Interview with Bitcoin OG Guanghua: Vitalik Is Not a Heretic of Bitcoin, He Will Eventually Return

TechFlow Selected TechFlow Selected

Interview with Bitcoin OG Guanghua: Vitalik Is Not a Heretic of Bitcoin, He Will Eventually Return

After this bull market, Bitcoin will become a slow and steady bull like Apple's stock, and there will no longer be obvious four-year cycles.

26x14: Co-founder of 7UpDAO (@26x14eth)

Guanghua: Co-founder of BEVM (@gguoss)

Over the past seven or eight years, Guanghua has been deeply involved in Bitcoin ecosystem development. He is a firm believer in Bitcoin technology, and even during Ethereum’s most prosperous and wealth-generating periods over the last three to four years, he never left the Bitcoin technical community. Guanghua is also an exceptionally kind person—kind toward technology, and kind toward human relationships. He says that the sadness felt when colleagues depart during market cycles is itself part of understanding those cycles.

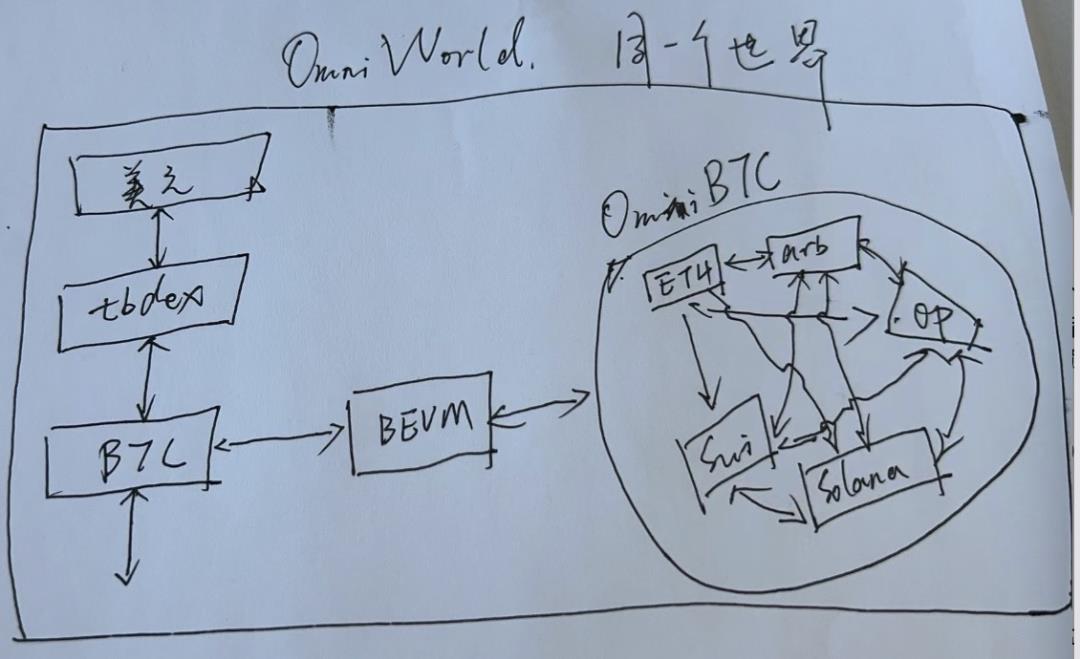

Guanghua is also someone with exceptional strategic insight and deep technical foresight. He believes that after this bull market, Bitcoin will evolve into a slow, steady bull market—much like Apple stock—and will no longer exhibit clear four-year cyclical patterns. He also predicts that blockchain will eventually resemble the World Wide Web: Bitcoin on Layer 1, Ethereum on Layer 2, and high-performance chains on Layer 3. Users will interact with the system seamlessly, without needing to know whether they're using a metropolitan, national, or local network.

Guanghua is also refreshingly authentic—a veteran OG with a boyish side. He still remembers Satoshi Nakamoto's famous dismissive reply: "If you don't believe me or don't get it, I don't have time to try to convince you, sorry."

--26x14 (Co-founder of 7UpDAO)

The full version is available on the podcast. Below is the edited transcript:

26x14: How did your journey with Bitcoin begin? What was the earliest story?

Guanghua: It started back in 2014, right after graduation, when I joined a major domestic AI company working on robotic arms. Some colleagues would play games together when tired from work, and while gaming, everyone was mining various coins—Cosmos Coin, Starfield Coin, other altcoins. At first, I thought Bitcoin was just like those altcoins—global scams. Then in 2016, I was doing technical research for a national project involving privacy-preserving ring signatures for financial bill chains—ring signatures being a precursor to ZK privacy tech.

That’s when I went looking for relevant code and first encountered the Bitcoin Core team—they had a repository called Elements, a sidechain. From that moment, I completely fell in love with Bitcoin. In fact, the dominant narrative in today’s Bitcoin ecosystem was already present as early as 2016. That sidechain already supported scalability, and the ring signature tech at the time was a precursor to range proofs in zk-SNARKs/zk-STARKs. Looking back now, it feels astonishing—like it happened yesterday. And now it feels like a cycle returning, only this time with stronger community consensus.

26x14: So all your past blockchain ventures have revolved around the Bitcoin ecosystem? You’ve never stepped outside?

Guanghua: Yes, I used to focus on BTC cross-chain bridges. Five or six years ago, we launched a chain that cumulatively bridged 100,000 Bitcoins—earlier than Polkadot went live. Back then, Gavin Wood (Polkadot founder) seemed cool—he was formerly Ethereum’s CTO, and he wanted to build interoperability across encrypted markets. So we thought: why not help build a BTC bridge within Polkadot’s ecosystem? Our idea was simple: if Polkadot’s vision is interconnectivity, then enabling BTC connectivity would let Bitcoin interoperate with other ecosystems.

26x14: During Ethereum’s peak years, you didn’t leave the Bitcoin ecosystem to join in. Why not?

Guanghua: Haha. Human thinking can be narrow, especially for technical developers—we often become arrogant and stubborn. Back in 2016, I spent just one week modifying Ethereum’s Python consensus implementation to PoA and then built a consortium chain business on top.

The first Bitcoin code I ever saw was written by Gavin Wood in C++ over three months in 2014. Ethereum’s core tech was hand-built by Gavin himself. So afterward, I focused my efforts on scaling via Gavin Wood’s Polkadot ecosystem—I thought bringing BTC onto Polkadot’s scaling solution would be more interesting.

Many friends suggested we should instead bring BTC to scale within Ethereum’s ecosystem, but as a developer back then, I found Ethereum’s tech less impressive—I preferred Polkadot more. Later, I realized some misjudgments in that decision.

26x14: Did you already believe then that the blockchain world should be about smart contracts within the BTC ecosystem—not building a separate new world of smart contracts outside BTC?

Guanghua: Yes—but this idea didn’t originate with me. It actually came from Vitalik (Ethereum founder) and BM (EOS founder). Here’s an interesting point: in 2010, BM got famously dismissed by Satoshi with the line: “If you don’t believe me or don’t get it, I don’t have time to try to convince you, sorry.” But what BM was trying to tell Satoshi was precisely the desire to make Bitcoin scalable.

Vitalik originally also wanted to make Bitcoin scalable. Later, BM created BitShares—it was the first DEX based on the Bitcoin protocol. Meanwhile, Vitalik and his team developed Colored Coins, which allowed users to issue tokens on the BTC ecosystem—anyone could build assets on Bitcoin and trade them.

After working on Colored Coins, Vitalik reached out to BM to collaborate on writing a smart contract platform for Bitcoin. So many of the exciting things happening in the Bitcoin ecosystem today were already envisioned around 2014. My own belief in building smart contracts atop the BTC ecosystem and Bitcoin protocol gradually formed through these earlier developments, crystallizing around 2016.

I even wrote code for EOS in 2017–2018 and was among the first to launch nodes on EOS—all out of respect for BM and his ideas. On Vitalik’s side, I followed Gavin Wood more closely, since Vitalik himself doesn’t write much code. So later, I devoted significant energy to Polkadot, which Gavin founded after leaving Ethereum.

26x14: Hearing you recount this history, I suddenly feel like Vitalik was once a “heretic” from the Bitcoin ecosystem—and now there’s a kind of Jerusalem-style comeback underway.

Guanghua: Haha, interesting—there’s definitely something to that.

26x14: Having lived through multiple cycles, how do you view market cycles?

Guanghua: I actually love bear markets the most. You’ll notice that no matter the cycle, people always leave—some exit rich after a bull run, others leave after enduring a long bear market without profit. But departure isn’t about money—it’s about lack of passion. Regardless, bear markets make you more grounded. Personally, I’m quite emotional because I value the connection with colleagues—meeting them feels like a rare fate. When someone suddenly leaves, I feel deep sorrow. That grief is part of understanding cycles.

Another observation: everyone talks about Bitcoin’s four-year halving cycle driving bull/bear markets. But I think a bigger factor isn’t the halving—it’s the U.S. presidential election every four years. The U.S. dollar is the world’s strongest currency, and I’ve noticed that every bull market begins in a U.S. election year, and ends shortly after the president is elected—almost always. Before elections, candidates adopt EA (Effective Altruism), supporting all industries to create prosperity. After the election, it shifts to e/acc (effective accelerationism)—refined self-interest—where the financial backers start harvesting profits. It’s a striking correlation.

26x14: This bull market arrived so quickly—did that surprise you? If so, how strongly?

Guanghua: It did—very strongly. But it hasn’t disrupted our rhythm; we just need to accelerate. We’ve been preparing for this for six years. Recently, our BEVM project released a whitepaper as a commemorative NFT—10,000 copies. To participate, users had to copy a code snippet and send a transaction to Bitcoin. Initially, I minted 30 myself. Two hours later, 25 of them were invalid. Turns out tens of thousands of addresses were minting simultaneously. Out of 10,000 NFTs, only about 1,300–1,400 succeeded. Participants immediately pushed the price up 40–50x. I thought: wow, what’s happening to this market? It shocked me. I knew—the market had arrived.

26x14: When did you originally expect this bull market to happen? What was your basis?

Guanghua: I expected the bull market to start after next year’s halving and end the following year—lasting about one year. But the current market’s momentum and intensity far exceed my expectations.

My miscalculation—this “cutting the boat where the sword fell”—was due to past patterns: previous bull markets usually followed a negative event, then truly began around April or May. For example, last cycle’s downturn was March 12 (“312”), and the real bull run kicked off in May. This timing aligns with hydropower activation—around May, electricity costs drop sharply in certain provinces.

This time, ETF approval expectations were just a catalyst. The bigger driver was the confirmation of no rate hikes—so all asset classes rose, with Bitcoin rising more because, as a risk-on asset, it’s more sensitive and held more widely by retail investors.

26x14: Do you think this bull market differs significantly from previous ones? What’s the biggest difference?

Guanghua: The biggest difference is reduced volatility—each cycle may see smaller swings than before. Previously, markets dropped sharply before bull runs. We’re still waiting for such a dip to buy low, but it might not come—or won’t be as severe. Also, going forward, Bitcoin’s bull-bear cycles may change. Given the lack of a major pre-bull crash this time, Bitcoin’s future trend may resemble Nasdaq—long-term slow growth with mild fluctuations, making cycles increasingly indistinct.

26x14: Your logic suggests large capital inflows, strong appreciation expectations, minimal selling pressure, hence lower volatility and sustained slow bull trends. But you also mentioned U.S. elections impact Bitcoin prices. How do these two factors combine—what’s the net effect?

Guanghua: Election impacts affect all asset classes. Bitcoin’s current market cap is ~$900B—already top 10 among tech stocks (Apple, Microsoft, Google, Amazon, Nvidia, Bitcoin, Meta, Tesla). Apple’s market cap is over three times larger. As Bitcoin grows, this gap may shrink further. If we use Apple’s stock trajectory to gauge Bitcoin’s future path, it will stabilize into a long-term slow bull—its size and capital base are now so large that different players balance each other out, reducing volatility and risk characteristics, making extreme swings less likely.

26x14: Got it. So this is the last bull market for us founders, communities, and retail investors.

Guanghua: Exactly. Previously, price consensus centered on BTC, while community consensus leaned toward Ethereum. Now, community consensus is shifting back to BTC. You can see earlier capital chasing high-performance public chains—Polkadot and EOS in earlier cycles, Solana in the last, and now Ethereum L2s. Top 10 L2s now have ~$3B market caps. Everything started with Bitcoin, then diverged outward. But now, the community isn’t expanding outward anymore. They recognize Ethereum’s tech has hit saturation and needs practical monetization and real-world applications.

Currently, Bitcoin’s highest-valued token $ordi is only ~$1B. Yet Bitcoin’s capital base is three times Ethereum’s. Logically, Bitcoin’s ecosystem market cap should also be three times Ethereum’s. This sets a very high ceiling and expectation. Ethereum has done much already, but the Bitcoin ecosystem remains largely untamed wilderness—despite having triple the capital. Won’t this two-year bull cycle rapidly close the gap between Bitcoin and Ethereum ecosystems? And won’t it close fast?

Once Bitcoin closes this gap, the entire blockchain world forms a closed loop—just like the internet industry, with a few dominant players and sectors. The opportunity for ordinary people lies in this window—when Bitcoin catches up. This chance is bigger and more urgent than ever before. What’s missing isn’t technology or proven models—it’s awareness previously overlooked. Just as we once focused national efforts on developing Shenzhen, the Bitcoin ecosystem will experience “Shenzhen speed.”

Once this window closes, crypto becomes as predictable as the old internet era—big money and giants enter, grassroots opportunities vanish.

26x14: Why is Bitcoin’s rise happening now—not last year or the year before? What triggered it?

Guanghua: The key breakthrough happened around October 2021—Bitcoin’s first major upgrade at age 13: Taproot. A landmark upgrade in Bitcoin’s underlying tech. It includes three BIPs (Bitcoin Improvement Proposals), the first two being revolutionary.

First is Schnorr Signatures—a signing algorithm allowing aggregation of thousands of signatures without bloating gas or storage. Vitalik tried to implement Schnorr on Ethereum but hasn’t succeeded yet—shows how hard it is. However, Gavin Wood’s Polkadot Substrate framework later supported Schnorr, though sadly Polkadot lacked inclusive mechanisms to grow its ecosystem.

The second BIP is MAST (Merklized Alternative Script Tree), which allows users to embed scripts in a tree structure and, combined with Schnorr, enables innovative contract designs on Bitcoin. While not Turing-complete, it can simulate Turing-complete behaviors. It can’t achieve full while(if) loops, but by assembling numerous if...else statements, it can approximate while(if) logic.

Thus, Taproot’s two key BIPs laid a solid, scalable foundation for Bitcoin. Delving deeper into the code reveals an elegant design philosophy—beautiful, stunning, almost magical cryptography. Only after Taproot could decentralized L2s emerge on Bitcoin; before, it wasn’t possible. If you’re a Bitcoin holder, you may know Bitcoin has five address types—the [bc1p] prefix marks Taproot-upgraded addresses. Many users buying inscriptions or using Lightning Network assets use these addresses.

But why didn’t it explode right after Taproot launched in Oct 2021, but only post-Chinese New Year this year? We started promoting Taproot tech two years ago—even filed related patents approved by China’s patent office. But looking back, pushing it earlier was difficult. When the tech landed, infrastructure like Bitcoin web wallets and token issuance protocols hadn’t emerged. Even if developed, user adoption and understanding take time.

All this takes time to mature. Last year, Bitcoin NFTs began gaining traction. By March this year, BRC-20 inscriptions surged. Now we’re at unprecedented highs. You can see the timeline—from Bitcoin NFTs last year, to BRC-20 in March, to now—largely tracks Taproot’s rollout. Users just lag slightly behind tech iterations.

26x14: Where does the Bitcoin ecosystem capture the most value?

Guanghua: Short-term, inscription tokens like $ordi and $sat have shown 100x–1000x returns—rare elsewhere now. We’re bullish on Ordinals, which include three parts: first, NFTs that gained traction last year; second, BRC-20 this year, enabling fair meme launches; third, Runes protocol—which supports BRC-20 and is ERC-20 compatible, offering better exit channels for investors.

The direction represented by Runes will explode in the next few years—it enables proven Ethereum concepts like Launchpads. Also, some CEXs could rise to top tier via it, attracting more deposits through Bitcoin trading pairs. Plus, DeFi “quad suite” and game mechanics validated on Ethereum will thrive in Bitcoin’s ecosystem. Of course, Bitcoin still lags Ethereum in smart contract capability, so the Bitcoin ecosystem needs L2s even more than Ethereum. While Ethereum L2s share similarities with L1, BTC L2s solve problems BTC fundamentally cannot.

But I predict next year won’t decide who dominates BTC L2—next-next bull market will. So the greatest value capture in Bitcoin’s ecosystem may not be this current bull run, but the next cycle—when a BTC L2 oligarch emerges to rival or surpass Ethereum. It’s even possible Vitalik himself brings Ethereum onto BTC L2. Personally, I know many top ETH L2 projects considered crossing over to BTC L2 a year ago—they may ultimately return to the Bitcoin ecosystem. Look at OP’s whitepaper—one year ago their roadmap mentioned eventually building BTC L2; Starknet’s CEO has openly stated they plan to use ZK for BTC L2.

26x14: So today’s landscape may not follow the script—many surprises lie ahead.

Guanghua: Yes, giants with hundreds of millions in funding are waiting—just watching for the right moment. BTC ecosystem market cap should reach 20% of Bitcoin’s total—about 4.2 million BTC. Within that, BTC L2 may take half—~10% of Bitcoin’s total market cap. Leading projects in niche sectors—memes and DeFi quad suite—might each take ~2%, forming the full 20% puzzle. Meme assets may crown a leader this bull cycle, but L2 dominance may take another four years to settle.

26x14: When do you expect Bitcoin’s DeFi Summer?

Guanghua: Second half of next year.

26x14: Until then, memes dominate?

Guanghua: Yes, mainly memes—but “semi-centralized” exchanges will rise too, like OKX’s wallet or Unisat Swap—these “semi-centralized” platforms will gain popularity before DeFi does.

26x14: What about Ethereum’s future? What happens to Ethereum L2, ZK, and other heavily funded tech narratives? Your prediction?

Guanghua: Ethereum must be anxious. Often, what kills you isn’t your imagined rival. Who’d have thought the script would show Ethereum not killed by high-performance chains fighting uphill, but by the original originator—Bitcoin? After years of struggle, you look up—and someone three times your market cap is still standing there, watching. All your past success might’ve just been self-delusion. In my view, Ethereum’s best outcome is ETH mainnet embracing Bitcoin’s ecosystem—becoming a BTC L2.

As for ZK—it’s like AI a decade ago. Everyone knows it’s the future, a stable narrative, but also knows it won’t arrive anytime soon—and no one knows exactly when. But if ZK lands, applying it to empower BTC L2 would be extremely powerful. Bitcoin uses PoW, ZK requires intensive computation. Simply propose a BIP to add an OP code to Bitcoin’s consensus layer to verify ZK algorithms. Then Bitcoin miners can natively support ZK computation, enabling infinite scaling via ZK, while PoW miners secure these computations. So perhaps ZK fits PoW better?

26x14: Why do you envision ETH mainnet becoming BTC L2, rather than ETH L2 integrating with BTC L2?

Guanghua: If ETH L2 integrates BTC L2, ETH L2’s market cap could surpass Ethereum mainnet’s.

26x14: What do you think was Vitalik’s true “grand strategy” in moving blockchain from PoW to PoS?

Guanghua: I didn’t fully appreciate Ethereum before, so I missed 2020’s DeFi Summer. Looking back, Vitalik is incredibly smart—not just inclusive, but perfectly timed. Back in 2016, he announced Ethereum would implement Sharding and transition to PoS. When miners were building hardware, he said: stop, we’re switching from PoW to PoS. His timing was brilliant—why announce in 2016 but only finalize it last year? He introduced ETH burning—now, among all PoS networks, only Ethereum is truly secure. Vitalik once said only Ethereum can successfully run a PoS network.

Because only by solving PoS inflation can the network stay secure—otherwise, PoS tokens trend downward, eventually nearing zero. Ethereum’s PoS is secure thanks to an EIP introducing ETH burns, ensuring deflation during issuance. This design, planning, and perfect timing reveal Vitalik’s deep calculation. From proposing PoS in 2016 to launching in 2022, six years of patience—withstanding community criticism—is beyond most.

Why push PoS? Perhaps because he sees miners as less valuable. Bitcoin differs—it carries monetary and gold-like traits, secured by labor, power, and computational effort. But ETH’s value comes differently—driven by technological and financial innovation. Its mission is efficient asset creation. It aims to redirect funds that would go to PoW laborers toward innovators building financial tech—creating a self-sustaining value loop.

26x14: In Bitcoin’s narrative, is there room for PoS? Will it remain purely PoW, or a hybrid PoW+PoS ecosystem?

Guanghua: Combine both—approach with inclusiveness. Layer 1 stays PoW—monetary, gold-like—perfect for PoW. But for Layer 2 ecosystems, consider tech attributes—adopt PoS, proven by Ethereum. Let BTC’s ecosystem serve both PoW and PoS user bases together. Historically, chains surviving past cycles shared one trait: inclusiveness. Only inclusive systems achieve true decentralization.

26x14: Blockchain economy today remains attention-driven. Bitcoin has captured massive attention. Ethereum retains its base. What about other chains—Move, Ton, etc.? Developer bandwidth is limited. Are these players the biggest losers from Bitcoin’s rise?

Guanghua: First, maintain inclusiveness. Tech progress accumulates, even if not reflected in token economics.

Personally, I envision: Bitcoin, with its elegant monetary and gold-like code design, sits at Layer 1; Ethereum, with strong fintech and ecosystem design, at Layer 2; Layer 3 hosts high-throughput chains closer to social apps and games—less finance-focused, more接地气. The whole system becomes a unified framework—just like the World Wide Web.

Initially, only LANs existed. Then LANs interconnected into MANs. MANs linked into national networks. Finally, global interconnection formed the WWW. Blockchain will follow—starting fragmented, eventually unified. Users won’t care which layer they’re on, or whether it’s MAN or LAN tech—they’ll only care about service experience. Ultimately, blockchain becomes a complete, full-stack system. Bitcoin as Layer 1 simply has the most elegant code fit for that role.

26x14: I fully buy this reasoning. Under this view, we may not have many more bull-bear cycles. Maybe just two more—and blockchain becomes part of fintech internet, reflecting tech-internet valuation and pricing.

26x14: Final question—for show—Who is Satoshi? Is he alive? Or just a symbol, a spiritual figure?

Guanghua: I see Satoshi as an idea—an ideal of fairer distribution and greater decentralization. Vitalik achieved great success because he’s closest to Satoshi’s ideals—most inclusive among founders, hence Ethereum ranks second. Personally, I whimsically imagine Satoshi as a time traveler—from a future where the dollar-based financial system collapsed—sent back to save humanity. That explains why he never spent his Bitcoins selfishly. I choose to believe this story—it makes me feel comfortable.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News