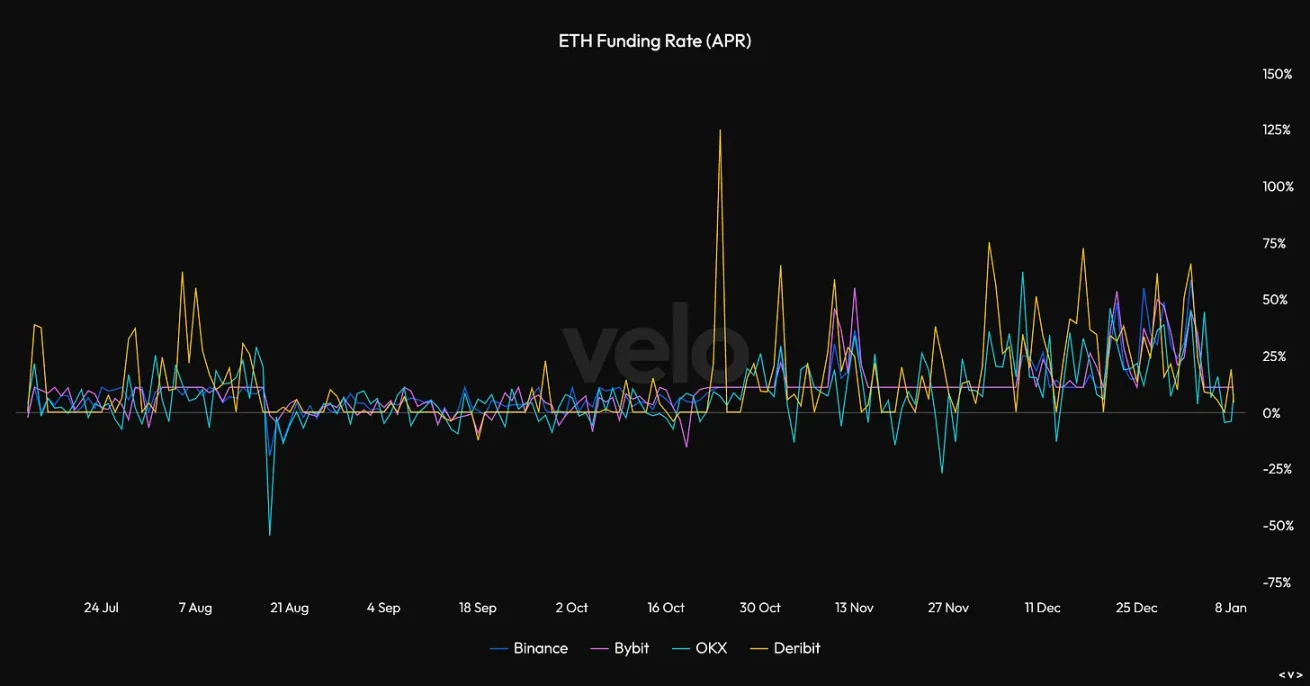

Annualized yield from ETH staking typically ranges between 3–5%, while funding rates in ETH derivatives are more volatile and heavily dependent on market demand for futures trading. As shown below, ETH futures funding rates recently surged above 70% amid market recovery, as traders eager to go long ETH pay high premiums. These funding fees are paid by longs to shorts.

During periods of strong bullish sentiment, the yield generated by USDe collateral could easily exceed 30–40%. Historically, however, over longer timeframes, yields have averaged around 5–15% APY.

Dual-Token Design

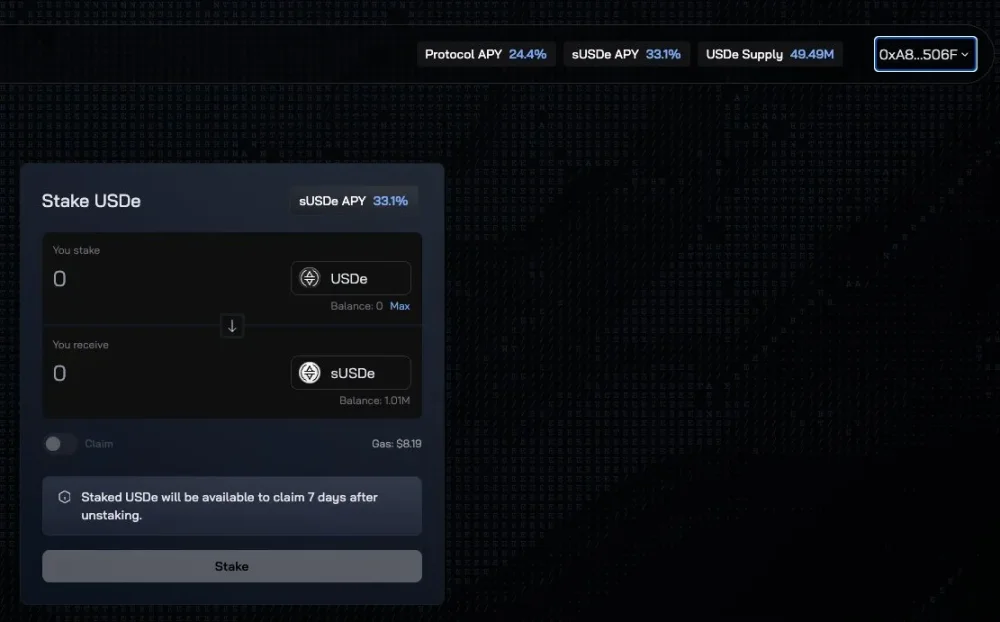

As noted earlier, users must stake their stablecoin as sUSDe to receive the yield generated by USDe. For example, if the total yield on USDe collateral is 15% but only half of all USDe is staked, sUSDe stakers would earn (15%/50%) = 30% APY.

Since USDe liquidity will be incentivized on DEXs like Curve and further integrated into various money markets and other DeFi applications, not all USDe is expected to participate in protocol yields. As illustrated below, total collateral yield is labeled “Protocol APY,” while staked sUSDe yield is labeled “sUSDe APY.”

Additionally, Ethena will specifically focus on integrating USDe into centralized exchange order books, differentiating the product from other on-chain stablecoins and driving broader adoption.

DeFi Integration and the Path to Decentralization

“We want to decouple the most important tool in crypto—stablecoins—from the traditional banking system. Our entire mission is to build a self-sustaining system where the most critical asset isn’t fully centralized.”

Ethena’s core argument is simple: separate the largest crypto product—stablecoins—from the traditional banking system. For USDe, there is no collateral risk tied to centralized assets like USDC or U.S. Treasuries. The only risk is ETH—one of the most decentralized and permissionless assets in the world.

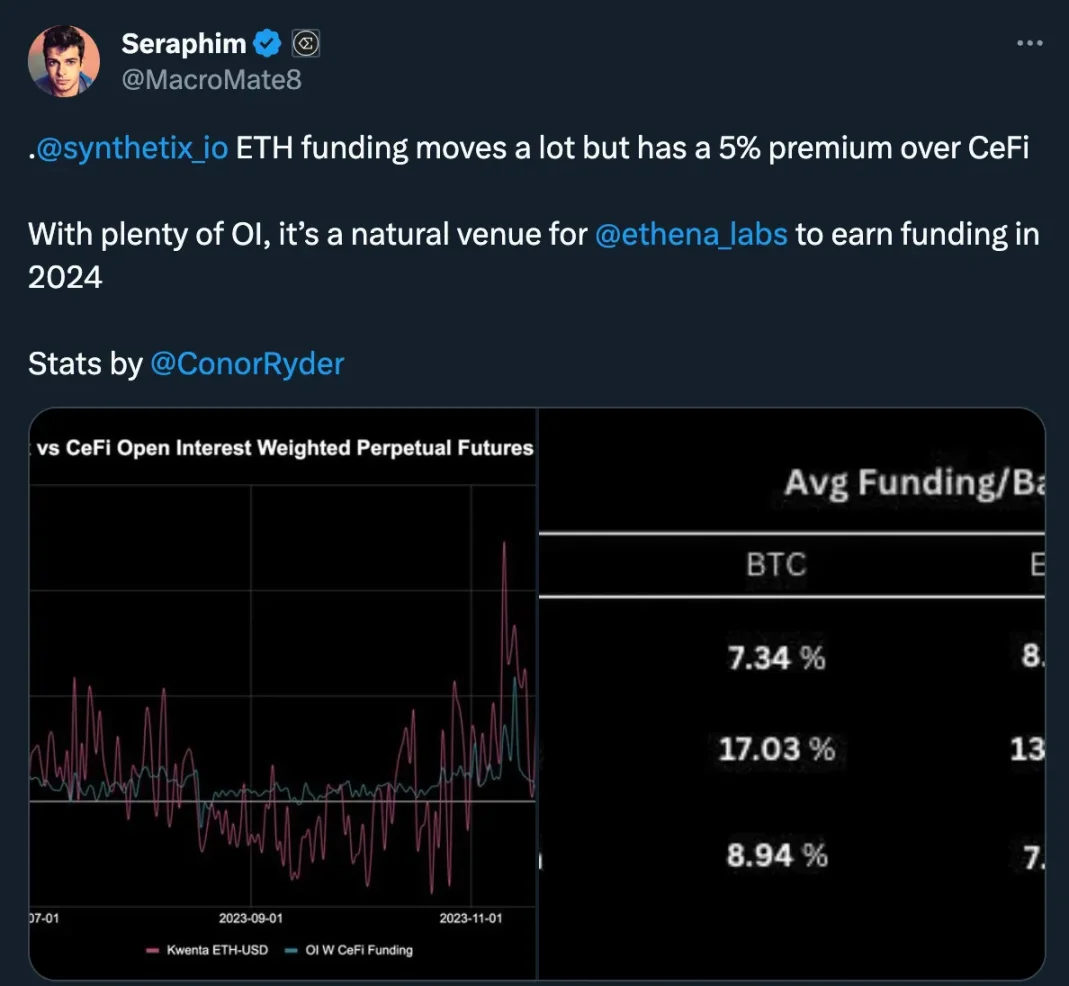

However, Ethena still has centralized aspects today. One is hedging staked ETH risk on centralized exchanges, primarily because most liquidity still resides there. Ethena is working toward full decentralization but is waiting for DEX derivatives to mature. The first step appears to be leveraging Synthetix and the Synthetix frontend as the initial DEX for such hedging—an item on the roadmap for later this year.

Integrating USDe/sUSDe into specific verticals makes strong sense:

-

USDe can serve as collateral for other stablecoins. FRAX and DAI, both heavily reliant on yields from traditional assets, may seek diversification and tap into crypto-native yields from sUSDe.

-

Money markets, such as lending platforms like Aave. Leverage looping strategies could offer sUSDe holders potentially higher returns through increased leverage.

-

sUSDe as high-yield collateral for leveraged trading on both CEXs and DEXs

2024 Roadmap

In the short term, Ethena is preparing for public launch, enabling users to mint and redeem USDe on the protocol and stake USDe to earn yield from the underlying collateral. Additionally, Ethena will incentivize liquidity across various DEXs to ensure users can trade the stablecoin with minimal slippage. The expected timeline is late January, when an airdrop program for the upcoming governance token may also be announced.

In the medium to long term, Ethena plans to integrate USDe into various DeFi protocols and centralized exchanges to grow supply and create strong utility. Ethena also intends to further decentralize by shifting short positions from centralized exchanges to DEXs.

Beyond that, Ethena will explore other assets as collateral for USDe, such as BTC and jitoSOL. These assets will also undergo delta hedging, with integration ultimately depending on whether they have deep liquidity and favorable funding rates from a yield perspective.

Conclusion

In summary, I am very excited about Ethena’s full rollout. Given the current yields generated by staking and funding rewards, USDe appears poised to become one of the largest on-chain stablecoins in crypto. Personally, I’m eager to see the USDe and sUSDe flywheel take off through various DeFi integrations, and secondly, Ethena’s shift toward a more decentralized model. As USDe grows, we hope Ethena’s smart contracts have been thoroughly audited and that the CEXs Ethena uses for hedging do not collapse. Like any DeFi protocol, Ethena and USDe carry clear risks—but their potential this year is worth watching.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News