MT Capital Research Report: Jito, Reshaping the Solana Staking Market Landscape

TechFlow Selected TechFlow Selected

MT Capital Research Report: Jito, Reshaping the Solana Staking Market Landscape

The more active the Solana network becomes, the greater the MEV value, and the more pronounced Jito's competitive advantage will be.

Authors: Severin & Ian, MT Capital

"Jito has performed exceptionally well during this wave of Solana's resurgence. As the first LSD protocol on Solana to offer both MEV rewards and staking yields, Jito is poised to reshape the competitive landscape of Solana’s LSD market."

TL;DR

-

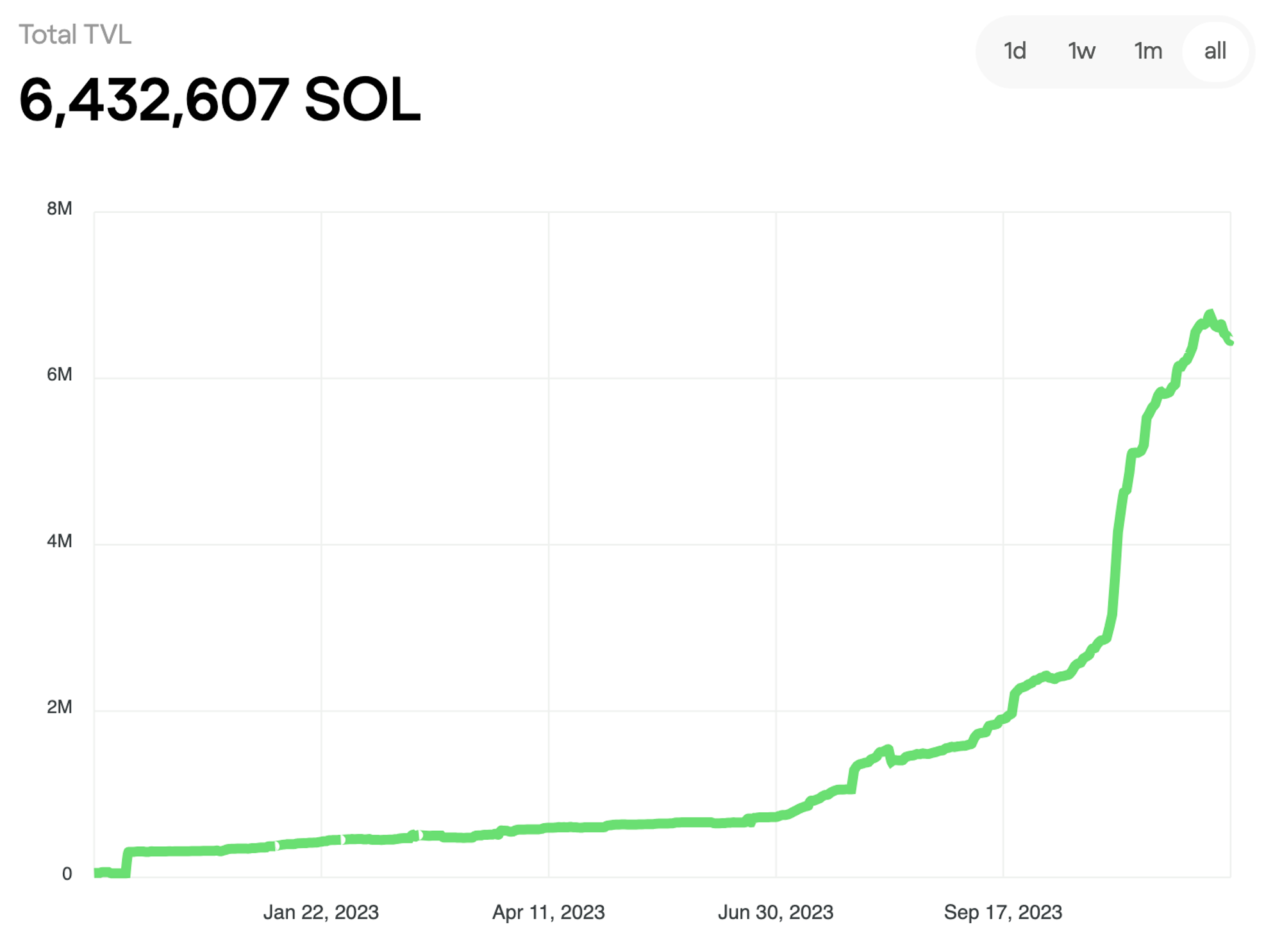

Jito is Solana’s first liquid staking protocol that offers both MEV and staking rewards. Its TVL has grown nearly 70% over the past 30 days, positioning it to reshape Solana’s staking market.

-

Jito is set to launch its governance token JTO. Early circulating supply will be limited, with primary selling pressure coming from airdrop recipients. The utility of JTO is currently limited, resulting in weak value capture. Jito will need new incentives and ecosystem expansion to sustain TVL growth, alleviate selling pressure from airdrop users, and maintain JTO’s value stability.

-

Backed by the influx of new assets, users, and rising transaction volumes on Solana—alongside Solana’s extremely low rate of liquid staking—the LSD protocols like Jito are well-positioned to capture higher staked TVL. The substantial potential MEV value on Solana gives Jito even greater upside potential.

-

Compared to Marinade, Jito’s gaps in ecosystem integration, decentralization, and staking model diversity are expected to narrow as Jito evolves. Meanwhile, Jito’s core competitive advantage in capturing and distributing MEV value will expand further as the Solana network thrives. Therefore, we hold an extremely optimistic outlook for Jito, which could surpass Marinade to become the leading LSD protocol in the Solana ecosystem.

-

Jito’s improving fundamentals will likely drive appreciation in the secondary market price of JTO. Based on the recent performance trends of LSD protocol tokens over the past month, we believe JTO will also exhibit stronger secondary market performance.

Jito: Solana’s First Liquid Staking Protocol with MEV Rewards

Jito Labs: Deep Expertise in Solana MEV

The Jito Network was launched by the Jito Labs team, which initially focused on building infrastructure for MEV on Solana. In July 2022, Jito Labs launched the Solana MEV Dashboard, analyzing over 36 billion transactions since January 2022 and categorizing their MEV activity. Then, in August 2022, Jito Labs announced a $10 million Series A funding round led by Multicoin Capital and Framework Ventures, with proceeds dedicated to enhancing MEV-related infrastructure.

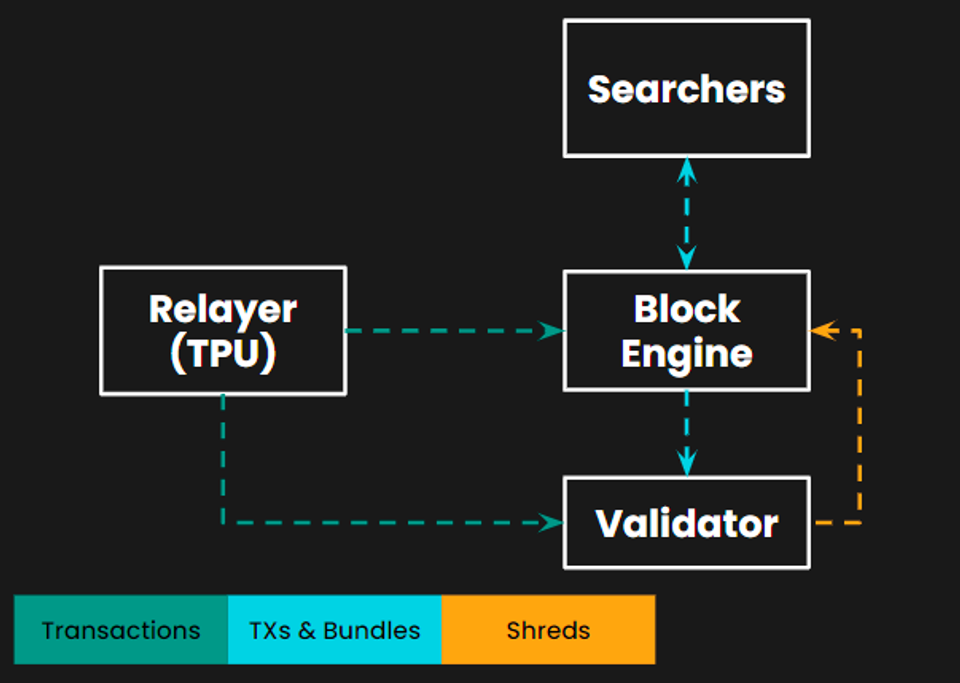

Following this, Jito Labs introduced several products including the Jito-Solana validator client and Jito Block Engine, optimizing MEV extraction and distribution, establishing itself as a key infrastructure provider in the Solana MEV space. The Jito Block Engine connects relays, searchers, and validators off-chain through an auction mechanism to address MEV challenges.

-

First, the Jito Block Engine receives transaction orders from relays and forwards them to searchers.

-

Next, searchers submit transaction bundles along with bids.

-

Finally, the Jito Block Engine simulates each bundle and selects the optimal one to forward to validators for processing.

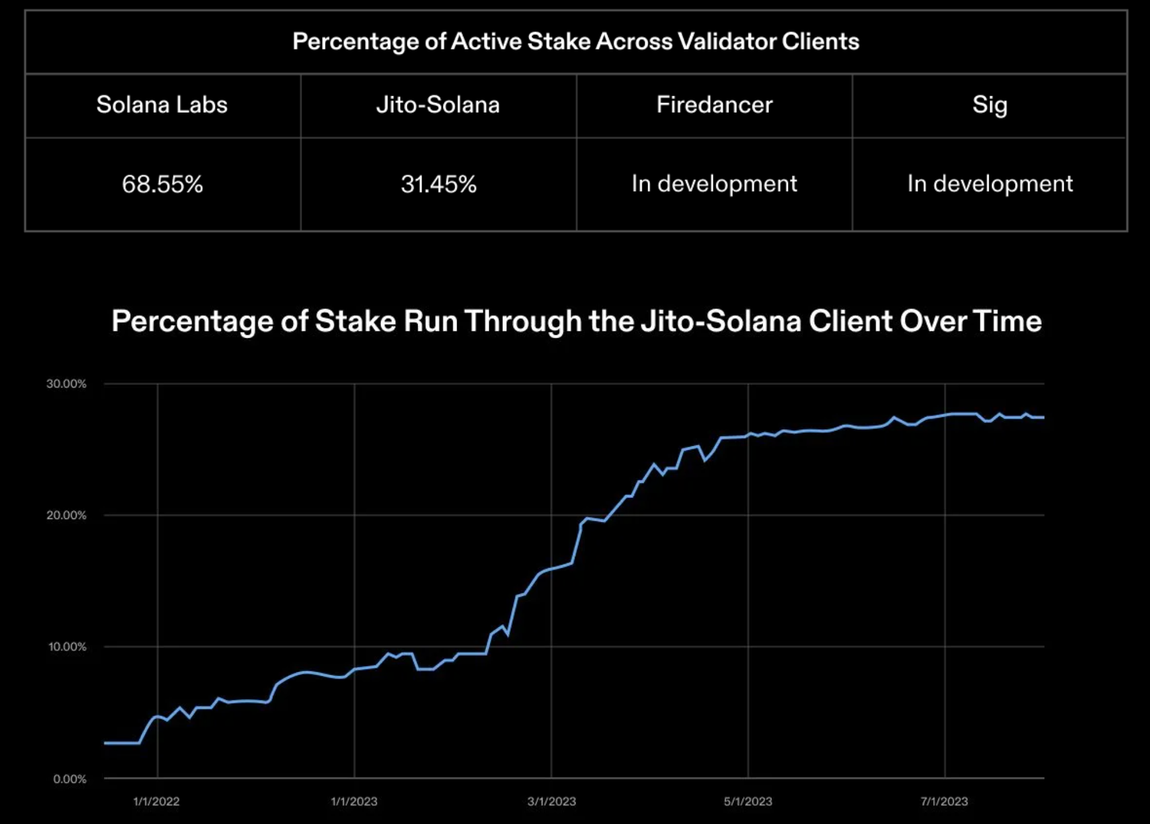

According to the Validator Health Report: October 2023 released by the Solana Foundation, approximately 31.45% of Solana validators currently use the Jito-Solana validator client developed by Jito Labs—demonstrating the team’s technical leadership in the MEV domain.

As adoption of the Jito-Solana validator client grows, so does the amount of MEV rewards captured via Jito-Solana, laying a solid foundation for Jito’s launch of an LSD module that includes MEV rewards.

Solana’s First LSD with MEV Rewards

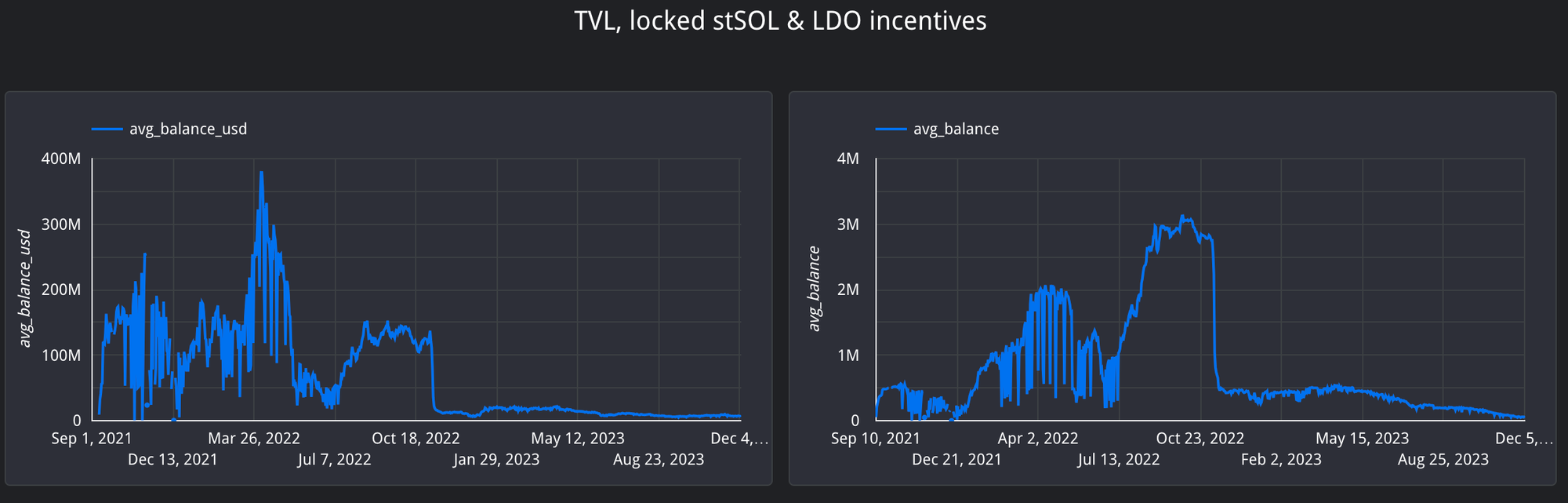

Poor timing hindered early growth of JitoSOL: In November 2022, just before the FTX collapse, amid strong momentum in the LSD sector, Jito Labs officially launched its staking service. Similar to other LSD protocols, users delegate SOL to validators and receive JitoSOL as a liquid token representing their stake. The price of JitoSOL increases over time to reflect accumulated staking rewards. Thanks to Jito Labs’ early focus on Solana MEV, Jito is also able to distribute MEV rewards to stakers, further boosting user returns. Unfortunately, shortly after announcing its LSD offering, FTX collapsed due to misappropriation of customer funds. Solana, closely tied to FTX, suffered massive liquidity outflows. As a result, following the launch of its staking module, Jito struggled with insufficient market confidence and demand for liquidity, leaving its TVL stagnant for a prolonged period.

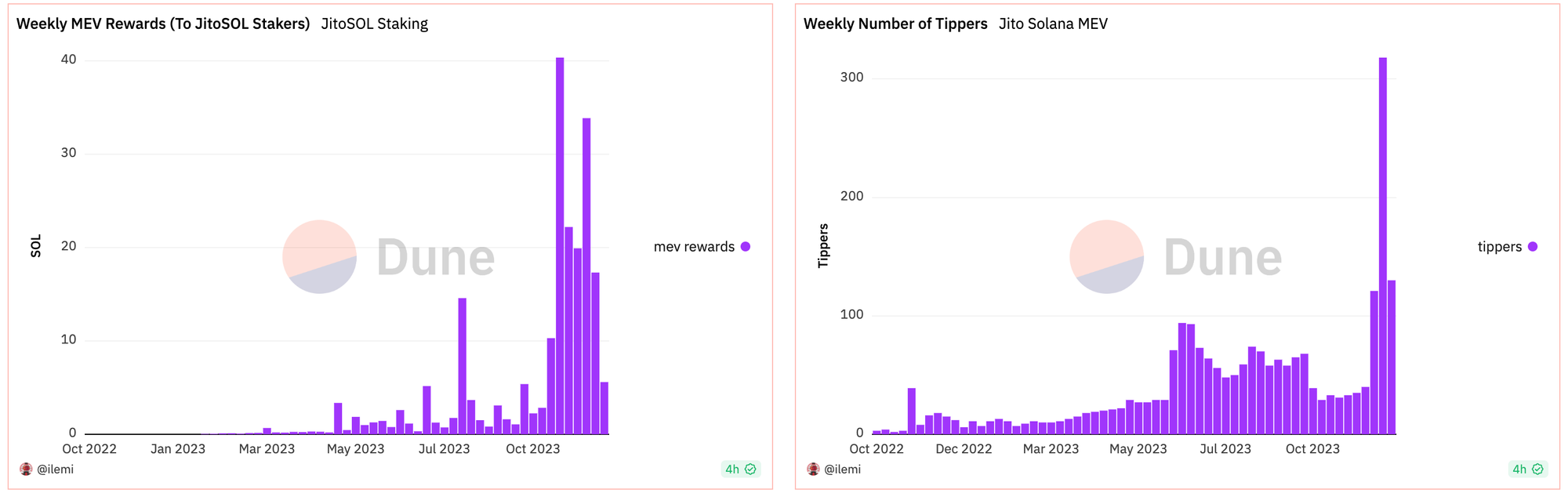

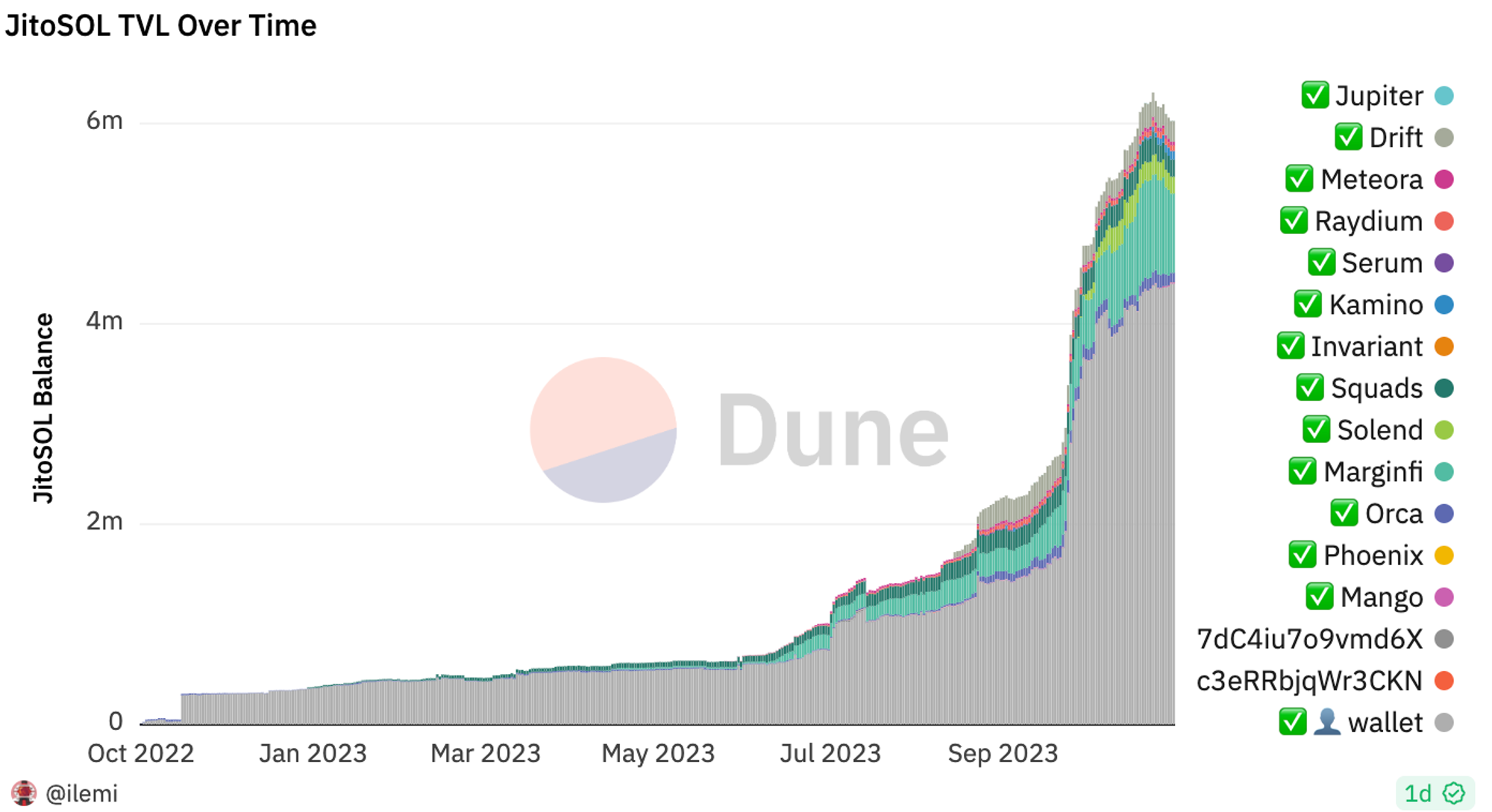

Points incentive program fuels Jito’s revival: With the recovery of the Solana ecosystem in the second half of this year, Jito’s TVL began gradually increasing. In August, Jito launched a points-based incentive campaign to accelerate widespread adoption of JitoSOL. Users earn points for staking with Jito, holding JitoSOL, using JitoSOL in DeFi activities, or inviting friends. These points represent contributions to the Jito community and serve as a key criterion for future airdrops. The introduction of the points program significantly steepened Jito’s TVL growth trajectory.

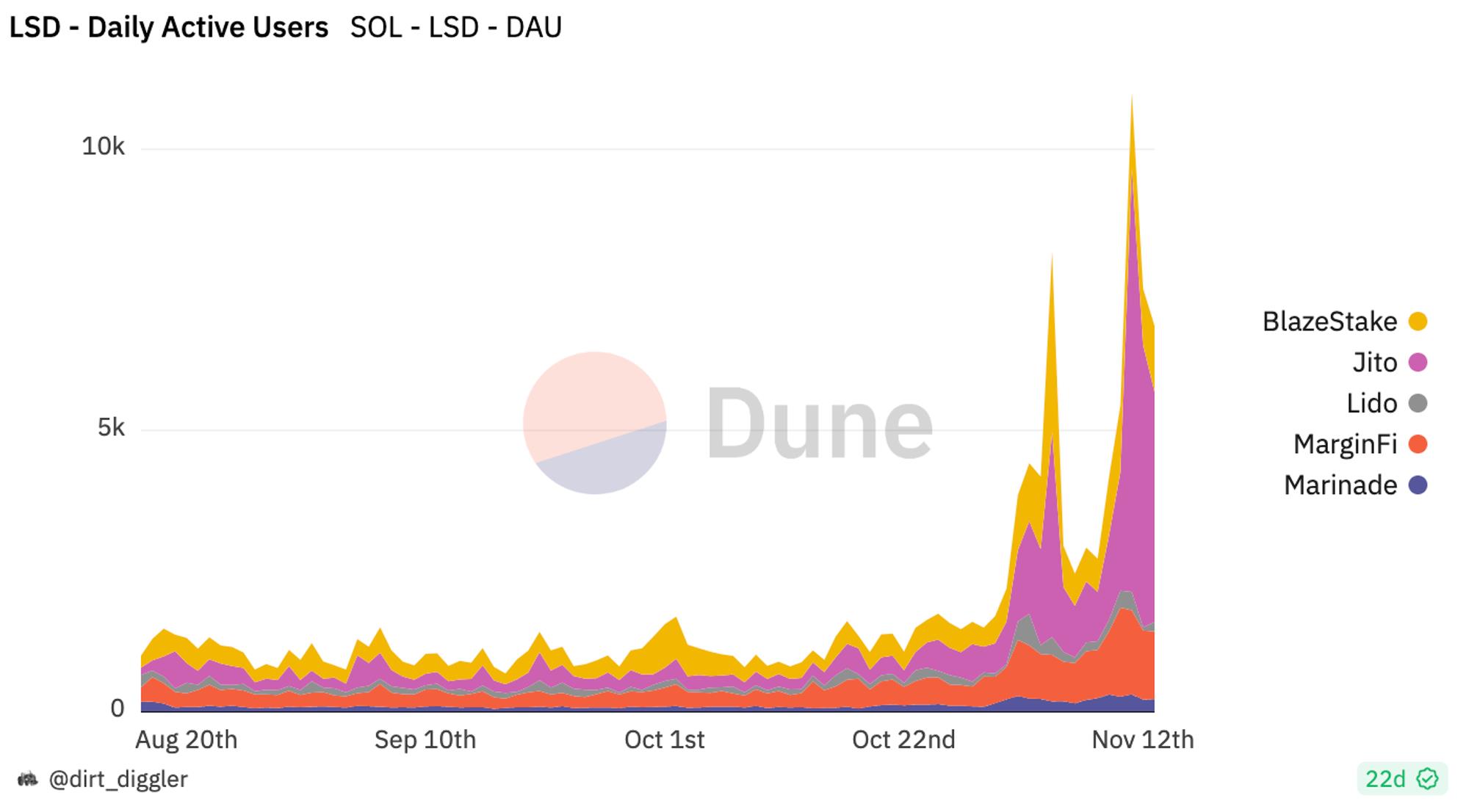

Lido exits, Jito captures Lido’s Solana market share: Meanwhile, in October, the Lido DAO voted to discontinue support for new SOL staking, with node operators beginning to exit the SOL staking market starting in November. Lido’s withdrawal left nearly $6M worth of stSOL seeking alternative staking solutions. Jito, offering both staking and MEV rewards along with its points incentives, successfully absorbed much of this stSOL, causing Jito’s TVL to surge and catapulting it into the top two LSD protocols on Solana.

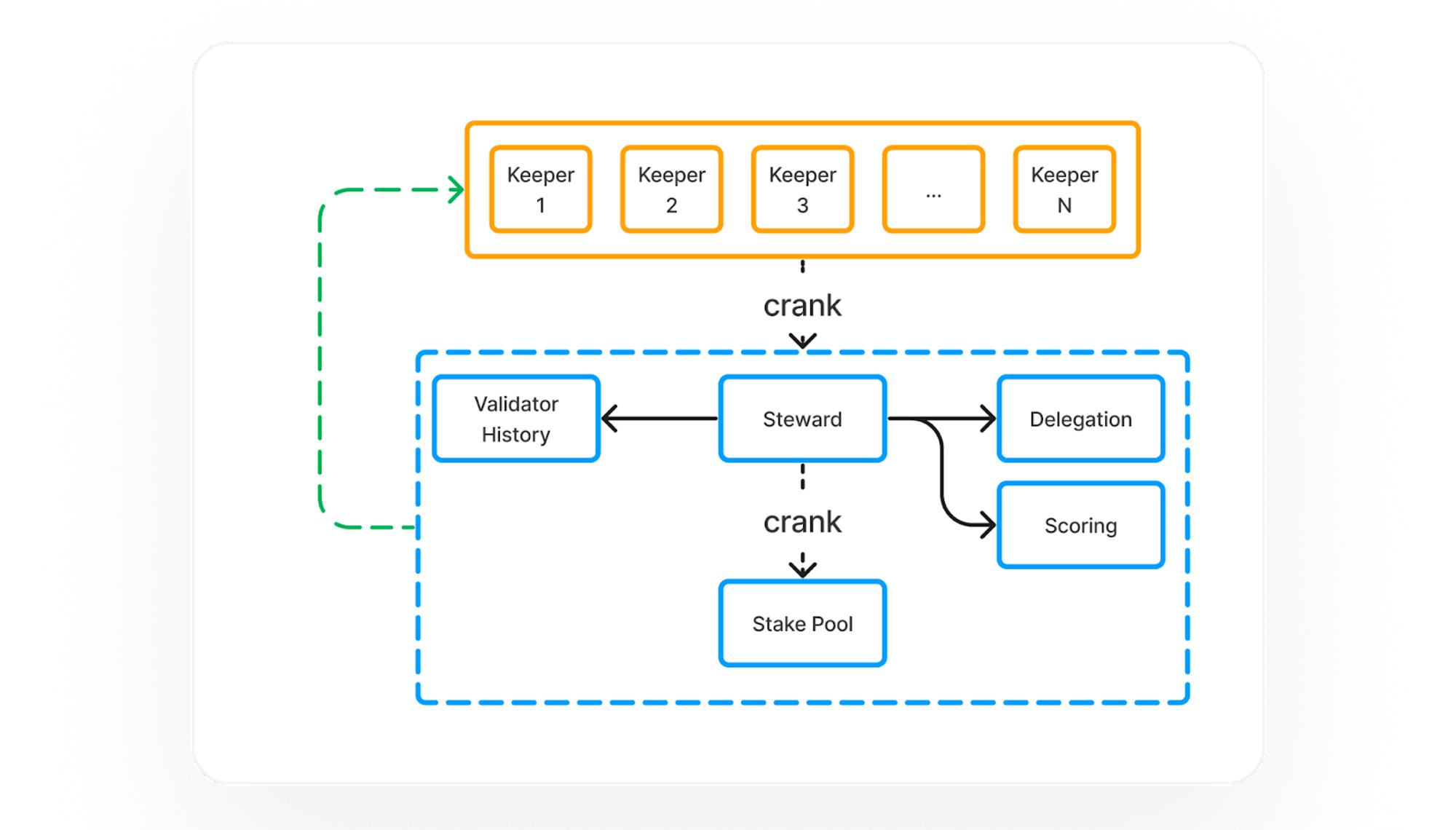

A More Decentralized Jito – StarkNet

To make the underlying validator pool and management of stake allocations more decentralized, Jito has proposed a future development plan centered on Jito StarkNet. Jito StarkNet is a self-sustaining, transparent, and decentralized smart management protocol for validator pools. It consists primarily of three components: Keepers, Validator History Program, and Steward Program.

-

The Validator History Program stores historical data for each validator over the past three years, including participation and correctness in consensus, commission rates, MEV extraction value, total staked amount, and ranking.

-

The Steward Program calculates a score and optimal delegation amount for each validator based on their on-chain historical records.

-

The Keepers Network then executes the allocation of stakes according to the Steward Program’s calculations.

In the Jito StarkNet system, validator behavior history becomes the sole benchmark for allocating stake delegations, encouraging healthy competition among validators to improve user staking experience. Additionally, stake management no longer relies on centralized protocol control but is instead automatically executed by the Steward Program and Keepers Network, making operations more decentralized.

Tokenomics

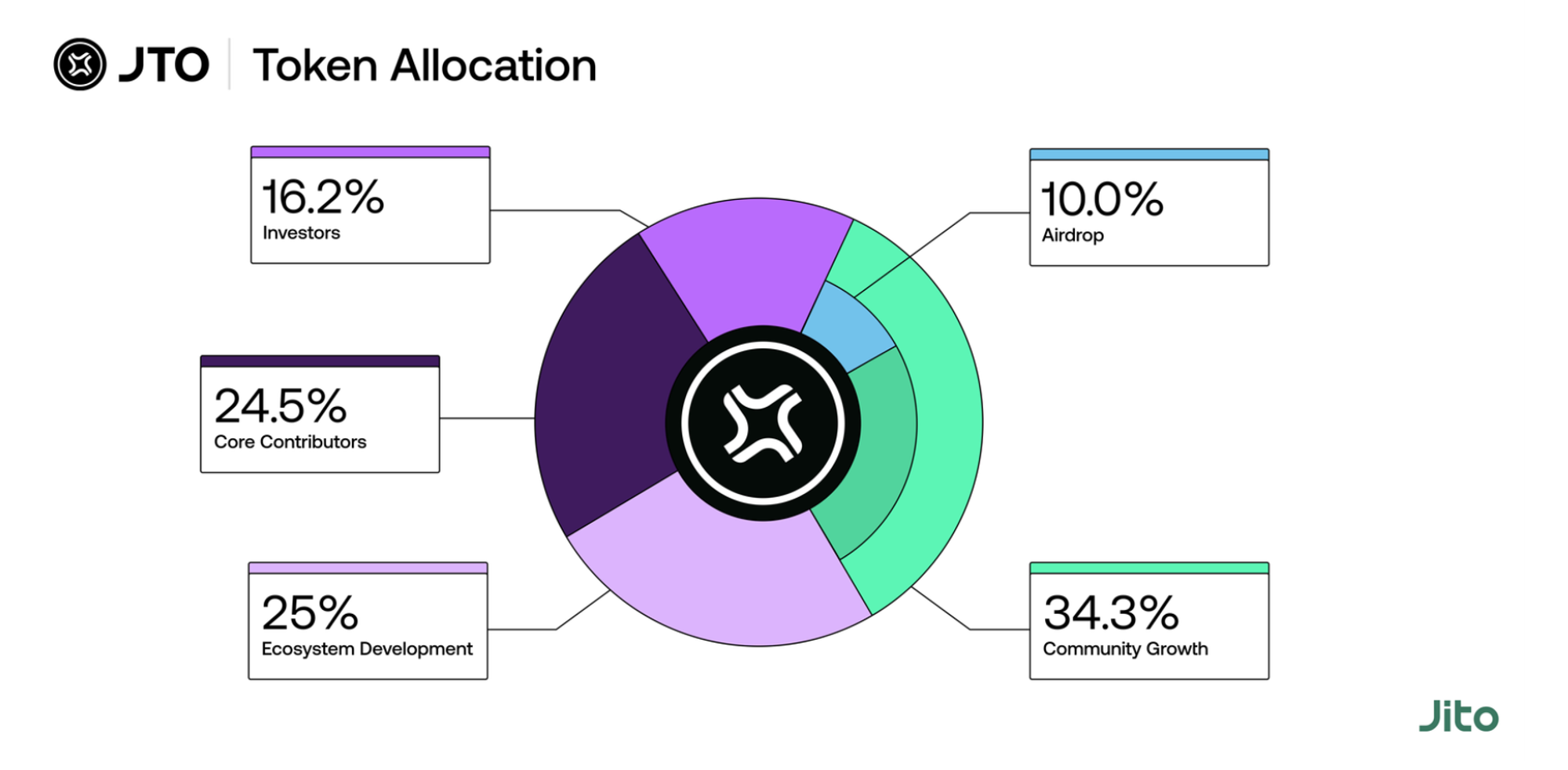

On November 28, the Jito Foundation announced the launch of its governance token JTO. The release of JTO marks a pivotal step in Jito’s evolution, serving as an airdrop reward for early contributors and granting governance rights to users.

Token Distribution: JTO has a total supply of 1 billion tokens, allocated as follows:

-

10% allocated for airdrops to early users;

-

24.3% controlled by the DAO for community growth;

-

24.5% and 16.2% allocated to the Jito team and early investors respectively, with a one-year lock-up and three-year vesting period;

-

25% reserved for ecosystem development;

Token Utility: JTO holders can vote on key protocol parameters and governance initiatives, including but not limited to:

-

Setting fees for the JitoSOL staking pool;

-

Adjusting key parameters in Jito StarkNet to optimize stake delegation strategies;

-

Managing DAO-held JTO tokens and fees collected from JitoSOL;

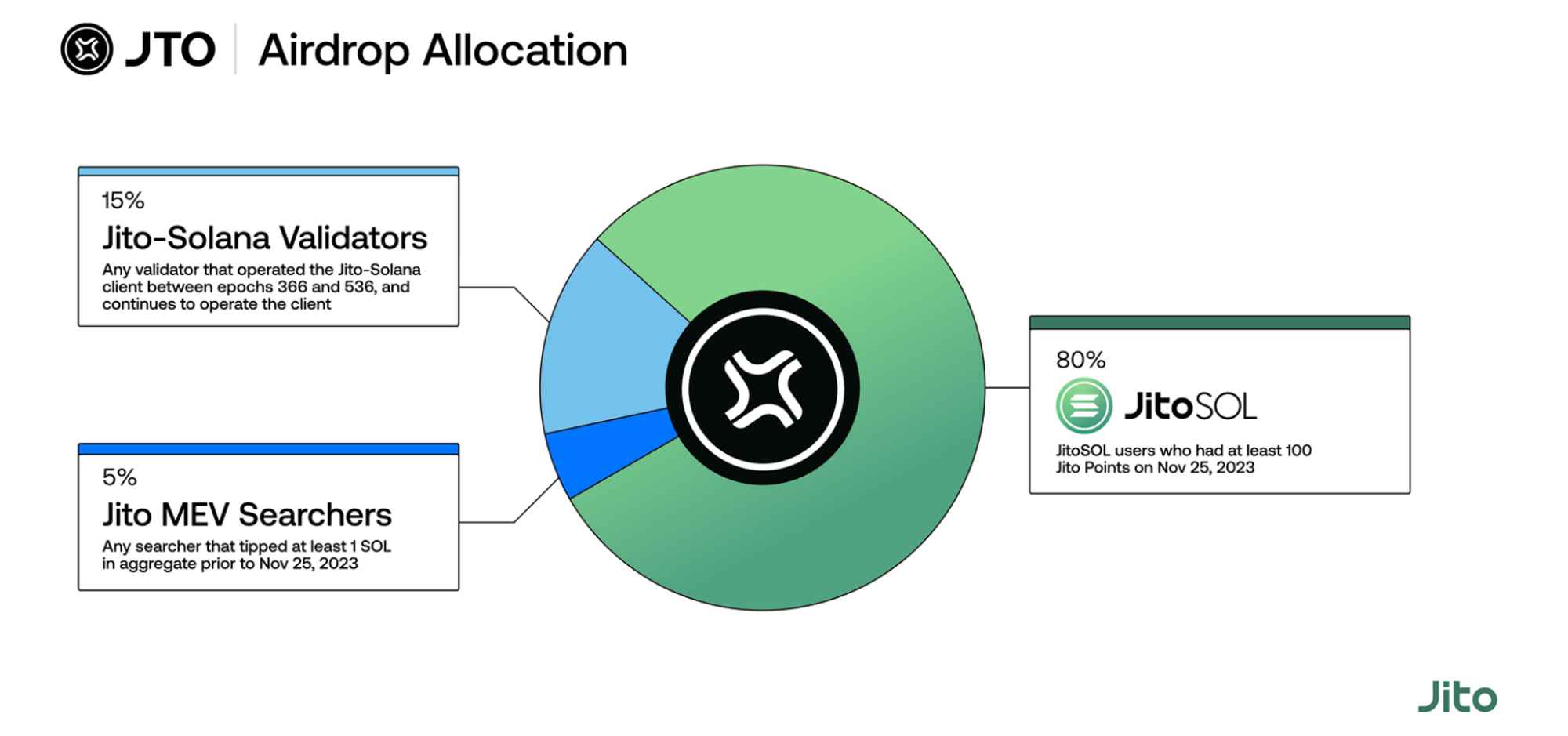

Airdrop Incentives: Early adopters of Jito have the opportunity to receive JTO airdrops. Specifically:

-

80% of tokens will be airdropped to JitoSOL holders and users;

-

15% to validators running the Jito-Solana client;

-

5% to Jito MEV searchers;

From the JTO token distribution, early circulating supply is limited, with main selling pressure coming from airdrop recipients. In terms of utility, JTO has relatively limited use cases and weaker value capture capabilities. Jito will require new incentives and ecosystem expansion to drive sustained TVL growth, thereby mitigating selling pressure from airdrop users and maintaining the stability of JTO’s value.

Future Outlook for Jito

Explosive Growth of Solana

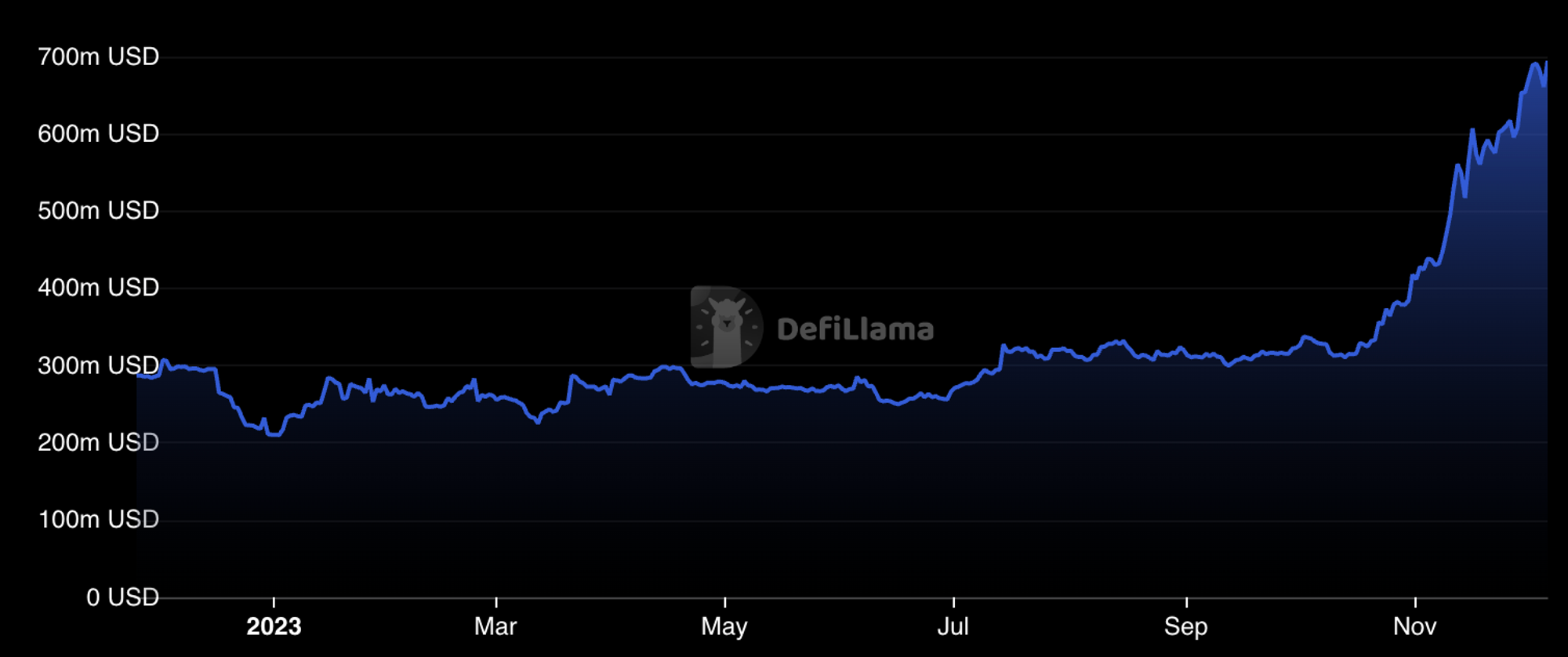

After the fallout from FTX’s collapse, Solana has finally emerged from hibernation and entered a phase of recovery. Since September, Solana’s TVL has surged dramatically, now approaching $700M. During this bull cycle, the average monthly TVL growth across the top ten blockchains was only 14.8%, whereas Solana achieved an impressive 85% monthly growth—far exceeding its peers. From an asset perspective, this massive inflow is expected to drive increased demand for SOL staking.

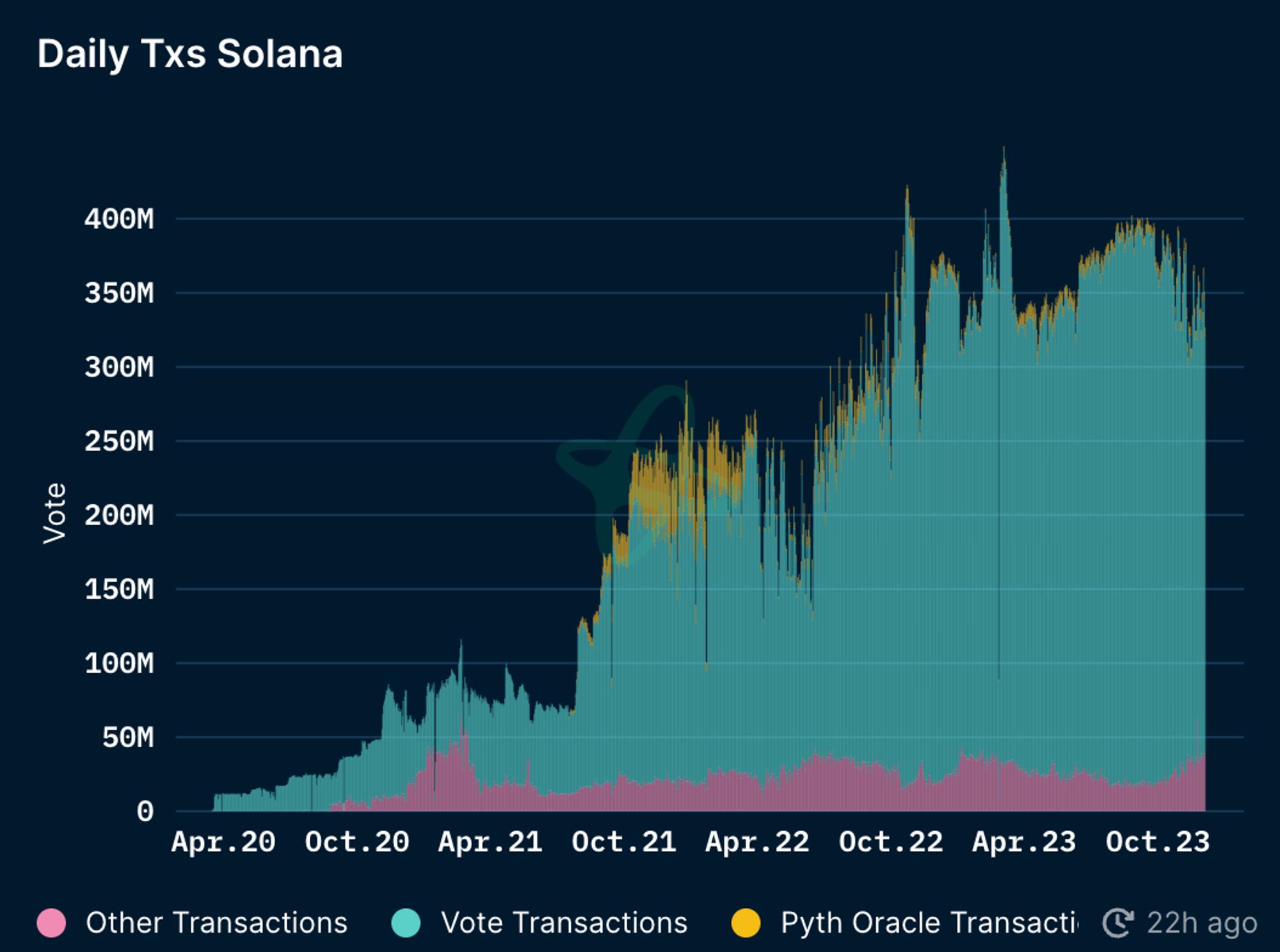

Beyond TVL growth, daily transaction volume on Solana has peaked near 400 million. Rising transaction volume not only increases network fees on Solana but also drives up MEV revenue, further fueling demand for staking platforms like Jito.

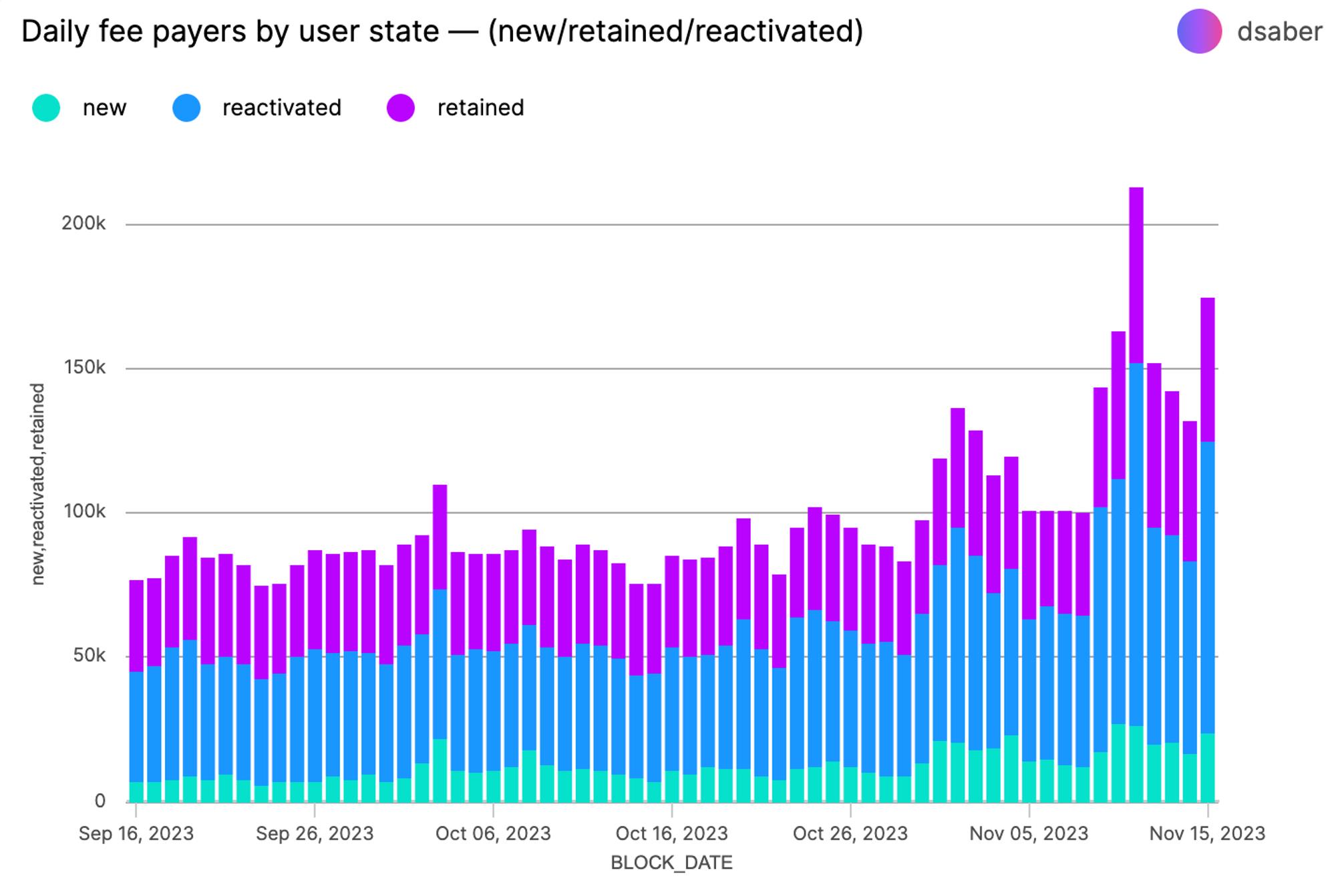

Additionally, the number of new and reactivated users on Solana continues to rise, broadening the potential user base for LSD protocols like Jito.

Significant Room for Growth in Solana LSD

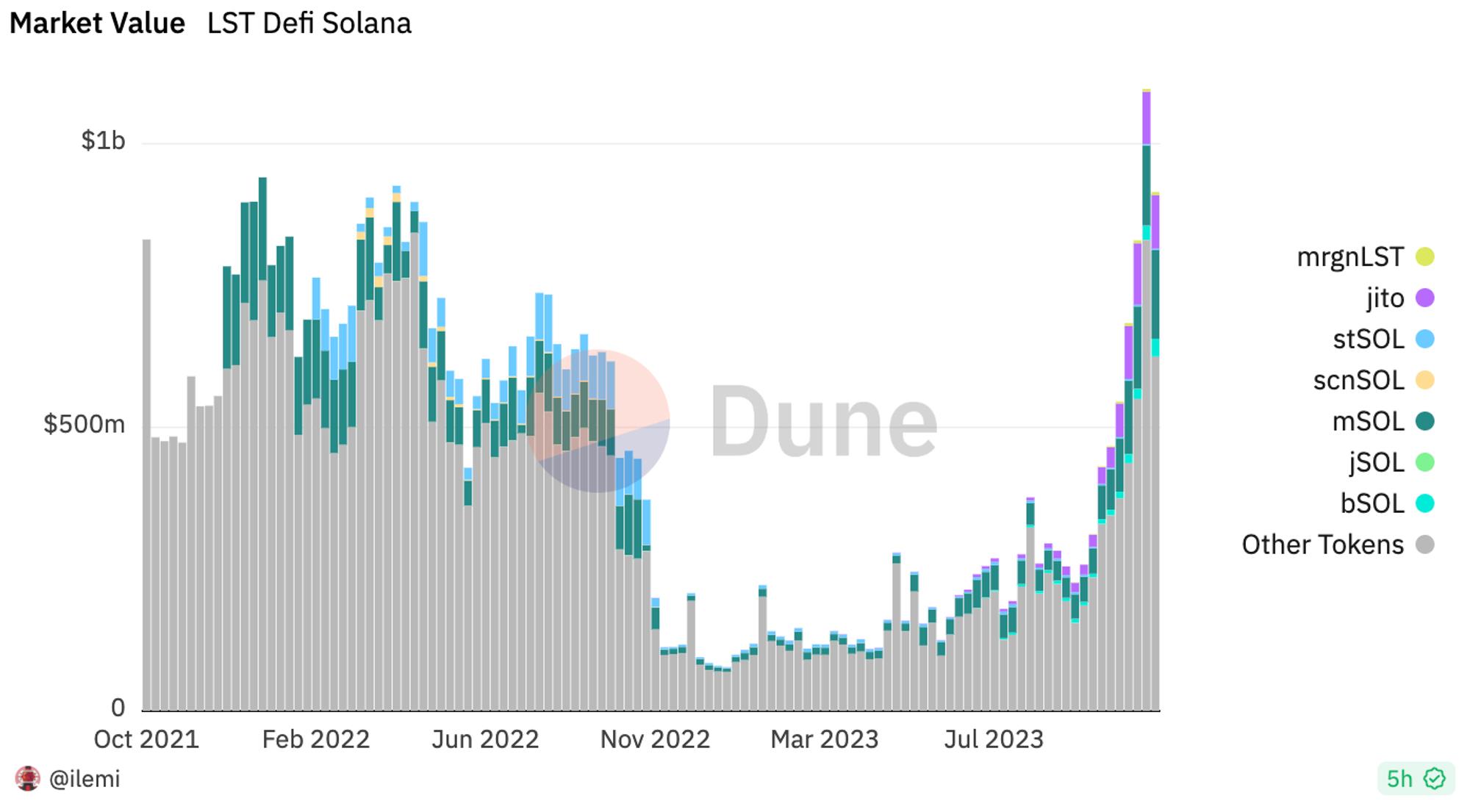

Although SOL’s current staking rate has reached 70.07%, the proportion of liquid staking remains only 3%-4%, indicating significant room for expansion. Compared to traditional staking, liquid staking provides users with a liquid token, enabling them to earn staking rewards while simultaneously participating in DeFi activities—resulting in higher capital efficiency. As shown below, liquid staking has experienced explosive growth alongside Solana’s ecosystem recovery. We expect liquid staking on Solana to gradually replace a larger share of traditional staking due to its superior capital efficiency in DeFi applications.

Massive MEV Value Potential on Solana

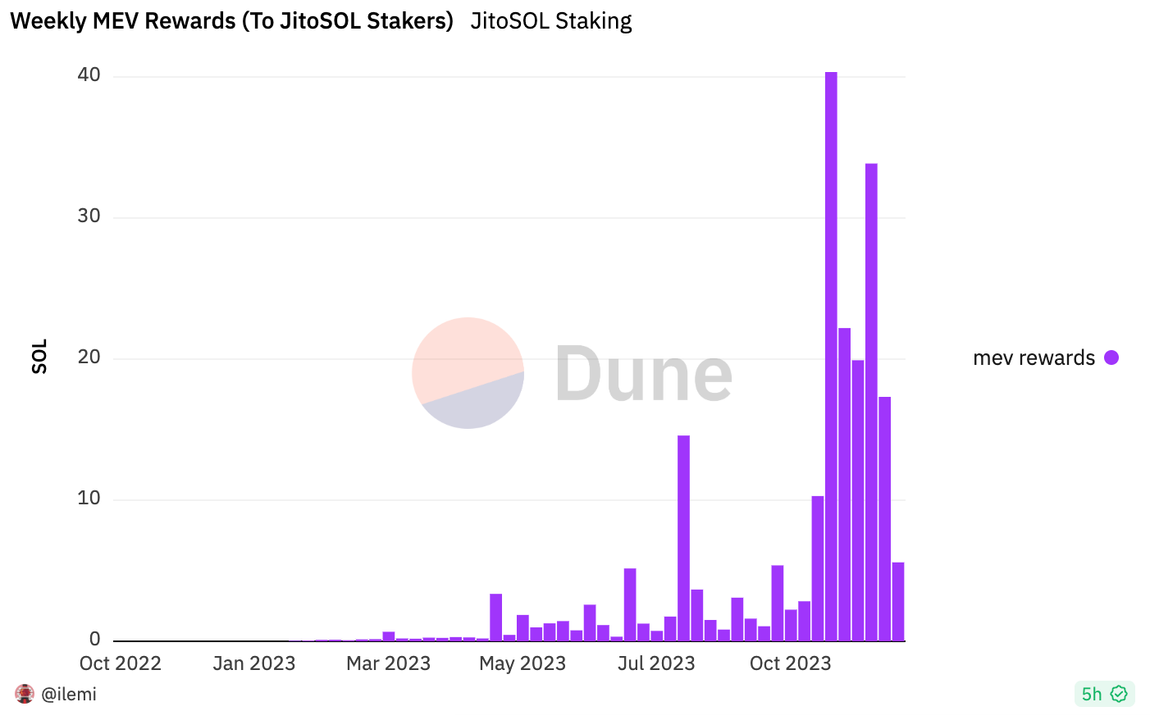

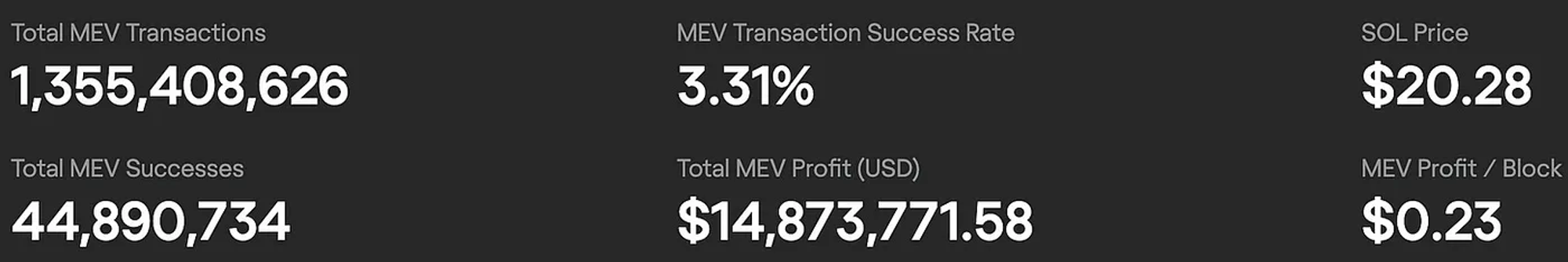

Since Jito distributes MEV rewards directly to JitoSOL holders, the higher the MEV value within Solana, the greater the staking rewards distributed to JitoSOL holders. Higher APR enhances the attractiveness of JitoSOL to users. Over the past year, Solana’s MEV profit reached $14M, and the potential for optimized MEV capture remains vast.

As the Solana network grows more active, the cumulative MEV value captured by Jito continues to increase. We expect this trend to persist, with Jito accumulating even more MEV value from rising network activity and redistributing it to JitoSOL holders.

Jito vs. Marinade: Unique Competitive Advantages

Marinade is the earliest LSD protocol in the Solana ecosystem, once achieving a peak TVL of $1.7B, and remains one of Jito’s biggest competitors. Compared to Marinade, Jito faces the following competitive disadvantages:

-

Marinade’s LST has a richer ecosystem compared to Jito’s LST;

-

Marinade operates more validators and achieves a higher degree of decentralization than Jito;

-

Marinade offers additional staking options beyond LSD;

Regarding disadvantage #1, as shown in the figure below, JitoSOL is actively expanding its ecosystem use cases and is now integrated into over 10 major DeFi protocols. Moreover, backed by Multicoin—a firm deeply embedded in the Solana ecosystem—Jito is well-positioned to form additional ecosystem partnerships in the future.

Regarding disadvantage #2, Marinade currently has about twice as many validators as Jito, giving it a clear edge in decentralization—a gap Jito cannot close in the short term. However, Jito is actively transitioning toward Jito-StarkNet, which could significantly enhance its level of decentralization in the future.

Beyond these disadvantages, Jito holds several competitive advantages over Marinade:

-

JitoSOL captures additional MEV rewards, offering slightly higher staking yields than Marinade;

-

Under similar incentive programs, Jito has attracted more active users during this Solana recovery cycle;

Jito’s ability to capture and distribute MEV value is its core long-term competitive advantage. The more active Solana’s network becomes and the higher the MEV value grows, the more pronounced this advantage becomes. Jito’s success in attracting active users also indicates that Marinade has not yet monopolized the LSD market, leaving ample room for competing LSD protocols like Jito to grow.

In summary, compared to Marinade, Jito’s gaps in ecosystem integration and decentralization are expected to shrink over time. Meanwhile, Jito’s core competitive advantage in MEV capture and distribution will continue to widen as the Solana network flourishes. Therefore, we maintain a highly optimistic outlook for Jito, which could surpass Marinade to become the dominant LSD protocol in the Solana ecosystem.

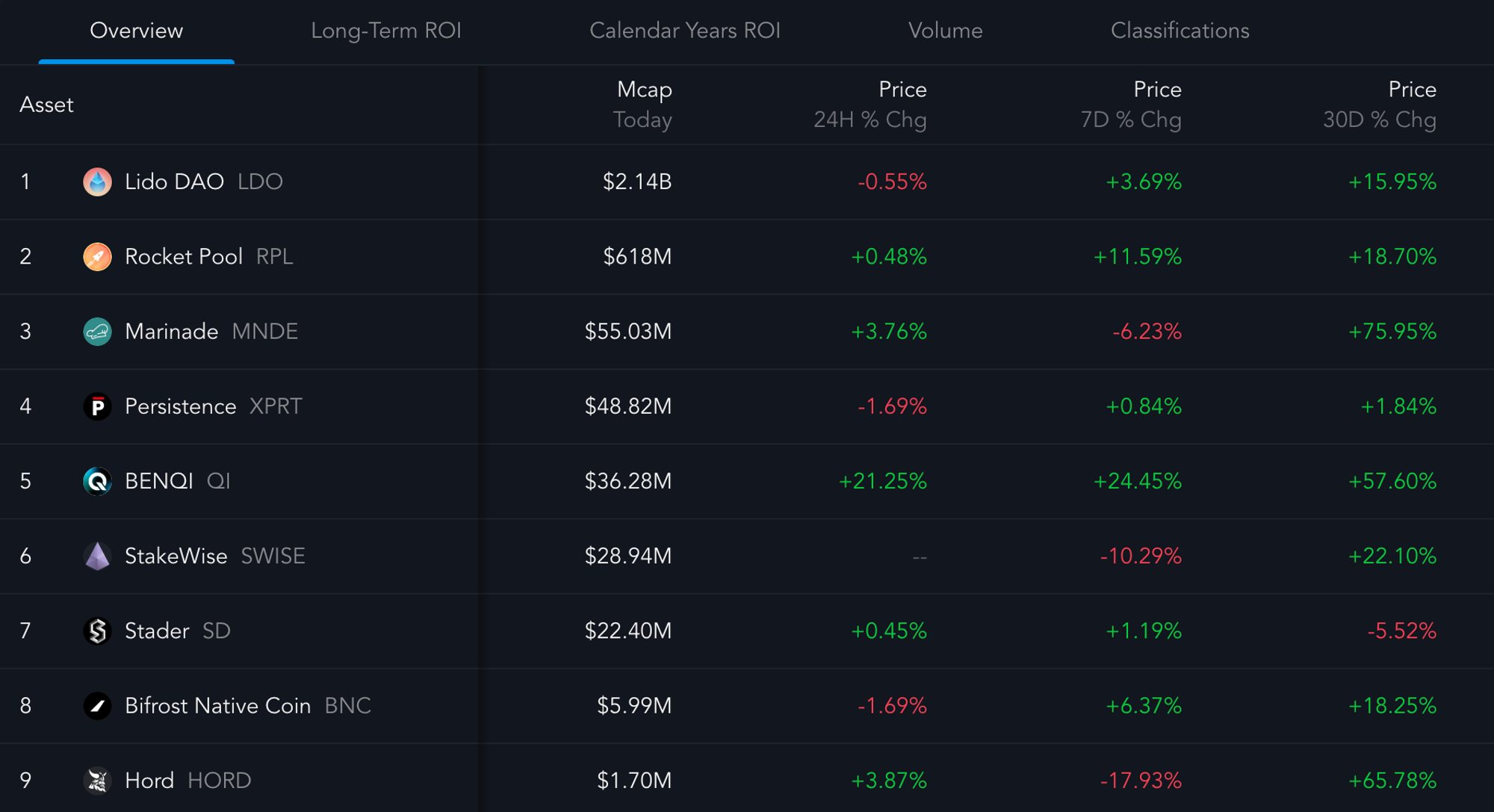

Jito’s steadily improving fundamentals will likely drive upward momentum in the secondary market price of JTO. Drawing parallels from the recent price trends of LSD protocol tokens over the past month, we believe JTO will also demonstrate stronger performance in the secondary market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News