Bricks and Blocks: A Study of Real Estate Projects in the RWA Market

TechFlow Selected TechFlow Selected

Bricks and Blocks: A Study of Real Estate Projects in the RWA Market

The asset tokenization and Security Token Offerings (STOs) of that time shared many similarities with today's RWA concept.

Author: Coresky

Introduction

The concept of Real World Assets (RWA) is not newly introduced to the cryptocurrency market—it has existed at least since 2018, when asset tokenization and Security Token Offerings (STOs) bore many similarities to today’s RWA concept. However, due to immature regulatory frameworks and a lack of clear advantages in potential returns, these early attempts failed to evolve into a mature, scalable market.

By 2022, as the United States continued raising interest rates, U.S. Treasury yields significantly surpassed stablecoin lending rates in the crypto sector. As a result, tokenizing U.S. Treasuries as RWA became increasingly attractive to the crypto industry. Established DeFi projects such as MakerDAO, Compound, and Aave, along with traditional financial institutions like Goldman Sachs, JPMorgan Chase, Siemens, and even some governments, began exploring RWA.

Over the past two years, a small number of real estate RWA projects have emerged. They aim to expand the real estate investment market in various ways, diversify real estate investment products, and lower entry barriers for real estate investors. This study will conduct case analyses of these projects, examining the design strengths and weaknesses of real estate RWA and its potential market. Since these projects primarily target North America’s real estate sector, the relevant policies, regulations, and market conditions discussed will focus mainly on the North American real estate market.

Approaches to Tokenizing the Real Estate Market

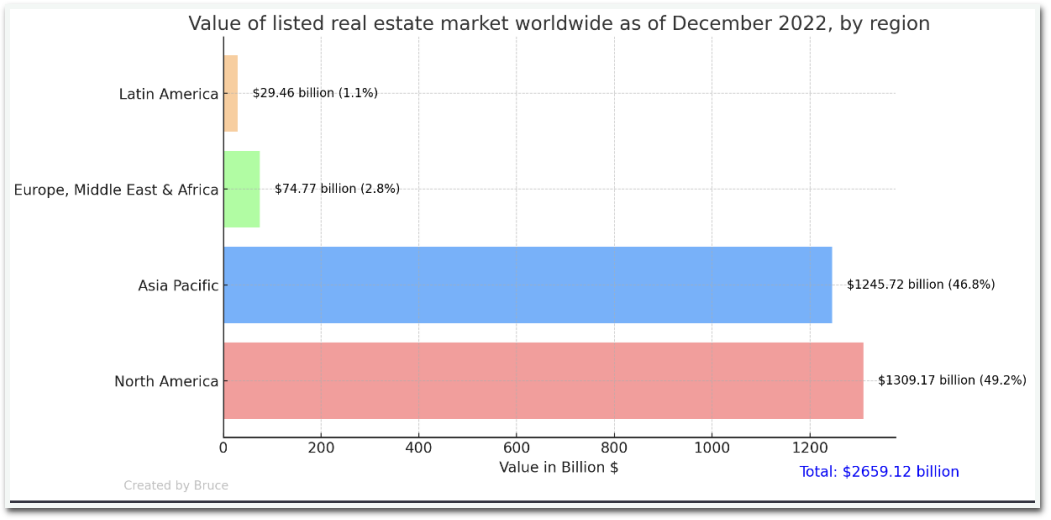

The real estate market is a vast domain filled with investment opportunities. A Statista report released in March 2023 showed that the listed real estate market in North America reached a substantial value of $1.3 trillion, while the global listed real estate market stood at $2.66 trillion.

The core objective of tokenizing the real estate market is to achieve one or more of the following goals: create more diversified and flexible real estate investment products, attract a broader investor base, and enhance the liquidity and value of real estate assets. These products typically take three main forms:

1) Fractional ownership financing of real estate.

2) Regional real estate market index products.

3) Using real estate tokens as collateral for lending.

Additionally, tokenizing real estate onto blockchains holds the potential to enhance transparency and democratize governance of real estate assets.

If you are familiar with Real Estate Investment Trusts (REITs), they are companies that own income-generating real estate and manage or finance properties. REITs offer investment opportunities similar to mutual funds, enabling ordinary investors to access dividend-like real estate investment income and total returns, while also supporting regional real estate market growth. REITs and real estate RWA share many similarities in offering fractionalized real estate investment opportunities—both effectively lower investment thresholds and enhance asset liquidity. However, traditional REITs typically do not offer investors management rights or ownership, maintaining a centralized operational model. Despite this, their rigorous asset review, operations, and investment structures under strict regulatory frameworks provide reference models for real estate RWA projects.

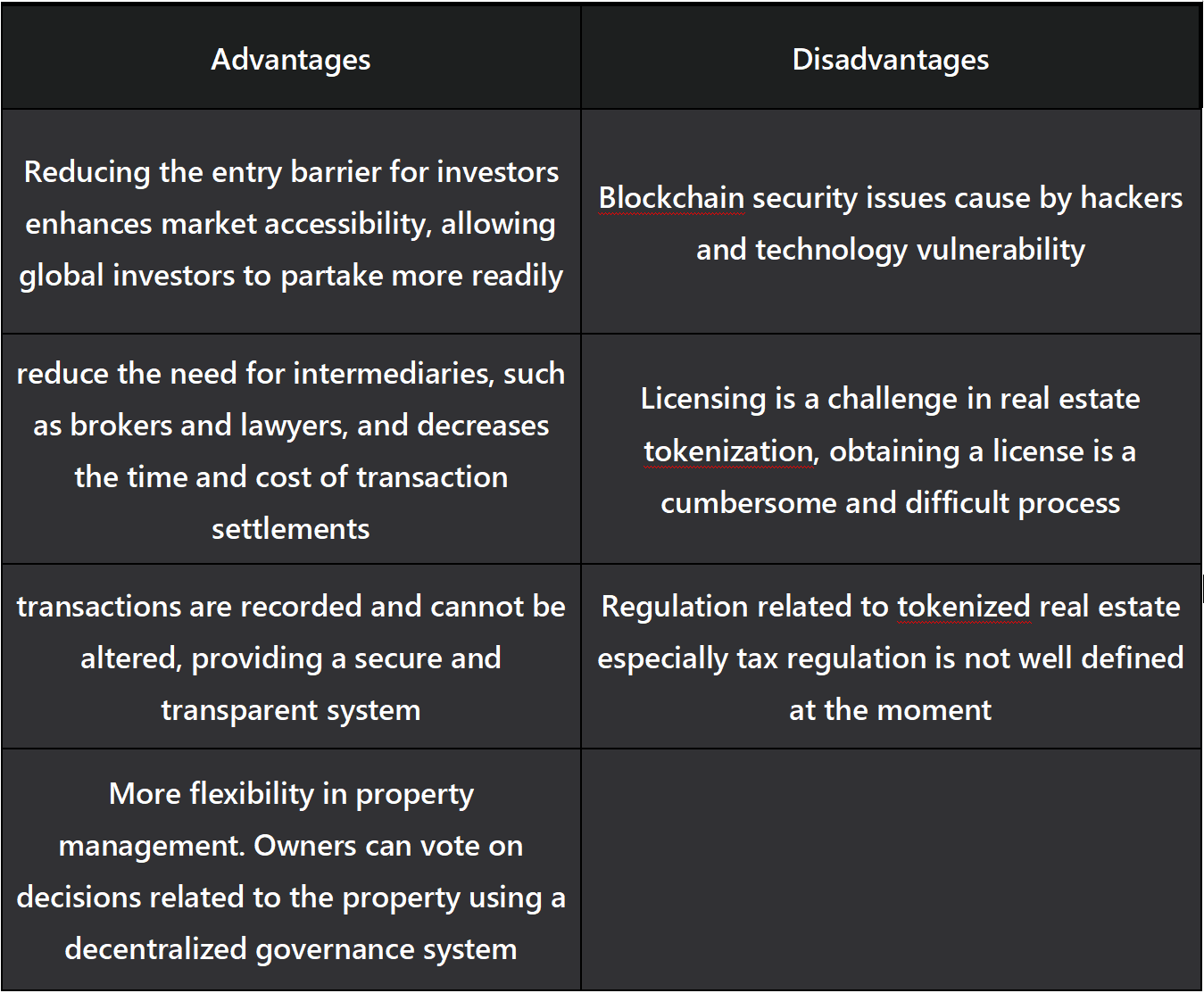

Based on observations of real estate RWA project operations over the past two years, we now have a clearer understanding of their strengths and weaknesses.

Typically, real estate RWA projects exhibit the above advantages and disadvantages. However, upon deeper investigation into specific cases, it becomes evident that due to differences in management and product approaches, each project faces distinct operational realities.

Case Studies

In this chapter, I analyze three real estate RWA projects. Each adopts a different approach to tokenizing the real estate market and is representative within its respective niche. It should be noted that these projects are still in early stages, and their products have not undergone long-term or extensive market validation.

‣ RealT

Launched in 2019, RealT is one of the earliest real estate RWA projects, focusing on tokenizing U.S. residential real estate for retail investment via the Ethereum and Gnosis blockchains (primarily on Gnosis).

RealT purchases residential properties and tokenizes them in compliance with U.S. regulations. Responsibilities for property management, maintenance, and rent collection are delegated to third-party management firms. After deducting fees, rental income generated by these properties is distributed to token holders. Although RealT manages the tokenization process, it is legally separated from the companies holding the real estate assets. As stated on its website, if the managing company defaults, token owners have the right to appoint another firm to manage the property. Notably, the protocol does not require RealT to invest in the property tokens it brings to market. Token holders receive monthly rental distributions, minus approximately 2.5% for maintenance reserves and around 10% in management fees.

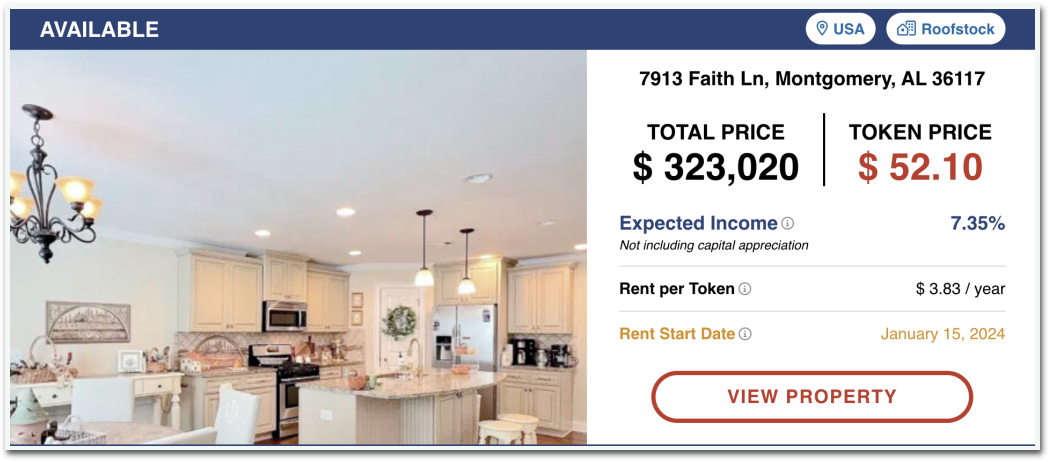

Take this property in Montgomery as an example: the total value of the real estate tokens is $323,020, with each token priced at $52.10, totaling 6,200 tokens issued. The property generates $2,600 in monthly rental income. After deducting $622 in operating and management fees, the net monthly profit is $1,978, amounting to $23,736 annually. Each token thus receives $3.83 in distributions, yielding an annual return rate of 7.35%.

For this property, RealT offered 100% of the tokens to the market, meaning RealT did not co-invest with customers, allowing it to operate a nearly risk-free model. The management firm takes 8% of the rent and the remainder from maintenance fees, while the investment platform charges only 2% for tokenization, selecting managers, and oversight. This approach allows the RealT team to save significant management time and focus on identifying qualified properties and bringing them to market.

However, while fractional ownership helps distribute risk among investors, it also introduces challenges. When individual investments are too small, the cost of corporate governance becomes prohibitively high and unsustainable. As explained in Laurens Swinkels’ report, conflicts of interest exist between real estate token holders and RealT. RealT selects management firms for its owned properties; if RealT holds a large stake, it has strong incentives to minimize management costs, as poor management would significantly affect it. However, if RealT’s ownership is too large, it reduces token liquidity, and minority shareholders may neglect oversight responsibilities, expecting major shareholders to monitor the hired managers. Conversely, if RealT’s stake is minimal, it may lack sufficient incentive to diligently select and supervise managers, making effective oversight extremely difficult for numerous retail investors.

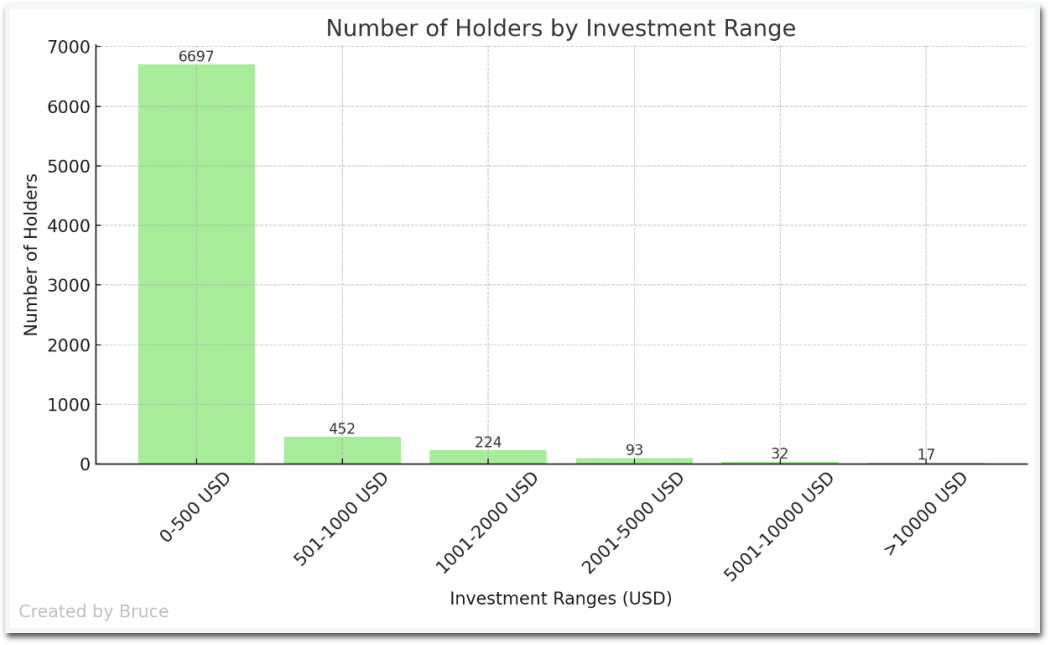

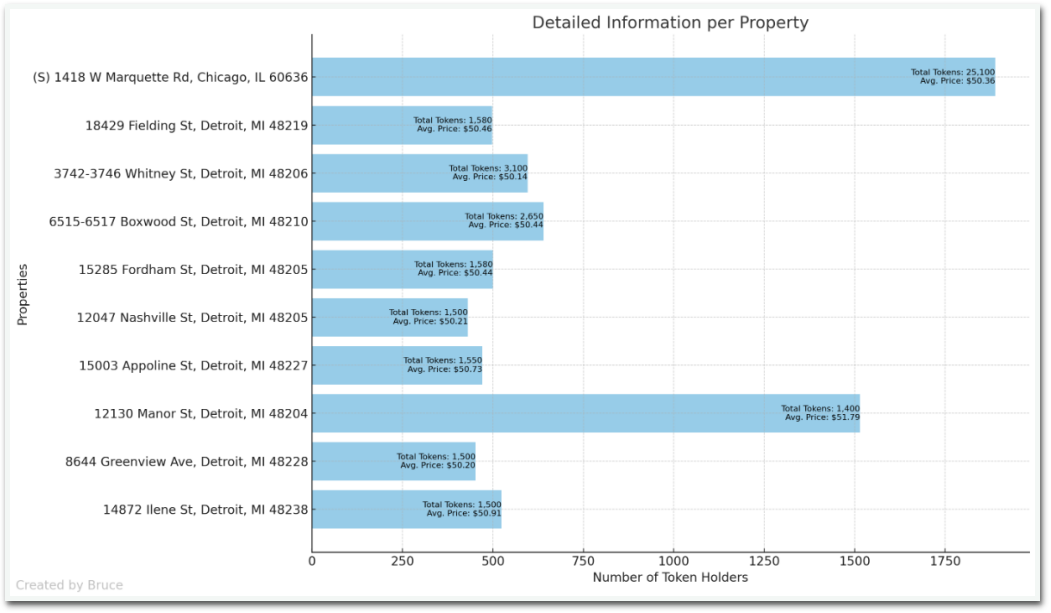

By examining the ten most recently sold-out property tokens on RealT’s marketplace and using blockchain explorers to determine the number of holders per property, we can observe RealT’s distribution strategy. As shown in the chart, RealT divides properties into varying numbers of tokens to keep each token price around $50. Most properties are located in Detroit, with approximately 500 token holders per property, and two properties having over 1,000 holders. Combining this with the number of tokens held per investor reveals the investment range of RealT investors.

Approximately 90% of RealT investors invest less than $500, about 9% invest between $500 and $2,000, and 1% invest more than that. This indicates that RealT has succeeded to some extent in creating a real estate investment market for retail investors and increasing housing market liquidity.

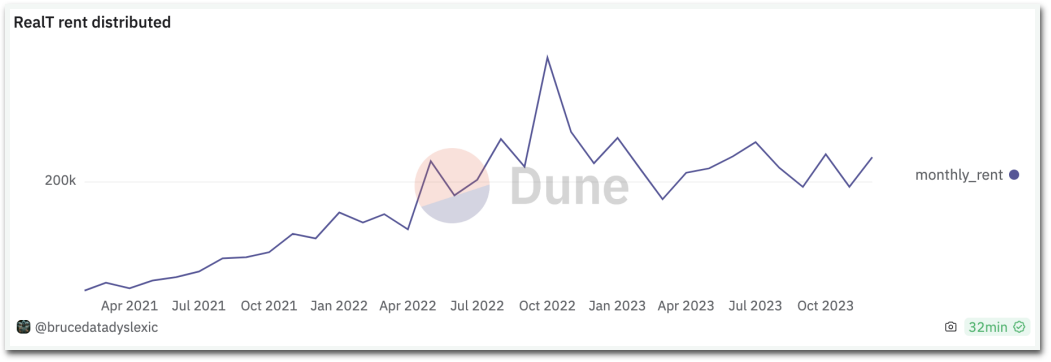

Further checking transaction data from RealT’s wallet address on its primary network, Gnosis (wallet address: 0xE7D97868265078bd5022Bc2622C94dFc1Ef1D402), shows that RealT has distributed approximately $6 million in rental income. Platform fees fluctuate between 2.5% and 3% of rent, depending on maintenance, insurance, and taxes, translating to roughly $150K–$180K in platform revenue over the past two years. However, since RealT is not required to participate in real estate investments—and if it chooses to, there are no defined limits or disclosures on its involvement—its actual profit from rental income remains unknown.

From a corporate structure perspective, RealT established Real Token Inc. in Delaware as the core entity. This entity owns no real estate assets; it serves solely as the operational entity for the RealT project. Additionally, RealT formed Real Token LLC in Delaware as a parent company for a series of real estate entities. Like Real Token Inc., Real Token LLC (LLC: Limited Liability Company) does not own any real estate assets; its main purpose is to streamline legal procedures, allowing users to invest in all properties by contracting with just one company. Finally, RealT established separate series LLCs for each invested property. As subsidiaries of Real Token LLC, each series LLC owns a specific property and its corresponding tokens. This structure aims to ensure that financial or legal issues with one property do not impact other properties or the parent company’s operations under RealT.

‣ Parcl

Parcl is a DeFi investment platform enabling users to trade price movements in global real estate markets. Parcl uses an AMM architecture to bring real estate-related synthetic assets to market. Parcl launched Parcl Labs Price Feed to create region-specific real estate indices based on sales history, with historical duration varying according to property transaction frequency. Once an index is created, investors can speculate on property price trends by taking long or short positions on regional real estate prices.

This method avoids the legal complexities of actual real estate operations, as no physical property transactions occur. One might question whether it truly qualifies as a real estate RWA project, as it does not meet the aforementioned criteria. However, it is a relatively popular RWA project backed by Coinbase, Solana Ventures, Dragonfly, and many other well-known industry players. Due to its uniqueness, including it in discussions on real estate RWA product diversification is reasonable.

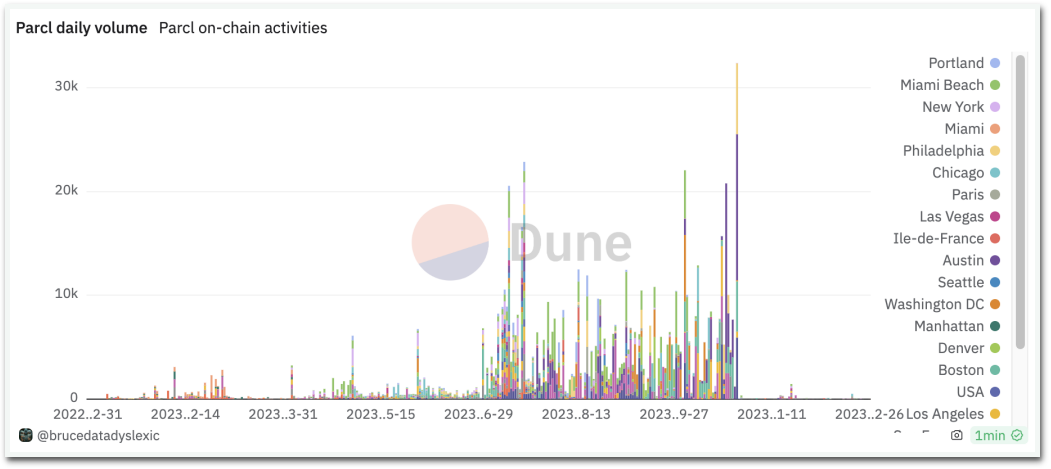

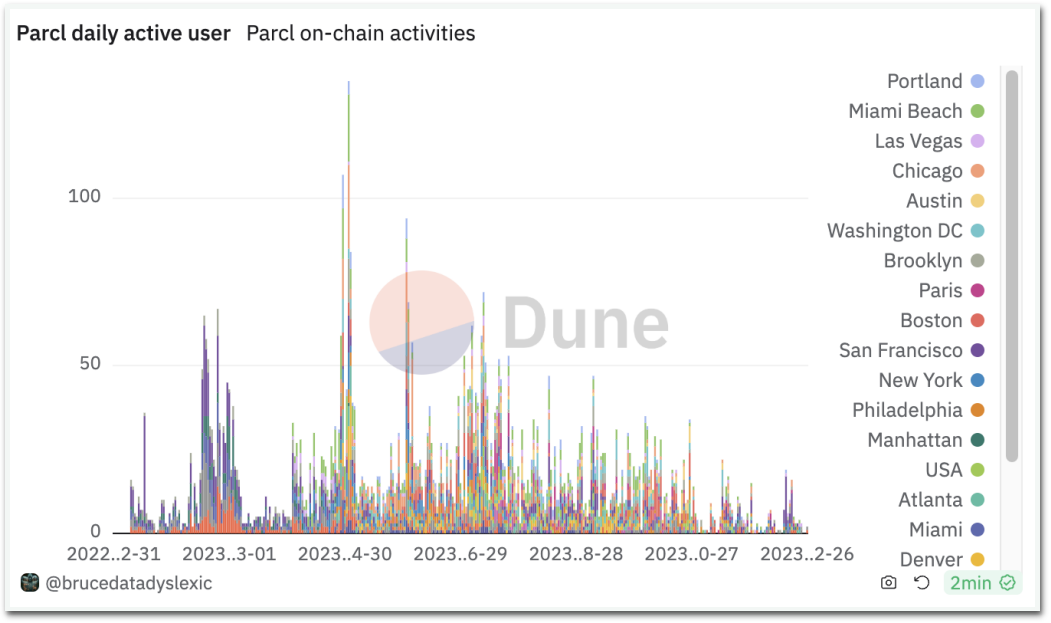

Parcl launched its testnet on Solana in May 2022 and currently has a TVL of $16 million. However, after over a year of operation, Parcl has attracted little attention, with daily trading volume below $10,000 and fewer than 50 daily active users.

(The drop in trading volume on October 26 was due to the Parcl V3 upgrade, which changed pool addresses and deactivated many trading pairs, so volumes after that date were not included.)

Parcl’s product is user-friendly and rapidly upgraded, with maturely designed Parcl Labs price feeds and index markets. Operationally, the Parcl team actively runs user acquisition programs like Parcl Points and Real Estate Royale. Despite these advantages and support from prominent investors, Parcl maintains relatively low market attention and market share, with a small user base and limited trading volume. This may suggest, to some extent, that the crypto market is not yet ready for real estate index products.

‣ Reinno

Large cryptocurrency companies like Ripple and MakerDAO are also exploring real estate RWA products. In July, Ripple announced that its central bank digital currency team is experimenting with enabling users to tokenize properties and use them for mortgage loans. MakerDAO has partnered with Robinland to support real estate-backed lending. RealT also offers the option to use tokenized real estate as loan collateral, but this service is limited to its own issued real estate tokens. Essentially, this service resembles a token lending product and does not substantially enhance capital liquidity for individual real estate owners.

Reinno was a project launched in 2020 and discontinued in 2022. Though it left little trace in the market, it introduced two notable real estate RWA-related products.

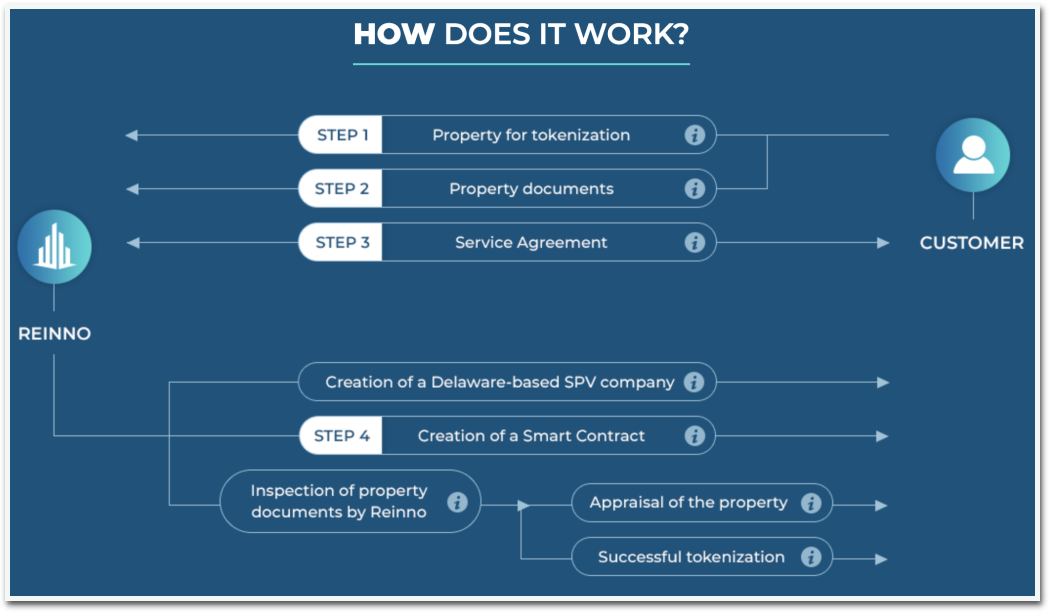

The first product was a loan service based on tokenized real estate. When property owners needed financing, they could submit property documents to Reinno. Upon approval, Reinno would establish a Special Purpose Vehicle (SPV) for them in Delaware (an SPV is a subsidiary created by a parent company to isolate financial risk. Its independent legal status ensures its obligations remain secure even if the parent company goes bankrupt. In the U.S., SPVs are often equivalent to LLCs). Reinno would then create a smart contract for the real estate tokens, allowing owners to deposit tokens as collateral and borrow against them, with loan limits based on token value.

(RealT, Reinno, and many other projects choose Delaware for registration because: 1) Delaware has the most comprehensive, frequently updated, and professional corporate legal system in the U.S. and globally, offering greater security and reliability compared to other states and jurisdictions; 2) most U.S. tech startups, two-thirds of Fortune 500 companies, and 80% of U.S. IPO firms incorporate in Delaware; 3) individuals worldwide can easily set up a Delaware company online from home for as little as a few hundred dollars. These services even provide access to all tools and documents needed for operation, including Employer Identification Numbers (EIN) and tax IDs, and automatically generate articles of incorporation.)

The second product was mortgage financing: after purchasing a property with a bank mortgage, users could tokenize the ownership for refinancing. The funds obtained were used to repay the bank mortgage, after which customers repaid the loan to the protocol at a fixed interest rate.

Reinno’s operations remained centralized and offline, typically requiring clients to visit offices and submit property documents. Approaches like Reinno’s carry clear risks. First, if borrowers default and stop repayments, Reinno—as a tokenization service rather than lender—would face difficulties suing them. Reinno does not actually own the mortgaged property; the loans are funded by users who choose to provide capital on the platform. Without direct loan contracts between borrowers and lenders—especially in the context of fractionalized real estate token financing—there is no robust legal framework to protect these lenders. Reinno did not provide detailed measures to mitigate this default risk. Second, if property owners decide to sell the house after borrowing, or stop paying their bank mortgage after Reinno completes the refinancing, such title transfers cannot be effectively prevented by Reinno, resulting in a form of “double spending” of the property’s value by lenders. These obvious risks may have contributed to the project’s shutdown. Future real estate RWA initiatives will require more mature legal frameworks to resolve such issues.

Several other real estate RWA projects are not included here for the following reasons: 1) they are very similar to those mentioned and have smaller market shares; 2) they remain in conceptual stages with insufficient information for meaningful discussion; 3) they are RWA projects capable of supporting real estate business but currently focus on other RWAs such as bonds or securities. Below is a list of these projects for interested readers to explore independently.

Conclusion

Real estate RWA is a relatively new concept without an established market size or dominant players. Projects currently operating in this space remain small in scale and user base. This field requires strict compliance and mature legal frameworks for regulation. Some projects adopt risk-isolated corporate structures or focus on real estate-related financial products as investment targets to reduce operational risks. However, to fully realize the maximum potential of real estate RWA—buying, selling properties, and advancing mortgage legislation and operational compliance are indispensable.

On the legislative front, no clear, consistent framework for real estate RWA currently exists. The U.S. Securities and Exchange Commission classifies most tokens as securities, the Commodity Futures Trading Commission views some as commodities, the U.S. Treasury’s Financial Crimes Enforcement Network categorizes certain tokens as currency, and the Internal Revenue Service treats some as taxable property. Moreover, no international regulatory framework is available for reference. Regulatory inconsistency in classifying real estate tokens leads to unclear rules and procedural confusion, both of which threaten potential investors and jeopardize the long-term viability of real estate tokenization.

Yet, despite this regulatory uncertainty, many renowned financial institutions and cryptocurrency companies continue exploring real estate RWA. A few projects have demonstrated limited feasibility through 1–2 years of operation. Given that real estate is a massive segment of the financial investment landscape, it is reasonable to believe that as relevant legal frameworks are established and refined, real estate RWA will experience rapid and vigorous growth.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News