Decoding Synthetix V3: A New Vision for Synthetic Assets, Breaking Through the Liquidity Ceiling

TechFlow Selected TechFlow Selected

Decoding Synthetix V3: A New Vision for Synthetic Assets, Breaking Through the Liquidity Ceiling

Liquidity has always been the most important topic in the DeFi world.

Produced by: TechFlow Research Institute

Author: Yu Zhong Kuang Shui

Liquidity has always been the most critical topic in the DeFi world.

The DeFi Summer was fueled by liquidity mining, and the high incentives from liquidity mining attracted a wave of mercenary liquidity providers to various protocols. Thanks to abundant liquidity, users can trade assets on decentralized exchanges with minimal slippage.

Since then, beyond expanding DeFi functionalities, protocols have continued innovating product designs—building on liquidity mining—to attract more liquidity and make deeper use of it, ultimately delivering better user experiences.

Synthetix is a prime example.

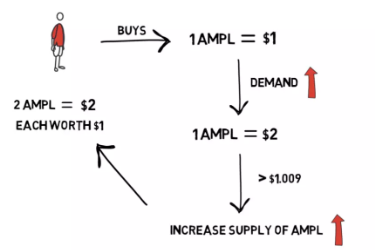

As one of the oldest DeFi protocols in the blockchain ecosystem, Synthetix is best known for its synthetic asset offerings. Users can mint synthetic assets called Synths by staking $SNX. Synths are ERC20 tokens whose prices are pegged to external assets via oracles, including fiat currencies like USD, cryptocurrencies, stocks, and perpetual futures.

Unlike other DeFi protocols, Synthetix does not rely on traditional order books or peer-to-peer (P2P) counterparties for trading. Instead, all liquidity in the protocol is provided collectively by $SNX stakers. To incentivize participation, stakers receive inflationary $SNX rewards, along with fee income generated from providing liquidity to Perps and atomic swaps.

Put differently, Synthetix offers users a large-scale financial venue where they provide liquidity by staking $SNX and minting Synths. Once Synths (also known as sTokens) are minted, users can leverage them across various protocols built atop Synthetix—such as Perps, Kwenta, and Lyra—for trading purposes. The value of Synths represents a shared debt pool among $SNX stakers. This implies that profits made by some users equate to increased debt for others, while losses incurred by some translate into reduced debt for the rest.

Furthermore, Synthetix introduced atomic swaps, enabling users to exchange large amounts of tokens without slippage. For instance, when swapping ETH for USDC, the internal path involves first converting ETH to sETH via Curve, then using Synthetix to swap sETH to sUSD with zero slippage, and finally converting sUSD back to USDC through Curve. With support from aggregators like 1inch, Synthetix has become a major competitor to DEXs such as Uniswap.

However, since Synths can only be minted by $SNX stakers, the total market value of Synths is capped by the valuation of $SNX. Currently valued at $1 billion, and requiring a 400% collateralization ratio, the Synths market is limited to $250 million. This constraint ultimately limits the potential of atomic swaps—atomic swaps require Synths as underlying assets, so the size of the Synths market directly determines how much trading volume atomic swaps can support.

The deployment of Synthetix V3 aims to address the lack of liquidity facing its atomic swap functionality—the most pressing issue for Synthetix in the near term.

How Does V3 Deepen Protocol Liquidity?

The first step of V3 is to expand the market scale of Synths—that is, deepen liquidity.

"V3 creates a universal vault system independent of collateral types, where each vault supports a single type of collateral asset. These vaults can be combined and connected to one or more market liquidity pools," states the Synthetix documentation introducing V3. Eight related proposals, SIP-302 to SIP-310, have already been approved.

This means that in addition to $SNX, Synthetix will now support other common assets as collateral for minting Synths, thereby expanding the overall market size of Synths. Examples include delta-neutral positions composed of spot ETH and short perpetual ETH positions. In the future, Synthetix may also support liquid staking derivatives (LSDs) backed by ETH.

Another notable development is that Synthetix will soon offer cross-chain atomic swaps for participants across the EVM ecosystem. Cross-chain users will only need to pay gas fees on the originating chain.

Similar to CDP-based money markets, Synthetix incorporates risk controls into its vault design. Specific vaults will be linked to individual or multiple designated markets to manage risk exposure. Users will have the option to allocate their assets to specific vaults based on their risk appetite.

Differentiated vaults represent different levels of risk exposure. Unlike V2, where all users faced uniform risk exposure, Synthetix V3 allows users to control their risk profile according to personal preferences when staking.

Ultimately, this leads to varied incentive structures across different vaults to guide liquidity. Going forward, Synthetix plans to leverage protocols like Lyra and Thales to manage specific vaults, channeling liquidity through token incentives and governance participation. In the longer term, vaults will allow fully permissionless deployment, enabling developers to easily build derivative protocols powered by Synthetix liquidity. Synthetix aims to evolve into a Liquidity-as-a-Service (LaaS) protocol, establishing itself as a permissionless derivatives liquidity platform that powers the next generation of DeFi products.

Additionally, to enhance usability—giving users lower risk exposure and more flexibility at the synthetic asset level—Synthetix has passed SIP-255 and SIP-301.

SIP-255

SIP-255 automatically burns the fee revenue earned from atomic swaps and uses it to repay the staker’s debt. This process is automatic, similar to auto-compounding features offered by other protocols. However, if a user wishes to directly receive the atomic swap fees (in sUSD), they must manually repay their outstanding Synths debt to unlock the actual reward (sUSD).

The core objective of SIP-255 is to improve capital efficiency for staked assets—automatic debt reduction lowers the total debt ceiling over time, allowing stakers to mint more Synths gradually.

SIP-301

SIP-301 allows users to tokenize their staked positions as ERC721 NFTs and delegate these NFTs to specific addresses. The proposal aims to let stakers delegate operational control of their stakes to another account without unstaking, saving gas costs and improving user experience.

In Conclusion

Today, Synthetix V3 has been deployed on both Ethereum and Optimism. We can see that by introducing V3, Synthetix aims to expand the market scale of Synths by broadening the range of acceptable collateral types. While scaling up the market size, Synthetix enhances user experience by implementing multiple vaults and debt pools that offer varying degrees of risk exposure for stakers.

Beyond unlocking greater liquidity potential, Synthetix intends to leverage its robust liquidity to serve as a modular liquidity layer for developers, enabling them to build derivative protocols on top of Synthetix without going through a cold-start phase. An increasing number of protocols built on Synthetix will continue to drive the growth of the Synthetix ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News