Reviewing current popular crypto narratives, on-chain Alpha and the latest DeFi developments

TechFlow Selected TechFlow Selected

Reviewing current popular crypto narratives, on-chain Alpha and the latest DeFi developments

$ORDI is more like a meme coin because it doesn't actually have any real use case.

Author: The DeFi Investor

Translation: TechFlow

In today's article, we'll cover the following three topics:

-

The hottest current narratives in crypto, and some projects worth watching

-

This week’s on-chain Alpha

-

Latest developments in DeFi

Hottest Crypto Narratives

In a bull market, getting in early on a few key narratives is often enough to succeed.

For example, in 2021, those who rode the most popular narratives managed to multiply their investments by 10x or more.

After two years of bear market, liquidity has recently started flowing back into the crypto market.

Given that market conditions have improved significantly, now is the perfect time to start trading crypto narratives again.

Below are the current trending crypto narratives and my thoughts on their future potential:

1. Bitcoin DeFi + Meme Coins

Historically, BTC is always one of the best-performing assets at the beginning of a new bull run. This time is no different—BTC dominance has increased by 38% since the start of this year!

This has led to a renewed strong narrative around projects building on or directly tied to Bitcoin.

For instance, $ORDI (Ordinals), the first BRC-20 token on Bitcoin, has appreciated over 15x since early October.

$ORDI is more of a meme coin, as it doesn't really have any actual utility.

Many other BRC-20 tokens launched recently on Bitcoin have also performed extremely well, but the reality is that very few have dedicated teams building innovative technological products behind them.

However, there are some projects actually innovating on Bitcoin.

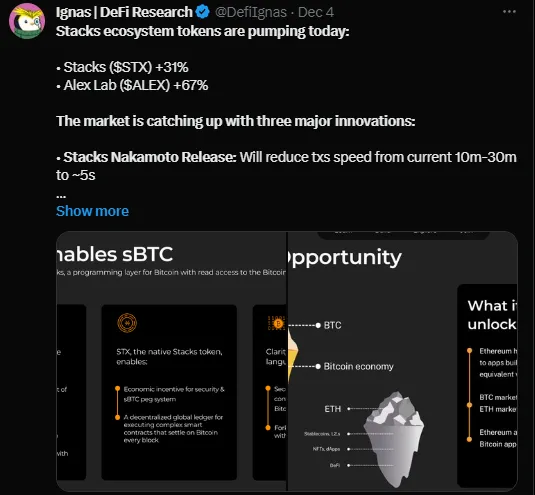

Stacks is a great example. Stacks is essentially a Bitcoin L2 project that enables smart contracts on Bitcoin, aiming to make Bitcoin DeFi the next big thing. As long as BTC continues to rise and until a spot BTC ETF gets approved, I expect projects building on Bitcoin to remain in focus.

But after that, market attention will likely shift toward other altcoins.

2. Crypto AI

I first covered the AI narrative in an article in early November.

Since then, many AI tokens have outperformed all expectations—TAO is up 4x, OLAS over 5x—and it seems like every week at least one other AI token stands out.

The exact reason for this recent surge isn’t entirely clear, but the dramatic events at OpenAI in November certainly contributed—particularly the sudden firing of its CEO—which highlighted the demand for decentralized AI.

Some AI tokens I'm watching:

-

TAO – Bittensor is creating a peer-to-peer decentralized AI marketplace

-

RNDR – Render Network is the leading provider of decentralized GPU rendering solutions

-

PHB – Phoenix is a blockchain infrastructure platform for decentralized AI

-

OLAS – Olas is a unified off-chain service network

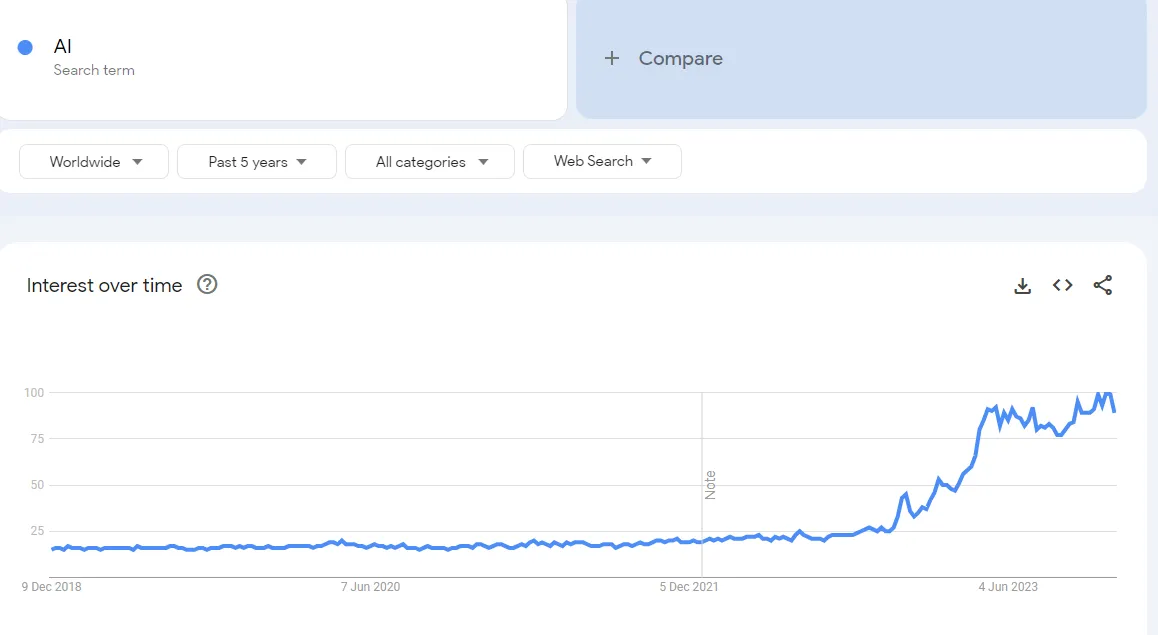

As shown in the chart above, Google search traffic for AI has reached an all-time high.

Given this trend and all the surrounding hype, crypto AI could be one of the top-performing narratives during the bull market.

3. Solana

Disclaimer: I hold ETH and SOL

Ethereum L2s have received significant attention over the past few years.

However, currently, L2 blockchains are still less scalable and more expensive than L1s like Solana. True, L2s are continuously improving, but they may still take several years before being able to handle mass adoption.

Therefore, the L1 narrative has recently regained momentum. Solana is one of the main beneficiaries—SOL has tripled in the past 40 days.

The reasons behind Solana’s rally are simple:

-

Strong technology: Solana can process thousands of transactions at a fee of just $0.0003—this is a big deal. The network experienced over ten outages in the past, but the good news is that it hasn’t had a single downtime in the last six months

-

Loyal community: Solana has one of the strongest communities on Crypto Twitter, and they’re extremely passionate

-

Thriving ecosystem: Whether it’s DeFi, gaming, or NFTs, Solana has several high-quality projects across all sectors. While it still has a long way to go to catch up with Ethereum, it’s definitely on the right track

-

Additionally, the Firedancer network upgrade is expected in 2024, which will allow Solana to handle up to 1 million transactions per second. In comparison, Visa currently handles about 24,000 transactions per second!

Most importantly, many top-tier ecosystem projects—including Pyth Network and Jupiter—have recently announced airdrops for early users. These airdrops have brought massive amounts of liquidity and users into the Solana ecosystem.

Solana has all the ingredients needed to capture the attention of both retail and institutional investors. I wouldn’t be surprised if SOL performs strongly throughout the bull market.

4. GameFi

I haven’t talked much about GameFi before, and frankly, most crypto games are overvalued and not fun to play.

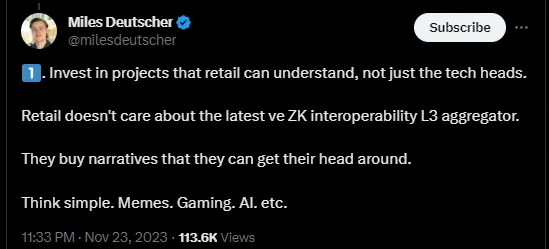

But as an investor, your goal is to predict what others will find interesting in the future. GameFi appears to be an obvious investment theme in a bull market because it’s easy for retail investors to understand.

Since early October, many GameFi tokens have significantly outperformed the broader market:

-

IMX up nearly 3x

-

RON up nearly 5x

-

PRIME up 3x

-

CROWN up 5x

I expect GameFi projects to experience explosive popularity growth, just like they did in the previous bull market.

Currently, I’m still actively researching the Web3 gaming ecosystem. At some point in the future, I may highlight the most promising GameFi projects in my articles.

On-Chain Alpha

Crypto fundraising activity is surging.

Source: @DefiIgnas

As you can see, crypto fundraising has seen significant growth for the first time in months.

Latest Developments in DeFi

-

Fraxchain testnet launched by Frax Finance. Fraxchain is an upcoming innovative Ethereum L2 set to launch in early 2024

-

Celestia introduced an Ethereum fallback option for L2s built using Optimism’s OP Stack. This fallback enhances security in case Celestia goes down

-

Arbitrum DAO approved $23 million in grants to support ecosystem projects, including Vela Exchange, Synapse, and Stargate. Perpetual DEXs received the largest allocations, with Gains Network receiving 4.5 million ARB, and Vela and WOOFi each receiving 1 million ARB

-

Injective announced its biggest mainnet upgrade ever, Volan, will launch in a few weeks. No further details available yet

-

Hashflow announced Hashflow 2.0 and its deployment on Solana. Hashflow 2.0 features smart order routing for better trade quotes and an improved user experience

-

Jupiter, the largest Solana DEX aggregator, announced $JUP airdrop distribution. If you’ve used it before, you might be eligible

-

Rage Trade launched the beta version of its V2 Perp Aggregator. Rage V2 will aggregate major derivatives DEXs to offer the best trade prices

-

Mantle launched its liquid staking protocol. This marks Mantle’s second core product alongside the Mantle L2 network

-

Balancer V3, a new AMM iteration with new features, pool types, and tools, has been announced. The upgrade is planned for Q2 2024

-

SEC delays decision on Grayscale’s proposed spot $ETH ETF until January 25

-

Aevo launched aeUSD, a yield-generating stablecoin usable as collateral on its derivatives DEX. aeUSD offers users a 4.75% APY on deposits and allows trading with up to 20x leverage

-

Starknet Foundation confirmed the snapshot for its token airdrop

-

Empyreal launched SDK v1, enabling developers to easily build dApps. The project also announced a collaboration with Banana Gun

That’s all—this concludes today’s article. See you next time!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News