Crypto Analyst: Why I’m Bullish on Synthetix’s Future?

TechFlow Selected TechFlow Selected

Crypto Analyst: Why I’m Bullish on Synthetix’s Future?

Synthetix: Home to one of the hardest-working teams and one of the most active DAOs in the entire DeFi ecosystem.

Written by: Secret Salsa

Translated by: TechFlow intern

Introduction to SNX

Like other OG DeFi projects, Synthetix has been crushed by the market over the past few months, with many participants being liquidated due to poor management of their sUSD debt positions. As the SNX price plummeted, participants had to add extra SNX collateral or repay sUSD debt to maintain an adequate collateralization ratio and meet margin requirements.

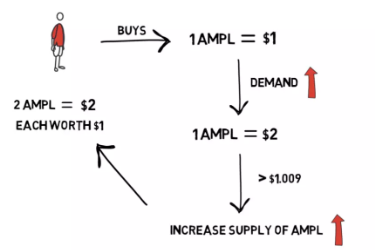

The Synthetix debt model has always been a double-edged sword: during bull markets, degens use sUSD debt to buy other tokens or more SNX, overleveraging their SNX collateral positions. As the SNX token rises in price, it generates additional sUSD fees and inflation rewards, fueling the SNX flywheel.

But when the market turns bearish and all token prices crash, the debt wipes out all speculators who can’t repay, leading to a chain reaction of SNX liquidations.

It’s no surprise that SNX dropped 90% from its ATH ($28.53) to its current price ($2.93). However, it has already surged 88% last month.

What Happened?

No matter what others say about Synthetix, they truly have one of the hardest-working teams and one of the most active DAOs in the entire DeFi ecosystem.

While the sUSD debt model has some drawbacks, it also brings significant benefits—such as enabling whales to benefit from better pricing through Synthetix’s synthetic assets (sUSD, sETH, sBTC, etc.).

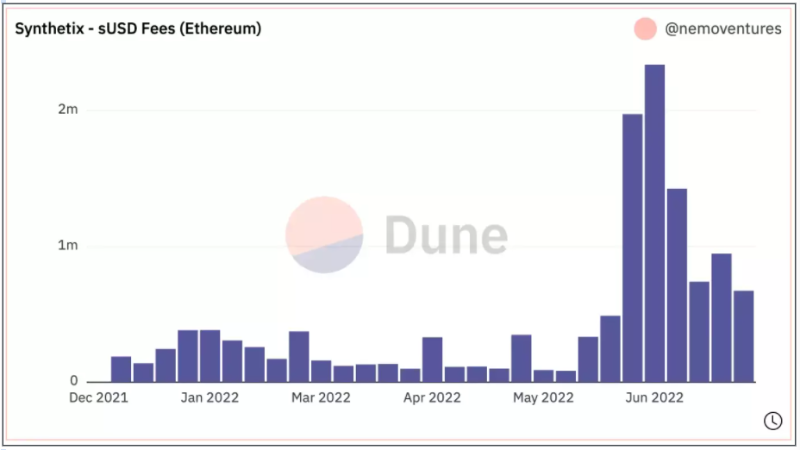

This model is already operational and, thanks to Curve and DEX aggregators like 1inch, now delivers substantial weekly sUSD fees to SNX stakers.

Beyond that, Synthetix has started spinning off other projects based on the theory of sUSD’s infinite liquidity—allowing large traders to trade on Synthetix without suffering slippage or spreads, unlike traditional financial markets.

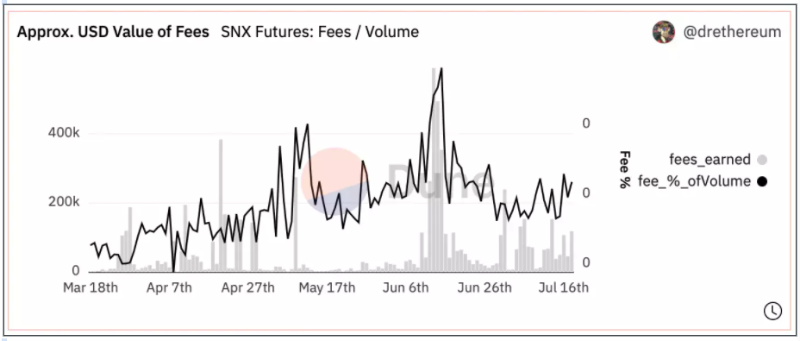

From a fee perspective, the most promising development for SNX stakers is Kwenta, which has launched futures trading on Optimism L2 and has already seen a rebound in trading volume.

This also brings additional fees to SNX stakers.

Therefore, from a fundamental standpoint, these two factors alone should justify the recent price surge.

But the question remains: once the market stabilizes, will there be enough momentum to return to previous highs? Because Synthetix currently has a highly complex and fragmented architecture, existing only on Ethereum and Optimism L2.

Why SNX Can Return to ATH

Protocol Layer

Over the past few years, Synthetix has constantly evolved, as the team has never settled for the status quo—whether during crises or while implementing new features and ideas.

Synthetix began as a synthetic asset trading DEX—or simply put, a dApp built on Ethereum.

With V3 scheduled for release in 2023, the project will transition into a protocol layer where other projects build dApps and leverage its liquidity. The more it's used and integrated across DeFi, the more fees it generates—bringing diversified revenue streams to SNX investors.

From an integration standpoint, Synthetix is also one of the most advanced projects on Optimism L2. As Optimism grows, so does Synthetix. When new projects launch on Optimism, they often turn to Synthetix to bootstrap liquidity or activity, creating synergies and driving higher-frequency usage of the Synthetix protocol—which in turn generates even more fees.

Once Synthetix v3 launches, it will enable faster deployment across other L2s and potentially other L1s, such as Polygon or Avalanche.

Universal Bridge

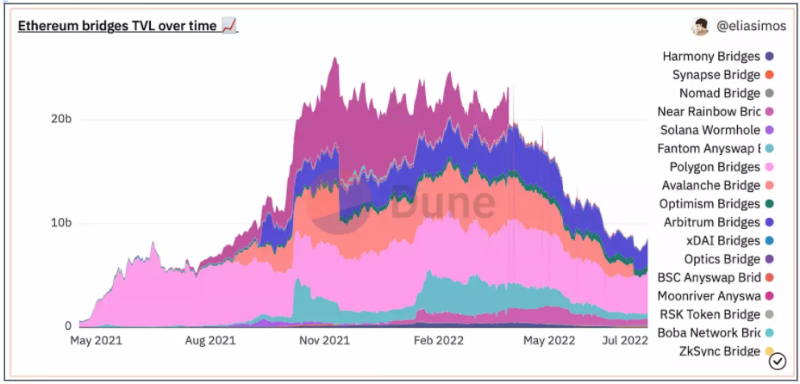

Once Synthetix is deployed across multiple L1s and L2s, it can act as a universal bridge or Synth Teleporter—enabling the most efficient cross-chain transfer of tokens and currencies: faster delivery, safer, and cheaper than traditional cross-chain bridges, which rely on liquidity pools for deposits and withdrawals.

Kain described this best in SIP-204:

Most token bridges rely on one network as the "native" network for each token. This means that when a token is bridged, the destination network receives a "wrapped" version of the token, while the native token remains stored in the bridge contract on the source network. This is suboptimal because it requires perpetual security guarantees for the bridge to ensure the value of assets on the destination network. Most such bridges rely on multisig setups, putting all assets on the destination network at risk.

Synth Teleporters are not bridges. They are a different type that burns and mints assets to transfer them across chains:

This ensures the total supply of each synthetic asset remains constant, without requiring two versions of the same asset to be secured. For transmitting information between networks, there are two ways to implement this system: one relies on Chainlink; the second uses signed messages generated by Teleporters on each network to authorize minting and burning of assets on the counterpart Teleporter.

The cross-chain bridge market is large, currently with $8.7B in TVL and peaking at $24B. Synthetix will soon have the tools to capture a share of this market.

Powerful Trading Protocol

Decentralized trading—whether spot or leveraged—has remained extremely popular for quite some time. There's fierce competition among chains and protocols to attract traders.

So far, the most popular trading venue has likely been dYdX, which currently operates on its own L2 based on StarkNet.

dYdX is the center of decentralized trading—for now. But having a good product is one thing; it's absolutely not everything. Sound tokenomics are equally crucial.

Without it, friction arises between users and holders. dYdX is a good product, but its failed tokenomics serve as a perfect example. dYdX’s relative success stems from generous trading incentives offered to traders, at the expense of DYDX token holders and massive VC token unlocks.

In contrast, Synthetix offers both an attractive product and strong tokenomics, rewarding SNX holders via weekly dividends—with APY consistently above 100% for several weeks.

More importantly, Synthetix is a protocol not just usable on Kwenta, but also attractive to many other teams who want to launch derivatives on it—thanks to zero slippage, infinite liquidity, and fully customizable products.

Again, SNX stakers earn even more fees.

Two Drawbacks

sUSD Debt

It's well known that to participate in SNX staking, you must lock up your SNX and mint sUSD (which is debt owed to the Synthetix platform). From the moment you become an SNX staker, you're exposed to Synthetix’s global debt pool.

In practice, SNX stakers are the counterparty to any trader using Synthetix’s synthetic assets (sETH, sBTC, etc.). This means your debt position can increase (e.g., if traders profit from holding sETH and ETH is rising) or decrease (if traders lose on average).

The original idea behind Synthetix was that, on average, traders tend to lose money—so Synthetix would profit.

When your debt amount fluctuates with traders’ positions and settlements, you’re fully exposed to market movements.

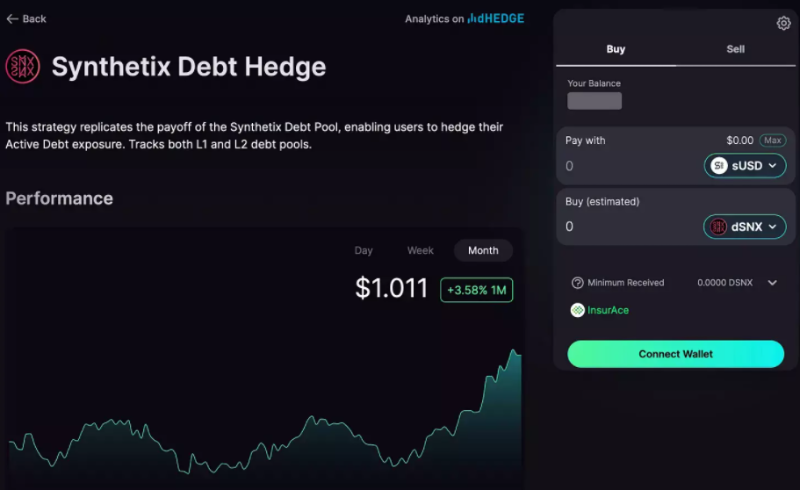

However, thanks to dHedge and its derivative Toros, it's now possible to completely hedge your debt position on Optimism L2—by using your minted sUSD to purchase dSNX, so you’re no longer affected by market volatility and your debt won't grow over time.

Simply put, if you stake some SNX and mint 1,000 sUSD, you now have a $1,000 debt that fluctuates with trading activity. If you want to keep your debt fixed at $1,000, you can use your $1,000 to buy dSNX—the Toros system will hedge your debt on your behalf.

The Toros dSNX pool is accessible on the Optimism network.

In our view, sUSD debt management has historically been the main barrier to accessing Synthetix, as many users don’t fully understand the concept or implications of sUSD debt.

Now that you can hedge your debt, Synthetix has become simpler and much easier to use—especially for users who don’t want to manage their positions 24/7.

sUSD Liquidity on Optimism

There is currently no meaningful sUSD liquidity on Optimism, so whales cannot execute trades on Kwenta.

However, this is about to change, as Synthetix has opened an sUSD bridge between Ethereum and Optimism—now allowing you to buy large amounts of sUSD on Ethereum and transfer it to Optimism to start trading. The only remaining downside is that bridging back from Optimism to Ethereum still requires a 7-day waiting period. Synth Teleporters can't arrive fast enough.

Risks

The main risks we already know:

Regulation: If governments begin regulating DeFi everywhere...

Hacks/Vulnerabilities: Synthetix is a complex protocol, so hackers may find exploits. That said, Synthetix has heavily invested in security and hasn’t been truly hacked so far (except perhaps front-running issues, which are more like system bugs than actual hacks).

Conclusion

For years, Synthetix has never stopped moving forward—it’s still impressive to see their commitment to advancing the protocol. Moreover, the protocol has solid fundamentals, healthy tokenomics, and an ambitious roadmap.

The Synthetix v3 roadmap planned for 2023 is extensive and will undoubtedly bring even more fees to SNX stakers.

Given Synthetix’s progress across all fronts and their strategy of funneling fees to SNX stakers, it's hard to be bearish on Synthetix.

More fees mean higher dividends for SNX stakers.

We can't predict the future, nor whether the current bear market has ended or will last another year—or many. We don’t know. But we do believe that later this year and into 2023, trading volume related to Synthetix across all dApps will surge (and even more so once V3 launches).

And if that happens, SNX will eventually return to ATH.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News