Synthetix proposes ending inflation: reshaping SNX stakers' rewards, potentially becoming a deflationary blue-chip project

TechFlow Selected TechFlow Selected

Synthetix proposes ending inflation: reshaping SNX stakers' rewards, potentially becoming a deflationary blue-chip project

SNX ending inflation means a reallocation of权益 between stakers and regular token holders.

Author: Jiang Haibo, PANews

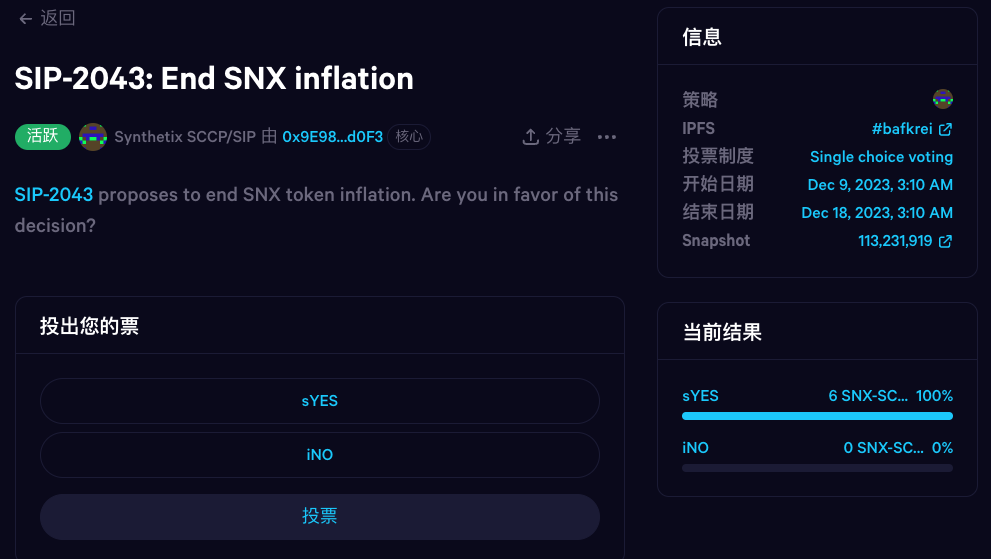

On December 9, Synthetix's improvement proposal No. 2043, "SIP-2043: End SNX Inflation," began voting on Snapshot. If passed, this proposal would mark the end of the mining and inflation era for Synthetix, and SNX would become a non-inflationary (potentially deflationary) blue-chip token.

According to Synthetix's governance framework, its governance bodies include several committees and groups elected by SNX stakers, with elections held every four months. The Spartan Council (SC) is the core governing body responsible for voting on improvement proposals and parameter changes.

As of the morning of December 11, six out of eight Spartan Council members had voted on SIP-2043, all in support, indicating a high likelihood of passage. The final vote will conclude on December 18.

Shifting Interests of Stakers and General Token Holders

Under protocol rules, SNX stakers in Synthetix act as counterparties to synthetic asset and perpetual contract traders. In return, they earn trading fee rewards and SNX inflation incentives.

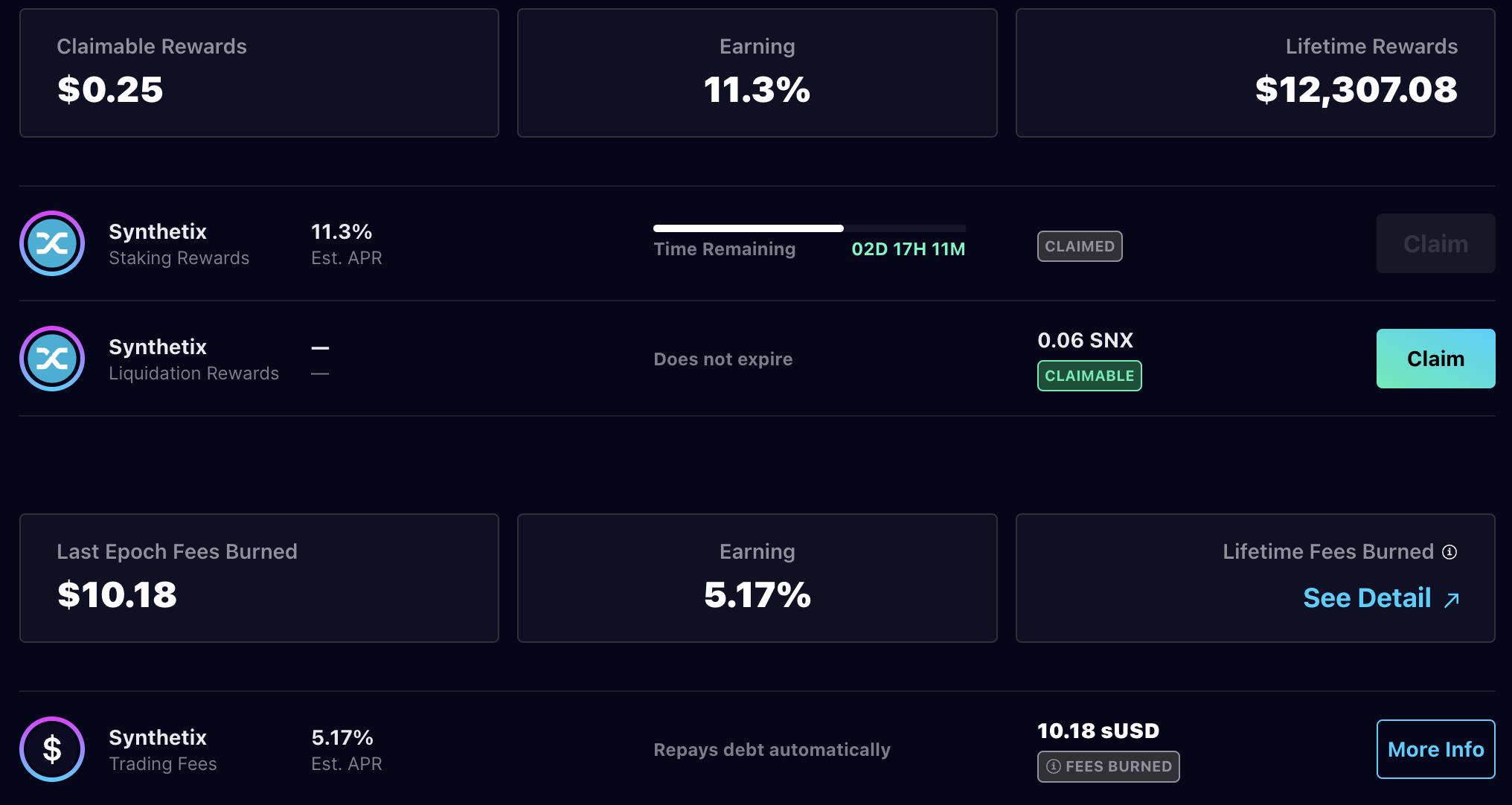

Previously, SNX stakers' benefits included: PnL from being counterparties + inflation rewards + sUSD debt reduction via fee burning. With Synthetix’s Andromeda upgrade voted to deploy on Base, if the current proposal passes, staker benefits will shift to: PnL from being counterparties + sUSD debt reduction through trading fees + trading fee revenue generated on Base.

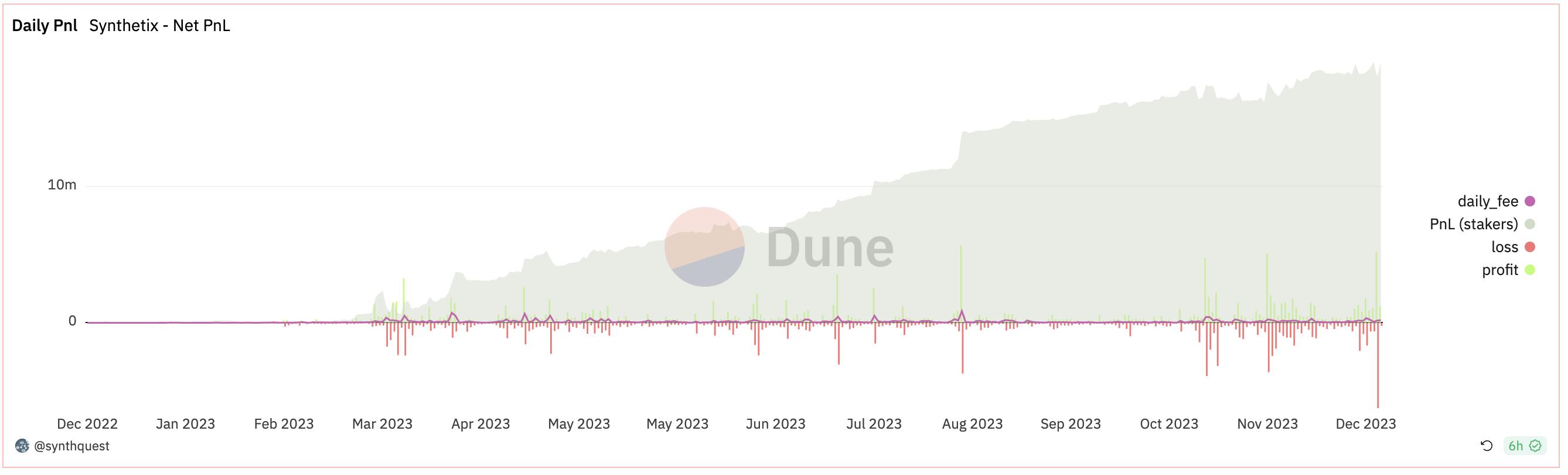

Compared to other perpetual futures platforms, income for SNX stakers as liquidity providers is more stable. As shown below, the returns for SNX stakers (including trading fees and counterparty PnL) have remained almost consistently upward.

As illustrated below, during the previous Epoch (November 30 – December 6), inflation contributed an APR above 10%, while sUSD debt burn from trading fees delivered an APR above 5%. Exact figures may vary based on collateralization ratios.

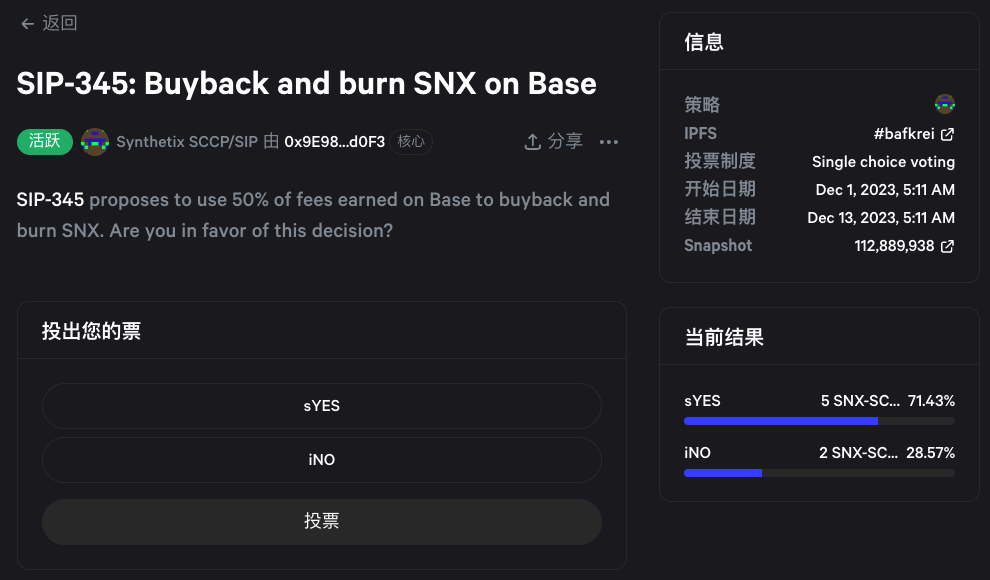

This proposal comes at a time when inflation has already decreased significantly compared to earlier levels. Additionally, Synthetix v3 is about to launch on Base, generating new revenue streams. Meanwhile, SIP-345, currently under vote, proposes using 50% of Base-generated fees to buy back and burn SNX, with the remaining 50% distributed to liquidity providers. However, this proposal remains contentious, with voting ending on December 13.

Even without new inflation income, the existing stable staking yields combined with additional revenue from Base could be sufficient to maintain adequate staking participation.

For general SNX holders, this proposal enhances their position, as downward price pressure caused by inflationary supply will disappear. If SIP-345 passes, SNX could enter a deflationary phase.

Importance of SNX Staking

For Synthetix, maintaining a high staking ratio is more critical than for many other protocols. Whether issuing synthetic assets or supporting perpetual contracts, sufficient scale of synthetics issuance is essential.

sUSD is an "endogenous collateralized stablecoin," backed solely by SNX within the same system—a model that most similar projects have failed to sustain. To ensure stability, Synthetix requires a 500% over-collateralization ratio for minting sUSD, making liquidations rare even during sharp drops in SNX value.

This means the more SNX is staked, the greater the amount of synthetic assets that can be issued. Currently, in Synthetix's perpetual contract trading, only sUSD can be used as margin. The supply of sUSD may constrain trading volume; if sUSD lacks sufficient secondary market liquidity, users purchasing sUSD for trading or margin top-ups might face premiums of 1% or higher, negatively impacting user experience. This was precisely why high inflation was previously used to incentivize staking.

However, this constraint may soon be lifted. The upcoming Andromeda version deploying on Base will allow USDC to be used as margin. From this perspective, the importance of sUSD will diminish, and Synthetix’s reliance on SNX stakers will decrease accordingly.

Multiple Past Inflation Adjustments

Synthetix has undergone multiple inflation adjustments throughout its history and is considered one of the earliest projects to introduce liquidity mining. A gradual reduction in inflation was part of the original long-term plan.

In 2019, when Synthetix rebranded from its predecessor Haaven—a stablecoin project—to focus on synthetic assets, it initiated a period of high inflation to attract capital for staking, sUSD minting, and rapid token distribution. Annual staking rewards initially approached 100%.

In March 2019, Synthetix established an inflation schedule planning to issue up to 245 million SNX, starting with 1.44 million SNX per week, halving every 52 weeks for a total duration of 260 weeks.

Due to uncertainties around the halving mechanism, proposals SIP-23 and SIP-24 introduced in September and October 2019 shifted to weekly inflation adjustments with a gradual decline. By August 2023, the inflation rate had dropped to 2.5%.

In August 2022, Kain also proposed ending SNX inflation and capping the total SNX supply at 300 million, but that proposal remained in draft form and never proceeded to a vote.

Summary

The current proposal to end inflation represents a reallocation of interests between SNX stakers and general token holders. The proposal is highly likely to pass, eliminating inflation-based incentives for stakers and stopping the ongoing dilution of non-staking holders’ ownership.

Stakers’ income—derived from acting as counterparties and collecting trading fees—is relatively stable and has trended upward over time. This steady return may continue to attract sufficient staking volume. With the imminent deployment of the Andromeda upgrade on Base, where USDC will serve as collateral, dependence on sUSD and SNX stakers will further decline, while opening up new revenue opportunities for stakers.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News