Thala Protocol: The LSD-Powered Full Stack, Engine of Aptos Ecosystem Revival

TechFlow Selected TechFlow Selected

Thala Protocol: The LSD-Powered Full Stack, Engine of Aptos Ecosystem Revival

As a leading "jack-of-all-trades" in the Aptos ecosystem, Thala can tap into more narratives with its comprehensive product suite.

Author: TechFlow

With the market heating up, new Layer 1 public chains are gradually recovering.

From Solana to Avalanche, we can clearly observe a rotation effect and capital spillover within the same L1 sector—similar to how Bitcoin inscriptions sparked similar activity across other blockchains after gaining popularity on BTC.

However, such rotation requires a native representative protocol as its foundation within an ecosystem.

Projects like Orca on Solana and Benqi on Avalanche have served as engines for their respective ecosystem recoveries. Following this logic, we find that Thala, a native DeFi protocol on Aptos, has quietly seen significant price growth.

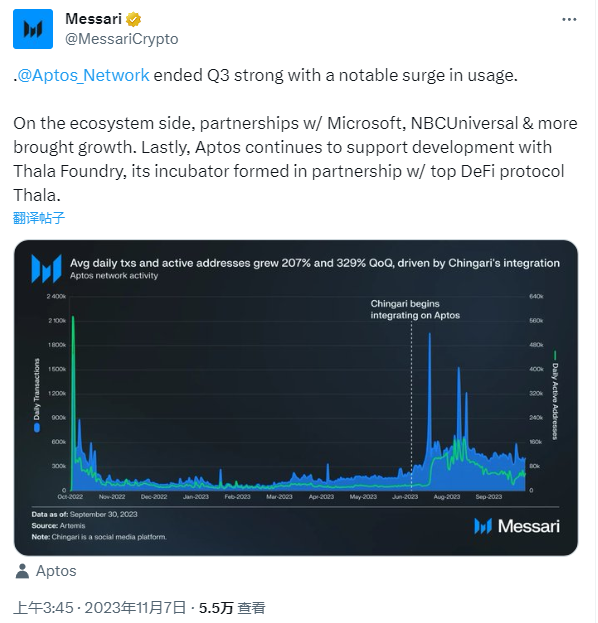

In early November, Messari already observed signs of Aptos' recovery, noting a significant surge in network usage during Q3 of this year. The official team continues to support the development of Thala Foundry—the incubator co-founded with Thala, the top-tier DeFi protocol on its ecosystem.

It is clear that Thala currently maintains close ties with the Aptos official team.

Considering that current market attention may not yet be focused on Aptos, understanding the movements of key projects within this ecosystem could help us capture potential upcoming opportunities. In fact, earlier this year, we conducted an in-depth analysis of Thala Protocol’s product and technical design in our article titled "Deep Dive into Thala Protocol: The First DeFi Protocol Built on Aptos’ Native Stablecoin."

Nearly a year later, beyond Thala’s recent price increase, how exactly has the product evolved? And what new developments lie ahead?

After compiling recent project updates, we found that Thala has effectively become the DeFi cornerstone of the Aptos ecosystem, integrating stablecoins, AMM, launchpad, RWA, and liquid staking into one cohesive platform, creating a virtuous cycle among these components.

On the eve of a possible collective breakout among L1 ecosystems, Thala deserves closer attention.

Building the Foundation of Liquidity on Aptos

For any public chain ecosystem, the liquidity market is vital to its prosperity—especially for newly established ones. Markets require capital volume, capital efficiency, and attention—all of which depend on a robust internal liquidity infrastructure.

When it comes to liquidity, DeFi's importance cannot be overstated. From enabling users to create and participate in liquidity pools, lending assets, to economic designs that lock liquidity for staking rewards—a well-designed DeFi protocol can activate an entire ecosystem’s capital flow.

Judging from nearly a year of development, Thala is undeniably a comprehensive DeFi protocol and serves as the foundation of liquidity on Aptos.

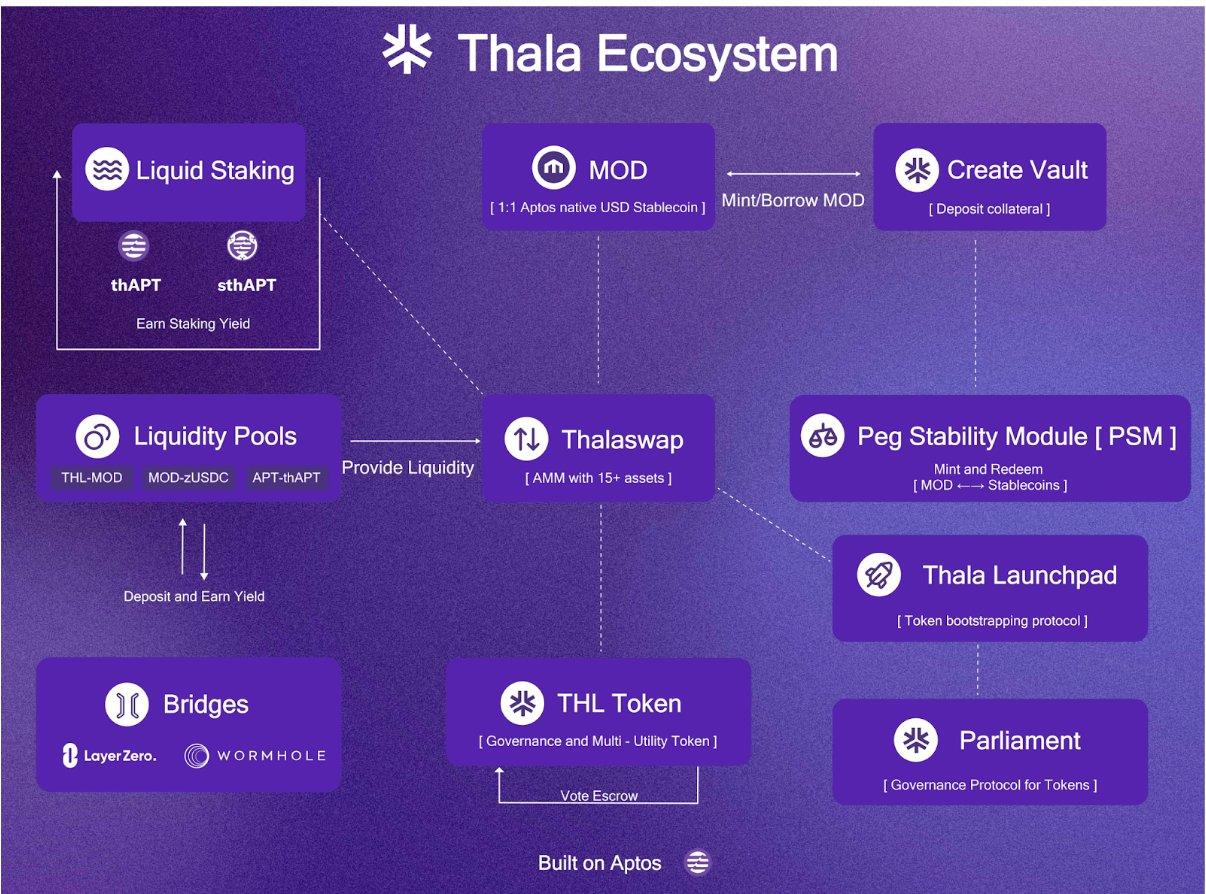

Reviewing its existing product structure:

-

MOD (Move Dollar): An over-collateralized stablecoin on Aptos. The minting and supply of MOD provide a source of liquidity for other DeFi projects, spawning additional use cases and utilities;

-

Thala Swap: A decentralized exchange based on automated market maker (AMM) mechanisms, offering different pooling strategies and yield models;

-

Launchpad: A new asset launchpad built upon the "liquidity bootstrapping pool" feature within Thala Swap. By setting initial and final weights for two assets over a period, it guides user liquidity participation and enables swapping between assets—commonly understood as using existing tokens to swap for new tokens.

As previously mentioned in earlier articles, these three elements form a flywheel for liquidity growth and ecosystem expansion, which we will not elaborate further here.

Beyond these, Thala also launched a product module related to real-world assets (RWA) in July. Users can now collateralize tokenized assets—including corporate bonds, consumer loans, and treasury bills—to borrow the stablecoin MOD, thereby further enhancing MOD’s appeal and utility.

Combining all of Thala’s product components reveals that Thala functions as a comprehensive DeFi platform, enabling asset mobility on Aptos.

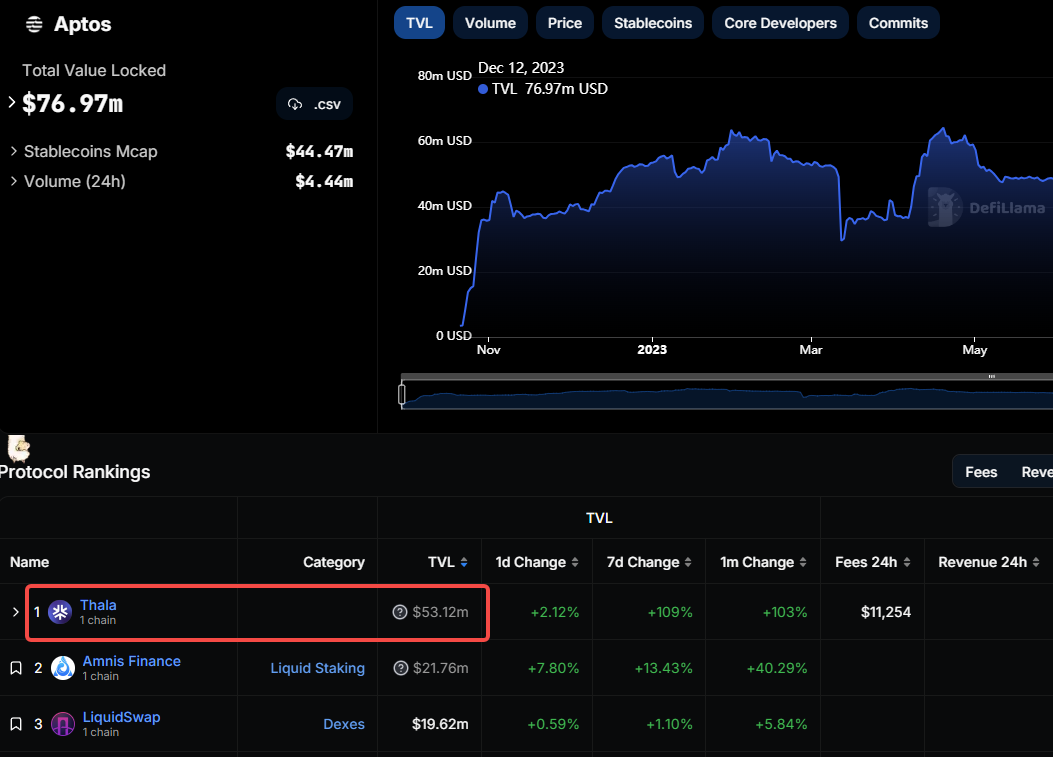

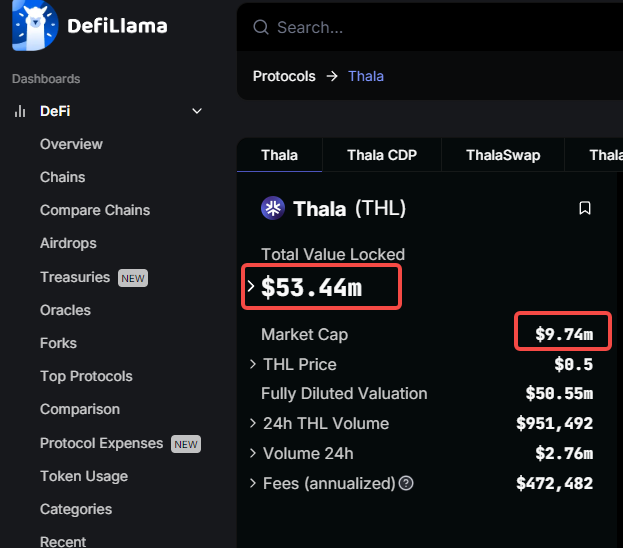

Moreover, looking deeper into the ecosystem through TVL metrics, it's evident that Thala leads among native protocols on Aptos, with consistently growing data. In the past week alone, its TVL surged by over 100%, reaching approximately $53 million.

Market-leading projects often perform better when capital flows in, but they still need new functionalities and compelling narratives to sustain momentum. Beyond Thala’s existing product suite, what new features could attract more attention and potentially ignite market sentiment?

Powered by LSD: Another Path to Asset Yield

The recent surge in JITO has revitalized Solana’s entire liquid staking landscape, demonstrating strong market validation for this sector.

Likewise, on Aptos, Thala launched its LSD-related product on November 23. Technically, LSD involves staking a blockchain’s native token to maintain network security and stability; from an asset perspective, it offers native token holders another way to generate yield.

With the addition of LSD, Thala has become the only complete DeFi solution on Aptos. Currently, no other competitor in the Aptos ecosystem offers LSD functionality.

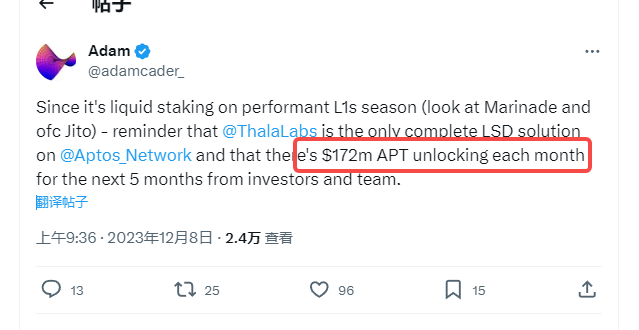

Notably, over the next five months, Aptos’ native token APT will unlock tokens worth $172 million, most of which belong to investors and core team members. For the sake of maintaining APT’s price stability and long-term development, the project team is unlikely to dump large quantities of unlocked tokens onto the market.

So where will these newly unlocked APT tokens go?

Capital always seeks maximum returns. Under conditions where market impact must be minimized, Thala’s liquid staking product could become a key vessel absorbing the massive inflow of unlocked APT.

Additionally, data shows that over 866 million APT tokens (about 81% of total supply) are staked across more than 116 validators on Aptos.

Yet only 0.4% of this amount (approximately $28 million) actively participates in liquid staking protocols, contributing negligible value to the broader DeFi ecosystem.

Given the lack of native assets in nascent ecosystems, LSD can serve as an effective tool to bootstrap liquidity and create new use cases for protocols. This undoubtedly provides a favorable external environment for Thala to attract more staked assets.

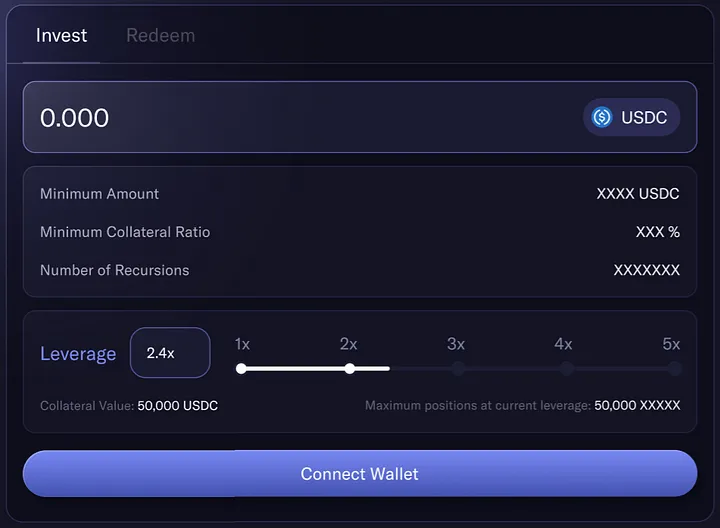

From a product standpoint, Thala holds a monopolistic advantage due to the absence of competitors. It can further amplify this edge through its own stablecoin and AMM mechanisms. With these business expectations and tailwinds in mind, let’s examine the specific design of Thala’s LSD product:

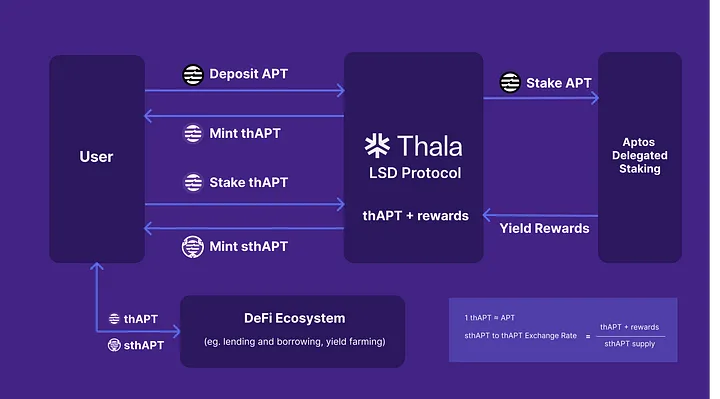

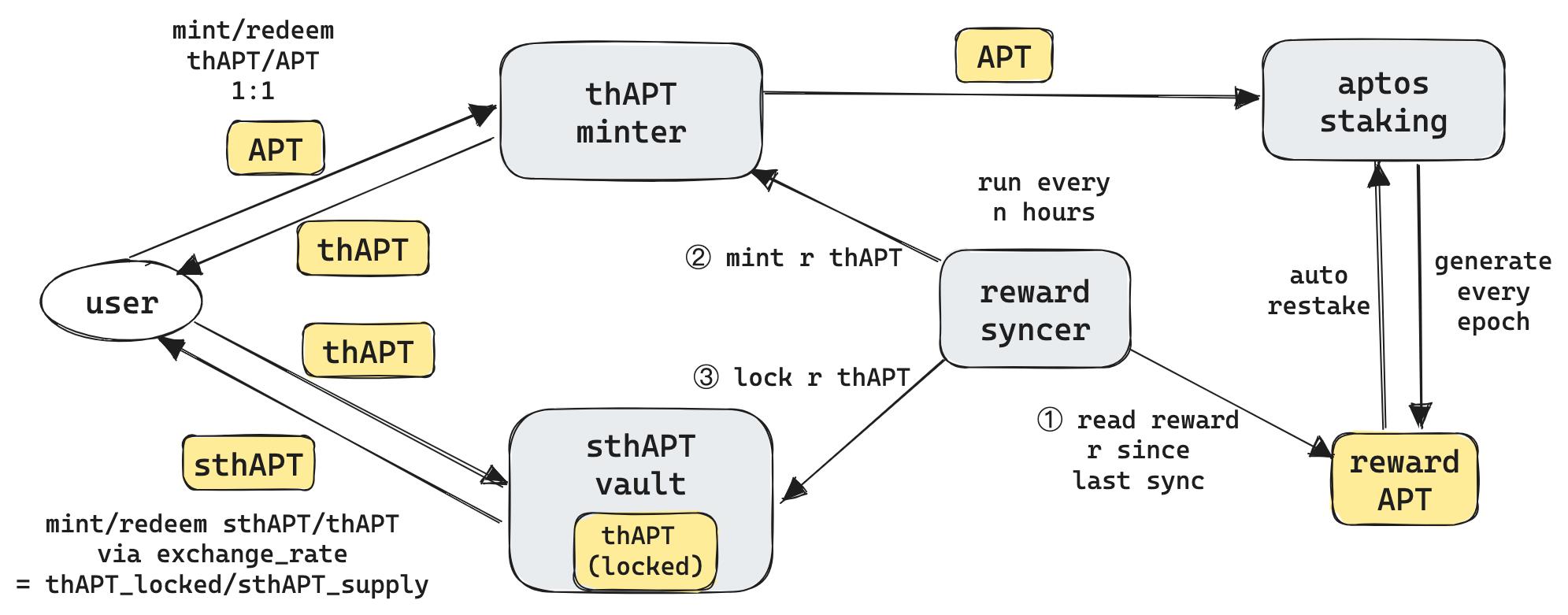

1. Assets involved in Thala’s liquid staking:

-

thAPT: A non-rebasing deposit receipt pegged 1:1 to APT.

-

sthAPT: A rebasing deposit receipt that appreciates over time as validator rewards accumulate.

2. Forms and roles of these assets:

-

thAPT is a deposit receipt that can be directly minted and redeemed for APT. Users deposit APT into the Thala protocol and receive an equivalent amount of thAPT representing their staked APT.

-

sthAPT represents staking rewards. Users mint sthAPT by depositing thAPT into Thala’s LSD module, reflecting the yield earned from staking APT via Thala’s validators.

3. Liquid staking process and participants:

-

Users deposit APT into the Thala protocol and receive thAPT.

-

Users can choose to deposit thAPT into the LSD module to mint sthAPT, which increases in value over time.

-

Validators operate network nodes, ensuring network security and stability, and earn rewards accordingly.

-

The thAPT-APT stable pool provides liquidity, supporting trading between thAPT and APT.

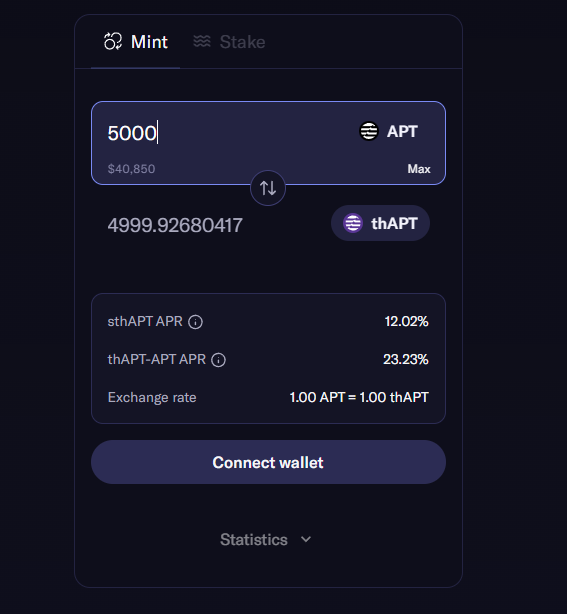

4. Rewards for different participants:

-

sthAPT holders receive 100% of sthAPT validator rewards plus 80% of thAPT validator rewards.

-

The remaining 20% of thAPT validator rewards are used to incentivize liquidity providers in the thAPT-APT stable pool on ThalaSwap.

-

Validators earn APT rewards for running nodes and maintaining network stability. Thala itself does not charge commission, though nodes delegated to ParaFi Technologies and Bware Labs (two blockchain service providers) charge a 7% fee.

-

For liquidity providers, Thala plans to reduce emissions in the stable pool while increasing support for the thAPT-APT pair, offering greater incentives to early participants.

In short, Thala’s liquid staking allows APT holders to stake their assets in tokenized form and earn potentially high yields through sthAPT, while retaining asset liquidity. This mechanism also rewards validators securing the network and incentivizes liquidity provision, boosting overall ecosystem vitality.

With LSD added, Thala now boasts a more complete product suite. The combined power of LSD + stablecoin + swap (AMM) + launchpad makes Thala the go-to full-stack DeFi infrastructure on Aptos.

For anyone looking to engage with the Aptos ecosystem, Thala is an unavoidable gateway. This unique ecosystem positioning, coupled with a multifunctional product matrix, significantly enhances its potential and growth prospects.

Recent Catalysts

Beyond the addition of LSD, what other catalysts could drive Thala’s growth?

According to the project’s official dashboard, since launching its liquid staking feature, Thala’s total value locked (TVL) has surpassed $55 million, with nearly half of that in APT. This proportion could grow further given the upcoming APT unlocks and increased market recognition of other L1s.

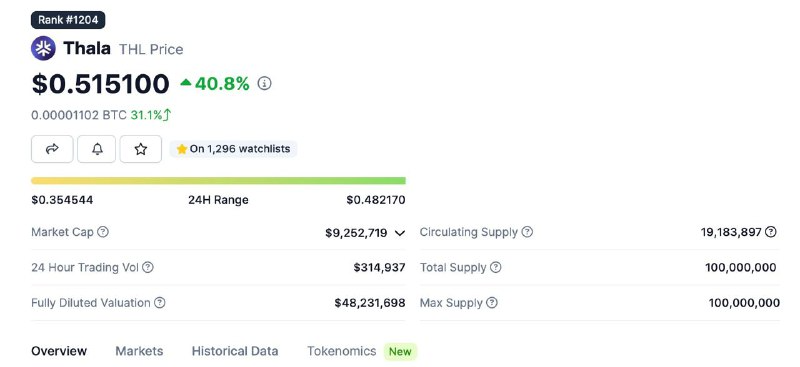

Additionally, according to DefiLlama, Thala’s current market cap stands at around $9.74 million, while its TVL has reached $55 million (based on official dashboard), meaning a relatively small project is supporting an asset base several times larger than its market valuation—potentially indicating that Thala is currently undervalued by the market.

Beyond data metrics, the following events are also worth watching:

-

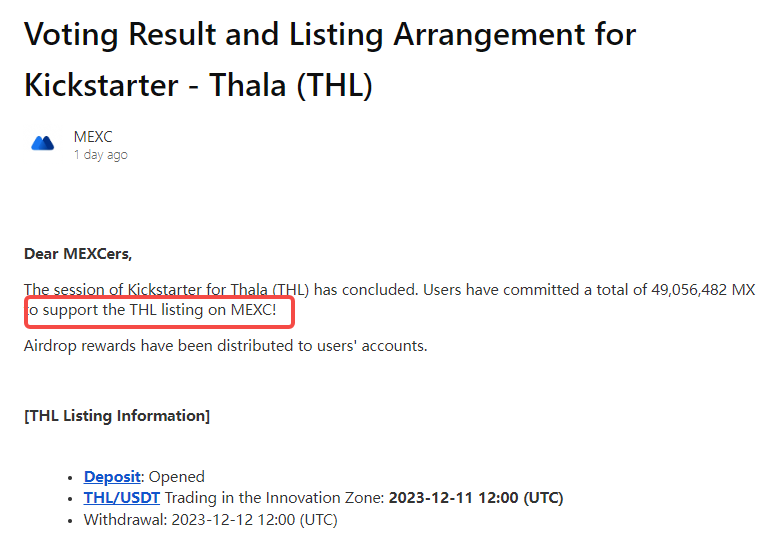

More CEX Listings: MEXC recently held a vote and decided to list THL, Thala’s native token.

-

OKX Wallet Integration: Users can now access Thala Protocol directly via OKX’s Web3 wallet to perform swaps, staking, minting, and other functions. Given OKX Wallet’s multi-chain compatibility, this eliminates cross-chain transfer costs and lowers the barrier to entry for participating in Thala.

-

Co-Creation of a $1 Million DeFi Incentive Program with Aptos Foundation: Both parties announced the formation of Thala Foundry, aiming to incentivize developers to propose “unique strategies and use cases powered by the Aptos L1 blockchain.” Since incentive programs often lead to new protocols—and these tend to develop token or functional partnerships with existing stakeholders—Thala’s financial backing acts as a positive catalyst for the project itself.

-

Calls for Aptos Official to Launch Tokens on Thala: Thala’s official Twitter account suggested that Aptos should leverage its Launchpad to issue new tokens, making full use of Thala’s features while enriching the ecosystem. From an operational cost perspective, there’s no reason for new projects to use one launchpad and then add liquidity on a separate DeFi protocol—Thala’s integrated offerings can meet both needs simultaneously, increasing collaboration potential.

Overall, although the Aptos ecosystem may not currently be in the spotlight like Solana, this doesn’t mean it lacks breakout potential or future attention.

As a leading “Swiss Army knife” in the Aptos ecosystem, Thala’s broad product suite enables it to tap into multiple narratives. A promising performance may just be beginning.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News