Jito launches nearly $200 million JTO airdrop, Solana ecosystem prepares for a comeback battle

TechFlow Selected TechFlow Selected

Jito launches nearly $200 million JTO airdrop, Solana ecosystem prepares for a comeback battle

"You just need to invest $40 on the chain, and in a few months, you'll get $9,882."

By Mary Liu, BitpushNews

Jito is the fourth DeFi protocol on the Solana ecosystem this year to announce an airdrop, following Pyth, Jupiter, and Meteora.

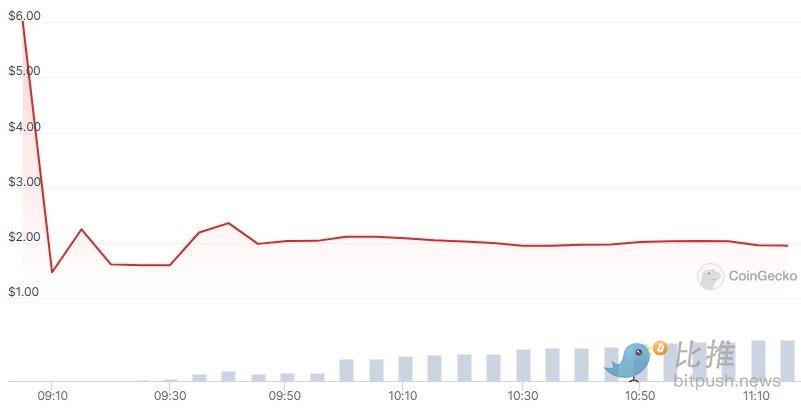

At 11 a.m. Eastern Time on Thursday, Jito opened its airdrop to users, distributing 90 million JTO governance tokens—10% of the total supply—worth over $2 billion at press time.

Overall, Jito followed the well-trodden path of emerging protocols distributing governance tokens via airdrops to early users.

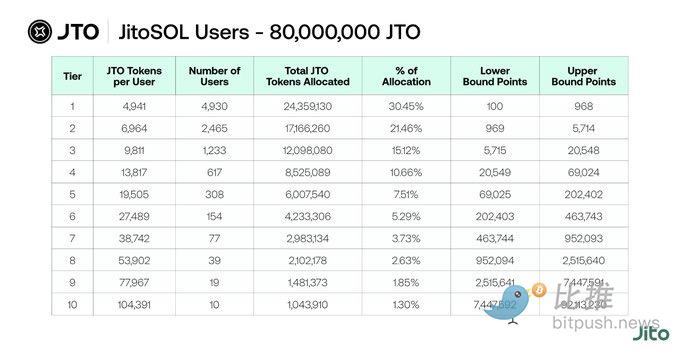

Jito distributed tokens based on the amount of JitoSOL liquid staking tokens held and lent by addresses to DeFi protocols, while also rewarding validators and MEV searchers. Unclaimed tokens will go into a treasury controlled by the Jito decentralized autonomous organization (DAO). JTO tokens will be used to govern both the staking platform and the treasury.

Jito allows users to stake their Solana (SOL) in exchange for the protocol’s JitoSOL token, which can then be traded or used as collateral—similar to how Lido stakes Ethereum (stETH).

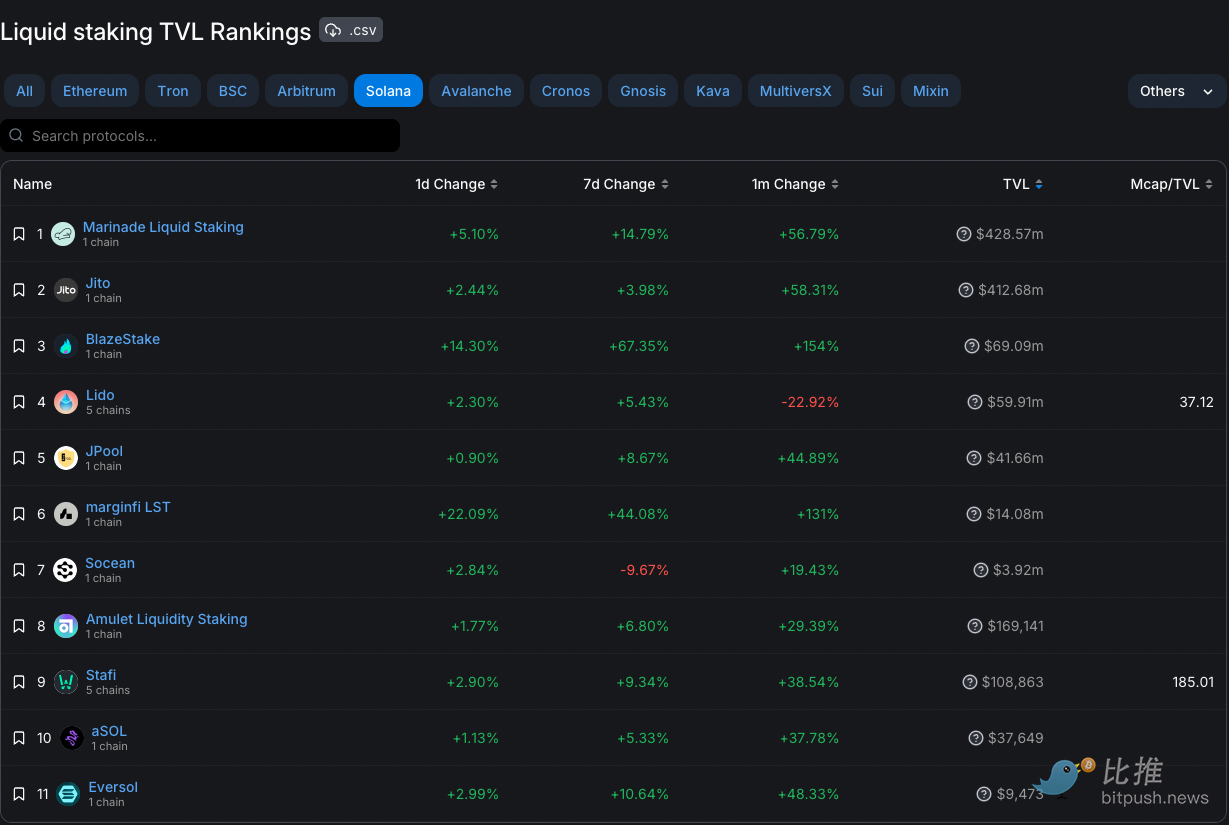

According to data from DeFiLlama, Jito and Marinade are the two largest liquid staking providers on Solana, each with a total value locked (TVL) of approximately $425 million. (The leading LSD protocol, Lido, has a TVL of $21.45 billion.)

Dan Smith, research analyst at Blockworks, wrote on X: "Today, 9,852 addresses claimed between $9,800 and $208,000 from the Jito airdrop. If you simply put $40 on-chain months ago, you just received $9,882. It feels like—'the familiar crypto market is back'."

Wallet holders have 18 months to claim their JTO airdrop. Ryan West, research analyst at Blockworks Research, noted this would allow users to defer both their claim and associated tax obligations into 2024.

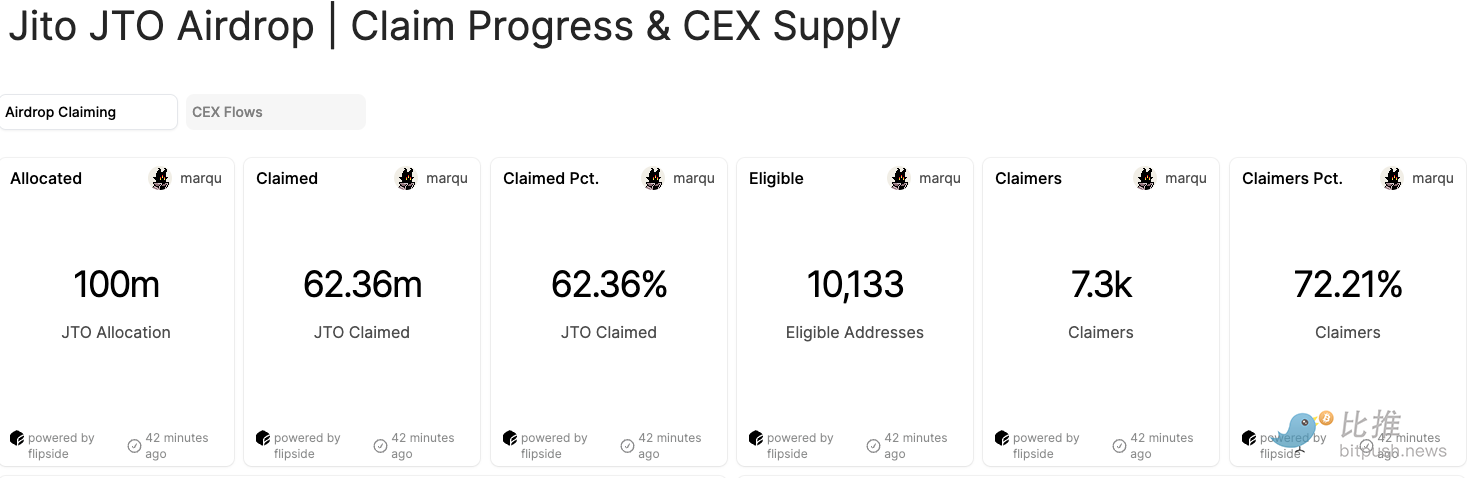

Despite the long claiming window, according to the Flipside Crypto dashboard, 54 million out of the 90 million newly available tokens—60%—were claimed within four hours after the airdrop. At press time, the claimed ratio reached 62.36%.

JTO whales do not appear to be rushing to sell; the same dashboard shows that only three out of the 20 largest recipients sold any JTO tokens.

Airdrop Fuels Solana Ecosystem Revival

Blue-chip DeFi protocol Uniswap airdropped 150 million UNI governance tokens to users in September 2020, worth over $900 million at today’s prices. While most UNI recipients eventually sold their tokens, the massive wealth effect still propelled Uniswap forward. Ryan Watkins of Syncracy Capital likened the UNI airdrop to a “stimulus check” at the time.

The JTO airdrop is also seen as a potential catalyst for the recent revival of the Solana ecosystem. SOL has gradually moved past its association with FTX, with its price rising more than fourfold over the past year.

Positive signs are emerging in Solana’s NFT market, and decentralized exchanges on Solana recorded $7.3 billion in trading volume in November—the busiest month to date.

Zano Shermani, CTO of Jito Labs, said during a Twitter Space on Thursday that the airdrop helps drive growth on Solana. He added that a new generation of projects has learned from the mistakes of earlier ones, referencing the “very poor tokenomics” of assets launched during Solana’s bull run in mid-to-late 2021.

Steven, Director of Analysis at The Block, posted on X: "Back then, the Compound and Uniswap airdrops kicked off the DeFi summer, injecting massive liquidity into a hungry market and encouraging dozens of projects to follow suit with their own airdrops. I think JTO did exactly that today. If Solana projects are smart, they’ll immediately start paying attention and leveraging this effect."

Altcoins Benefit

Multiple centralized exchanges including Coinbase, Binance, and MEXC have listed JTO trading. According to CoinGecko, JTO’s fully diluted valuation exceeds $2 billion, briefly surpassing Ethereum’s leading liquid staking protocol Lido during intraday trading.

The launch of JTO also coincides with altcoins continuing their strong rally this year. Solana’s native token (SOL) is up over 550% year-to-date. Polygon (MATIC) and Chainlink (LINK) both saw gains last month and maintained around 16% increases on Thursday.

Bitcoin (BTC) retreated to around $43,100 on Thursday after briefly breaking above $44,000 earlier in the week. In contrast, Ethereum (ETH) continued its upward momentum, gaining an additional 4.2% over the past 24 hours.

Analysts at cryptocurrency research firm Kaiko found that altcoins’ share of total crypto trading volume surged to 67% last week—the highest level since March 2022.

Kaiko analysts added: "In early November, daily altcoin trading volume surged above $20 billion for the first time since April 2023. While altcoin trading remains driven by offshore markets, Binance’s influence has waned, with its share of global altcoin trading volume dropping to 46% last week, down from 60% in September 2022."

Interest in altcoins isn’t limited to native crypto traders. According to research from cryptocurrency investment firm Fineqia, assets under management for exchange-traded products (ETPs) holding Solana increased by 99% last month.

Fineqia analysts added: "Following a 172% increase in October, ETPs holding SOL as an underlying asset have grown 443% over the past two months, accounting for 77% of the growth in assets managed by altcoin index products."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News