30-Day Surge of 19x: A Brief Analysis of Automotive DePIN Models Represented by Hivemapper

TechFlow Selected TechFlow Selected

30-Day Surge of 19x: A Brief Analysis of Automotive DePIN Models Represented by Hivemapper

The real world will integrate with Web3, and the long-sought mass adoption of Web3 will finally arrive.

TL; DR

Massive potential in the global automotive market: There are over 1.6 billion vehicles worldwide, but only 250 million are connected;

We can refer to this paradigm as "Drive To Earn" or "DeDrive";

DePIN achieves bottom-up coupling between real-world physical assets and on-chain systems: Nearly all automotive-related DePIN projects are backed by real-world revenue streams, with tokenomics serving as a flywheel mechanism that integrates organically with existing product ecosystems.

DePIN & Drive To Earn

The term DePIN was coined by Messari, referring to Decentralized Physical Infrastructure Networks—decentralized networks of physical infrastructure. Messari divides the DePIN sector into four main categories: service networks, wireless networks, sensor networks, and energy networks.

If categorized by hardware form factors, they can be broadly divided into three types: computing, storage, and general-purpose applications.

General-purpose applications include well-known devices such as wireless routers and dashcams. For individual (C-end) users, there is a natural demand for better hardware experiences. Meanwhile, enterprise (B-end) customers have intrinsic motivation to collect more precise data to optimize their products. As a result, we’ve seen promising momentum in DePIN-based projects like MOBILE (centered on smartphones), HONEY, and DIMO (focused on automobiles). Among these, ecosystems built around car data collection and decentralized supporting services stand out particularly.

One key reason is that cars—being among the most significant assets for individuals globally—have an extensive user base. Currently, the global vehicle fleet exceeds 1.6 billion units. With a world population of about 7 billion, this means roughly one in every four people owns a car. These vehicles traverse over 64 million kilometers of roads worldwide.

However, according to statistics, road traffic accidents claim 1.3 million lives annually, with 90% occurring in low- and middle-income countries. Relative to their number of vehicles and road networks, these nations suffer disproportionately high fatality rates.

Thus, both C-end and B-end demands are especially urgent within the automotive domain.

Connected Vehicles and DeDrive

On another front, with the widespread development of IoT concepts, the idea of “Internet of Vehicles” (IoV)—using vehicles as platforms for smart infrastructure—has gained increasing attention from governments and investors globally.

While IoV partially addresses the challenge of automotive data collection, excessive centralization among related companies, coupled with manufacturers building proprietary moats and relying on custom development, hinders cost-sharing in R&D. Ultimately, these costs are passed onto consumers, limiting the broader adoption of connected vehicles.

With the rise of blockchain and DePIN, a new paradigm has emerged: integrating blockchain technology and crypto incentives into device manufacturing to accelerate capital flywheels, attract wider user participation through token rewards, and enable users to earn value from contributing. This model is gradually becoming a consensus within the Web3 context.

We can call this paradigm “Drive To Earn,” or “DeDrive.”

Current representative DeDrive projects include Hivemapper and Dimo. Future Money Group will analyze these two projects along with other associated Drive-to-Earn initiatives.

DeDrive Concept Projects

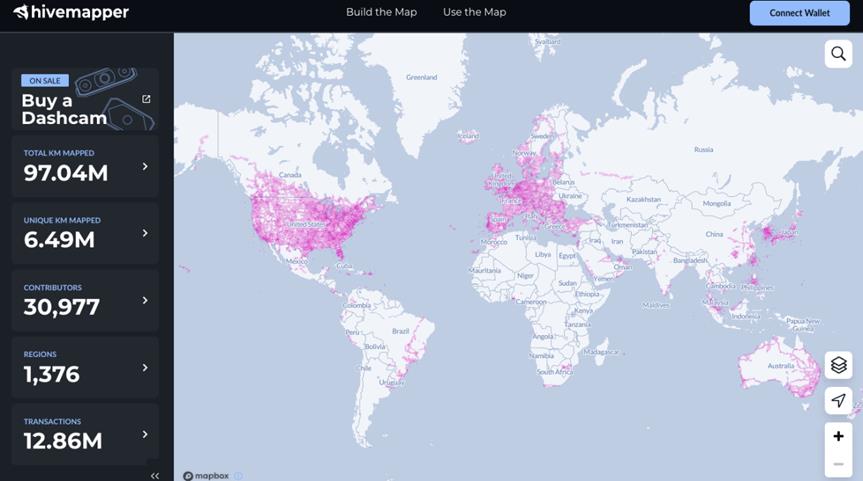

Hivemapper

Hivemapper is one of the top DePIN projects on Solana, aiming to create a decentralized version of “Google Maps.” Users purchase Hivemapper’s dashcam, use it while driving, and share real-time video footage to earn HONEY tokens.

Hivemapper aggregates map and traffic data collected via logistics and mapping companies—specialized user groups—and packages them into API interfaces available to B2B or B2C clients.

Compared to Google Maps, Hivemapper leverages token incentives to ensure contributors remain motivated and accurate. Additionally, due to its token-based model, Hivemapper faces lower operational expenses and can offer cheaper, higher-value APIs—giving it a competitive edge.

In fact, as an alternative to Google Maps API, millions of companies rely on Google's location data services, whose pricing has significantly increased in recent years.

As a challenger to Google Maps, Hivemapper theoretically holds a potential market value at least comparable to that of Google Maps.

The Hivemapper network consists of two primary components:

1. Dashcam: An open-source device that captures 4K images and GPS metadata. It includes a LoRa sensor using Helium’s IoT network to verify location.

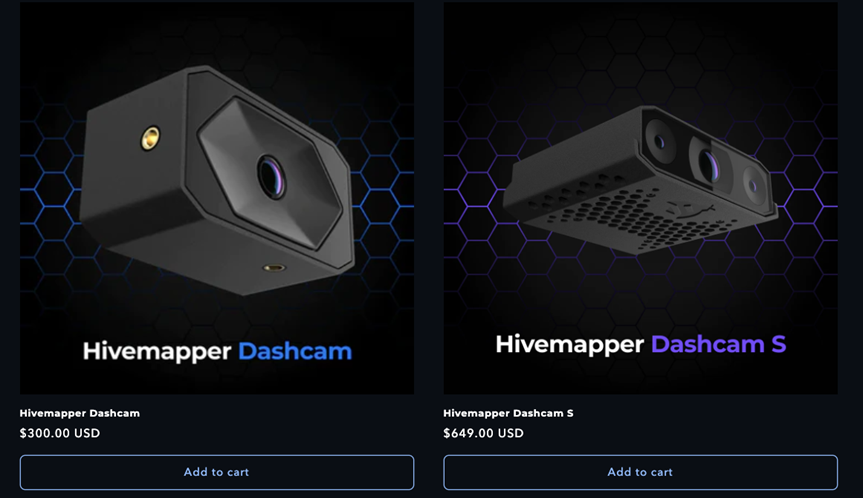

Currently, Hivemapper offers two versions: the Hivemapper Dashcam ($300) and the S version ($649). The former supports standard mapping with up to 4K 10fps recording; the latter is smaller, more discreet, and capable of 4K 30fps.

2. Hivemapper Contributor App: This app pairs with the dashcam via Wi-Fi, transferring image and location data from the device to the user, then uploads the data to the mapping network for processing.

Tokenomics: The HONEY token has a fixed maximum supply of 10 billion, allocated as follows:

• 40% to contributors, as rewards for submitting map data;

• 20% to investors, as initial funding for mainnet launch;

• 35% to Hivemapper employees, for daily operations and ongoing development;

• 5% donated to the foundation to support governance and long-term success.

HONEY serves as the economic incentive within the Hivemapper ecosystem, balancing the needs of two key groups:

1. Map data contributors: Rewarded with HONEY for uploading information, editing maps, and training AI models.

2. Enterprises and developers using map data: They pay (and burn) HONEY when accessing Hivemapper’s API services.

Overall, the on-chain marketplace between contributors and clients operates under a Burn & Mint equilibrium: Every time a client burns HONEY to access data, an equivalent amount is minted and distributed back to contributors.

As demand for map data increases, the rate of HONEY burning and re-minting accelerates accordingly.

To date, Hivemapper has mapped over 96 million kilometers of roads across 1,376 regions, supported by more than 30,000 global contributors, generating nearly 13 million transactions.

Dimo

Dimo is a car IoT platform built on Polygon that enables drivers to collect and share vehicle data, including mileage, speed, location tracking, tire pressure, battery/engine health, and more.

If Hivemapper focuses on external environmental data from vehicles, Dimo specializes in internal vehicle performance data.

By analyzing vehicle data, Dimo can predict maintenance needs and alert users proactively. Drivers gain deeper insights into their vehicles and earn DIMO tokens by contributing data to the ecosystem. Data consumers can extract performance metrics on batteries, autonomous systems, controls, etc., enabling disruptive new applications in fine-grained insurance, ride-hailing, navigation, vehicle financing, and energy network optimization.

Globally, there are approximately 1.6 billion vehicles, but only around 250 million are currently connected. On one hand, manufacturers like Tesla often charge users additional fees for services based on aggregated driving and road condition data after selling the car. On the other hand, about 84% of vehicles on the road—especially older models—remain unconnected.

This presents a massive opportunity for Dimo. Similar to Hivemapper, Dimo’s offering includes both hardware and a mobile app.

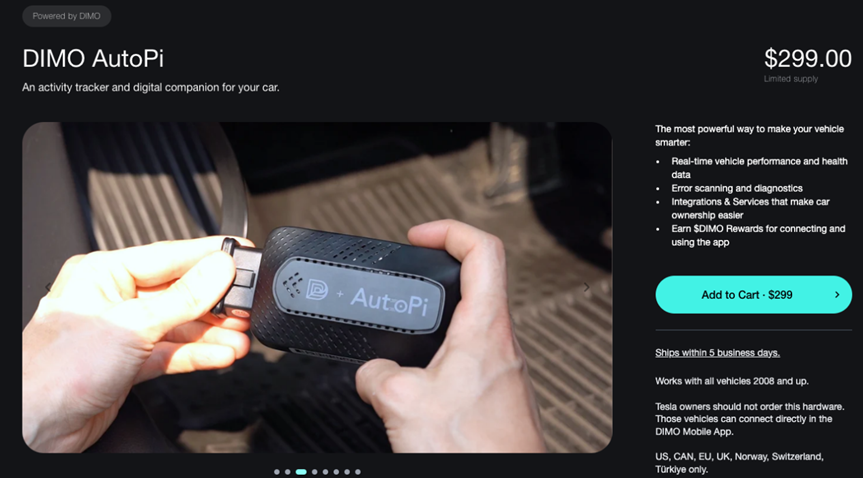

Its hardware device, AutoPi ($299), plugs into a vehicle and enables internet connectivity for any car manufactured since 2008.

Once connected, users can monitor their car’s performance and health in real time via the app and earn DIMO tokens during the process.

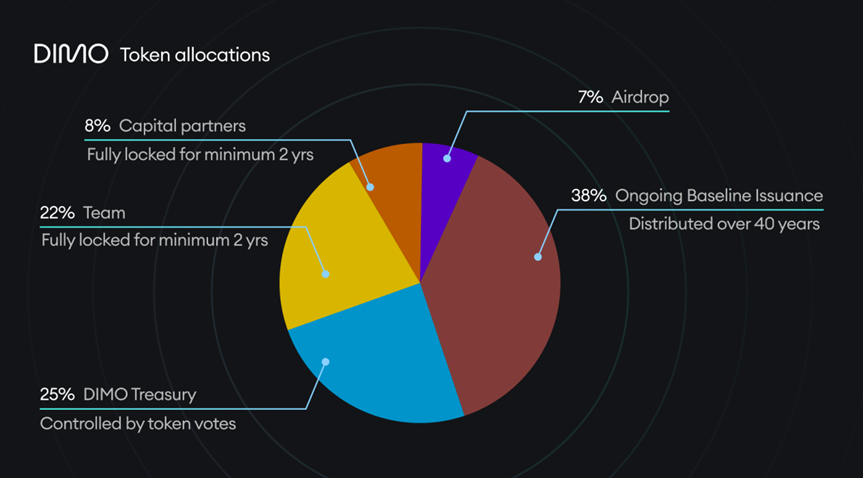

Tokenomics: DIMO is the native token of the Dimo protocol, used to reward users and contributors.

Total token supply is 1 billion, allocated as follows:

• 38% baseline issuance (380 million DIMO) distributed over 40 years—1,105,000 $DIMO weekly in Year 1, decreasing by 15% annually;

• 22% to the Dimo treasury, for bounties and grants to contributors;

• 22% to the team, locked for two years, then linearly unlocked monthly over three years;

• 8% to investors, also locked for two years and linearly unlocked over three years;

• 7% allocated to airdrops.

Currently, DIMO serves four main functions:

1. Reward distribution: Users can earn DIMO in two ways.

Baseline issuance: Users earn DIMO simply by keeping their device connected—even if no third party uses their data.

The amount of DIMO issued increases weekly. Earning efficiency depends on user account tier, which is determined by how early they joined the Dimo ecosystem. Early adopters receive progressively larger weekly rewards.

Market issuance: Users earn additional DIMO when transacting with authorized DIMO apps. The amount and terms are set by each app developer.

2. Transaction medium: Token holders can buy/sell vehicle data and purchase Dimo AutoPi hardware using $DIMO.

3. Governance rights: $DIMO holders can vote on protocol operations, including software upgrades, standards, fee structures, and reward mechanisms.

4. Community membership: Holding $DIMO grants access to exclusive features and events.

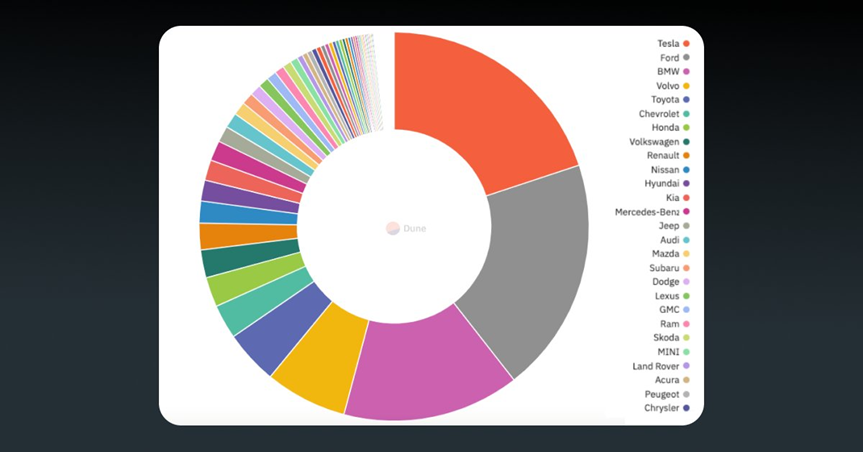

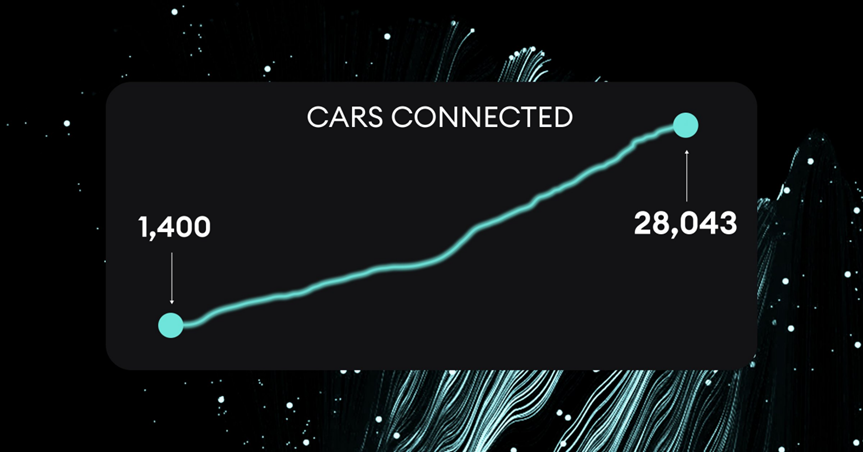

So far, nearly 28,000 vehicles have been connected to the Dimo network, accumulating over 153 million kilometers driven. A total of 71 car brands are integrated, led by Tesla, Ford, and BMW. Over the past year, more than 57 million $DIMO tokens have been distributed to users—worth approximately $13 million. If valuing each connected vehicle, the network’s total valuation exceeds $750 million.

Atlas Navi

Atlas Navi is the first AI-powered Drive-to-Earn navigation app. Using smartphone cameras, it detects road conditions (closures, construction, potholes), accidents, lane-level traffic, available parking spots, police presence, and helps drivers reroute to avoid congestion. It uses licensed 3D NFT vehicles to represent drivers and rewards users for sharing camera data (optional) per mile driven.

Atlas Navi’s tokenomics consist of three components:

1. Vehicle NFTs: Similar to Stepn’s sneakers (with consumable elements like water tanks and fuel), only NFT holders can earn MILE through Atlas Navi and convert it into NAVI.

2. MILE: A points-like token tracking driving distance. Users can exchange MILE for NAVI based on their owned NFTs.

Users can also perform "Drive to Earn" with different vehicle NFTs.

3. NAVI: The native token of the Atlas Navi ecosystem, used as rewards for Drive-to-Earn activities and for paying subscriptions to official NFTs and services.

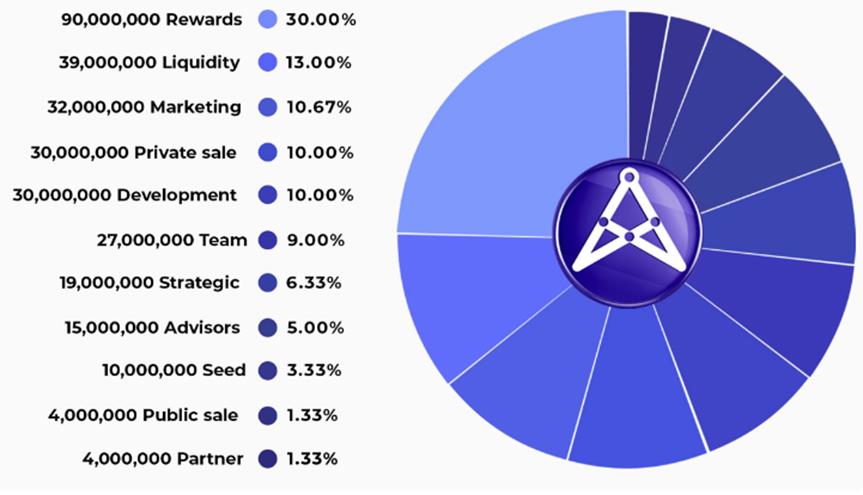

Total supply of NAVI is 300 million, allocated as follows:

• 30% for user incentives

• 9% to team

• 10% to development team

• 10.67% for marketing

• 13% for initial liquidity

• 5% to advisors.

The above three are currently the most popular and best-performing DeDrive projects in the market. In fact, there are many more automotive-focused DePIN products emerging.

For example, Moveo: focused on connected vehicles and insurtech, Moveo uses custom onboard hardware and patented software to combine vehicle and driver data, delivering deep insights into driving safety and innovative services.

Or Soarchain: A Cosmos-based application-specific blockchain designed to enable direct, fast data transmission between vehicles, infrastructure, and networks. On Soarchain, vehicles share data via cellular tech and record it on-chain, earning the native Soarchain token. The platform allows anonymous, private contributions to the vehicle network while maximizing user benefits through decentralized apps and rewarding participation.

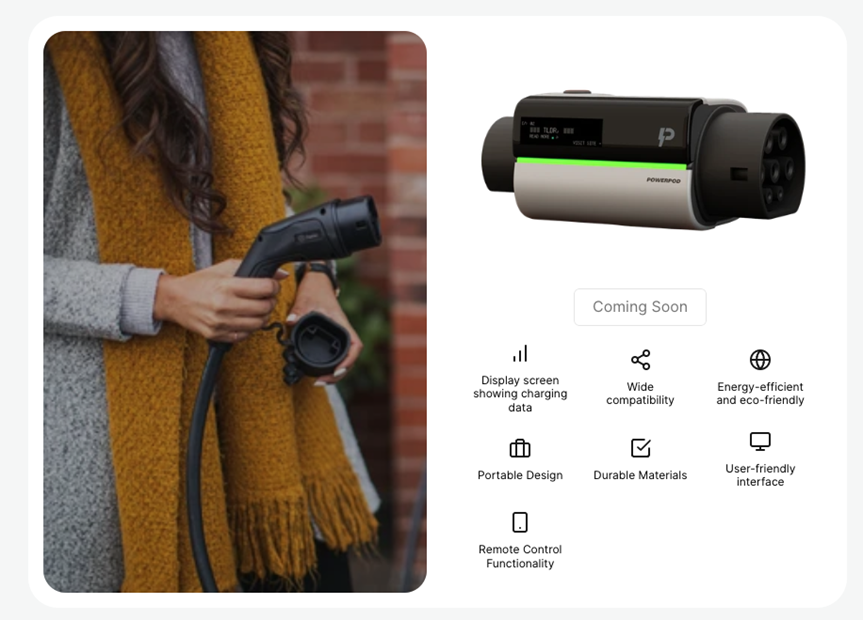

Additionally, there are DePIN projects focused on EV charging, such as PowerPod.

PowerPod

PowerPod is a global electric vehicle (EV) charging network aiming to rapidly scale with low maintenance costs through decentralized governance, GameFi mechanics, and positive yield models. Owned by individuals and communities, it avoids issues inherent in centralized management. Blockchain ensures data security and transaction transparency. Cutting-edge charging technology guarantees safe, efficient, highly compatible charging, offering personalized and intelligent services. In the future, PowerPod aims to extend and complement traditional power grids, forming a new hybrid electricity supply network.

PowerPod will produce a series of smart hardware devices to ensure charging behavior is measurable, computable, and trustworthy.

Phase one will focus on charging gun adapters. By attaching removable adapters to non-data-sharing chargers, critical charging data can be accurately captured and securely sent to the blockchain. Smart contracts will calculate incentives based on this data.

Phase two involves high-performance home AC chargers.

Phase three introduces “mobile chargers,” allowing owners to charge via standard outlets in emergencies (current: 10–16A).

Tokenomics: PowerPod adopts a dual-token model similar to Hivemapper and Dimo: Points + Token.

PT is an uncapped, algorithmically generated points currency awarded for positive behaviors (e.g., earning 1 PT for every 1 kWh charged via a PowerPod smart charger).

PPD is the ecosystem’s native and governance token.

Total PPD supply is 100 million, with 12.5 million minted in Year 1, halving every four years. Allocation:

• 45% for behavioral incentives

• 15% to developers

• 18% to investors

• 2% to advisors

• 20% to the ecosystem.

Moreover, mined PPD is pooled into a dividend pool. The pool distributes rewards every 12 hours based on each user’s proportion of total deposited PT. Once PT is transferred to the dividend pool, it cannot be withdrawn, and after payout, that batch of PT is burned.

For example, if user John deposits 100 PT into the pool and the total reaches 10,000 PT by the end of the cycle, he receives 1% of the accumulated 77 PPD (assuming ~7,706 PPD per distribution in Year 1). After distribution, all 10,000 PT in the pool are destroyed.

Differences Between DeDrive and Move to Earn

At first glance, DeDrive projects may resemble Move-to-Earn projects like Stepn in terms of token generation. However, they differ fundamentally. While both help expand Web3 awareness by incentivizing user behavior in accessible ways, X-to-Earn projects like Stepn are primarily driven by tokenomics—essentially sustaining a Ponzi-like structure by continuously attracting new users. In contrast, DeDrive projects are grounded in real-world assets and reflect tech companies embracing blockchain and decentralization principles.

As observed, nearly all the cases mentioned are backed by real-world revenue, with tokenomics acting as a flywheel that integrates seamlessly into existing product frameworks.

We might say that while X-to-Earn projects like Stepn demonstrate and validate the paradigm of earning on-chain through human activity, DeDrive projects like Hivemapper achieve bottom-up integration between physical-world assets and blockchain systems. The former influences economic foundations top-down; the latter builds foundational pillars for the upper layers from the ground up.

Conclusion

Automotive DePIN—or DeDrive—projects are deepening the connection between the traditional world and Web3. For instance, Dimo founder Andy C. has discussed the vision of creating a blockchain-based DMV and tokenizing vehicle ownership. If realized, such innovations would mark a large-scale entry of blockchain into real-world systems. Data has value—every piece contributed by DePIN participants deserves meaningful analysis, utilization, and greater impact.

In the future, the DePIN paradigm centered on vehicles will expand further into adjacent sectors—impacting areas like vehicle insurance, used car markets, parts and repair, road construction, and car rentals more profoundly than smartphone-based DePINs. Eventually, the physical world and Web3 will converge, bringing about the long-sought mass adoption of Web3.

We have strong reasons to remain optimistic about DePIN’s prospects. But before the full DePIN era arrives, DeDrive may lead the way and become one of the most sought-after investment themes in the market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News