Price hits nearly 15-month high: decoding the logic behind Synthetix token's rise

TechFlow Selected TechFlow Selected

Price hits nearly 15-month high: decoding the logic behind Synthetix token's rise

Overall, factors such as the upcoming launch of V3, incentive programs, and staking dividends are driving up the price of SNX.

Author: Nancy, PANews

The long-anticipated Perps V3 is about to launch. On November 20, veteran DeFi protocol Synthetix announced that Perps V3 will debut on Base via the Andromeda release.

According to Synthetix, Perps V3 plans to introduce several new features, including support for multiple collateral types such as sUSD, sETH, and sBTC; cross-margining across positions to simplify the trading experience; improved control and flexibility through account-based access; upgrades to liquidations with smarter processes for large positions, including configurable partial liquidation delays; and the ability for developers to select any on-chain oracle.

Notably, V3 is specifically designed for derivatives protocols and liquidity providers (LPs), aiming to provide infrastructure and liquidity for rapidly launching on-chain derivatives while enabling LPs to supply derivative liquidity and earn rewards. Months ago, Synthetix announced that V3 would launch in Q4 of this year and initiated a governance proposal to deploy "V3 on Base," which passed with 100% approval.

Worth noting, the decentralized perpetual exchange Infinex will also launch alongside Perps V3. Infinex addresses key friction points of DEXs—such as high slippage, low liquidity, high fees, and elevated market risks for LPs—and enables trading on Optimism with governance powered by Synthetix's SNX token, serving as the "missing piece" to bring broader user participation into DeFi. Synthetix founder Kain Warwick previously stated, “From a trading standpoint, DeFi functionality is quite close to CeFi. We have liquidity, markets, depth, execution speed. But we’re still missing one critical component.”

Synthetix noted that the launch of V3 builds upon the massive success of V2, which brought a paradigm shift for on-chain perpetuals by focusing on risk management and introducing now-standard features like dynamic funding rates and price impact mechanisms. This drove over $30 billion in trading volume on Synthetix and generated tens of millions of dollars in fees for liquidity providers.

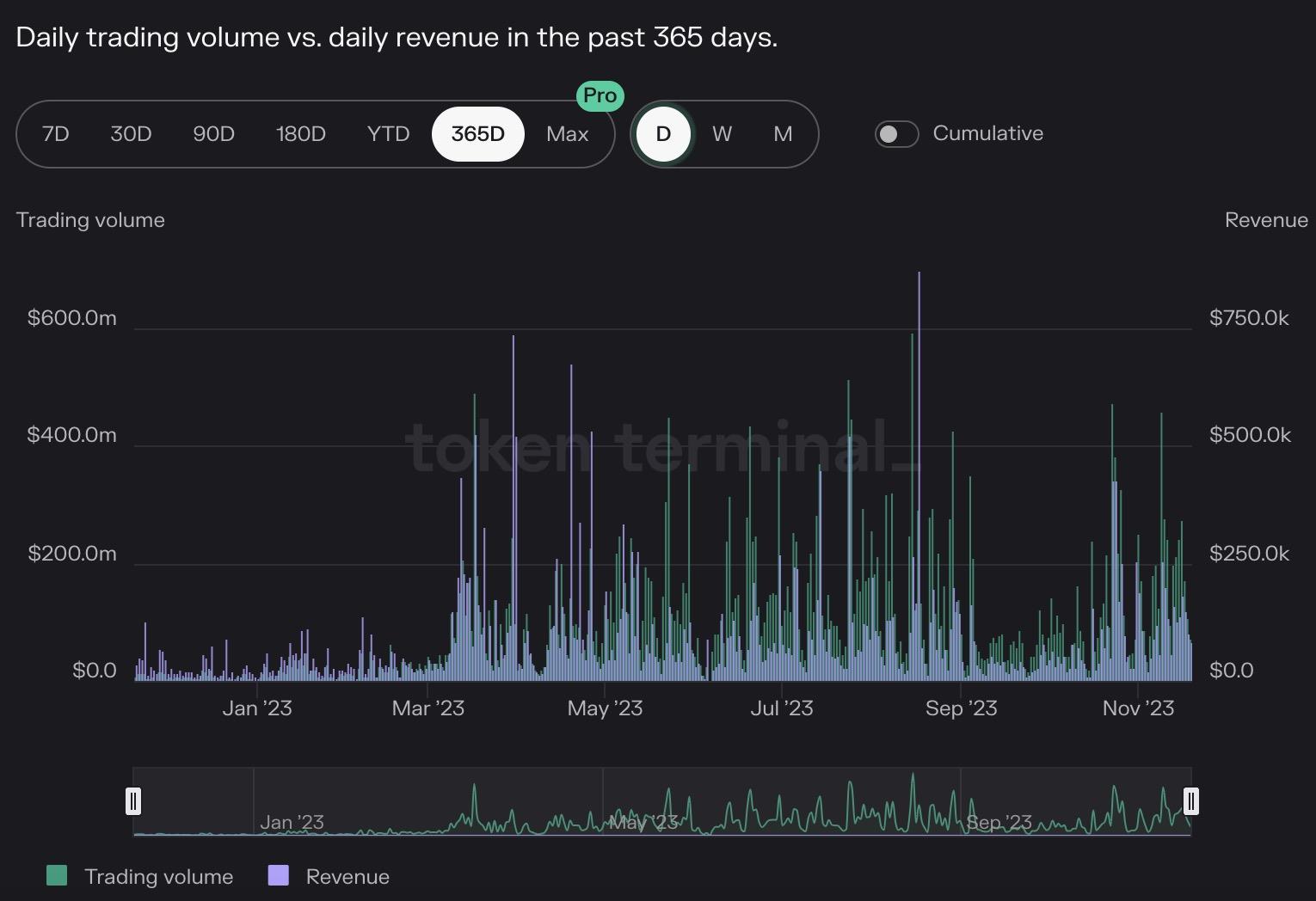

According to Token Terminal data, as of November 20, Synthetix’s total trading volume reached $36.94 billion, representing an increase of approximately 209.9% over the past year. Moreover, Synthetix currently generates around $51.29 million in annual revenue, with a 202% surge in the last 30 days alone—all of which goes to SNX stakers. Dune数据显示 shows that as of November 20, there are approximately 60,600 stakers, with total SNX staked exceeding $680 million.

Source: Token Terminal

The significant growth in Synthetix’s trading volume and revenue can be attributed to its Synthetix Perps Optimism trading incentive program. In April, Synthetix Perps launched an incentive campaign on Optimism, distributing 200,000 OP tokens weekly based on trader scores and SNX staking participation, spanning twenty weeks. In September, Synthetix extended the program by five additional weeks, reducing the weekly distribution to 100,000 OP (totaling 500,000 OP), capped by the fees generated. These subsidies, covering most transaction costs, greatly stimulated trading activity on Synthetix Perps.

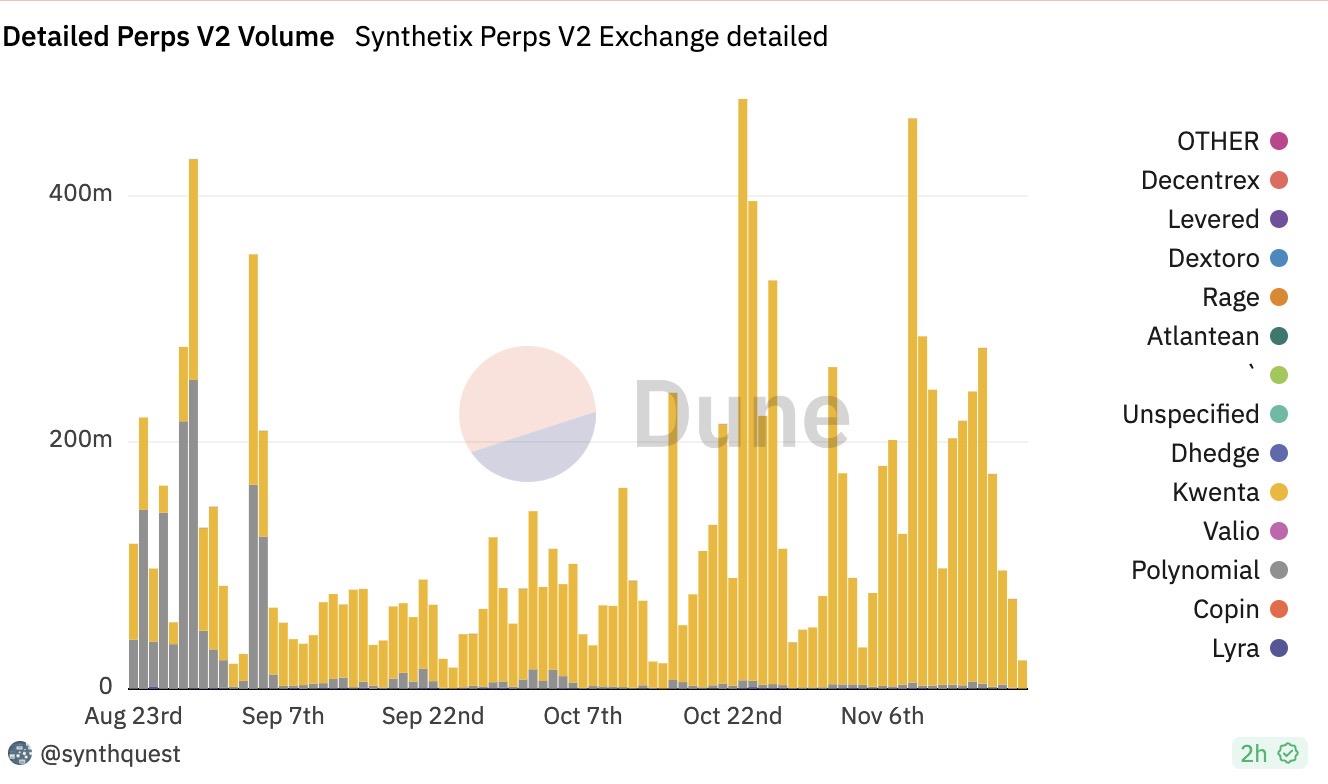

According to Dune数据显示, over the past month, daily trading volume on Synthetix Perps V2 peaked at nearly $480 million, though the vast majority was driven by the derivatives platform Kwenta. However, following the conclusion of the incentive program, Perps V2 saw a notable decline in trading volume. As of November 20, its daily trading volume stands at approximately $23 million.

In terms of trading volume and revenue, Synthetix is comparable to competitors like GMX. However, it lags significantly behind GMX and dYdX in active user counts.

Additionally, Token Terminal数据显示 indicates strong performance for the SNX token in the secondary market, with price and trading volume increasing approximately 83% and 152.4%, respectively, over the past 30 days. In just the last 24 hours, SNX trading volume reached as high as $180 million, with prices hitting their highest level since September last year.

However, according to on-chain analytics platform Santiment, as of November 20, Synthetix’s DAA (Dev-Adjusted Alpha) stood at -24.08%. Typically, when DAA divergence drops below zero, it signals a potential “sell” signal, suggesting possible manipulation by whales. Within the past 24 hours, whale transactions involving at least $100,000 worth of SNX surged from 3 to 10 trades.

Source: Santiment

Overall, the upcoming launch of V3, ongoing incentives, and staking rewards are collectively driving the upward momentum in SNX’s price.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News