Deep Dive into Synthetix V3: Unveiling Upgraded Functional Modules, Economic Model, and Revenue Metrics

TechFlow Selected TechFlow Selected

Deep Dive into Synthetix V3: Unveiling Upgraded Functional Modules, Economic Model, and Revenue Metrics

This article will interpret Snx V3 through data and application scenarios.

Author: BitAns, Krypital Group

Edited by: Krypital Group

After FTX's bankruptcy, decentralized derivatives exchanges have seen significant increases in trading volume and attention. In recent years, with the maturation of Layer 2 solutions and various Appchain open-source architectures, the reliability and concurrency performance of DEXs have greatly improved. The Dex PERP sector has become one of the highest-returning product categories during this bear market. As the industry continues to explore decentralization, such products will undoubtedly become a crucial component moving forward.

Currently, mainstream designs for decentralized derivatives primarily fall into two models: the orderbook model represented by Dydx, and the pool-and-vault model exemplified by Synthetix (Snx). Snx has evolved from its 2017 origins as an asset synthetization platform into a modular liquidity protocol, aiming to serve as a universal liquidity layer for on-chain financial products. These new features and improvements are expected to drive fresh business growth and revaluation. This article will analyze Snx V3 through data and use cases.

TOC:

I. Understanding Snx V2’s Current Mechanisms

II. New Functional Modules in Snx V3

- A. Liquidity-as-a-Service

- B. New Debt Pool and Collateral Mechanism

- C. Perps V2 and Perps V3 Engines

- D. Oracle Improvements: Mitigating Oracle Latency Arbitrage

- E. Cross-Chain Liquidity Solutions

III. Economic Model + Revenue Data

I. Snx V2 Operational Mechanism

To better understand V3, we first need to briefly review Snx’s existing design and its current challenges.

There are two core user types within the Snx ecosystem:

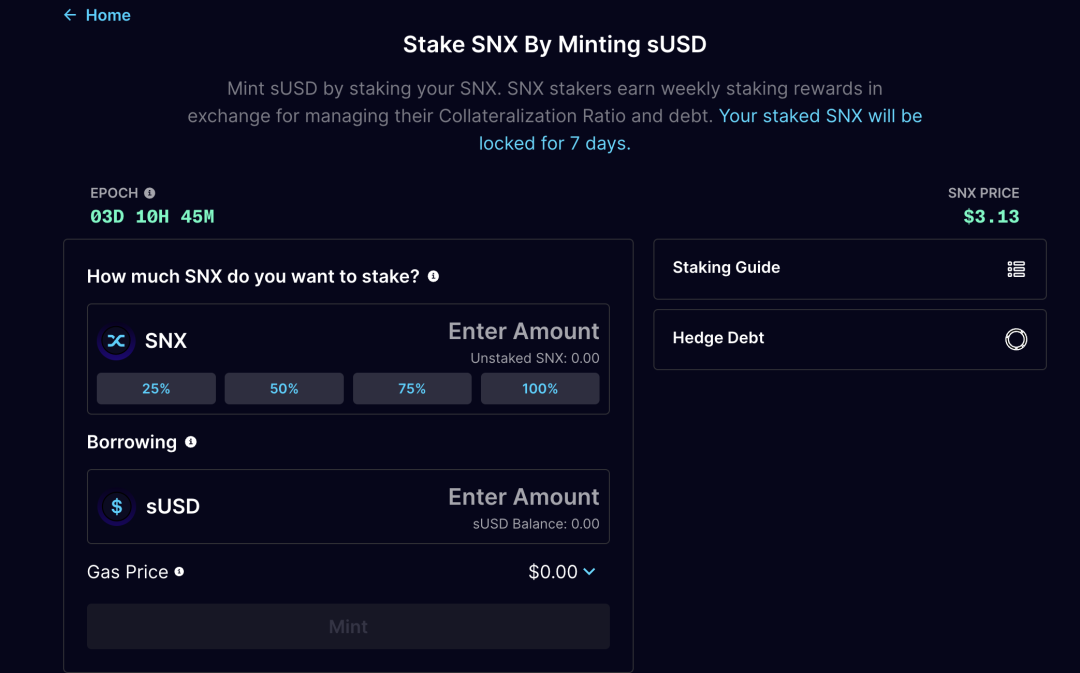

1. Stakers:Users who stake SNX tokens to earn inflationary rewards and a share of traders’ transaction fees.

2. Traders:Users conducting atomic swaps or perpetual (perp) trades within the Snx protocol.

Principle of Synthetic Assets

Stablecoin minting works by locking collateral to generate USD-pegged tokens. Similarly, users can lock assets and use oracle price feeds to generate synthetic tokens that track stocks, gold, or other assets.

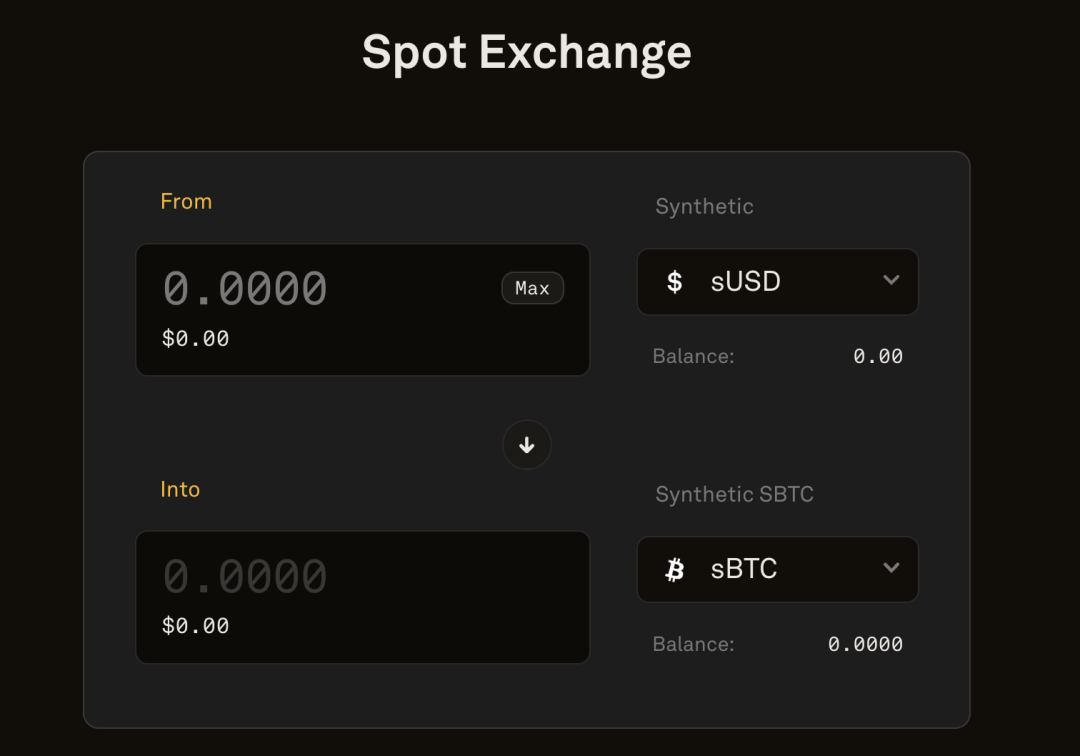

The Snx ecosystem currently includes sUSD (pegged to USD), sBTC (pegged to Bitcoin), and sETH (pegged to Ethereum), collectively known as Synths.

All system liabilities are settled in sUSD. In Snx V2, only stakers can mint sUSD by locking SNX—effectively borrowing sUSD against their SNX. Thus, the issued sUSD represents both user and systemic debt.

When the collateralization ratio exceeds 400% (subject to DAO voting based on market conditions), stakers receive inflation rewards and fee income. If the ratio drops below 160%, the staker has a 12-hour grace period to either add more collateral or repay sUSD to restore the ratio above 400%; otherwise, they risk liquidation. To unstake, a staker must fully repay their sUSD debt.

Atomic Swap Process

Synthetic asset trades occur via smart contracts that burn one token and mint another. Therefore, assuming sufficient TVL, there is no slippage aside from minor delays due to price feed updates.

Dynamic Debt Pool Mechanism

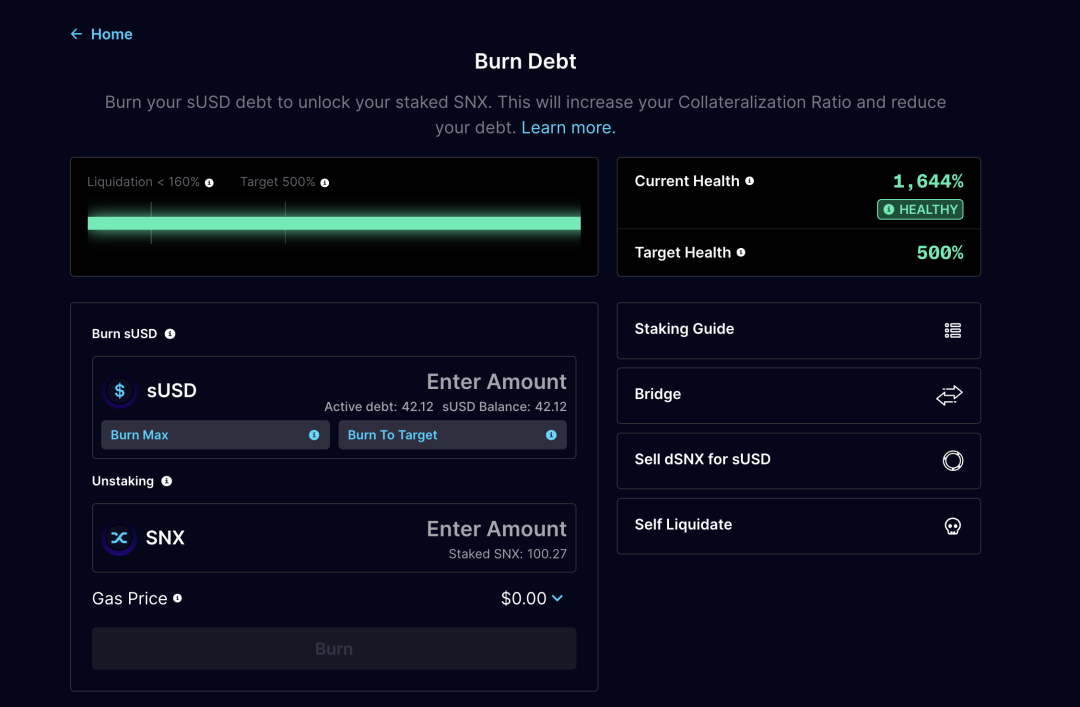

The total value of all Synths in the system equals the system’s total issued debt.

If a trader converts sUSD into another synth like sBTC, the overall debt fluctuates with the price movement of that synth. Therefore, the system’s liability is not fixed—it’s dynamic. All stakers proportionally share the total system debt. Thus, even a staker who only mints sUSD without further activity still experiences dynamic changes in their debt exposure.

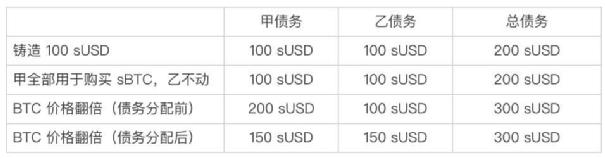

Example:

Assume only two users, A and B, each mint 100 sUSD by staking SNX. Suppose BTC is priced at $100. When A swaps 100 sUSD for 1 sBTC, the protocol burns 100 sUSD from the debt pool and issues 1 sBTC.

If B takes no action, when BTC doubles in price, both A and B’s debts rise to 150 sUSD. However, A’s asset is now worth 200 sUSD while B’s remains at 100 sUSD. A sells sBTC for 200 sUSD and redeems SNX using 150 sUSD. B, however, needs to buy an additional 50 sUSD to redeem their locked SNX.

Thus, when traders lose money, the loss reduces the total value of the global debt pool, lowering the average debt level across all stakers—effectively distributing gains (reduced debt) proportionally. Conversely, profitable trades increase the pool’s liabilities, forcing stakers to absorb losses—requiring them to purchase extra sUSD to redeem their SNX.

Snx supports spot atomic swaps and perpetual futures. With a sufficiently large pool, individual trades have minimal impact, allowing stakers to earn fees from every trade. According to the Kelly criterion, stakers are expected to be net profitable over time.

However, if long/short positions become unbalanced, under extreme or one-sided market conditions, stakers may face situations where others profit at their expense. To further mitigate staker risk, V3 introduces mechanisms to maintain delta neutrality.

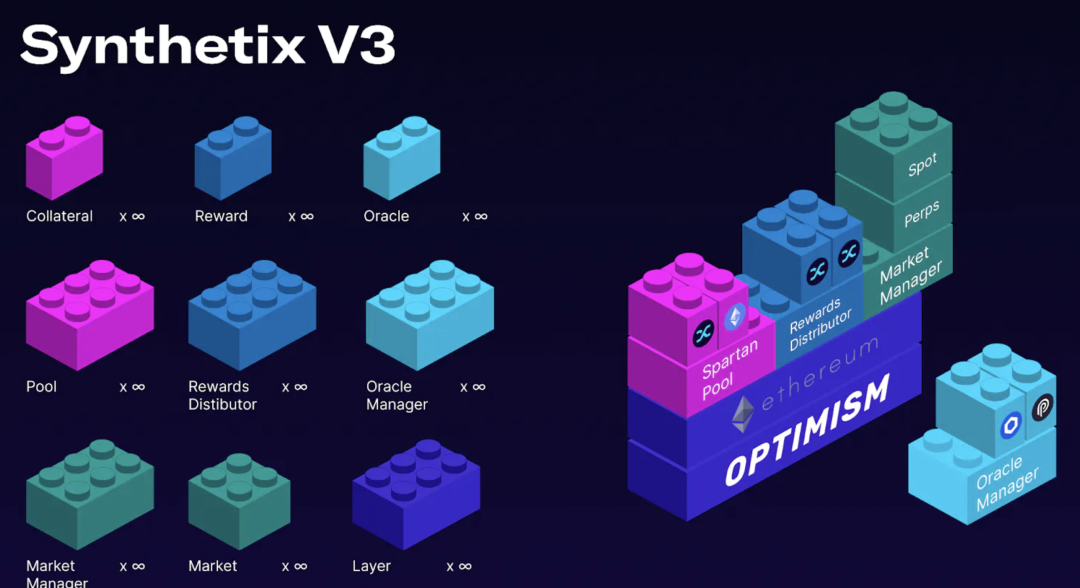

What Does Snx V3 Bring?

Liquidity-as-a-Service

After two years of refactoring, Synthetix V3 has repositioned itself as a liquidity layer for decentralized finance. V3 will roll out in phases over the coming months, with V2 functionalities becoming a subset of V3. Once fully launched, developers building new derivatives markets—such as perpetuals, spot, options, insurance, and exotic derivatives—can directly integrate with Snx’s debt pool for instant liquidity, eliminating the need to build from scratch.

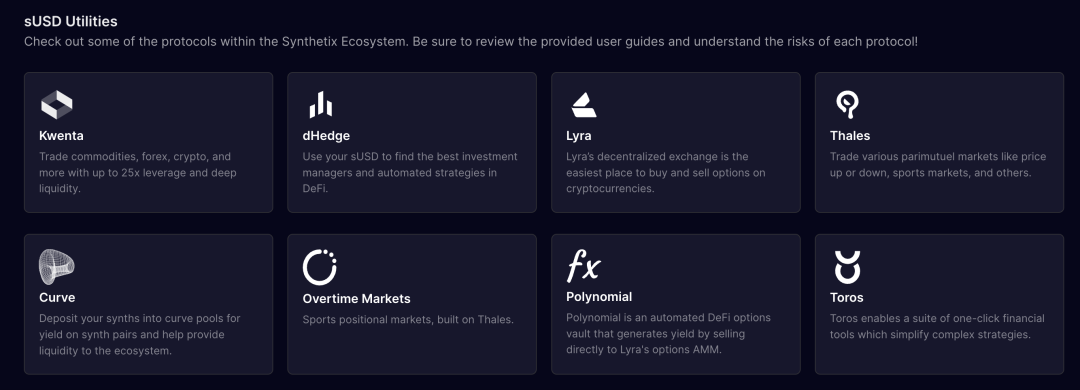

Current products in the Snx ecosystem include:

Snx-proposed application examples:

- Perpetual Futures / Options / Structured Products: Support for perp trading, leveraged positions, basis trading, and funding rate arbitrage.

Example: Currently live platforms like Kwenta and Polynomial; GMX could also be built on Synthetix V3.

- NFT-Fi Lending / Perpetual Contracts: Users can borrow synthetic assets pegged to NFT prices or create perpetual markets speculating on future NFT valuations.

For example, nftperp.xyz could be built on Synthetix V3.

- Insurance Markets: Users can purchase various risk insurance contracts, secured in pools and managed by smart contracts.

Example: Nexus Mutual could operate on Synthetix V3.

- Prediction Markets / Binary Options / Sports Betting: Users can speculate on event outcomes.

Examples: Election results or sports events. Existing Snx ecosystem projects include Lyra and dHedge.

- RWA Markets: With reliable oracles and verified real-world entities, it becomes feasible to create synthetic assets for art, carbon credits, or other off-chain assets and trade them on-chain.

New Debt Pools and Collateral

As mentioned, in Snx’s Pool-and-Vault model, stakers temporarily act as counterparty to traders. The size of the staker debt pool determines the liquidity ceiling.

Single-collateral risks include:

-

Limits maximum open interest by SNX’s market cap, constraining trader liquidity.

-

Different synthetic assets have varying volatility, leading to mismatched risk-reward profiles for stakers.

-

Under extreme conditions, potential for cascading liquidations exists.

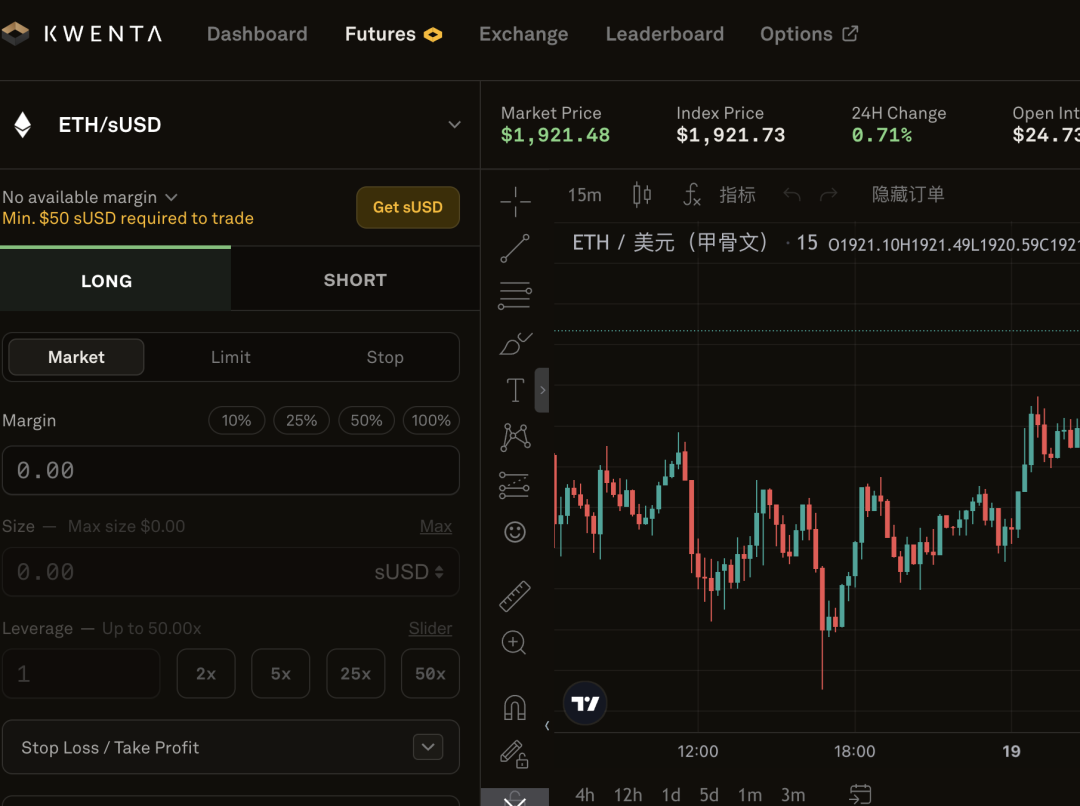

From Kwenta, we see the total open positions held across Snx. During OP incentive campaigns, BTC and ETH long/short positions have repeatedly approached system capacity limits.

To address these issues, V3 introduces the following:

a. Isolated Debt Pools

In current Synthetix V2, all trades go through a single SNX-backed debt pool. Given differing volatilities across synthetic assets, this leads to uneven risk and return exposure. To solve this (examples detailed later in the oracle latency section),

Synthetix V3 passed SIP-302: Pools (V3), enabling stakers to choose which markets to provide liquidity for based on their risk appetite. Through governance voting, each pool’s collateral type and caps are determined. Risks can thus be contained locally. It also offers SNX stakers opportunities for higher returns by accepting greater risk, giving them more control over exposure—e.g., choosing to support only major assets like ETH and BTC while avoiding long-tail markets like NFTs.

b. Multi-Collateral Mechanism

V3 introduces a universal collateral vault system compatible with multiple collateral types. Beyond $SNX, Synthetix will support other assets as collateral to expand the synth market size.

Governance votes will determine which additional assets are accepted—e.g., ETH could be approved as collateral. Eight related proposals (SIP-302 to 310) have already been approved.

The new pool and vault system brings three key benefits:

- Better risk management: Pools linked to specific markets carry defined exposures.

- Improved hedging: Market-specific pools allow precise hedging.

- Broader collateral scope: Stakers can deposit any asset accepted by the pool, mitigating single-asset risk.

Perps V2 and V3 Engines

Perps is Snx’s decentralized perpetual engine powered by debt pool liquidity.

- Synthetix Perps V1 beta launched in March 2022, generating over $5.2 billion in trading volume and delivering $18.1 million in fee revenue to stakers—without any trading incentives.

-

Synthetix Perps V2 launched in December 2022—the current version—offering lower fees, improved scalability, and capital efficiency with isolated margin.

-

Synthetix Perps V3 is scheduled for release in Q4 this year. It supports all V2 features plus new capabilities such as cross-margin, enhanced risk management, and measures to eliminate market bias—including price impact controls and dynamic funding rates.

Founder Kain Warwick stated that Synthetix aims to launch Perps V3 along with its new front-end, Infinex, by Q4.

The team says Infinex will focus on simplifying decentralized perp trading. Compared to other DEXs, it aims to deliver superior UX by eliminating the cumbersome need to sign every transaction.

Maintaining Delta Neutrality

Perps V2 efficiently matches buyers and sellers. Snx stakers only act as temporary counterparties, taking on short-term risk. Incentives encourage traders to keep markets balanced.

Synthetix uses funding fees and premium/discount pricing to balance long and short open interest. The congested side pays funding fees, while the opposite side receives them.

On centralized exchanges, funding fees are typically charged every 8 hours. On Synthetix, they accrue in real-time as positions are held. Trades that widen imbalance incur premiums; those restoring balance receive discounts. This mechanism incentivizes arbitrageurs to correct deviations promptly, reducing LP risk in one-sided markets.

Oracle Improvement Proposal

Mitigating Oracle Latency Arbitrage

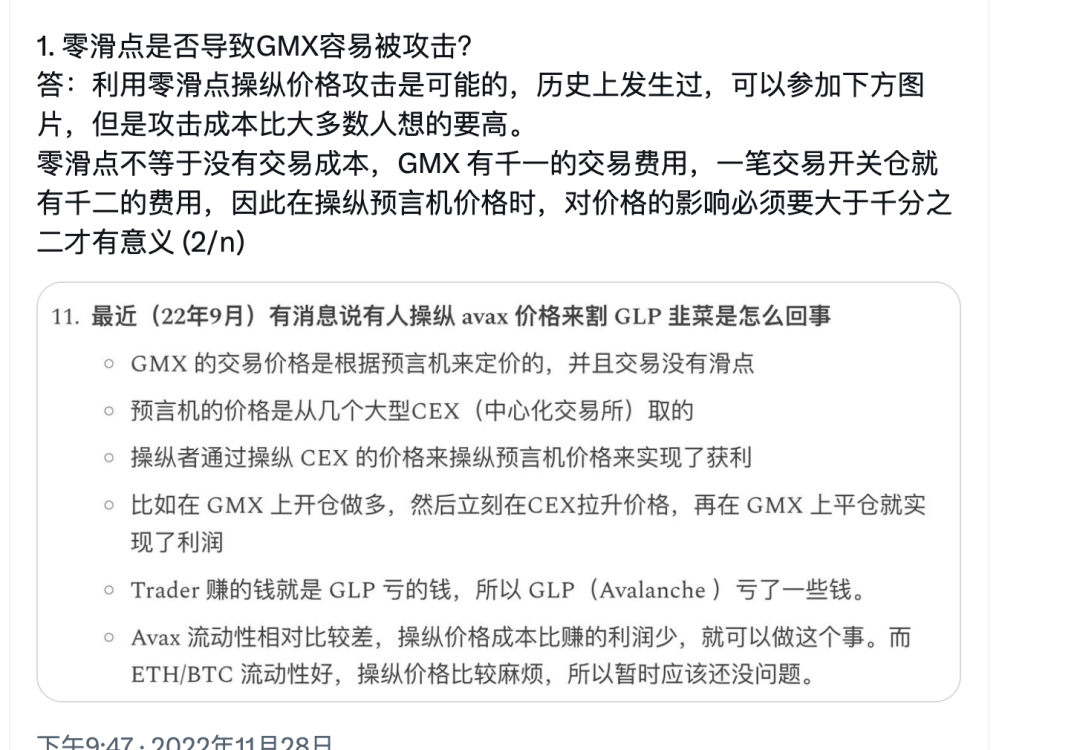

Oracle latency arbitrage has been a key reason why DEXs struggle to compete with centralized exchanges.

In earlier versions, Synthetix relied on Chainlink oracles, but on-chain price updates lag behind real-time market movements, creating front-running opportunities. Under Synthetix’s zero-slippage model, stakers bear the losses. For instance, if ETH rises from $1,000 to $1,010 but Chainlink still reports $1,000, a user can swap sUSD for sETH at the outdated price. After the oracle updates, they profit $10 per sETH—gains extracted directly from stakers’ losses due to latency arbitrage.

Supplementary example: GMX, Snx’s main competitor, currently employs a different strategy.

Source: CapitalismLab

Snx now offers an oracle manager: market creators can select from multiple oracle solutions and configure custom aggregations, giving integrators greater control over pricing oracles. This opens opportunities for supporting new markets and assets.

Example: Selecting the lowest BTC spot price from TWAPs of Chainlink, Pyth, and Uniswap.

Synthetix (Snx) is exploring two solutions to combat oracle latency arbitrage:

- Hindsight Oracle: A solution developed with Pyth Network using asynchronous transactions and configured delay periods to reduce latency arbitrage opportunities. This helps lower DeFi trading costs, improving competitiveness.

- Chainlink Low-Latency Data Feeds: An alternative solution from Chainlink offering faster data delivery to minimize arbitrage windows. In some aspects, it outperforms the hindsight oracle—e.g., not relying on third-party keepers to execute trades, reducing costs and preserving data privacy for providers.

Pyth and Snx Collaboration Overview:

https://www.youtube.com/watch?v=UAFR4c4-DPk&ab_channel=PythNetwork

Off-chain oracles deliver fast on-chain prices at competitive costs, playing a key role in significantly reducing trading fees. By addressing oracle latency arbitrage, Synthetix now offers trading fees between 0.2% and 0.6% for major pairs—comparable to Binance’s top VIP tiers.

Cross-Chain Solution

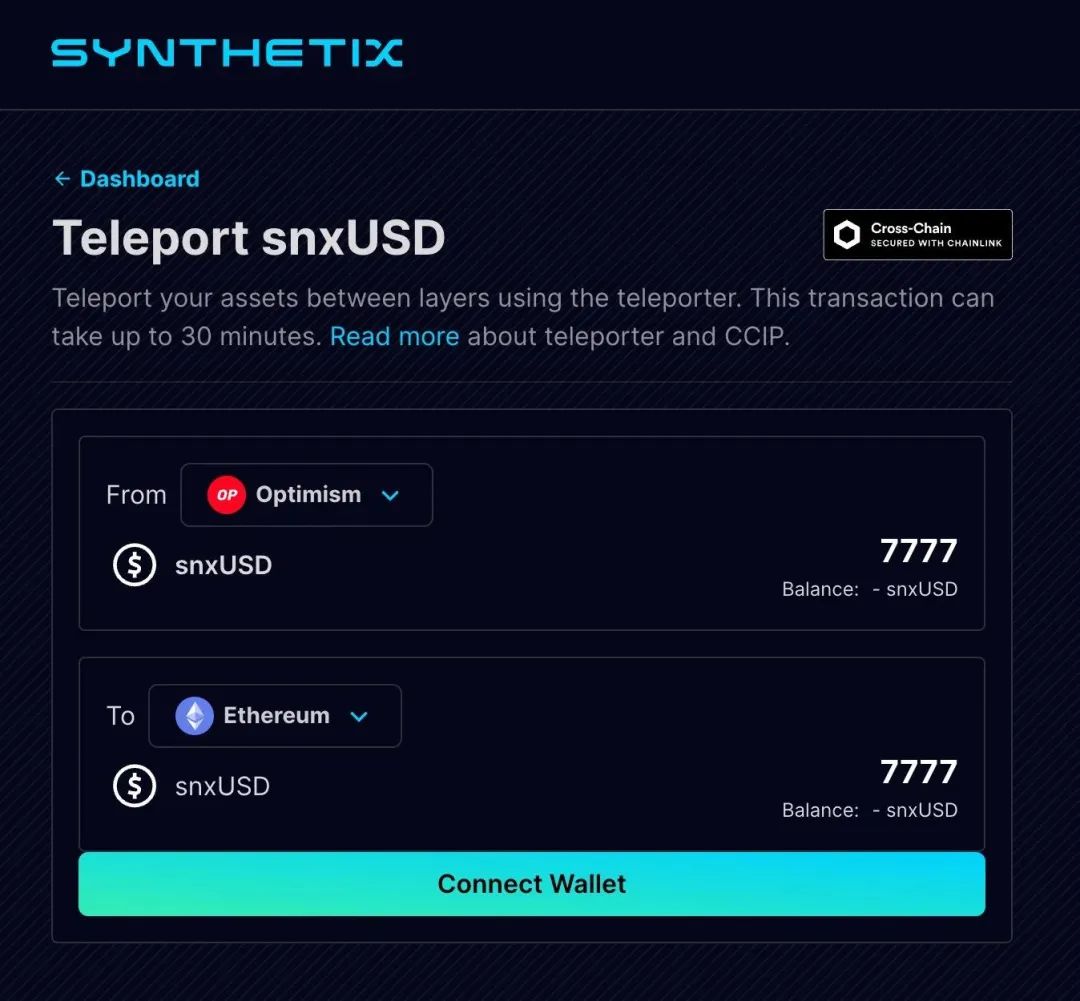

Teleporters – For stablecoins

Proposal SIP-311 introduces Teleporters, which enable burning newUSD on one chain, transmitting a cross-chain message, and minting newUSD on another chain.

- This allows newUSD to be used across any chain where Synthetix is deployed—no bridges, no transfer slippage.

- Enables shared collateral across chains within the liquidity layer.

- Fast movement between chains without challenge periods, including fast withdrawals from L2 to L1.

Cross-Chain Liquidity Pools

For debt pools

-

SIP-312 enables all markets and pools across chains to access the current state of combined collateral across all chains.

-

This means Perps markets can rapidly deploy to new chains and leverage existing collateral from Optimism and Ethereum mainnet debt pools.

Through Teleporters and cross-chain liquidity pools, Synthetix’s liquidity layer can expand to any EVM chain, with new deployments instantly accessing liquidity from other chains.

Economic Model + Revenue Data

Synthetix generates revenue from multiple streams: primarily fees from perpetual contracts and synthetic asset swaps, perp and SNX liquidation fees, and minting/burning fees. All protocol revenue is distributed to integrators and SNX stakers.

Revenue Distribution to Integrators

Products like Kwenta that integrate Snx are called “integrators.” Snx rewards them with a portion of trading fees paid in SNX: 10% for the first $1M in fees, 7.5% for $1–5M, and 5% for >$5M. Integrators can decide how to use these fees—for example, to strengthen their native token economy.

The Snx development team no longer runs front-ends directly. Instead, by incentivizing integrators, the network effect grows stronger, increasing the likelihood of broader integration and establishing Snx as a critical DeFi component.

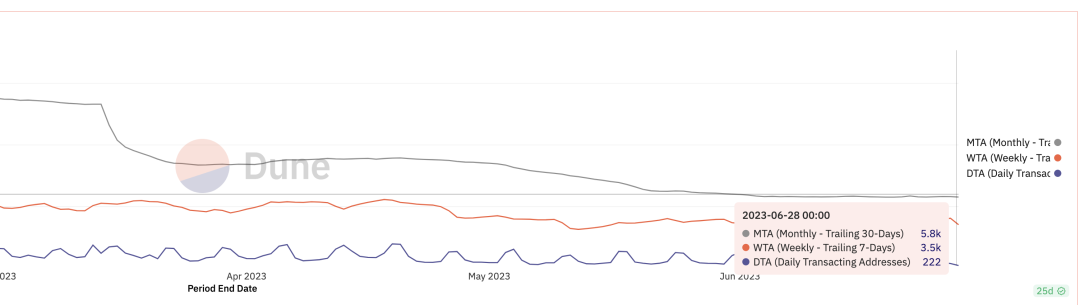

User Growth Trends

As of July 23, when this article was published, Synthetix’s TVL, monthly trading volume, and fee income are comparable to competitor GMX. However, daily and monthly active user counts remain far below GMX and Dydx.

Perp V2 Trading Volume

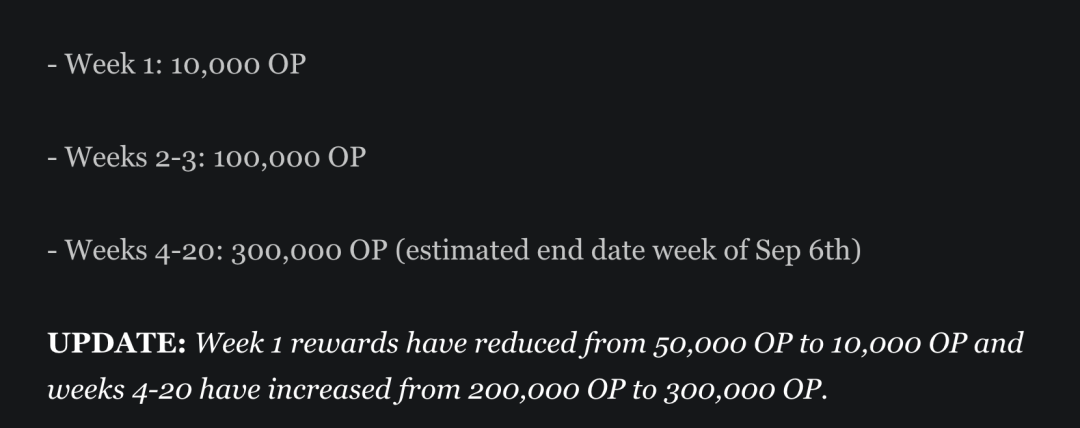

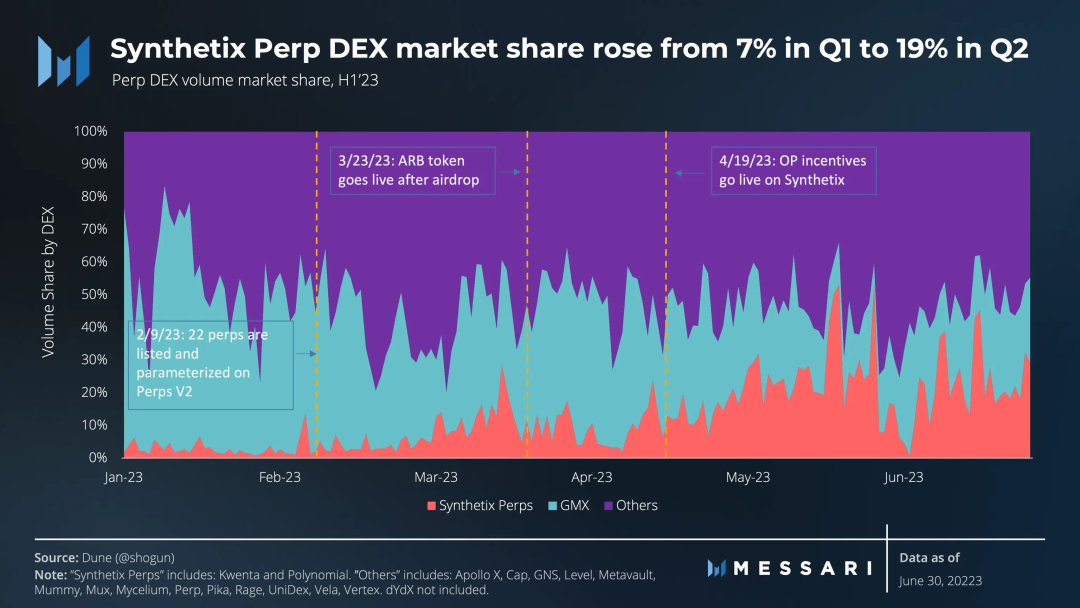

Synthetix Perps joined Optimism’s liquidity incentive program. Traders on Synthetix Perps are eligible for OP airdrops.

The OP incentive program began on April 19, and currently covers approximately 80% of trading fees.

According to Messari, subsidy-driven incentives have strongly boosted trading volume. Transaction count and volume have surged.

Despite rising transaction volumes, user numbers haven’t grown significantly—indicating volume gains come mostly from increased activity by existing users.

The OP reward program runs until September 13, so retention rates will be clearer after Q3.

Trader Activity Trends

Data source:

https://dune.com/queries/452148/859385?1+Project+Name_t6c1ea=Synthetix&4+End+Date_d83555=2023-06-28+00%3A00%3A00

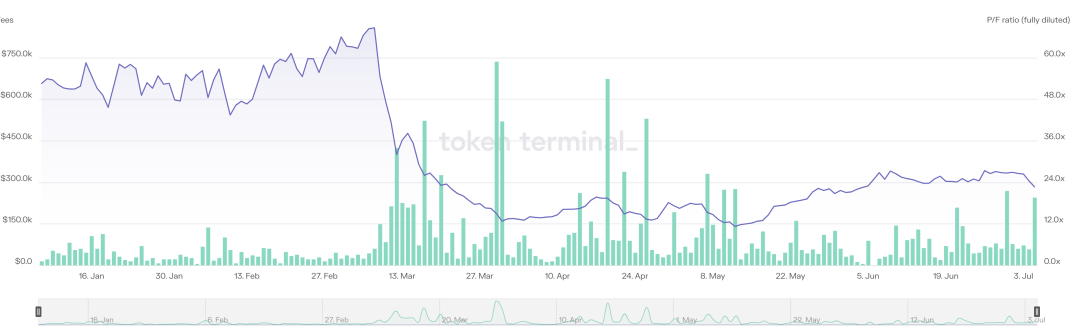

PE Ratio

With rising trading volume comes higher revenue and staker yields. Snx’s PE ratio has declined from 50x during the bull market to a more reasonable 10x–15x range.

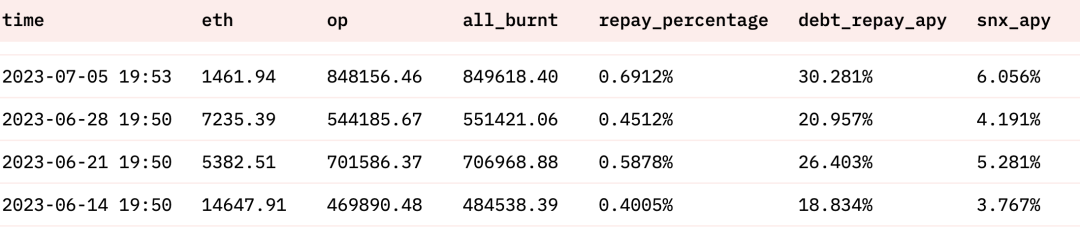

Weekly Fee Revenue for Stakers

Data source:

https://dune.com/synthetix_community/fee-burn

Exploring a New Token Model

Snx is currently fully circulating, with ~5% annual inflation rewards going to stakers.

In August 2022, Synthetix founder Kain Warwick proposed SIP-276, suggesting capping SNX supply at 300 million and halting emissions thereafter. This proposal has not yet passed.

In June this year, Kain proposed a new SNX staking module for Synthetix V3. This module would simplify staking—users deposit SNX without facing market risk or needing to hedge. Initially funded by the Treasury Council, future protocol revenues may also flow into this pool. Kain emphasized this simpler staking method aims to attract more new users to Synthetix V3. The proposal is under discussion and could boost SNX staking rates.

Conclusion

Long-term, the decentralized derivatives trading space holds massive potential. The launch of Snx V3 marks a major milestone for the protocol, introducing numerous new features and improvements. These upgrades enhance capital efficiency and security, remove liquidity caps, improve user experience, and attract more participants. Once fully launched, V3 is expected to drive significant new business growth and revaluation, becoming a widely integrated core DeFi component.

However, current user growth remains slow, and the full rollout timeline for V3 is uncertain. The yield profile under the new token model and post-Q3 retention rates will be key valuation metrics for SNX holders in the near term.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News