Bitcoin Spot ETF Launch: An In-Depth Analysis of the Current State and Potential of Crypto ETPs

TechFlow Selected TechFlow Selected

Bitcoin Spot ETF Launch: An In-Depth Analysis of the Current State and Potential of Crypto ETPs

Crypto ETPs are about to have their moment in the spotlight.

Author: Diana Biggs, Partner at 1kx

Translation: Luffy, Foresight News

Exchange-traded products (ETPs) offer retail and institutional investors a convenient, regulated, and low-cost way to gain exposure to a wide range of underlying investments—including cryptocurrencies.

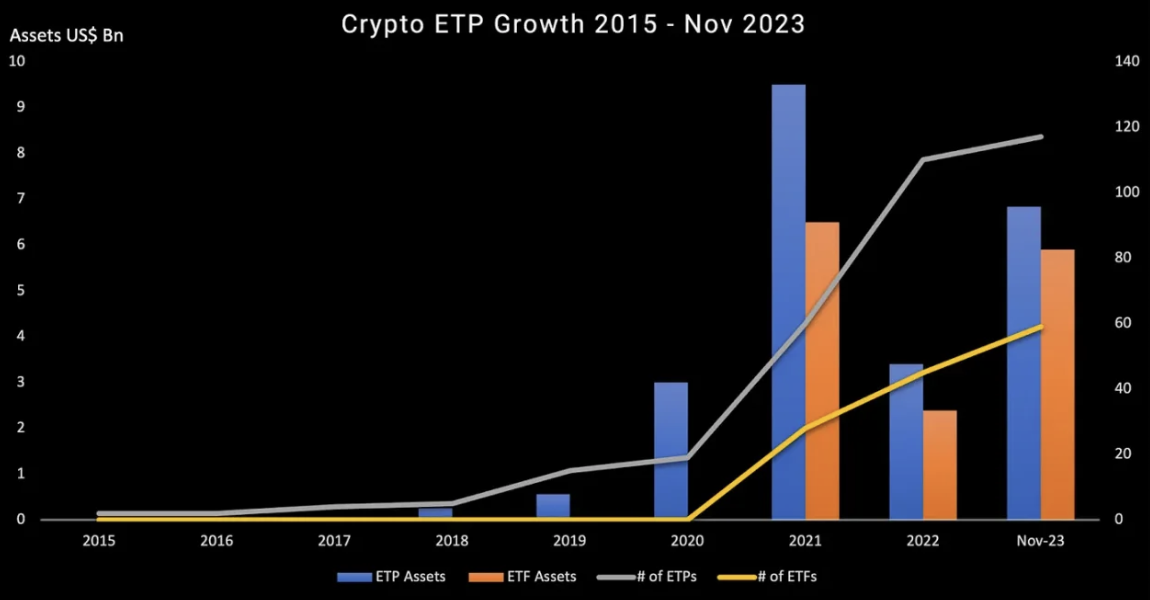

Since the launch of the first Bitcoin-tracking product in Sweden in 2015, crypto ETPs have expanded from Europe to markets around the world. The number of crypto ETP offerings has grown from just 17 at the end of 2020 to approximately 180 today. As more traditional financial institutions join native crypto firms in launching these products, ETPs are not only expanding investor access to crypto but also advancing overall market acceptance of digital assets within global financial systems.

This article provides an overview of cryptocurrency ETPs, including current product types, operational models, regional developments, and key areas we’re watching in this rapidly evolving space.

Overview of Cryptocurrency ETPs

What Are Cryptocurrency ETPs?

Exchange-traded products (ETPs) are financial instruments traded on regulated securities exchanges during regular trading hours, designed to track the returns of an underlying benchmark, asset, or portfolio.

ETPs fall into three main categories: exchange-traded funds (ETFs), exchange-traded notes (ETNs), and exchange-traded commodities (ETCs). ETFs are investment funds, while ETNs and ETCs are debt securities—ETCs tracking physical commodities like gold and oil, and ETNs used for other financial instruments. Since the creation of the first ETF in 1993, ETPs have evolved over three decades from simple stock index trackers into one of the most innovative categories of investment products, offering investors access to a broad array of novel asset classes.

Note: While “ETP” is the umbrella term for such products, it is sometimes used specifically to refer to debt-structured exchange-traded products.

Over the past two decades, ETPs have experienced sustained growth, now totaling 11,859 products and 23,931 listings across 81 exchanges in 63 countries, offered by 718 providers. ETFs dominate in terms of assets under management (AUM), accounting for approximately $10.7 trillion—or 98%—of the total $10.99 trillion in ETP AUM globally (data from ETFGI as of November 2023). Oliver Wyman forecasts that ETF growth will accelerate in coming years, with annual market expansion projected between 13% and 18% from 2022 to 2027.

Source: ETFGI

The convenience and accessibility of ETPs make them a popular tool for opening new asset classes—including cryptocurrencies—and investment strategies to investors.

The first Bitcoin ETP was launched in 2015 by XBT Provider (later acquired by Coinshares) on the Nasdaq Stockholm. Market growth remained relatively modest until the second half of 2020, when both crypto-native entrants and traditional issuers began launching products at a stronger pace—a trend that continues today. In February 2021, Purpose Investments in Canada launched Purpose Bitcoin on the Toronto Stock Exchange, becoming the world’s first Bitcoin ETF. Although debt-structured crypto ETPs still far outnumber crypto ETFs in terms of count and AUM, we expect this dynamic to shift, particularly with the anticipated opening of the U.S. spot ETF market.

Source: ETFGI

The number of crypto products has steadily increased, especially over the past three years. According to ETFGI, there were 176 crypto ETFs and ETPs globally as of November 2023. Assets invested in these products grew 120% in the first 11 months of 2023 alone, rising from $5.79 billion at the end of 2022 to $12.73 billion by the end of November 2023.

Why Choose Cryptocurrency ETPs?

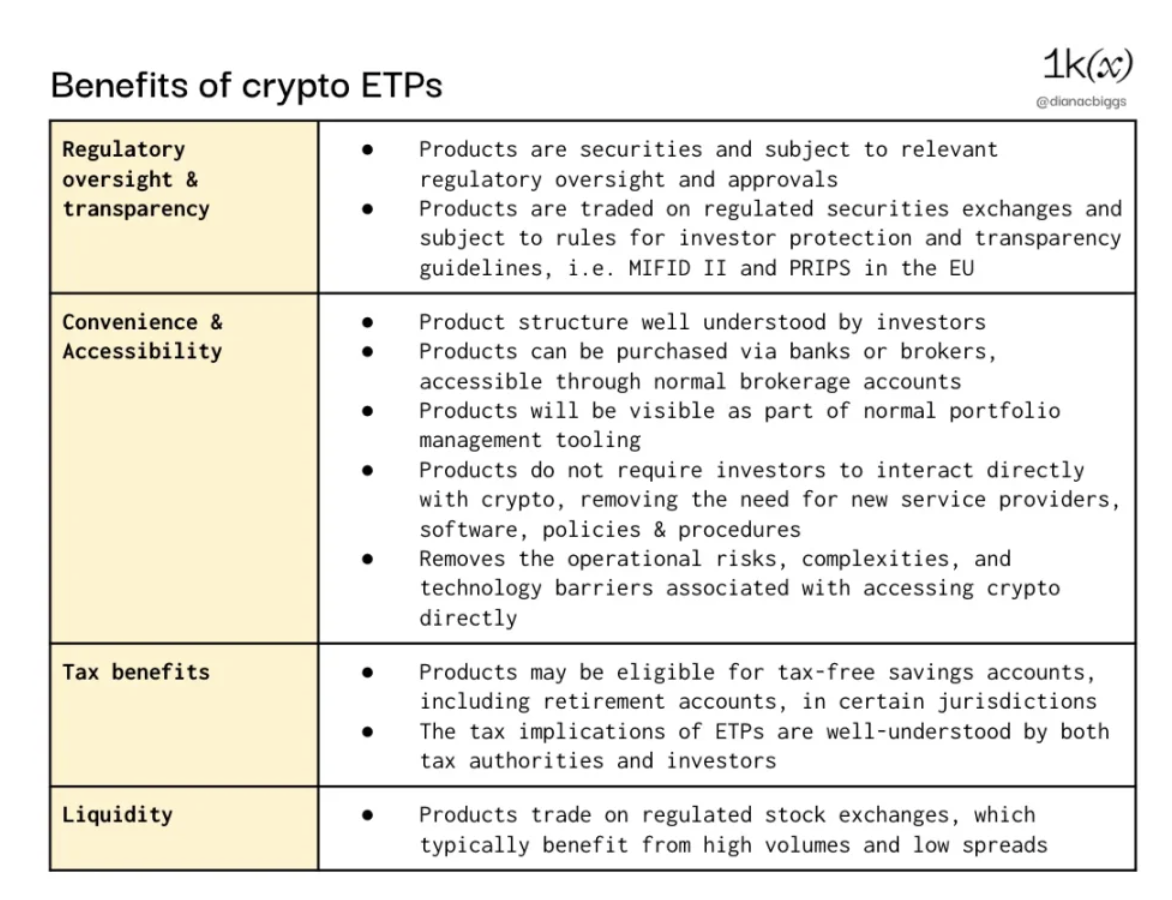

The concept of crypto ETPs may seem counterintuitive to those within the native crypto space: ETPs introduce intermediaries, whereas the goal of crypto technology is to eliminate them. However, as familiar and regulated investment vehicles, ETPs provide access to cryptocurrencies for a broader investor audience who might otherwise be unable to invest due to various constraints. For example, retail investors may lack the tools, time, risk tolerance, or expertise required to invest directly in crypto. ETPs structured as traditional securities open access for institutional investors, who may be restricted to investing only in such instruments or who may avoid direct crypto holdings due to regulatory, compliance, technical, or other reasons.

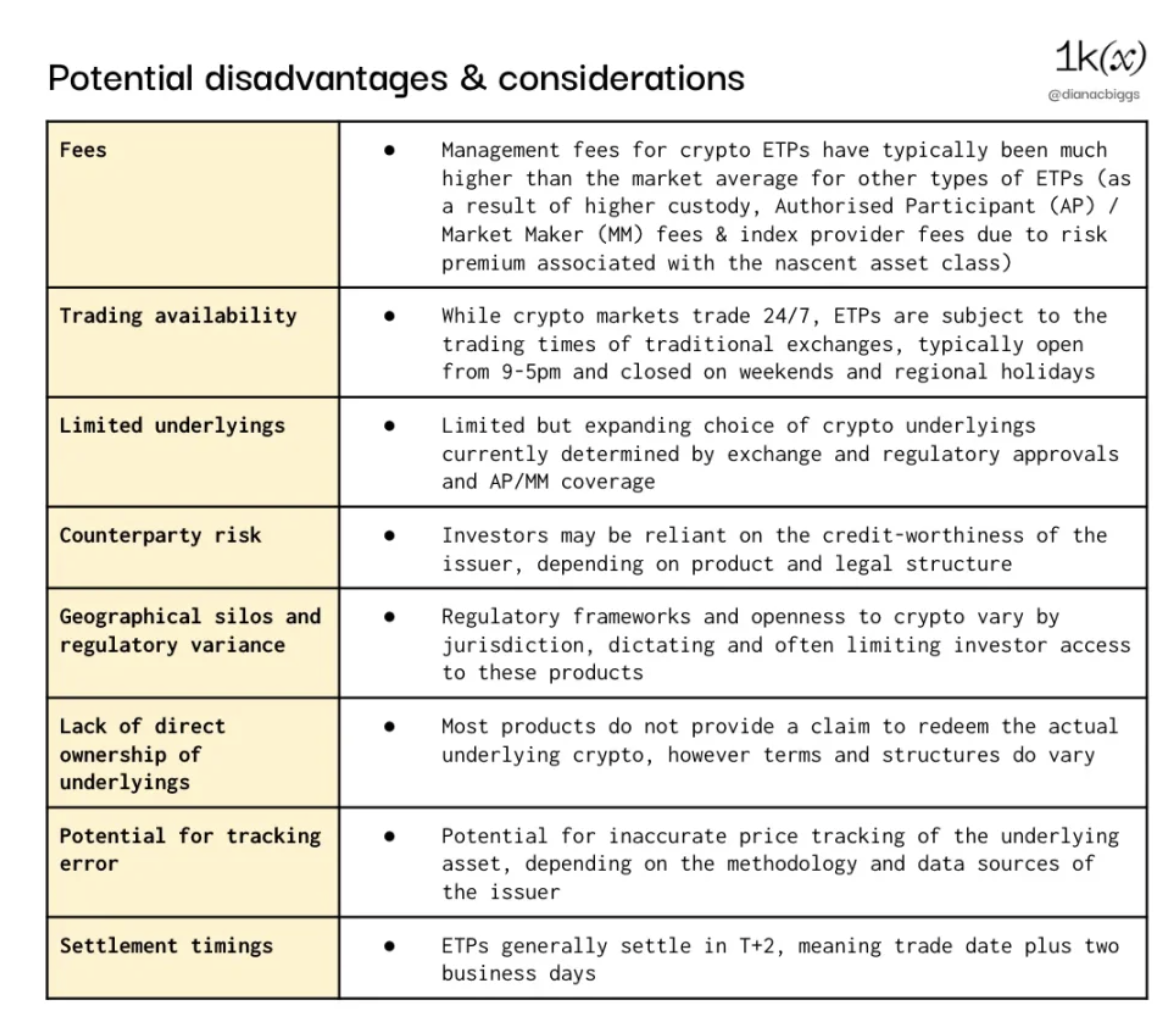

Compared to direct crypto purchases, ETPs also come with potential drawbacks and considerations (though not all investors view these as negatives). These include higher fees for crypto ETPs compared to other ETPs (although competition has driven fees down significantly), limited trading hours relative to crypto’s 24/7 markets, counterparty risks, currency exchange risks, and settlement delays.

Note: Geographic restrictions include examples such as European crypto ETPs typically not being registered under the U.S. Securities Act of 1933 and therefore unavailable to U.S. investors; the UK FCA prohibits the sale of crypto ETPs to retail investors.

Product Structures

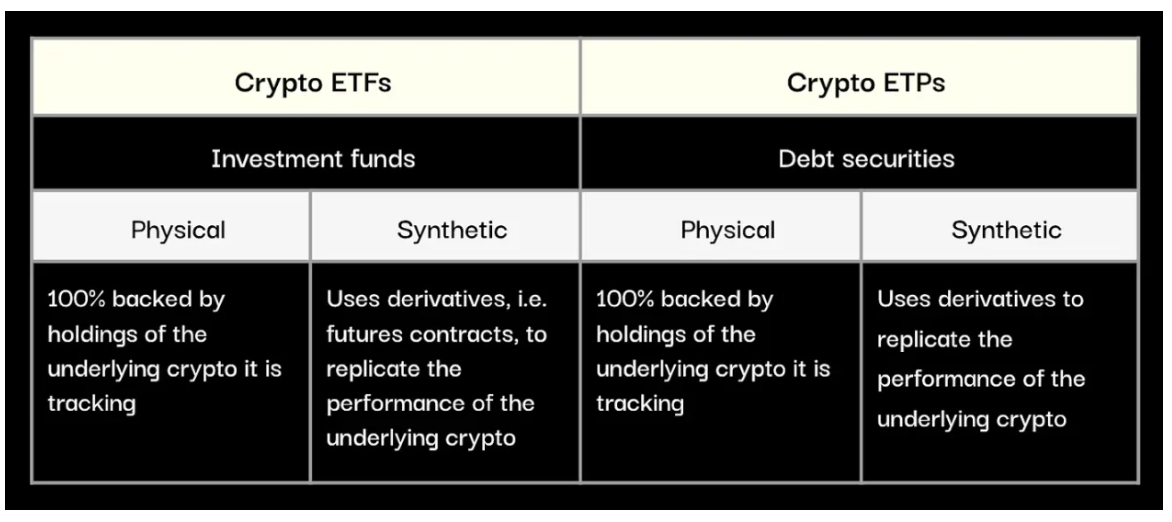

Broadly speaking, crypto ETPs fall into two main categories: ETFs vs. other ETPs, and physically backed vs. synthetic structures.

Cryptocurrency ETF Structures

An ETF is structured as a fund, with investor holdings represented as fund shares. The fund is typically legally separated from its issuing entity through trusts, investment companies, or limited partnerships, protecting investor holdings in the event of the parent company or issuer’s bankruptcy. ETFs are generally subject to additional rules and transparency requirements depending on jurisdiction—for example, ETFs registered in the EU and sold to EU investors typically must comply with UCITS (Undertakings for Collective Investment in Transferable Securities) regulations, which impose diversification requirements such as limiting any single asset to no more than 10% of the fund’s value.

Today, most crypto ETFs are either spot or futures-based. Spot ETFs hold direct ownership of the underlying crypto assets, secured by independent custodians. Futures ETFs, on the other hand, do not hold the underlying cryptocurrency but instead purchase futures contracts on the asset. As a result, these products do not directly track the spot price of the underlying asset and are generally considered more complex, costly, and less transparent and intuitive for investors.

Cryptocurrency ETP Structures

Crypto ETPs (in this context, referring to non-ETF products) are structured as debt securities. While they face less stringent structural requirements than ETFs, their disclosure obligations are very similar.

Physically backed crypto ETPs are secured debt contracts, fully collateralized 1:1 by holdings of the underlying cryptocurrency. The crypto assets are purchased and held in custody by independent third-party custodians under the supervision of a designated trustee, who holds rights and interests on behalf of ETP holders and oversees redemption procedures in the event of issuer insolvency.

Synthetic ETPs are unsecured debt contracts, meaning the issuer does not hold the underlying asset but instead uses derivatives and swaps to track its performance (specific structures and terms may vary). As such, synthetic ETPs carry greater counterparty risk, as there is no legal requirement for full backing by physical assets. XBT Provider and Valour are two crypto ETP issuers offering synthetic products.

Overall, physically backed ETPs dominate the market, as many investors prefer the transparency and reduced counterparty risk they offer.

Crypto Product Issuers

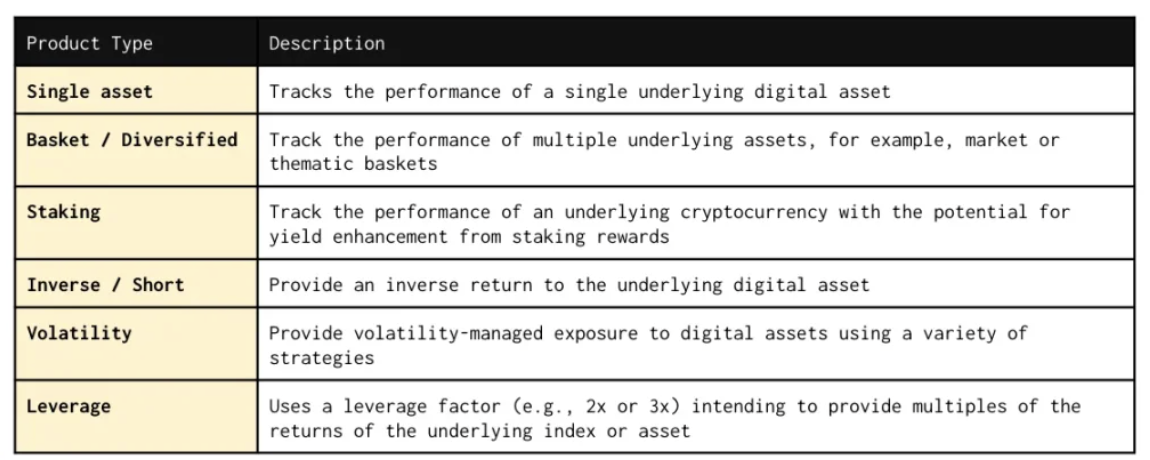

Crypto ETPs initially focused on tracking single digital assets, but today’s market includes baskets, staking, short, leveraged, and volatility-managed index products.

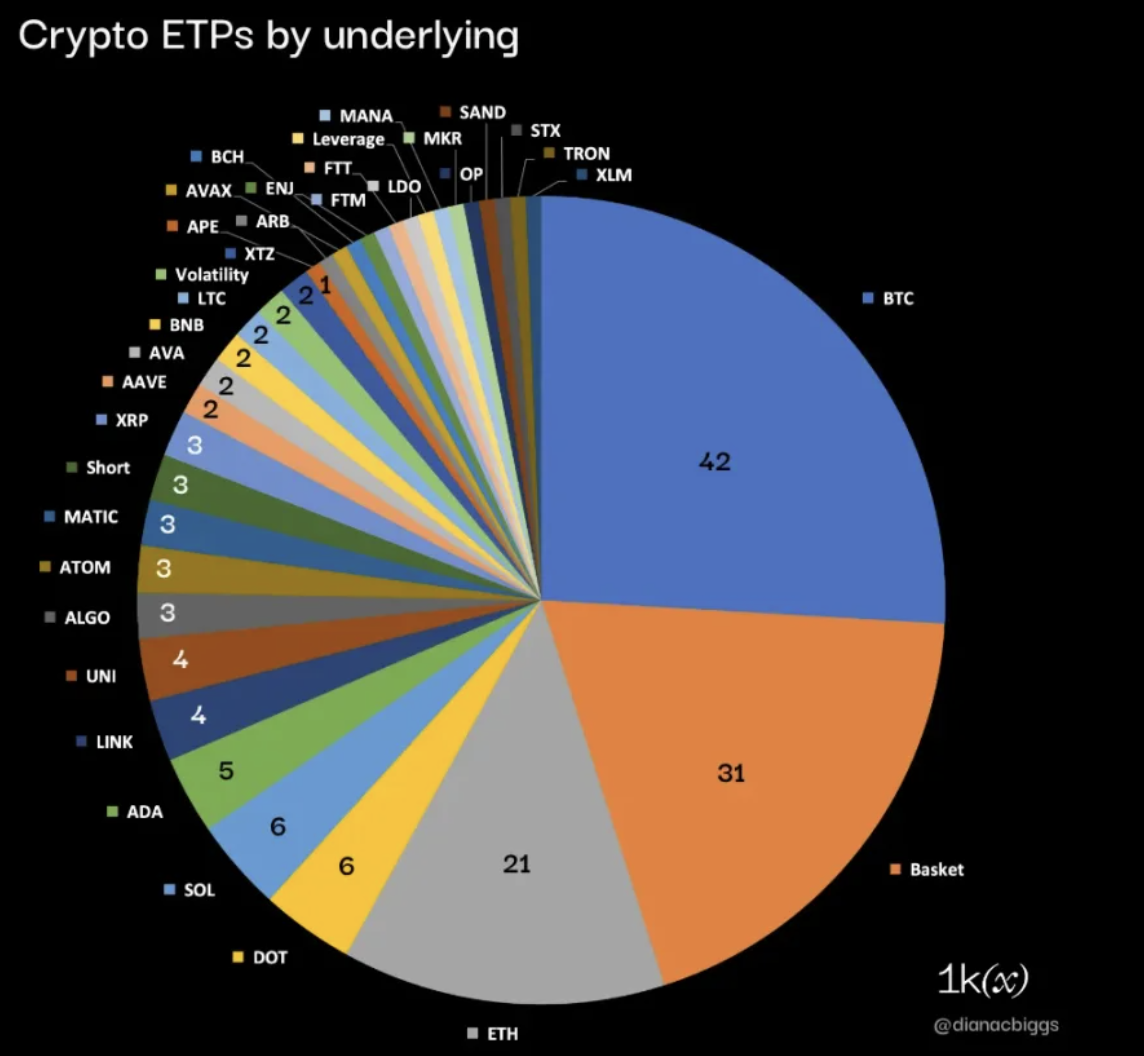

In terms of underlying assets, according to recent data compiled by BitMEX Research (excluding equity-linked and OTC funds), among 162 crypto ETPs, Bitcoin, Ethereum, and basket products account for 58%, while the remaining 42% consist of long-tail single digital assets, as well as short, volatility, and leveraged products.

Data from 162 crypto ETPs (excluding equities and OTC funds); Source: BitMEX Research, 1kx Research

Of these 162 products, 121 are ETPs and 41 are ETFs, including 16 futures ETFs and 11 pending U.S. spot Bitcoin ETFs. There are currently 14 staking products (where investors benefit from staking yields): 13 ETPs and 1 ETF.

Largest Products by Assets Under Management (AUM)

The largest crypto ETP by AUM is the ProShares Bitcoin Strategy ETF, a U.S.-based futures ETF that held $1.68 billion in assets as of January 2, 2024. As shown in the table below, nine of the top 14 crypto ETPs by AUM track Bitcoin (64%); the remaining five include three tracking Ethereum, one Solana, and one BNB.

Source: BitMEX Research, 1kx Research

Among these 14 products, four are registered in Switzerland (all issued by 21Shares), three in Canada, two in Jersey, and one each in Germany, the U.S., and Liechtenstein.

Of the top 14 by AUM, four are ETFs (three spot, one futures); the remaining ten are ETPs—eight physically backed and two synthetic.

Product Innovation

Launching new crypto ETPs involves several constraints, including regulatory and exchange listing requirements, liquidity standards, investor demand, and availability of public pricing data and fiat trading pairs. That said, as more players enter the market seeking market share and differentiation—and as regulators, service providers, and investors deepen their understanding and acceptance of the asset class—we are seeing continuous innovation from issuers and index providers.

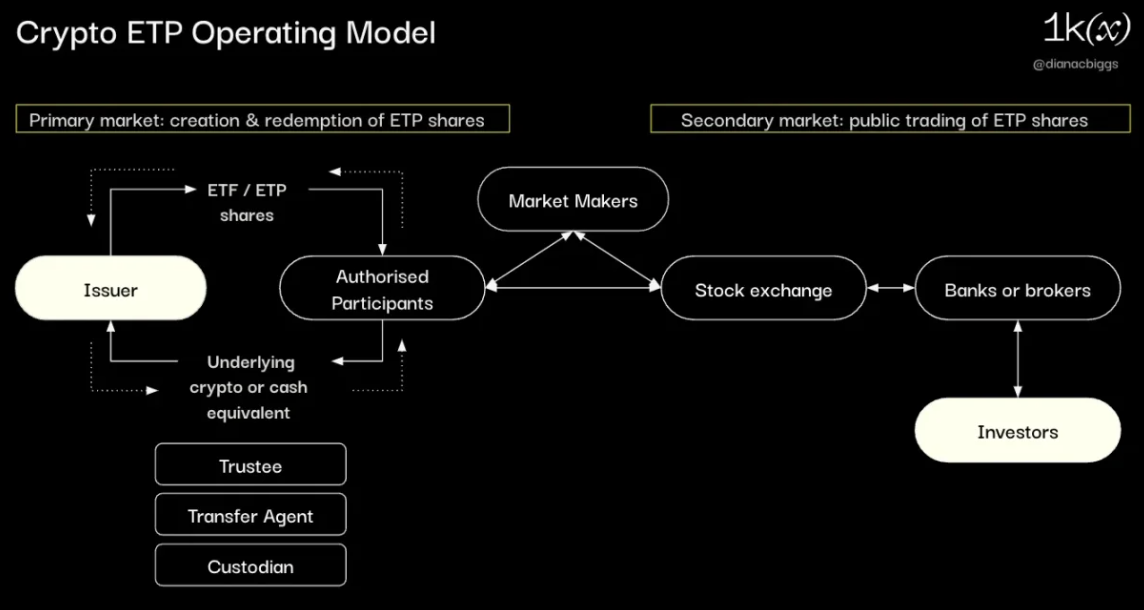

Crypto ETP Operational Models

The process begins with the issuer—the investment company or trust launching the product—who prepares a prospectus for regulatory approval. Requirements vary by jurisdiction, but generally include details about the issuer, board members, financial statements, product design, underlying assets, expected markets and service providers, risk disclosures, net asset value (NAV) calculations, fee structures, and redemption processes.

After regulatory approval and securing necessary service providers, the issuer applies for listing on target securities exchanges. Eligibility rules for product types and underlying assets differ across exchanges.

The operational model and scope of service providers can vary based on product type, jurisdiction, and issuer design. A typical model is outlined below:

In the primary market, the issuer exchanges product shares with authorized participants (APs) for the underlying crypto assets (“in-kind”) or cash equivalents, delivering or receiving the underlying crypto assets to/from designated custodians as needed. Depending on structure, transfer agents and trustees may assist in collateral settlement and fund transfers.

While APs manage creation and redemption in the primary market, market makers provide liquidity in the secondary market, ensuring efficient and continuous trading.

Investors buy and sell products in the secondary market, typically placing orders through banks or brokers, who execute trades directly or via intermediaries on relevant exchanges.

Stakeholders and Service Providers

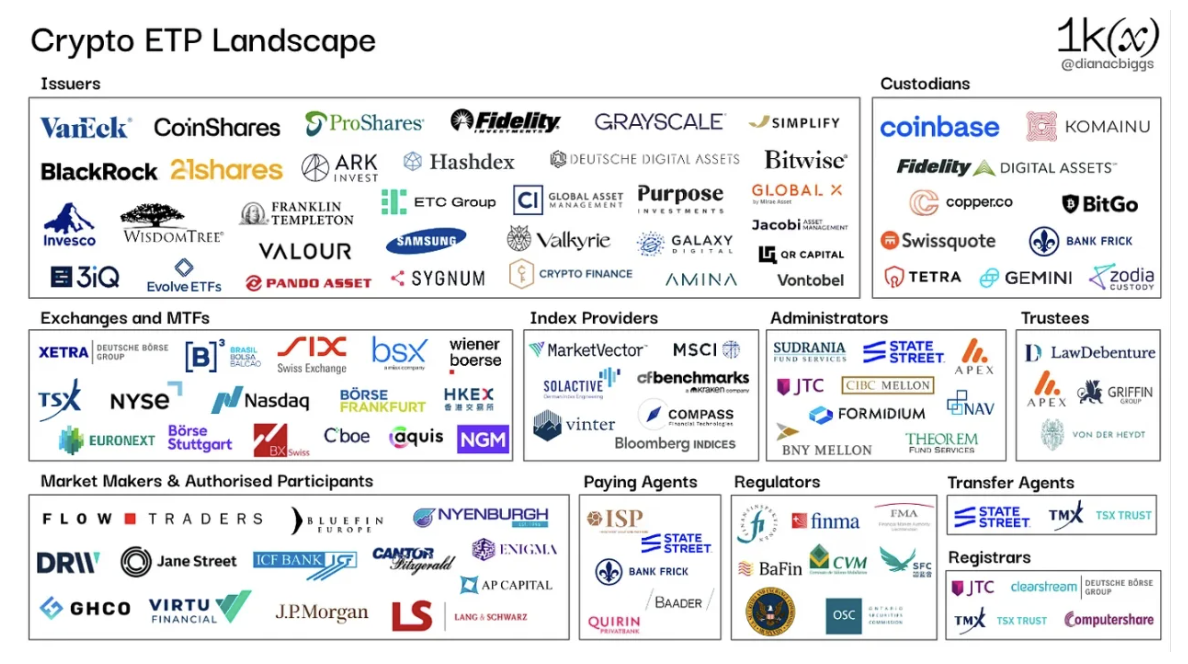

Issuers

Issuers are responsible for the overall design and creation of ETPs, coordinating and managing intermediaries throughout the product lifecycle. Regulatory oversight varies by jurisdiction. Regulators evaluate issuers during prospectus review, and exchanges do so during listing, with requirements potentially including corporate governance, capital adequacy, and periodic audits. Issuers often establish standalone special-purpose vehicles (SPVs) to issue products. Initially dominated by crypto-native firms such as Coinshares, 21Shares, 3iQ, Hashdex, and Valour, the landscape has increasingly welcomed traditional finance players including WisdomTree, Fidelity, Invesco, VanEck, and, pending SEC approval, Franklin Templeton and BlackRock.

Custodians

Custodians hold the underlying crypto assets backing physically backed ETPs. Custodians used by ETP issuers include Coinbase, Fidelity Digital Assets, Itaventures, Komainu, BitGo, Copper, Swissquote, Tetra Trust, Zodia Custody, and Gemini.

Market Makers

Market makers (MMs) are liquidity providers hired by issuers to ensure sufficient liquidity by offering two-way quotes on exchanges per contractual terms. Key market makers include Flow Traders and GHCO.

Authorized Participants (APs)

Authorized participants (typically banks or broker-dealers) have the right to create and redeem ETP shares directly with the issuer daily. They deliver underlying assets or cash equivalents to receive newly created ETP shares, or return shares to redeem the underlying assets or cash. Interest among APs in crypto, especially assets beyond BTC and ETH, may vary due to regulatory uncertainty and market conditions. Active APs in crypto ETPs include Flow Traders, GHCO, Virtu Financial, DRW, Bluefin, and Enigma Securities. JPMorgan Chase, Jane Street, and Cantor Fitzgerald & Co. have recently been named as APs in U.S. spot Bitcoin ETF filings.

Index Providers

Index providers are responsible for creating, designing, calculating, and maintaining the indices and benchmarks tracked by ETPs, offering transparency and reliability to issuers and investors. In certain jurisdictions, index providers are regulated—for example, under the EU’s Benchmark Regulation (BMR). Active index providers in crypto ETPs include MarketVector Indexes, CF Benchmarks (acquired by Kraken in 2019), Vinter (a crypto-native index provider), Bloomberg, and Compass.

Exchanges and Multilateral Trading Facilities (MTFs)

An exchange or MTF’s willingness to list a crypto ETP depends first on local regulations and regulatory approval of the issuer’s prospectus. After that, it becomes a business decision based on the ETP issuer’s and product’s eligibility criteria, typically involving assessments of liquidity, compliance, publicly available pricing, and risk mitigation. Listing rules vary—for example, Germany’s Xetra only lists asset-backed ETPs, while six Swiss exchanges have specific rules for eligible crypto underlying assets.

Trustees

Trustees are responsible for safeguarding assets and representing the interests of ETP holders or investors. Their specific roles and responsibilities may vary depending on the ETP’s structure and legal arrangements. Trustees active in crypto ETPs include Law Debenture Trust Corporation, Apex Corporate Trust Services, Bankhaus von der Heydt, and Griffin Trust.

Administrators

Administrators support the overall operations of ETPs. Services may include accounting, regulatory compliance, financial reporting, and shareholder services. Administrators active in crypto ETPs include State Street, JTC Fund Solutions, CIBC Mellon Global Securities Services, Theorem Fund Services, NAV Consulting, Formidium, and BNY Mellon.

Other Service Providers

Additional service providers that may play roles in ETP programs and product lifecycles include, but are not limited to, paying agents (responsible for registering new ETP units and obtaining ISINs from local agencies), transfer agents (for maintaining shareholder records and other duties), calculation agents (for computing NAV of underlying assets), and registrars (for maintaining shareholder records). Depending on product type, issuer, and jurisdiction, these roles may overlap or be fulfilled by different parties.

On Fees

ETPs charge management fees, also known as expense ratios or sponsor fees, to cover product management and operating costs. These fees are calculated annually as a percentage of holdings and deducted daily or periodically from NAV. Many early crypto ETPs charged up to 2.5%, while typical ETP fees range from 0.05% to 0.75%. Charging 2.5% AUM fees when alternatives charge 0% highlights the stickiness and first-mover advantage of these products.

We expect fees to become a key differentiator for new products, as demonstrated by the current U.S. spot ETF landscape. The first companies to announce fees were Invesco and Galaxy, waiving fees for the first six months and first $5 billion in AUM, and Fidelity offering a 0.39% fee. As of January 8, announcements from other issuers confirmed that a fee war has indeed begun:

Source: James Seyffart, January 8, 2024

Regional Landscape

Europe

Crypto ETPs originated in Europe, with the first Bitcoin product launched in Sweden in 2015—an XBT Provider ETP tracking synthetic assets. In Europe, crypto ETP issuers benefit from the single market: once a prospectus is approved by a regulator in one EU country, the product can also be listed in other member states (via a “passporting” mechanism). Sweden’s SFSA remains a popular choice for prospectus approvals. Germany is another jurisdiction that has approved crypto ETP prospectuses, with strong accessibility across major exchange groups such as Deutsche Börse and Boerse Stuttgart Group.

ETPs remain the dominant product type in Europe, while the absence of true crypto ETFs largely stems from UCITS regulations. Most European ETFs comply with UCITS to benefit from pan-European passporting, enabling sales to retail investors across EU countries. However, UCITS rules are currently incompatible with single-asset trackers like Bitcoin ETFs. For instance, UCITS diversification rules limit any single holding to no more than 10% of fund assets, and require underlying assets to be qualified financial instruments. In June 2023, the European Commission tasked ESMA (European Securities and Markets Authority) with assessing whether UCITS rules need updating to accommodate crypto assets. However, the intent appears to be evaluating additional safeguards rather than expanding eligible product types. ESMA’s opinion is due by October 31, 2024.

Switzerland

In 2016, Switzerland became the second jurisdiction after Sweden to approve and list crypto ETPs, with Bank Vontobel launching a Bitcoin-tracking ETP on SIX Swiss Exchange. Subsequently, the world’s first crypto index product was launched in Switzerland in November 2018—a physically backed basket ETP comprising Bitcoin, Ethereum, Ripple, and Litecoin, issued by 21Shares. SIX Swiss Exchange has specific rules for crypto underlying assets, including that “the cryptocurrency must rank among the top 15 by USD market cap at the time of applying for temporary trading permission.” Our research indicates that SIX-listed crypto assets are widely used as underlying assets across global products. BX Swiss also permits crypto-based products, requiring the underlying asset to be among the top 50 by market cap.

United Kingdom

In October 2020, the UK Financial Conduct Authority (FCA) banned the sale, marketing, and distribution of any crypto derivatives to retail investors. Many crypto ETPs are listed on the UK’s Aquis Exchange but are available only to professional investors.

Canada

Canada was the first country to approve a Bitcoin ETF, with Purpose Investments launching the first product on the Toronto Stock Exchange (TSX) in February 2021, followed shortly by an Ethereum ETF. In October 2023, 3iQ launched North America’s first staking-enabled Ethereum ETF, incorporating staking rewards into fund returns. Other Canadian crypto ETF issuers include Fidelity Investments Canada, CI Global Asset Management (CI GAM) in partnership with Galaxy, and Evolve Funds.

Brazil

Brazil followed closely behind Canada. In March 2021, Brazil’s securities regulator (CVM) approved Latin America’s first Bitcoin ETF. Brazilian crypto ETF issuers include crypto asset managers Hashdex and QR Capital, as well as Itaú Asset Management in partnership with Galaxy.

United States

To date, only crypto futures ETFs have been approved by the SEC and made available to investors. ProShares launched the first Bitcoin futures ETF on October 19, 2021, which became one of the most actively traded funds in history, attracting over $1 billion in assets within its first few days of trading.

Source: Bloomberg, via Twitter from Eric Balchunas, Senior ETF Analyst at Bloomberg

Two years later, on October 2, 2023, ProShares, VanEck, and Bitwise launched the first Ethereum futures ETFs in the U.S. Futures products typically require greater investor sophistication and incur additional costs, rebalancing-related tracking errors, and performance drag. Notably, the underlying futures contracts trade on the Chicago Mercantile Exchange (CME) and fall under commodity regulation—this is a commonly cited explanation for why futures ETFs were approved before spot products.

The first U.S. spot Bitcoin ETF application was filed by the Winklevoss twins in July 2013 and resubmitted multiple times in subsequent years, ultimately rejected. A decade later, on June 15, 2023, BlackRock, the world’s largest asset manager, filed an application for the iShares Bitcoin Trust. BlackRock’s brand influence and strong track record (according to Bloomberg’s Eric Balchunas, BlackRock has been rejected only once out of 575 ETF applications) changed the game, making the U.S. spot Bitcoin ETF one of the most anticipated financial products ever.

On August 29, 2023, momentum shifted further when the U.S. Court of Appeals for the D.C. Circuit ruled in favor of Grayscale in its case against the SEC, stating that the SEC’s denial of Grayscale’s proposed Bitcoin ETF was “arbitrary and capricious.”

Fast forward to today, 11 issuers have submitted spot Bitcoin ETF applications currently under SEC review of their S-1 filings: BlackRock, Grayscale, 21Shares & ARK Invest, Bitwise, VanEck, WisdomTree, Invesco Galaxy, Fidelity, Valkyrie, Hashdex, and Franklin Templeton. In recent weeks, meetings between the SEC and issuers have increased, and the SEC has instructed all issuers to adopt a cash creation model—meaning the exchange of assets for ETF share creation and redemption must occur in cash, not Bitcoin. Typically, for efficiency, asset exchanges between APs and ETF issuers occur in-kind. While the SEC has not publicly explained its rationale, it likely aims to avoid appearing to endorse large banks and broker-dealers engaging in crypto trading.

As of the evening of January 5, 2024, all 11 applicants have filed amended 19b-4 forms proposing rule changes allowing exchanges to list and trade the products. These must be approved by the SEC.

Source: Bloomberg, via James Seyffart’s Twitter, January 5, 2024

The final step is SEC approval of the final S-1 forms. Market expectations currently point to approval around January 10, with listings and trading potentially commencing within 24–48 hours thereafter.

We will closely monitor capital flows and trading volumes during the first week to assess competitive dynamics among the 11 issuers. Larger ETFs tend to attract more investor interest due to cost efficiency and liquidity advantages. Seed capital amounts can thus provide a competitive edge. Bitwise’s S-1 filing on December 29 indicated up to $200 million in initial commitments, while BlackRock reported $10 million in seed sales. Notably, rumors on January 5 suggested BlackRock may have prepared $2 billion for the first week of trading. Bloomberg’s Eric Balchunas noted this would align with BlackRock’s brand given other funds’ seed sizes, though it would far exceed any prior ETF launch.

BlackRock, VanEck, Ark & 21Shares, Fidelity, Hashdex, Invesco & Galaxy, and Grayscale have also filed applications for spot Ethereum ETFs, with the first SEC response deadline set for May 23, 2024.

Hong Kong

One year after the U.S. SEC’s approval, Hong Kong’s Securities and Futures Commission (SFC) approved crypto futures ETFs in October 2022. Asset manager CSOP launched two funds—one Bitcoin and one Ethereum—on December 16, 2022. In December 2023, the SFC and Hong Kong Monetary Authority issued a joint circular outlining guidance for crypto investment products, stating that “in light of recent market developments,” the SFC will now accept applications for spot crypto ETFs. The updated guidelines confirm that both physical and cash creation and redemption models are permitted. Overseas-issued crypto ETPs not specifically approved by the SFC will be available only to professional investors.

What’s Next for Crypto ETPs?

Growing investor demand for crypto exposure makes ETPs an attractive, familiar, and regulated pathway. Driven by this demand, both crypto-native and traditional asset managers continue to innovate and expand their offerings. The approval of U.S. spot ETFs in 2024 could serve as a catalyst for global growth.

As this space evolves, our key focus areas include:

Intensifying issuer competition and its impact on fees, ETP flows across regions and issuers, and long-term consolidation or exit of smaller players;

Shifting consumer and institutional awareness and acceptance of crypto, amplified by marketing power from global leaders like BlackRock;

Increasing numbers of exchanges, asset managers, distributors, and other institutional participants and service providers entering the space;

Timeline for adoption and integration of these products into advisory models;

Growth of institutional staking, including expansion of staking products available to investors and liquidity solutions developed by issuers;

Rise of on-chain structured products: As we’ve long believed, the future is on-chain, and recent collaboration between 21.co (parent of 21Shares) and Index Coop signals how ETP issuers are beginning to move in this direction.

Note: Over-the-counter (OTC) closed-end crypto funds (e.g., those offered by Grayscale) are not included in this analysis.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News