MRC-20: Unpacking the Surge of Move Smart Inscriptions

TechFlow Selected TechFlow Selected

MRC-20: Unpacking the Surge of Move Smart Inscriptions

Completing 10 Billion MOVE in Three Days! Are MRC-20 "Smart Inscriptions" Going Viral? Do Inscriptions Herald a New Narrative?

By Bo Cai

10 billion $MOVE tokens minted in just three days—has the MRC20 "smart inscription" gone viral? Is a new narrative emerging for inscriptions? Are we entering an era of Inscription 2.0? Why is the Move ecosystem considered ideal for issuing smart inscriptions? What happens when inscriptions gain composability and greater interactivity? How does the Move ecosystem differ from Bitcoin and Ethereum when it comes to launching inscriptions?

Let’s dive into what’s behind the recent explosion of the MRC20 smart inscription $MOVE on TechFlow.

The most defining trend in the crypto space this year has been the surge of inscriptions within the Bitcoin ecosystem, sparking a retail frenzy. I, too, missed out on this wave—playing the role of a sage who saw only technical regression and another gambling scheme at first glance, overlooking the powerful narrative of fair distribution that underpins such trends. After all, narratives are key drivers of price.

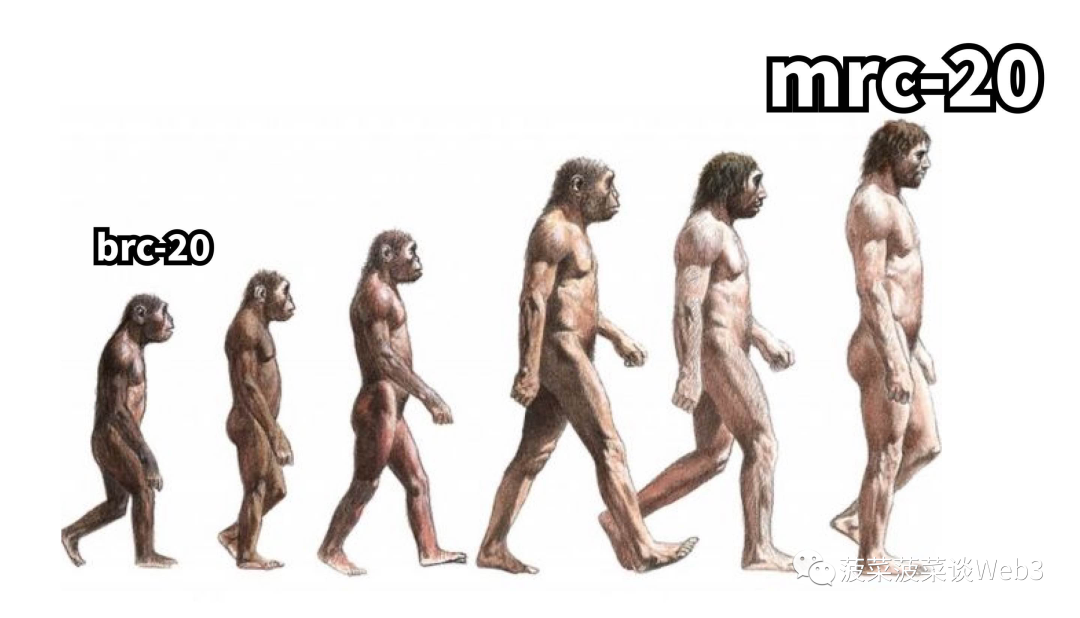

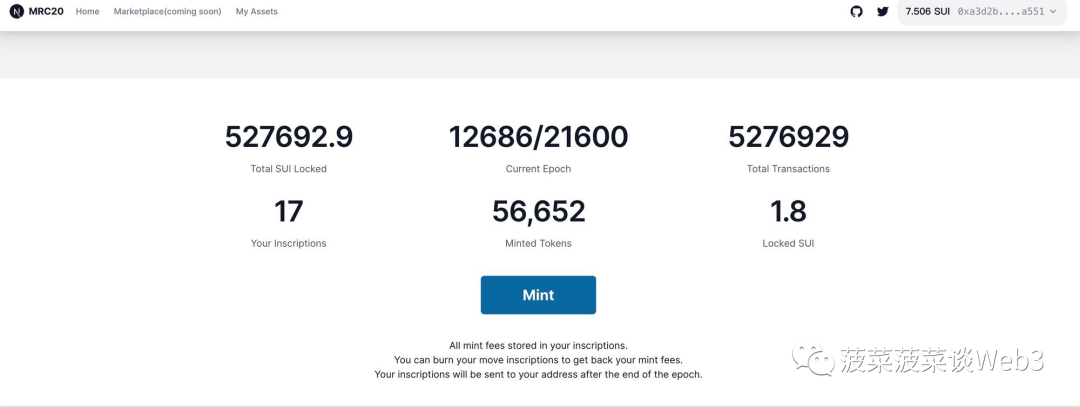

As general enthusiasm around inscriptions begins to cool, a new phenomenon has emerged—the sudden rise of MRC20 smart inscriptions on the Move ecosystem. The first MRC20 inscription, $MOVE, was launched on January 1, 2024. Within just three days, all 10 billion $MOVE tokens were fully minted, with over 100w+SUI locked—accounting for roughly 1/200 of SUI blockchain's total TVL—and nearly 50,000 unique minting addresses. So why did Move’s smart inscription succeed?

Here are several key advantages according to Bo Cai:

1. Low Transaction Costs and High Speed

The popularity of Bitcoin inscriptions has led to network congestion and exorbitant fees, resulting in high friction costs and long wait times for minting and trading—major pain points affecting user experience.

In contrast, minting inscriptions on the Move ecosystem incurs negligible gas fees, while ultra-fast transaction confirmations deliver a seamless, smooth user experience.

2. Inherits Core Features of Inscriptions

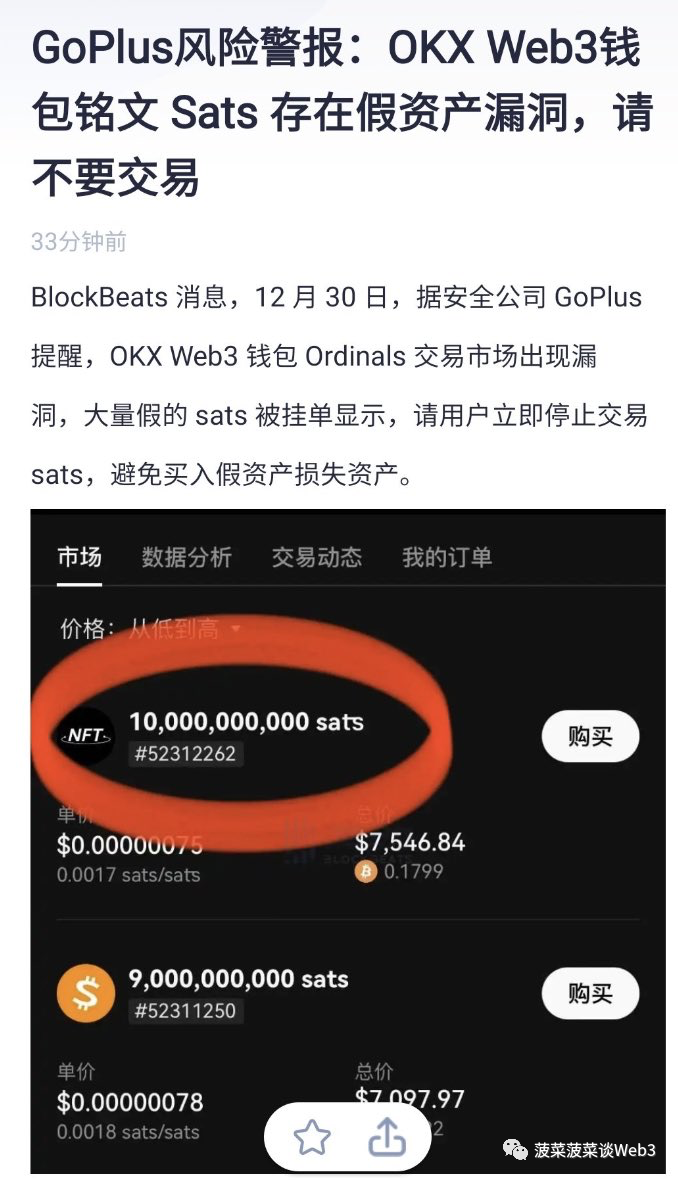

Bitcoin inscriptions essentially engrave an "NFT" onto a satoshi, embedding a fungible amount (Amount) within that NFT—similar to having an FT nested inside an NFT. Since Bitcoin lacks native smart contracts, an external indexing mechanism is required to track inscription circulation, which can introduce vulnerabilities—such as the recent indexing rule flaw discovered in OKX.

This structure—FT embedded in NFT—is conceptually identical to ERC-3525’s Semi-Fungible Token (SFT) standard. In a smart contract-enabled environment like Move, such structures can be natively expressed. Moreover, similar to Bitcoin inscriptions, these can still support fair launches. But unlike Bitcoin, Move’s account-based model (non-UTXO) naturally eliminates the need for centralized indexing mechanisms. So beyond inheriting inscription-like features, what additional advantages do “smart inscriptions” offer?

3. Decoupling of Smart Contracts and Asset Ownership

On Ethereum, assets are tightly coupled with smart contracts. If a contract contains bugs, if the project team maliciously upgrades it, or if backdoors exist, users’ assets could be at risk.

In the Move ecosystem, asset ownership is decoupled from smart contracts. Even if a contract fails or is compromised, users retain full control over their assets.

Think of a Move smart inscription as a secure box containing your locked assets, where you hold the key. The validation of access rights is enforced by the blockchain itself, meaning holders of Move smart inscriptions face almost no contract-related security risks.

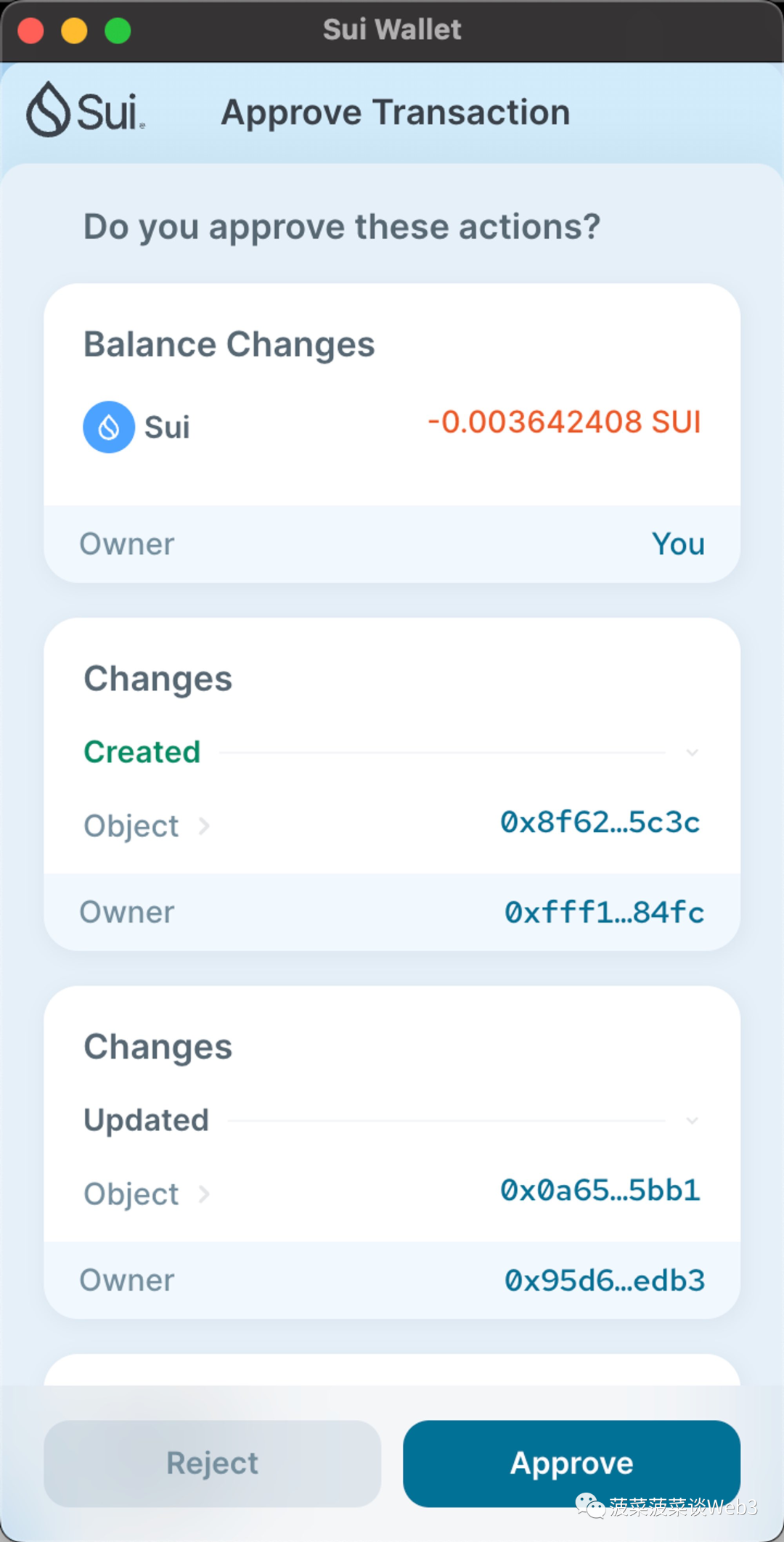

At the wallet level, Move wallets often provide visualized operations, clearly showing how account balances change after transactions—making them more intuitive and safer for beginners.

4. Greater Playability and Composability

Due to Move’s unique structural design, the Move ecosystem does not require adherence to rigid token standards like Ethereum, offering far greater flexibility in asset issuance.

Bitcoin suffers from limited extensibility and composability, making inscription use cases relatively monotonous. Smart inscriptions unlock vastly expanded possibilities. Take MRC20’s $MOVE as an example:

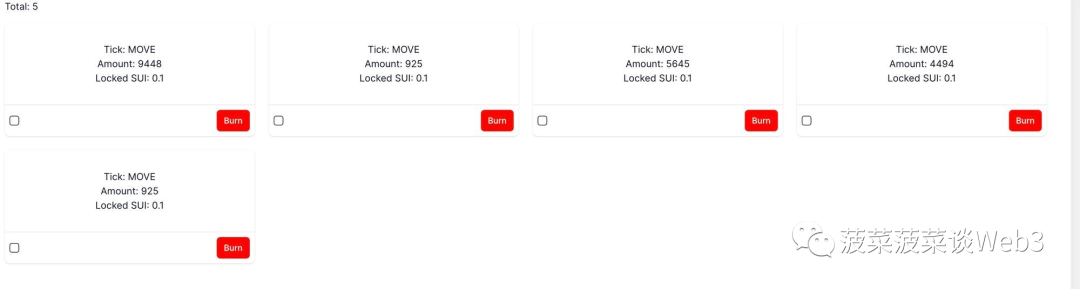

$MOVE has a total supply of 10 billion, requiring 21,600 epochs to fully mint—all without fixed denominations, since each inscription holds a variable number of $MOVE tokens.

With one epoch currently lasting one minute, the entire minting process will take approximately 15 days, ensuring decentralization and fair distribution.

The gameplay: Each address can mint one inscription per epoch (i.e., once per minute).

Each mint requires locking 0.1 SUI into the inscription. Submitting multiple mints within a single epoch won’t increase the number of inscriptions received, but any additional 0.1 SUI payments will stack and remain locked within that epoch’s inscription.

All locked SUI resides entirely within the user’s own inscription—never transferred to third-party accounts or contracts. Users can burn the inscription at any time to reclaim their locked SUI.

Additionally, two bonus mechanics add further excitement:

1. **Rage Acceleration Mode**: If 500 unique addresses participate in an epoch, acceleration mode activates—triggering the next epoch immediately upon reaching 500 participants. This reduces the overall minting duration, breaking the fixed one-minute interval.

2. **Winning Bonus Mode**: The first address to mint in each epoch receives an extra inscription from the previous epoch’s activity—without needing to lock 0.1 SUI.

The variable denomination design means each participant receives a dynamically allocated amount of $MOVE per epoch based on participation numbers—potentially rewarding early adopters more generously. Such mechanisms could even be randomized within set ranges, resembling lottery tickets and tapping into human gambling instincts.

The ability to lock SUI empowers users to destroy their inscriptions anytime and retrieve their principal. Funds remain fully self-custodied, never exposed to third-party control, allowing users full flexibility and reversibility.

Bonus mechanics open up endless creative potential—enabling complex game theory models, utility enhancements, integration with omnichain games, or modular Lego-style applications. The possibilities are limitless.

In my view, Bitcoin inscription participants are ultimately chasing “fair launches”—in plain terms, they desire a “fair casino.” Issuing inscriptions offers exactly that. However, given growing controversy—some Bitcoin developers argue inscriptions are spam attacks or bugs—the community is becoming increasingly divided.

Move smart inscriptions are natively on-chain assets, likely bringing positive momentum to the Move ecosystem. If users simply seek a fair casino, wouldn’t a lower-barrier, lower-cost, better-experience, and more feature-rich alternative be a superior option?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News